Retirement accounts like your 401(k) and IRA are designed for the long haul, with rules in place to discourage early access. The most significant of these is the IRS's 10% early withdrawal penalty for distributions taken before age 59½. However, life is unpredictable, and sometimes you need access to those funds sooner than planned. The IRS recognizes this and has established specific circumstances where this penalty is waived, creating a set of valuable financial lifelines.

Understanding these provisions can provide crucial flexibility when you need it most, allowing you to navigate significant life events without incurring steep penalties. Whether you are buying your first home, covering qualified higher education expenses, or managing a medical crisis, knowing the rules is essential. This guide offers a comprehensive roundup of the 10 early withdrawal penalty exceptions, providing in-depth explanations, eligibility requirements, and practical scenarios to help you make informed decisions.

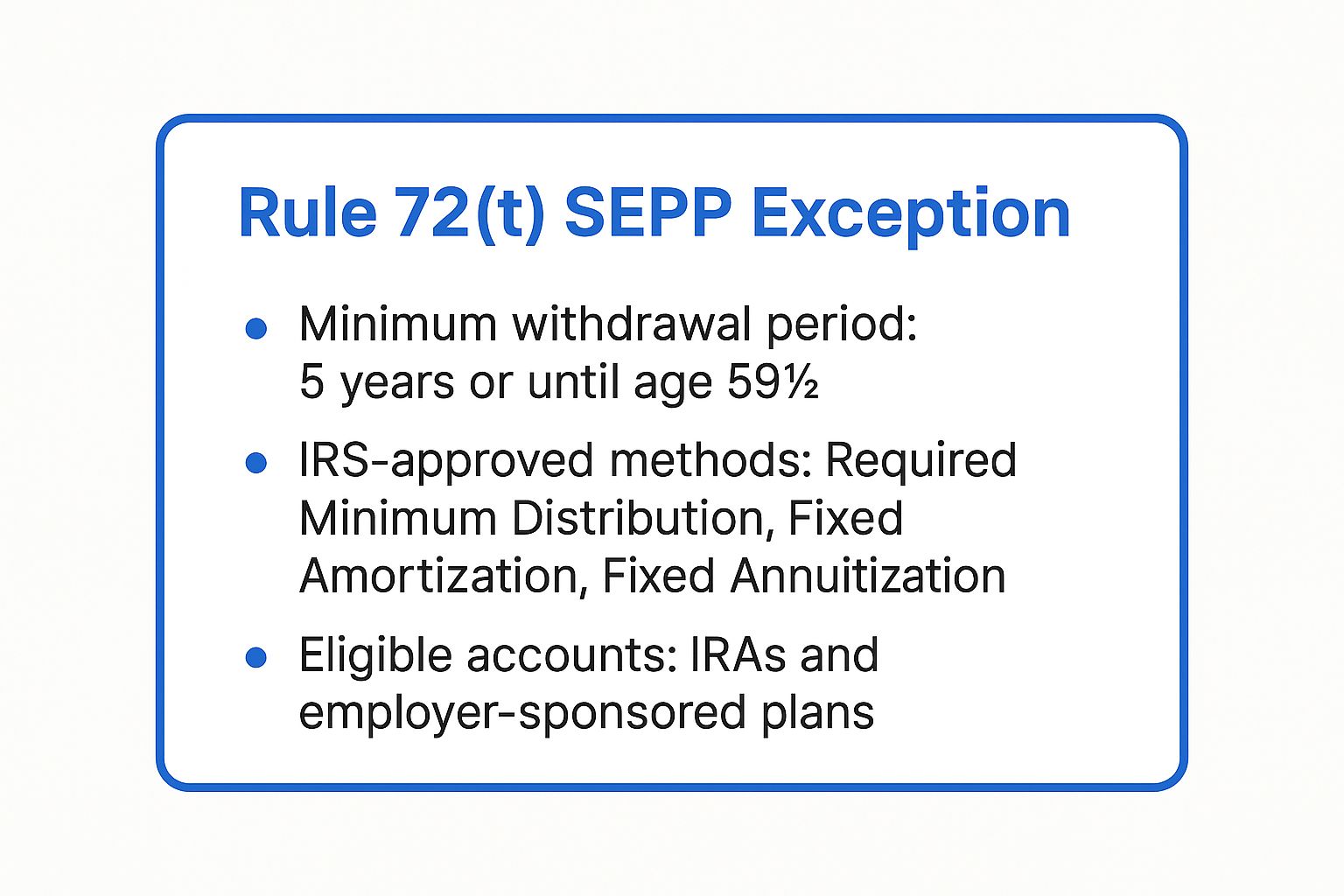

We will explore each exception in detail, from using funds for unreimbursed medical expenses to covering health insurance premiums while unemployed. We will also explore specialized strategies like the Rule 72(t) SEPP, a powerful tool for creating a penalty-free income stream for early retirement, a topic Spivak Financial Group at (844) 776-3728 specializes in. These rules are periodically updated, so for a deeper dive into recent changes that might expand your options, explore the new 401(k) penalty-free withdrawal rules for emergencies. This article will equip you with the knowledge to access your own money, on your own terms, without paying an unnecessary price.

1. Rule 72(t) – Substantially Equal Periodic Payments (SEPP)

If you're considering early retirement or need to access your retirement funds before the standard age of 59½, the Substantially Equal Periodic Payments (SEPP) plan, governed by IRS Rule 72(t), is one of the most powerful tools available. This provision is one of the key 10 early withdrawal penalty exceptions because it allows you to create a steady income stream from your IRA or other qualified retirement plans without incurring the typical 10% early withdrawal penalty.

A SEPP plan requires you to commit to a series of withdrawals for a specific duration: either five years or until you reach age 59½, whichever period is longer. This makes it an ideal "bridge" income source, commonly used by members of the FIRE (Financial Independence, Retire Early) community to fund their living expenses until their other retirement accounts become accessible without penalty.

How SEPP Works

To initiate a SEPP, you must calculate your annual withdrawal amount using one of three IRS-approved methods. Each method uses your life expectancy and a reasonable interest rate, but they produce different payment streams:

- Required Minimum Distribution (RMD) Method: This results in a payment amount that recalculates annually. It often starts as the lowest payment but fluctuates with your account balance.

- Fixed Amortization Method: This calculates a fixed annual payment for the entire duration of the plan, much like a mortgage payment.

- Fixed Annuitization Method: This method also provides a fixed annual payment, determined by dividing your account balance by an annuity factor from the IRS.

Here’s a quick reference summarizing the core components of a SEPP plan under Rule 72(t).

This visual highlights the critical commitment required and the structured calculation methods you must adhere to when using this exception.

Key Considerations for Implementation

The rigidity of a SEPP plan is its biggest drawback. Once you begin, you cannot modify the payments or take any other distributions from that specific account without risking a retroactive 10% penalty on all previous withdrawals, plus interest.

Expert Insight: "Because of its complexity and the severe penalties for errors, we always advise clients to work with a specialist. It’s wise to only allocate the portion of your retirement funds needed for the SEPP into a separate IRA to maintain flexibility with your remaining assets."

Given the strict rules, consulting a financial professional is crucial. Experts like those at Spivak Financial Group, also known as the 72t Professor, specialize in these complex calculations. Meticulous record-keeping is non-negotiable to ensure compliance throughout the plan's duration.

2. First-Time Home Purchase

Saving for a down payment is often the biggest hurdle to homeownership, but your IRA can provide a significant boost. The IRS allows you to withdraw up to a lifetime maximum of $10,000 from your traditional IRA penalty-free to buy, build, or rebuild a first home. This provision is one of the most accessible 10 early withdrawal penalty exceptions because it helps turn retirement savings into a tangible, immediate asset for you or your family.

To qualify, you must meet the IRS definition of a "first-time homebuyer," which simply means you have not owned a primary residence in the past two years. This exception is surprisingly flexible; the funds can be used for a home for yourself, your spouse, or even for your or your spouse's child, grandchild, or parent.

How the First-Time Homebuyer Exception Works

The process is straightforward, but timing is critical. You must use the funds for qualified acquisition costs, such as the down payment or closing costs, within 120 days of the withdrawal. This 120-day window requires careful coordination with your home-buying timeline. For example, a married couple could potentially combine their limits, withdrawing $10,000 from each of their respective IRAs for a total of $20,000 toward their new home. It's important to note this exception applies to IRAs, not 401(k)s. If your funds are in a 401(k), you would need to roll them over into an IRA first. You can explore a deeper dive into understanding how to access 401(k) funds early on 72tprofessor.com.

Key Considerations for Implementation

While you avoid the 10% early withdrawal penalty, the amount you withdraw is still subject to regular income tax. It's crucial to account for this tax liability to avoid a surprise bill. Meticulous documentation, including a signed settlement statement or contract, is necessary to prove the funds were used correctly within the 120-day period.

Expert Insight: "Using IRA funds for a home purchase can be a game-changer, but it's not a decision to take lightly. We guide our clients at Spivak Financial Group to weigh the long-term impact on their retirement against the immediate benefit of homeownership. Proper planning ensures you meet all IRS deadlines and avoid any costly mistakes."

Before proceeding, evaluate all your financing options. While this exception is powerful, depleting retirement funds should be a calculated decision. Consulting with a financial expert can help determine if this is the right move for your financial situation.

3. Qualified Higher Education Expenses

Funding a college education is a significant financial challenge, but your retirement account can serve as a valuable resource without triggering a penalty. The qualified higher education expenses provision is a popular entry among the 10 early withdrawal penalty exceptions, as it allows IRA owners to take distributions before age 59½ to cover schooling costs. This exception applies not only to your own education but also to that of your spouse, children, or even grandchildren.

This rule provides crucial flexibility for families facing tuition bills, allowing them to tap into their savings to invest in education. It covers a broad range of costs, from tuition and mandatory fees to books, supplies, and necessary equipment. It can even cover room and board for students enrolled at least half-time in a degree program.

How It Works

To use this exception, the distribution from your IRA must be used to pay for qualified expenses at an eligible educational institution. An eligible institution is any college, university, vocational school, or other postsecondary educational institution eligible to participate in a student aid program administered by the U.S. Department of Education. For example, a parent could withdraw $30,000 from their IRA to pay their daughter's university tuition, or an individual returning to graduate school at age 45 could use their own IRA funds penalty-free.

Keep in mind that while the 10% early withdrawal penalty is waived, the amount you withdraw is still considered taxable income. It's essential to coordinate this strategy with other educational financial benefits to ensure you're making the most efficient choice.

Key Considerations for Implementation

Meticulous record-keeping is non-negotiable when utilizing this exception. You must be able to prove that the funds were used for legitimate educational costs.

- Document Everything: Keep all receipts, invoices, and bank statements related to tuition, fees, books, and other qualified expenses.

- Verify Eligibility: Confirm that the school is an IRS-eligible institution before you take the withdrawal.

- Time Your Withdrawals: The distribution must occur in the same tax year that the expenses are paid.

- Consider Financial Aid: Be aware that an IRA withdrawal is counted as income, which could potentially reduce the student's eligibility for need-based financial aid in the following year.

Expert Insight: "While this exception is a great tool, it's not a simple decision. Withdrawing from retirement assets should be a last resort. We guide clients to evaluate all options, including education tax credits like the American Opportunity Credit, which can sometimes be more advantageous."

Navigating the interplay between retirement withdrawals and education tax planning can be complex. Consulting with a financial expert, such as the team at Spivak Financial Group, can help you make a decision that supports your family's educational goals without jeopardizing your long-term financial security.

4. Unreimbursed Medical Expenses Exceeding 7.5% of AGI

Significant medical costs can create immense financial strain, but an often-overlooked provision allows you to use retirement funds to ease the burden. This exception is a vital part of the 10 early withdrawal penalty exceptions because it permits penalty-free withdrawals from an IRA to cover substantial medical bills. It’s designed specifically for situations where your out-of-pocket medical costs exceed a specific income threshold.

To qualify, your unreimbursed medical expenses for the year must be greater than 7.5% of your adjusted gross income (AGI). The amount you can withdraw without the 10% penalty is limited to the portion of expenses that exceeds this 7.5% AGI floor. This provision applies to qualifying medical expenses for you, your spouse, or your dependents, and the withdrawal must be made in the same year the expenses are paid.

How This Medical Expense Exception Works

The calculation is the most critical part of using this exception correctly. You first determine your AGI for the tax year, then calculate 7.5% of that figure. Any qualifying medical expenses paid during that year above this threshold can be covered by a penalty-free IRA withdrawal.

For example, if your AGI is $80,000, your threshold is $6,000 (7.5% of $80,000). If you incur $15,000 in unreimbursed medical bills for a major surgery, you could withdraw up to $9,000 ($15,000 – $6,000) from your IRA without the 10% early withdrawal penalty. Note that the withdrawal will still be subject to ordinary income tax.

Key Considerations for Implementation

Meticulous record-keeping is absolutely essential. You must be able to prove both the total amount of your medical expenses and your AGI for the year. The IRS defines qualifying medical expenses broadly, including payments for diagnoses, treatments, and preventative care, but you must ensure your costs fit the criteria.

Expert Insight: "This exception requires careful timing and calculation. We advise clients to tally all medical receipts and finalize their AGI before taking a distribution to avoid miscalculations. It’s a targeted tool for managing a healthcare crisis, not a general fund for minor medical costs."

It's also important to consider all available options. Using funds from a Health Savings Account (HSA) is often more tax-efficient since those withdrawals are typically tax-free. However, for those without an HSA or with costs exceeding their HSA balance, this IRA exception provides a crucial safety net. Understanding the specific rules can make a significant difference during a difficult time. Learn more about when you can take money out of an IRA without penalty to ensure you are making an informed decision.

5. Health Insurance Premiums While Unemployed

Losing a job is a significant financial shock, and the high cost of health insurance can add immense pressure during unemployment. Recognizing this hardship, the IRS provides a crucial provision that ranks among the most practical of the 10 early withdrawal penalty exceptions. This rule allows you to use your IRA funds to pay for health insurance premiums without the 10% early withdrawal penalty, providing a vital financial lifeline when you need it most.

To qualify, you must have received federal or state unemployment compensation for 12 consecutive weeks. The withdrawal must be made in the same year you received the unemployment benefits or the following year. Importantly, you don't have to be unemployed at the exact moment you take the distribution, as long as you take it no later than 60 days after you start a new job. This exception can be used to pay premiums for yourself, your spouse, and your dependents.

How This Exception Works

The process for using this exception is straightforward but requires careful documentation. Once you have received unemployment benefits for 12 consecutive weeks, you can withdraw an amount from your IRA equal to the health insurance premiums you have paid. This can be a lifesaver for those needing to purchase COBRA coverage or a plan through the ACA marketplace.

For example, imagine a recently laid-off worker facing $800 monthly COBRA premiums. After receiving unemployment for 12 weeks, they could withdraw $2,400 from their IRA to cover three months of premiums without penalty. This provides immediate relief and ensures their family's health coverage is not interrupted during their job search.

Key Considerations for Implementation

While this exception is beneficial, it requires meticulous record-keeping. You must be able to prove both your receipt of 12 weeks of unemployment compensation and the exact amount you paid for health insurance premiums. The penalty-free withdrawal amount cannot exceed the total premiums paid during the qualifying period.

Expert Insight: "This exception is a targeted form of relief. It's not a blank check to pull from your retirement. We counsel clients to calculate their exact premium costs and withdraw only that specific amount. Keeping clear records of unemployment stubs and premium payment receipts is non-negotiable for proving eligibility to the IRS."

Before tapping into your retirement savings, it's wise to explore all options. You should compare the cost of using this exception against other possibilities, like subsidies available through the Affordable Care Act (ACA) marketplace. A financial professional can help you determine the most cost-effective way to maintain health coverage.

6. IRS Levy

While most exceptions to the early withdrawal penalty involve voluntary actions, an IRS levy is a forceful, involuntary distribution. If you have significant unpaid back taxes, the IRS has the authority to seize assets to satisfy your debt, including funds from your IRA or 401(k). This action makes the list of 10 early withdrawal penalty exceptions because the 10% penalty is waived on the amount withdrawn to satisfy the federal tax levy.

This exception is not a financial strategy but rather a consequence of prolonged non-payment of taxes. It serves as a last resort for the IRS after other collection attempts, such as notices and liens, have failed. While the penalty is avoided, the withdrawn amount is still subject to regular income tax, and the seizure can significantly impact your retirement savings.

How an IRS Levy Works

An IRS levy is a legal seizure of your property to satisfy a tax debt. When the IRS levies a retirement account, your plan administrator is legally obligated to turn over the funds to the government. The process is not immediate and is preceded by a series of notices.

- Notice and Demand: The IRS sends a bill for the taxes owed.

- Notice of Intent to Levy: If the bill is not paid, you will receive a final notice giving you 30 days to pay or make other arrangements.

- Seizure: After the 30-day period, the IRS can levy your assets, including your retirement account.

For instance, if a small business owner has a $30,000 tax liability and fails to respond to IRS notices, the agency could levy their IRA. The $30,000 withdrawn to pay the debt would be exempt from the 10% early withdrawal penalty, though it would be counted as taxable income for that year.

Key Considerations for Implementation

The best way to "implement" this exception is to avoid it altogether. An IRS levy is a severe collection action that should be prevented by proactively addressing tax issues. Responding immediately to all IRS correspondence is the first and most critical step. Explore all available options, such as setting up an installment agreement or an Offer in Compromise, to resolve your debt.

Expert Insight: "An IRS levy on a retirement account is a clear sign that communication has broken down. We urge clients to never ignore IRS notices. Engaging with a qualified tax professional as soon as a problem arises can prevent this drastic outcome and protect your retirement assets from seizure."

If you receive a levy notice, contact a tax professional immediately. They can help you understand your rights and negotiate with the IRS on your behalf. To learn more about the various reasons for penalty-free withdrawals, you can find helpful information that further explains what are the reasons to take money out of a 401(k) without penalty. Protecting your retirement savings should always be the primary goal.

7. Disability Exception

A total and permanent disability can bring unforeseen financial hardship, making access to retirement funds a necessity rather than a choice. The IRS provides for this contingency, making disability one of the most critical 10 early withdrawal penalty exceptions. This provision allows individuals who become totally and permanently disabled to withdraw funds from their IRA, 401(k), or other qualified retirement plans before age 59½ without the 10% penalty.

This exception is designed to provide a financial lifeline for those whose earning capacity has been permanently compromised by a severe physical or mental condition. To qualify, you must be able to prove to the IRS that you are unable to engage in any "substantial gainful activity" due to your condition, which is expected to be long-term, indefinite, or result in death.

How the Disability Exception Works

Unlike other exceptions that involve complex calculations, qualifying for the disability exception hinges on medical certification. The core requirement is a physician's statement certifying that your condition meets the IRS's stringent definition of total and permanent disability. It's important to note that this definition can differ from those used by other agencies, like the Social Security Administration.

Once you have the necessary medical proof, you can take distributions from your retirement account. While these withdrawals are exempt from the 10% early withdrawal penalty, they are still subject to ordinary income tax.

- Example 1: An individual who suffers a severe spinal injury in an accident is certified by their doctor as permanently unable to work. They can access their IRA funds penalty-free to cover living expenses and medical costs.

- Example 2: A person diagnosed with a progressive neurological disease that prevents them from performing their job duties uses this exception to withdraw from their 401(k) to supplement their disability income.

Key Considerations for Implementation

The burden of proof for this exception lies entirely with the taxpayer. The IRS can request documentation at any time, so maintaining meticulous records is essential. You must be prepared to demonstrate that your condition prevents any substantial gainful activity, not just your previous line of work.

Expert Insight: "Proving total and permanent disability to the IRS requires clear, definitive medical evidence. We guide clients to secure a formal letter from their physician that explicitly states the condition's nature, its permanence, and the resulting inability to perform any substantial gainful activity. This documentation is non-negotiable."

Given the specific legal and medical definitions involved, consulting with a financial advisor and potentially a disability attorney is a prudent step. Professionals like those at Spivak Financial Group can help ensure your situation aligns with IRS requirements before you proceed with a withdrawal, preventing potential disputes and penalties down the road.

8. Qualified Domestic Relations Order (QDRO)

Divorce is a financially complex process, and the division of retirement assets is often a major point of contention. A Qualified Domestic Relations Order (QDRO) is a legal instrument that provides a penalty-free way to access these funds, making it one of the most critical 10 early withdrawal penalty exceptions for those undergoing a marital separation. A QDRO allows an "alternate payee" (typically an ex-spouse) to receive a portion of their former partner's employer-sponsored retirement plan, such as a 401(k) or pension, without triggering the 10% early withdrawal penalty.

This exception is specifically designed to facilitate the fair division of marital assets. It's important to note that this rule applies only to employer-sponsored plans like 401(k)s, 403(b)s, and pensions. The division of IRA assets in a divorce is handled differently and does not use a QDRO. For those navigating the complexities of dissolving a marriage, understanding how retirement assets are divided and the specific legal mechanisms like QDROs is essential. Further insights can be found in resources discussing surviving the financial storm of divorce and retirement in Texas.

How a QDRO Works

A QDRO is a judgment, decree, or order that recognizes a spouse, former spouse, child, or other dependent's right to receive all or a portion of the benefits from a retirement plan. For the penalty exception to apply, the distribution must be made directly from the plan to the alternate payee as stipulated in the QDRO.

Once the QDRO is approved by both the court and the plan administrator, the alternate payee has several options:

- Take a Cash Distribution: Withdraw the funds directly. While the 10% penalty is waived, the distribution is still subject to ordinary income tax.

- Roll Over to an IRA: Transfer the funds into a traditional IRA. This move defers income taxes and allows the money to continue growing tax-deferred.

- Leave Funds in the Plan: Some plans may allow the alternate payee to maintain an account within the original plan.

Key Considerations for Implementation

The language of a QDRO must be precise and meet the specific requirements of both the IRS and the retirement plan administrator. Any errors can lead to significant delays or even outright rejection of the order, jeopardizing the penalty-free status.

Expert Insight: "A QDRO is not a boilerplate document. Each retirement plan has its own rules. Failing to get pre-approval from the plan administrator before the divorce is finalized is a common and costly mistake. Always engage an attorney who specializes in QDROs to draft the order."

Due to the legal and financial complexities, professional guidance is non-negotiable. It is crucial to have the draft QDRO reviewed by the plan administrator before the divorce decree is finalized to ensure compliance. This proactive step helps avoid future complications and ensures a smooth, penalty-free transfer of assets.

9. Death of Account Owner

The death of a retirement account owner is a difficult time, and the IRS provides a provision to ease the financial burden on beneficiaries. This is one of the most straightforward 10 early withdrawal penalty exceptions, as it allows inheritors to access funds from a retirement account without facing the 10% early withdrawal penalty. This exception applies regardless of the beneficiary's age or the age of the deceased account owner.

This rule enables beneficiaries to use the inherited funds for immediate needs, such as paying for funeral expenses, settling the deceased's final debts, or managing their own financial obligations. While the 10% penalty is waived, it's crucial to remember that distributions from traditional IRAs or 401(k)s are still subject to ordinary income tax.

How This Exception Works

When a beneficiary inherits a retirement account, they can take distributions of any amount at any time without the early withdrawal penalty. The rules differ slightly depending on the beneficiary's relationship to the deceased:

- Spouse Beneficiaries: A surviving spouse has the most flexibility. They can treat the IRA as their own by rolling it into their existing IRA, or they can open an inherited IRA. The rollover option often makes sense for younger spouses who don't need immediate access to the funds.

- Non-Spouse Beneficiaries: Most non-spouse beneficiaries (like children or siblings) must move the funds into a specially titled inherited IRA. Under the SECURE Act, most of these beneficiaries are required to withdraw all assets from the account within 10 years following the original owner's death.

For example, a 35-year-old who inherits her parent's traditional IRA can take a distribution to pay for funeral costs without penalty. Similarly, a non-spouse beneficiary could withdraw funds from an inherited 401(k) to use as a down payment on a home.

Key Considerations for Implementation

The primary consideration for beneficiaries is managing the tax liability. A large, lump-sum distribution could push you into a higher tax bracket for that year, significantly reducing the net amount you receive.

Expert Insight: "When a client inherits an IRA, our first step is to map out a distribution strategy that aligns with the 10-year rule and their personal tax situation. Spreading distributions over several years can often minimize the overall tax impact and preserve more of the inheritance."

Navigating the rules for inherited accounts, especially after the SECURE Act, can be complex. Consulting with a financial professional, like the team at Spivak Financial Group, is essential to understand your options. A professional can help you create a tax-efficient withdrawal plan, ensure compliance with distribution deadlines, and make the best decision for your long-term financial health.

10. Military Reservist Called to Active Duty

The call to active duty can create significant financial disruption for military reservists and their families. To address this, the IRS provides a crucial exception that allows qualified reservists to take distributions from their retirement accounts without the 10% early withdrawal penalty. This provision is one of the most important 10 early withdrawal penalty exceptions because it offers a vital financial lifeline during a period of national service.

This exception applies to distributions made from IRAs and 401(k)s by a member of a reserve component who is called to active duty after September 11, 2001. The active duty period must be for more than 179 days or for an indefinite period. The penalty-free withdrawal must be taken during the active duty period, beginning on the date of the order and ending at the close of the active duty period.

How This Exception Works

This provision is designed to help reservists manage the income fluctuations and unexpected expenses that often accompany a call-up. For example, a Naval Reserve officer on a 12-month deployment might need to withdraw funds from their IRA to help their spouse cover mortgage payments and childcare costs while they experience a temporary change in household income.

The amount withdrawn is still subject to regular income tax, but avoiding the 10% penalty can provide thousands of dollars in immediate savings. This exception applies to what the IRS terms "qualified reservist distributions" and is specifically designed to support service members during their active duty commitment.

Key Considerations for Implementation

Proper documentation is essential to qualify for this exception. You must keep a copy of your activation orders that clearly state the period of active duty is for more than 179 days. It's also important to only withdraw what is necessary to meet your financial needs.

- Recontribution Window: You have a two-year window after your active duty period ends to recontribute the funds to your retirement account. This special provision allows you to restore your retirement savings without it counting toward your annual contribution limits.

- Explore Alternatives: Before tapping into retirement funds, explore other military financial assistance programs, such as those offered by the Servicemembers Civil Relief Act (SCRA) or military aid societies.

- Plan for Taxes: Remember that the withdrawn amount will be included in your taxable income for the year. Plan accordingly to avoid a surprise tax bill.

Expert Insight: "This exception provides necessary flexibility for our service members. We always advise reservists to document everything and consult with a financial professional who understands the unique challenges military families face to ensure all rules are met and long-term financial goals are protected."

Given the unique circumstances, working with a firm that understands complex distribution rules, like Spivak Financial Group, can provide clarity and confidence. Careful planning ensures you can meet immediate needs without jeopardizing your future retirement security.

10 Early Withdrawal Penalty Exceptions Comparison

| Exception/Use Case | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Rule 72(t) – SEPP | High – requires precise calculations, IRS methods | Professional tax/financial advisor recommended | Penalty-free early withdrawals; taxes apply | Early retirees needing steady income before 59½ | Flexible IRS-approved methods; penalty avoidance |

| First-Time Home Purchase | Low – straightforward withdrawal process | Minimal documentation; coordinate timing | Up to $10,000 penalty-free withdrawal | Purchasing first home; down payment support | Facilitates homeownership; no repayment required |

| Qualified Higher Education Expenses | Moderate – needs detailed expense documentation | Keep receipts, IRS-eligible institution verification | Unlimited penalty-free withdrawals on qualified expenses | Paying college or grad school costs | No withdrawal limits; multiple beneficiaries covered |

| Unreimbursed Medical Expenses >7.5% AGI | Moderate to high – complex threshold and documentation | Meticulous tracking of medical bills | Penalty-free withdrawal on expenses exceeding threshold | Covering large medical costs exceeding AGI threshold | No withdrawal limit once threshold met; broad expense range |

| Health Insurance Premiums While Unemployed | Moderate – requires proof of unemployment and premium records | Documentation of unemployment and premiums | Penalty-free withdrawals for health insurance premiums | Paying premiums during unemployment | No dollar limit; covers family premiums |

| IRS Levy | Low – involuntary distribution by IRS | Respond to IRS notices promptly | Penalty waived on levied amount | Tax debt collection via levy | Automatic penalty exception; resolves tax debt portion |

| Disability Exception | Moderate – requires physician certification | Medical documentation and IRS qualification | Penalty-free access for total/permanent disability | Totally and permanently disabled individuals | No withdrawal limits; applies to all accounts |

| Qualified Domestic Relations Order (QDRO) | High – legal process involving courts and plan administrators | Legal attorney involvement | Penalty-free withdrawals by alternate payee | Retirement asset division during divorce | Protects alternate payee; penalty-free access |

| Death of Account Owner | Low – automatic exception upon death | Understanding beneficiary rules | Beneficiaries access funds penalty-free | Distributions by beneficiaries after owner's death | No age restriction; supports estate settlement |

| Military Reservist Called to Active Duty | Moderate – requires proof of deployment | Military orders and documentation | Penalty-free withdrawals during active duty | Reservists activated 180+ days needing cash flow | No withdrawal limits; recontribution option |

Making the Right Choice for Your Financial Future

Navigating the landscape of retirement accounts can feel like traversing a complex maze, especially when faced with an immediate need for funds before the age of 59½. As we've explored, the IRS provides a series of specific pathways to access your hard-earned savings without incurring the standard 10% early withdrawal penalty. These 10 early withdrawal penalty exceptions are not loopholes; they are intentional provisions designed to offer financial flexibility during some of life's most significant and often challenging moments.

From the excitement of purchasing a first home to the necessity of covering substantial medical bills or funding higher education, each exception serves a distinct purpose. Understanding the nuances of these rules empowers you to make strategic decisions rather than feeling trapped by your account's age restrictions. However, this power comes with a significant responsibility: the responsibility to understand the full scope of your actions.

Key Takeaways: A Strategic Recap

Before you proceed, it is vital to internalize a few core principles that underpin all these exceptions. Grasping these concepts will protect both your present financial stability and your future retirement security.

- Penalty vs. Tax: Remember, an exception only saves you from the 10% early withdrawal penalty. It does not eliminate your obligation to pay ordinary income taxes on the withdrawn amount (unless it's from a Roth account and is a qualified distribution). This is the single most common misunderstanding, and overlooking it can lead to a significant and unexpected tax bill.

- Documentation is Paramount: For every exception, from disability to qualified higher education expenses, the burden of proof is on you. The IRS requires meticulous record-keeping. You must be prepared to produce receipts, invoices, court orders like a QDRO, or official letters to substantiate your claim for a penalty-free withdrawal. Proactive and organized documentation is your best defense in an audit.

- Long-Term Opportunity Cost: Every dollar you withdraw today is a dollar (plus all its potential future earnings) that you won't have in retirement. While an immediate need might seem paramount, always weigh it against the long-term impact on your nest egg. A $20,000 withdrawal today could mean $80,000 less in your account 25 years from now, depending on market returns.

Your Actionable Next Steps

Knowledge is only the first step; action is what shapes your financial destiny. Before initiating any early withdrawal, follow this deliberate process:

- Verify Your Eligibility: Re-read the specific requirements for the exception you plan to use. Do you meet the AGI thresholds for medical expenses? Does your home purchase qualify as a "first-time" buy under the IRS definition? Don't assume; verify.

- Consult a Professional: While this article provides a comprehensive overview, it is not a substitute for personalized financial advice. A tax professional or a certified financial planner can analyze your unique situation, confirm your eligibility, and model the long-term financial impact of a withdrawal. This is especially critical for complex strategies like a Rule 72(t) SEPP.

- Explore Alternatives: Is the early withdrawal truly your only option? Could a low-interest personal loan, a home equity line of credit (HELOC), or other non-retirement assets meet your immediate need without derailing your long-term goals? Exhaust all other avenues first.

Mastering these 10 early withdrawal penalty exceptions transforms you from a passive saver into an active, strategic manager of your own financial future. It provides you with the tools to handle life's curveballs without jeopardizing your security. For those planning a structured early retirement, the Rule 72(t) SEPP stands out as a uniquely powerful tool, but its complexity demands expert guidance. The specialists at Spivak Financial Group are dedicated to navigating these intricate rules. To see how a meticulously crafted 72(t) plan can provide a penalty-free income stream tailored to your goals, contact the team at Spivak Financial Group at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260, or call (844) 776-3728. Your informed decision today is the bedrock of a secure and prosperous tomorrow.

For those specifically interested in creating a penalty-free income stream for early retirement, the Rule 72(t) exception requires precise calculations and flawless execution. The experts at 72tProfessor.com specialize exclusively in designing and implementing these complex plans to meet IRS guidelines. Visit 72tProfessor.com to learn how their specialized knowledge can help you unlock your retirement funds early and with confidence.