Getting a tax form in the mail can feel a bit like opening a puzzle box, especially when you see codes you don't recognize. But if you've spotted 1099-R code 7D, you can probably breathe a sigh of relief. This little code is actually good news.

In a nutshell, Code 7D tells the IRS that your distribution was "normal" and you shouldn't be hit with the dreaded 10% early withdrawal penalty, even if you're under the typical retirement age of 59½. It’s a signal that you’ve played by your specific retirement plan's rules and are officially retired according to their definition.

Unlocking the Meaning of Code 7D

When you see Code 7D in Box 7 of your Form 1099-R, it's your plan administrator sending a very specific message to the IRS. They are certifying that your distribution is penalty-free because you have separated from your employer and met the plan's unique criteria for a "normal retirement age."

This is a really important distinction. It cleanly separates your situation from a standard early withdrawal, which almost always comes with a hefty penalty. The IRS gets it—many retirement plans, especially in certain professions like public safety or skilled trades, allow for retirement much earlier than the 59½ benchmark that applies to IRAs.

If you want to get a better handle on all the different codes and what they mean, our comprehensive guide to Form 1099-R is a great place to start.

What Is a "Normal Retirement Age" Anyway?

Here’s the catch: the term "normal retirement age" isn't a single, universal number. It’s defined by the fine print inside your specific retirement plan documents. While the IRS generally sets the penalty-free withdrawal age at 59½, your individual plan can set its own—and often much earlier—threshold.

These plan-specific rules are usually based on things like:

- A Specific Age: Some plans might simply set the normal retirement age at 55.

- Years of Service: Another plan might require 30 years of service to qualify, no matter how old you are.

- A Combination of Both: Many pension plans use a "Rule of 85," where your age plus your years of service must add up to 85 or more.

Think of Code 7D as a special pass from your employer directly to the IRS. It basically says, "Don't worry, this person followed our rules for retirement. No penalty needed here."

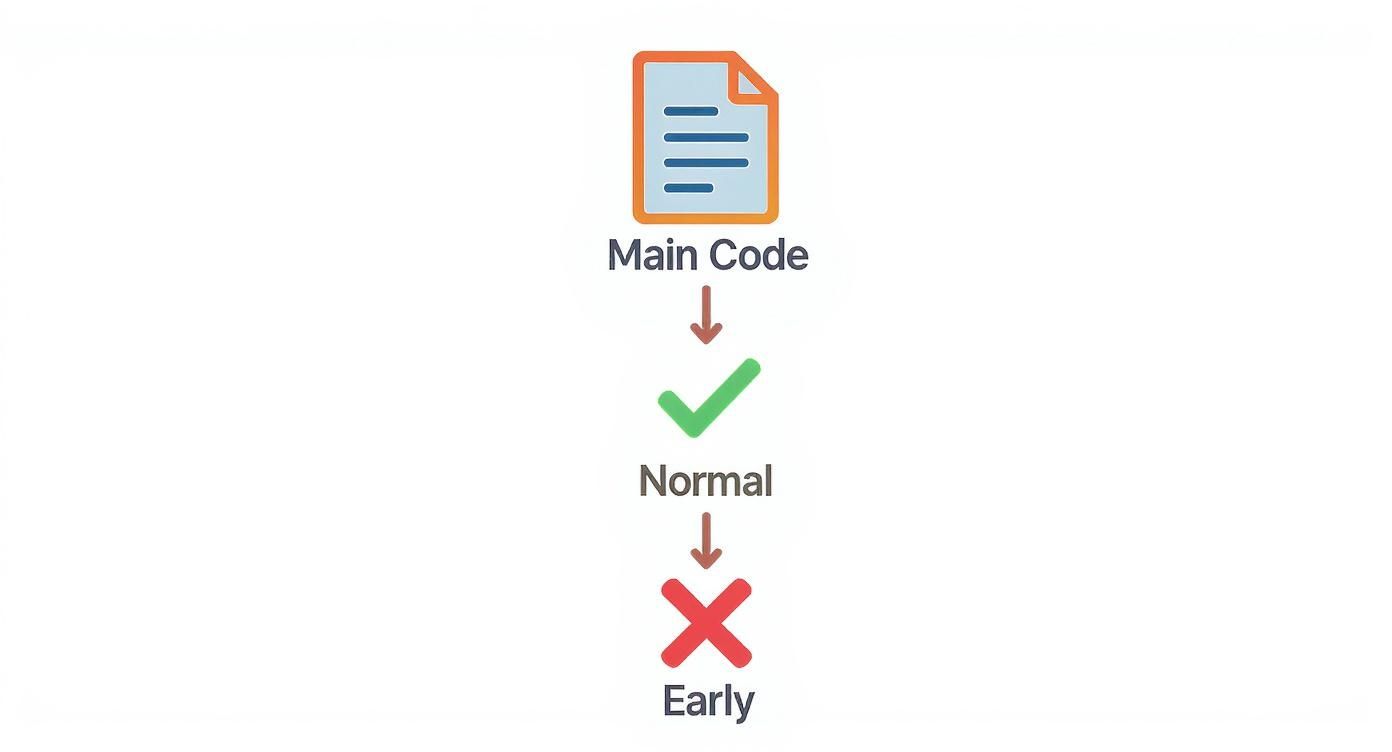

Visualizing 1099-R Code Categories

It can be helpful to see where Code 7D fits in the grand scheme of things. This simple flowchart shows how the IRS categorizes distribution codes, separating the "Normal" ones (like 7D) from the "Early" ones that might trigger a penalty.

As you can see, Code 7D lands squarely in the "Normal" category. This visual confirmation should give you peace of mind that your distribution isn't being flagged as a premature withdrawal that needs extra scrutiny or taxes. Getting this right from the start makes tax time a whole lot smoother.

The Key Difference Between Code 7D and Code 7

When you glance at Box 7 on your 1099-R, it's easy to see the number "7" and assume it's all the same. But that little letter "D" that sometimes follows it makes a world of difference. Understanding the distinction between Code 7 and Code 7D is one of the most common hangups for early retirees, and getting it right is absolutely critical for your tax return.

Both codes tell the IRS you're taking a "normal distribution," which means you're exempt from that dreaded 10% early withdrawal penalty. The key, however, is why the distribution is considered normal.

Think of it this way: Code 7 is the universal rule, while Code 7D is a local one specific to your employer's plan. Code 7 is simple—it just means you’ve hit age 59½. Once you cross that birthday, your age is all that matters.

Code 7D, on the other hand, is all about the fine print in your company's retirement plan documents. It signifies you've met the plan's specific criteria for "normal retirement age," which can often be much earlier than 59½. This is a crucial detail that protects younger retirees from being incorrectly flagged for a penalty.

Age vs. Plan Rules: The Deciding Factor

The entire difference boils down to what qualifies your distribution as "normal."

- Code 7 Trigger: Your birthdate. The moment you are 59½ or older, this becomes the standard code for nearly all retirement account withdrawals.

- Code 7D Trigger: Your plan's specific rules. This is often a combination of your age and years of service, something you'll frequently see in professions like law enforcement, aviation, or skilled trades where retirement timelines are different.

Here’s a look at a standard Form 1099-R, where you'd find these all-important codes in Box 7.

When your plan administrator puts Code 7D in that box, they're sending a direct message to the IRS. They are confirming that, according to their own rules, you are eligible for a penalty-free withdrawal, regardless of the general age requirement.

A Real-World Example

Let's imagine a public safety officer who is eligible to retire at age 50 after putting in 25 years of service. If she decides to take a distribution at age 52, her 1099-R should correctly show Code 7D. Why? Because she met her plan's unique retirement criteria.

Now, consider her 60-year-old colleague from the same department. When he takes a distribution, his form will show Code 7 because his age is now the primary qualifying factor. This is a massive distinction, especially when you compare it to other early withdrawal strategies, like those laid out in the 72(t) distribution rules.

These codes are far from rare. In 2023 alone, an estimated 3.2 million taxpayers reported distributions under these normal codes, accounting for over $187 billion.

How Code 7D Affects Your Tax Filing

Spotting Code 7D on your 1099-R is a good first step, but knowing what to do with it come tax time is what really matters. While this code is your golden ticket to avoiding the 10% early withdrawal penalty, it's critical to remember one thing: this distribution is not tax-free.

The money you took out is almost always treated as ordinary income. Think of it this way—it gets taxed at your regular federal and state income tax rates for the year, just as if it were a paycheck. Your Form 1099-R lays this out clearly in Box 2a, which shows the specific taxable portion of your distribution.

From Form 1099-R to Your 1040

When it's time to file, the number from Box 2a on your 1099-R gets carried over directly to your Form 1040. It simply becomes part of your total gross income for the year. The magic of Code 7D happens behind the scenes.

This simple code is what tells the IRS's automated systems not to slap you with an early withdrawal penalty. It’s a powerful little signal that prevents a lot of headaches, saving you from the stress of getting an automated penalty notice (like a CP2000) and having to prove your distribution was part of a legitimate plan. When your plan administrator gets this code right, it makes for a much smoother tax season.

For a deeper dive into the tax side of things, our guide explaining how 72t distributions are taxed has all the details.

Handling Special Scenarios

Of course, not every distribution is cut-and-dry. Your own situation might have a few twists, like after-tax contributions or rollovers, which can change your final tax bill.

- After-Tax Contributions: Did you contribute money to your retirement plan that had already been taxed? If so, you get a portion of your distribution back tax-free. This amount, your "return of basis," is reported in Box 5 of your 1099-R.

- Rollovers: If your plan was to roll the money into another qualified account (like an IRA), you typically have 60 days to complete the transfer to keep it tax-deferred. An incorrect code on the form could throw a wrench in that process.

Getting the reporting right for a Code 7D distribution isn’t just about dodging a penalty—it’s about calculating your income tax accurately. A simple mistake can lead to overpaying or underpaying the IRS, and both scenarios create financial headaches you just don't need.

Real-World Scenarios for a Code 7D Distribution

Tax codes can feel pretty abstract until you see them in action. Let's make 1099-R code 7d more concrete by walking through a few real-world examples. These stories bring the rules to life and can help you see if your own situation lines up with a common penalty-free early retirement path.

Each of these people retired before the standard age of 59½. Even so, their distributions were considered "normal" according to their specific plans. This is the exact scenario Code 7D was designed to handle.

Example 1: The Police Officer

Meet Sarah, a dedicated police officer who joined the force at 22. Her public safety pension plan defines "normal retirement" as reaching age 50 with at least 25 years of service. After an impressive 30 years, she decides to hang up her badge and retire at the age of 52.

When Sarah starts drawing from her pension, the plan administrator issues a Form 1099-R. The key detail is in Box 7, which correctly shows distribution Code 7D.

So, why that code? Even though she's well under 59½, she fully met her plan's specific retirement rules. That code signals to the IRS that her distribution is penalty-free because she played by the book—her employer's book.

Example 2: The Corporate Employee

Now, let's look at David, who worked for a large manufacturing company for 35 years. His company’s 401(k) plan has what's known as a "Rule of 85." This provision lets an employee retire with full benefits once their age plus their years of service adds up to 85 or more.

David is 55, and with his 35 years on the job, his total comes to 90. He’s golden. He qualifies under the rule, separates from the company, and starts taking distributions.

Sure enough, his Form 1099-R also arrives with Code 7D. The plan administrator used this code to certify that David met the company's internal definition of a normal retirement, protecting him from any early withdrawal penalties.

Example 3: The Airline Pilot

Finally, let’s consider Maria, an airline pilot. Federal regulations require commercial pilots to retire by age 65. However, her airline's retirement plan sweetens the deal, allowing pilots to retire with full benefits at 58 after logging 20 years of service.

Maria decides to retire right at 58. The funds she receives from her qualified retirement plan are reported on a 1099-R with—you guessed it—Code 7D.

These scenarios all share a common thread: the retirement plan's internal rules, not the universal IRS age of 59½, dictated the terms of the distribution. Code 7D is simply the messenger that communicates this important detail to the tax authorities.

In every case, the code prevents an automatic penalty and helps ensure their tax filing process goes smoothly. Seeing your own story in these examples can give you the clarity and confidence you need as you navigate your early retirement finances.

What to Do If Your 1099-R Seems Incorrect

Getting a Form 1099-R in the mail with a code that doesn't look right can definitely be a heart-stopping moment, but don't panic. The most common mix-up we see is getting a Code 1 (early distribution) when you were expecting a 1099-R code 7D. The very first thing to do is become your own best advocate and confirm your plan's specific rules.

You need to track down the plan's official definition of its "normal retirement age." This isn't some vague concept; it's a specific rule buried in a document called the Summary Plan Description (SPD). Think of the SPD as the owner's manual for your retirement plan—it lays out every detail, from who is eligible to how and when you can take your money out.

Verifying Your Plan's Rules

If you don't have your SPD handy (and let's be honest, who does?), you can almost always get a copy by contacting your former employer's HR or benefits department. Once you have it, flip to the section on retirement eligibility or distributions.

Your mission is to find the exact criteria for a "normal retirement." Does it list a specific age? A certain number of years of service? Or maybe a combination, like the popular "Rule of 85"? If the circumstances of your retirement perfectly match what's written in that document, you have an ironclad case that your 1099-R should be marked with Code 7D.

Taking Action to Correct an Error

Once you've confirmed the code is wrong, your next call is to the plan administrator—the company that actually sent you the 1099-R. Be ready to explain exactly why you think the code is incorrect, and be prepared to point to the specific language in your SPD that backs you up.

What you're asking for is a corrected Form 1099-R. This new version will look almost identical to the old one, but it will have the "CORRECTED" box checked at the very top and, most importantly, will show the right distribution code. This is by far the cleanest and best way to fix the problem before the IRS even gets involved.

Spivak Financial Group Tip: Don't wait on this. Plan administrators can move at a glacial pace when it comes to issuing corrected forms. The last thing you want is for their delay to push you past your tax filing deadline, so start this process the moment you spot a potential issue.

What If You Can't Get a Corrected Form in Time?

So what happens if the clock is ticking and you still don't have that corrected 1099-R before it's time to file? First, you still have to file on time. But you'll need to take one extra step to make things right.

You'll need to file Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts, along with your main tax return. On this form, you'll report the distribution but also claim an exemption from that nasty 10% penalty. You'll explain that you qualified for the exemption because you met your plan's normal retirement age.

While this approach works, it's a bit like patching a hole instead of fixing it right the first time. Getting the corrected 1099-R is always the better route because it prevents any potential red flags or automated penalty notices from the IRS down the line.

Your Top Questions About Code 7D, Answered

Navigating retirement tax forms can feel like you're trying to decipher a secret language, but once you understand the codes, you gain a lot of confidence. Let's tackle some of the most common questions that pop up around 1099-R code 7D to clear up any confusion.

We've pulled together the most pressing concerns to give you a quick go-to guide.

I'm 57 and Just Retired. Is Code 7D Correct on My 1099-R?

Yes, this is very likely the correct code for your situation. Seeing a 1099-R with code 7D at age 57 is actually a common and welcome sight for many early retirees.

All this code means is that you met your specific company retirement plan's rules for a "normal retirement." These internal rules are often based on a mix of age and years of service—think something like reaching age 55 with 20 years on the job.

If you want to be 100% certain, the best thing to do is check your plan's Summary Plan Description (SPD) or give your old HR department a call. The code simply tells the IRS that your distribution is penalty-free because you hit your plan's unique milestone, not because you reached the general retirement age of 59½.

Does Code 7D Mean My Distribution Is Tax-Free?

No, and this is probably the most critical point to understand. Code 7D is only about waiving the 10% early withdrawal penalty.

That money is still considered ordinary income and will be taxed at your standard federal and state rates. Look at Box 2a on your Form 1099-R—that's the number the IRS sees as taxable income.

The only way a part of your distribution would be tax-free is if you had made after-tax contributions to the plan during your career. That money, known as your cost basis, would be shown in Box 5 and isn't taxed a second time when you withdraw it.

A Code 7D distribution is penalty-free, not tax-free. It's an important distinction that ensures you report your income correctly and avoid any nasty surprises when you file.

What If I Got Code 1 Instead of 7D?

You need to jump on this right away. Getting a Code 1 on your 1099-R tells the IRS you took a standard early distribution and owe the 10% penalty—exactly what you're trying to avoid.

Your first move should be to contact your plan administrator. Explain that you retired after meeting the plan's normal retirement age requirements and ask them to issue a corrected Form 1099-R with Code 7D.

If you can't get a corrected form before you have to file your taxes, you'll need to file Form 5329 with your return. You can use this form to claim an exemption from the penalty, but trust me, getting the corrected 1099-R is always the cleaner and more straightforward solution.

How Is Code 7D Different from a 72(t) SEPP?

These are two completely different paths to get penalty-free access to your retirement funds before 59½. They aren't interchangeable and are designed for different scenarios.

- Code 7D: This applies only when you've left your job and met your employer plan's specific rules for normal retirement. It's tied directly to the provisions of that one plan.

- 72(t) SEPP: This refers to a series of structured withdrawals (Substantially Equal Periodic Payments) that you can set up from an IRA at any age, and it has nothing to do with your employer's rules. These distributions are typically marked with Code 2 on the 1099-R.

Basically, if your 401(k) or pension plan allows for a Code 7D distribution, you wouldn't need a 72(t) plan for those funds. They are separate tools for separate jobs.

Planning a successful early retirement hinges on smart strategies and a solid grasp of the rules. At Spivak Financial Group, we specialize in helping people build penalty-free income streams to reach their financial goals ahead of schedule. Find out how a 72(t) SEPP can create the consistent, life-changing income you need.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com