At its heart, a period certain annuity is a straightforward contract that delivers a guaranteed stream of income for a specific number of years—say, 10, 15, or 20 years. It’s different from a life annuity, which pays out until you pass away. With a period certain structure, if you die before the term is up, your named beneficiary gets the rest of the payments.

This simple feature makes it an incredibly predictable and reliable tool for retirement planning.

Unlocking Predictable Retirement Income

Think of it like a subscription service for your retirement income. You pay a lump sum to an insurance company, and they, in turn, contractually agree to send you a fixed "paycheck" every month for a predetermined number of years. Simple as that.

This structure completely removes the guesswork from a portion of your retirement income. You know exactly how much cash flow you'll have and for precisely how long. For anyone trying to map out their finances, especially in the early years of retirement, this predictability is its biggest strength.

The Power of a Guaranteed Term

The absolute defining feature here is the guarantee. The payments are tied to the calendar, not your lifespan. This creates a powerful safety net for your loved ones.

Let’s say you have a 15-year annuity and pass away in year seven. The contract doesn’t just end. Instead, your beneficiary will continue to receive those same payments for the remaining eight years. This provides tremendous peace of mind, ensuring the full value of what you paid for is delivered, no matter what happens to you. It's a great way to secure an income stream for yourself without giving up the potential to leave a legacy.

The bottom line is absolute certainty. You know the exact number of payments you and your beneficiary will receive and the precise dollar amount of each one. It completely takes longevity risk out of the equation for that specific period.

Period Certain Annuity at a Glance

To make it even clearer, let's break down the core components of a period certain annuity in a simple table.

| Feature | Description |

|---|---|

| Payout Structure | Provides fixed, regular payments for a predetermined number of years. |

| Guarantee | Payments are guaranteed for the entire term, regardless of how long you live. |

| Beneficiary Protection | If you pass away before the term ends, your beneficiary receives the remaining payments. |

| Predictability | Offers a known income stream, making it easy to budget and plan. |

| Primary Use Case | Ideal for bridging income gaps, such as in early retirement or for SEPP plans. |

This table shows why this annuity is so effective for specific financial goals where certainty is the top priority.

Ideal for Bridging Income Gaps

So, why would someone choose a fixed term over a lifetime of income? For many people, particularly those planning to retire early, it’s all about creating a financial bridge. A period certain annuity is the perfect tool for generating income to cover your living expenses for a very specific window of time.

Here are a few common scenarios where this strategy really shines:

- Early Retirement: It can provide the income you need to live on between the day you stop working and the day you can tap into other retirement funds, like a 401(k) or IRA, without getting hit with penalties.

- Delaying Social Security: You can use the annuity payments to fund your lifestyle for a few years, allowing your Social Security benefits to grow. This can significantly boost your government payouts for the rest of your life.

- Funding Rule 72(t)/SEPP Plans: This is a crucial strategy we’ll dig into much deeper. The fixed, predictable payments from a period certain annuity align perfectly with the strict IRS requirements for taking penalty-free early withdrawals from your retirement accounts.

How Your Annuity Payouts Are Calculated

You might think figuring out your guaranteed payments involves some kind of complex Wall Street wizardry, but with a period certain annuity, it's actually much simpler than you'd expect. Unlike life annuities that rely on tricky life expectancy tables, this is more of a straightforward financial calculation.

The insurance company’s math really just boils down to three key things. These pieces work together to set the exact amount you'll receive in your regular income stream.

The Core Calculation Factors

The whole idea behind the payout math is to give you your entire principal back, plus interest, over the exact timeline you picked out. It all comes down to these main variables:

- Your Initial Investment: This is the starting block. The lump-sum premium you put in is the foundation for everything, so a larger principal will naturally lead to a larger payment.

- The Length of the Period: The term you choose—whether it's 10, 15, or 20 years—directly shapes your payment amount. Go with a shorter period, and you'll see higher individual payments. A longer period stretches the money out into smaller, more frequent checks.

- The Prevailing Interest Rate: This is the rate of return the insurance company is using for your funds. When interest rates are higher, your money grows more, which translates directly into a bigger payout for you.

This simple, clear-cut calculation is what makes a period certain annuity such a predictable and transparent tool for planning your retirement income.

The core guarantee is refreshingly simple: if you pass away before the period ends, the payments don't just stop. Your named beneficiary steps in and receives the exact same payments for the rest of the term, making sure the full value of your investment is paid out.

Why Interest Rates Matter So Much

The interest rate environment is a huge piece of the puzzle and can dramatically change how attractive annuity payouts are. When you hand over your lump sum, the insurer doesn't just let it sit there. They invest it, mostly in very stable, fixed-income assets like high-quality corporate and government bonds. The returns they get from these investments are what fund your future payments.

So, when interest rates are higher, the insurance company earns more on its investments. That extra return allows them to turn around and offer you a much more generous guaranteed payment stream. This direct connection is a big reason we've seen a recent surge in annuity popularity.

In fact, the annuity market has seen explosive growth, with total sales topping $1.1 trillion between 2022 and 2024 alone. That’s a 70% jump since 2014, and it's been largely fueled by a higher interest rate environment that makes these guaranteed income products look a lot more appealing.

How a Period Certain Payout Differs

The way a period certain annuity is calculated is unique because it completely takes longevity risk off the table—for both you and the insurer. The company isn't making a bet on how long you're going to live. Instead, they have a simple contractual obligation to make a specific number of payments over a pre-defined term.

This is a world away from life annuities, which demand complex actuarial math based on mortality data and life expectancy tables. The simplified structure of a period certain annuity is what makes it such a stable and easy-to-understand source of income.

Estimating Your Potential Retirement Income Stream

Theory and formulas are helpful, but let's be honest—it’s the numbers that really matter. Seeing a period certain annuity in action is what makes the concept click. So, let's walk through a few real-world scenarios to show you exactly how your choices can shape your financial future.

These examples will cut through the jargon and help you visualize the trade-offs. The big decision usually boils down to this: do you want higher payments for a shorter time, or a more modest but longer-lasting income stream?

Scenario 1: The Early Retirement Bridge

Let's meet Alex, an early retiree who’s 52 years old and has $500,000 sitting in a traditional IRA. Alex is ready to leave the workforce now but needs a steady income to bridge the gap until age 59.5, which is when other retirement funds can be tapped without penalty.

That's a 7.5-year window that needs to be covered. A 15-year period certain annuity is a fantastic tool for this. It would create a reliable "paycheck" that not only gets Alex to age 59.5 but continues well into the first phase of traditional retirement, providing a solid financial foundation for years to come.

Scenario 2: Comparing Term Lengths

Now, let's stick with that $500,000 principal and see how changing the length of the certain period affects the income you get. This is where you can really see the direct trade-off between the size of your payments and their duration.

It's simple, really. A shorter term forces the insurance company to pay back your principal and interest faster, which means bigger checks for you. A longer term spreads those same funds over more years, resulting in smaller but more sustainable payments.

The key takeaway is that you are in control. You can tailor the income stream to match your specific needs, whether it's maximizing cash flow for a few years or creating a smaller, more sustained source of funds for the long haul.

To make this crystal clear, let’s compare a 10-year term against a 20-year term. If you're looking for a broader look at early retirement strategies beyond annuities, this practical guide to retiring early is a great resource.

Sample Payout Scenarios for a $500,000 Annuity

To illustrate how the length of the 'certain period' directly impacts the annual payout from a hypothetical $500,000 investment, let's look at some sample numbers. Remember, these are estimates based on a sample interest rate.

| Certain Period | Estimated Annual Payout | Key Consideration |

|---|---|---|

| 10 Years | Approximately $60,000 | Provides a higher annual income, ideal for covering significant short-term expenses or bridging a smaller gap to retirement. |

| 15 Years | Approximately $45,000 | Offers a balanced approach, delivering a substantial income stream over a longer duration that covers the early retirement years. |

| 20 Years | Approximately $37,500 | Delivers a lower but more extended income, perfect for those who prioritize a longer-term, predictable financial safety net. |

Note: These figures are hypothetical estimates for illustrative purposes. Actual payouts depend on the prevailing interest rates at the time of purchase.

As you can see, there isn't one "best" answer here. The right choice is completely personal—it all depends on your financial goals, your retirement timeline, and the lifestyle you want to fund.

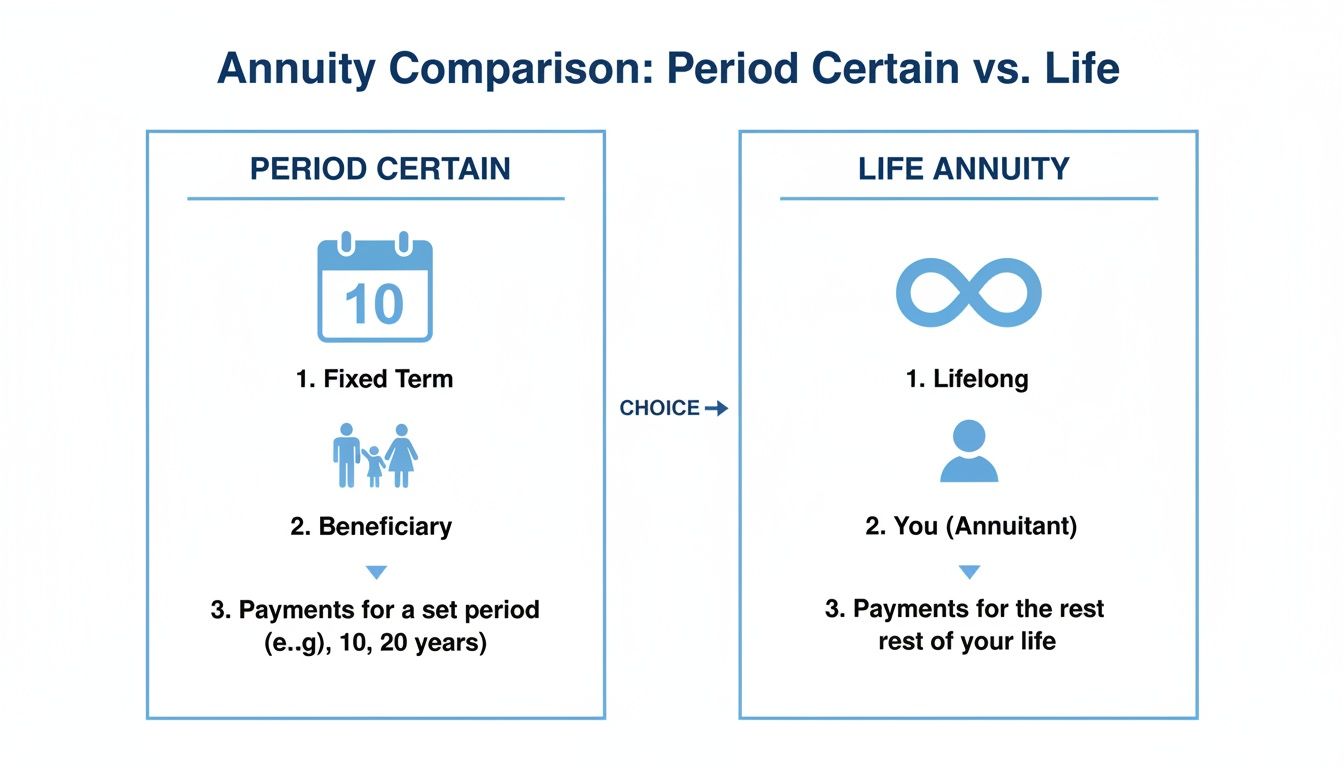

Period Certain Annuity vs Life Annuity

Picking the right annuity is a lot like choosing the right tool for a specific job. You wouldn't use a sledgehammer to hang a picture frame, right? Both a period certain annuity and a life annuity can generate income, but they solve very different financial problems, especially for someone planning an early retirement.

The choice really boils down to one critical question: Is your main goal certainty for a set period of time, or is it security for your entire lifetime?

A period certain annuity is a precision instrument. It’s built to deliver a guaranteed stream of income for a fixed number of years—say, 10 or 15. Its entire purpose is to provide predictable payments over a clearly defined timeline, making it a perfect tool for bridging a specific income gap.

On the other hand, a life annuity acts as a longevity shield. Its mission is to protect you against the very real risk of outliving your money. It provides payments for as long as you live, no matter how long that turns out to be. It offers lifetime security, which is an incredibly powerful benefit for long-term financial peace of mind.

Defining Your Financial Goal

The best choice hinges completely on what you're trying to accomplish. Are you trying to build a predictable income bridge to get you from an early retirement at age 50 to your Social Security start date at 65? A period certain annuity absolutely excels here. Its structure is finite and guaranteed, and it even ensures your beneficiary receives any remaining value if you pass away before the term is up.

But, if your biggest fear is running out of savings when you're 90 years old, a life annuity is the more appropriate tool. It’s essentially a form of financial insurance against a long life, though this protection typically comes at the cost of lower payments and no beneficiary protection on the simplest plans. For anyone interested in creating an income stream that feels like a personal pension, you can dive deeper into the concept of pensionizing your assets.

The core difference is the specific risk each one tackles. A period certain annuity eliminates the timing risk for a specific period, while a life annuity eliminates the longevity risk for your entire life.

The Impact of Interest Rates on Your Choice

Recent economic shifts have made this decision even more interesting. With interest rates rising dramatically since 2022, period-certain annuities have become a much bigger player in retirement planning.

Annuity quotes are highly sensitive to interest rates—one study found a correlation coefficient of 0.96—which means today's higher rates often lead to significantly better payouts for fixed-term products. This makes the predictable, locked-in income from a period certain annuity mathematically attractive right now.

Ultimately, the decision isn't about which product is "better" in a vacuum, but which one is better for you. For an early retiree using a 72(t) SEPP plan, the predictable, penalty-free income from a period certain annuity often aligns perfectly with their strategic needs.

Using a Period Certain Annuity for Your 72(t) SEPP

If you're an early retiree, one of your biggest challenges is getting access to your retirement money before age 59.5 without getting hit with a painful 10% IRS penalty. This is exactly where a Substantially Equal Periodic Payment (SEPP) plan, which falls under IRS Rule 72(t), comes into play. And one of the simplest, most effective tools for setting up one of these plans is a period certain annuity.

The beauty of a period certain annuity is that its structure aligns perfectly with what the IRS demands for a SEPP. It's designed to give you a fixed, predictable payment stream for a specific number of years. This completely sidesteps the compliance headaches and tricky annual recalculations that often trip people up when they use other 72(t) methods.

The ‘Set It and Forget It’ Advantage

Think of this strategy as putting your early retirement income on cruise control. Once you’ve funded the annuity with your IRA or 401(k) money and the payments begin, the whole process is locked in. The insurance company sends you the exact same check on a set schedule, automatically satisfying the "substantially equal" part of the rule.

This approach gives you incredible peace of mind. You no longer have to sweat market downturns that might force you to adjust your withdrawal amount or worry about accidentally breaking one of the complex rules and triggering a cascade of penalties. It’s a clean, direct path to creating the income bridge you need to get to age 59.5. For a deeper dive into the specific regulations, you can explore the Substantially Equal Periodic Payments rules in our detailed guide.

This infographic breaks down the key difference between a period certain annuity—perfect for this kind of fixed-term income strategy—and a traditional life annuity.

As you can see, the fixed term and the ability to name a beneficiary are what make the period certain annuity such a reliable tool for a SEPP plan.

A Mathematically Superior Approach

Beyond just being simple, using a period certain annuity for a 72(t) plan is often a mathematically smart move. Historically, there's been a very strong connection between long-term bond yields and the payout rates insurance companies can offer on annuities. This is because insurers invest heavily in these bonds to guarantee the payments they’ve promised you.

For an early retiree setting up a 72(t) SEPP, this means the current interest rate environment can lead to some very attractive guaranteed payment rates. In many cases, it makes the annuity a far better option than just trying to withdraw money from your account on your own.

The core benefit is simple: A period certain annuity transforms a complex IRS rule into a simple, automated income stream. It removes the guesswork and compliance headaches, allowing you to focus on your early retirement.

At Spivak Financial Group, we live and breathe these strategies. If you want to see how a compliant 72(t) plan could be structured for your financial goals, give our team a call at (844) 776-3728.

Common Questions About Period Certain Annuities

Even after you get the hang of how a period certain annuity works, it's totally normal to have a few practical questions pop up. Let's tackle the most common ones we hear, giving you some straight answers so you can feel confident about the details.

Think of this as your quick-reference guide for any lingering questions about beneficiaries, taxes, and how these annuities play out in the real world.

What Happens If I Die Before the Certain Period Ends?

This is probably the number one question people ask, and it gets right to the heart of what makes this annuity so valuable. If you pass away before the guaranteed payment period is over, your designated beneficiary simply steps in and receives the rest of the payments, right on schedule.

It's that simple. For example, if you have a 15-year period certain annuity and you die in year 10, your beneficiary gets that same guaranteed income stream for the remaining 5 years. This feature ensures the full value of your contract is paid out, creating a vital financial backstop for your loved ones.

Are Payments from a Period Certain Annuity Taxable?

Yes, the income you receive from an annuity is generally taxable. The real question is how it's taxed, which all comes down to the type of money you used to fund it.

- Pre-Tax Funds: If you funded the annuity with money from a traditional IRA or 401(k), the entire payment is taxed as ordinary income. This makes sense because that money has never been taxed.

- After-Tax Funds: If you used money that's already been taxed (from a savings account, for instance), only the earnings portion of each payment is considered taxable income. A portion of each payment is considered a tax-free return of your original principal.

Getting this right is crucial. This is definitely an area where getting professional guidance can save you from a costly tax surprise down the road.

Can I Change My Mind After Starting the Annuity?

In nearly all cases, once a period certain annuity is "annuitized"—meaning the income payments have officially begun—the contract becomes irrevocable. You can't change the term length, call a timeout on the payments, or ask for a lump-sum cash-out.

This rigidity is a feature, not a bug. The insurance company builds its entire financial model around being able to support your guaranteed income for the full term. That unbreakable commitment is what makes the payments so reliable and predictable, which is exactly what you need when using it for a 72(t) SEPP plan. For more on managing financial tools like annuities, it's helpful to understand What is a Power of Attorney.

The key takeaway is that a period certain annuity is a commitment. Its strength lies in its unchangeable, guaranteed structure, which provides a level of income certainty that few other financial products can match.

This solid structure makes it a fantastic tool for a 72(t) plan because it completely removes the risk of you accidentally miscalculating or breaking the IRS's complicated rules.

Spivak Financial Group, headquartered at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260, specializes in designing and implementing these strategies for early retirees. If you're ready to explore how a period certain annuity can help you unlock your retirement funds penalty-free, visit us at https://72tprofessor.com or call (844) 776-3728 to learn more.