When you're in a financial bind, that big pile of money sitting in your retirement account can look mighty tempting. It's a common question: "Can I take a loan from my IRA?"

The answer, in no uncertain terms, is no. Unlike a 401(k), the IRS has drawn a hard line in the sand—you absolutely cannot take a traditional loan against your IRA.

Understanding IRA Fund Access Rules

While a direct loan is off the table, don't mistake this rule for a complete dead end. The real issue is the fundamental difference between an IRA and a 401(k). Think of a 401(k) as an employer-sponsored plan, often with a whole administrative team built-in to manage things like participant loans.

An Individual Retirement Arrangement (IRA), on the other hand, is a personal trust agreement between you and a financial institution. Its rules are much stricter because its sole purpose is long-term savings, not short-term lending.

If you try to take money out of a traditional IRA before age 59½ and don't follow one of the specific exceptions allowed by the IRS, that money is considered an early distribution. This will trigger a painful 10% penalty on top of your regular income taxes. It's a costly mistake to make, and one that highlights why understanding the rules is so critical. For more on this trend, the Plan Sponsor Council of America offers insights into the rise in retirement plan loans.

It’s Not Loaning, It’s Accessing

The trick is to stop thinking about "borrowing" and start thinking about "accessing." While you can't get a loan, the IRS provides a few legal workarounds to get to your funds for emergencies or short-term needs.

These aren't loans in the traditional sense. They're strategic financial moves, and each comes with its own set of rules, timelines, and potential consequences that you need to weigh carefully.

Your main options include:

- The 60-Day Rollover Rule: This lets you withdraw funds for a short period, essentially giving yourself a temporary, interest-free bridge loan, as long as you put the exact amount back within 60 days.

- Withdrawing Roth IRA Contributions: If you have a Roth IRA, you're in luck. You can pull out your original contributions (but not the earnings) anytime you want, completely tax-free and penalty-free.

- Penalty-Free Distributions: The IRS has carved out several exceptions to that nasty 10% early withdrawal penalty for specific life events, like buying your first home or paying for qualified education expenses.

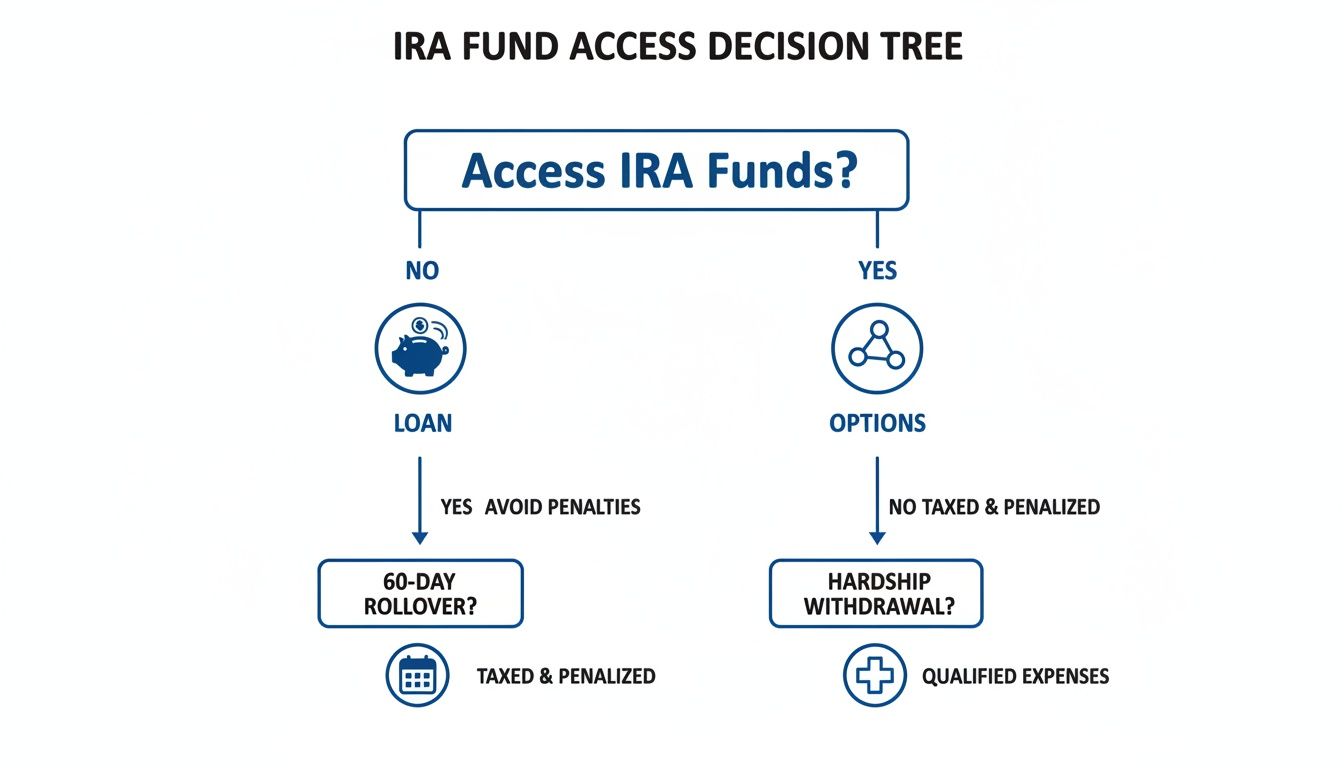

This decision tree gives you a quick visual of the paths you can take to get to your IRA funds—and makes it clear that a direct loan isn't one of them.

As the chart shows, while "loaning" is prohibited, approved "options" like a 60-day rollover or a qualified hardship withdrawal are available, each with its own specific rules. We'll dive deep into each of these alternatives throughout this guide.

The differences between how you can tap into an IRA versus a 401(k) are significant. Let's break them down side-by-side.

IRA vs 401(k) Accessing Your Funds at a Glance

| Feature | IRA (Traditional & SEP) | 401(k) |

|---|---|---|

| Direct Loans Allowed? | No, strictly prohibited. | Yes, if the employer's plan allows it (most do). |

| Loan Amount | N/A | Typically up to 50% of your vested balance or $50,000, whichever is less. |

| Repayment Terms | N/A | Usually requires regular payments over a 5-year term. |

| Early Withdrawal Penalty | 10% penalty before age 59½, plus income tax (unless an exception applies). | 10% penalty before age 59½, plus income tax (unless an exception applies). |

| Access to Contributions | Only Roth IRA contributions can be withdrawn tax/penalty-free at any time. | Varies by plan; in-service withdrawals may be restricted. |

This table makes it clear: if you need a true loan, a 401(k) is the only retirement vehicle that offers one. For IRA owners, the approach has to be different, focusing instead on the specific withdrawal exceptions the IRS allows.

Why Your IRA Isn't a Piggy Bank

Ever asked, "Can I take a loan from my IRA?" and gotten a hard "no"? There's a very good reason for that, and it goes right to the heart of what an IRA is and isn't. An Individual Retirement Arrangement is not just a savings account with a fancy name; it's a personal retirement trust, and it’s governed by a strict set of rules designed for one thing: long-term growth.

Think of your IRA as a financial time capsule. Its entire structure is built to encourage you to leave the money untouched, letting it compound for decades. The goal of the legislation is simple: to protect your future self from your present-day emergencies. The rules are deliberately rigid to stop you from dipping into it casually.

An employer-sponsored plan like a 401(k), on the other hand, often operates more like a company credit union. These plans are built with the administrative horsepower to manage loans, track repayments, and handle all the paperwork because loan options are a built-in feature. Your IRA simply doesn't have this infrastructure because, by design, it's not supposed to.

Trust Structure vs. Employer Plans

The critical difference is in the legal framework. An IRA is a trust or custodial account set up for the exclusive benefit of you and your heirs. The bank or brokerage holding your IRA (the custodian) has a legal obligation to follow IRS rules, which flat-out prohibit the owner from borrowing against the assets.

In fact, pledging your IRA as collateral for a loan is a major IRS violation known as a "prohibited transaction." This move can have disastrous consequences, potentially forcing the entire account to be treated as a taxable distribution in that year.

This is a world away from 401(k) plans, which fall under different regulations from the Employee Retirement Income Security Act (ERISA). ERISA lets plan sponsors include loan provisions, which makes a 401(k) a more flexible tool—though still one meant primarily for retirement.

The bottom line is that IRA assets are meant to be walled off and preserved for retirement. Treating it like a checking or savings account completely undermines its purpose and the tax breaks Congress gives us to encourage long-term financial security.

The Sheer Scale of IRA Savings

These strict rules also reflect just how important IRAs are to America's retirement system. Individual Retirement Accounts hold a truly staggering amount of wealth. As of mid-2025, IRAs in the U.S. held approximately $18 trillion in assets.

That number highlights why the rules are so protective. If millions of people started tapping these funds early through loans, it could seriously jeopardize the long-term retirement security of the country. You can find more insights into retirement trends and data over on NerdWallet.

Getting a handle on the "why" behind the no-loan rule is key. It's not the IRS being difficult; it's a deliberate design feature meant to safeguard your future. Keeping this in mind helps you respect the rules and make smarter, more strategic moves when you absolutely need to access your money before retirement.

Using the 60-Day Rollover as a Short-Term Bridge

Since the IRS strictly forbids taking a direct loan from your IRA, the closest you can get to borrowing from yourself is by using a clever—but very risky—strategy involving the 60-day rollover rule. This isn't a loan in the traditional sense. Instead, it's a loophole that lets you withdraw funds from your IRA for any reason, as long as you put the full amount back within a very tight deadline.

Think of it like a very short-term, interest-free bridge loan from your own retirement savings. You can use the cash to cover a temporary financial gap, but the moment that money leaves your account, a countdown timer starts. You have exactly 60 calendar days to get every penny back into an IRA. Not business days. 60 calendar days.

If you make it back under the wire, the transaction is treated as a tax-free rollover. No taxes, no penalties. But if you're even a single day late, the consequences are immediate and severe.

How the 60-Day Rollover Works in Practice

The process itself isn't complicated, but it demands perfect execution. What you're doing is called an indirect rollover—the money is paid out to you directly, and you are responsible for getting it back into a retirement account. You can learn more about the mechanics of what a rollover is and how it functions in our detailed guide.

Let's walk through a real-world scenario to see how this plays out.

Scenario: Sarah is buying her first home and needs $20,000 for a down payment. She's selling some stock to cover it, but the sale won't settle for another 30 days, and she risks losing the house. She decides the 60-day rule is her best option.

- Withdrawal: Sarah calls her IRA custodian and requests a $20,000 distribution. The check is sent to her, and the 60-day clock begins the day she receives the funds.

- Short-Term Use: She immediately uses the $20,000 for the down payment, securing her new home.

- Repayment: Three weeks later, her stock sale goes through. She takes $20,000 from the proceeds and deposits it back into an IRA. Since this was done well within the 60-day window, the IRS considers it a valid rollover.

- Result: Sarah successfully bridged her financial gap. She used her retirement money when she needed it and avoided all taxes and penalties because she returned it on time.

This worked out perfectly for Sarah because she had a concrete, guaranteed plan to get the money back. Attempting this without a rock-solid repayment strategy is like walking a tightrope with no safety net.

The Unforgiving Risks of Missing the Deadline

The biggest danger here is the unforgiving nature of that 60-day deadline. There is virtually no wiggle room. If you fail to deposit the full amount within that window, the entire withdrawal is instantly reclassified as a permanent distribution.

This triggers a painful financial domino effect:

- Ordinary Income Tax: The $20,000 is now considered taxable income for the year. This could easily bump you into a higher tax bracket.

- 10% Early Withdrawal Penalty: If you're under age 59½, the IRS will tack on a 10% penalty on the entire amount.

- Irreversible Action: Once the 60 days are up, the damage is done. You can't undo the distribution, and the tax bill is locked in.

For example, if Sarah missed her deadline on that $20,000 and is in the 24% federal tax bracket, her misstep would be a costly one. She'd owe $4,800 in federal income tax plus a $2,000 penalty, for a total hit of $6,800—all for being a day late.

While the IRS can grant a waiver in rare cases—like a mistake made by your financial institution or a federally declared disaster—your own financial hardship almost never qualifies. You simply can't assume you'll get an extension.

On top of all this, the IRS only allows you to do this once per 12-month period across all of your IRAs combined. This is not a strategy to be used repeatedly for cash flow. It's an emergency tool, and it should be treated with extreme caution.

Tapping Your Roth IRA Contributions: The Tax and Penalty-Free Loophole

If you have a Roth IRA, you're sitting on a powerful and often overlooked source of cash. Because Roth IRAs are funded with money you've already paid taxes on, the IRS gives you a fantastic perk: you can withdraw your direct contributions whenever you want, for whatever reason, completely free of taxes and penalties.

This rule applies no matter how old you are, making it an incredibly flexible financial tool.

It helps to think of your Roth IRA as having two separate buckets. The first bucket holds your contributions—all the money you've personally put in over the years. The second bucket holds the earnings—the profits, growth, and returns your investments have generated. You can always dip into the contribution bucket, but the earnings bucket is generally locked until you turn 59½ to avoid a tax bill.

This unique feature means a Roth IRA can double as an emergency fund of last resort. While it's not a "loan" in the traditional sense, this rule lets you get your hands on a chunk of your money without the high-stakes pressure of a 60-day rollover or the strict criteria of a hardship withdrawal.

How the IRS Ordering Rules Work in Your Favor

The IRS has a very specific pecking order for how money comes out of a Roth IRA. These "ordering rules" are a huge win for account holders because they guarantee that the tax-free money you put in is always the first money that comes out.

Here’s the sequence the IRS follows for withdrawals:

- Direct Contributions: All your regular, annual contributions are withdrawn first. This money is 100% tax-free and penalty-free.

- Conversion and Rollover Money: Next up is any money you converted from a Traditional IRA. This is usually tax-free but can get hit with a penalty if you withdraw it within five years of the conversion.

- Earnings: Your investment growth is the absolute last thing to be touched. If you take out earnings before age 59½, you'll almost certainly face both income tax and the 10% early withdrawal penalty.

This structure provides a fantastic safety net. As long as the amount you pull out is less than or equal to the total you’ve ever contributed, you won't owe a dime to the IRS.

A Real-World Example of Withdrawing Contributions

Let's walk through a quick scenario to see how this plays out in real life.

Imagine you're 40 and have been diligently putting $5,000 a year into your Roth IRA for the last five years. Your total contributions add up to $25,000. The market has been good to you, and your account is now worth $32,000, which means you have $7,000 in earnings.

Suddenly, a pipe bursts and you're facing a $15,000 bill for emergency home repairs. Because that $15,000 is less than your $25,000 in total contributions, you can withdraw it without paying any taxes or penalties. Your remaining $17,000 ($10,000 in contributions plus $7,000 in earnings) stays right where it is, continuing to grow for your retirement.

This example really highlights the flexibility of a Roth IRA. The key is to keep meticulous records of your contributions so you know exactly how much you can access. Your IRA custodian sends you a Form 5498 each year, which serves as the official record of your contributions. Hang on to those

Navigating Penalty-Free Hardship Withdrawals

While you can't take a loan from your IRA, life has a way of throwing curveballs that require cash, and fast. For these specific—and often stressful—situations, the IRS has carved out a handful of exceptions that let you tap your IRA before age 59½ without that painful 10% early withdrawal penalty.

But let's be crystal clear: these are not loans. They are permanent distributions, often called hardship withdrawals. Getting the rules right is critical because they can be a financial lifeline. Misunderstanding them, however, can lead to a world of expensive mistakes. Even when you dodge the penalty, there's one thing you can't escape: the money you pull out is almost always considered taxable income for the year.

What Qualifies as a Hardship Withdrawal

The IRS is very particular about what counts as a true hardship. These exceptions are meant for significant life events, not for covering everyday bills or a vacation. If your situation doesn't fit squarely into one of their approved categories, you can bet the 10% penalty will apply.

Here are some of the most common reasons you can access IRA funds without getting hit with the penalty:

- First-Time Home Purchase: You can pull out a lifetime maximum of $10,000 to buy, build, or rebuild a first home. This can be for you, your spouse, your kids, or even your grandkids.

- Qualified Higher Education Expenses: You can use the money to pay for tuition, fees, books, and other required expenses for yourself, a spouse, child, or grandchild at an eligible college or university.

- Major Medical Expenses: This allows you to withdraw an amount to cover unreimbursed medical bills that exceed 7.5% of your adjusted gross income (AGI) for the year.

- Health Insurance Premiums: If you find yourself unemployed, you can use IRA money to pay for health insurance premiums once you've received unemployment checks for 12 consecutive weeks.

- Permanent Disability: If you become totally and permanently disabled, your IRA funds become accessible without the early withdrawal penalty.

- IRS Levy: If the IRS comes knocking and places a levy on your IRA to settle a tax debt, that withdrawal is exempt from the 10% penalty.

For a closer look at the fine print, our guide breaks down the complete list of the 10 early withdrawal penalty exceptions and what you need to know for each.

The Taxable Income Reality

It’s easy to get so focused on avoiding the 10% penalty that you forget about Uncle Sam's other hand in your pocket: income tax. Let me say it again: when you take a hardship withdrawal from a Traditional, SEP, or SIMPLE IRA, every dollar is added to your taxable income for that year.

Let's say you're in the 22% federal tax bracket and need $15,000 for your child's qualified college tuition. You successfully avoid the $1,500 early withdrawal penalty (that's the 10%). Great. But you'll still have to write a check to the IRS for $3,300 in federal income tax, not to mention any state taxes.

That tax bite can seriously shrink the amount of money that actually ends up in your hands. It’s absolutely vital to factor this into your math. You might even need to withdraw more than your initial expense just to cover the taxes you'll owe. This is the key difference between a withdrawal and a loan—with a loan, the money isn't taxed if you pay it back. With a hardship withdrawal, that tax bill is permanent.

Documentation and Proof Are Your Responsibility

When you claim a hardship distribution, the burden of proof is 100% on you. Your IRA custodian isn’t going to ask for receipts or check if you qualify. They’ll just process the withdrawal and report it to the IRS on Form 1099-R.

That means you need to keep meticulous records—closing documents from a home purchase, tuition statements from a university, or itemized bills for medical expenses. If the IRS ever decides to audit you, this is the paperwork that will stand between you and a retroactive 10% penalty, plus interest and other fees. You are your own compliance department here, so be prepared.

Creating an Income Stream With a 72(t) Plan

If you need a consistent, predictable income from your IRA before hitting age 59½, there’s a powerful—but very strict—option available. It’s known as a Series of Substantially Equal Periodic Payments (SEPP), though you'll more commonly hear it called a 72(t) plan, named after its section in the IRS tax code.

Let's be clear: this is not a loan or a quick, one-time withdrawal.

Think of it less like tapping an emergency fund and more like activating your own personal pension, just a bit earlier than planned. It’s a formal agreement you make with the IRS to receive a calculated stream of income from your retirement savings.

This strategy is built for people who are serious about early retirement or need a reliable income to bridge the gap until they turn 59½. It is absolutely not a fix for a short-term cash crunch, because the rules are incredibly rigid.

Understanding the SEPP Commitment

When you start a 72(t) plan, you're locking yourself into a schedule of specific, calculated distributions every year. This arrangement is non-negotiable and must continue for at least five full years or until you turn 59½, whichever period is longer.

This long-term commitment is the absolute heart of a 72(t) plan. If you break this pact—by changing the payment amount, taking an extra distribution, or stopping payments early—the consequences are severe. The IRS will go back and retroactively apply the 10% early withdrawal penalty to every single distribution you've taken under the plan, plus interest.

Because of this inflexibility, a 72(t) is really only for people who have mapped out their early retirement income needs with precision. It's a strategic financial move, not a casual one.

How Payments Are Calculated and Paid

The IRS gives you three different methods to figure out your annual payment amount, each one factoring in your account balance and life expectancy. The math can get complicated, but the goal is always the same: to create a sustainable withdrawal plan that doesn't drain your account too quickly.

Once you pick a calculation method and the payments begin, you have to stick to it. No exceptions. While the payments must be taken at least annually, you can set them up to come monthly, quarterly, or in one lump sum each year to match your personal cash flow. This provides a steady, reliable income stream you can build a budget around.

Getting the calculations and the schedule right is absolutely critical. That’s why it’s so important to fully understand all the 72(t) distribution rules before you even think about starting a plan.

Ultimately, the power of a 72(t) is its ability to unlock your retirement savings for early income without getting hit by penalties. So while the answer to "can I take a loan from my IRA?" is a firm "no," a SEPP offers a perfectly legal and effective alternative when a steady, long-term income is what you truly need.

Common Questions About Accessing Your IRA Funds

Once you start digging into the rules and alternatives for tapping into your retirement money, a lot of specific questions pop up. It's easy to get tangled in the details, especially when you're under financial pressure. Let's clear the air and get you direct answers to the most common questions we hear from clients.

What Happens If I Miss the 60-Day Rollover Deadline?

Miss that 60-day window for an indirect rollover, and the consequences are both immediate and painful. The IRS doesn't mess around here—the entire amount you took out instantly becomes a permanent, taxable distribution for the year.

That means you'll owe ordinary income taxes on the whole thing. And if you're under 59½? Tack on a hefty 10% early withdrawal penalty. While the IRS might grant a waiver for a rare event like a postal service error or a mistake by your bank, they almost never accept personal financial hardship as an excuse. You absolutely must treat that 60-day limit as a hard, non-negotiable deadline.

Can I Roll My IRA Into a 401(k) to Take a Loan?

Yes, this is a legitimate workaround that can indirectly give you loan access to your retirement funds. The strategy involves moving your IRA money into your current employer's 401(k).

But it's not a given. This only works if two things are true: your employer's 401(k) plan must accept incoming rollovers from IRAs, and the plan must offer a loan feature to its participants. Once the money is in your 401(k), it's governed by that plan's specific loan rules. It's crucial to confirm both of these provisions are available before you even think about starting this multi-step process.

Do I Have to Pay Back a Hardship Withdrawal from My IRA?

No, you don't. A hardship withdrawal isn't a loan, so there's no way to pay it back. It is a one-way street—a permanent distribution from your retirement account.

Even if the IRS waives the 10% early withdrawal penalty because you have a qualified hardship (like buying your first home or facing major medical bills), the money you take out is still considered taxable income for that year. Unlike a 401(k) loan that you repay over time, an IRA hardship distribution is a final transaction that permanently shrinks your nest egg.

Navigating these complex rules requires expertise and careful planning. At Spivak Financial Group, we specialize in helping individuals access their retirement funds strategically and in full compliance with IRS regulations. Find out how we can help you achieve your financial goals by visiting us at https://72tprofessor.com.