Yes, you absolutely can retire at 50, but it requires a completely different playbook than waiting until your 60s. Success demands meticulous planning, a serious nest egg, and a smart strategy to access your funds without getting hit with steep IRS penalties before age 59½.

The Reality of Retiring at 50

Leaving the workforce at 50 sounds incredible, doesn't it? It’s not just about escaping the daily grind; it's about gaining decades of freedom to travel, chase a passion, or simply live life on your own terms.

But this dream comes with a major hurdle: the longevity gap. Retiring at 50 means your savings might need to support you for 30, 40, or even 50 years. That’s a long time.

This extended timeline cranks up the volume on every financial risk, from inflation eating away at your purchasing power to a sudden market downturn. It also means you can't just dip into your 401(k) or IRA whenever you want. Doing that before age 59½ usually triggers a painful 10% early withdrawal penalty on top of your regular income taxes.

Three Pillars of a Successful Early Retirement

To pull this off, your financial plan needs to stand on three unshakable pillars. If any one of them is weak, the whole structure could come crashing down.

- A Substantial Nest Egg: This is non-negotiable. Your savings have to be large enough to carry you for a much longer period, which means decades of aggressive saving and disciplined investing.

- Reliable Income Streams: You need a dependable way to turn that pile of savings into a consistent cash flow. This is where specialized strategies become crucial for creating a predictable "paycheck" for yourself.

- A Penalty-Free Withdrawal Strategy: This is the key that unlocks your retirement funds early. A tool like a 72(t) Substantially Equal Periodic Payment (SEPP) plan is designed specifically to give you penalty-free access to your retirement accounts before the traditional age.

Retiring at 50 is less about crossing a finish line and more about building a financial bridge. This bridge has to be strong enough to carry you from your last day of work through the next several decades, covering all of life's expected—and unexpected—costs along the way.

To really grasp the difference in scale, it helps to see the numbers side-by-side.

Retiring at 50 vs Traditional Retirement at 65

This table highlights just how much higher the stakes are when you shave 15 years off the traditional timeline.

| Factor | Retiring at 50 | Retiring at 65 |

|---|---|---|

| Retirement Duration | 30-50+ years | 15-30+ years |

| Savings Goal | Significantly higher to cover a longer period. | Lower due to fewer years of withdrawals. |

| Access to Funds | Requires penalty-free strategies (like 72(t) SEPPs) before 59½. | Standard withdrawals available penalty-free after 59½. |

| Social Security | Cannot claim until at least age 62; delaying is crucial. | Can begin claiming closer to retirement age. |

| Healthcare | Must self-fund insurance until Medicare eligibility at 65. | Medicare is available at retirement age. |

| Inflation Risk | Much higher; portfolio must outpace inflation for decades. | Lower due to a shorter retirement horizon. |

As you can see, the path to a successful retirement at 50 is much more demanding and leaves far less room for error.

Bridging the Savings Gap

The challenge of saving enough money is very real. According to the Natixis Global Retirement Index, Americans are now facing an average savings shortfall of over $1 million compared to what they think they’ll need.

For anyone aiming to retire at 50, this number just underscores the absolute necessity of a solid plan to make those funds last. You can read more about these retirement savings findings to get a sense of the broader landscape.

Ultimately, asking "can I retire at 50?" isn't just a financial question—it's a planning question. With the right strategy, a realistic budget, and professional guidance, turning this ambitious goal into your reality is entirely possible.

How to Calculate Your Early Retirement Number

Moving from the daydream of early retirement to an actual, workable plan boils down to one critical question: How much money do you really need? Answering "can I retire at 50" hinges on finding your personal retirement number—a figure that’s completely unique to your life, your goals, and your spending habits. Forget the generic online calculators that just spit out a one-size-fits-all answer.

Figuring out your number is less about complex Wall Street formulas and more about some honest self-assessment. Think of it like this: planning a weekend trip is easy, but planning a long sea voyage is another beast entirely. A decade-spanning journey needs meticulous planning for every possible scenario—storms, equipment failures, and running out of supplies. Your 30-to-40-year retirement is that long voyage.

Start with Your Annual Expenses

The foundation of your retirement number is what you expect to spend each year. The best place to start is by tracking your current expenses for a few months to get a truly realistic picture of where your money is going. Then, you'll need to adjust this figure for what life will look like when you're not working.

Some costs will vanish (like your daily commute), but others might jump significantly (like travel and hobbies). And don't forget to budget for major one-time expenses you can see on the horizon, like replacing a car or helping fund a wedding.

The most overlooked—and potentially devastating—expense is healthcare. Before you’re eligible for Medicare at 65, you are on the hook for 100% of your health insurance premiums. These can easily run into the tens of thousands of dollars per year. Underestimating this single line item can completely derail an otherwise solid plan.

Once you have a baseline annual expense number, it’s time to factor in inflation. Over 30 years, even a modest 3% inflation rate will more than double your cost of living. Your calculations absolutely must anticipate this silent wealth-killer.

Applying the 4% Rule with Caution

A common starting point for retirement math is the famous 4% Rule. This guideline suggests you can safely withdraw 4% of your total portfolio in your first year of retirement, adjust that amount for inflation each year after, and have a high probability of your money lasting for 30 years.

- Example: If you need $80,000 per year to live on, the 4% Rule suggests you need a $2 million nest egg ($80,000 ÷ 0.04).

But here’s the catch: that rule was built for a standard 30-year retirement. If you retire at 50, your money might need to last 40 years or even longer. This extended timeline puts a lot of extra stress on the math, making a more conservative withdrawal rate—perhaps 3% or 3.5%—a much safer bet for early retirees. Using a 3.5% rate for that same $80,000 income bumps your target nest egg up to nearly $2.3 million.

The Lifestyle Impact on Your Number

At the end of the day, your lifestyle choices are the biggest variable in this whole equation. The number for a quiet, home-based retirement is vastly different from one that includes extensive international travel. This is where you have the most control.

The challenge for many aspiring early retirees is the gap between their goals and their ability to save. A recent Goldman Sachs Retirement Survey revealed that basic expenses now consume 51% of after-tax income for homeowners, with healthcare eating another 16%. This "Financial Vortex" leaves precious little room for saving, a trend that's only expected to get worse. You can discover more insights from this retirement savings report to get a feel for the modern financial pressures. This reality makes a disciplined and aggressive savings strategy non-negotiable.

Ultimately, calculating your number is what transforms a vague dream into an actionable target. It’s the first real step on your journey, giving you a clear destination to aim for. A solid grasp of your financial needs is a core component of successful early retirement planning and sets the stage for building a durable strategy.

Accessing Your Retirement Funds Before Age 59½

So, you’ve done the heavy lifting. You’ve crunched the numbers, figured out your target, and built a serious nest egg. Now for the make-or-break question for anyone hoping to retire at 50: How do you actually get your hands on that money?

Most of your savings are probably tucked away in tax-advantaged accounts like a 401(k) or an IRA. The IRS keeps a close watch on these funds, and they don't like it when you tap them before you turn 59½. If you do, you'll normally get hit with a painful 10% early withdrawal penalty on top of regular income taxes. That penalty alone can throw a wrench in the best-laid plans.

But don't worry, there's a way around it. The IRS has a few key exceptions, and one of them is the absolute cornerstone of nearly every successful early retirement strategy.

The 72(t) SEPP: Your Financial Bridge

For an early retiree, the most powerful tool in the toolbox is Rule 72(t). This rule allows you to take Substantially Equal Periodic Payments (SEPPs) from your retirement accounts without that dreaded 10% penalty.

Think of a 72(t) SEPP as a formal, pre-approved allowance you pay yourself from your own savings. It’s a structured agreement with the IRS that creates a reliable income stream to bridge the years between your early retirement date and age 59½.

Now, this isn't something you jump into lightly. Setting up a 72(t) plan is a serious commitment. Once you begin, you must stick to the precise withdrawal schedule for at least five years or until you turn 59½, whichever is longer. One wrong move—taking too much, too little, or even missing a payment—can blow up the whole plan. If that happens, the IRS can retroactively slap you with all the penalties you thought you'd avoided, plus interest. It's a costly mistake.

The rigid nature of a 72(t) SEPP is both its greatest strength and its biggest risk. It forces the discipline needed to create a predictable income stream, but it offers zero flexibility. This is exactly why getting professional guidance isn’t just a good idea—it’s essential to avoid a financial misstep you can't undo.

Understanding the Three Calculation Methods

The IRS gives you three different ways to calculate your annual SEPP amount. They all use your account balance, a life expectancy table, and a reasonable interest rate, but each one spits out a different number. The right choice depends entirely on how much income you need.

- Required Minimum Distribution (RMD) Method: This is the most straightforward option. Your annual payout is simply your account balance divided by a life expectancy factor. The catch? The payment amount gets recalculated every year, which means your income can go up or down.

- Amortization Method: This approach calculates a fixed annual payment, kind of like a mortgage. It amortizes your account balance over your life expectancy, which usually produces a higher and more stable income stream than the RMD method. It’s a very popular choice for this reason.

- Annuitization Method: This method also creates a fixed annual payment, but it uses an annuity factor in its calculation. The income it produces typically falls somewhere between the RMD and Amortization methods, giving you another solid option for consistent cash flow.

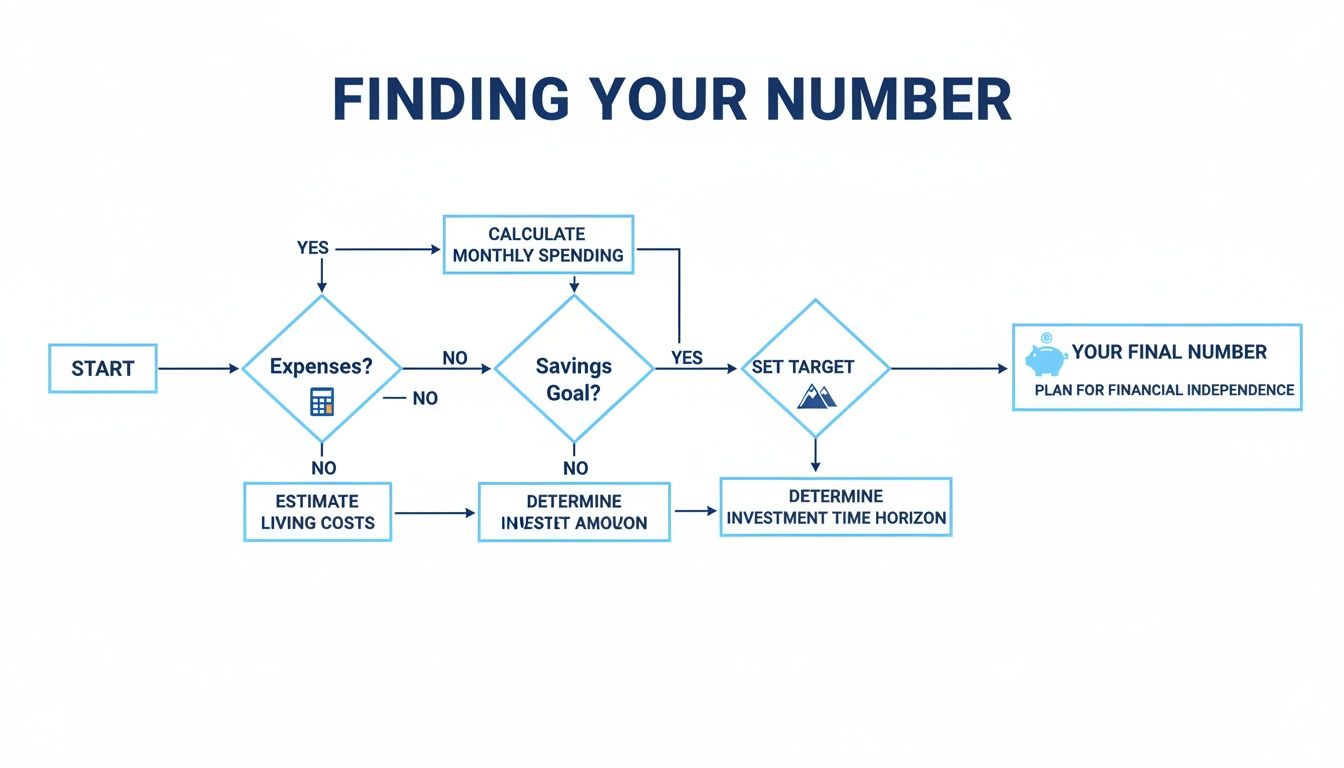

Before you even start thinking about withdrawal methods, though, you have to know your target number inside and out. This flowchart gives a great overview of that initial planning process.

As you can see, understanding your expenses and your final savings goal is the critical first step. Only then can you build a smart withdrawal strategy to make it happen.

While 72(t) plans are a primary tool, it's helpful to see how they stack up against other, less common options.

Here's a quick look at the main ways to get penalty-free access to your retirement funds before you hit the traditional retirement age.

Penalty-Free Withdrawal Options Before Age 59½

| Withdrawal Method | How It Works | Best For… | Key Consideration |

|---|---|---|---|

| Rule 72(t) SEPP | A series of structured, equal payments from an IRA or 401(k). | Creating a predictable income stream to cover living expenses over many years. | Extremely rigid. You're locked into the payment schedule for 5+ years. |

| The Rule of 55 | If you leave your job in the year you turn 55 (or later), you can take penalty-free withdrawals from that specific 401(k). | People who are laid off or retire from a company with a large 401(k) at or after age 55. | Only applies to the 401(k) from your most recent employer; IRAs are not eligible. |

| Roth IRA Contributions | You can withdraw the money you directly contributed to a Roth IRA at any time, for any reason, tax- and penalty-free. | Accessing a smaller, flexible pool of cash for one-time expenses or supplemental income. | You can't touch any of the earnings in the account without taxes and penalties until age 59½. |

| Taxable Brokerage Account | Funds are available at any time. You only pay capital gains tax on the investment growth when you sell. | Funding the first few years of retirement to delay tapping into retirement accounts. | Not tax-advantaged, so you'll owe taxes on dividends and capital gains along the way. |

Each of these has its place, but for creating a true "paycheck" in early retirement, the 72(t) SEPP is often the most practical and powerful solution.

The Critical Role of Professional Guidance

Because the rules are so strict and the math is so precise, setting up a 72(t) plan is not a DIY weekend project. One small miscalculation can trigger a cascade of penalties that you can't reverse.

A financial professional who specializes in these distributions can model all three calculation methods to find the perfect fit for your income needs. They make sure every single step is compliant with IRS rules, from picking the right interest rate to ensuring the withdrawals are executed perfectly.

There are many more nuances to consider, and you can dig deeper into the details behind these penalty-free IRA withdrawals. This is where having an expert in your corner becomes invaluable. With the right strategy and guidance, you can confidently unlock your funds and start living your retirement dream years ahead of schedule.

Navigating the Biggest Risks of Early Retirement

Pulling off a successful retirement at 50 is about so much more than just hitting a magic number in your bank account. The real challenge is making sure that money lasts for the rest of your life. Building that nest egg was only half the battle. Now, you have to become its staunchest defender against the very real threats that can sink even the best-laid plans.

Think of your retirement savings as a ship you’ve just launched on a 30- or 40-year voyage. You’d never set sail without preparing for storms, and you shouldn’t enter retirement without a plan to weather financial turbulence. Let’s confront the biggest risks you’ll face head-on.

The Threat of Longevity and Inflation

Ironically, the best-case scenario of a long, healthy life creates a massive financial problem: longevity risk. This is the very real danger of outliving your money. When you retire at 50, your savings might need to support you until you’re 90 or even older. Every extra year of life puts more strain on your portfolio.

Working in tandem with longevity is its destructive partner, inflation risk. Inflation is the silent thief that eats away at your purchasing power over time. The $80,000 you need to live comfortably today could require $160,000 in 25 years just to maintain the same lifestyle. A plan that ignores inflation isn't a plan at all—it’s a countdown to failure.

These twin threats are a big reason why retirement confidence often plummets as people hit their 50s. Recent data shows the average retirement is projected to stretch to 21 years by 2043, and retiree costs keep outpacing general inflation. You can learn more about the factors driving retirement confidence to see how these pressures are building.

The Danger of Market Downturns

Another huge threat is market risk, and specifically, the sequence of returns. A nasty market crash in the first few years after you retire can be absolutely devastating. If you're forced to sell investments in a down market to cover living expenses, you lock in losses and permanently cripple your portfolio’s ability to recover.

Imagine two retirees, both with identical $2 million portfolios. Retiree A enjoys a few years of solid market growth right after quitting work. Retiree B, however, gets hit with a 20% downturn right out of the gate. Even if the market roars back, Retiree B’s portfolio will be significantly smaller and may never catch up, all because they had to sell assets at the worst possible time.

Building a cash cushion—enough to cover one to two years of living expenses—is a powerful defense against this risk. It allows you to avoid selling stocks during a downturn, giving your portfolio the breathing room it needs to recover.

Solving the Healthcare Puzzle

Finally, there’s the healthcare puzzle. For anyone asking "can I retire at 50," this is often the most expensive and complicated piece to solve. You are 15 years away from Medicare eligibility, which means you’re on your own for health insurance until you turn 65.

And this isn't a minor expense; it can easily be one of your biggest annual budget items. For many early retirees, the most viable option is the Affordable Care Act (ACA) marketplace, where you can find plans and potentially qualify for subsidies based on your income.

- Actionable Strategy: This is where things get interesting. When you structure your early retirement income—say, through a 72(t) SEPP—you can sometimes manage your Modified Adjusted Gross Income (MAGI) to maximize your ACA subsidies. This can dramatically lower your premium costs.

Navigating these risks requires more than just a big pile of cash; it demands a resilient strategy. By building a cash buffer, locking down a solid healthcare plan, and designing a flexible withdrawal strategy, you're building a financial fortress that can withstand the curveballs life will inevitably throw your way. This proactive defense is what separates a dream of early retirement from a successful one.

Building Alternative Income Streams

When you hear "retire at 50," it’s easy to picture a hard stop—trading your work calendar for a hammock and never earning another dime. But in reality, a strong, resilient early retirement plan is rarely that black and white. In fact, one of the smartest moves you can make is to build alternative income streams to add layers of security to your financial future.

Think of these income sources as a crucial buffer, taking some of the pressure off your primary nest egg. They aren't a sign that your savings plan failed; they're the safety nets that give your core retirement funds and your 72(t) SEPP the breathing room they need to grow and last for the long haul.

The Power of an Encore Career

One of the most effective ways to do this is by embracing an 'encore career' or a 'bridge job.' This isn't about diving back into a high-stress, 40-hour workweek. Far from it. It's about finding fulfilling part-time work that aligns with a passion, gives you a sense of purpose, and, most importantly, brings in some cash.

This could be anything from consulting in your old field for just 10 hours a week to turning a woodworking hobby into a small business or teaching a class at the local community college. The income from a bridge job can cover a huge chunk of your annual expenses, which means you can withdraw less from your portfolio. This is an incredibly powerful strategy during market downturns when the last thing you want to do is sell your investments at a loss.

A bridge job completely changes the math on your retirement budget. Earning just $25,000 a year could mean reducing your portfolio withdrawals by that exact amount, dramatically extending how long your savings will last. It’s a powerful defense against the risk of outliving your money.

Creating Flexible Financial Buffers

Beyond earning new income, how you structure your existing assets can create massive flexibility. This is where a well-funded taxable brokerage account becomes an indispensable tool for anyone aiming to retire at 50.

Sure, it doesn't have the tax-deferral magic of a 401(k), but it offers something just as valuable: unrestricted access. You can sell assets and pull out funds anytime you want without getting hit with the dreaded 10% early withdrawal penalty. This account can be your financial multi-tool, used to:

- Cover big, unexpected costs without messing up your 72(t) SEPP schedule.

- Bridge the gap for the first year or two of retirement, letting your tax-advantaged accounts grow untouched a bit longer.

- Give you a flexible source of cash to manage your taxable income for things like healthcare subsidies.

Another fantastic tactic is the strategic Roth conversion. This is where you move money from a traditional pre-tax IRA or 401(k) into a Roth IRA, paying the income tax on that amount today. The magic happens five years later, when that converted principal becomes available to you completely tax- and penalty-free, creating yet another bucket of highly accessible money.

Many of us imagine a slow, gradual wind-down from work, but reality often has other plans. Vanguard's latest Retirement Outlook shows that over four in ten Americans are on track for retirement, but other research reveals a critical disconnect. The dream of a phased retirement often crashes against the reality of an abrupt 'hard stop' from a health issue or layoff, as highlighted in reports on the global retirement landscape. This makes having these alternative income streams and flexible accounts absolutely essential for a secure early retirement.

Ultimately, building these options is all about creating control and peace of mind. They are key parts of the broader financial independence strategies that truly make a successful—and stress-free—early retirement possible.

Your Action Plan to Retire at 50

Just knowing the rules isn't enough; you have to put that knowledge into practice. The dream of retiring at 50 stops being a vague wish and starts becoming a real project the moment you create a roadmap. Think of this as your checklist for turning that dream into a well-executed reality.

We'll break it down by timeframe, giving you clear, actionable steps along the way.

10+ Years Out: The Foundation Phase

With a decade or more on the clock, your mission is simple: build the financial engine that will power your early retirement. This is all about maximum accumulation and ruthlessly eliminating anything holding you back.

- Become Aggressively Debt-Free: Your number one priority is wiping out all high-interest debt. Credit cards, personal loans—get rid of them. Every dollar you’re not paying in interest is another dollar you can put to work for your future.

- Max Out Every Tax-Advantaged Dollar: You need to be contributing the absolute maximum allowed to your 401(k), especially if you get a company match (that’s free money!). On top of that, fully fund an IRA, whether it’s a Traditional or Roth. These accounts are your most powerful tools for building wealth.

- Open a Taxable Investment Account: This is non-negotiable. Start a separate brokerage account and fund it consistently. This "flexibility fund" is the critical bridge you'll use for income in those early years before you can touch your retirement accounts without penalty.

5 Years Out: The Strategy Phase

As retirement gets closer, the game changes. You’re shifting from pure saving to smart, strategic positioning. The goal now is to dial in your numbers, build financial shock absorbers, and get your assets ready for the big switch from earning to spending.

If you haven't already, this is the time to seriously consider hiring a financial professional who lives and breathes early retirement planning and 72(t) distributions. The complexity ramps up from here, and one wrong move can be costly and irreversible. A specialist can stress-test your plan and make sure every detail is airtight.

- Put Your Plan Through a Stress-Test: Don't just assume it will work. Run simulations. What happens if the market tanks the year you retire? Does your plan fall apart, or does it hold up? You need to know the answer before it happens.

- Get Real About Your Retirement Budget: Move from a rough estimate to a detailed, line-by-line breakdown of exactly what you'll spend. Track your current spending with an eagle eye for a few months to make sure your retirement numbers are based in reality, not fantasy.

- Deep-Dive into Healthcare: Start researching the ACA marketplace. Get a feel for the plans, the networks, and the costs in your area. Your income strategy in retirement will directly affect any subsidies you might get, making this a massive piece of the financial puzzle.

The Final 2 Years: The Execution Phase

This is it—the final countdown. The moves you make now are all about locking in your strategy, taking some risk off the table, and making the final preparations for a seamless exit from the workforce.

- Build Your Cash Fortress: You absolutely need 1-2 years of living expenses sitting in a safe, liquid account like a high-yield savings account. This is your buffer. It’s what protects you from being forced to sell investments when the market is down.

- Lock in Your 72(t) SEPP Strategy: Sit down with your financial pro and finalize the 72(t) SEPP calculation. You’ll need to make a firm decision on which method to use—Amortization, Annuitization, or RMD—to generate the precise income stream you need.

- Confirm Every Income Source: It's time to triple-check your math. Account for every dollar you expect from your taxable account withdrawals, a potential bridge job, or any other source, and make sure it all flows together in your final, detailed cash flow plan.

Common Questions About Retiring at 50

Even with a great plan, a few key questions always pop up when people get serious about retiring at 50. Let's tackle some of the most common ones head-on.

What Happens If My Finances Change After Starting a 72(t) SEPP?

Think of a 72(t) SEPP plan as being set in concrete once you begin. The IRS rules are incredibly strict, and you’re locked into that calculated payment schedule for at least five years or until you turn 59½—whichever period is longer.

If you try to modify the plan by taking an extra withdrawal or tinkering with the payment amount, you risk "busting" the whole thing. This mistake triggers a brutal retroactive 10% penalty on every single distribution you've already taken, plus interest. It’s a costly error, which is exactly why having a separate cash cushion for emergencies is non-negotiable and why professional guidance is essential to build a plan that can go the distance.

How Should I Balance Savings Between a 401(k) and a Brokerage Account?

Finding the right balance here is all about weighing tax breaks against flexibility. Your 401(k) or IRA is your long-term wealth-building engine, supercharged by tax-deferred or tax-free growth. This is the foundation of your nest egg.

But a taxable brokerage account is your liquidity lifeline. It’s the flexible pot of money you can tap for expenses before age 59½ without having to worry about penalties. The best strategy is a two-pronged approach: max out your tax-advantaged accounts to let them grow, while also consistently feeding a brokerage account to give yourself that crucial near-term flexibility.

Can I Still Save for Retirement If I Work Part-Time After 50?

Absolutely, and it’s a fantastic strategy. Taking on a part-time "bridge job" not only brings in some cash but also lets you keep your savings momentum going strong. As long as you have earned income, you can keep right on contributing to an IRA.

Even better, if you're self-employed or working as an independent contractor, you might be able to open and contribute to a Solo 401(k). This approach lets you gently transition into retirement while actively making your financial future even more secure.

Navigating the complexities of early retirement requires expert guidance. The team at Spivak Financial Group specializes in creating penalty-free income streams with 72(t) SEPPs to help you achieve your goals. Contact us for a consultation.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com