Getting into your Fidelity 401(k) isn't as simple as swiping a debit card. It’s more like a series of locked doors, each with its own specific key and set of rules. The Fidelity 401(k) terms of withdrawal that apply to you are a mash-up of broad IRS regulations and the specific rules your own employer has put in place.

It's critical to remember that not all plans allow every type of withdrawal, which is why your first stop should always be your plan documents.

Decoding Your Fidelity 401k Withdrawal Options

Think of your 401(k) as a secure financial vault. You've got a whole ring of keys, but each one is designed to open the door under very different circumstances. Knowing which key to use—and when—is the absolute first step to making a smart decision about your retirement funds. We're going to go through every key on that ring, from standard retirement distributions to early access for emergencies and even more strategic income streams.

The money in that account represents years of your hard work and disciplined saving. And it adds up. As of early 2025, Fidelity reported the average 401(k) balance hit $127,100, a whopping 39% growth from just five years prior. That growth was fueled by record-high employee contribution rates, which now average 9.5%, creating a combined savings rate of 14.3% when you factor in the employer match.

These numbers aren't just statistics; they highlight how important it is to be careful and deliberate when you decide to tap into that nest egg.

The Two Pillars of Withdrawal Rules

Every single withdrawal you consider from your Fidelity 401(k) is governed by two sets of rules that work in tandem. Grasping this dual structure is non-negotiable before you make a move.

- IRS Regulations: The IRS sets the universal, nationwide rules for all 401(k) plans. This includes the famous age 59½ benchmark for penalty-free withdrawals, the official definition of a "hardship," and, of course, the taxes you'll owe on the money.

- Employer Plan Rules: Your employer, as the plan sponsor, gets to decide which of the IRS-allowed options they want to include in your specific plan. For example, the IRS says 401(k) loans are perfectly legal, but your company has no obligation to offer them.

This means you can't assume something is allowed just because you read about it online. You must always check your plan's Summary Plan Description (SPD), which you can find on your Fidelity NetBenefits portal, to see what your options truly are.

Your 401(k) is not a checking account. Each withdrawal is a taxable event with potential penalties. The key is to match the right type of withdrawal to your specific financial need while minimizing taxes and fees.

Core Withdrawal Concepts to Know

Before we get into the weeds of complex scenarios, let’s get the basic vocabulary down. The terms of withdrawal for a Fidelity 401(k) generally fall into a few primary buckets, and each one serves a different purpose. We'll be laying out the fundamental concepts behind rollovers, loans, hardship withdrawals, and standard distributions.

For a broader overview, our guide on how to take money from your 401k provides excellent background on these foundational topics. Think of this article as your roadmap—it will help you figure out which path aligns with your financial situation and ensure you know the right questions to ask before you act.

Tapping Your 401(k) Before Age 59½? Here’s What You Need to Know

Most of us have heard the big warning: touch your 401(k) before you’re 59½ and you’ll get slammed with a massive 10% IRS early withdrawal penalty. While that’s generally true, it’s not the whole story. It’s better to think of that penalty as the default setting, not an unbreakable rule.

Life happens, and the IRS gets that. Unexpected financial emergencies don't always wait for a convenient time. Because of this, they've created specific, well-defined situations where you can access your 401(k) money without getting hit with that extra 10% penalty. You'll still owe regular income tax on the withdrawal, but dodging the penalty can save you thousands.

When The 10% Penalty Doesn't Apply

The IRS has built in several exceptions to the early withdrawal penalty. These aren't secret loopholes; they are established provisions designed for significant life events.

Here are the key situations where you might get a penalty-free pass:

- Total and Permanent Disability: If a permanent disability prevents you from working, the IRS allows you to access your retirement funds without the penalty.

- Separation from Service: This is a big one. If you leave your job—whether you quit, get laid off, or retire—in the year you turn 55 or older, you can take distributions from that specific 401(k) penalty-free.

- Substantially Equal Periodic Payments (SEPP): This is a powerful strategy, often called a 72(t) distribution. It involves setting up a series of structured, annual payments from your account. We'll dive deep into this later.

- Qualified Domestic Relations Order (QDRO): During a divorce, a court might issue a QDRO ordering a portion of your 401(k) to be paid to your ex-spouse or dependent. These distributions are not subject to the 10% penalty.

- Excessive Medical Expenses: You can take a penalty-free withdrawal to pay for unreimbursed medical bills that are more than 7.5% of your adjusted gross income (AGI).

- IRS Levy: If the IRS has to take money directly from your 401(k) to cover a tax debt, they won't add the 10% penalty on top of it.

Knowing these exceptions is the first step in figuring out the Fidelity 401(k) terms of withdrawal that might work for your situation.

A Tale of Two Withdrawals: An Example

Let's look at a real-world scenario to see how much this matters. Imagine two friends, both 50 years old and in the 22% federal tax bracket. Each needs to pull $20,000 from their Fidelity 401(k).

Person A needs the cash for a kitchen remodel. Unfortunately, this doesn't qualify for a penalty exception.

- 10% IRS Penalty: $2,000

- 22% Federal Income Tax: $4,400

- Total Taxes & Penalty: $6,400

- Money in Hand: $13,600

Person B needs the money to cover major medical bills that are well over 7.5% of their income, so they do qualify for an exception.

- 10% IRS Penalty: $0

- 22% Federal Income Tax: $4,400

- Total Taxes & Penalty: $4,400

- Money in Hand: $15,600

By fitting the IRS criteria, Person B kept an extra $2,000. This shows just how critical it is to check if your situation qualifies for an exception before you make a move.

The Single Most Important Step: Check Your Plan Documents

Now for a crucial detail that trips a lot of people up: just because the IRS allows a penalty-free withdrawal doesn't automatically mean your 401(k) plan has to offer it. Your employer, as the plan sponsor, decides which withdrawal options are actually available to you.

Before you go any further, log into your Fidelity NetBenefits account and find your Summary Plan Description (SPD). This document is the official rulebook for your 401(k). It will tell you exactly what types of distributions your plan permits, like those for disability or medical expenses, before retirement age. Assuming an option is available without checking the SPD is one of the most common and costly mistakes you can make.

Choosing Between a Hardship Withdrawal and a 401(k) Loan

When a financial emergency hits, your 401(k) can feel like a life raft in a storm. But which rope should you grab? For people still on the job, the two most common options are a hardship withdrawal and a 401(k) loan. While they both offer a quick cash infusion, they operate in completely different ways and have wildly different impacts on your future.

Think of a 401(k) loan as taking a loan from your future self. It's exactly what it sounds like—you're borrowing from your own retirement savings. The plan is to pay it all back, plus interest, usually through automatic deductions from your paycheck.

A hardship withdrawal, on the other hand, is a one-way street. That money is taken out for good. This isn't a loan you repay; it's a permanent distribution that comes with immediate tax consequences and, more often than not, a steep 10% early withdrawal penalty.

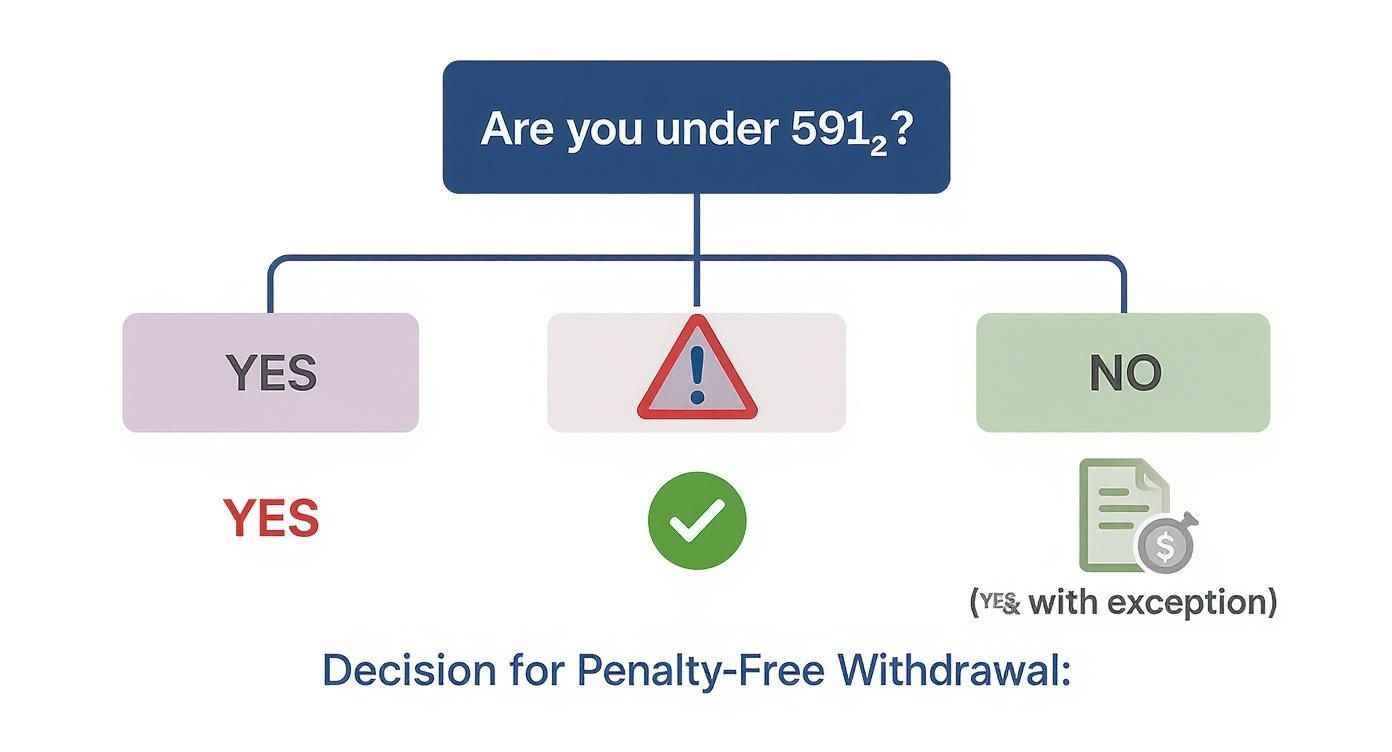

This decision tree helps visualize when that 10% penalty might come into play, based on your age and unique situation.

The key takeaway here is that while being under 59½ is the general rule for triggering the penalty, there are very specific, documented exceptions that can save you a lot of money when you need it most.

The 401(k) Loan Path

On the surface, a 401(k) loan can seem like the perfect solution. You aren't technically being taxed or penalized on the money you borrow, as long as you play by the rules. Even the interest you pay goes right back into your own account, which feels like a win.

But there are some serious risks lurking beneath the surface. What happens if you leave your job, whether you choose to or not? Many plans demand you repay the entire outstanding loan balance in a very short amount of time. If you can't, the whole amount is treated as a taxable distribution. That means you'll be hit with income taxes and that 10% penalty if you're under 59½.

To really get a handle on the potential pitfalls, it's worth understanding all the consequences of borrowing from your 401k.

When is a Hardship Withdrawal an Option?

You can't just claim a hardship withdrawal because it's been a tough month. The IRS has a very strict definition of what qualifies as an "immediate and heavy financial need," and Fidelity has to enforce those rules on behalf of your employer's plan.

The generally accepted "safe harbor" reasons include some pretty serious situations:

- Medical Care: Unreimbursed medical bills for you, your spouse, or your dependents.

- Home Purchase: Specific costs tied directly to buying your primary home (this doesn't include mortgage payments).

- Education Expenses: Paying for tuition, fees, and room and board for the next 12 months of higher education for you, your spouse, or dependents.

- Preventing Eviction or Foreclosure: Funds needed to stop you from being kicked out of your rental or losing your primary home.

- Funeral Expenses: Covering burial or funeral costs for a deceased parent, spouse, child, or dependent.

- Home Repairs: Certain expenses needed to repair damage to your main home.

You'll almost certainly need to provide Fidelity with documentation to prove your case. Crucially, you're only allowed to withdraw the exact amount needed to cover the emergency, and you have to show that you've already tapped all other available resources—including taking out a 401(k) loan if one is available.

A hardship withdrawal should always be your absolute last resort. It permanently shrinks your retirement savings, robs you of all future growth on that money, and comes with a guaranteed tax bill.

Creating Penalty-Free Income With a Rule 72(t) SEPP

If you're dreaming of retiring early, that dreaded 10% penalty on 401(k) withdrawals before age 59½ can feel like a massive roadblock. But there’s a powerful, IRS-approved strategy that lets you create a steady income stream from your Fidelity 401(k) without getting hit by that penalty. It’s known as IRS Rule 72(t), which sets up what’s called a Substantially Equal Periodic Payment (SEPP) plan.

Think of a SEPP less like a one-off withdrawal and more like creating your own private pension from the money you’ve worked so hard to save. It's a formal plan where you commit to receiving a series of precisely calculated payments over a specific period. This gives early retirees a predictable income, but it demands absolute precision.

How a SEPP Works

At its core, a SEPP plan lets you take distributions from your retirement account every year without the usual 10% early withdrawal penalty. Here’s the catch: once you start, you must continue taking these payments for at least five full years or until you hit age 59½, whichever is longer.

For instance, if you start a SEPP at age 52, you’re locked in until you're 59½. If you start one at age 58, you have to keep it going until you're 63 (that's five full years). This long-term commitment is a non-negotiable part of the deal.

The Three IRS-Approved Calculation Methods

The IRS doesn’t just let you pull a number out of thin air for your yearly payment. The amount has to be figured out using one of three very specific, approved methods. Each one looks at your account balance, your life expectancy, and a reasonable interest rate to determine your annual distribution.

- Required Minimum Distribution (RMD) Method: This is the most straightforward calculation. It simply divides your account balance by your life expectancy factor, which results in a payment amount that gets recalculated each year. This method usually gives you the smallest annual payment.

- Amortization Method: This method calculates a fixed annual payment for the life of the plan. It essentially amortizes your account balance over your life expectancy using an approved interest rate. The payment stays the same every year.

- Annuitization Method: This approach uses an annuity factor from official IRS tables to turn your account balance into a steady stream of fixed annual payments.

Picking the right method is a huge decision. It directly impacts your yearly income and how fast you’ll draw down your retirement savings. It's a good idea to dig into the substantially equal periodic payments rules to see how these calculations play out before you make a choice.

A SEPP is a powerful tool, but it's not a flexible one. It's like setting a train on its tracks—once it's moving, you can't easily change its course or speed without significant consequences.

The Critical Importance of Precision

The single biggest risk with a SEPP is making a mistake. The IRS rules are rigid, and they don't do second chances. If you mess with your payment schedule, take out the wrong amount, or stop the plan before the required time is up, the consequences are severe.

Just one slip-up can blow up the entire plan, right back to the very beginning. That means the 10% early withdrawal penalty gets retroactively applied to every single distribution you’ve taken since day one, plus interest. What started as a smart financial strategy can turn into a costly disaster in a heartbeat.

This is exactly why getting expert guidance isn't just a good idea—it's essential. Navigating the Fidelity 401k terms of withdrawal for a SEPP requires a deep understanding of IRS regulations. A firm like Spivak Financial Group, which specializes in these complex plans, can ensure every calculation is spot-on and your plan stays compliant. That protects you from devastating penalties and keeps your financial future secure.

Managing Rollovers and RMDs in Retirement

Once you stop working and start thinking about retirement, your relationship with your Fidelity 401(k) enters a new phase. The goal shifts from accumulating as much as you can to withdrawing your money wisely. This brings two big topics to the forefront: rollovers and Required Minimum Distributions (RMDs).

Getting a handle on these concepts is absolutely critical. It's how you protect the nest egg you've worked so hard to build, give yourself more flexibility, and—most importantly—stay on the right side of the IRS.

The Strategic Power of a Rollover

When you leave your job, you've got a big decision to make about that 401(k). You can often leave it where it is, but a lot of people find it makes more sense to roll the money into an Individual Retirement Account, or IRA. This isn't just shuffling paperwork; it's a strategic move that can open up a world of new possibilities.

Think of it this way: your 401(k) is like a tool kit your company gave you. It’s got some solid, reliable tools, but it only has the specific ones your employer picked out. An IRA, on the other hand, is like getting the keys to the entire hardware store.

You suddenly gain access to a massive universe of investment choices—individual stocks, bonds, a wider variety of ETFs, and other options that probably weren't available in your 401(k). This flexibility is huge because it lets you build a portfolio that’s perfectly matched to your specific needs in retirement.

Another major win is consolidation. If you’re like most people, you might have a few old 401(k)s scattered around from past jobs. Rolling them all into one IRA just makes life simpler. It’s far easier to track your performance, manage your beneficiaries, and plan your withdrawals when everything is in one place.

Direct vs. Indirect Rollovers

When you decide to do a rollover, you'll have to choose between a direct or an indirect one. This choice has immediate and significant tax implications, so it's one you want to get right.

- Direct Rollover: This is the cleanest, simplest, and safest way to go. Fidelity sends the money straight to your new IRA custodian. The funds never even hit your personal bank account, which means no taxes are withheld and there’s no room for error.

- Indirect Rollover: This route is more complicated. Fidelity will cut you a check for your 401(k) balance, but first, they’re required to withhold 20% for federal taxes. You then have just 60 days to deposit the entire original amount into your new IRA. That means you have to come up with that missing 20% from your own pocket and then hope to get it back from the IRS when you file your taxes next year.

Missing that 60-day deadline is a financial disaster. The IRS will treat the whole amount as a taxable distribution, and if you’re under 59½, you'll get slapped with the 10% early withdrawal penalty on top of it. For pretty much everyone, a direct rollover is the only way to go.

Understanding Required Minimum Distributions (RMDs)

You can't just leave money in your pre-tax retirement accounts forever. At some point, the IRS wants to collect the taxes you've been deferring, and that’s where Required Minimum Distributions (RMDs) come in. These are mandatory annual withdrawals you have to start taking from your 401(k)s and traditional IRAs.

The IRS says you have to start taking these withdrawals at a specific age—which was recently updated to age 73 as of the 2023 rule changes. This is a critical piece of Fidelity's 401(k) withdrawal terms.

The RMD amount is calculated using your account balance from the end of the previous year and an official IRS life expectancy table. While Fidelity offers tools to help you figure this out, the final responsibility to take the right amount on time is yours. You can learn more about how a 401k works directly from Fidelity's learning center.

Messing this up comes with one of the most painful penalties the IRS has: a 25% tax on the amount you were supposed to take but didn't. That’s on top of the regular income tax you already owed on that money. With a penalty that severe, getting your RMDs right is a non-negotiable part of managing your money in retirement.

Common Questions About Fidelity 401(k) Withdrawals

When it comes to your retirement money, a lot of practical questions can come up. It's completely normal. This last section tackles some of the most common things people ask about the Fidelity 401(k) withdrawal process. Think of it as a quick-reference guide to give you clear answers and a bit more confidence before you make any moves.

How Long Does a Fidelity 401(k) Withdrawal Take?

This is usually the first question on everyone's mind, and the honest answer is: it depends. There isn't a single, one-size-fits-all timeline for getting your hands on your money. The type of withdrawal you're requesting makes all the difference.

For instance, a standard distribution after leaving your job usually takes about 5-10 business days for the funds to hit your bank account or for a check to arrive in the mail. A 401(k) loan is often much faster. We have seen clients get their loan money in as few as 2-3 business days once the request is buttoned up.

Hardship withdrawals, on the other hand, are a different animal. They almost always take longer because you have to submit paperwork proving you have an "immediate and heavy financial need." That adds an extra verification step for Fidelity. The best way to get a solid timeline is to log into your Fidelity NetBenefits account or just give them a call.

Can I Take Money from My 401(k) While Still Employed?

Yes, you often can, but your options get a lot narrower. The Fidelity 401(k) terms of withdrawal are very specific about what’s allowed for active employees, and it’s your employer who sets most of these rules.

Generally, you'll be looking at one of these options:

- 401(k) Loans: This is the most common route. Most plans let you borrow from your balance and pay it back, with interest, directly from your paycheck.

- In-Service Withdrawals: Some—but definitely not all—plans allow for what’s called an "in-service" distribution once you hit age 59½. This lets you take money out without quitting or proving you’re in a tough spot.

- Hardship Withdrawals: If your situation fits the strict IRS criteria for a financial hardship, this might be an option. But consider it a last resort, since you'll still owe taxes and likely penalties.

What you can't do is simply roll your money over to an IRA or take a standard distribution while you're still on the payroll. The key is to check your Summary Plan Description (SPD) on Fidelity's site to see exactly what your specific plan allows.

The rule of thumb is simple: your employer’s plan document is the ultimate authority. Just because the IRS permits a certain type of withdrawal does not mean your company has opted to include it in your plan.

What Is the First Step to Start a Withdrawal with Fidelity?

Getting the ball rolling is actually pretty straightforward. Your best starting point is to log into your Fidelity NetBenefits account, either on their website or through the mobile app.

Once you’re in, head over to your 401(k) account details. You should see a pretty obvious link or tab labeled "Loans or Withdrawals." Fidelity has done a good job designing their online portal to walk you through the options your specific plan allows. It will even help you estimate the tax hit and let you fill out the forms online in most cases.

Now, if you're dealing with something more complex, like setting up a Rule 72(t) SEPP or handling a Qualified Domestic Relations Order (QDRO) from a divorce, your first step should be a phone call. It's just smart to talk to a Fidelity rep or a financial advisor who knows these transactions inside and out to make sure everything is handled correctly from the get-go.

Are State Taxes Due on My Fidelity 401(k) Withdrawal?

Yes, almost always. This is a huge one that people often forget. It's easy to get tunnel vision on federal taxes, but your state wants its piece of the pie, too. Your 401(k) distribution is typically treated as taxable income in the state where you live.

A few states don't have an income tax, and some others give special tax breaks on retirement income, but you can't assume that applies to you. When you go through the withdrawal process, Fidelity will give you the option to withhold for federal taxes (a mandatory 20% is taken out for lump-sum distributions paid directly to you) and will usually offer a voluntary option for state withholding.

Be careful, though. You are the one ultimately on the hook for making sure the right amount of state tax is paid. What Fidelity withholds might not be enough to cover your actual bill. To avoid a nasty surprise come tax time, talking to a tax professional is a non-negotiable step.

Navigating these complex rules, especially for early retirement strategies like a 72(t) SEPP, requires expertise. At Spivak Financial Group, we specialize in creating compliant, penalty-free income streams to help you achieve your financial goals. Learn how we can help at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com