Thinking about dipping into your 401(k) before retirement? It can feel like a quick fix when you need cash, but it’s a move that comes with some serious financial strings attached, namely the 401k early withdrawal penalty.

If you take money out before you hit age 59½, the IRS will typically hit you with a 10% 401k early withdrawal penalty right off the top. On top of that, the entire amount you withdraw is taxed as ordinary income. This one-two punch means the amount you actually pocket is often much smaller than you expect.

The Real Cost of Cashing Out Your 401k Early

Picture your 401(k) as a savings account on steroids, supercharged by decades of compound growth. Every dollar is a seed planted for your future. Cashing out early is like harvesting your crops halfway through the season—you get a little something now, but you give up the massive harvest you would have had later.

The immediate hit comes from two places: that nasty 10% 401k withdrawal penalty and your regular income taxes. It’s a common mistake to only focus on the penalty, but for many people, the income tax bill is actually the bigger problem.

Understanding the Double Financial Hit

When you take an early distribution, that money gets added right on top of your other income for the year. A big withdrawal could easily bump you into a higher tax bracket, meaning you’ll pay a higher tax rate than you’re used to on that chunk of cash.

Let’s walk through what this really looks like.

Say you need $20,000 for a major home repair and decide your 401(k) is the only option. The moment you make that withdrawal, the financial haircut begins, and the numbers can be pretty jarring.

The IRS rules are designed to keep that money locked up for retirement. Breaking the seal before age 59½ triggers the penalty and taxes, a system intended to make you think twice. For a deeper dive into these rules, including hardship distributions, this guide from Business Insider is a great resource.

Quick Look at the Costs of a $20,000 Early Withdrawal

To really see how this plays out, a table can help illustrate the damage. Here’s a breakdown of what happens to that $20,000 you need.

| Expense Category | Estimated Cost | Explanation |

|---|---|---|

| Initial Withdrawal | $20,000 | The gross amount you take from your 401(k). |

| 10% Early Withdrawal Penalty | -$2,000 | An immediate penalty paid directly to the IRS. |

| Federal Income Tax (22% Bracket) | -$4,400 | Your withdrawal is taxed as income at your marginal rate. |

| State Income Tax (5% Rate) | -$1,000 | Don’t forget state taxes, which vary but add to the cost. |

| Net Amount Received | $12,600 | The cash that actually ends up in your bank account. |

So, to get your hands on $12,600, you had to pull $20,000 from your retirement savings. You lost nearly 37% of your money to penalties and taxes before it ever helped you.

And that’s just the immediate loss. The real, hidden cost is the decades of future compound growth you’ve just thrown away. That’s the part that can truly derail your retirement plans.

Calculating the Full Price of a 401(k) Withdrawal

Most people focus on the 10% early withdrawal penalty, but that’s really just the tip of the iceberg. It gets all the attention, sure, but the real financial damage comes from a much bigger player: taxes.

To understand the true cost, you have to look at the entire picture. This isn’t just theory—it’s essential math for protecting your hard-earned retirement savings. The IRS doesn’t see your 401(k) withdrawal as simple savings; it’s treated as ordinary income, just like your salary. This is where the costs really start to stack up, often catching people by surprise.

Step 1: Start with the Penalty

The first piece of the puzzle is the most straightforward. The federal government hits you with a flat 10% penalty on the gross amount you pull out if you’re under age 59½ and don’t qualify for a special exception. It’s designed specifically to make you think twice.

So, if you withdraw $50,000, the penalty alone is a clean $5,000. That amount is gone right off the top, leaving you with $45,000 before any other taxes even enter the conversation. It’s a significant and immediate loss.

Step 2: Factor in Federal Income Taxes

Next up, you have to account for federal income taxes. This is a critical detail that trips a lot of people up: the entire $50,000 you withdrew gets added to your total taxable income for the year.

Let’s say your annual taxable income is normally $60,000. Taking out that $50,000 from your 401(k) instantly bumps your total taxable income to $110,000. That jump can easily push a huge chunk of your withdrawal into a higher tax bracket than you’re used to paying.

For example, a single filer in 2024 earning $60,000 is in the 22% tax bracket. The $50,000 withdrawal shoves their total income into the 24% bracket. Suddenly, a good portion of their money is being taxed at a higher rate than they ever planned for.

Step 3: Don’t Forget State Income Taxes

The hits don’t stop at the federal level. Most states also tax retirement distributions as income, adding yet another layer to the total cost. Depending on where you live, state income tax rates can run anywhere from 0% to over 13%.

Forgetting to account for state taxes is a common mistake that leads to a nasty surprise when you file your return. If your state has a 5% income tax, that’s another $2,500 gone from your original $50,000 withdrawal.

Here’s how the complete picture breaks down for that $50,000 withdrawal:

- Initial Withdrawal Amount: $50,000

- 10% Early Withdrawal Penalty: -$5,000

- Federal Tax (24% blended rate): -$12,000

- State Tax (5% rate): -$2,500

- Your Take-Home Amount: $30,500

In this all-too-common scenario, you actually lost $19,500—nearly 40% of your retirement money—just to get your hands on $30,500 in cash. When you lay it all out, the true cost of 401(k) early withdrawal penalties becomes painfully clear.

The Hidden Cost of Lost Future Growth

The immediate sticker shock from taxes and penalties is bad enough, but it’s not the real story. The most devastating cost of an early withdrawal isn’t the money you lose today—it’s the future wealth you’ll never get the chance to build. This is the unseen damage, the lost opportunity cost, where a seemingly small decision now creates a massive retirement shortfall later.

Think of your 401(k) as a young fruit tree you’ve been nurturing. Withdrawing funds early is like chopping that tree down for a bit of firewood. Sure, you get a short-term benefit—warmth for a night—but you sacrifice all the fruit that tree would have produced for years and years to come. That’s how compound growth works, turning small, consistent investments into something truly substantial over time.

The Power of Compounding You Give Up

When you pull money out of your 401(k), you’re not just taking the principal amount. You are permanently yanking that money out of the market, killing its ability to grow and compound on itself. Over a couple of decades, the effect is staggering.

The financial hit goes way beyond the initial 10% penalty. Over the last decade, the S&P 500’s average annual return was around 13.84%. So when you withdraw money, you’re not just losing the cash in your hand; you’re losing all the potential compounded returns that money could have earned for years. Taking out $10,000 today could easily mean losing tens of thousands of dollars in future growth. You can play with the numbers yourself using a withdrawal calculator to see the potential effects on your retirement savings.

The real trade-off isn’t just about getting immediate cash versus paying penalties. It’s about sacrificing long-term security and financial freedom for a short-term fix. Every dollar you remove is a dollar that can no longer work for your future self.

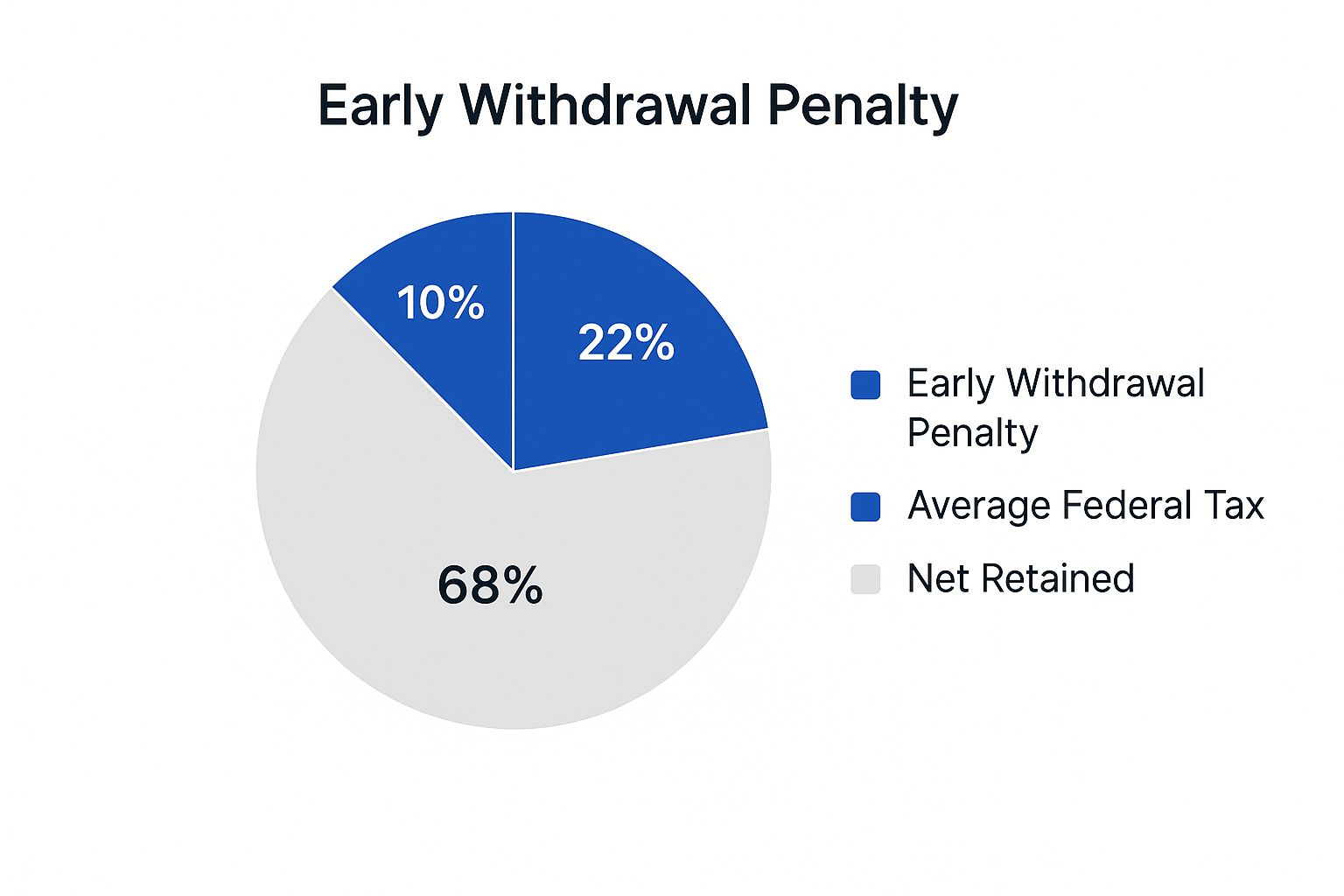

This infographic breaks down the upfront costs perfectly, showing how taxes and penalties shrink your withdrawal before you even start thinking about lost growth.

As you can see, a huge chunk of your withdrawal—often over 30%—can get eaten up by immediate taxes and penalties, leaving you with far less than you originally planned for.

The Future Value of a $10,000 Withdrawal

Let’s make this tangible. The table below shows just how much a seemingly small $10,000 withdrawal today can cost your future self. We’ll use a conservative 8% average annual return to really drive home the power of compounding.

| Time Until Retirement | Potential Lost Growth (at 8% average annual return) | Total Future Value Lost |

|---|---|---|

| 10 Years | $11,589 | $21,589 |

| 20 Years | $36,610 | $46,610 |

| 30 Years | $90,626 | $100,626 |

The numbers don’t lie. That $10,000 withdrawal made 30 years before you retire doesn’t just cost you $10,000. It costs you over $100,000 in future retirement funds. This is the brutal, hidden math of early withdrawals. You’re not just paying a fee; you’re selling your future financial security for pennies on the dollar today. Understanding that trade-off is the first step to protecting your long-term goals.

How to Legally Avoid the 10 Percent Penalty

While that 10% early withdrawal penalty feels like a locked door, it’s not completely sealed. The IRS knows life can throw you a curveball, so they’ve built in a few specific keys to unlock your retirement funds when you truly need them.

But here’s the critical part: even if the penalty is waived, you will almost always still owe ordinary income tax on the money you take out. These aren’t loopholes; they’re specific exceptions for genuine hardship.

And don’t get tripped up by your plan’s rules. Just because your 401(k) plan allows a “hardship withdrawal” doesn’t mean the IRS will automatically waive its 10% penalty. You have to meet one of their specific, approved conditions.

Qualifying for Total and Permanent Disability

One of the most clear-cut exceptions is for a total and permanent disability. If a medical condition leaves you unable to perform any substantial, gainful work, you can typically access your 401(k) funds without the penalty.

This isn’t for temporary situations. You’ll need to provide solid proof from a doctor confirming your disability is expected to be long-term or terminal. The IRS is very strict here, as this exception is reserved for life-altering circumstances that permanently remove your ability to earn a living.

Medical Expense Withdrawals

Sky-high medical bills are another area where the IRS offers some relief. You can take a penalty-free withdrawal to cover unreimbursed medical expenses that are more than a certain percentage of your income.

The rule is that you can withdraw an amount equal to the medical costs that exceed 7.5% of your adjusted gross income (AGI). So, if your AGI is $80,000, the first $6,000 of your medical bills don’t count. You could only take a penalty-free withdrawal for any qualifying costs above that $6,000 mark.

It’s crucial to get the math right. You’re only allowed to withdraw the amount above that 7.5% threshold without penalty.

The Rule of 55 Separation from Service

This one is a favorite for people planning an early retirement. It’s called the “Rule of 55,” and it applies if you leave your job—whether you quit, get laid off, or retire—in or after the year you turn 55.

The catch? You can only take penalty-free distributions from the 401(k) of the company you just left. Money sitting in old 401(k)s from previous jobs or in your IRAs isn’t eligible for this specific rule.

Other Important Penalty Exceptions

Beyond those more common situations, the IRS has a few other specific exceptions, each with its own set of rules you have to follow to the letter.

- Substantially Equal Periodic Payments (SEPP): Governed by IRS Rule 72(t), this strategy lets you take a series of calculated payments over many years. It’s a powerful but complex option that demands careful planning. To dive deeper, you can see https://72tprofessor.com/how-does-72t-work/.

- Qualified Domestic Relations Order (QDRO): In a divorce, if a court orders a portion of your 401(k) to be given to your spouse, ex-spouse, or dependent, that distribution is penalty-free for the person receiving it.

- Qualified Disaster Recovery Distributions: Recent laws allow penalty-free withdrawals of up to $22,000 if you’ve suffered an economic loss in a federally declared disaster area.

- IRS Levy: If the IRS comes directly to your 401(k) to collect on a tax debt, you won’t be hit with the additional 10% penalty on the amount they take.

Unfortunately, early withdrawals are becoming more common. In 2024, nearly 9.3% of 401(k) participants took an early distribution, potentially facing these penalties. Knowing these exceptions can provide a critical financial lifeline when you need it most. To stay on top of the latest rules, you can explore new early withdrawal regulations here.

Smarter Alternatives to an Early 401k Withdrawal

When you’re in a financial bind, raiding your 401k can seem like the only way out. But before you pull that trigger—and get hit with 401k early withdrawal penalties, taxes, and lost future growth—it’s absolutely critical to explore your other options. Tapping into your retirement should be the last resort, not your first move.

Fortunately, there are several smarter ways to get the cash you need without completely derailing your retirement plans. These strategies have their own rules and risks, of course, but they often lead to a much better financial outcome than simply cashing out a chunk of your life’s savings. The key is to carefully weigh each one against your immediate needs and long-term goals.

Taking a Loan from Your 401k

One of the most common alternatives is to borrow from your 401k instead of making a permanent withdrawal. This is a whole different ballgame because you’re borrowing from yourself with the full intention of paying it back. The biggest advantage? You sidestep the immediate 10% penalty and the income taxes that come with a withdrawal.

Instead, you repay the loan, plus interest, directly into your own retirement account. In a way, you’re paying interest to yourself, helping to replenish the funds you took out. But it’s not without some serious risks to think about:

- Job Separation Risk: This is the big one. If you leave your job for any reason—whether you quit or are laid off—your plan will likely demand you repay the entire loan balance in a very short time. If you can’t, the outstanding amount is reclassified as a taxable distribution, which means you’re suddenly on the hook for both income taxes and that dreaded 10% penalty.

- Lost Growth: While that money is out of your account, it’s not invested in the market. You’re missing out on any potential gains it could have been generating, which can still set your retirement timeline back, even if you pay the loan back in full.

A 401k loan can be a useful tool for short-term cash needs, but it’s not a risk-free solution. The potential for a “deemed distribution” if you can’t repay it after leaving a job is a major financial trap that has caught many people by surprise.

Getting the details right between borrowing and other strategies is crucial. For a deeper dive, you can learn more about borrowing from your 401k versus using a 72t SEPP distribution.

Considering a HELOC or Personal Loan

Looking beyond your retirement plan, other borrowing options might be a better fit and less damaging to your long-term wealth. Two of the most common are a Home Equity Line of Credit (HELOC) or a standard personal loan.

A HELOC lets you tap into the equity you’ve built in your home. Interest rates are often lower than other types of loans, and you might even get a tax deduction on the interest if you use the money for home improvements. The major drawback, however, is that your house is the collateral. If you fail to repay, you could be putting your home at risk.

A personal loan is an unsecured loan from a bank or credit union based on your credit score. The interest rates are usually higher than a HELOC, but you don’t have to put up any collateral. While the interest payments don’t build any assets, this option completely insulates your retirement savings and your home, making it a much safer play for your long-term financial health.

Weighing Your Options Carefully

Ultimately, the right path depends entirely on your personal situation. A 401k loan might make sense if your job is stable and the amount you need is relatively small. A HELOC could be a great choice for a large, planned expense if you have plenty of home equity. A personal loan offers a clean, straightforward way to get cash without touching your most important assets.

The key is to analyze each one, understand the real-world pros and cons, and choose the path that solves your immediate problem with the least amount of long-term financial damage.

Get a Clear Path Forward for Your Finances

Trying to sort through complex financial decisions on your own can feel incredibly overwhelming. While this guide gives you a solid foundation for understanding 401(k) early withdrawal penalties, every person’s situation is unique and really deserves a personalized strategy. This is where talking to a financial advisor can save you from making costly mistakes.

An expert can take a close look at your specific circumstances, walk you through the long-term consequences of a withdrawal, and even point out alternatives you might not have thought of. When you’re up against a major financial choice, applying structured essential decision-making frameworks is a great way to map out your options and arrive at a much more confident conclusion.

Here at Spivak Financial Group, our entire team is focused on helping you find the right solution for your life.

We truly believe a proactive plan is the best defense against financial uncertainty. Our goal is to empower you with the clarity needed to protect both your present needs and your future retirement goals.

Don’t leave something as important as your financial future to chance. Getting on the right track can start with a simple conversation.

Contact Spivak Financial Group today at (844) 776-3728 to schedule a consultation and let’s build a plan that works for you. Our office is located at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260.

Common Questions: 401k Early Withdrawal Penalty

Navigating the rules around your 401(k) can feel like trying to find your way through a maze, especially when you’re under financial pressure. To help you make sense of it all, here are some straightforward answers to the most common questions we hear about 401(k) early withdrawal penalties.

Getting these details right can be the difference between a smart move and a costly mistake.

Does the 10 Percent Penalty Apply to Roth 401k Withdrawals?

Yes, but there’s a crucial twist compared to a traditional 401(k). With a Roth 401(k), the 10% early withdrawal penalty only hits the earnings portion of your money if you’re under age 59½.

Since your direct contributions were made with post-tax dollars, you can generally pull those out at any time, completely tax-free and penalty-free. This is a huge leg up on a traditional 401(k), where every single dollar you withdraw gets hit with both income tax and the potential penalty.

Is a Hardship Withdrawal Exempt from the 10 Percent Penalty?

This is a common misconception that catches so many people off guard: no, it’s not automatically exempt. A hardship withdrawal simply means your plan is allowing you to access your funds for what they define as an “immediate and heavy financial need.” But getting your plan’s permission does not automatically get you a pass from the IRS on the 10% penalty.

To avoid that penalty, your situation also has to fit one of the specific IRS penalty exceptions, like having medical bills that climb above 7.5% of your income. Think of the plan’s hardship provision and the IRS’s penalty exception as two totally separate hurdles you have to clear.

Think of it this way: your plan gives you permission to open the door to your funds (the hardship), but only the IRS can waive the toll you have to pay to walk through it (the 10% penalty).

What Happens If I Have a 401k Loan and Lose My Job?

This is one of the most dangerous financial traps out there. If you leave your job with an outstanding 401(k) loan, the clock starts ticking—fast. You typically have a very short window to repay the entire loan balance.

Miss that deadline, and the whole outstanding amount is reclassified as a taxable distribution. Not only does it get added to your income for the year, but if you’re under 59½, you’ll also get slapped with that painful 10% 401k withdrawal penalty. A simple loan can suddenly become a massive tax headache. For a deeper dive, you can learn how to get your retirement money without penalty in our video guide.

How Do I Report an Early Withdrawal on My Taxes?

Your 401(k) plan administrator will send you Form 1099-R, which spells out exactly how much you withdrew. You’ll use the numbers from this form to report the distribution as income on your yearly tax return.

Now, if you believe you qualify for an exception to the 10% penalty, you can’t just ignore it. You must file IRS Form 5329, “Additional Taxes on Qualified Plans,” along with your regular tax return. This is the official form where you claim your exemption and tell the IRS why that penalty shouldn’t apply to you.

Making the right decision with your retirement funds is crucial. At Spivak Financial Group, our team at (844) 776-3728 is dedicated to helping you find clear answers and a confident path forward. Navigating these rules doesn’t have to be a solo journey. To learn more about unlocking penalty-free income streams, visit us at 72tProfessor.com.