A 60-day rollover is a method the IRS allows for moving money out of a retirement account, like a 401(k) or an IRA, and into another one. The catch? You have exactly 60 days to complete the deposit, or you could face a hefty tax bill and penalties.

Think of it as taking a short-term, high-stakes loan from your own retirement savings. Meeting that 60-day deadline is everything.

Understanding the 60-Day Rollover Rule

When you hear the term "60-day rollover," you should immediately think of personal responsibility—and risk. This method, also known as an "indirect rollover," puts the entire process squarely on your shoulders.

Here’s how it works: your plan administrator cuts you a check for your retirement funds. From the moment you have that money in hand, a strict 60-day clock starts ticking.

Your mission is to get the full amount of that withdrawal into a new, eligible retirement account before the deadline hits. If you make it, the transfer is considered tax-free. But if you miss the deadline, even by a day, the IRS treats the whole amount as a taxable distribution. This can trigger not only a big income tax bill but also a painful 10% early withdrawal penalty if you're under age 59½.

Who Uses This Method and Why

While it's not the safest route, some people choose the 60-day rollover for a few specific reasons. It's often used by those changing jobs who want to move an old 401(k) into an IRA for greater investment flexibility. Others might use it to consolidate several retirement accounts into one.

Still, it's vital to know that much safer alternatives exist. We cover these in more detail in our guide on what constitutes a rollover.

Given how often people switch jobs these days, it's a decision millions of Americans face each year. To put the risk into perspective, imagine a $50,000 indirect rollover that misses the deadline. That mistake could easily lead to a tax bill of up to $15,000, plus another $5,000 in penalties. According to an industry analysis on PlanSponsor.com, the U.S. rollover market is massive and growing, highlighting just how many people are navigating this complex process.

60-Day Rollover vs. Direct Rollover

Before you even think about attempting a 60-day rollover, you need to understand its much safer cousin: the direct rollover. A direct, or "trustee-to-trustee," transfer is exactly what it sounds like. The money moves directly from one financial institution to another. You never touch it.

This one simple difference removes nearly all the risks that come with the 60-day rule.

Key Takeaway: The primary difference between a 60-day rollover and a direct rollover is who handles the money. In a direct rollover, the institutions handle it, protecting you from deadlines and tax withholding. In a 60-day rollover, you handle it, assuming all the risk.

To make the choice clearer, let's break down the key distinctions.

60-Day Rollover vs. Direct Rollover at a Glance

This table offers a quick side-by-side comparison to help you see why one method is overwhelmingly preferred by financial experts.

| Feature | 60-Day Rollover (Indirect) | Direct Rollover (Trustee-to-Trustee) |

|---|---|---|

| Who Handles the Funds? | You receive a check made out to you. | The financial institutions transfer the money directly. |

| Risk of Missing Deadline | High. You have a strict 60-day window to deposit the funds. | None. The transfer happens automatically between custodians. |

| Tax Withholding | Mandatory 20% withholding on funds from an employer plan (e.g., 401k). | None. 100% of your funds are transferred. |

| Potential for Error | High. One mistake can lead to taxes and penalties. | Low. The process is handled by professionals. |

| Best For | Very rare situations, such as needing a short-term, interest-free loan (with high risk). | Almost everyone. It's the safest, simplest, and most reliable method. |

As you can see, the direct rollover is the clear winner for safety and simplicity. It eliminates the deadlines, the tax withholding headaches, and the potential for a costly mistake.

How to Pull Off a 60-Day Rollover Without Mistakes

Successfully navigating a 60-day rollover is all about precision and paying close attention to the details. Think of it as a pre-flight checklist for your retirement savings; every single step has to be done correctly to ensure your money lands safely in its new account. If you miss one little detail, the whole plan can fall apart, leaving you with a nasty tax bill and penalties. This guide will walk you through the essential timeline and the exact actions you need to take to get your rollover done right.

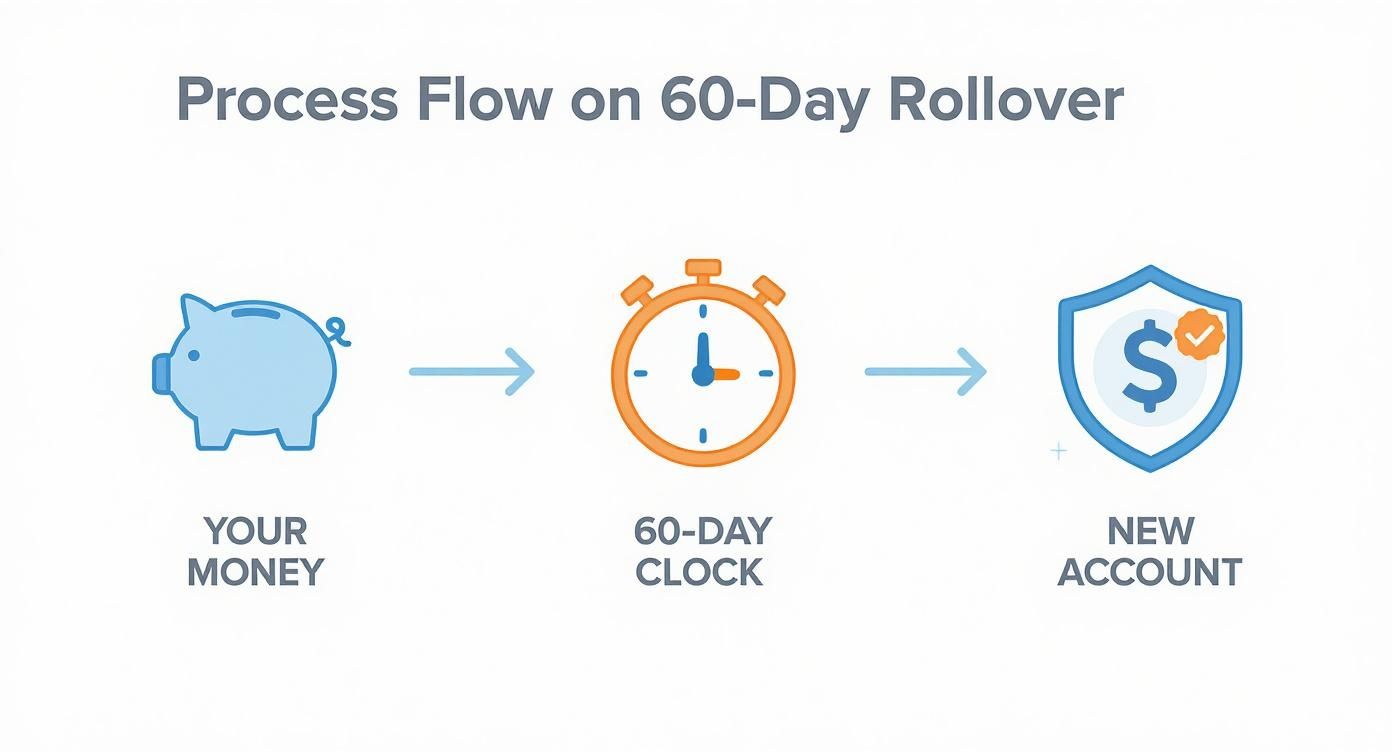

This visual shows the three main phases of the 60-day rollover: getting the money out, racing against the 60-day clock, and getting the funds safely into a new account.

The biggest takeaway here? You, the account holder, are the one moving the money. That puts you right in the middle, which means there’s a risk of human error every step of the way.

Step 1: Start the Withdrawal from Your Old Account

The process kicks off when you make a formal request to your current retirement plan administrator—whether it's a 401(k), 403(b), or another company plan. When you call them or fill out their paperwork, you have to be very clear that you want a full distribution paid directly to you.

Don't be surprised if the administrator asks if you're sure you don't want to do a direct rollover instead. They do this because it's the safer, simpler option for most people. But if you’ve decided the 60-day method is what you need, you’ll just have to confirm your choice.

Once they process your request, they will cut you a check. Crucially, this check will be made out to your name, not to your new financial institution. This is the key detail that makes it an indirect rollover.

Step 2: The 60-Day Clock Starts Now

This is the most critical part of the entire process. The 60-day clock starts the second you receive the funds. It doesn't matter when the check was mailed, what the postmark date is, or when the money left your old account. The countdown begins the day that money is officially in your hands.

Critical Alert: The 60-day period includes weekends and holidays. The IRS counts 60 calendar days, not business days. Miscalculating this deadline is one of the most common—and most expensive—mistakes people make.

You absolutely must document the exact date you get that check. Snap a picture of the envelope with the postmark, keep the certified mail receipt, or make a note of the date it was directly deposited. This proof can be a lifesaver if there’s ever a question about the timeline.

Step 3: Deposit the Full Amount into Your New Account

Before that 60-day window slams shut, you must deposit the entire gross distribution into your new retirement account (like an IRA). And this is where another huge pitfall pops up, especially if you're coming from an employer plan.

If you’re rolling over a 401(k), the plan administrator is legally required to withhold 20% for federal taxes. So, for example, if you request a $100,000 distribution, the check you get will only be for $80,000. The problem is, to complete a tax-free rollover, you have to deposit the full $100,000.

That means you have to find that missing $20,000 somewhere else—like your personal savings—to complete the deposit. You'll get that withheld money back when you file your taxes, but you have to bridge that gap yourself in the short term. If you fail to deposit the full gross amount, the IRS treats the shortfall as a taxable distribution.

Step 4: Document and Report the Rollover

Your job isn't quite done once the money is safely in the new account. Reporting it correctly to the IRS is essential to avoid any trouble down the road.

Here’s what you need to do:

- Keep Meticulous Records: Hang on to every piece of paper from both the old and new custodians. This means the distribution statement, the check stub, and the deposit confirmation from your new account.

- Watch for Tax Forms: Your old plan administrator will send you a Form 1099-R showing the gross distribution. The code in Box 7 will likely flag it as a taxable event, which is why your tax return reporting is so important.

- Report Correctly on Your Taxes: When you file your Form 1040, you’ll report the total distribution amount on the appropriate line. But right next to it, you will list $0 as the taxable amount and write "ROLLOVER." This is how you signal to the IRS that you completed the transaction properly within the 60-day window.

By following these steps to the letter, you can manage the risks that come with a 60-day rollover. But as you can see, there’s simply no room for error. It's a strategy that should only be used when you have a complete understanding and a rock-solid plan.

Decoding Strict IRS Rules and Costly Penalties

While a 60-day rollover sounds simple on paper, the IRS rules governing it are incredibly strict and unforgiving. Think of these regulations as hidden tripwires. One wrong step can trigger a cascade of costly penalties, turning a routine financial move into a major tax nightmare.

Understanding these rules isn't just good practice; it's essential for protecting your hard-earned retirement savings. We'll focus on two of the biggest financial traps you can run into: the mandatory tax withholding on employer plans and the confusing "one-rollover-per-year" rule for IRAs.

Ignoring these regulations can seriously derail your financial future, but knowing what they are is the first step toward avoiding them completely.

The Mandatory 20 Percent Withholding Trap

Here's the first major snag. When you request a 60-day rollover from an employer-sponsored plan like a 401(k) or 403(b), the IRS forces your plan administrator to withhold a minimum of 20% for federal income taxes. This is not optional. You can't ask them to waive it, even if you promise to roll the full amount over right away.

This withholding creates an immediate financial shortfall you're personally on the hook for. The IRS doesn't care that you only received 80% of your money; they expect you to deposit 100% of the original distribution into the new account to complete a valid, tax-free rollover.

Let's walk through a real-world scenario to see how this plays out.

Example: The $10,000 Shortfall

Imagine you decide to roll over $50,000 from your old 401(k).

- You ask your old employer for a distribution check made out to you.

- Your plan administrator is required to withhold 20%, which is $10,000 ($50,000 x 0.20).

- The check you receive in the mail is only for $40,000.

To pull off a tax-free rollover, you must deposit the full $50,000 into your new IRA within the 60-day window. That means you have to come up with the missing $10,000 from somewhere else, like your personal savings. If you only deposit the $40,000 you actually received, the IRS will treat that $10,000 shortfall as a taxable distribution, hitting you with income tax and a potential 10% early withdrawal penalty.

You can get the withheld $10,000 back, but only when you file your tax return for that year. The IRS sees it as a prepayment of taxes, which you can claim as a credit. However, this refund comes months later, long after your 60-day rollover deadline has passed.

The One-Rollover-Per-Year Rule for IRAs

The second major trap is the IRS's strict "one-rollover-per-year" rule, which applies specifically to IRA-to-IRA rollovers. This rule is often misunderstood and can lead to disastrous tax consequences if you get it wrong.

The rule states that you can only make one tax-free, 60-day rollover from one IRA to another IRA in any 12-month period. This 12-month clock starts on the day you receive the distribution from the first IRA, not on January 1st.

This limitation was put in place to stop people from using their retirement funds as a series of short-term, interest-free loans. A single misstep can invalidate your second rollover, making the entire amount a taxable distribution.

Critical Clarifications on the One-Year Rule

It's vital to understand what this rule does and does not cover.

- It Applies to All Your IRAs: The limit is one rollover for all of your IRAs combined, not one per account.

- It Does Not Apply to Conversions: Moving money from a Traditional IRA to a Roth IRA (a Roth conversion) doesn't count toward this limit.

- It Does Not Apply to Direct Transfers: The rule only applies to 60-day indirect rollovers where you take possession of the funds. It does not apply to trustee-to-trustee (direct) transfers, where the money moves directly between institutions without you ever touching it.

Because of these complex rules and the high financial stakes, many financial experts at firms like Spivak Financial Group advise clients to avoid the 60-day rollover whenever possible. The risk of a simple mistake causing significant tax damage is often too high when a much safer alternative—the direct rollover—is readily available.

Avoiding the Most Common 60-Day Rollover Pitfalls

Knowing the official IRS rules is one thing, but navigating the real world of a 60-day rollover is another. It's a landscape filled with common, costly mistakes that can trip up even the most diligent person. Flawless execution is the only option here, because one small misstep can have huge financial consequences. Think of this section as your field guide to sidestepping those frequent but completely avoidable errors.

We'll walk through everything from simple calendar goofs to the kinds of tax reporting errors that send up red flags at the IRS. For every potential pitfall, there's a straightforward, proactive strategy to protect your retirement savings. Armed with the right knowledge, you can get through this process with confidence.

The Deadline Miscalculation Error

One of the most common—and devastating—mistakes is simply miscalculating the 60-day deadline. People often hear "60 days" and think it means business days. The reality is the IRS counts every single day: weekends and holidays included.

This isn't a minor detail. If your 60th day happens to land on a Sunday or a federal holiday, you don't get a pass until the next business day. The deadline is absolute.

To avoid this trap, the moment you receive the funds, pull out a calendar. Mark the date and count out exactly 60 calendar days. Set multiple reminders on your phone as that final date gets closer. Never, ever assume you have more time than you actually do.

The 20 Percent Withholding Shortfall

We've mentioned it before, but it's worth repeating because it catches so many people off guard. When you roll money out of an employer plan like a 401(k), they are required to withhold 20% for federal taxes. The gut-punch comes when you get a check for only 80% of your account value but realize you're on the hook for depositing 100% of it.

If you don't make up that 20% difference out of your own pocket, the IRS treats the withheld amount as a taxable distribution. That means it’s subject to your ordinary income tax rate, plus a potential 10% early withdrawal penalty.

Proactive Strategy: Before you even start the rollover process, have the cash to cover that 20% ready to go. If you're rolling over $50,000, you will get a check for $40,000. You need to have that other $10,000 sitting in a separate account, ready to be deposited along with the check. This isn't just a good idea; it's non-negotiable.

Depositing Funds into the Wrong Account

Another subtle but damaging mistake is putting the rollover money into the wrong kind of account. For instance, you can't just drop pre-tax 401(k) funds into a Roth IRA. That move isn't a rollover; it's a taxable Roth conversion, and you'll get a tax bill to match.

Even worse is depositing the money into a non-retirement account, like your personal checking or brokerage account. Doing that instantly invalidates the entire rollover. The full amount immediately becomes a taxable distribution.

Here's how you stay on the straight and narrow:

- Open the Correct Account First: Get your new rollover IRA set up and ready before you even ask for the distribution from your old plan.

- Confirm the Account Type: When you open the new account, double-check with the financial institution that it's a "Rollover IRA" or a "Traditional IRA" specifically designed to receive pre-tax funds.

- Provide Clear Instructions: When you go to make the deposit, make it crystal clear that this is a "rollover contribution." This ensures it's coded correctly from the start.

Tax Reporting Mistakes

You can do everything else perfectly, but a simple mistake on your tax return can still trigger an IRS inquiry. Your old plan will send you a Form 1099-R reporting the distribution. From there, the ball is in your court to prove to the IRS that the money was safely rolled over.

The most frequent reporting error is just forgetting to note the rollover on your Form 1040. If the IRS sees the distribution from the 1099-R but doesn't see you account for it as a non-taxable event, they'll just assume you owe taxes and penalties on the whole amount.

Be sure to report the gross distribution amount on the correct line of your tax return, put $0 in the box for the taxable amount, and write the word "ROLLOVER" next to the line. Keeping meticulous records from both financial institutions is your best defense if the IRS has questions. Navigating these details is precisely why many people seek out professional help. For expert guidance on complex retirement transactions, you can reach out to Spivak Financial Group at (844) 776-3728 to ensure every step is handled correctly.

Why a Direct Rollover Is Almost Always Safer

After looking at the tight deadlines, mandatory tax withholding, and all the ways a 60-day rollover can go wrong, it’s pretty clear why this method is so risky. Thankfully, there’s a much simpler and more secure alternative that financial professionals almost universally recommend: the direct rollover.

Here's a good way to think about it: a 60-day rollover is like being asked to carry a briefcase full of your life savings across a busy city. A direct rollover is like using an armored truck. Both get the money where it needs to go, but one is overwhelmingly safer and cuts out nearly all the risk.

This hands-off approach is the gold standard for moving retirement money, protecting your nest egg from unnecessary headaches and costly mistakes.

The Power of Keeping Your Hands Off the Money

A direct rollover, sometimes called a trustee-to-trustee transfer, is exactly what it sounds like. The money moves straight from one financial institution (the "trustee") to another, and you never actually take possession of the funds.

Your old 401(k) plan administrator will either wire the money to your new account or cut a check made payable to the new institution for your benefit—something like, "Fidelity Management Trust Co. FBO [Your Name]." Because the funds never hit your personal bank account, the whole process is insulated from human error.

This one simple difference is what makes the direct rollover so much more secure. It neatly sidesteps all the biggest dangers you’d face with a 60-day rollover.

Eliminating the Biggest Rollover Risks

When you opt for a direct rollover, you automatically avoid the most common and expensive pitfalls. The transfer is managed by professionals, which neutralizes the primary threats to your retirement savings.

Here’s how a direct rollover protects you:

- No 60-Day Deadline: Since you never get the money, there’s no ticking clock. The institutions handle the transfer, so you don’t have to stress about missing that critical deadline and triggering a massive tax bill.

- No Mandatory 20% Withholding: That nasty 20% mandatory withholding only applies when a distribution is paid directly to you. In a direct rollover, 100% of your money is moved to the new account, with nothing sent to the IRS.

- Reduced Chance of Error: The pros are handling it. This removes the risk of you miscalculating the deadline, accidentally depositing the funds into the wrong account, or forgetting to make up the withholding amount from your own pocket.

This method ensures your money gets where it needs to go smoothly, completely, and without any surprise tax consequences.

A Clear Comparison Direct vs Indirect Rollovers

To really see why the direct rollover is the preferred choice, putting them side-by-side makes the advantages crystal clear. One path is simple and secure; the other is complicated and full of risk. For more on your options, you can check out our detailed guide on how to take money from a 401(k) safely.

| Feature | Direct Rollover (Trustee-to-Trustee) | 60-Day Indirect Rollover |

|---|---|---|

| Fund Movement | Money is sent directly from the old institution to the new one. | A check is made out to you, and you are responsible for depositing it. |

| Possession of Funds | You never touch the money. | You take temporary possession of the funds. |

| Tax Withholding | None. 100% of your money is transferred. | Mandatory 20% withholding from employer plans (e.g., 401k). |

| Deadline Pressure | None. The transfer is handled professionally. | Strict 60-day deadline that includes weekends and holidays. |

| Complexity | Low. You fill out paperwork, and the institutions do the rest. | High. You manage every step and bear all the responsibility and risk. |

The bottom line is clear: a direct rollover insulates you from the rules and deadlines that make an indirect, 60-day rollover so dangerous. Unless you have a very specific, well-understood reason for needing temporary access to the funds, the direct rollover is always the smarter, safer path for your financial future.

How a Rollover Can Jeopardize Your 72(t) SEPP Plan

When you're using a Substantially Equal Periodic Payment (SEPP) plan, often called a 72(t), the rules around moving money are more than just strict—they're landmines. A SEPP is an incredible tool that lets you access retirement funds before age 59½ without penalties, but it’s built on a foundation of unforgiving IRS regulations. One wrong move can blow up your entire financial strategy.

The most critical thing to grasp is this: the IRS treats almost any change to the IRA funding your SEPP as a "modification" of the plan. This includes rolling money into the account just as much as rolling money out of it. Making that mistake doesn't just mess up future payments; it retroactively nukes the entire plan from the day you started it.

The Modification Rule and Its Painful Consequences

Think of your SEPP as a delicate, sealed ecosystem. Once you set it up, you can't add anything to it or take anything from it, other than the scheduled payments. A rollover, no matter how small or well-intentioned, is like cracking that seal. The whole thing shatters.

When a SEPP is modified, the fallout is both severe and immediate:

- Retroactive Penalties: The 10% early withdrawal penalty gets slapped on every single distribution you've ever taken from the plan.

- Compounded Interest: To make matters worse, the IRS charges interest on those penalties, going all the way back to the year each distribution would have been taxed.

That means a simple, innocent attempt to consolidate your accounts with a 60 day rollover can trigger a massive, blindsiding tax bill that erases years of careful financial planning.

The IRS views an IRA under a 72(t) plan as a sealed system. Any contribution or distribution outside of the scheduled SEPP payments breaks that seal and busts the entire plan, with penalties applied retroactively.

A Case Study in Costly Mistakes

Let's look at a common, and costly, scenario. An individual, we'll call her Jane, has a $500,000 IRA that's funding her 72(t) SEPP. Two years into her payment schedule, she leaves her job and decides to roll her old $100,000 401(k) into that same IRA to keep things simple.

By doing this, Jane just modified her SEPP. The IRS now sees all her previous SEPP distributions as unqualified early withdrawals. If she had taken $25,000 a year for those two years, that $50,000 is now subject to a $5,000 penalty (10%), plus interest.

This is a critical warning for anyone on a 72(t) plan. The rules are absolute, and a single rollover can unravel everything. You can learn more by exploring the detailed Substantially Equal Periodic Payments rules that govern these complex plans.

Because the stakes are so high, it is essential to get professional guidance before moving any money connected to a SEPP. You can contact an expert like the 72t Professor at Spivak Financial Group at (844) 776-3728 to make sure a simple transaction doesn't turn into a financial catastrophe.

Answering Your Top Questions About the 60-Day Rollover

When you're dealing with something as high-stakes as a 60-day rollover, it's natural to have a few questions. Let's tackle some of the most common ones to clear up any confusion and help you sidestep some very expensive mistakes.

What Happens If I Miss the 60-Day Deadline?

Missing the deadline is a big deal. Even being one day late triggers some serious financial consequences. The IRS will immediately reclassify the entire amount as a taxable distribution for that year.

This means you'll owe ordinary income taxes on the full amount. And if you're under age 59½, the hit gets worse—you'll also get slapped with an additional 10% early withdrawal penalty. While the IRS might grant a waiver in very specific cases, like a documented bank error or a severe personal tragedy, you can't count on it. Getting that relief is a long shot and requires a formal request.

Can I Use the Rollover Money for a Short-Term Loan?

Technically, yes, the money is in your hands. But this is one of the riskiest financial maneuvers you can attempt with your retirement savings. You're essentially betting your entire nest egg that nothing will go wrong.

If you can't redeposit the full amount back into a retirement account within those 60 days—for any reason at all—it's no longer a rollover. It becomes a permanent, taxable withdrawal. Any money not returned, including the 20% automatically withheld from a 401(k), gets hit with both income taxes and potential penalties.

Expert Warning: Using a 60-day rollover as a short-term, interest-free loan is playing with fire. One small miscalculation or an unexpected bill can cause an irreversible tax disaster.

Does the 20 Percent Withholding Apply to IRA Rollovers?

No, it doesn't. That mandatory 20% federal tax withholding is a rule specifically for distributions from employer-sponsored plans like a 401(k) or 403(b).

When you move money from one IRA to another using a 60-day rollover, there's no automatic withholding. But don't let that fool you into thinking it's risk-free. You're still subject to the strict one-rollover-per-year rule for all your IRA-to-IRA transfers, which is why a direct, trustee-to-trustee transfer is almost always the safer bet.

How Do I Report a 60-Day Rollover on My Taxes?

Reporting this correctly on your tax return is how you prove to the IRS you completed the rollover properly. Your old plan administrator will send you a Form 1099-R showing the total amount you took out.

When you file your Form 1040, you’ll report that gross distribution amount on the line for pensions and annuities. The key step is to then enter $0 as the taxable amount and write the word "ROLLOVER" in the margin next to that line. This simple note tells the IRS it was a non-taxable event.

Navigating complex retirement rules like the 60-day rollover or a 72(t) SEPP requires precision and expert knowledge. At Spivak Financial Group, we specialize in creating safe, penalty-free early retirement income streams. Let the experts at 72tProfessor.com guide you toward a secure financial future.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com