So, what exactly is a qualified retirement account? Think of it as a special savings plan that plays by IRS rules to earn some serious tax perks. It's like a VIP lounge for your money, shielding it from the annual tax hits that regular investment accounts have to deal with. This protection is what helps your savings grow so much faster over the long haul.

Decoding Your Retirement Savings Options

Let's cut through the jargon. At its core, a qualified retirement account is just a tax-advantaged vehicle designed to help you save for the future. The "qualified" part simply means it follows guidelines set by the Internal Revenue Service (IRS). In exchange for playing by their rules, your money gets special tax treatment that lets it compound much more powerfully than it would in a standard brokerage account.

The whole point is to encourage people to save for the long term by making it financially rewarding. Of course, this comes with a few strings attached—things like contribution limits and withdrawal rules—to make sure the accounts are used for their real purpose: funding your life after you stop working.

Key Features of a Qualified Account

These accounts aren't all the same, but they share a few core characteristics that really set them apart from your everyday savings or investment accounts. Getting a handle on these features is the first step to building a solid financial plan.

To make it simple, let's break down the fundamental traits that every qualified retirement account shares.

Key Features of a Qualified Retirement Account at a Glance

| Feature | Description |

|---|---|

| Tax Advantages | Your money grows with either a tax deferral (like a Traditional 401(k)) or completely tax-free withdrawals in retirement (like a Roth IRA). |

| Contribution Limits | The IRS puts a cap on how much you can put in each year to prevent abuse of the tax benefits. |

| Withdrawal Rules | You generally can't touch the money before age 59½ without facing income taxes and a 10% penalty, though some exceptions do exist. |

| ERISA Protection | These plans are typically protected from creditors under the Employee Retirement Income Security Act of 1974 (ERISA). |

Understanding these four pillars is crucial because they dictate how you can use the account to build wealth and eventually access your money.

Here's a closer look at what those features mean in the real world:

- Tax Advantages: This is the big one. You either get a tax break now (tax-deferred) or a tax break later (tax-free). Both options let your investments grow without being chipped away by annual taxes.

- Contribution Limits: The IRS sets these limits each year. For example, in 2025, the employee contribution limit for a 401(k) is $23,500. If you're 50 or older, you can add an extra $7,500 as a "catch-up" contribution. For more data on savings trends, the Investment Company Institute is a great resource.

- Withdrawal Rules: The government wants this money saved for retirement. That's why pulling funds out before age 59½ usually triggers income tax and a 10% penalty. There are exceptions, but they are specific.

Navigating the Different Types of Plans

Okay, so you know what a qualified retirement account is. That’s step one. Step two is realizing they aren't all the same—they come in different flavors, each designed for a different kind of saver.

Generally, these plans fall into two big buckets: the ones you get through your job and the ones you open yourself.

For most Americans, the journey starts with an employer-sponsored plan. Think of accounts like the classic 401(k) for private companies or a 403(b) if you work for a non-profit or a public school. The biggest perk here is convenience. Your contributions come right out of your paycheck, and best of all, many employers offer a match. That’s literally free money.

Then you have the individual plans, which put you squarely in the driver's seat. These are your Individual Retirement Arrangements, better known as IRAs. The two most common are the Traditional IRA and the Roth IRA. You can open one at almost any brokerage, which unlocks a massive menu of investment choices far beyond what most workplace plans offer.

Employer-Sponsored Versus Individual Plans

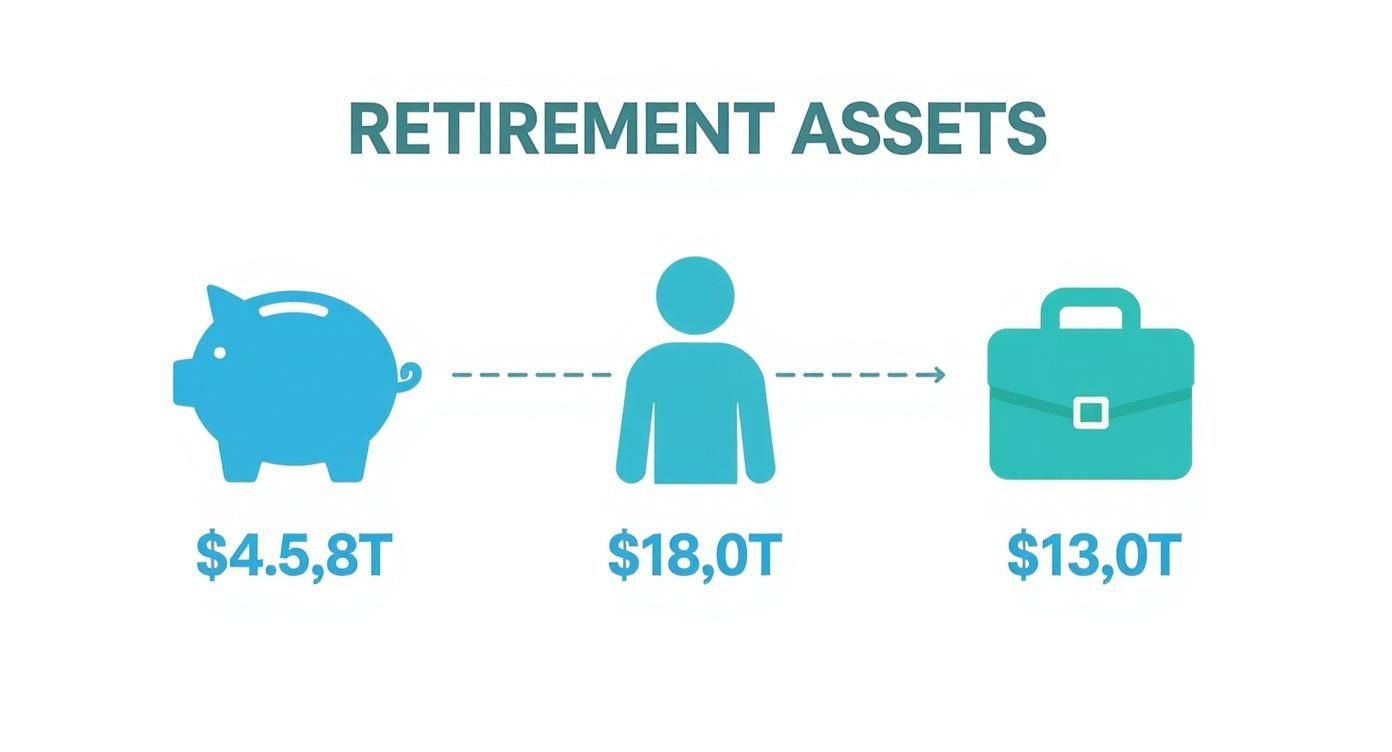

The scale of these accounts is staggering. By mid-2025, retirement assets in the United States—most of which are in qualified accounts—hit an estimated $45.8 trillion. Of that, IRAs held a massive $18.0 trillion, while defined contribution (DC) plans like 401(k)s accounted for $13.0 trillion.

This just goes to show how vital both types of plans are for building wealth. A 401(k) is a fantastic tool, especially with an employer match, but an IRA is the perfect partner to it—or a great primary account if you're self-employed. In fact, many people use both to really maximize their tax savings.

Key Takeaway: It’s not just about who offers the plan. The real difference comes down to control and investment options. Employer plans are simple; individual plans are flexible.

So, which one should you focus on? It all depends on your situation. If your job offers a 401(k) match, your first move should always be to contribute enough to grab that full match. Don't leave free money on the table. After that, you might channel extra savings into an IRA.

Of course, knowing the rules for getting your money out is just as important. For a deeper dive, check out our guide on how to access 401(k) funds early.

To make things a bit clearer, let's break down the most common accounts side-by-side.

Comparing Common Qualified Retirement Accounts

Here’s a quick comparison of the most popular qualified retirement accounts, showing who they're for, their main tax benefit, and how much you can contribute in 2025.

| Account Type | Primary User | Key Tax Benefit | 2025 Contribution Limit (Employee) |

|---|---|---|---|

| 401(k) | Employees of for-profit companies | Pre-tax contributions lower your current taxable income. | $23,500 |

| 403(b) | Public school & non-profit employees | Similar to a 401(k), with pre-tax contributions. | $23,500 |

| Traditional IRA | Anyone with earned income | Contributions may be tax-deductible, lowering taxable income. | $7,000 |

| Roth IRA | Anyone with earned income (income limits apply) | Contributions are post-tax, but withdrawals in retirement are tax-free. | $7,000 |

This table gives you a snapshot of your options. As you can see, each account has its own unique strengths, and the best choice often depends on your personal financial picture and long-term goals.

How Tax Advantages Power Your Savings Growth

Let's get straight to the point: the single biggest benefit of a qualified retirement account is how it handles taxes. This isn't just a small perk; it’s the high-octane fuel that powers your savings, letting your money compound far more effectively over the years.

Think of it as putting your investments on an express train. They get to skip all the local stops—those annual taxes on capital gains and dividends—that slow down a regular brokerage account.

When it comes to these tax benefits, they generally come in two main flavors: pay later or pay now.

-

Tax-Deferred Growth (Pay Later): With accounts like a Traditional 401(k) or IRA, you often contribute with pre-tax dollars. This has the immediate effect of lowering your taxable income for the year. From there, your money grows completely untouched by taxes. You only settle up with the IRS when you withdraw the funds in retirement.

-

Tax-Exempt Growth (Pay Now): With a Roth 401(k) or Roth IRA, the script is flipped. You contribute after-tax money, so there's no upfront deduction. But here's the magic: your investments still grow tax-free, and every qualified withdrawal you make in retirement is 100% tax-free.

The Compounding Effect in Action

To really see how powerful this is, let's run a quick comparison. Imagine you put $10,000 into a standard, taxable brokerage account. Every single year, a chunk of your returns could get shaved off to pay taxes on dividends and capital gains, creating a constant drag on your growth.

Now, let's take that same $10,000 and place it inside a qualified retirement account. For the next 30 years, it grows completely sheltered from that annual tax drag. This uninterrupted compounding means your nest egg can become significantly larger by the time you retire, purely because the tax man was kept at bay.

This tax-sheltered growth is the fundamental reason why understanding these accounts is so critical for long-term financial planning. It’s a government-endorsed strategy designed to help your money work harder for you.

The chart below gives you a sense of just how massive these retirement assets are across the U.S.

We're talking about trillions of dollars actively growing inside these tax-advantaged structures. For business owners, maximizing these accounts is absolutely key, and you can find more great insights in these helpful small business tax tips.

And if you really want to round out your knowledge, learning about alternative tax strategies for retirement can give you a much more complete picture of your financial options.

Understanding the Rules of the Road

With all those powerful tax benefits come some important rules you need to follow. A qualified retirement account operates within a framework set by the IRS, and getting a handle on these "rules of the road" is absolutely essential to avoid costly mistakes.

Think of them as guardrails that keep your savings on the right path toward retirement.

The most famous rule, of course, is the age 59½ guideline. Generally speaking, if you pull money from your qualified account before hitting this age, you’ll owe both income tax on the amount and a stiff 10% early withdrawal penalty. This rule exists for a simple reason: to discourage people from dipping into their nest egg for anything other than its intended purpose.

But life happens, and sometimes you might need access to your funds sooner. For a deep dive into these special situations, you can explore the rules for a 72(t) distribution, a specific provision that allows for penalty-free early withdrawals if you take them as a series of structured payments.

Key Regulations to Know

Beyond the big 59½ rule, a few other regulations shape how you manage your account. Staying on the right side of these is key to getting the most out of your plan and steering clear of penalties.

-

Contribution Limits: Each year, the IRS sets a cap on how much you can contribute. These limits prevent the ultra-wealthy from sheltering unlimited cash from taxes and are usually adjusted for inflation.

-

Catch-Up Contributions: To give folks nearing retirement a chance to turbo-charge their savings, the IRS allows anyone aged 50 and older to contribute an extra amount over and above the standard limit.

-

Required Minimum Distributions (RMDs): Uncle Sam doesn't let you keep money in tax-deferred accounts forever. Once you hit a certain age (currently 73), you have to start taking annual withdrawals, known as RMDs.

A simple and effective "rule of the road" for growing your retirement funds is to use a strategy like Dollar Cost Averaging. It’s a disciplined way to invest that helps smooth out the bumps of market volatility over the long haul.

Important Takeaway: These rules aren't meant to be punishments. They are designed to ensure qualified retirement accounts are used for their real purpose—providing financial security when you finally hang up your hat.

Why This Savings Model Is a Global Standard

The idea behind a qualified retirement account isn't some uniquely American experiment. It's actually a proven, worldwide strategy for building national financial security. When governments offer tax breaks, they're giving everyday people a powerful incentive to save for their own futures.

This simple but effective approach reduces the long-term strain on social safety nets and creates a stable system you can feel good about. It's essentially the blueprint for a strong retirement foundation, and it’s one that many of the world's most successful economies have adopted.

A Look at Global Pension Systems

If you zoom out and look at pension systems across the globe, you'll see tax-advantaged accounts forming the backbone of most of them. The Mercer CFA Institute Global Pension Index 2025 is a great resource that evaluates these systems, and it consistently ranks countries that rely on these principles at the very top.

Take a look at the heavy hitters: the Netherlands (Index score 85.4), Iceland (84.0), and Denmark (82.3) all use similar structures to encourage robust private savings. This global consensus shows just how effective the principles behind qualified retirement accounts really are.

So, when you contribute to your 401(k) or IRA, you're not just saving for yourself. You're participating in a savings model that's celebrated for its stability and success on the world stage.

The Big Picture: Your qualified retirement account is part of a time-tested, global strategy. Its core principles—tax-advantaged growth and disciplined saving—are the same ones that empower millions of people around the world to achieve a secure retirement. This context should give you confidence in the system's strength and reliability.

Got Questions About Qualified Accounts? We've Got Answers

As you get deeper into retirement planning, you’re bound to have some questions pop up. It's totally normal. Getting a handle on these common scenarios is what builds confidence and helps you make smarter money moves. Let's walk through some of the big ones.

Can You Have a 401k and an IRA at the Same Time?

You absolutely can, and honestly, it’s a fantastic strategy to really ramp up your savings.

A lot of people contribute just enough to their 401(k) to get the full employer match—I mean, who says no to free money?—and then they open an IRA. An IRA can give you way more investment options or just let you save more once you've maxed out your 401(k) contributions for the year.

Just be aware that if you're covered by a retirement plan at work, your ability to deduct your Traditional IRA contributions might be limited, depending on how much you make.

Pro Tip: Using both a 401(k) and an IRA is a go-to move for savvy savers. It's a powerful way to maximize every tax-advantaged dollar you can, building a much more robust nest egg for your future.

What Is the Difference Between Qualified and Non-Qualified Accounts?

It really all boils down to one thing: taxes.

A qualified account, like your 401(k) or an IRA, is a special type of account that meets a bunch of IRS rules to earn you tax breaks. The biggest one is usually tax-deferred growth. On the flip side, a non-qualified account—think of a standard brokerage account—doesn't have those tax perks. You'll pay taxes on your investment gains as you go, but the trade-off is total flexibility. There are no age restrictions on when you can pull your money out.

What Happens to Your 401k When You Change Jobs?

Don't worry, when you leave a job, your 401(k) money doesn't just vanish. You've got a few options, and it's important to choose wisely.

- Leave It Be: You can often just leave the money right where it is in your old employer's plan. It's a simple, low-effort choice.

- Roll It Over: This is a popular one. You can move the funds to your new company’s 401(k) or, even better, into an IRA. An IRA rollover gives you the most control and a wider universe of investment choices.

- Cash It Out: I almost always advise against this. Cashing out your 401(k) might feel good in the short term, but you'll likely get hit with a huge tax bill and a steep 10% early withdrawal penalty.

What Is Vesting in a 401k Plan?

Vesting is just a fancy word for ownership. It’s simpler than it sounds.

Any money you personally contribute to your 401(k) is 100% yours, right from day one. That's your money. The vesting part applies to the matching funds your employer contributes. Companies use a vesting schedule to encourage you to stick around. This means you have to work there for a certain amount of time, usually between three to five years, before you gain full ownership of the company's contributions.

Knowing the rules is step one, but what happens when you need your money before age 59½ without getting slammed by penalties? At Spivak Financial Group, we're experts in strategies like the 72(t) SEPP that can unlock your savings early. Let us show you what's possible at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728