A 403 b hardship withdrawal is a permanent distribution from your retirement plan, something you should only consider as a last resort for an immediate and heavy financial need. Unlike a loan, you don't pay this money back. That makes it a serious financial decision with permanent consequences for your retirement security.

Understanding the 403b Hardship Withdrawal

Think of your 403(b) account as a financial fortress you’ve spent years building to protect your future self. A hardship withdrawal is like taking a battering ram to the front gate—it gets you what you need right now, but it creates permanent damage that can't be undone. It’s a lifeline designed for truly dire financial emergencies when every other option has been exhausted.

This isn't as simple as asking for your own money. To qualify, you have to prove to the IRS that your situation meets their strict standard of an "immediate and heavy financial need." This rule is in place to make sure these withdrawals are used for genuine crises, not just for covering discretionary spending or fixing a temporary cash flow problem.

Essentially, the IRS needs to see that you have no other reasonable way out of your financial predicament. This could mean facing an unexpected medical catastrophe, preventing the foreclosure of your home, or other urgent situations we'll dive into later.

Key Characteristics of a Hardship Withdrawal

It’s crucial to understand the fundamental features of a hardship withdrawal before you even think about pulling the trigger. It is fundamentally different from any other way of accessing your retirement funds.

Here are the key points to burn into your memory:

- It Is Not a Loan: The money you take out is gone for good. There's no repayment plan because it's a permanent distribution from your account.

- There Are Strict Eligibility Rules: You absolutely must meet the specific criteria defined by the IRS for what constitutes a hardship. Just wanting the money isn't enough.

- It Comes with Costs: The withdrawal is almost always subject to ordinary income tax. On top of that, you'll likely face a painful 10% early withdrawal penalty if you're under age 59½.

- It Destroys Future Growth: This is the hidden, most devastating cost. You lose all future tax-deferred growth on the money you pull out, which can dramatically shrink your final retirement nest egg.

At Spivak Financial Group, we counsel our clients to treat a hardship withdrawal as the absolute final emergency button. While it offers immediate relief, the long-term cost to your financial future is steep and irreversible.

Before going any further, it's vital to grasp these basics. The table below offers a quick summary of what you're getting into.

403b Hardship Withdrawal at a Glance

This table breaks down the core components of a 403(b) hardship withdrawal for easy reference.

| Feature | Description |

|---|---|

| Purpose | To provide financial relief for an immediate and heavy financial need. |

| Repayment | Not required; this is a permanent distribution from your account. |

| Tax Implications | The withdrawn amount is treated as ordinary income and is taxable. |

| Penalties | A 10% early withdrawal penalty often applies if you are under age 59½. |

| Eligibility | Governed by strict IRS rules and specific plan provisions. |

Keep these characteristics in mind as we explore the specific rules and processes involved. Understanding them is the first step in making a responsible decision.

Understanding the IRS Rules for Hardship Withdrawals

When you take a 403(b) hardship withdrawal, you're stepping into the IRS's world, and they have very specific rules. They’ve built a strict framework to make sure these withdrawals are only used for genuine, unavoidable emergencies. To get your request approved, you have to pass two critical tests that prove your situation is both urgent and financially overwhelming.

Think of it like getting through two locked gates. You have to unlock both to access your funds. If you can’t get past either one, the door to your retirement savings stays shut.

The First Test: An Immediate and Heavy Financial Need

First, you have to prove you have an "immediate and heavy financial need." This is more than just having a big, unexpected bill show up in the mail. The IRS is looking for a true financial crisis—something that needs to be dealt with right now and simply can't be put off.

This need must come from an unforeseen event. For instance, a sudden medical diagnosis that requires costly surgery would likely qualify. On the flip side, wanting to buy a new car or finally pay off that nagging credit card debt won't meet this high bar.

The burden is on you to prove your situation is severe and requires you to act immediately. Your plan administrator is the gatekeeper here, and they will look closely at your request to make sure it fits squarely within these tough IRS guidelines.

The Second Test: Necessary to Satisfy the Need

Getting past the first gate isn't enough. You also have to prove the withdrawal is strictly "necessary to satisfy the financial need." This rule is a one-two punch that often trips people up.

First, you can only take out the exact amount you need to handle the crisis. If you have a $15,000 medical bill, you can only request $15,000, plus whatever is needed to cover the taxes and penalties. You can't ask for $25,000 just to have a little extra cushion.

Second—and this is the big one—you must have already exhausted all of your other reasonably available financial resources. This is a deal-breaker for many people.

The IRS requires you to certify that you have no other means to meet the financial need. This means you must have already liquidated other assets and sought commercial loans before turning to your retirement savings as a final option.

This rule exists to ensure your 403(b) is genuinely your last resort. Before you even think about applying, you need to have already looked into:

- Savings and Investments: You're expected to use cash you can get to, like funds in your savings, checking, or brokerage accounts.

- Insurance or Liquidation: Can the need be covered by an insurance policy? Can you sell other assets to raise the cash?

- Commercial Loans: The IRS wants to see that you've tried to get a loan from a bank or credit union on reasonable terms.

- Plan Loans: If your 403(b) plan offers loans, you almost always have to take one of those before you can even be considered for a hardship withdrawal.

What Funds Can You Actually Access?

Even if you pass both IRS tests with flying colors, you can't just drain your entire 403(b) account. The rules are very specific about which pools of money are fair game for a hardship distribution.

Generally, you can only pull from:

- Your own pre-tax contributions.

- Certain employer contributions that were made before 1989.

So, what's off-limits? The earnings your contributions have generated and most of your employer's matching funds are typically locked away. This rule is there to protect the long-term growth of your retirement savings, even during a crisis. It can feel restrictive, but knowing these limits upfront is key to avoiding compliance headaches. It's also important to remember that while hardship withdrawals are tough to get, there are other ways to access your money early. You can learn more in our guide covering the 10 early withdrawal penalty exceptions.

Qualifying Events for a Hardship Withdrawal

So, you've determined you have an "immediate and heavy financial need." That's the first hurdle. Now, you have to prove your situation fits into one of the specific categories the IRS officially recognizes.

These are often called "safe harbor" events. Think of them as pre-approved emergencies. If your reason for needing the money is on this list, you automatically satisfy the IRS's first major test. But be prepared—your plan administrator will need clear documentation to back up your claim.

Let’s translate these official rules into the real-world situations you might be facing.

IRS Safe Harbor Qualifying Events for Hardship Withdrawals

The IRS has a clear-cut list of situations that qualify for a hardship withdrawal. The table below breaks down each "safe harbor" event and what you need to know about it.

| Qualifying Event | Description and Key Considerations |

|---|---|

| Medical Care Expenses | For significant medical costs for yourself, your spouse, dependents, or beneficiary that are not covered by insurance. This isn't for routine co-pays; think major procedures or treatments. You'll need medical bills or an Explanation of Benefits (EOB). |

| Home Purchase Costs | To cover costs directly related to buying your main home, like a down payment or closing costs. This does not include paying your regular mortgage. |

| Preventing Eviction or Foreclosure | A lifeline if you're on the verge of losing your primary residence. You can use the funds to stop an eviction or halt a foreclosure proceeding. You’ll need an official eviction or foreclosure notice with the amount due and a deadline. |

| Higher Education Expenses | To pay for tuition and related fees for the next 12 months of post-secondary education. This can be for you, your spouse, your kids, or your plan beneficiary. Note that this usually doesn't cover room and board. |

| Home Repair Costs | For repairs needed on your main home after damage from events like fires, floods, or major storms. You'll need detailed estimates or invoices from contractors. |

| Funeral and Burial Expenses | To cover the costs of a funeral for a deceased parent, spouse, child, or plan beneficiary. Invoices from the funeral home will be required. |

| Federally Declared Disasters | If you've suffered a loss in an area designated by FEMA as a disaster zone, you may qualify. This provides a crucial backstop for those hit by hurricanes, wildfires, and other disasters. |

| Domestic Abuse Survivors | Thanks to the SECURE 2.0 Act, survivors of domestic abuse can self-certify their situation and withdraw up to $10,000 (indexed for inflation) within one year of the incident. |

It's crucial to gather the right paperwork for your specific situation. Your plan administrator will not approve your request without proof that your need is real and fits neatly into one of these categories.

The IRS rules are designed to ensure funds are used for foundational needs like health and shelter. Proving that the expense is directly tied to one of these core areas is critical for your application's success.

Interestingly, while hardship withdrawals are on the rise in some retirement plans, data suggests 403(b) participants use them sparingly. A 2025 survey showed that only 1.1% of 403(b) participants took hardship withdrawals in 2024. This trend may be influenced by the growing adoption of new SECURE 2.0 provisions, which offer alternatives for emergencies, disasters, and domestic violence situations. You can discover more insights about these trends and their drivers from the Plan Sponsor Council of America.

The True Cost: Taxes, Penalties, and Opportunity Lost

A 403(b) hardship withdrawal can feel like a life raft when you're in financial trouble, but it's crucial to understand that the money you receive is anything but free. Tapping into those funds early unleashes a wave of immediate costs and long-term consequences that can seriously harm your retirement readiness. Before you make a decision you can't undo, you need to know exactly what you're getting into.

First, let's be clear: this isn't a tax-free loan to yourself. It's a taxable distribution from an account that's been growing tax-deferred. The entire amount you pull out gets added to your income for the year, which can easily bump you into a higher tax bracket and leave you with a surprisingly hefty tax bill come April.

The Double Hit of Taxes and Penalties

The first blow comes from ordinary income tax. Unlike long-term capital gains that often get a friendlier tax rate, your hardship withdrawal is taxed at your regular, marginal income tax rate. If you're in the 22% federal tax bracket, you’re saying goodbye to nearly a quarter of your money right off the bat—and that's before any state taxes kick in.

The second, and often more painful, blow is the 10% early withdrawal penalty. If you're under age 59½, the IRS typically tacks on this extra penalty. Think of it as a punishment specifically designed to keep people from raiding their retirement nest eggs prematurely. While a few exceptions exist, a standard hardship withdrawal usually isn't one of them.

When you combine federal income tax, state income tax, and that 10% penalty, it's not uncommon to see 30% to 40% or more of your withdrawal vanish. That means a request for $10,000 might only put $6,000 to $7,000 in your pocket.

Let’s walk through a quick example to see just how this plays out in the real world.

A Real-World Example of the Financial Impact

Imagine you're under 59½, you're in the 22% federal tax bracket, and you need $10,000 for a qualifying hardship. Here's a look at the math:

- Initial Withdrawal: $10,000

- Federal Income Tax (22%): -$2,200

- 10% Early Withdrawal Penalty: -$1,000

- Total Immediate Costs: -$3,200

- Net Cash Received: $6,800

In this all-too-common scenario, it cost you $3,200 just to get to your own money. To actually receive the full $10,000 you need, you would have to pull out closer to $14,700, draining your retirement account even faster. For anyone looking for ways to avoid this penalty, our guide on penalty-free IRA withdrawals is a good place to start exploring other potential avenues.

The Silent Killer: Opportunity Cost

The most devastating cost isn't the immediate tax hit—it's the opportunity cost. The money you pull out today is money that can no longer grow and compound tax-deferred for your future. You are permanently sacrificing decades of potential growth.

That $10,000 you took out could have grown into $40,000, $50,000, or even more by the time you stop working. This lost growth is a quiet but powerful force that can leave a massive hole in your nest egg, potentially forcing you to work years longer or live on far less in retirement.

Interestingly, the data shows 403(b) participants are much more disciplined than their 401(k) counterparts. While hardship withdrawals from 401(k)s jumped to 4.8% of participants in 2024, 403(b) plans saw withdrawals from only 1.1% of participants. This could be due to new options available under the SECURE 2.0 Act, which may offer different tax consequences. You can read the full research about these plan trends for a deeper dive.

How to Apply for a Hardship Withdrawal

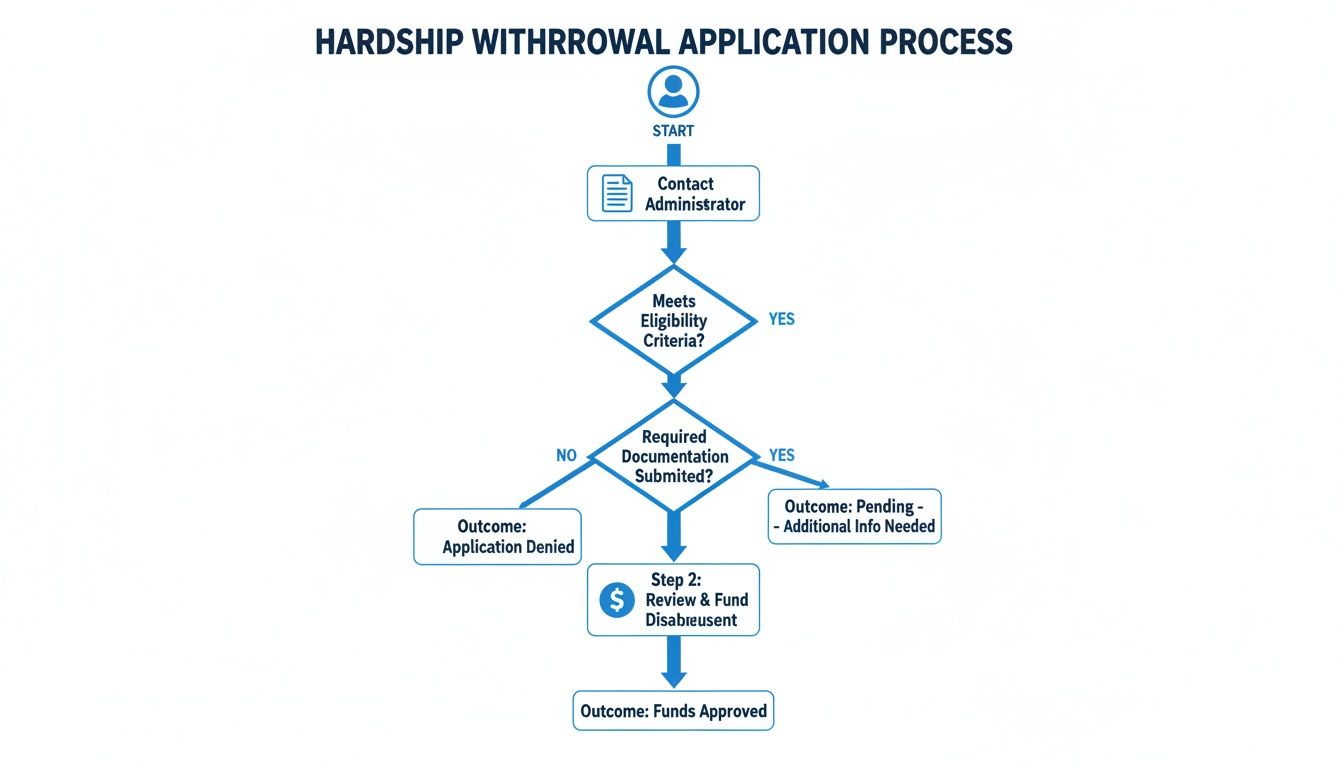

Applying for a 403(b) hardship withdrawal might feel overwhelming, but it's really just a step-by-step process. If you think of it as building a case for your financial need, it becomes much more manageable. The clearer your story and the stronger your evidence, the smoother things will go.

The whole thing kicks off with one simple action: reaching out to your 403(b) plan administrator. They're the ones managing your account, so they hold the keys to any withdrawal request. They’ll give you the specific forms and a checklist of everything they need based on your plan's rules.

Step 1: Contact Your Plan Administrator

Your first move is to call or email your plan administrator and ask for a hardship withdrawal application packet. This is your chance to get ahead of the game and set clear expectations right from the start.

Don't just ask for the forms. Use this conversation to find out exactly what documents they require, how long it usually takes to get the money after you apply, and if they have any specific rules that go beyond the basic IRS guidelines. Getting these details upfront can save you a ton of time and prevent frustrating back-and-forth later.

Step 2: Gather Your Documentation

This is where the rubber meets the road. Your plan administrator needs solid proof that you're facing an "immediate and heavy financial need" as defined by the IRS. Just saying you have a hardship isn't enough—you have to back it up with paperwork.

The exact documents you'll need will depend on your situation, but here are some common examples:

- Medical Expenses: You'll likely need itemized hospital or clinic bills and the Explanation of Benefits (EOB) from your insurance company showing your out-of-pocket costs.

- Preventing Foreclosure or Eviction: Look for an official notice from your lender or landlord that clearly shows the amount you owe and the deadline to avoid losing your home.

- Home Purchase: A signed purchase agreement or closing statement that details the costs you're responsible for will be key.

- Tuition Payments: Get an official invoice from the school that lists the student's name, the amount due, and the payment deadline.

- Home Repairs: You'll need signed, detailed estimates from licensed contractors that explain the work and the total cost.

Meticulous record-keeping is your best friend here. Your plan administrator has a legal duty to verify your need, and the number one reason requests get denied is incomplete or unconvincing documentation.

Step 3: Complete and Submit the Application

With all your documents in hand, it's time to fill out the official hardship withdrawal form. It will ask for your personal info, the amount you need, and for you to formally declare that you're eligible.

This is where you'll encounter the idea of self-certification. You’ll have to sign a statement, essentially swearing to a few key things:

- The withdrawal is truly for an "immediate and heavy financial need."

- The amount you're asking for is no more than what's necessary to solve the problem.

- You’ve already tried to get the money from other reasonable sources.

Even though you self-certify, you absolutely must keep all your supporting documents in a safe place. The IRS can audit your withdrawal years down the road. If you can't produce the proof to back up your claim, you could be on the hook for major back taxes and penalties.

Once you submit the full package, the administrator will review it. The timeline can vary, but you can generally expect a decision—and the funds, if approved—within a few business days to a couple of weeks.

Exploring Smarter Alternatives to a Hardship Withdrawal

Tapping into your 403(b) for a hardship withdrawal is a serious financial move with permanent ripple effects on your retirement. Think of it as hitting the big red emergency button—you only do it when every other option has failed. Before you go that route, it’s critical to explore all the other avenues first.

The goal is to find a less destructive path to get the cash you need. Thankfully, several smarter strategies can provide financial relief without derailing your future. Let’s walk through them.

As you can see, the process isn’t simple. It requires jumping through hoops and getting approval from your plan administrator, which underscores why it’s best saved as a true last resort.

The 403(b) Loan: A More Favorable Option

If your plan offers it, a 403(b) loan is almost always a better first choice. With a loan, you're essentially borrowing from yourself. You get the cash you need now and then pay it back into your own account, usually over five years through simple payroll deductions.

The biggest win here? You completely sidestep the immediate income tax hit and that painful 10% early withdrawal penalty.

Every dollar you repay, plus interest, goes right back into your retirement account. Your nest egg stays intact and keeps growing for the future. A hardship withdrawal, on the other hand, pulls that money out forever, erasing all its potential future growth along with it.

Taking a 403(b) loan is like borrowing a book from your future self—you get to use it now, but you have every intention of putting it back on the shelf. A hardship withdrawal is like ripping the pages out for good.

Rule 72(t) SEPP: An Advanced Strategy

For those who need a predictable, steady income stream rather than a lump sum, there's a powerful strategy called a Substantially Equal Periodic Payment (SEPP) plan. Governed by IRS Rule 72(t), this allows you to take a series of penalty-free payments from your retirement account before you turn 59½.

The catch is that you have to stick to a strict payment schedule for at least five years, or until you reach age 59½—whichever period is longer. It requires precision and careful planning, so it's a move best made with some professional guidance. If you have other similar accounts, our guide explains in detail how to take money from a 401(k) using strategies just like this one.

Non-Retirement Financial Solutions

Before you even think about touching your retirement funds, look at solutions that are completely separate from your 403(b). Often, a financial crisis can be solved without having to sacrifice your long-term security.

Here are a few powerful steps to consider:

- Negotiate with Creditors: You'd be surprised how many lenders or medical offices are willing to work with you. A simple phone call explaining your situation can often lead to a payment plan or even a reduced settlement amount.

- Personal Loans or Lines of Credit: Yes, they come with interest. But that interest is often far less costly than the combined taxes and penalties you’d pay on a hardship withdrawal.

- Budgeting and Expense Reduction: Take a hard look at where your money is going. A deep dive into your budget can often free up cash you didn't know you had, which can then be put toward your emergency.

It's also worth understanding all your financial protections. For instance, knowing how retirement savings are protected in Chapter 13 bankruptcy can provide peace of mind and might open up alternatives for managing overwhelming debt.

The good news is that people are getting the message. In 2024, hardship withdrawals from plans like 403(b)s hit a low of just 1.1% of participants. This trend is helped by new SECURE 2.0 Act provisions, like the option for a $1,000 emergency withdrawal, which 42.1% of plans have already adopted to help people manage smaller financial shocks.

Got Questions About Hardship Withdrawals? We've Got Answers.

When you're staring down the barrel of a 403(b) hardship withdrawal, it's natural for a lot of specific questions to pop up. Let's tackle some of the most common ones to make sure you have a rock-solid understanding of what you're getting into.

Do I Have to Repay a 403b Hardship Withdrawal?

Absolutely not. This is one of the most critical distinctions to understand: a hardship withdrawal is a permanent distribution, not a loan. You never have to pay it back.

That might sound like a good thing, but it's the very reason this should be your last resort. Once you take that money out, it's gone for good—along with all the potential growth it would have generated for your retirement.

How Long Does the Hardship Withdrawal Process Take?

The timeline really depends on your plan administrator. Once you’ve submitted all the required paperwork, you can typically expect to wait anywhere from a few business days up to two weeks to get approval and see the funds. It's always best to check directly with your plan provider to get a handle on their specific processing times.

Your plan administrator has the job of verifying your need according to strict IRS rules. Most delays happen because of simple things like incomplete forms or not providing enough proof. Do yourself a favor and double-check every piece of paper before you send it in.

Can My Hardship Withdrawal Request Be Denied?

Yes, it can. Your plan administrator has the final say and can deny your request if you don't fit the IRS criteria or fail to meet your specific plan's rules. A denial often happens when you can't provide solid documentation of your financial emergency or if the administrator believes you have other financial resources you could tap into first.

Will Taking a Hardship Withdrawal Affect My Future Contributions?

It used to. In the past, the rules forced you into a six-month suspension of your 403(b) contributions after taking a hardship withdrawal.

Thankfully, recent legislation got rid of that mandatory suspension. While it’s no longer a federal requirement, you should still glance at your specific plan documents. Some plans might technically still have their own internal rules, though it's become pretty uncommon.

A hardship withdrawal is a serious financial decision with permanent consequences. Before you pull the trigger, it’s vital to explore every other option on the table.

At Spivak Financial Group, we help clients find better ways to access their retirement funds, like the 72(t) SEPP strategy that can provide penalty-free income. Find out if this could be a smarter solution for your situation by visiting us at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728