Thinking about tapping into your retirement savings early? It's a tempting thought, especially when life throws a curveball, but it's a decision loaded with serious financial strings attached. Dipping into those funds before you hit age 59½ almost always triggers a painful 10% IRS penalty, and that's on top of the regular income tax you'll owe. This one-two punch can take a huge bite out of your nest egg and ripple through your long-term financial plans.

The Reality of Taking Money Out of Retirement Early

Imagine your retirement fund is like a tree you've painstakingly grown from a sapling. Cashing it out early is like chopping it down for firewood when it was just about to produce a lifetime of fruit. Sure, it solves a short-term problem, but you lose out on all the future growth that was right around the corner.

If you're feeling the pressure, you're not alone. Many people find themselves in a tight spot where their retirement account looks like the only life raft. In fact, it's become surprisingly common. Every year, about 13% of people between 25 and 55 make a penalized early withdrawal from their retirement savings.

These early distributions add up to nearly 25% of all the money contributed annually, which is a staggering blow to the retirement security of millions. You can explore more data on this trend in retirement saving in America.

Weighing an Immediate Need Against Future Security

This is the classic dilemma: solve a crisis today or protect your tomorrow? An early withdrawal gives you cash in hand, but it creates two massive problems. First, there's the immediate loss from taxes and penalties. Second, and often more devastating, is the invisible loss of future compound growth. That $10,000 you pull out today could have easily become $40,000 or more by the time you actually planned to retire.

A premature withdrawal doesn't just shrink your balance today; it permanently clips the wings of your future self. It's a choice that demands a hard look at every single alternative first.

To give you a clearer picture, here's a quick summary of what you're up against.

Early Withdrawal At a Glance

| Consideration | Typical Impact |

|---|---|

| IRS Penalty | A 10% penalty is applied to the taxable portion of the distribution. |

| Income Taxes | The withdrawn amount is added to your income and taxed at your regular rate. |

| Lost Growth | You forfeit all future tax-deferred compound interest on the withdrawn funds. |

| Reduced Nest Egg | Your principal balance is permanently lowered, reducing your retirement security. |

Making an informed choice means understanding both the immediate hit and the long-term opportunity cost.

What This Guide Covers

We built this guide to give you a clear, no-nonsense roadmap for navigating this decision. We're going to walk through:

- The true costs, including the 10% IRS penalty and how income tax works on withdrawals.

- Smarter alternatives that can get you cash without raiding your retirement account.

- Legitimate, penalty-free exceptions for big life events like a disability or buying your first home.

- Strategic plans, like a 72(t) SEPP, that allow structured, penalty-free access under specific rules.

Understanding these moving parts is the first step toward making a decision that protects your financial health, both now and in the future. At Spivak Financial Group, we help clients make sense of their options every day. Give us a call at (844) 776-3728 to talk through your situation.

Understanding the True Cost of an Early Withdrawal

Dipping into your retirement money ahead of schedule isn't like taking cash from a checking account. It's a decision loaded with costs—some obvious, some hidden—that can seriously shrink your nest egg for years to come.

The most immediate hit is the 10% early withdrawal penalty the IRS slaps on distributions taken before you hit age 59½. But that’s just the tip of the iceberg.

This penalty doesn’t take the place of your regular income taxes; it’s an extra tax piled right on top. The money you pull out is also counted as income for the year, which can easily bump you into a higher tax bracket and leave you with a much bigger bill for Uncle Sam.

The One-Two Punch of Taxes and Penalties

Let's walk through a real-world example to see just how damaging this can be. Say you need $20,000 for a sudden emergency and decide to pull it from your 401(k).

- You're in the 22% federal income tax bracket.

- Your state charges a 5% income tax.

Most people mistakenly think they’ll just lose the 10% penalty. The reality is far more painful.

Your Actual Take-Home Cash

- IRS Early Withdrawal Penalty: 10% of $20,000 = $2,000

- Federal Income Tax: 22% of $20,000 = $4,400

- State Income Tax: 5% of $20,000 = $1,000

In this scenario, your $20,000 withdrawal is instantly whittled down to just $12,600. A staggering $7,400—or 37% of your money—is gone before you even get to use it.

This immediate loss turns a seemingly simple solution into an expensive mistake. And believe it or not, these upfront costs are only part of the story. The "invisible" costs can hurt even more down the road.

The Invisible Cost of Lost Compounding

Beyond the instant tax hit lies a much deeper financial wound: the loss of future growth. This is often called opportunity cost. When you withdraw money from a retirement account, you're not just taking out the cash; you're killing off all the future earnings that money could have generated.

Think of it like chopping down a young apple tree for firewood. You get a little warmth today, but you give up decades of future apple harvests. That $20,000 you just took out could have easily grown into $80,000 or more over the next 20 to 30 years, all thanks to the magic of tax-deferred compounding.

This isn’t just theory; it’s backed by foundational financial research. The famous Trinity Study, for example, showed just how vital it is to protect your retirement principal. It found that retirement portfolios with withdrawal rates over 6% a year had a less than 75% chance of lasting through a 30-year retirement. Taking a big, early lump sum is like an extreme withdrawal, dramatically raising the odds you'll run out of money when you need it most.

Projecting the Full Long-Term Impact

To really see the long-term damage, you have to look beyond a simple tax calculation. You need to understand how a smaller starting balance will alter your financial path for decades to come. Tools like a Monte Carlo simulation can project thousands of possible financial outcomes, revealing the full and often shocking scope of what that early withdrawal truly costs you.

These projections usually tell a sobering story: a single early withdrawal can push your retirement date back by years or force you to get by on a much smaller income in your golden years. It’s a decision with a very long echo. Before making any move, it's critical to speak with a financial professional who can map out these consequences for your specific situation. The team at Spivak Financial Group is available at (844) 776-3728 to help you see the full picture.

How to Navigate Penalty-Free Withdrawal Exceptions

While that 10% penalty is a powerful deterrent against taking money out of your retirement early, the IRS gets it—life happens. Sometimes things come up that are completely out of your control. For exactly these situations, they've carved out specific exceptions that can act as a financial lifeline, letting you tap into your funds without that painful extra hit.

But let's be crystal clear on one thing. Even if you qualify for an exception, you're only sidestepping the 10% penalty. The money you pull out is still considered taxable income, meaning you'll owe federal and state income taxes on it. Think of these exceptions less as a free pass and more as a way to control the damage during a genuine crisis.

Getting this right means paying close attention to the details, as every exception comes with its own strict set of rules and documentation requirements.

Qualifying for Medical Expense Withdrawals

One of the most common escape hatches is for unreimbursed medical expenses. If you find yourself with medical bills that climb higher than 7.5% of your adjusted gross income (AGI) for the year, you can withdraw money from your retirement account, penalty-free, to cover the amount above that threshold.

Let's make that real. Say your AGI is $80,000. Your threshold is $6,000 (7.5% of $80,000). If you're facing $15,000 in unreimbursed medical bills, you could withdraw up to $9,000 ($15,000 minus $6,000) without the 10% penalty biting you. Just be sure to keep meticulous records of all your bills and payments, because you’ll need them if the IRS comes knocking.

Disability and Health Insurance Exceptions

Another critical group of exceptions is built around significant health challenges and job loss.

- Total and Permanent Disability: If you become totally and permanently disabled, you can access your retirement funds without the early withdrawal penalty. This isn't a self-diagnosis; you'll need a doctor's certification stating you can't perform any substantial gainful activity due to your condition.

- Health Insurance Premiums: If you lose your job and have been receiving unemployment compensation for 12 consecutive weeks, you can use retirement funds penalty-free. This money is specifically for paying health insurance premiums for yourself, your spouse, and your dependents.

These rules exist to provide some much-needed financial breathing room during some of life's absolute toughest moments.

Understanding these specific exceptions is key to making a financially sound decision in a difficult time. Getting it wrong can be costly, but getting it right can save you thousands in unnecessary penalties.

Education and Homebuying Opportunities

The IRS also provides penalty-free pathways for big life milestones, like paying for college or buying your first home. Here’s a crucial distinction, though: these exceptions usually only apply to IRAs, not 401(k)s. If your money is in a 401(k), you’d typically need to roll it over into an IRA first to take advantage of these.

Higher Education Expenses

You can take money out of an IRA penalty-free to cover qualified higher education expenses. This isn't just for you—it can be for your spouse, children, or even your grandchildren. Qualifying costs include tuition, fees, books, and other required supplies.

First-Time Home Purchase

Dreaming of homeownership? You can withdraw a lifetime maximum of $10,000 from your IRA penalty-free to help buy, build, or rebuild a first home. If you and your spouse are both first-time buyers, you can each pull out $10,000 from your respective IRAs for a combined $20,000 toward your new place.

Common Exceptions to the 10% Early Withdrawal Penalty

To help you see how this all fits together, here’s a quick comparison of the most common exceptions and the accounts they typically apply to. Always remember to double-check your specific plan documents, because not all 401(k) plans will allow for every type of withdrawal, even if the IRS does.

| Exception Type | Brief Description | Common Account Types |

|---|---|---|

| Medical Expenses | Covers costs exceeding 7.5% of your AGI. | IRA, 401(k), 403(b) |

| Disability | For total and permanent disability. | IRA, 401(k), 403(b) |

| First-Time Homebuyer | Up to $10,000 lifetime limit for a first home. | IRA Only |

| Higher Education | For qualified tuition, fees, and books. | IRA Only |

| Military Reservist | For reservists called to active duty. | IRA, 401(k), 403(b) |

While these exceptions are incredibly useful, they are often narrow and designed for very specific situations. If you need more substantial or flexible access to your funds before hitting age 59½, a structured plan might be a much better fit.

You can learn more about how to cash out a 401k without penalty in our detailed guide. For complex situations, speaking with an expert at Spivak Financial Group at (844) 776-3728 can provide clarity and direction.

Exploring the 72(t) SEPP Strategic Withdrawal Plan

So what happens if you need a steady, predictable income stream before you hit retirement age? The penalty-free exceptions we’ve already covered are great, but they’re mostly designed for one-off events. For a more robust, long-term solution for taking money out of retirement early, you’ll want to look at a strategy called a Series of Substantially Equal Periodic Payments, or SEPP.

Governed by IRS Rule 72(t), this strategy is powerful. It essentially lets you turn your retirement account into your own private pension, giving you penalty-free income before you turn 59½. It’s a perfect fit for early retirees or anyone who needs a consistent cash flow over many years. But be warned: it demands absolute precision and a serious long-term commitment.

How a 72(t) SEPP Works

You can think of a 72(t) SEPP as a formal contract you make with the IRS. In exchange for the IRS waiving the 10% early withdrawal penalty, you agree to take a very specific, carefully calculated amount of money from your IRA or 401(k) every single year. This isn't a "take what you need, when you need it" deal; the payment amount is locked in by strict formulas.

The IRS gives you three approved methods to figure out your annual distribution. Each one takes your account balance, your life expectancy, and a reasonable interest rate into account to arrive at your magic number.

The Three IRS-Approved Calculation Methods

Choosing the right calculation method is your first critical decision. It directly sets your annual income and impacts the health of your portfolio for years to come.

- Required Minimum Distribution (RMD) Method: This is the most straightforward formula. It simply divides your account balance by a life expectancy factor from the IRS tables. Because the payment amount is recalculated every year, it will go up and down with your account balance and age. This method usually gives you the lowest initial payment, but it’s flexible.

- Amortization Method: This approach calculates a fixed annual payment that’s designed to evenly draw down your retirement account over your life expectancy, much like a mortgage payment. The payment amount stays exactly the same year after year, giving you a stable and predictable income.

- Annuitization Method: This method also gives you a fixed annual payment, but it uses an annuity factor from IRS tables to determine the amount. The math is a little different, and the payment often lands somewhere between what the RMD and amortization methods would produce.

Getting into the weeds of these calculations can get complex, and picking the wrong one can have consequences that stick with you. For a much deeper dive into the mechanics, you can explore how a 72t SEPP plan works in our detailed guide.

The most crucial thing to understand about a 72(t) plan is its rigidity. Once you start, you are locked in. You cannot stop or change the payments for at least five years or until you reach age 59½—whichever period is longer.

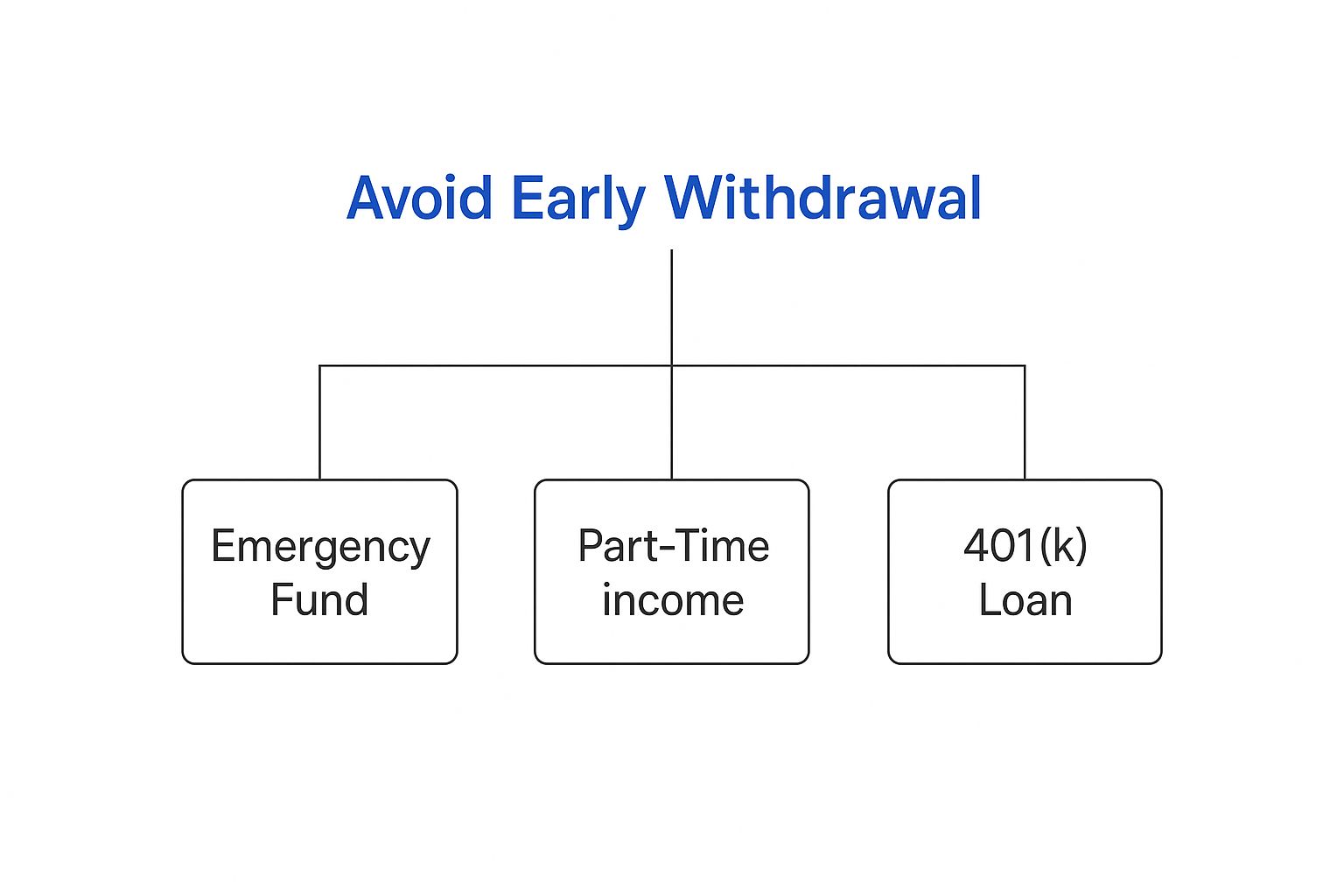

This chart helps put the decision to take an early withdrawal into perspective.

As you can see, strategies like building an emergency fund or even taking out a 401(k) loan are often better first steps before you resort to pulling money out of your retirement accounts for good.

The Unforgiving Nature of SEPP Rules

Breaking your 72(t) agreement with the IRS has truly severe consequences. If you take too much, too little, or just stop the payments before your lock-in period is over, the IRS will hit you with the 10% penalty retroactively. That means applying it to every single withdrawal you’ve made since day one, plus interest. There is absolutely no wiggle room here.

It’s this unforgiving nature that makes a 72(t) plan something you should never try to DIY. We're seeing more people look into these plans as economic pressures mount. Hardship withdrawals from 401(k)s have skyrocketed, hitting a record high of over 1,500 in May 2025 alone. That's a jaw-dropping 365% increase compared to the five-year average before 2022, fueled by inflation and the restart of student loan repayments. This trend really underscores why a structured, disciplined solution like a SEPP is becoming more attractive.

To pull this strategy off perfectly, you need professional guidance. A financial advisor who specializes in this area can help you select the right calculation method, keep you compliant with all the IRS rules, and manage your investments to support the distributions. At Spivak Financial Group, our team lives and breathes these plans. Give us a call at our Scottsdale office at (844) 776-3728 or stop by 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260 to make sure your early retirement income plan is built to last.

Smarter Alternatives to an Early Withdrawal

Before you even think about tapping into your retirement funds ahead of schedule, you have to treat that decision as the absolute last resort. Taking money out of retirement early can feel like a quick fix, but it's a costly move that can permanently damage your long-term financial security.

It's better to explore every other option first. This can save you a mountain of headaches from unnecessary taxes, penalties, and—worst of all—the irreversible loss of future compound growth. Think of it like a fire alarm in a glass box: you only break it in a true, unavoidable crisis after you've checked every single door. The goal is to find a solution that acts like a bridge over a rough patch, not a wrecking ball to your financial foundation.

Evaluating Your Non-Retirement Options First

Before your retirement account even enters the picture, take a hard look at other places you might find cash. Many of these avenues are designed for short-term needs and come with far fewer long-term consequences.

- Personal Loans: While you'll pay interest, a personal loan from a bank or credit union is straightforward. The costs are predictable, and it leaves your retirement savings completely untouched.

- Home Equity Line of Credit (HELOC): If you're a homeowner, a HELOC lets you borrow against your home's equity. Interest rates are often more favorable than personal loans, but it's critical to make payments on time since your house is on the line.

- Negotiating with Creditors: Sometimes the simplest solution is the most effective. Just talking to the people you owe can make a huge difference. Many creditors are willing to set up a temporary payment plan if you're proactive, which can free up your cash flow right away.

- Generating Extra Income: It's not always an option, but picking up a side gig or selling some things you no longer need can provide a quick cash boost without taking on new debt or raiding your nest egg.

Of course, the best way to avoid this stressful situation altogether is by having a solid financial buffer in place. Taking the time for building a robust emergency fund is one of the most powerful steps you can take to prepare for life's curveballs.

Leveraging a 401(k) Loan

If you've exhausted other options and still need funds, a 401(k) loan is almost always a better move than a permanent withdrawal. A loan allows you to borrow from your own savings—typically up to 50% of your vested balance or $50,000, whichever is less.

The best part? You pay the interest back to yourself, and there are no immediate taxes or penalties as long as you stick to the repayment schedule.

A 401(k) loan is borrowing from your future self, while an early withdrawal is robbing your future self. The first path allows for recovery; the second causes permanent damage.

But be aware, these loans aren't risk-free. If you leave your job for any reason, the entire loan balance may become due very quickly. If you can't repay it, the outstanding amount gets treated as a taxable distribution, triggering all the taxes and penalties you were trying to avoid.

Understanding the distinction is vital, and our guide on borrowing from your 401k versus a 72(t) SEPP breaks down the critical details. To get clear on the best path for your specific situation, a conversation with a professional at Spivak Financial Group at (844) 776-3728 can make all the difference.

Common Questions About Early Retirement Withdrawals

Thinking about tapping into your retirement funds early? It's natural to have a lot of specific, practical questions pop up. Before you make a decision that can impact your finances for years to come, it's critical to get clear answers.

Let's walk through some of the most common questions we hear.

How Long Does It Take to Get My Money?

Once you've pulled the trigger on a 401(k) withdrawal, you're probably wondering when you'll see the cash. It's not instant.

After you submit all the necessary forms to your plan administrator, you can generally expect to wait anywhere from a few business days to a couple of weeks to get your funds. Delays often happen if the paperwork isn't filled out perfectly or if your specific plan has a quirky processing schedule. The money will usually arrive via direct deposit or a physical check—the electronic transfer is almost always faster.

The big takeaway here is to plan ahead. An early withdrawal isn't like a quick trip to the ATM. You need to build that processing time into your financial timeline so the money is there when you actually need it.

Can I Repay an Early Withdrawal to Avoid Penalties?

This is a really common point of confusion, and the short answer is almost always no. A withdrawal is considered a permanent distribution. It’s completely different from a 401(k) loan, which is structured from the start to be paid back over a set period. You can’t simply "undo" a withdrawal to erase the tax hit and penalties.

The moment that money leaves your account, the IRS flags it as a taxable event for that calendar year. The only way to put money back into a retirement account is by making new contributions, which have their own annual limits and won't reverse the financial impact of the withdrawal.

Do Early Withdrawals Affect Social Security?

Taking an early withdrawal from your 401(k) or IRA won't directly lower the Social Security benefit you're entitled to down the road. But—and this is a big but—it can have a very real indirect effect on your taxes.

Here’s how: the money you withdraw is treated as taxable income. This could easily bump your total income into a higher bracket, which in turn could make a portion of your future Social Security benefits taxable when you finally start collecting them. It’s a crucial detail to consider for your long-term tax strategy, as it can definitely impact how much net income you have to live on in your golden years.

Navigating these complexities requires more than just guesswork; it demands careful planning and expert guidance. The team at Spivak Financial Group specializes in creating solid strategies like the 72(t) SEPP to provide penalty-free income when you need it most. Learn how you can access your funds with confidence at https://72tprofessor.com.