Tapping into your 401(k) before retirement is certainly possible, but it comes at a price that can be shockingly steep. You're not just taking out your money; you're also inviting the IRS to take a significant cut through a 10% early withdrawal penalty and ordinary income taxes.

This double-hit can dramatically shrink the amount of cash that actually lands in your bank account.

The Unfiltered Truth About Early 401(k) Withdrawals

When you’re in a financial bind, that growing 401(k) balance can look like a life raft. But treating it like a checking account triggers a cascade of financial consequences that most people simply don't see coming.

The IRS designed these accounts with a single purpose in mind: saving for retirement. When you access those funds before age 59½, you're breaking the rules of the game, and the penalties are there to make you think twice.

The Immediate Financial Hit

First, you'll get hit with the 10% early withdrawal penalty. It’s a flat tax applied to the entire amount you take out, right off the top.

But that's just the beginning. The money you withdraw is also considered taxable income for the year. This means it gets added to your other earnings and is taxed at your regular income tax rate. For a lot of people, this unexpected bump in income is enough to push them into a higher tax bracket, leading to a much bigger tax bill than they anticipated.

Let's break down what a $20,000 early withdrawal actually looks like after taxes and penalties.

The True Cost of a $20,000 Early 401(k) Withdrawal

This table illustrates the immediate financial impact of an early withdrawal, showing how taxes and penalties reduce the net amount you receive.

| Item | Amount | Description |

|---|---|---|

| Initial Withdrawal | $20,000 | The gross amount taken from your 401(k) account. |

| 10% Early Withdrawal Penalty | -$2,000 | A flat penalty charged by the IRS for withdrawals before age 59½. |

| Federal Income Tax (Est. 22%) | -$4,400 | Your withdrawal is taxed as ordinary income. This is a hypothetical rate. |

| State Income Tax (Est. 5%) | -$1,000 | Many states also tax retirement withdrawals. This is a hypothetical rate. |

| Net Amount Received | $12,600 | The actual cash you're left with after all taxes and penalties. |

As you can see, a $20,000 withdrawal quickly shrinks to just $12,600. You lose nearly 40% of your money right out of the gate.

The Hidden Long-Term Damage

Beyond the immediate financial sting, there’s a much deeper, often ignored, cost: the loss of future growth. When you pull money from your 401(k), you're not just taking out the cash. You're permanently sacrificing all the future compound interest that money would have earned.

Think about it this way. A 40-year-old who takes out that $20,000 isn't just losing $20,000.

- Assuming a modest 6% annual return, that $20,000 could have grown to over $80,000 by the time they retire.

- That future value is gone for good.

This lost opportunity is the real, hidden tragedy of an early withdrawal. You're patching a short-term financial hole by creating a massive, long-term setback for your retirement.

Unfortunately, this is becoming an increasingly common story. The rate of hardship withdrawals has surged, with a record number of people tapping into their retirement funds. One major 401(k) provider reported a staggering 365% increase in these withdrawals by May 2025 compared to the 2016-2021 average. You can read more about these concerning trends on Paychex.com.

How to Avoid the 10 Percent Early Withdrawal Penalty

Dipping into your 401(k) before retirement age usually comes with a nasty sting: a 10% early withdrawal penalty on top of regular income taxes. But what many people don't realize is that the IRS has built-in exceptions for certain major life events.

Knowing these rules can be a financial lifesaver, potentially saving you thousands if you're forced to tap into your retirement savings early. Just remember, even if you qualify to skip the penalty, you’ll still owe ordinary income tax on every dollar you take out. The exception just saves you from that extra 10% hit.

The Rule of 55 Explained

One of the most common ways to sidestep the penalty is what's known as the "Rule of 55." It’s pretty straightforward: if you leave your job in the year you turn 55 or older, you can start taking penalty-free distributions from that specific 401(k). This applies whether you were laid off, you quit, or you retired.

Let's say a 56-year-old manager gets laid off. She can immediately begin taking money from that company's 401(k) without the 10% penalty. Here's the catch, though—the rule only applies to the 401(k) from the job she just left. Any money sitting in a 401(k) from a previous employer is still locked up until she hits age 59½.

Common Life Event Exceptions

Beyond the Rule of 55, the IRS allows penalty-free access for a handful of other tough situations. These are specifically designed to give you some financial breathing room when you need it most.

Some of the most frequent qualifying events include:

- Total and Permanent Disability: If you become permanently disabled and can no longer work, you can access your 401(k) funds without penalty.

- High Medical Bills: You can take a penalty-free withdrawal to pay for unreimbursed medical expenses that are more than 7.5% of your adjusted gross income (AGI).

- Qualified Domestic Relations Order (QDRO): In a divorce, if a court orders a portion of your 401(k) to go to your ex-spouse or a dependent, that distribution is penalty-free for the person receiving it.

- Military Service: Qualified military reservists who are called to active duty for over 179 days can make penalty-free withdrawals.

A "hardship withdrawal" is often misunderstood. It doesn't automatically get you out of the 10% penalty. A hardship just gives you permission from your plan administrator to access the money; unless your reason lines up with one of the specific IRS exceptions above, you'll still owe the penalty and taxes.

Using Substantially Equal Periodic Payments (SEPP)

There’s another powerful, though more complicated, strategy for penalty-free access: a Series of Substantially Equal Periodic Payments (SEPP), also known as a 72(t) distribution. This lets you take withdrawals at any age by committing to a fixed schedule of annual payments for a set period.

A SEPP plan is really designed for someone who needs a steady, predictable income stream, not a one-time lump sum. The calculations are complex, and once you start, you are locked into that payment schedule. If you break it, the IRS can retroactively apply the 10% penalty to every distribution you've already taken.

For anyone dreaming of early retirement, learning about how a 72(t) works is essential, as it offers a structured way to fund your life before age 59½. This isn't a DIY project, though—it demands careful planning with a financial professional to ensure everything is set up correctly from day one.

Navigating 401k Hardship Withdrawals

When a real financial crisis hits, tapping into your 401(k) early can feel like the only move you have left. In these tough moments, your plan might offer what's known as a hardship withdrawal. But this isn't a loophole for a new car or a vacation; it's a specific provision designed for severe financial distress.

The IRS has a clear definition for this: an "immediate and heavy financial need." This isn't just vague government talk. It boils down to a specific list of situations where you absolutely need the money to prevent a catastrophic outcome.

What Actually Qualifies as a Financial Hardship?

To get the green light from your plan administrator, your reason for needing the cash has to fit into one of several recognized categories. While individual plans can have slight variations, the IRS generally signs off on hardship withdrawals for these situations:

- Preventing Eviction or Foreclosure: Money needed to keep from losing your primary residence.

- Major Medical Bills: Funds to cover significant, uninsured medical expenses for yourself, your spouse, or your dependents.

- Tuition and Educational Fees: Paying for the next 12 months of higher education costs for yourself, your spouse, or your dependents.

- Funeral Expenses: Covering the costs related to a funeral for a parent, spouse, child, or dependent.

- Home Purchase: Funds for costs directly tied to buying your main home (this does not include mortgage payments).

- Repairing Home Damage: Cash needed to fix damage to your primary home that would qualify for a casualty loss tax deduction.

You also have to demonstrate that you've run out of other options. This means showing you don't have other financial resources reasonably available to handle the crisis.

The Big Misconception About Hardship Withdrawals

Here’s the critical detail that trips a lot of people up: getting approved for a hardship withdrawal does not automatically get you out of the 10% early withdrawal penalty. It’s simply your plan’s permission slip to access your own money.

You’ll still owe regular income tax on every dollar you take out, and in most cases, that 10% penalty gets tacked right on top. Think of it as an emergency access pass, not a get-out-of-jail-free card.

Even more importantly, a hardship withdrawal is a one-way street. Unlike a 401(k) loan, you can never put this money back. You are permanently shrinking your retirement nest egg and giving up all the future growth that money could have earned. It should always, always be your absolute last resort.

Interestingly, the data shows this isn't a problem spread evenly across the workforce. The hardship withdrawal rate for hourly workers is 2.2%, which is more than three times higher than the 0.7% rate for salaried employees. This disparity is often tied to income instability, which unfortunately forces more people to raid their retirement funds just to get by. You can dig into more of this data on early retirement plan withdrawals from NAPA-Net.

Smarter Alternatives to an Early Withdrawal

Before you commit to the permanent damage of taking money out of your 401(k) early, it's absolutely crucial to pause and look at other options. A withdrawal might seem like the quickest fix for a cash crunch, but in our experience, it's often the most destructive financial decision a person can make.

Smarter alternatives can give you the cash you need without sacrificing decades of future growth.

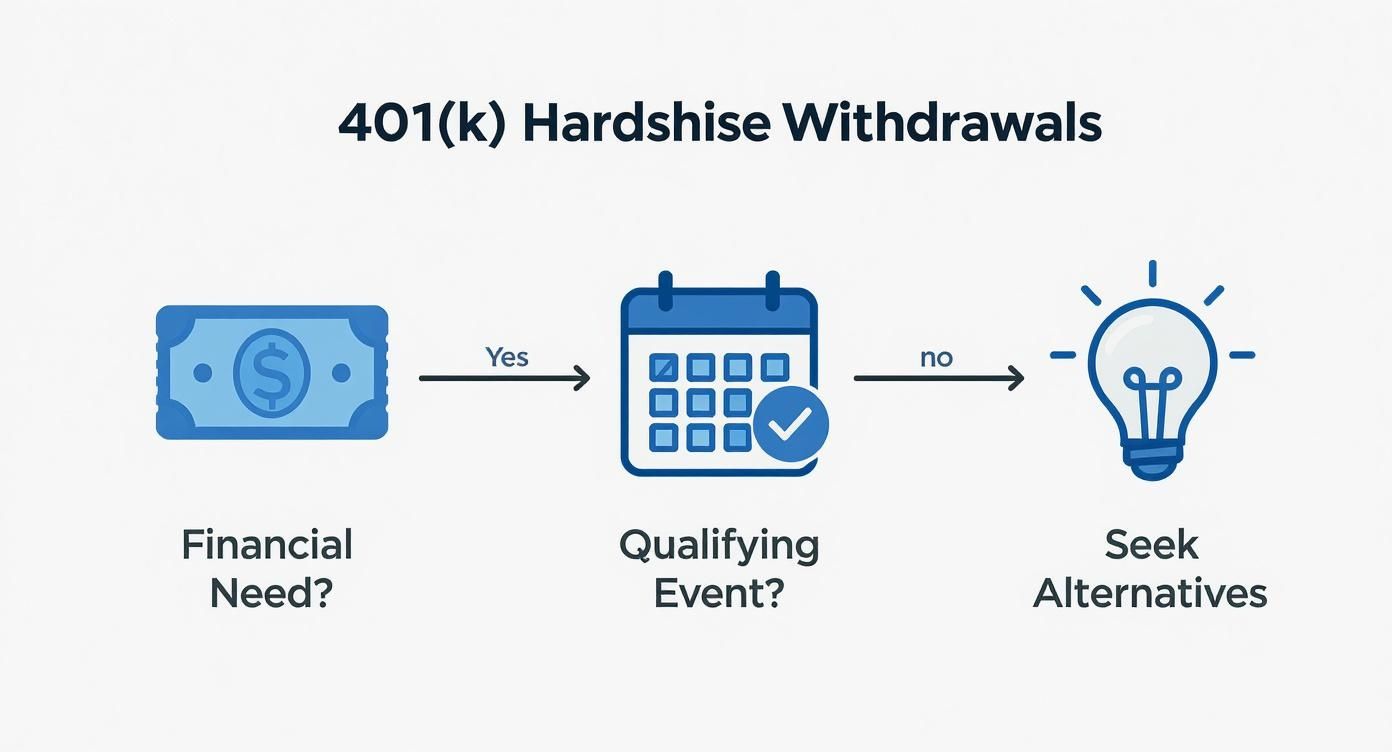

This decision tree gives you a great visual for the initial thought process you should have when you're facing a financial bind.

As the graphic shows, if you don't have a qualifying event triggering your need for cash, exploring other avenues should be your very first move. Let's dig into what those alternatives actually look like.

Consider a 401(k) Loan Instead

If your plan allows for it—and many do—a 401(k) loan is almost always a better choice than an outright withdrawal. When you take a loan, you’re not really borrowing from a bank; you’re borrowing from yourself.

The best part? The interest you pay goes right back into your own retirement account.

Here’s why it’s such a compelling alternative:

- No Taxes or Penalties: As long as you stick to the repayment schedule, you won't owe a dime in income taxes or that nasty 10% early withdrawal penalty.

- Keeps Your Money Invested: While the borrowed amount is temporarily out of the market, the rest of your 401(k) balance stays right where it is, continuing to work and grow for your future.

The biggest risk here is your job status. If you leave your employer, whether you quit or are laid off, you might have to repay the entire loan balance in a very short amount of time. If you can't, the outstanding balance gets reclassified as a taxable distribution, and all those penalties you were trying to avoid will suddenly kick in.

Tapping your retirement savings has become more common, but it comes at a steep price. The average early withdrawal means losing tax-deferred compound growth that can amount to hundreds of thousands of dollars over time. For example, a $20,000 early withdrawal in your 40s could mean missing out on over $80,000 in growth by retirement, assuming a 6% annual return. Discover more insights about the long-term impact of early 401(k) withdrawals on Business Insider.

Exploring Other Financial Tools

Your 401(k) should never be your first-line emergency fund. Before you even think about touching it, you need to investigate other financial products that are actually designed for liquidity—without forcing you to raid your future.

To help put these choices into perspective, let's compare them side-by-side.

Early 401k Withdrawal vs. 401k Loan vs. Personal Loan

| Feature | Early 401(k) Withdrawal | 401(k) Loan | Personal Loan |

|---|---|---|---|

| Immediate Tax Hit? | Yes, taxed as ordinary income. | No, if repaid on time. | No tax implications. |

| Early Penalty (Under 59½)? | Yes, typically a 10% penalty. | No, if repaid on time. | No penalties. |

| Repayment Required? | No, the money is gone for good. | Yes, with interest paid to yourself. | Yes, with interest paid to a lender. |

| Impact on Credit Score? | No direct impact. | No, doesn't appear on credit reports. | Yes, new debt and payment history. |

| Impact on Retirement Growth? | Permanent loss of principal and future compound growth. | Temporary loss of growth on borrowed funds. | No impact on retirement savings. |

| Job Loss Risk? | None. | High risk; immediate repayment often required. | No direct job-related risk. |

Looking at the table, it’s clear that a withdrawal is the most damaging option by far.

A personal loan is a solid option if you have a good credit score. Interest rates can be competitive, and the repayment terms are clear and fixed from day one. Most importantly, it has zero impact on your retirement savings.

If you're a homeowner, a Home Equity Line of Credit (HELOC) is another powerful tool. It lets you borrow against the equity you've built in your home, often at a much lower interest rate than a personal loan or credit card.

While these options involve taking on new debt, they protect your retirement nest egg from permanent harm. For those who need a more structured income stream, it’s worth taking the time to compare the pros and cons of borrowing from a 401(k) versus setting up a 72(t) SEPP. Making the right choice always requires a careful look at your entire financial picture.

The Process for Taking a 401k Withdrawal

So, you've weighed every alternative and decided that tapping into your 401(k) early is the only way forward. It’s a tough spot to be in, but if you’ve reached this conclusion, the next step is to understand the mechanics of the process. Getting this right is crucial to making sure things go smoothly and you avoid any costly surprises down the road.

From the moment you decide to withdraw until the money hits your account, there's a specific path involving paperwork, tax rules, and timelines you need to get a handle on.

Your first move is a practical one: contact your 401(k) plan administrator. This might be the HR department at your current (or former) job, or it could be a third-party financial firm like Fidelity or Vanguard. Think of them as the gatekeepers to your funds; they'll provide the official withdrawal application forms you need to get started.

Don't assume the process is the same as it was at your last job. Every plan has its own unique rules. When you call, ask them directly about their specific procedures, what documents you’ll need, and how long it typically takes to get paid. This one phone call can save you a ton of guesswork and headaches.

Nailing the Paperwork

Once you have the forms, take your time filling them out. This isn't just routine paperwork—the details you provide here have serious financial consequences. You’ll have to specify the exact amount you want to withdraw and, critically, the reason for taking the money.

If you think your situation qualifies for an exception to the 10% early withdrawal penalty (like a total and permanent disability or substantial medical bills), you have to state that clearly on the form. Be prepared to back it up with documentation. This could mean gathering medical records, court orders, or other official proof. If you don't provide the right evidence, you could get hit with the penalty automatically.

It's on you to prove you qualify for an exception. The plan administrator won't connect the dots for you. Double-check every requirement before you submit anything to avoid getting your request denied or slapped with an unnecessary penalty.

Understanding Tax Withholding

This is the part that trips up a lot of people. When you take an early distribution, your plan administrator is required by federal law to automatically withhold 20% of the total amount for taxes. This is mandatory and non-negotiable.

Here’s a real-world example: let's say you need exactly $10,000 for an emergency. If you request a $10,000 withdrawal, they’ll withhold $2,000 for federal taxes, and you'll only receive $8,000. To actually get $10,000 in your hands, you’d need to request a withdrawal of $12,500. ($12,500 x 20% = $2,500 in withholding).

And that’s just the federal side. You also need to factor in state income taxes. Some states have their own withholding rules, while others don't tax retirement income at all. It's essential to check your state's tax laws to see the full picture.

Remember, the 20% withholding is just a down payment on your tax bill. Your final tax liability could be higher or lower depending on your total income for the year. You'll settle up with the IRS when you file your annual tax return. If you want to dig deeper into this, check out our guide on understanding how to access 401k funds early.

Common Questions About Early 401k Withdrawals

Once you get past the big topics of penalties and taxes, the practical, "what if" questions about early 401(k) withdrawals always start popping up. We’ve heard them all over the years. Getting clear answers to these common questions is what lets you move forward confidently.

A lot of people think it’s an all-or-nothing deal. They ask if they have to take out their entire balance. The answer is almost always no. You can usually withdraw just a portion of your 401(k), which is a huge relief. This lets you take just enough to cover your immediate need while leaving the rest of your money invested and growing for the long haul.

Leaving Your Job and Accessing Funds

Here's one we get all the time: "What happens if I leave my employer—can I avoid the penalty then?" It's a logical question, but unfortunately, it doesn't quite work that way.

Leaving your job opens the door to rolling over your 401(k), but it doesn't give you a free pass on the 10% early withdrawal penalty if you're under age 59½.

The one big exception to know is the "Rule of 55." This rule allows you to take penalty-free distributions if you leave your job in the year you turn 55 or older. If that rule doesn't apply to you, the standard penalty rules are still in effect, even if you’re no longer with the company.

Understanding the Tax Impact and Repayment

So, how does taking money out of your 401(k) early actually hit your taxes? The IRS treats it as ordinary income. The amount you withdraw gets added right on top of your other income for the year. This can easily bump you into a higher tax bracket, leading to a much larger tax bill than you might have been expecting.

A huge misconception we have to clear up constantly is the idea that a hardship withdrawal can be paid back like a loan. This is flat-out wrong. Once you take a hardship distribution, that money is gone for good and cannot be put back into the account. It permanently shrinks your retirement savings.

This is a critical difference from a 401(k) loan, which is specifically designed to be repaid. A withdrawal is a final transaction that takes a permanent bite out of your nest egg.

Finally, what about the truly awful situations where someone was scammed into making a withdrawal? It's heartbreaking, but under current law, even victims of fraud are generally on the hook for the 10% early withdrawal penalty. Taxpayer advocates are pushing hard for changes to waive this penalty for scam victims, but as it stands today, the penalty usually applies—adding a final financial insult to a devastating injury.

Navigating these complexities is where expert guidance becomes invaluable. The team at Spivak Financial Group specializes in helping individuals access their retirement funds strategically, including setting up penalty-free income streams through 72(t) SEPP plans.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com