Generally, IRA withdrawal exceptions let you get your hands on your retirement money before age 59½ without that nasty 10% penalty. You’ll still owe regular income tax on the withdrawal, of course. These exceptions are carved out for specific life events, like buying your first home, footing the bill for college, or covering some hefty medical expenses. Knowing what qualifies is the key to tapping your savings when you really need to, without getting hit with extra fees.

Understanding the 10% Early Withdrawal Penalty

Think of your IRA as a long-term savings bucket, designed to grow until you're ready to hang up your work boots. To keep you from dipping into it too early, the IRS slaps a 10% additional tax—what most of us call an early withdrawal penalty—on any money you take out before you hit age 59½. It’s a pretty powerful incentive to leave that money alone and let it work for your future self.

But life happens. The IRS gets that. Big, unexpected events can create an urgent need for cash, and sometimes your retirement account is the only place to turn. That’s precisely why Congress created a list of official IRA withdrawal exceptions.

Why These Exceptions Exist

Let's be clear: these exceptions aren't secret loopholes or clever tax dodges. They are intentionally built into the tax code to act as a financial lifeline when you're navigating a major life event. The government recognizes that things like buying your first home, dealing with a disability, or facing a mountain of medical bills are legitimate reasons to tap your retirement funds ahead of schedule.

These rules give you some much-needed flexibility. They ensure your retirement funds can be there for you not just in your golden years, but also during some of life's most challenging moments. It's all about striking a balance between encouraging you to save for the long haul and giving you access to your own money when you truly need it.

The whole point of these exceptions is to make sure the tax code doesn't unfairly punish people who are dealing with unavoidable and often expensive life events. It's about providing a little relief when it's needed most.

Setting the Stage for Your Financial Strategy

While these penalty-free withdrawals are fantastic tools for one-off situations, they're just one piece of the financial puzzle. If you're planning a full-blown early retirement, you'll need a completely different strategy to create a steady, reliable income stream. Getting a handle on the landscape of penalty-free IRA withdrawals is the first step in building a plan that works for you.

This is where getting some expert guidance can make all the difference. The rules for each exception can be tricky, and one small misstep could land you with a surprise tax bill from the IRS. At Spivak Financial Group, our team at 72tProfessor.com specializes in helping people just like you understand their options, making sure every financial move is made with confidence and clarity.

Unlocking Your IRA for Major Life Milestones

While the whole point of an IRA is to save for your golden years, the IRS gets that life happens long before you hit age 59½. Big moments—like buying a home or sending a kid to college—often come with big price tags.

Thankfully, the tax code has some built-in flexibility. Specific IRA withdrawal exceptions allow you to access your savings for these milestones without getting hit with that painful 10% early withdrawal penalty. Think of your IRA less like a locked vault and more like a flexible tool you can use to build your life, not just your retirement.

The First-Time Homebuyer Exception

This is one of the most popular exceptions, and for good reason. It can be a real game-changer for getting into the housing market. Normally, pulling money from your IRA before 59½ means a stiff penalty, but this rule lets you take out up to $10,000 penalty-free to help buy your first home.

What's a "first-time" homebuyer? The IRS definition is broader than you might think. You qualify if you (and your spouse) haven't owned a primary residence in the past two years. This $10,000 is a lifetime limit per person. But here’s a great tip: if you and your spouse are both buying your first home together, you can each pull $10,000 from your respective IRAs for a combined $20,000 toward your down payment or closing costs. You can learn more about how IRA withdrawals can avoid penalties with some additional research.

Just keep a couple of important conditions in mind:

- You're on the clock: The money must be used to buy, build, or rebuild a main home within 120 days of the withdrawal. This can be for you, your spouse, your kids, grandkids, or even your parents.

- The IRS definition is key: Remember, it's about not owning a primary home in the two years leading up to the purchase date.

Funding Qualified Higher Education Expenses

College costs are no joke, and this exception gives you a powerful way to tackle them. You can use your IRA funds to pay for qualified higher education expenses for yourself, your spouse, your children, or your grandchildren.

The best part? Unlike the homebuyer rule, there is no dollar limit. The penalty-free amount you can take is limited only by the total of the qualified education expenses for that year. It’s a fantastic option for families trying to minimize student loan debt.

One critical reminder: While you dodge the 10% penalty, the money you withdraw still counts as taxable income for the year. Always factor that into your planning to avoid a surprise tax bill come April.

So what counts as a "qualified expense"? It generally covers:

- Tuition and fees

- Books, supplies, and required equipment

- Room and board (as long as the student is enrolled at least half-time)

New Additions: Birth or Adoption Expenses

Welcoming a new child is an exciting (and expensive!) time. A relatively new exception helps new parents manage those costs. You can withdraw up to $5,000 penalty-free from your IRA for expenses related to a birth or legal adoption.

This withdrawal has to be made within one year of the child's birth or the date the adoption is finalized. And just like the homebuyer rule, it’s per parent. That means each parent can take a $5,000 distribution from their own IRA, giving you a potential $10,000 total per couple, per child.

A unique feature here is that you might be able to repay this distribution back into your IRA, a benefit most other exceptions don't offer.

To make these rules easier to digest, here's a quick side-by-side comparison.

Key Life Event IRA Withdrawal Exceptions at a Glance

This table gives you a quick snapshot of the limits and rules for the most common life-event exceptions.

| Exception Type | Penalty-Free Limit | Key Conditions |

|---|---|---|

| First-Time Homebuyer | $10,000 (Lifetime) | Must not have owned a primary residence in the prior 2 years. Funds must be used within 120 days. |

| Higher Education | No dollar limit | Must be used for qualified education expenses at an eligible institution for yourself, spouse, child, or grandchild. |

| Birth or Adoption | $5,000 (Per parent, per child) | Withdrawal must occur within one year of the birth or adoption finalization. Repayment may be possible. |

While these exceptions are incredibly helpful, always be sure you understand the fine print—especially the tax implications—before making a withdrawal.

Accessing Funds During Health and Financial Hardship

Life’s most difficult moments—a sudden health crisis or an unexpected job loss—often come with a heavy financial burden. During these times, your energy should be focused on getting back on your feet, not stressing over tax penalties.

Thankfully, the IRS understands this. They’ve built in specific IRA withdrawal exceptions that act as a financial safety net. These rules are designed with compassion, letting you tap into your retirement savings when you absolutely need them most, without getting hit with that standard 10% early withdrawal penalty. Knowing how these exceptions work can bring a massive sense of relief during an already challenging time.

Total and Permanent Disability Exception

One of the most powerful hardship exceptions is for a total and permanent disability. If a severe illness or injury leaves you unable to work, this rule lets you access your IRA funds penalty-free, no matter your age.

The IRS definition is strict but clear: you must be unable to perform any "substantial gainful activity" due to a physical or mental condition. This isn't a temporary situation; the condition must be expected to last for a long, continuous period, be indefinite, or result in death.

To qualify, you need a physician to certify that your condition meets these specific criteria. This exception has been a lifeline for many, especially considering CDC data showed 13.7% of U.S. adults had a disability in 2023.

Covering High Unreimbursed Medical Expenses

Even with good insurance, a major medical event can leave you with a mountain of bills. The IRS provides an exception that allows you to take penalty-free IRA distributions to help cover these costs, but there's a specific threshold you have to meet.

You can only take a penalty-free withdrawal for the amount of your medical bills that exceeds 7.5% of your Adjusted Gross Income (AGI) for the year. Your AGI is your gross income minus specific deductions, and you can find it on your Form 1040.

Calculating Your Withdrawal Limit

Let's make this real. Say your AGI for the year is $80,000. Your threshold is 7.5% of that, which comes out to $6,000 ($80,000 x 0.075). If you racked up $15,000 in unreimbursed medical expenses, you could withdraw $9,000 ($15,000 – $6,000) from your IRA without the 10% penalty.

It's critical that the withdrawal happens in the same year you incur the expenses. Be sure to keep meticulous records of everything—receipts, doctor's statements, you name it—to back up your claim if the IRS ever asks.

Health Insurance Premiums While Unemployed

Losing your job is stressful enough. The last thing you need is the added worry of losing your health coverage. There’s a specific IRA withdrawal exception designed to help you bridge this gap by letting you pay for health insurance premiums penalty-free.

To use this exception, you have to check all of these boxes:

- You lost your job.

- You received unemployment benefits for 12 consecutive weeks (under state or federal law).

- You take the IRA distribution in the same year you received unemployment, or in the year immediately following.

- The amount you withdraw is not more than the total amount you paid for health insurance for yourself, your spouse, and your dependents.

This provision is a crucial lifeline, ensuring you can keep essential health coverage for your family while you're out of work. If you're exploring other ways to tap into your accounts, our guide on accessing retirement funds early offers more insights.

These hardship provisions show that your retirement savings can be more than just a nest egg for the future; they can be a vital resource during life's most demanding chapters. Here at Spivak Financial Group, our team at 72tProfessor.com is ready to provide empathetic and expert guidance to help you navigate these times.

New Rules for Emergency and Special Situations

The world of retirement planning isn't static—far from it. The rules are always evolving, and recent legislation like the SECURE 2.0 Act has brought some major changes. It's introduced a few brand-new IRA withdrawal exceptions that act as a financial lifeline when life throws you a curveball.

These updates give you more flexibility than ever to tap into your savings for urgent needs, all without getting hit by that dreaded 10% early withdrawal penalty. Here at Spivak Financial Group and 72tProfessor.com, we live and breathe this stuff. Staying on top of these changes is what lets us give our clients the most current and effective strategies for their financial lives.

Emergency Personal Expense Distributions

One of the biggest game-changers is a new exception for emergency personal expenses. This rule lets you take out up to $1,000 once a year from your IRA or 401(k) to cover "unforeseeable or immediate financial needs."

What really makes this powerful is that it’s based on self-certification. You just have to confirm the money is for a personal or family emergency—no need to submit a mountain of paperwork to your plan administrator. This change directly addresses a real problem; Vanguard reported that early withdrawals from retirement plans hit a record 3.6% in 2023. You can get more details on how the IRS handles these new exceptions from their recent guidance.

But here’s the best part: you can pay it back. You have a three-year window to repay the distribution, and it’s treated just like a rollover. If you do, you’re eligible to take another emergency distribution later without having to wait three years.

Withdrawals for Victims of Domestic Abuse

Recognizing the immense financial pressure that comes with escaping an abusive situation, SECURE 2.0 created a truly compassionate new exception. A survivor of domestic abuse can now withdraw the lesser of $10,000 (a figure that will be indexed for inflation) or 50% of their vested account balance, completely penalty-free.

This has to be done within one year from the date the person became a victim of abuse by a spouse or domestic partner. Just like the emergency expense rule, this one comes with a three-year repayment option, giving survivors a chance to rebuild their retirement savings once they’ve reached a safer financial place.

Federally Declared Disaster Relief

When a major disaster hits, the road to recovery can be incredibly long and expensive. Another key update now allows for penalty-free distributions for people affected by federally declared disasters.

If your main home is in a qualified disaster area and you've suffered an economic loss, you can pull up to $22,000 from your retirement accounts. This isn’t a loan, but a distribution. However, you still have the option to repay the funds over three years. Plus, you can spread the income from the withdrawal over three tax years, which can soften the immediate tax hit during an already difficult time.

How to Properly Claim an Exception and Avoid Mistakes

Knowing you qualify for one of the many IRA withdrawal exceptions is a great first step, but it’s only half the battle. To actually sidestep that 10% penalty, you have to report the withdrawal correctly to the IRS. It isn't automatic; you have to formally claim your exception.

The whole process hinges on one specific tax document: IRS Form 5329, Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts. Think of this form as your official request to have the penalty waived. Filing it correctly is the difference between a penalty-free distribution and an expensive, unexpected tax bill.

Filing IRS Form 5329 The Right Way

When you take an early distribution from your IRA, your brokerage or bank will send you a Form 1099-R. Take a look at Box 7, "Distribution code(s)." You'll probably see a code ‘1’, which signals an early withdrawal to the IRS. That little number is what automatically flags your account for the 10% penalty.

Your job is to counteract that trigger by filing Form 5329 with your annual tax return. On this form, you’ll report the total amount of your early withdrawal and then enter the specific exception code that matches your situation. This code tells the IRS exactly why you believe the 10% additional tax shouldn't apply to you.

Here are some of the most common exception codes you'll see on Form 5329:

- Code 01: Distribution due to total and permanent disability.

- Code 03: Distribution for unreimbursed medical expenses that exceed 7.5% of your AGI.

- Code 04: Distribution for health insurance premiums while you were unemployed.

- Code 05: Distribution for qualified higher education expenses.

- Code 09: Distribution for a first-time home purchase (up to the $10,000 limit).

Choosing the correct code is absolutely crucial. Submitting the wrong one can lead to delays, frustrating IRS inquiries, or even an incorrect tax assessment. This is where getting professional guidance can be a real game-changer.

Common Pitfalls and How to Avoid Them

Claiming an IRA withdrawal exception might seem straightforward on the surface, but a few common mistakes can trip up even the most careful people. Avoiding these pitfalls is the key to making sure your withdrawal stays penalty-free.

The most frequent error is simply forgetting to file Form 5329. So many people assume that because they qualify for an exception, they don't need to do anything else. That's a costly assumption. If you don't file the form, the IRS will likely assume the penalty applies and send you a notice for the unpaid tax.

Another major issue is a misunderstanding of the rules. For example, someone might use the first-time homebuyer exception but then fail to use the funds within the required 120-day window. Or they might withdraw money for medical bills but miscalculate the 7.5% AGI threshold.

Always double-check the specific requirements for your exception. The IRS rules are precise, and "close enough" rarely works when it comes to taxes.

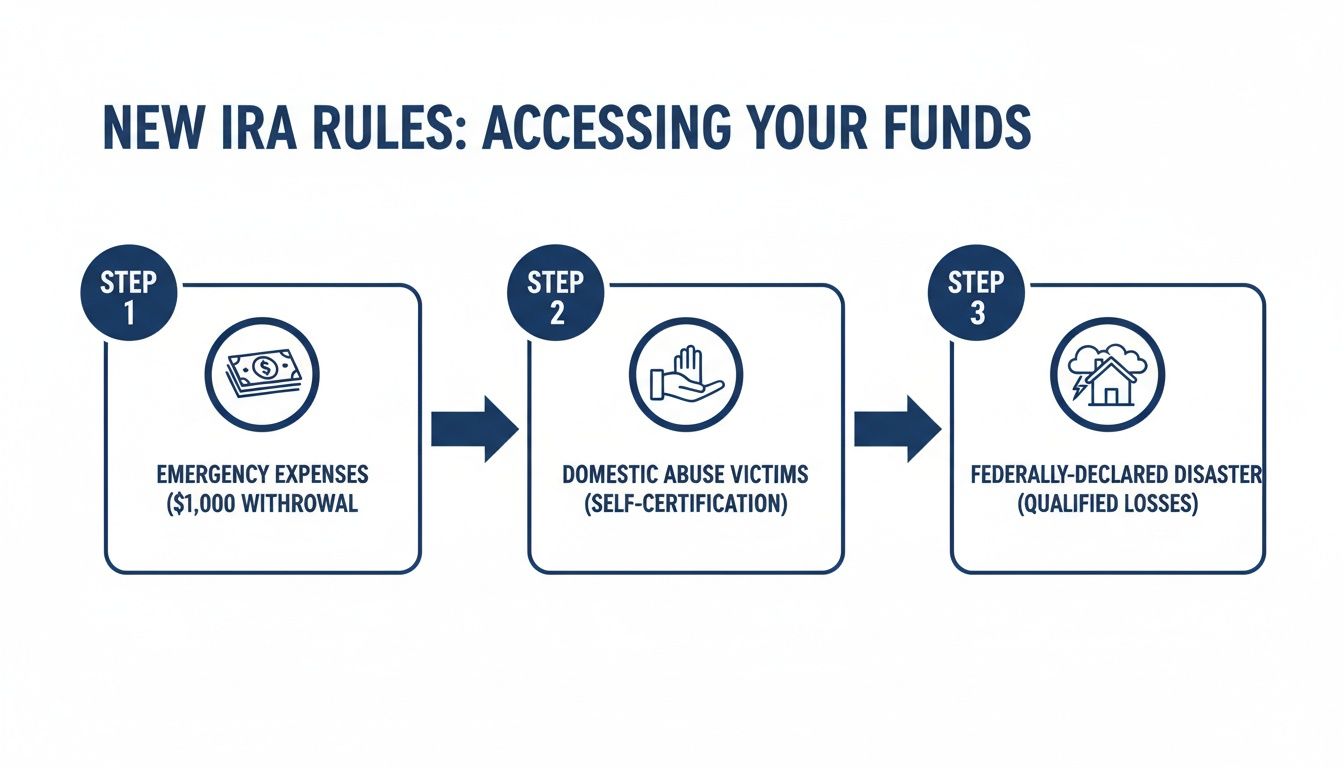

This infographic outlines some of the newest IRA withdrawal exceptions, and you'll notice each has its own specific rules and process.

The visual highlights the process for newer exceptions like emergency expenses, domestic abuse relief, and disaster aid, underscoring just how important it is to understand each unique pathway.

Finally, poor record-keeping can be a disaster. If the IRS ever questions your claim, the burden of proof is on you. You must have the documentation to back it up, including things like:

- Receipts for medical or education expenses.

- Closing documents for a home purchase.

- A physician's letter certifying a disability.

Without proper proof, you risk having your exception disallowed. Keep a dedicated file for all related paperwork for at least three years after filing your return. The best strategy is to get it right the first time, and consulting with a specialist at Spivak Financial Group and 72tProfessor.com ensures you navigate the process flawlessly.

Balancing One-Time Exceptions with 72(t) SEPP Strategies

The IRA withdrawal exceptions we've covered are powerful tools, no doubt. They act like financial lifelines for specific, isolated life events. I often tell my clients to think of them as the spare tire in their car. It's incredibly useful for getting you out of a jam, like a flat from hitting an unexpected pothole on the road of life. It solves an immediate, one-time problem.

But what if you're not just trying to fix a single flat tire? What if your real goal is to start a long road trip into early retirement, well before you hit age 59½? For a journey like that, a spare tire just won't cut it. You need a full set of durable, reliable tires designed to go the distance.

The Difference Between a Lifeline and an Income Stream

This is where the line between a one-time exception and a long-term strategy becomes crystal clear. Using an exception for a first home or a medical emergency is a single transaction—a targeted solution for a specific, immediate need. It is not, however, a sustainable plan for generating the kind of predictable, ongoing income you'll need to cover living expenses for years, or even decades, before traditional retirement age.

Trying to fund an early retirement by patching together various one-time exceptions simply isn't a viable strategy. It’s totally unpredictable and hinges on you constantly meeting a narrow set of IRS criteria. For a truly sustainable early retirement, you need a different tool in your financial toolbox.

The core difference is purpose. One-time exceptions are designed for emergencies and major life events. A structured income plan, like a 72(t) SEPP, is designed for lifestyle funding.

Introducing the 72(t) SEPP Plan

This brings us to a Substantially Equal Periodic Payments (SEPP) plan, which you'll often hear called a 72(t) distribution. Governed by IRS Code Section 72(t)(2)(A)(iv), a SEPP allows you to take a series of carefully calculated, penalty-free withdrawals from your IRA, no matter your age.

Unlike a one-off withdrawal, a 72(t) SEPP is specifically designed to create a consistent, predictable income stream. It’s the engine for your early retirement journey, providing the reliable funds you need to live on month after month, year after year. To get into the nitty-gritty, our detailed guide explains the Substantially Equal Periodic Payments rules that govern these powerful plans.

Here’s a simple way to look at how they compare:

| Feature | One-Time IRA Exceptions | 72(t) SEPP Plan |

|---|---|---|

| Purpose | Solve a single, specific financial need (e.g., home purchase, medical bills). | Create a long-term, predictable income stream for early retirement. |

| Frequency | A single withdrawal event. | A series of ongoing, calculated payments. |

| Flexibility | Rules are rigid and tied to specific qualifying events. | The payment schedule is fixed for a set period, offering stability. |

| Best For | Unexpected emergencies or planned major life milestones. | Funding a deliberate, planned early retirement lifestyle. |

Using Both Strategies Together

Here at Spivak Financial Group, our specialists at 72tProfessor.com often help clients see that these aren't mutually exclusive options. They can work together. For instance, you might use a one-time exception for a down payment on a home this year, and then establish a 72(t) SEPP plan next year to officially kick off your early retirement.

Understanding how to strategically combine these tools can completely transform your financial plan. By knowing when to use the "spare tire" and when it's time to invest in a "brand-new set," you can navigate both life's emergencies and your long-term goals with confidence and financial security.

Common Questions About IRA Exceptions

Digging into the details of IRA withdrawal exceptions always brings up a few tricky questions. Let's walk through some of the most common ones we hear, so you can apply these rules with confidence.

Do I Still Pay Income Tax on a Penalty-Free Withdrawal?

Yes, you almost certainly will. This is a point that trips up a lot of people. Getting an "exception" means you get to skip the 10% early withdrawal penalty, but it doesn't make the withdrawal tax-free.

Think of it like this: the IRS has two potential taxes on an early withdrawal, the penalty and the regular income tax. An exception is a get-out-of-jail-free card for the penalty, but the income tax bill still comes due. The money you pull out is still treated as ordinary income for the year.

Can I Use the First-Time Homebuyer Exception for a 401(k)?

Unfortunately, no. This is a huge distinction and a very common source of confusion. The $10,000 first-time homebuyer exception is written specifically for IRAs and only IRAs.

While your 401(k) plan might let you take a hardship withdrawal to buy a house, that's a completely different rule. That 401(k) withdrawal won't qualify for this particular penalty waiver, meaning you'd still get hit with the 10% penalty if you're under 59½.

This highlights a critical lesson: retirement account rules are not one-size-fits-all. A strategy that works perfectly for an IRA might be a costly mistake with a 401(k), even when you're using the money for the exact same purpose.

Can I Repay an Early Withdrawal to My IRA?

For most exceptions, the answer is a firm no. A penalty-free withdrawal for something like medical bills or college tuition is a one-way transaction. It's not like a 60-day rollover where you can put the funds back. Once the money is out, it's out for good.

However, the game has changed a bit recently. The SECURE 2.0 Act created a few new exceptions that actually do allow you to repay the funds. Withdrawals for things like emergency expenses, domestic abuse, or a federally declared disaster can now be paid back over a three-year period, letting you rebuild your retirement savings.

Navigating these complex rules requires precision and expertise. At Spivak Financial Group, the specialists at 72tprofessor.com can help you understand every option, ensuring your financial decisions are both strategic and compliant.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com