So, can you actually roll your 401(k) over to an IRA while you're still working at the same company?

Yes, you often can. This move is officially called an "in-service distribution," but it's not a universal guarantee. Your ability to do this hinges entirely on the rules of your employer's 401(k) plan.

Many plans have specific provisions that allow it, most commonly an age requirement, like reaching age 59½.

Understanding The In-Service Rollover

A lot of people think their 401(k) money is completely locked down until they leave their job. While that's often true, a surprising number of plans offer the flexibility to move your funds sooner. It's a strategic maneuver that's becoming more popular as people look for greater control over their retirement savings.

This isn't just a niche strategy, either. The trend of shifting funds from employer plans to personal IRAs is massive. Rollovers are now the primary source of new money flowing into IRAs, and projections show this accelerating. Annual rollovers are expected to hit about $1.15 trillion by 2030—that's nearly double the amount from 2020. This data highlights a significant shift in how Americans are managing their retirement assets.

Why Would You Even Want To Do This?

It's a fair question. Why bother moving your 401(k) funds while you're still on the payroll? It usually boils down to a few key motivations:

- Vastly More Investment Choices: Most 401(k) plans give you a limited menu of mutual funds. An IRA, on the other hand, opens up a nearly endless universe of options—individual stocks, bonds, ETFs, real estate, and more.

- Account Consolidation: If you've collected a few old 401(k)s from previous jobs, an in-service rollover lets you bring everything under one roof in a single, streamlined IRA.

- Access to Personalized Financial Advice: With an IRA, you can work directly with a financial advisor you choose, getting personalized guidance that's rarely available through a standard workplace plan.

At its core, this is about taking the reins of your own financial future. For a deeper dive into the basic mechanics, our guide on what a rollover is covers the essential background.

Key Differences At A Glance

Before you jump in, it's crucial to understand the trade-offs. Keeping your money in a 401(k) versus moving it to an IRA involves some fundamental differences, and each has features that could impact your long-term strategy.

An in-service rollover isn't always an all-or-nothing deal. Many plans let you roll over specific pots of money—like vested employer matching funds or after-tax contributions—while leaving your own pre-tax deferrals right where they are.

To help you see the pros and cons clearly, here’s a quick comparison of the primary features of a 401(k) versus a Rollover IRA.

401k Vs Rollover IRA Key Differences

| Feature | Typical 401k Plan | Rollover IRA |

|---|---|---|

| Investment Options | Limited menu of mutual funds chosen by the employer. | Virtually unlimited choices: stocks, bonds, ETFs, mutual funds, real estate, etc. |

| Fees | Often lower institutional-level fund fees, but may have administrative fees. | Can vary widely. You have control over choosing low-cost investments and providers. |

| Withdrawal Flexibility | Limited. Rules are set by the plan (e.g., loans, hardship withdrawals). | More flexible. You can typically withdraw funds anytime, subject to taxes and penalties. |

| Access to Advice | General education or access to a plan-level advisor. | You can hire any financial advisor for personalized, one-on-one guidance. |

| Creditor Protection | Strong federal protection under ERISA. | Protection varies by state law, though often still very strong. |

| Account Consolidation | Only holds funds from your current employer. | Can consolidate funds from multiple old 401(k)s, 403(b)s, and other IRAs. |

This table should give you a good starting point for weighing whether a 401(k) rollover to an IRA while still employed aligns with your financial goals. Remember, the right choice always comes down to your personal situation and what you value most in a retirement account.

Confirming Your Eligibility and Understanding Plan Rules

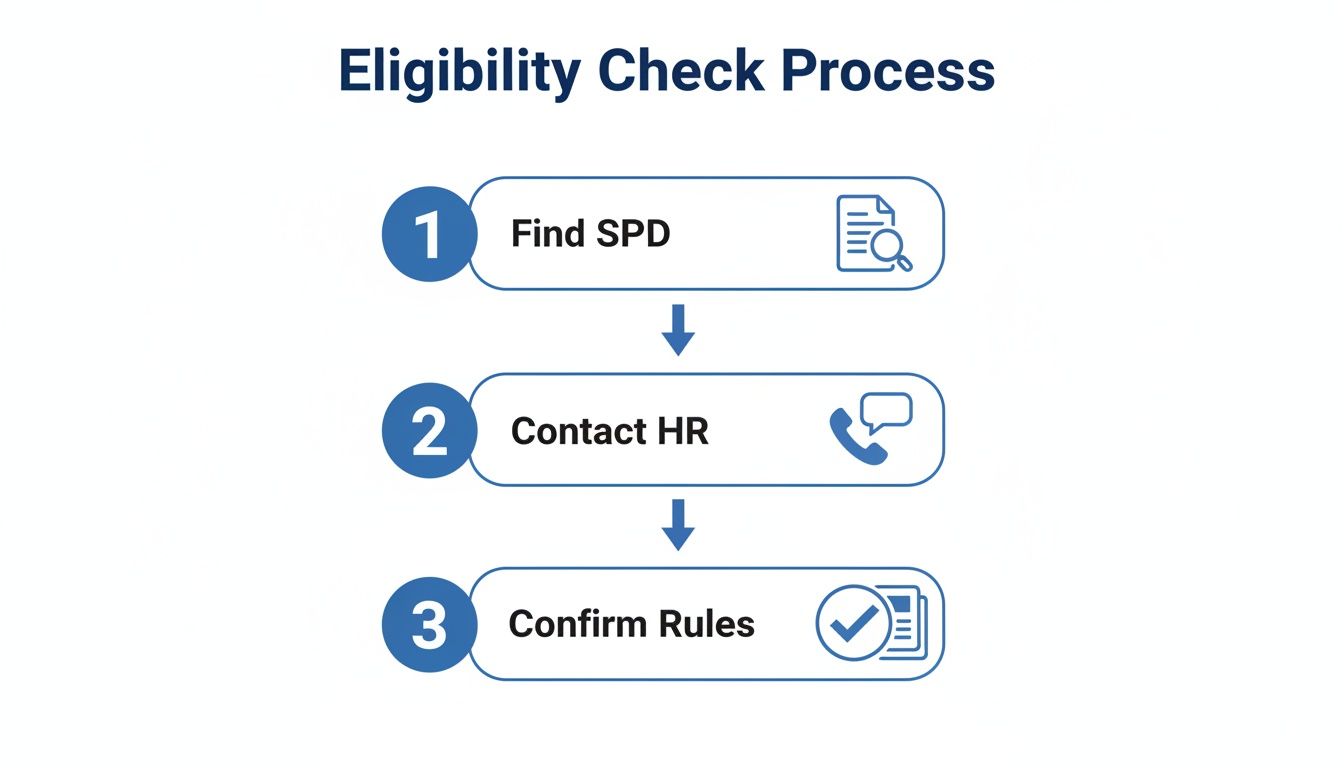

So, you're thinking about an in-service 401(k) rollover to an IRA while still employed. Before you get too far down the road, you need a definitive "yes" from your plan provider. Hoping it's allowed isn't a strategy.

Your starting point is a critical document called the Summary Plan Description (SPD). Think of this as the official rulebook for your 401(k). It spells out exactly what you can and can't do with your money.

You can usually find the SPD on your company’s internal benefits portal or directly on the website of your 401(k) administrator, like Fidelity, Vanguard, or Charles Schwab. Once you have it, do a quick search for terms like "in-service distribution," "in-service withdrawal," or "rollover." The language can be a bit dense, but this is where the clues are hidden.

Finding the Right Person to Ask

While the SPD is your official source, sometimes it’s just easier to talk to a person. You could start with your company's HR or benefits department. They can usually point you to the SPD or give you the contact info for the 401(k) administration company.

For the most accurate answer, though, we always recommend speaking directly with a representative from the plan administrator. They live and breathe these rules every single day and can give you a straight answer without any guesswork.

Real-World Scenario: Jane's Discovery

Jane, a 60-year-old marketing director, wanted to consolidate her retirement accounts to get a clearer financial picture. She found her SPD online and saw a mention of distributions at age 59½, but the legalese was confusing. She just picked up the phone and called the 800 number for her 401(k) provider. After a short wait, a specialist confirmed her plan did, in fact, allow a full in-service rollover of her entire vested balance because she was over the age requirement.

Key Questions to Ask Your Plan Administrator

When you get on the phone, don't be vague. Go in with a list of specific questions to make sure you get all the information you need in one shot.

Here’s a quick checklist to guide that conversation:

- Does my plan permit in-service distributions or rollovers while I am still an active employee? This is the big one. You need a clear yes or no.

- What are the specific eligibility requirements? Ask about age triggers (like 59½), years of service, or any other hoops you have to jump through.

- Which of my funds are eligible to be rolled over? It’s not always an all-or-nothing deal. Make sure to ask about the different "money types."

That last point trips a lot of people up. Many don't realize their 401(k) balance isn't just one lump sum; it's often made up of different buckets of money, and each one might have different rules.

Understanding Your "Money Types"

Your 401(k) isn't just one big pot of cash. It's usually divided into several categories, and your plan might only let you roll over certain ones.

- Employee Pre-Tax Deferrals: This is the money you contribute from your paycheck before taxes.

- Vested Employer Match: These are the matching funds from your company that are now officially yours.

- Vested Profit Sharing: If your company offers profit sharing, this is the portion that has met the vesting schedule.

- Rollover Contributions: This is any money you might have rolled into this 401(k) from an old job.

- After-Tax (Non-Roth) Contributions: Some plans let you make extra contributions after taxes have already been taken out.

For instance, your plan might let you roll over your vested employer match and after-tax money once you hit 59½, but force you to keep your own pre-tax contributions in the plan until you leave the company. Getting this level of detail is absolutely essential before you make any moves.

Executing a Flawless Direct Rollover

Once your plan administrator gives you the green light for a 401(k) rollover to IRA while still employed, it's time to get down to the mechanics. Getting this part right is absolutely critical—one small mistake can lead to a world of unnecessary taxes and penalties. The safest and most common way to handle this is through a direct rollover, often called a trustee-to-trustee transfer.

This method keeps the money moving from one retirement account to another without ever passing through your personal bank account. That's the secret to keeping the tax man out of it.

Kicking Things Off: Open Your New IRA

Your first move is to open a brand-new IRA that will receive the funds. People often call this a "Rollover IRA," but honestly, any traditional IRA will do the trick. You have total freedom here to pick the financial institution that works for you, whether it's a big brokerage like Fidelity or Schwab, a robo-advisor, or your local bank.

When you're setting up the account, make it clear to the new institution that you're planning to fund it with a 401(k) rollover. They'll give you all the account details you need for the next step.

Getting the Paperwork from Your 401(k) Administrator

With your new IRA established and ready to go, it’s time to go back to your 401(k) plan administrator. Let them know you want to start an in-service rollover. They'll hand over a distribution or rollover packet, which is just a fancy term for a stack of forms that require your full attention.

Of course, this assumes you've already done the prep work to confirm you're even allowed to do this.

As the diagram shows, the groundwork is simple but essential: dig up your Summary Plan Description (SPD), chat with HR to confirm the policy, and get a clear "yes" on the rules before you proceed.

Nailing the Rollover Forms

This is where the rubber meets the road. That rollover form will ask how you want the money distributed, and you must select the direct rollover option.

You'll need to fill in the details of your new IRA, including:

- The name of the new firm (e.g., "XYZ Brokerage").

- Your new IRA account number.

- Specific instructions for who gets the check. It has to be made payable to the new custodian for your benefit. The magic words are something like: "XYZ Brokerage FBO [Your Name]." FBO simply means "For the Benefit Of."

Whatever you do, don't have the check made out to you personally. This one detail is what defines a direct rollover and keeps the entire transaction tax-free.

Crucial Warning: The Danger of an 'Indirect' Rollover

If that check is made payable to you, it's now considered an 'indirect' rollover. Your employer is then required by law to immediately withhold 20% for federal taxes. To make matters worse, you have just 60 days to deposit the full amount (including that 20% you never even saw) into your new IRA. If you miss that window, the whole distribution becomes taxable income, and you might get slapped with a 10% early withdrawal penalty. Just stick to the direct rollover. It's clean and safe.

After you've triple-checked the forms, send them back to your 401(k) administrator. It's always a good idea to follow up in a week or so just to make sure they have what they need and see where things stand. Down the line, you'll get tax documents for the transaction, and our guide to understanding Form 1099-R can help you make sense of it all.

Thinking ahead like this is more common than you might realize. Research from industry sources shows that most rollover decisions are made with purpose, with a significant percentage of people deciding to roll over funds before even leaving their jobs. The reasons are pretty straightforward: avoiding orphaned accounts, consolidating assets, and seeking access to better investment choices.

Navigating Special Considerations and Complex Scenarios

An in-service 401(k) rollover isn't always a straightforward transfer of cash. Your retirement account is often a mix of different assets and contribution types, each with its own set of rules that demand careful attention.

Getting these details right is the key to a successful financial strategy and, more importantly, avoiding some pretty costly tax mistakes. From company stock with unique tax treatment to outstanding loans, every situation needs its own game plan. Let's walk through the most common ones.

Handling Company Stock and NUA

If your 401(k) holds company stock, you need to pause and think before rolling it over. You could be sitting on a massive tax-saving opportunity called Net Unrealized Appreciation (NUA).

NUA is simply the difference between what your plan originally paid for the stock (the cost basis) and what it's worth today. Here’s the play: instead of rolling the stock into an IRA, you can transfer the shares directly into a taxable brokerage account. When you do that, you only pay ordinary income tax on the original cost basis.

That "NUA"—all the growth—isn't taxed until you decide to sell the shares. And when you do? It’s taxed at the much friendlier long-term capital gains rate. This can lead to huge tax savings compared to rolling it into a traditional IRA, where every dollar you eventually withdraw gets taxed as ordinary income.

Dealing with After-Tax 401k Contributions

Some plans let you make after-tax (non-Roth) contributions once you've hit your regular pre-tax limits. These funds are a fantastic opportunity, but they require some careful handling during a rollover to prevent a tax headache.

The trick is to cleanly separate your after-tax contributions (your non-taxable basis) from their earnings (which are pre-tax and taxable). A popular and effective strategy is to perform two rollovers at the same time:

- Roll the pre-tax earnings over to a traditional Rollover IRA.

- Roll the after-tax basis directly into a Roth IRA.

This move, often called a "mega backdoor Roth," gets your after-tax money into a Roth account completely tax-free. From there, it can grow and eventually be withdrawn tax-free down the road.

What About an Outstanding 401k Loan?

An outstanding 401(k) loan can throw a major wrench into your rollover plans. The simple fact is, you cannot roll over a 401(k) loan. Most plans will demand you repay the loan in full before they let you move the rest of your money.

If you try to roll over your account with a loan still on the books, the unpaid balance is usually treated as a "loan offset." This immediately turns it into a taxable distribution. To make matters worse, if you're under 59½, that amount will likely get slapped with a 10% early withdrawal penalty, unless you have a qualifying exception.

Before you even think about starting a rollover, your first call should be to your plan administrator. Find out their specific rules on loans. You can also explore other ways to sidestep that penalty in our detailed guide on early withdrawal penalty exceptions.

Rolling Over a Roth 401k

If you're lucky enough to have a Roth 401(k), the rollover process is pretty simple, but there's one critical detail to watch: the 5-year rule for qualified distributions. To take earnings from a Roth IRA tax-free, the account needs to have been open for at least five years, and you have to be over age 59½.

Here’s the nuance: when you roll a Roth 401(k) to a Roth IRA, the 5-year clock for your Roth IRA is based on when you first contributed to any Roth IRA, not your Roth 401(k). If this rollover creates your very first Roth IRA, a brand new 5-year clock starts ticking for any future earnings to be withdrawn tax-free.

Summary of Complex Scenarios

Navigating these special cases requires a clear understanding of the rules and a solid action plan. The table below breaks down these common but complex scenarios into what you need to watch out for and what to do next.

Special Rollover Scenarios and Key Actions

| Scenario | What to Watch Out For | Recommended Action |

|---|---|---|

| Company Stock | Losing the powerful Net Unrealized Appreciation (NUA) tax benefit. | Analyze the stock's cost basis vs. its current market value. Think about moving shares to a brokerage account to capture the NUA advantage. |

| After-Tax Money | Accidentally mixing taxable earnings with non-taxable contributions, which creates a messy tax situation. | Split the rollover: send pre-tax earnings to a Traditional IRA and the after-tax basis directly to a Roth IRA. |

| 401k Loan | The outstanding loan balance becoming a taxable distribution, plus a potential 10% penalty. | Repay the loan in full before you start the rollover, or get crystal clear on your plan's specific rules. |

| Roth 401k | Resetting or misunderstanding the 5-year rule for tax-free withdrawal of earnings in the new Roth IRA. | Roll funds directly to a Roth IRA and be sure to track when your first Roth IRA was funded to monitor the 5-year clock. |

Paying close attention to these details ensures your rollover is not just a transfer of funds, but a strategic move that enhances your overall financial picture.

Weighing the Pros and Cons of an In-Service Rollover

Deciding whether to execute a 401k rollover to IRA while still employed isn't a simple yes-or-no question. It's a real trade-off. You're weighing the benefits you could gain against some unique advantages you might be giving up. To make the right call, you need to look at both sides of the coin and measure them against your own financial goals.

On one hand, the pull of an IRA is strong, usually driven by a desire for more control and flexibility. On the other hand, the built-in perks of a 401(k) provide a valuable safety net that you shouldn’t dismiss too quickly.

The Case for Making the Move

For most people, the main reason to even consider an in-service rollover comes down to one word: options. An IRA opens up a huge world of investment choices that most 401(k) plans just can't compete with. You go from a limited menu of a dozen or so mutual funds to an entire universe of stocks, bonds, ETFs, and even alternative investments.

This expansion of choice brings other key advantages to the table:

- Account Consolidation: It's a chance to finally bring those old 401(k)s and other retirement funds under one roof. This simplifies your financial life and gives you a much clearer picture of your overall portfolio.

- Potential for Lower Fees: While many 401(k)s offer low-cost institutional funds, an IRA gives you more direct control over administrative fees and investment expenses. You get to shop around for the best deal.

- Access to Advanced Strategies: This is a big one. Moving funds to an IRA is often the first step for implementing specific financial plans, like setting up a 72(t) Substantially Equal Periodic Payment (SEPP) to generate penalty-free income before you hit age 59½.

This isn't just a niche strategy; it's part of a massive shift in how people manage retirement savings. The flow of money from 401(k)s to IRAs is projected to swell to over $1.1 trillion every year by 2030. You can explore more data on these massive rollover flows and their market impact if you're curious about the numbers.

Reasons to Hit the Brakes

Despite all the compelling reasons to move your money, there are some very good reasons to think twice before leaving your 401(k) behind. These employer plans have powerful, built-in benefits that are easy to forget about until they're gone.

One of the biggest things you give up is the incredible creditor protection offered under federal ERISA law. Your 401(k) assets are shielded from almost all creditors and lawsuits. IRA protections, on the other hand, vary by state and often don't offer that same level of security.

Beyond the legal safeguards, there are other practical benefits you could lose out on:

- 401(k) Loans: Many plans let you borrow against your balance, which can be a lifesaver in an emergency. An IRA simply doesn't offer this feature.

- Unique Investment Options: Some 401(k)s offer access to things like stable value funds or other institutional asset classes that you just can't buy as an individual retail investor.

- The Rule of 55: This is a huge one. If you leave your job in the year you turn 55 or later, you can take penalty-free withdrawals from that specific 401(k). Once you roll those funds into an IRA, that privilege is gone, and you’re back to waiting until age 59½.

Ultimately, the choice to do a 401k rollover to IRA while still employed is a deeply personal one. You have to weigh the freedom and flexibility of an IRA against the stability and unique protections of your 401(k). Think about your long-term goals, your comfort with risk, and whether the benefits you’d gain are truly worth what you’d be leaving on the table.

Your In-Service Rollover Questions Answered

After digging into the mechanics of a 401(k) rollover to an IRA while still employed, you probably have a few specific questions still rattling around. Let's clear those up. This is where we tackle the most common "what ifs" and "how does this affect…" scenarios we hear from clients, making sure you have the full picture before you act.

Will I Be Taxed on a 401(k) to IRA Rollover While Employed?

No, not if you do it the right way. A properly executed direct rollover—often called a trustee-to-trustee transfer—is a completely non-taxable event. The money simply moves from your 401(k) plan administrator straight to your new IRA custodian. You never actually take possession of it.

Here’s the critical part: the check from your 401(k) provider must be made payable directly to your new IRA custodian, not to you. If your name is on that check, the IRS considers it a distribution. That instantly triggers a mandatory 20% federal tax withholding and starts a 60-day countdown to get the full amount (including the part they withheld) into another retirement account to avoid taxes and penalties.

Stick with the direct method. It’s clean, simple, and tax-free.

Can I Still Contribute to My 401(k) After a Rollover?

Absolutely. An in-service rollover has zero impact on your ability to keep contributing to your 401(k). Your regular payroll deductions will continue without interruption, and you'll keep building your savings in the plan just like you always have.

Think of it this way: you're just moving a chunk of your existing balance out, not closing the account. Your 401(k) stays open and active, ready for all future contributions and any employer match you're entitled to.

What Happens to My Future Employer Match?

Nothing changes. Your eligibility for an employer match is completely separate from an in-service rollover. As long as you keep contributing from your paycheck, you'll continue to receive whatever company match you're entitled to based on the plan's rules.

The money you’re moving is almost always your 100% vested balance—the portion that legally belongs to you. Shifting this vested money to an IRA doesn't alter your employment status or your ongoing participation in the 401(k) plan.

It's important to remember that you can usually only roll over your vested balance. If you have unvested employer contributions, those will remain in the 401(k) plan until they meet the plan's vesting schedule.

How Does Moving Funds to an IRA Affect My Ability to Set Up a 72(t) SEPP?

For anyone considering early retirement income, moving funds from a 401(k) to an IRA isn't just a good idea—it's often a necessary first step. An IRA gives you the control and flexibility needed to establish a 72(t) Substantially Equal Periodic Payment (SEPP) plan.

A 72(t) SEPP is an IRS-approved strategy that allows you to take penalty-free distributions from your retirement account before you turn 59½. While some 401(k) plans might technically permit 72(t) distributions on paper, finding one that actually supports them in practice is incredibly rare. Most plan administrators simply aren't set up to handle the complex calculations and rigid payment schedules.

By completing a 401(k) rollover to an IRA while still employed, you put your money into an account where setting up and managing a 72(t) SEPP is a standard, straightforward process. This move gives you direct control over your assets and unlocks the potential to create a reliable income stream to fund an early retirement on your own terms.

Navigating the complexities of an in-service rollover or planning for early retirement income requires expert guidance. The team at Spivak Financial Group specializes in these precise strategies, including the setup and management of 72(t) SEPPs.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

To explore how you can unlock your retirement funds early and without penalty, visit us at https://72tprofessor.com and take control of your financial future.