So, you're a high-income earner, and you've probably heard that the door to a Roth IRA is closed to you. Well, not quite. There’s a well-known financial strategy called the backdoor Roth conversion, and it’s designed specifically for people who exceed the IRS income limits for direct Roth contributions.

At its core, it's a simple, two-step process: you make a non-deductible contribution to a traditional IRA and then promptly convert those funds into a Roth IRA. This maneuver legally bypasses the income restrictions, unlocking the powerful benefits of tax-free growth and withdrawals in retirement.

Why High Earners Need The Backdoor Roth Conversion

For many successful professionals, hitting a certain income level comes with an unexpected downside—you can no longer contribute directly to a Roth IRA. This is a huge missed opportunity, since Roth accounts offer the incredible advantage of completely tax-free withdrawals once you retire.

As your Modified Adjusted Gross Income (MAGI) goes up, the IRS first reduces and then completely eliminates your ability to contribute. This is where the backdoor Roth conversion comes into play. It’s a legitimate workaround for anyone who is "phased out" by the income limits.

You simply contribute after-tax money into a traditional IRA—an account with no income caps for contributions—and then you convert that traditional IRA to a Roth IRA. Problem solved.

Roth IRA Direct Contribution Income Limits

Here's a look at the income phase-out ranges that prevent high earners from contributing directly to a Roth IRA. If your MAGI falls into these brackets, you’ll see why the backdoor strategy is so essential.

| Filing Status | MAGI Phase-Out Range (Contribution Limit Reduced) | MAGI Limit (No Contribution Allowed) |

|---|---|---|

| Single, Head of Household | $146,000 – $161,000 | $161,000 or more |

| Married Filing Jointly, Qualified Widow(er) | $230,000 – $240,000 | $240,000 or more |

| Married Filing Separately | $0 – $10,000 | $10,000 or more |

As you can see, the income thresholds aren't exceptionally high, making the backdoor Roth conversion a routine financial move for many households.

The Rise Of A Popular Retirement Strategy

The backdoor Roth conversion really took off after 2010 when legislative changes made it more accessible. By the mid-2020s, it became a standard tactic in financial planning, particularly as IRA contribution limits crept higher.

For 2025, the limit is $7,000, with an additional $1,000 catch-up contribution for those aged 50 and over. Because the law lets anyone convert traditional IRA funds to a Roth regardless of their income, this strategy remains a cornerstone of modern retirement planning. You can explore a detailed comparison of retirement accounts to see how each one fits different financial goals.

The motivation is crystal clear: build a bucket of money you can access in retirement without owing the government a single cent. This kind of tax diversification is a game-changer. While your traditional 401(k) and IRA give you a tax deduction today, every dollar you pull out later is taxed as ordinary income.

A Roth IRA flips that equation. You forgo a tax break now for the much larger benefit of tax-free income later in life, when your tax bracket could be just as high, if not higher.

Unlocking Tax-Free Growth

Ultimately, the real power of the backdoor Roth conversion is what it protects: your future growth. Every dollar your investments earn inside the Roth IRA grows entirely tax-free.

When you start taking qualified withdrawals down the road, you get to keep 100% of your money—both the contributions and all the earnings. For a step-by-step walkthrough, check out Your Guide to the Backdoor Roth IRA Conversion. This strategy is an essential tool for anyone serious about making their retirement savings as efficient and predictable as possible.

How to Execute Your Backdoor Roth Conversion

Think of the backdoor Roth conversion less as a single action and more as a deliberate sequence. Getting it right is your playbook for turning after-tax savings into a powerful, tax-free retirement asset. The whole thing kicks off with having the right accounts ready to go.

First things first, you'll need two specific accounts open at your brokerage: a traditional IRA and a Roth IRA. If you already have a Roth, you're halfway there. If not, opening both is usually a quick online process that takes just a few minutes.

Funding Your Traditional IRA

With your accounts set up, it's time to fund the traditional IRA. You’ll be making a non-deductible contribution, which just means you're using after-tax money sitting in your bank account. This is the critical piece of the puzzle—you're not taking a tax deduction for this contribution, which is precisely what allows the conversion to be tax-free.

For 2025, the annual contribution limit is $7,000, or $8,000 if you're age 50 or over. This money you contribute is what the IRS calls your "basis" in the traditional IRA, their way of tracking your after-tax funds.

It’s absolutely vital to leave these funds in cash or a money market account within the traditional IRA. Don't invest it. The goal is to get that money over to the Roth IRA as quickly as possible, and investing it first could generate small gains, which would be taxable and just complicate things.

The Conversion Mechanics

Once your contribution has fully settled in the traditional IRA—which usually takes one to five business days—it's time for the main event: the conversion. This is the moment you officially move the funds from your traditional IRA directly into your Roth IRA.

Most major brokerages make this incredibly simple. Look for a "convert" or "transfer" option in your online portal. The process generally boils down to:

- Select the source: Your traditional IRA.

- Choose the destination: Your Roth IRA.

- Specify the amount: Convert the full amount of your recent non-deductible contribution.

- Confirm: The brokerage handles the internal transfer, shifting the cash from one account to the other.

As long as you have no other pre-tax money in any traditional, SEP, or SIMPLE IRAs, this entire sequence is a non-taxable event.

Expert Tip: Don't let the money sit. The longer you wait after making the contribution, the more likely the funds could earn a few cents in interest or dividends. Any earnings that build up in the traditional IRA before the conversion will be taxed as ordinary income.

The Critical Role of Timing

Timing is everything for a clean backdoor Roth conversion. The ideal scenario is a near-zero gap between the funds settling in the traditional IRA and you hitting the "convert" button. This quick two-step is often called a "step transaction," and it's a perfectly legitimate strategy.

By converting immediately, you stop the account from earning even a few dollars in interest. While converting a tiny amount of earnings isn't a disaster—you'd just owe a little income tax on that growth—the goal is a perfectly clean, $0 tax liability conversion. It keeps your tax reporting simple and the strategy maximally efficient.

You have to be mindful of how even small amounts of pre-tax money can complicate things. For those with existing 401(k)s, it’s worth knowing all your options. For example, exploring a 401(k) rollover to an IRA while still employed can be a smart move, but it demands careful planning to avoid tripping up a backdoor Roth conversion because of the pro-rata rule, which we'll get into next.

Acting with precision is key. You contribute after-tax money, you wait for it to clear, and then you convert it right away. Follow that sequence, and you've successfully funded your Roth IRA, sidestepped the income limits, and positioned your money for decades of tax-free growth.

Navigating the Pro-Rata Rule to Avoid a Tax Trap

The backdoor Roth conversion seems simple enough on the surface, but there's one major pothole that can trip up even savvy investors: the pro-rata rule. This is where a supposedly tax-free move can suddenly trigger a surprise tax bill. Getting a handle on this rule isn't just a good idea; it's absolutely critical to pulling off the strategy correctly.

Here’s the deal: the IRS doesn't see your various IRAs as separate accounts. For the purpose of a conversion, they view all of your non-Roth IRAs—that includes any traditional IRAs, SEP IRAs, and SIMPLE IRAs—as one single, giant pool of money. The pro-rata rule then looks at the combined total of all these accounts to figure out how much of your conversion is taxable.

If the only money in your traditional IRA is the brand-new, non-deductible contribution you just made, you're in the clear. But things get complicated if you have other pre-tax funds sitting in any of those accounts, maybe from a 401(k) you rolled over years ago.

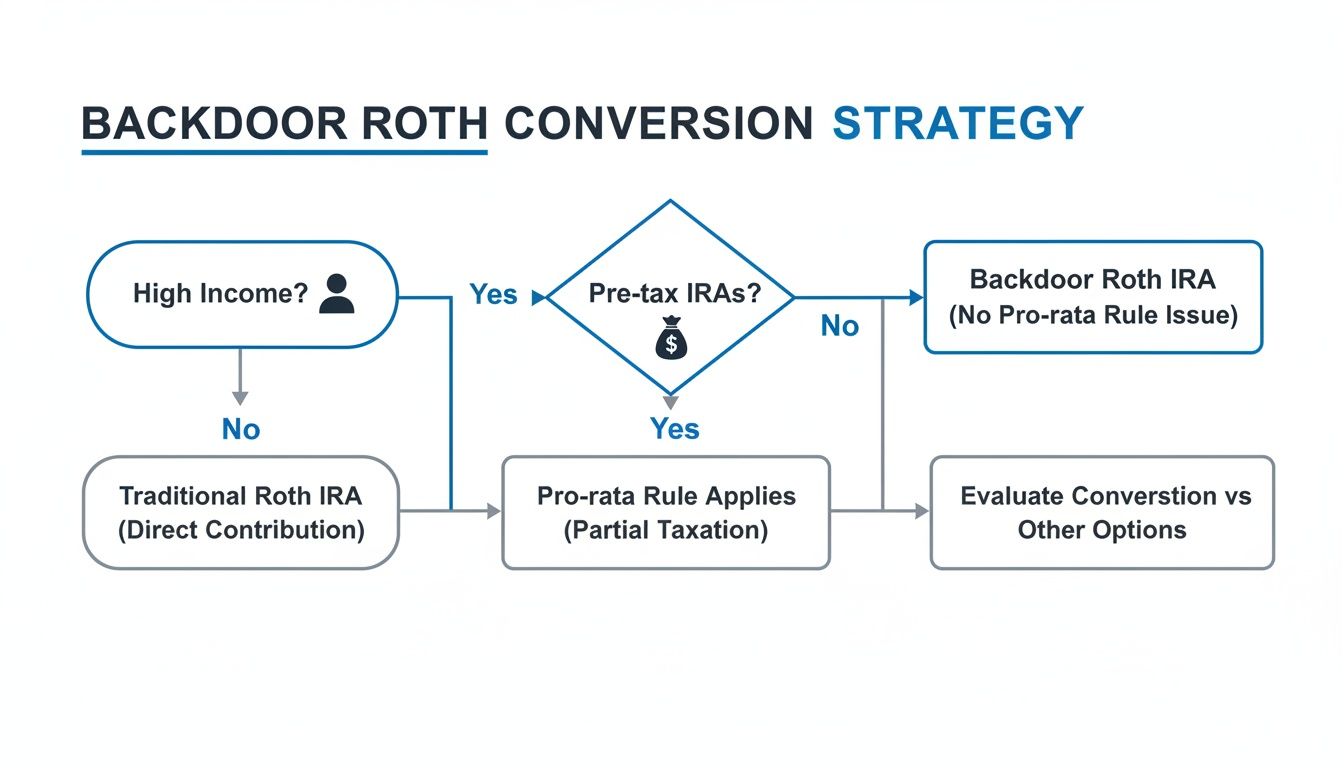

This decision tree gives you a great visual of the process and shows exactly where the pro-rata rule can become a problem.

As you can see, the game changes entirely if you have existing, pre-tax IRA balances. That's the single factor that complicates an otherwise straightforward strategy for high earners.

How the Pro-Rata Calculation Works

The name "pro-rata" literally means "in proportion," and that's precisely how the IRS applies the rule. It forces you to convert a proportional blend of your after-tax (non-deductible) money and your pre-tax money. You don't get to pick and choose—the IRS won't let you just convert the new after-tax dollars.

Let's walk through a common scenario to see this tax trap in action.

Say you have a traditional IRA with $90,000 in it from an old 401(k) rollover. All of that is pre-tax money. You then decide you want to do a backdoor Roth, so you contribute a fresh $10,000 in non-deductible funds to a new traditional IRA.

When it comes time to file your taxes, the IRS will look at your entire IRA picture as of December 31st of the conversion year:

- Pre-tax IRA balance: $90,000

- After-tax (basis) IRA balance: $10,000

- Total IRA balance: $100,000

In this scenario, your after-tax funds make up just 10% of your total IRA balance ($10,000 ÷ $100,000). That means only 10% of whatever you convert will be tax-free.

The table below breaks down exactly how the IRS calculation works when you try to convert just the $10,000 you contributed.

Pro-Rata Rule Calculation Example

| Line Item | Amount | Description |

|---|---|---|

| Pre-Tax IRA Funds | $90,000 | Existing balance from a previous 401(k) rollover. |

| After-Tax (Basis) IRA Funds | $10,000 | New non-deductible contribution for the backdoor Roth. |

| Total IRA Balance (as of Dec 31) | $100,000 | The aggregate value the IRS uses for the calculation. |

| Percentage of After-Tax Funds | 10% | Your after-tax basis ($10,000) divided by the total ($100,000). |

| Percentage of Pre-Tax Funds | 90% | Your pre-tax balance ($90,000) divided by the total ($100,000). |

| Amount of Conversion | $10,000 | The amount you intended to convert tax-free. |

| Tax-Free Portion of Conversion | $1,000 | 10% of the $10,000 conversion is considered a return of your after-tax basis. |

| Taxable Portion of Conversion | $9,000 | 90% of the $10,000 conversion is deemed pre-tax money and is now taxable income. |

So, when you convert that $10,000, the IRS says 90% of it ($9,000) is a conversion of your pre-tax funds. That $9,000 gets added to your taxable income for the year, which could easily cost you thousands in taxes you weren't expecting. This is the central risk of the backdoor Roth—the IRS pro‑rata rule requires conversions to be taxed proportionally based on your mix of after-tax and pre-tax IRA balances at year-end. You can dive deeper into how the pro-rata computation works on sdocpa.com.

The key takeaway is simple: Any pre-tax money in any of your traditional, SEP, or SIMPLE IRAs can make your backdoor Roth conversion partially or mostly taxable.

Your Strategy to Zero Out Pre-Tax IRA Balances

So how do you sidestep this tax trap? The mission is to isolate your non-deductible contribution so it’s the only money sitting in any of your traditional IRAs when you do the conversion. That means you need to find a new home for your existing pre-tax IRA funds.

For most people, the most effective solution is what’s known as a "reverse rollover."

This strategy is pretty straightforward: you move your pre-tax IRA funds into your current employer's 401(k) plan. Most, though not all, 401(k) plans accept incoming rollovers from traditional IRAs. You'll have to check your plan's documents or call the plan administrator to confirm they allow it.

If your plan gives you the green light, the process is simple:

- Reach out to your 401(k) provider and tell them you want to initiate a rollover from your traditional IRA.

- Move the entire pre-tax balance from your traditional, SEP, or SIMPLE IRAs into your 401(k).

- Wait for confirmation that the funds have moved. Your total balance across all IRAs subject to the pro-rata rule should now be $0.

Once those pre-tax funds are parked in your 401(k), they are out of the picture. A 401(k) is a different type of account and isn't aggregated with your IRAs for the pro-rata calculation.

With a completely clean slate, you're now free to proceed with your backdoor Roth conversion. You’ll make your new non-deductible contribution to an empty traditional IRA, and when you convert it, 100% of that conversion will be tax-free. This cleanup step is the key to executing a flawless backdoor Roth. At Spivak Financial Group, we help clients navigate these kinds of details to ensure their financial strategies actually work as intended.

Reporting Your Conversion Correctly on Form 8606

Pulling off a backdoor Roth conversion is only half the battle. The other half is telling the IRS you did it correctly, and that’s where IRS Form 8606, Nondeductible IRAs, comes into play.

Filing this form isn't optional—it's how you officially document your non-deductible contribution and prove to the IRS that your conversion was a tax-free event.

Sure, there's a $50 penalty for failing to file, but the real danger is much bigger. Without Form 8606, the IRS has no record of your after-tax contribution. They'll likely assume your entire conversion came from pre-tax funds, treat the whole thing as taxable income, and hit you with a completely unexpected tax bill. This form is your shield, creating the crucial paper trail you need.

Let's walk through how to fill it out without the usual tax-form headache.

Your Guide to Filling Out Form 8606

Once you know what each part is for, Form 8606 is more straightforward than it looks. For a standard backdoor Roth conversion, you’ll really only need to worry about Part I and Part II.

Let's use a simple scenario: you contributed $7,000 to a traditional IRA and then converted the full $7,000 to a Roth IRA. We'll also assume you have no other pre-tax IRA balances to worry about.

Part I Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, SEP, and SIMPLE IRAs

This is where you tell the IRS about your after-tax contribution and establish your "basis." Basis is just the IRS's term for the after-tax money you have in your IRAs.

- Line 1: This is where you enter your $7,000 non-deductible contribution. Simple enough.

- Line 2: Here, you'll put your total basis from all previous years. If this is your first time, it’s $0.

- Line 3: Just add lines 1 and 2. For our example, that's $7,000.

- Line 4 & 5: These lines deal with distributions. Since you did a conversion, not a regular withdrawal, you’ll enter $0 here. The conversion gets handled in Part II.

Getting this part right is the foundation of a successful tax-free conversion. For a deeper dive into this concept, you can learn more about what an IRA basis is and why it’s so important.

Calculating Your Taxable Amount

Now we get to the payoff. In Part II, you report the Roth conversion itself and demonstrate to the IRS that zero tax is due.

Part II Conversions From Traditional, SEP, or SIMPLE IRAs to Roth IRAs

This section calculates how much, if any, of your conversion is taxable. If you followed the steps correctly, the answer should be a nice, round zero.

- Line 16: Enter the total amount you converted to your Roth IRA. In our case, $7,000.

- Line 17: Bring down your basis from Line 3. That's also $7,000.

- Line 18: Subtract line 17 from line 16. The result? $0 ($7,000 – $7,000). This is the taxable amount of your conversion.

That $0 on Line 18 is exactly what you want to see. It’s the official proof that your backdoor Roth conversion was a non-taxable event because it was funded entirely with after-tax money.

By meticulously filling out Form 8606, you provide the IRS with a clear narrative: you made a non-deductible contribution, established your basis, and then converted that exact basis to a Roth IRA. This documentation protects you from erroneous tax assessments.

Finalizing Your Tax Reporting

Once Form 8606 is complete, you just attach it to your Form 1040 when you file your taxes for the year. The numbers from Form 8606 will flow through to your main tax return.

For example, the total conversion amount from Line 16 gets reported on Form 1040, but the taxable amount from Line 18 ($0) will also be reported, showing that no tax is actually owed on the transaction.

It’s a small piece of paperwork that has a huge impact on your financial future. Getting it right ensures your strategy for tax-free retirement growth stays secure and compliant. The experts at Spivak Financial Group can help review these details, ensuring every step is executed perfectly.

Advanced Strategies and Common Mistakes to Avoid

Once you get the basics of the backdoor Roth conversion down, it's the finer points and common tripwires that can make or break the strategy. Getting these details right is the difference between a smooth, tax-free outcome and an unexpected bill from the IRS.

A question I get all the time relates to the Roth five-year rule. It's crucial to know that every conversion you do starts its own five-year clock. If you pull those converted funds out before that five-year period is up and you're under age 59½, you could get hit with a 10% penalty on the principal. The IRS put this rule in place to keep people from using Roth IRAs like a checking account.

Another area of confusion is how the pro-rata rule works for married couples. The good news is, it's strictly an individual affair. Your IRA balances have zero impact on your spouse's conversion, and their accounts don't affect yours. Each of you has to look at your own traditional, SEP, and SIMPLE IRA balances to figure out if any part of your conversion will be taxable.

Handling Minor Earnings and IRS Doctrines

So what happens if your contribution earns a few bucks in interest while it's sitting in the traditional IRA, right before you convert it? Don't sweat it. This happens all the time and it's a simple fix.

When you convert the entire balance, you'll just include that little bit of growth. Let's say your $7,000 contribution earns $5 in interest before you can move the full $7,005 over to the Roth. You'll simply report that extra $5 as taxable income for the year. It's a tiny tax event that doesn't mess up the overall strategy.

Occasionally, savvy investors ask about the "step transaction doctrine," which is an IRS tool for collapsing a series of individual steps into a single event for tax purposes. While it sounds scary, the backdoor Roth conversion is a well-established and accepted strategy. As long as you follow the procedure and report it correctly, this doctrine isn't a practical concern here.

The whole point of a clean conversion is to minimize taxable earnings, not necessarily chase down every last penny. Paying tax on a few dollars of interest is a small price for getting thousands into a Roth IRA.

A Checklist of Common Pitfalls

Even with the best intentions, it's easy to make a simple mistake that can unravel a backdoor Roth conversion. Run through this checklist before you pull the trigger to make sure you haven't missed anything.

- Accidentally Deducting the Contribution: The entire strategy is built on making a non-deductible contribution. If you claim a tax deduction for your traditional IRA contribution by mistake, the conversion that follows will be 100% taxable.

- Ignoring Pre-Tax IRA Balances: This is the most expensive mistake you can make. You have to account for all traditional, SEP, and SIMPLE IRA assets. Always check for and clear out these balances before you make your non-deductible contribution.

- Messing Up Form 8606: Filling out Form 8606 incorrectly—or forgetting to file it altogether—can lead to penalties and make the IRS think your conversion is fully taxable. Double-check your basis and the conversion amounts you enter.

- Investing Funds Before Conversion: It's tempting, but investing the contribution inside the traditional IRA can generate taxable gains. The safest bet is to leave the money in a cash or money market fund until the conversion is totally finished.

For those who have already maxed out their traditional and backdoor Roth IRA contributions, it might be time to explore converting after-tax 401(k) contributions. This "mega backdoor Roth" strategy can unlock a huge amount of tax-free growth, but it has its own unique set of rules and requires a compliant employer plan. At Spivak Financial Group, we specialize in helping clients navigate these complexities to build robust, tax-efficient retirement plans.

Common Questions on the Backdoor Roth Strategy

Once you get the hang of the mechanics, a few specific questions almost always pop up. Let's walk through the most common ones we hear from clients, making sure you can move forward with total confidence.

How Quickly Should I Convert After I Contribute?

The short answer? As fast as your brokerage will let you.

While there's no official IRS waiting period, the best practice is to convert the money from your traditional IRA into the Roth IRA almost immediately. This usually means waiting for the initial contribution to settle, which can take anywhere from one to five business days.

The reason for the rush is simple: you want to prevent the money from earning anything while it's sitting in the traditional IRA. Any interest or dividends that pop up before the conversion are taxable as ordinary income for that year. A quick conversion helps keep the taxable amount of your backdoor Roth conversion at zero, or very close to it.

What Happens If I Forget to File Form 8606?

Forgetting to file Form 8606 is a surprisingly common misstep, and unfortunately, it can be a costly one. Without this form, the IRS has no record of your non-deductible contribution. That contribution is what establishes your after-tax basis, proving you already paid tax on that money.

If you don't file it, the IRS will likely assume your entire conversion came from pre-tax funds. The result? They'll treat the whole amount as taxable income, hitting you with a completely avoidable tax bill. If you realize you've made this mistake, you need to amend your tax return and include the completed Form 8606 right away.

Think of Form 8606 as your official receipt for the IRS. It’s the proof that your conversion was a non-taxable event, and it stops the IRS from defaulting to the assumption that all converted funds are taxable. Don't skip it.

Can I Do a Backdoor Roth If I Have a SEP or SIMPLE IRA?

Yes, but you need to be extremely careful here. This is where the IRS pro-rata rule can really trip you up. The rule forces you to aggregate the balances of all your traditional, SEP, and SIMPLE IRAs when figuring out the taxes on a conversion.

If you have a sizable pre-tax balance in a SEP or SIMPLE IRA, a huge chunk of your Roth conversion will suddenly become taxable income. Before you even think about doing this, you have to run the numbers using the pro-rata formula.

One of the best solutions is to see if your current employer's 401(k) plan accepts rollovers from SEP or SIMPLE IRAs. If you can move those pre-tax funds into your 401(k), you effectively wipe them off the pro-rata calculation slate, clearing the way for a clean, tax-free backdoor Roth conversion.

Does My Spouse’s IRA Balance Affect My Conversion?

Nope, not at all. Your spouse's retirement accounts have zero impact on your conversion. For the pro-rata rule, IRAs are treated as strictly individual accounts. The IRS only cares about the aggregated balances of your own traditional, SEP, and SIMPLE IRAs.

This means your spouse could have millions in a traditional IRA, and it wouldn't affect the tax treatment of your conversion one bit (and vice-versa). Each of you has to evaluate your own IRA situation independently. This separation is great because it allows one spouse to move forward with a tax-free conversion even if the other has large pre-tax IRA balances that would make it a bad deal for them.

Navigating complex retirement strategies like the backdoor Roth conversion requires careful planning and expert guidance. The team at Spivak Financial Group can help ensure you execute every step correctly, avoiding costly pitfalls and maximizing your tax-free growth potential. Contact us at (844) 776-3728 or visit our Scottsdale office at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260. Learn more about securing your financial future at https://72tprofessor.com.