The real difference between a Traditional IRA and a Roth IRA boils down to one simple question: Do you want to pay taxes now, or do you want to pay them later?

A Traditional IRA gives you a potential tax deduction on your contributions today, which is a nice immediate benefit. The catch is that you'll have to pay income tax on every dollar you withdraw in retirement. On the flip side, a Roth IRA uses after-tax contributions, meaning no upfront break, but it gives you the incredible advantage of completely tax-free qualified withdrawals down the road.

Unpacking the Core Differences

Choosing the right Individual Retirement Arrangement (IRA) is one of the most foundational steps you can take to build a secure financial future. While both Traditional and Roth IRAs are powerful tools for growing your wealth, their completely different tax structures create very different outcomes for you and your money.

The main distinction is how the IRS treats your contributions and, more importantly, your withdrawals.

Think of a Traditional IRA this way: you contribute with pre-tax dollars, which can lower your taxable income right now. This feels great in the short term. However, when you retire and start taking money out, every single dollar—both your original contributions and all the earnings—is taxed as ordinary income.

A Roth IRA is the complete opposite. You contribute with after-tax dollars, so you don't get that immediate tax break. The powerful trade-off? All of your qualified withdrawals in retirement are 100% tax-free. It's a huge advantage, especially if you expect your tax rate to be higher in the future. You can read more about how these tax treatments are structured on the government's official Treasury site.

This "pay now vs. pay later" framework is the single most critical difference to understand. Your choice doesn't just affect this year's tax bill; it shapes your financial flexibility for decades to come.

To help you see these differences side-by-side, here is a quick comparison.

Traditional IRA vs Roth IRA Feature Comparison

This table summarizes the key differences between a Traditional and a Roth IRA, giving you a quick reference for the features that matter most.

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax on Contributions | Contributions may be tax-deductible | Contributions are made with after-tax dollars |

| Tax on Withdrawals | Withdrawals are taxed as ordinary income | Qualified withdrawals are 100% tax-free |

| Income Limits for Contributions | No income limits to contribute | Income limits may restrict or prevent contributions |

| Required Minimum Distributions (RMDs) | Yes, generally starting at age 73 | No, not for the original account owner |

| Early Withdrawal of Contributions | Contributions are taxed and penalized | Contributions can be withdrawn tax-free and penalty-free at any time |

As you can see, the decision isn't just about taxes. It also involves income limits, when you're required to take money out, and how easily you can access your own contributions in an emergency. Each of these factors plays a big role in which account is the right fit for your specific situation.

How Taxes Shape Your Retirement Savings

The single biggest difference between a Traditional IRA and a Roth IRA boils down to one simple question: do you want to pay taxes now or pay them later? Your answer directly shapes how much money you'll actually have in your pocket during retirement, as each account follows a completely different tax path.

With a Traditional IRA, the main draw is the immediate gratification. You make contributions with pre-tax dollars, which can lower your taxable income for the year you contribute. This tax deduction provides an upfront savings, making it a very appealing choice if you’re looking to shrink your tax bill today.

Of course, this immediate perk comes with a long-term trade-off. Once you retire and start taking money out, every single dollar is taxed as ordinary income—that includes your original contributions and all the investment growth. This means your retirement income will be subject to whatever the tax rates are decades from now.

The Power of Paying Taxes Upfront

A Roth IRA completely flips that script. Contributions are made with after-tax dollars, so you don't get that immediate tax deduction. While your current tax bill won't get any smaller, the long-term benefit is where the Roth really shines.

The true magic of a Roth IRA happens in retirement. All of your qualified withdrawals—including your initial contributions and every last penny of investment growth—are 100% tax-free. By giving up a tax break today, you secure a source of tax-free income for your future, completely insulating your nest egg from the risk of future tax hikes.

Think of it this way: by paying taxes on your Roth contributions now, you are essentially buying tax insurance for your future. You lock in today’s tax rates, letting all your future growth compound completely shielded from the IRS.

Visualizing the Financial Impact

To really see the difference a Traditional and a Roth IRA can make, let’s walk through a quick example. Let's say you're in the 22% federal tax bracket and you contribute $7,000 to an IRA.

Here’s how that single contribution could play out over time:

- Traditional IRA Scenario: You contribute $7,000, which could potentially lower your current federal tax bill by $1,540 ($7,000 x 22%). If that account grows to $30,000 by the time you retire, the entire $30,000 withdrawal will be taxed as income.

- Roth IRA Scenario: You put in the same $7,000 using after-tax money, so you don't get an immediate tax break. But if that account also grows to $30,000, your qualified withdrawal of the full $30,000 is completely tax-free.

This simple comparison gets to the heart of the decision. The Traditional IRA offers relief now, while the Roth IRA delivers the powerful advantage of tax-free growth and withdrawals later. The right choice for you really depends on one key factor: do you think your tax rate will be higher now, or in retirement?

Navigating Contribution and Income Rules

Before you can use an IRA effectively, you have to know the rules of the game. A big part of that is understanding who can contribute to which account and how much. While the biggest difference between a Traditional IRA and a Roth IRA is how they're taxed, their eligibility requirements—especially around your income—are also worlds apart.

There is one key area where both accounts are on the same page: the annual contribution limit. The IRS sets a maximum dollar amount you can put into an IRA each year, and that limit is the same whether you choose a Traditional or a Roth. They also allow an extra "catch-up" contribution for anyone age 50 or older, giving you a chance to beef up your savings as retirement gets closer.

Roth IRA Income Limitations

This is where things start to diverge, and it's a big one. Your ability to contribute to a Roth IRA is tied directly to your Modified Adjusted Gross Income (MAGI). If you make too much money, the IRS will reduce the amount you can contribute, and eventually, you won't be able to contribute at all.

For the current year, the IRS sets specific income thresholds. If you’re a single filer with a MAGI above a certain level, or you're married filing jointly and your combined MAGI exceeds the limit, you're locked out of direct Roth contributions. You can find the exact income phase-out ranges on the official IRS retirement plan comparison chart.

This income cap is a really critical factor for many people. High earners are often blocked from contributing to a Roth directly, which pushes them toward other strategies like a backdoor Roth IRA conversion just to get access to its tax-free growth potential.

The Nuance of Traditional IRA Deductibility

The Traditional IRA, on the other hand, doesn't have any income limits on making a contribution. As long as you have earned income, you can put money into a Traditional IRA. But—and this is a nuance that trips a lot of people up—your ability to deduct that contribution on your taxes is another story.

Whether you can deduct your Traditional IRA contribution depends on two things: your income and whether you (or your spouse) are covered by a retirement plan at work, like a 401(k). If you have a workplace plan, your deduction is subject to income phase-out rules, just like the Roth IRA.

Here’s the simple breakdown:

- No Workplace Plan: You can fully deduct your Traditional IRA contributions, no matter how much you make.

- Have a Workplace Plan: Your deduction might be limited or even wiped out completely if your income goes over certain levels.

This means a high-earner with a 401(k) can still contribute to a Traditional IRA; they just might not get that upfront tax break. These are called non-deductible contributions. Getting these rules right is just as important as understanding the details of other accounts. For example, our guide on SIMPLE IRA transfer rules dives into similar critical details that can make or break your retirement strategy.

Understanding Your Withdrawal and Distribution Options

The long-term value of a retirement account isn’t just about how it grows; it’s about when and how you can actually get your hands on the money. The rules governing withdrawals are a major difference between an IRA and a Roth IRA, and they can impact everything from what you’re forced to do in your 70s to your ability to retire early.

With a Traditional IRA, the IRS eventually steps in and mandates that you start taking Required Minimum Distributions (RMDs) once you hit age 73. These withdrawals are calculated based on your account balance and life expectancy, and every dollar is taxed as ordinary income. If you don't take your RMD on time, you'll face a steep penalty. Essentially, you're forced to draw down your savings on the government's schedule, not your own.

The Roth IRA Advantage for Long-Term Flexibility

This is where the Roth IRA truly shines. For you, the original account owner, there are no Required Minimum Distributions. Ever. You can let your money continue to grow, completely tax-free, for your entire lifetime without being forced to take out a single penny.

This one feature provides two incredibly powerful benefits:

- Ultimate Control: You decide if and when to take money out. This gives you total control over your retirement income stream and, more importantly, your tax situation.

- Estate Planning Power: By avoiding RMDs, you can pass on a much larger, completely tax-free inheritance to your beneficiaries. This makes the Roth IRA an exceptional tool for multi-generational wealth planning.

The absence of RMDs is a game-changer for long-term financial strategy. It transforms your Roth IRA from just a retirement account into a flexible, multi-generational wealth-building vehicle.

Rules for Accessing Funds Before Age 59½

What happens if you need to tap into your savings before the traditional retirement age? Generally, both account types slap a 10% early withdrawal penalty on distributions taken before age 59½, on top of any income taxes you might owe.

But the IRS does provide some key exceptions to this penalty, and this is another area where the rules differ. Roth IRAs have a unique and powerful advantage: you can withdraw your own contributions (the money you put in, not the earnings) at any time, for any reason, completely tax-free and penalty-free. After all, you already paid taxes on that money.

For both account types, the 10% penalty might be waived for specific situations, such as:

- A first-time home purchase (up to a $10,000 lifetime limit)

- Qualified higher education expenses

- Certain medical expenses or health insurance premiums while unemployed

- Disability or death

Unlocking Early Retirement with a 72(t) SEPP

For anyone dreaming of an early retirement, one of the most powerful tools available is a provision known as Substantially Equal Periodic Payments (SEPP), or a 72(t) distribution. This IRS rule allows you to take penalty-free withdrawals from a Traditional IRA before age 59½ by setting up a series of fixed annual payments.

This is a highly structured process that demands precise calculations and strict adherence to IRS guidelines. A 72(t) SEPP can be a lifeline for early retirees, providing the steady income needed to bridge the gap until other retirement funds unlock. Given the complexity, working with a specialist like Spivak Financial Group is essential to make sure the plan is set up correctly.

For a deeper dive into this topic, you can explore the nuances of when you can take money out of an IRA without penalty in our detailed video guide.

Choosing the Right IRA for Your Financial Future

Knowing the mechanics of a Traditional versus a Roth IRA is one thing, but figuring out how they fit into your own life is what really matters. There’s no universal “best” choice here; the right answer is deeply personal and hinges on your current financial picture and where you see yourself down the road.

Let's cut through the noise. The decision usually boils down to one critical question: will your tax rate be higher now, or will it be higher in retirement? Answering that helps you decide whether to take a tax break today with a Traditional IRA or to lock in tax-free withdrawals for tomorrow with a Roth IRA. By looking at a few common scenarios, we can see how this plays out.

The Young Professional Starting Out

Picture a recent graduate just getting their career off the ground. They’re probably in one of the lowest tax brackets they'll ever be in. While the immediate tax deduction from a Traditional IRA might look appealing, it doesn't offer much of a benefit when your tax bill is already small.

This is where the Roth IRA really shines. By contributing after-tax dollars now, while in a low tax bracket, you're essentially prepaying your taxes at a discount. Every dollar that account earns over the next 30 or 40 years can then be withdrawn completely tax-free in retirement—a time when you’ll likely be in a much higher bracket.

The data backs this up. Roth IRAs are incredibly popular with younger savers. Research from the Investment Company Institute found that only 26% of Roth IRA holders were 60 or older. In contrast, 44% of Traditional IRA investors were in that same age group.

The High-Earning Professional at Peak Income

Now, think about a professional in their 40s or 50s who’s at their peak earning potential. They’re likely in one of the highest tax brackets of their life. For them, every dollar put into a Traditional IRA can create a significant, immediate tax deduction, which directly lowers their current high tax bill.

This upfront tax savings can be a powerful tool for managing a high income today. The strategy here is based on the assumption that during retirement, their income—and therefore their tax bracket—will be lower, making the taxes on withdrawals much more manageable.

The Strategic Early Retiree

Finally, let’s consider someone planning to retire early. This situation often demands a more sophisticated approach, and it might even involve using both types of accounts. An early retiree could use a 72(t) SEPP from their Traditional IRA to create a stream of penalty-free income before hitting age 59½.

At the same time, they could perform strategic Roth conversions during low-income years, moving money from pre-tax accounts into their tax-free Roth bucket. This maneuver helps them manage their long-term tax liability while making sure they have a flexible, tax-free source of cash later in retirement. It's a complex decision, and our guide on whether you should choose a Roth or not can walk you through the finer points.

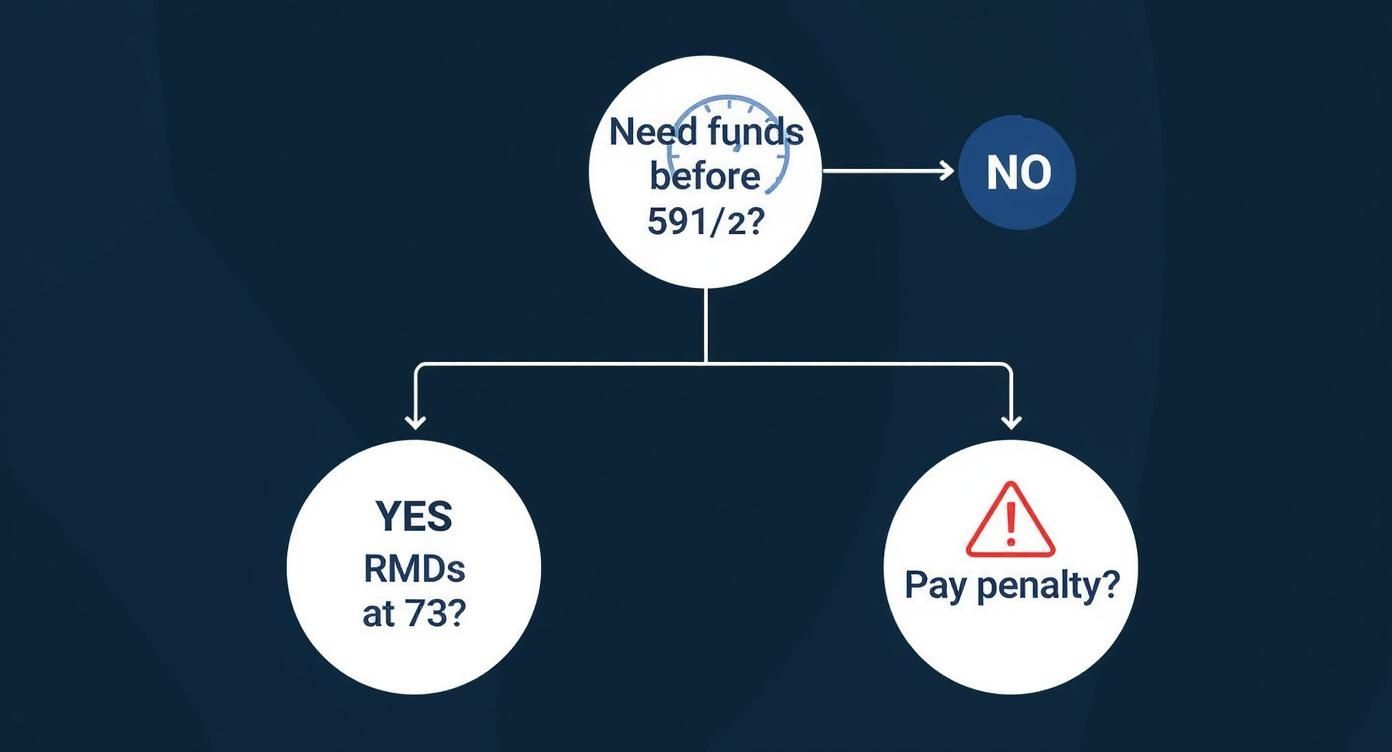

This flowchart can help you visualize the decisions you'll face when you need to access retirement funds, especially before the standard retirement age.

The main takeaway is that while early access is possible, it often comes with penalties unless you meet specific exceptions or use a structured plan like a 72(t).

Your Top IRA Questions, Answered

As you get deeper into retirement planning, specific questions always pop up. Let's tackle some of the most common ones people ask when weighing a Traditional IRA against a Roth IRA. Getting these details straight is key to making confident decisions.

Can I Have Both a Traditional IRA and a Roth IRA?

Yes, absolutely. Holding and funding both a Traditional IRA and a Roth IRA in the same year is not only allowed, but it's often a smart strategy. It gives you tax diversification in retirement—a pool of pre-tax money and a pool of tax-free money to pull from depending on your needs.

The one crucial rule to remember is that the annual contribution limit is a combined total for all your IRAs. So if the limit for the year is $7,000, you could split it $4,000 into your Roth and $3,000 into your Traditional. You just can't put $7,000 into each one.

What Is a Backdoor Roth IRA?

A backdoor Roth IRA is a well-known strategy for high-income earners who make too much to contribute to a Roth IRA directly. The process involves two steps: first, making a non-deductible contribution to a Traditional IRA, and then, right after, converting that money into a Roth IRA.

While this maneuver is perfectly legal, there's a major catch called the pro-rata rule. If you have other pre-tax funds sitting in any Traditional, SEP, or SIMPLE IRAs, the IRS forces you to treat the conversion as a mix of pre-tax and after-tax money, which can trigger a surprise tax bill. Executing a clean backdoor Roth often requires professional help to avoid costly mistakes.

What Happens to My IRA After I Pass Away?

When you pass away, the funds in your IRA go to the beneficiaries you've named on the account. The rules for how they can handle that money, however, are very different depending on their relationship to you.

- Spouses: A surviving spouse gets the most flexibility. They often have the option to roll the inherited IRA into their own, treating it as if it were always theirs.

- Non-Spouse Beneficiaries: For most other heirs, like children or grandchildren, the rules have gotten stricter. Under the SECURE Act, they generally have to empty the entire account within 10 years of your death.

This is where the Roth IRA truly shines as an estate planning tool. An inherited Roth IRA provides completely tax-free withdrawals for your beneficiaries. An inherited Traditional IRA, on the other hand, means every dollar they pull out is taxed as ordinary income.

The ability to leave behind a source of tax-free income is a powerful advantage of the Roth IRA. It’s a gift that secures not only your own retirement but can also give a significant financial head start to your loved ones.

Should I Contribute to My 401(k) or an IRA?

This is a classic question, and thankfully, the answer usually follows a clear order of operations. Your number one priority should always be contributing enough to your 401(k) to get the full employer match. Anything less is leaving free money on the table—it's the best return on investment you'll ever get.

Once you’ve captured the full match, the decision becomes more about options and fees. The vast majority of IRAs offer a much wider universe of investment choices—individual stocks, bonds, ETFs, and thousands of mutual funds—compared to the limited menu in a typical 401(k). If your workplace plan is loaded with high-fee funds or poor choices, it's often a much better move to direct any additional savings into an IRA.

Navigating complex retirement strategies like the ones discussed requires specialized knowledge. At Spivak Financial Group, we help clients build clear, effective plans for their financial future. To learn how you can achieve your retirement goals, contact us today.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com