A 457 deferred compensation plan is a unique, tax-advantaged retirement account built specifically for people in public service—think state and local government employees. At its core, it's a powerful way to defer, or postpone, receiving a chunk of your salary today. Instead, that money goes into a retirement account where it can grow, and as a bonus, it can lower your taxable income right now.

But its real claim to fame? The incredible flexibility it offers for accessing your money penalty-free when you leave your job, no matter how old you are.

Understanding This Powerful Retirement Tool

Picture a special savings bucket created just for the folks who keep our communities running—firefighters, police officers, teachers, and city administrators. That's exactly what a 457 deferred compensation plan is. It’s a retirement vehicle designed to help these essential workers build a secure future, and it works on a simple but brilliant principle.

With each paycheck, a pre-tax portion of your salary is automatically funneled into your 457 account. You then invest that money based on your personal goals, giving it the chance to grow over the years without getting hit by taxes annually. The immediate win is a smaller taxable income for the year, which could easily mean you owe less to the IRS each April.

Who Is Eligible for a 457 Plan?

Eligibility is where the 457 plan shows its exclusive nature. You can't just sign up for one anywhere; it’s a benefit tied to specific jobs. The main group of people who get access are employees of state and local governments.

The circle widens a little bit from there. Certain tax-exempt, non-governmental organizations, like some hospitals or unions, might offer these plans to their high-level managers and executives. For our focus on early retirement, though, we'll stick to the governmental 457(b) plan, which comes with the best protections and features for employees.

Here's a critical detail: assets in a governmental 457(b) plan are held in a trust for the exclusive benefit of you and your beneficiaries. This is a huge layer of security that protects your nest egg from your employer's creditors if they were to run into financial trouble.

The Defining Feature: Penalty-Free Access

The real magic of the 457 plan, especially if you're dreaming of an early exit from the workforce, is all about the withdrawal rules. Unlike a 401(k) or an IRA, which slaps you with a 10% early withdrawal penalty for touching your money before age 59½, the 457 plan has a total game-changer of an exception.

As soon as you separate from service—meaning you retire or simply leave your job—you can start taking money out of your 457 account. Immediately. With no early withdrawal penalty. This holds true whether you are 55, 50, or even in your 40s.

This single feature makes the 457 deferred compensation plan an absolute cornerstone for anyone looking to build an income bridge to cover their living expenses in the years before they hit traditional retirement age.

This unique "separation from service" rule has been a gift for early retirees, people leaving work to become caregivers, or adventurers who want to travel the world long before Medicare kicks in. First enacted under the Revenue Act of 1978, these plans really took off in the 1990s as states looked for modern benefits to attract top talent. You can dive deeper into the history and specific rules on Plansponsor.com. Just remember one key thing: while these distributions are penalty-free, they are still considered regular income and will be taxed as such.

Maximizing Your Contributions with Catch-Up Provisions

Knowing how much you can sock away in your 457 deferred compensation plan is the first step toward building a serious nest egg. The IRS sets annual limits on contributions, and these often track what you'd see in a 401(k) or 403(b).

These standard limits are quite generous on their own. But the real game-changer with a 457 plan lies in its unique and powerful catch-up provisions. These are special rules that let you contribute far more than the standard limit as you get closer to retirement, giving your savings a massive final push.

Let's break down the two main ways you can accelerate your savings.

The Standard Age 50 Catch-Up

First up is the most familiar tool: the Age 50+ catch-up provision. You’ve probably seen this feature in other retirement plans, and the 457 plan is no different. Once you hit age 50, the IRS lets you contribute an extra amount on top of the regular annual limit.

This is designed for folks who are in the home stretch of their careers. Life happens—mortgages, kids, college tuition—and it's not always possible to max out your retirement accounts in your 30s and 40s. The Age 50+ catch-up gives you a chance to make up for some of that lost time.

The Special 457 Last-Three-Years Catch-Up

Now, here’s where the 457 plan really shines. It offers a second, exceptionally potent catch-up option known as the Special 457(b) Catch-Up, often called the "last three years" provision. This is a savings supercharger available to employees in the three years right before they reach their plan's normal retirement age.

This special provision allows you to contribute up to double the normal annual deferral limit. The catch? You can only use it to make up for years when you were eligible to contribute but didn't put in the maximum allowed.

This means if you have "unused" contribution space from previous years, you can cram it into your account during this three-year window. It’s an incredibly aggressive way to fund your account right before you punch out for good.

There's one critical rule to remember: you can't use both the Age 50+ catch-up and the Special 457(b) Catch-Up in the same year. You have to pick the one that gives you the biggest advantage.

To see how this works, let's walk through a real-world scenario.

Example: A Police Officer's Final Push

- Meet Officer Miller: She’s 52 years old and has her sights set on retiring at 55.

- Her Goal: To absolutely maximize her 457 plan savings in her last three years on the force.

- The Opportunity: Looking back, she sees several years where she contributed far less than the maximum allowed. Her total "under-contributed" amount adds up to over $50,000.

- The Strategy: In the three years leading up to her retirement date (at ages 52, 53, and 54), Officer Miller can activate the Special 457(b) Catch-Up.

- The Result: If the standard annual limit is, say, $23,000, she could potentially contribute up to $46,000 each of those three years. Her total catch-up amount just can't exceed her lifetime under-contribution total.

This move allows her to rapidly inflate her retirement savings, giving her a much larger pool of penalty-free cash to draw from the very day she hangs up her uniform. This is exactly the kind of strategic advantage that can help you hit your retirement goals years ahead of schedule.

457(b) Plan Contribution Limits Overview

To help you visualize these numbers, the table below outlines the standard and catch-up contribution limits. This shows how your maximum potential contributions can change based on your age and proximity to retirement.

| Contribution Type | Description | Annual Limit Example |

|---|---|---|

| Standard Deferral | The maximum amount any eligible employee can contribute annually. | $23,000 |

| Age 50+ Catch-Up | An additional amount for employees who are age 50 or older. | $7,500 (on top of the standard limit) |

| Special 457(b) Catch-Up | Allows up to double the standard limit in the 3 years before retirement age to make up for prior under-contributions. | Up to $46,000 (cannot be used with Age 50+ catch-up) |

These figures, especially the Special Catch-Up, highlight the incredible savings power built into the 457(b) plan design. Keep in mind that these limits are subject to change, and it's always smart to check the latest IRS guidelines. For a look at projected future increases, Plansponsor.com offers some great insights.

How 457 Plans Stack Up Against 401(k)s and IRAs

When you’re trying to pick the right retirement account, it can feel like you’re staring into a bowl of alphabet soup. You’ve got 401(k)s, IRAs, 403(b)s, and each one comes with its own rulebook. But there's one account that often flies under the radar: the 457 deferred compensation plan.

The 457 plan has a few game-changing features that make it an incredibly powerful tool, especially if you're a public sector employee dreaming of an early retirement. Understanding how it differs from the more common accounts is the key to building a truly effective financial strategy.

Let's put these accounts side-by-side to see where the 457 really shines.

The Ultimate Advantage: Penalty-Free Early Withdrawals

Here it is—the single biggest difference and the one feature that makes the 457 plan an early retiree's best friend. Most retirement accounts, including 401(k)s, 403(b)s, and Traditional IRAs, will hit you with a painful 10% penalty if you touch your money before age 59½.

The 457 plan throws that rule right out the window.

As soon as you leave your job—what the IRS calls a "separation from service"—you can access your 457 plan funds immediately. There is zero early withdrawal penalty. This holds true whether you're 55, 45, or even 35.

This isn't just a minor perk; it's a strategic game-changer. It turns your 457 plan into a financial bridge, giving you the income you need to cover your expenses in those years between leaving your career and the age when your other retirement accounts unlock without penalty. You still have to pay ordinary income tax on the withdrawals, of course, but dodging that 10% penalty can literally save you tens of thousands of dollars.

To make this crystal clear, we've put together a simple table comparing the crucial features of these popular retirement accounts.

457 Plan vs. Other Retirement Accounts

This table breaks down the key distinctions between the 457(b) and other common retirement savings vehicles. Pay close attention to the row on early withdrawals—it’s where the 457(b) truly sets itself apart.

| Feature | 457(b) Plan | 401(k) Plan | 403(b) Plan | Traditional IRA |

|---|---|---|---|---|

| Eligible Employees | State/local government, some non-profits | Private-sector employees | Public education, non-profit employees | Anyone with earned income |

| Early Withdrawal Penalty | None after separation from service | 10% before age 59½ (some exceptions) | 10% before age 59½ (some exceptions) | 10% before age 59½ (some exceptions) |

| Catch-Up Options | Age 50+ and a Special "last 3 years" catch-up | Age 50+ catch-up only | Age 50+ catch-up only | Age 50+ catch-up only |

| Contribution Stacking | Can contribute alongside a 401(k) or 403(b) | Shared limit with 403(b) | Shared limit with 401(k) | Separate, lower contribution limits |

As you can see, the 457 plan holds a very unique position in the retirement world.

A Powerful Strategy: Doubling Your Savings

Here's another powerful, and often missed, strategy available to many public employees: contribution stacking. Most retirement plans, like the 401(k) and 403(b), share a single annual contribution limit under IRS section 402(g). That means if you happen to have access to both, your total combined contributions can't go over the limit for one.

The 457 deferred compensation plan plays by a different set of rules entirely.

If your employer offers both a 403(b) and a 457 plan—a pretty common setup for public school teachers or university hospital workers—you can contribute the full maximum to both plans at the same time. This is a massive advantage that allows you to effectively double your tax-deferred savings every single year.

For example, an eligible employee could max out both accounts, letting them defer a whopping $49,000 in 2026 ($24,500 each). With special catch-up provisions, that number can climb even higher. It’s no surprise that, according to the Investment Company Institute (ICI), over 13 million Americans held $1.2 trillion in governmental 457 plans by 2023, showing just how important these accounts have become.

Navigating Withdrawals and Rollover Strategies

Getting your money out of a retirement account is where the rubber really meets the road in your financial plan. For a 457 deferred compensation plan, this process is refreshingly simple and flexible—especially for anyone dreaming of an early retirement.

The plan's most famous feature is its "separation from service" rule. It’s a game-changer. This rule means the moment you leave your job, whether you're retiring for good or just moving on to a new company, you can start taking money out. You won't find this kind of immediate access in many other retirement accounts.

While you get to sidestep the dreaded 10% early withdrawal penalty, it's critical to remember that this money is still treated as ordinary income. You’ll have to pay federal and state income taxes on every dollar you take out.

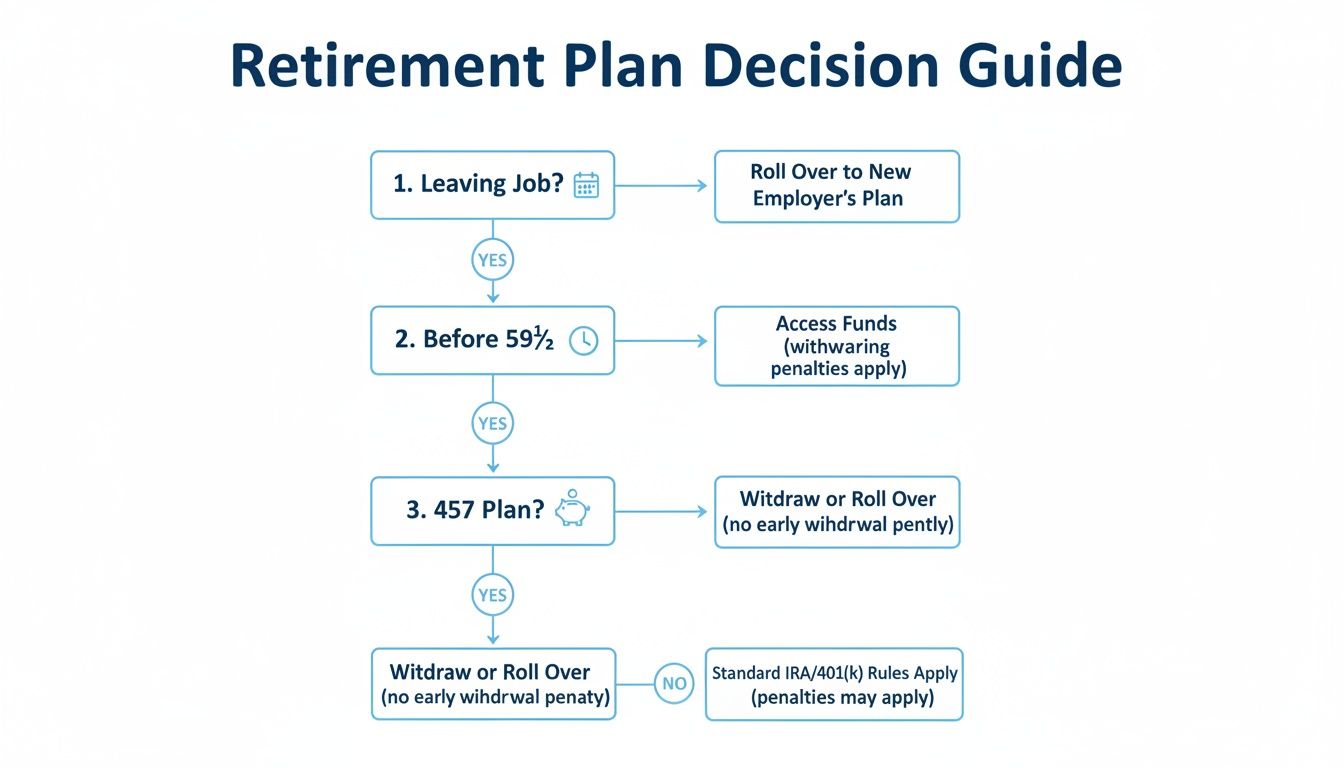

This decision tree gives you a great visual for how straightforward it is to access your 457 plan funds when you leave a job before the traditional retirement age.

As the flowchart shows, having a 457 plan completely bypasses the age 59½ restriction, offering a direct path to penalty-free income for early retirees.

Understanding Your Withdrawal Options

Once you've separated from service, you have a few ways to handle the money in your 457 plan. Your choice will come down to your immediate income needs, your bigger financial picture, and how much control you want over your investments.

Here are the most common paths people take:

- Systematic Withdrawals: You can set up regular payments—monthly, quarterly, or annually—to create a steady, predictable income stream. This is a very popular choice for early retirees looking to replace a paycheck.

- Lump-Sum Distribution: You also have the option to take all your money out at once. While this gives you a big chunk of cash right away, it can have serious tax consequences. You could easily find yourself pushed into a much higher tax bracket for that year.

- Leave It Be: You can just leave your funds right where they are in the 457 plan. They'll continue to grow tax-deferred until you hit the age for Required Minimum Distributions (RMDs).

For many people, the flexibility of a 457 plan is life-changing. Think about a hospital administrator or city worker in their early 50s. Maybe they need to manage caregiving responsibilities or finally want to travel, but they feel stuck because of that 59½ rule on their other accounts. The 457(b) is their penalty-free exit ramp.

Strategic Rollover Decisions

Taking withdrawals isn't your only move; you can also move the money elsewhere. A rollover is just the process of transferring your 457 funds into another tax-advantaged account, like a Traditional IRA or another employer’s plan.

A rollover can be a smart move if you're looking for more investment choices, want to consolidate your retirement accounts for easier management, or wish to execute specific financial strategies not available within your 457 plan.

But—and this is a big one—there’s a critical trade-off. Once you roll governmental 457(b) funds into an IRA or a 401(k), you lose that penalty-free withdrawal benefit. The money is now locked up until you hit 59½. Because of this, many early retirees decide to leave at least some of their money in the 457 plan to act as an income bridge until their other accounts become accessible.

Deciding whether to roll over is a major financial decision. If you're still working but are curious about moving funds from a different account, you can find some great information in our article about a 401(k) rollover to an IRA while still employed. This choice really hinges on your personal timeline and financial needs, making it the perfect topic to bring up with your financial advisor.

Building Your Early Retirement Income Bridge

This is where all the unique features of a 457 deferred compensation plan really come together. We can move from theory to a powerful, actionable strategy for anyone dreaming of early retirement.

Think of your 457 plan not just as another savings account, but as the cornerstone of your financial freedom—an income bridge that carries you from your last day at work to the day you can tap into your other retirement funds without penalty.

For many aspiring early retirees, the single biggest hurdle is figuring out how to generate income before age 59½. That age is the magic number when most retirement accounts unlock, but waiting for it can feel like an eternity. The 457 plan is the direct solution to this exact problem, making it a critical tactical tool for funding the first few years of your new life.

The 457 Plan as Your Financial Bridge

Imagine you need to cross a five-year gap. On one side is your final paycheck at age 55. On the other side is age 59½, the point where your IRA and 401(k) funds finally become accessible without that steep 10% early withdrawal penalty.

Your 457 deferred compensation plan is the material you use to build that bridge, one plank at a time. By drawing a steady income from this account, you can comfortably cover your living expenses during this critical waiting period.

This strategy offers two huge benefits:

- Immediate Income: From day one of retirement, you can start replacing your paycheck without worrying about penalties.

- Asset Preservation: Crucially, it allows your other investments, like your IRA or 401(k), to remain untouched. This gives them more time for tax-deferred growth.

That preservation part is a bigger deal than it sounds. Every extra year your other accounts can grow undisturbed can significantly boost your total wealth, securing a more comfortable financial future for decades to come.

A Real-World Example: Sarah's Early Retirement Story

Let's see this income bridge strategy in action with a simple scenario. Meet Sarah, a dedicated city planner who has diligently saved in both her 457 plan and a Traditional IRA.

- The Goal: Sarah is 55 and ready to retire. She has $250,000 in her 457 plan and $600,000 in her IRA.

- The Challenge: She needs $50,000 per year to live on but wants to avoid the 10% penalty on her IRA withdrawals at all costs.

- The Strategy: As soon as she retires, Sarah begins taking systematic, penalty-free withdrawals from her 457 plan. She sets up monthly payments that total $50,000 annually.

For the next five years, from age 55 to 59, Sarah lives entirely off her 457 funds. During this time, her $600,000 IRA continues to grow, untouched and unburdened by early withdrawals. By the time she turns 60, her IRA could have grown substantially, giving her a much larger nest egg to draw from for the rest of her life.

This strategic use of a 457 deferred compensation plan isn't just about accessing money early; it's about optimizing your entire retirement portfolio. It gives you the control and flexibility to engineer a seamless transition into the retirement you’ve always wanted.

Connecting the Bridge to Future Income Streams

The income bridge doesn't just end abruptly at age 59½. It's designed to connect you smoothly to your next phase of retirement income. Once Sarah's IRA is accessible without penalty, she can taper off or stop her 457 withdrawals and begin tapping into her now larger IRA.

By preserving her IRA, she also set herself up to consider other sophisticated income strategies later on. For instance, if she needed to tap her IRA before 59½ for some reason, she could look into a Substantially Equal Periodic Payment (SEPP) plan, also known as a 72(t) distribution—though her 457 plan makes this much less urgent.

Ultimately, the 457 plan gives you the power to design a retirement timeline that works for you, not one dictated by arbitrary age limits.

Putting Your 457 Plan to Work: Your Next Steps

Now that we’ve pulled back the curtain on the 457 deferred compensation plan, it’s time to move from theory to action. This account isn't just another place to stash savings; it's a powerful tool you can use to design the retirement you actually want, potentially on a much earlier timeline.

What really makes it stand out are those penalty-free withdrawals after you leave your job and the generous contribution limits, especially with the special catch-up rules. But, like any financial tool, the devil is in the details—you have to get familiar with your specific employer's plan. Taking a few deliberate, informed steps right now can change everything down the road.

Your Immediate To-Do List

To get the ball rolling, start with these three essential tasks. This isn't busywork; this is about gathering the personal data you need to build a strategy that works for you.

-

Confirm Your Eligibility: The first, most crucial step is a quick call or email to your HR or benefits department. Ask them one simple question: "Am I eligible for our governmental 457(b) plan, and if so, how do I enroll?"

-

Request the Plan Documents: Once you know you're eligible, your next request should be for the Summary Plan Description (SPD). Think of this document as the official rulebook for your plan. It will spell out everything from your investment options to the exact process for making withdrawals.

-

Evaluate Your Timeline: Take a hard look at your personal retirement goals. Does the 457’s ability to act as an income bridge line up with your ideal retirement date? From there, you can figure out how much you can realistically set aside in contributions.

By taking these concrete steps, you move from simply learning about the 457 plan to actively incorporating it into your financial future. This is the foundation for creating a cohesive retirement strategy.

Building a truly effective retirement income stream often means weaving your 457 plan together with other sources, like a 72(t) SEPP or even Social Security. This is where getting some professional guidance can be invaluable.

The specialists at Spivak Financial Group are experts in crafting early retirement income strategies that make the most of every asset you have. To ensure your plan is fully optimized for your unique situation, it's worth scheduling a consultation. You can reach out to the team at (844) 776-3728 or visit them online at https://72tprofessor.com to create a clear path forward.

Common Questions About 457 Plans

Even after getting the hang of how a 457 deferred compensation plan works, a few specific questions always seem to pop up. Let's tackle some of the most common ones to clear up any lingering confusion and help you move forward with confidence.

Can I Have a 457 Plan and a Roth IRA?

What about contributing to both a 457 plan and a Roth IRA at the same time? The short answer is, absolutely. The contribution limits for these two accounts are completely separate from one another.

This is a huge advantage. As long as you fall within the income limits for a Roth IRA, you can max out your Roth contributions and your 457 plan contributions in the same year. It's a fantastic way to create a powerful dual-savings strategy, pairing the tax-deferred growth of your 457 with the tax-free withdrawals a Roth promises down the road.

What Happens to My 457 If I Change Jobs?

So, you’re leaving your government job for a new role in the private sector. What happens to your plan? This is where the flexibility of a 457 plan really shines. You’ve got a few great options:

- Take the Money: You can start taking distributions right away to supplement your income, completely penalty-free.

- Let It Ride: You can simply leave the money right where it is to continue growing on a tax-deferred basis.

- Roll It Over: You can move the funds into a Traditional IRA. Or, if your new employer's plan allows it, you can roll it into their 401(k).

The ability to tap into your funds without a penalty the moment you leave your job is one of the biggest perks of a 457 deferred compensation plan. It offers a level of financial control you just don't find with most other retirement accounts.

Are All 457 Plans the Same?

No, and it's really important to know which kind you have. The two main flavors are governmental 457(b) plans and non-governmental 457(b) plans.

Governmental plans are the most common and are built for state and local public employees. Critically, your assets are held in a trust, which shields them from your employer's creditors. On the other hand, funds in a non-governmental plan (often found at certain non-profits) are technically considered assets of the employer, which could put your money at risk if the organization runs into financial trouble.

Navigating the rules of a 457 deferred compensation plan and weaving it into an early retirement strategy takes careful planning. At Spivak Financial Group, our team at https://72tprofessor.com specializes in creating the income streams you need to retire on your own terms.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728