Navigating your personal finances can feel like sailing a vast ocean without the right tools. It is easy to get lost. The best financial planning software acts as your digital compass, helping you chart a course toward your goals, whether that is mastering your budget, planning for retirement, or tracking complex investments. The options are more powerful and user-friendly than ever, but not every tool is suited for every sailor.

This comprehensive guide cuts through the noise to provide a detailed, hands-on look at the leading software solutions available today. We move beyond generic feature lists to explore the unique strengths, practical use cases, and honest limitations of each platform. Our goal is to help you find the perfect fit for your specific financial situation, from simple budgeting apps for families to sophisticated retirement modelers for those planning an early exit from the workforce.

Inside, you will find in-depth profiles of tools like Monarch Money, YNAB, Quicken, Empower Personal Dashboard, and specialized retirement planners. Each review includes screenshots, direct links, and expert analysis from the team at Spivak Financial Group to help you make an informed decision. For those looking to access retirement funds early or need advanced planning strategies, understanding these tools is a critical first step. Let's find the software that will empower you to take control and confidently steer your financial future.

1. Monarch Money

Monarch Money establishes itself as a premium, ad-free hub for modern personal finance management, making it a strong contender for the best financial planning software available. It excels at providing a holistic view of your finances by connecting to over 13,000 financial institutions, including banks, credit cards, investment accounts like Coinbase, and even real estate valuations via Zillow. This comprehensive aggregation allows users to track their net worth, manage budgets, and forecast cash flow with a high degree of accuracy.

The platform is particularly well-suited for collaborative financial planning. You can invite a partner or a financial advisor to your dashboard at no extra cost, making it ideal for households managing shared goals and expenses. The clean user interface and robust reporting tools present complex financial data in an easily digestible format across its web, iOS, and Android applications. While the platform offers powerful tools for self-management, some users may still wonder, do I really need a financial planner for retirement? Monarch can serve as a powerful supplement to professional advice.

Key Details & User Experience

Monarch Money operates on a subscription model, reinforcing its commitment to user privacy by never selling data or displaying ads. The user experience is consistently praised for its modern design and intuitive navigation.

- Pricing: Free 7-day trial, then a single plan at $14.99/month or $99.99/year.

- Availability: Currently limited to users in the United States and Canada.

- Unique Feature: The ability to add unlimited collaborators (spouses, partners, or advisors) is a significant differentiator.

Pros:

- Stellar, ad-free user interface

- Comprehensive account aggregation

- Strong collaboration features

Cons:

- Only available in the US and Canada

- Occasional data connection issues reported by some users

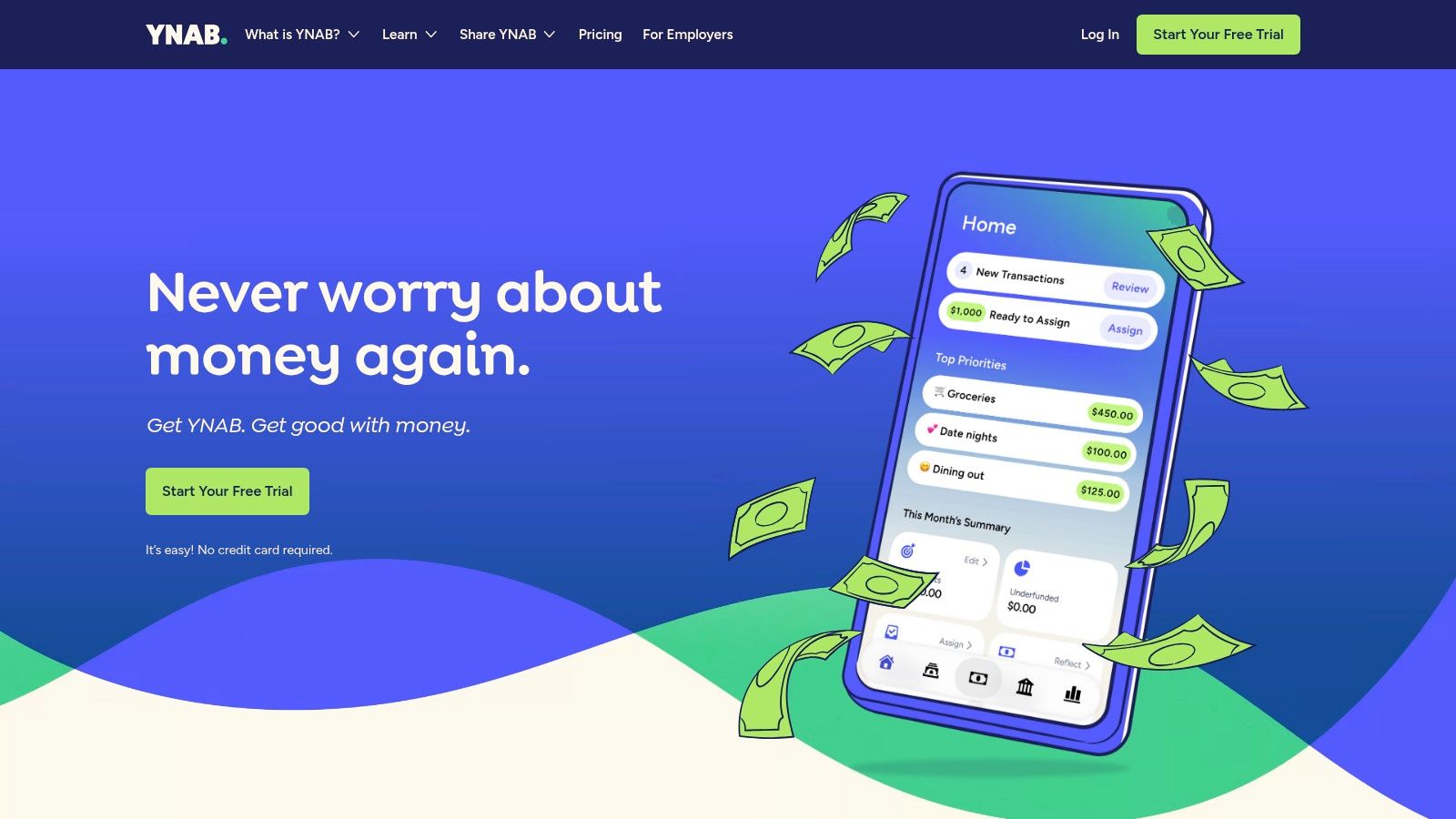

2. YNAB (You Need A Budget)

YNAB, which stands for "You Need A Budget," operates more like a proactive financial methodology than just a tracking tool, making it a unique entry among the best financial planning software. It is built entirely around the zero-based budgeting principle: give every dollar a job. This approach forces users to be intentional with their money, allocating income to expenses, debt payments, and savings goals until there is nothing left to assign. It excels at helping users break the paycheck-to-paycheck cycle and gain granular control over their spending habits.

The platform is renowned for its extensive educational resources, including free live workshops, video courses, and an active user community. This support system is designed to help users master its four-rule method and build lasting financial habits. For those seeking expert guidance on complex scenarios like early retirement distributions, which might be explored with specialists like the Spivak Financial Group, YNAB provides the foundational budget clarity needed before making such significant decisions. Real-time syncing across web and mobile apps ensures your budget is always current, whether you're at home or on the go.

Key Details & User Experience

YNAB's subscription model includes access to its full suite of tools and a wealth of educational content, all without ads. The user experience is focused and goal-oriented, though new users should expect a learning curve as they adapt to the zero-based budgeting mindset.

- Pricing: Free 34-day trial (no credit card required), then $14.99/month or $99.99/year.

- Availability: Available globally.

- Unique Feature: A single subscription can be shared with up to six people, making it an excellent collaborative tool for families and partners.

Pros:

- Highly effective for teaching proactive budgeting and financial discipline

- Extensive support and educational ecosystem

- Generous 34-day free trial to learn the system

Cons:

- Steeper learning curve than simple expense trackers

- Annual subscription is pricier than some alternatives

3. Quicken Simplifi

Quicken Simplifi positions itself as a streamlined, cloud-based solution for everyday financial management, earning its spot among the best financial planning software for those who prioritize simplicity and active cash-flow tracking. As a modern offshoot of the legacy Quicken brand, Simplifi offers a mobile-first experience designed to give users a clear, real-time picture of their spending, savings, and investments. Its core strength lies in its "Spending Plan," which moves beyond traditional budgeting to show you exactly what’s left to spend after accounting for bills and savings goals.

The platform provides a familiar Mint-style overview that many users find intuitive, presenting dashboards and watchlists for at-a-glance financial health checks. You can easily track your progress toward specific savings goals, monitor investment performance, and receive projected cash flow reports to avoid surprises. While it offers a powerful suite of tools for daily financial oversight, users with complex needs, such as those planning for early retirement or requiring specialized advice, might consult professionals like Spivak Financial Group to complement their self-management efforts.

Key Details & User Experience

Simplifi is built around an accessible, subscription-based model that ensures an ad-free environment, focusing squarely on user functionality. The web and mobile apps are praised for their clean design and straightforward navigation, making daily financial check-ins quick and painless.

- Pricing: Free 30-day trial, then a single plan typically priced at $3.99/month (billed annually). Frequent promotions can lower this cost.

- Availability: Accessible via web browser and dedicated iOS/Android mobile apps.

- Unique Feature: The "Spending Plan" provides a forward-looking view of discretionary funds, a departure from traditional, restrictive budget categories.

Pros:

- Very competitive annual price versus peers

- Intuitive, Mint-style overview for easy tracking

- Strong focus on real-time cash flow and spending

Cons:

- No free-forever version is available

- Some users report occasional connectivity quirks with bank links

4. Quicken Classic (Desktop)

As one of the longest-standing names in personal finance, Quicken Classic maintains its position as a powerhouse desktop-based solution, making it a formidable choice for the best financial planning software for users who prefer local data control. It provides an exceptionally detailed framework for managing every financial facet, from intricate budgeting and bill tracking to advanced investment portfolio analysis. Its strength lies in its depth, offering robust reporting capabilities that allow users to drill down into spending, tax implications, and long-term financial trajectories with precision.

Quicken is particularly well-suited for individuals with complex financial situations, such as multiple properties, small business income, or sophisticated investment portfolios. The desktop-first approach ensures that your primary data resides on your local machine, with an optional cloud sync for its companion web and mobile apps. Higher-tier versions like Premier unlock powerful tools, including portfolio X-ray analysis and advanced tax planning aids, providing a level of detail that many web-only applications cannot match.

Key Details & User Experience

Quicken Classic operates on an annual subscription model that provides ongoing connected services, updates, and support. The user experience is data-rich and comprehensive, though its traditional interface may have a steeper learning curve compared to modern, web-native platforms.

- Pricing: Annual subscriptions range from Classic Deluxe (

$59.88/year) to Premier ($83.88/year) and Business & Personal (~$119.88/year). Discounts are often available from retailers. - Availability: Primarily focused on users in the United States and Canada.

- Unique Feature: Its desktop-first architecture with local data storage provides enhanced privacy and control, a key differentiator from cloud-based competitors.

Pros:

- Extremely powerful for complex finances and investment tracking

- Rich, detailed reporting and tax planning tools

- Local data storage offers greater user control and privacy

Cons:

- Connected services require an ongoing subscription

- Some users report occasional issues with bank connection re-authentication

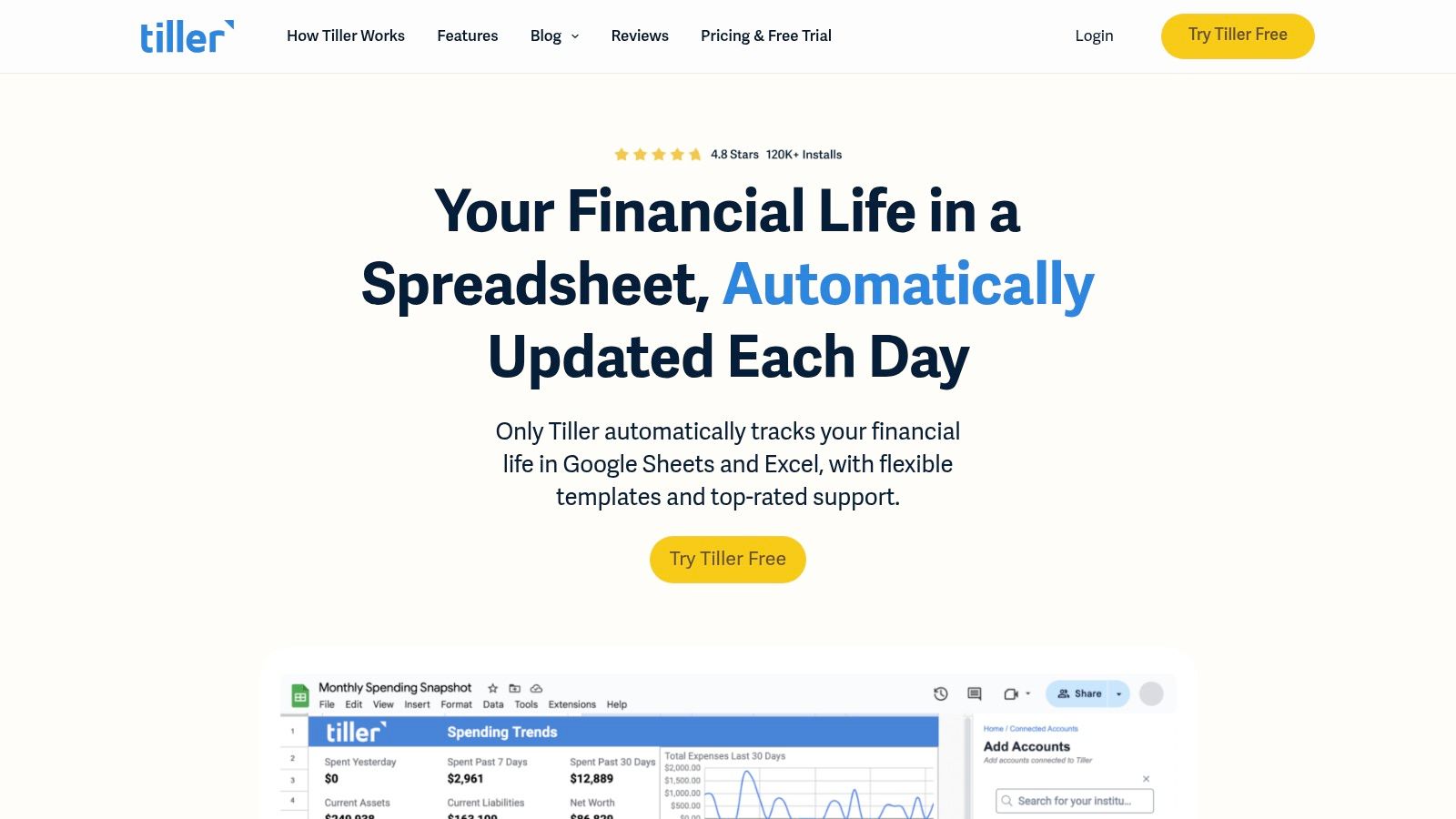

5. Tiller

For those who prefer the power and flexibility of spreadsheets, Tiller offers a unique approach that positions it as one of the best financial planning software options for hands-on users. Instead of a standalone app, Tiller securely automates your daily financial transactions and balances into your own Google Sheets or Microsoft Excel spreadsheets. This gives you complete ownership and control over your financial data, allowing for limitless customization beyond what typical apps can offer. It's an ideal system for data-driven individuals who want to build a truly personalized financial dashboard from the ground up.

Tiller bridges the gap between manual spreadsheet entry and automated budgeting apps by providing the best of both worlds. The service comes with a powerful Foundation Template to get you started, but its true strength lies in the vibrant community that creates and shares a wide array of templates for everything from debt-snowball tracking to retirement forecasting. Paired with its AutoCat feature for automatic transaction categorization, Tiller allows users to build a powerful, customized financial engine that suits their exact needs, a service that firms like Spivak Financial Group might recommend for clients who want granular control.

Key Details & User Experience

Tiller's user experience is centered entirely within the spreadsheet environment you're already familiar with. While it requires a learning curve for those new to advanced spreadsheet functions, it provides unparalleled flexibility and data privacy.

- Pricing: Free 30-day trial, then a single plan at $79/year.

- Availability: Primarily serves users in the United States and Canada.

- Unique Feature: The combination of automated bank feeds with the complete customizability of personal spreadsheets is Tiller’s key differentiator.

Pros:

- Maximum flexibility and data ownership in your own spreadsheets

- Large community template ecosystem for advanced planning

- Automates the tedious part of spreadsheet budgeting (data entry)

Cons:

- Requires comfort with spreadsheets and some manual customization

- Less turnkey than app-first budgeting tools

6. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard, widely known by its former name Personal Capital, offers one of the most robust free financial tracking platforms available, solidifying its position as a top choice for the best financial planning software. It excels at aggregating nearly all financial accounts, from banking and credit cards to loans and investments, into a single, comprehensive view. This unified dashboard allows users to monitor their net worth, analyze cash flow, and track portfolio performance with impressive detail.

The platform is particularly powerful for those focused on investment tracking and retirement planning. Its free tools include a Retirement Planner that runs Monte Carlo simulations to forecast your financial future and an Investment Checkup tool that analyzes your portfolio for asset allocation and hidden fees. While its core dashboard is free, Empower also offers paid wealth management services for clients with over $100,000 in investable assets. This dual offering makes it a scalable solution, though some may still wonder how do I choose the right advisor for their specific needs.

Key Details & User Experience

Empower's free dashboard is its main draw, providing institutional-grade tools at no cost. The user experience across its web and mobile apps is clean and data-rich, focusing heavily on investment metrics and long-term financial health.

- Pricing: The financial dashboard and all its planning tools are completely free. Paid advisory services are available for clients with over $100,000 in assets under management.

- Availability: Primarily available to users in the United States.

- Unique Feature: The free Retirement Planner and Investment Checkup tools offer a level of analysis typically found in paid software.

Pros:

- Extensive free toolkit for budgeting and investment analysis

- Powerful portfolio analysis and retirement forecasting tools

- Scales from a free DIY tool to a full-service wealth manager

Cons:

- Users with under $100k in assets may receive sales calls for advisory services

- Occasional account syncing issues have been reported by some users

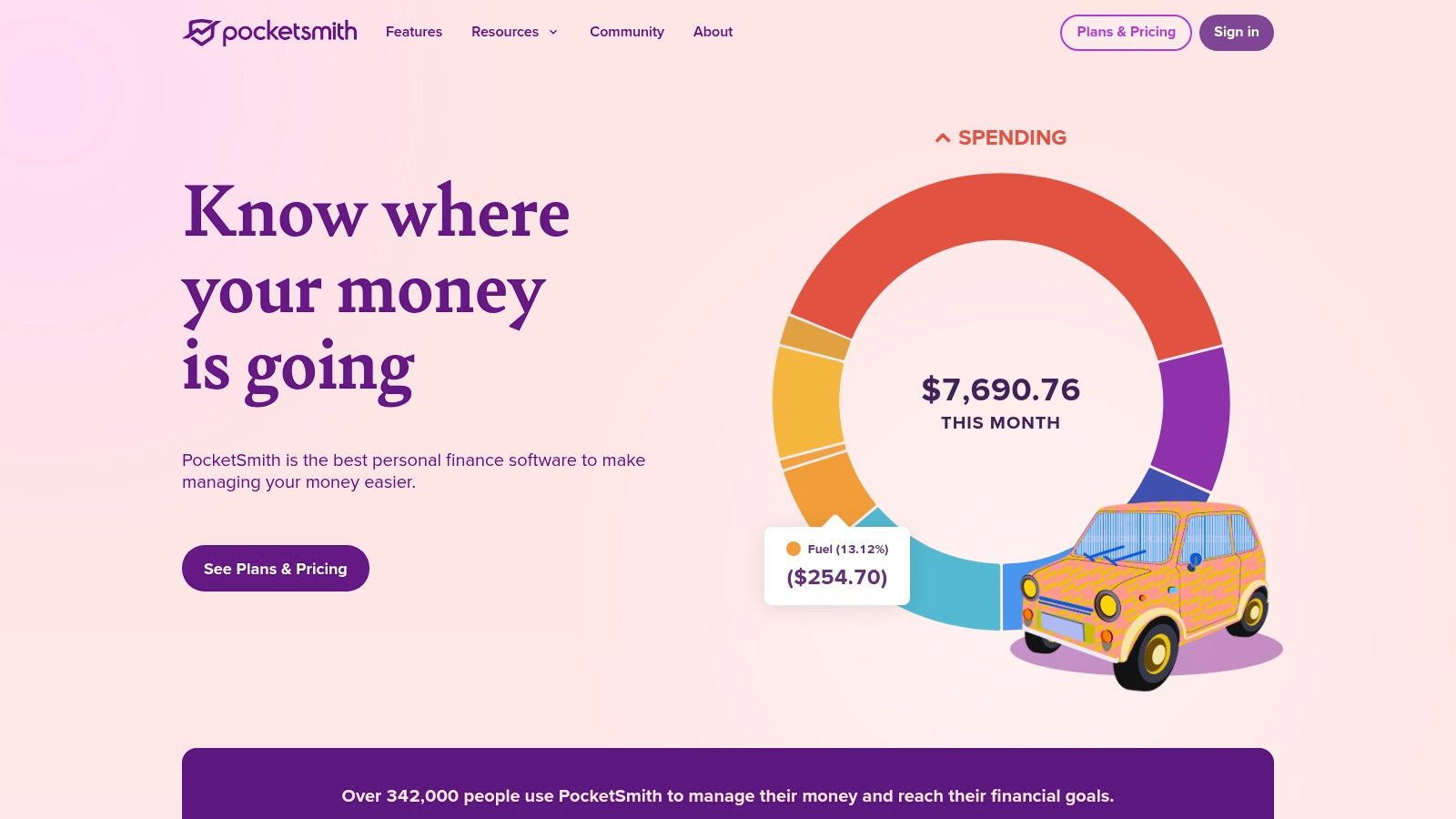

7. PocketSmith

PocketSmith carves out a unique space in the financial planning software landscape by focusing heavily on forward-looking cash flow forecasting and "what-if" scenario planning. It excels at helping users visualize their financial future, offering projections up to 60 years ahead. By connecting to thousands of banks globally with multi-currency support, it allows users to build a detailed financial picture and see how current spending decisions will impact long-term goals like early retirement or major purchases.

The platform’s strength lies in its calendar-based budgeting system, which provides a visual representation of upcoming bills and income, making it easy to anticipate financial crunches or surpluses. This feature, combined with its robust reporting tools, makes it an excellent choice for individuals who want to move beyond simple transaction tracking and actively model their financial future. For those exploring complex strategies, such as the options discussed by experts at Spivak Financial Group, PocketSmith provides the tools to simulate the potential outcomes of different financial choices.

Key Details & User Experience

PocketSmith is a web-first platform with companion mobile apps, offering a tiered subscription model based on the level of forecasting and automation desired. The user experience is data-rich and highly customizable, appealing to those who enjoy detailed financial analysis.

- Pricing: Free plan with manual entry. Paid plans range from Foundation ($9.95/month) to Fortune ($19.95/month) and Flourish ($39.95/month), with discounts for annual billing.

- Availability: Global, with multi-currency support.

- Unique Feature: Its 60-year financial forecasting and scenario modeling capabilities are standout features for long-range planning.

Pros:

- Powerful long-term projections and “what-if” scenarios

- Strong multi-currency support for international users

- Visual, calendar-based budgeting

Cons:

- App Store subscription plans differ from web plans; subscribing via the web is recommended

- The sheer number of features can be overwhelming for beginners

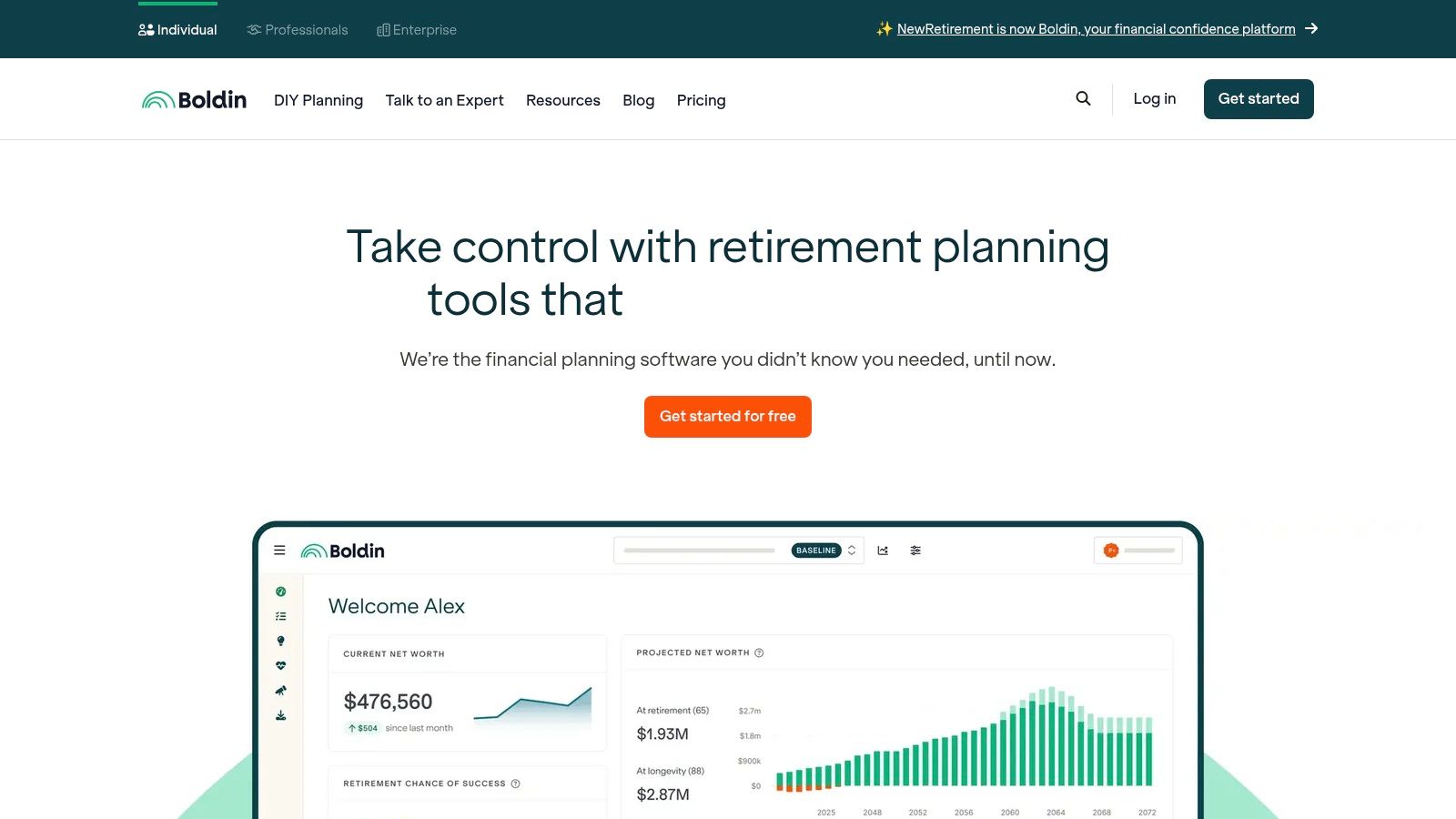

8. Boldin (formerly NewRetirement) – Retirement Planner

Boldin, which was formerly known as NewRetirement, carves out a specific niche as some of the best financial planning software for individuals laser-focused on retirement. It goes far beyond simple budgeting, offering a powerful, do-it-yourself suite for deep retirement planning. The platform allows users to build a detailed plan using over 100 different inputs, including complex variables like Social Security optimization, tax scenarios, Medicare costs, and Roth conversions. This level of detail enables robust scenario modeling and comparison, giving users a clear picture of their financial future.

The platform's strength lies in its Monte Carlo simulations, which stress-test a retirement plan against thousands of potential market outcomes to assess its probability of success. For those who want more hands-on guidance, Boldin offers live classes and optional sessions with certified coaches or financial advisors. While its core focus is not on daily expense tracking, it excels at helping users determine what is a good monthly retirement income to aim for. The blend of DIY tools and optional professional help makes it a uniquely flexible choice.

Key Details & User Experience

Boldin operates on a freemium model, with its most powerful features reserved for paid subscribers. The user interface is data-rich and geared towards planning rather than aesthetics, which is ideal for its target audience of serious pre-retirees and retirees.

- Pricing: Free basic planner. PlannerPlus is $120/year. PlannerPlus Live (with classes) is $348/year. Advisor (with a dedicated CFP) starts at $995.

- Availability: Primarily available to users in the United States.

- Unique Feature: The combination of an extremely detailed DIY planner with optional access to live classes and professional financial advisors is its core differentiator.

Pros:

- Deep retirement-centric planning tools

- Sophisticated scenario and tax modeling

- Optional coaching and advisor packages available

Cons:

- Less suited for day-to-day budgeting and expense tracking

- Some users report limitations with the account aggregation feature

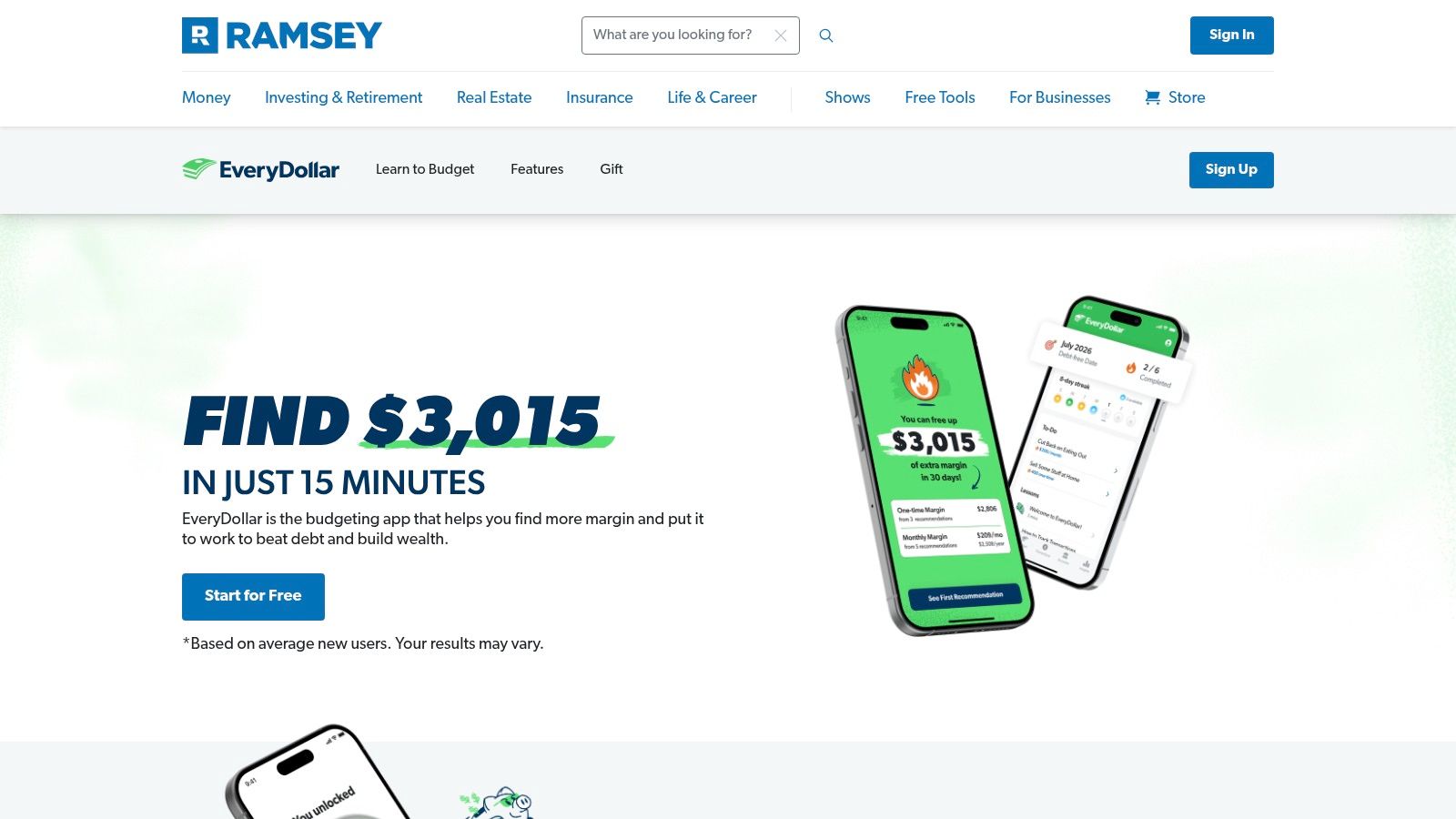

9. EveryDollar (Ramsey Solutions)

EveryDollar, developed by Ramsey Solutions, is a purpose-built budgeting app designed to implement Dave Ramsey's popular zero-based budgeting methodology. This approach requires you to assign a job to every single dollar of your income, ensuring that your expenses match your income exactly. The platform is excellent for users who want a structured, hands-on approach to gaining control over their spending and aggressively paying down debt, aligning with the "Baby Steps" financial plan. It provides a clear, no-nonsense framework for managing monthly cash flow.

The platform offers two distinct tiers. The free version requires manual transaction entry, which can be beneficial for those who need to feel every purchase to change spending habits. The premium version automates this process by connecting to your bank accounts, provides custom reporting, and offers paycheck planning features. For those seeking more guidance, the premium subscription also includes access to live Q&A coaching sessions and financial literacy content. This makes EveryDollar a strong candidate for the best financial planning software for individuals committed to a specific, proven financial system.

Key Details & User Experience

EveryDollar's user experience is straightforward and goal-oriented, focusing entirely on the zero-based budget. The interface, available on web and mobile, is clean and designed to minimize distraction, keeping you focused on your financial plan.

- Pricing: A free version is available for manual budgeting. The premium version offers a free trial, then costs $17.99/month, $79.99/year, or $129.99 for two years.

- Availability: Primarily focused on the US market; bank connections and some features have limited international support.

- Unique Feature: Its direct integration with the Ramsey "Baby Steps" philosophy provides a holistic system for users following that specific financial plan.

Pros:

- Simple, effective zero-based budgeting framework

- Strong free version for manual budgeting

- Aligned with a popular and structured financial methodology

Cons:

- Requires commitment to the Ramsey method to be fully effective

- Manual entry in the free tier can be time-consuming

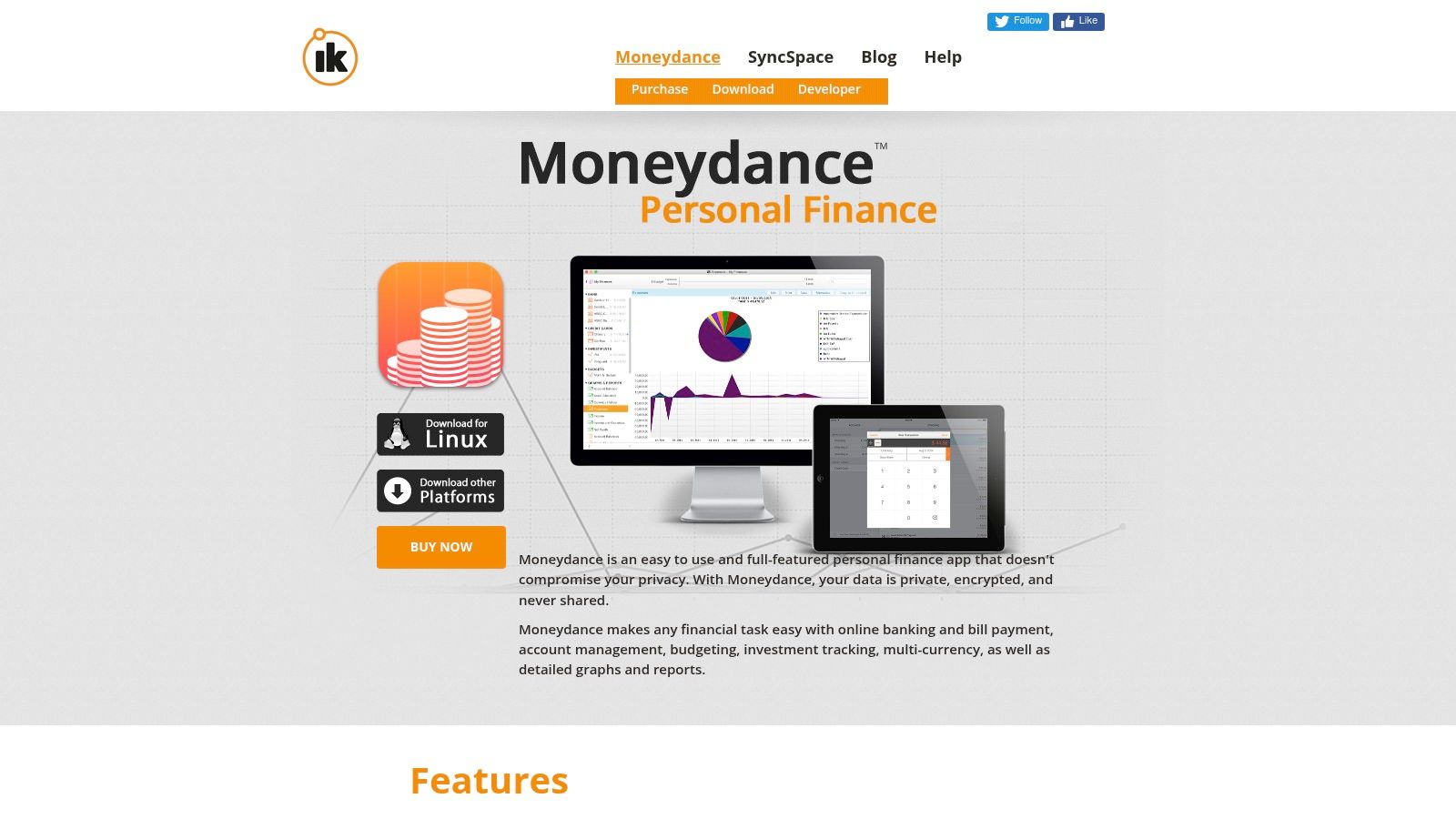

10. Moneydance

Moneydance carves out a unique niche in the modern landscape of financial tools by offering a robust, desktop-first personal finance application with a one-time purchase model. It stands as a powerful alternative for users wary of subscription fees and cloud-based data storage. Supporting Windows, Mac, and Linux, it provides comprehensive features like online banking, bill pay, budgeting, and particularly strong investment tracking, including multi-currency support. This makes it a solid choice for those who prefer their financial data stored locally and encrypted on their own machine.

The platform is designed for users who want complete control and ownership of their financial information. While it may not have the sleek, web-native feel of newer apps, its functionality is deep, offering advanced graphing and reporting tools to analyze spending, investments, and net worth. Companion mobile apps are available for on-the-go viewing and transaction entry, which then sync with the main desktop application. For those prioritizing privacy and a single-payment structure, Moneydance presents itself as some of the best financial planning software available for desktop users.

Key Details & User Experience

Moneydance is built around a perpetual license, a stark contrast to the prevalent SaaS model. The user experience is traditional and data-rich, appealing to those who appreciate function over form and want a long-term, offline-first solution.

- Pricing: A one-time purchase of $64.99, which includes free upgrades for the next version. A free trial is available with a 100-transaction limit.

- Availability: Global, with multi-currency support built-in for Windows, macOS, and Linux.

- Unique Feature: The perpetual license and local-first data storage are its key differentiators, ensuring privacy and eliminating recurring costs.

Pros:

- One-time payment model is cost-effective over the long term

- Strong privacy with encrypted, locally stored data

- Comprehensive investment tracking and multi-currency features

Cons:

- Desktop interface feels dated compared to modern web apps

- Mobile experience is less seamless than cloud-native competitors

- Cloud sync between devices requires separate configuration

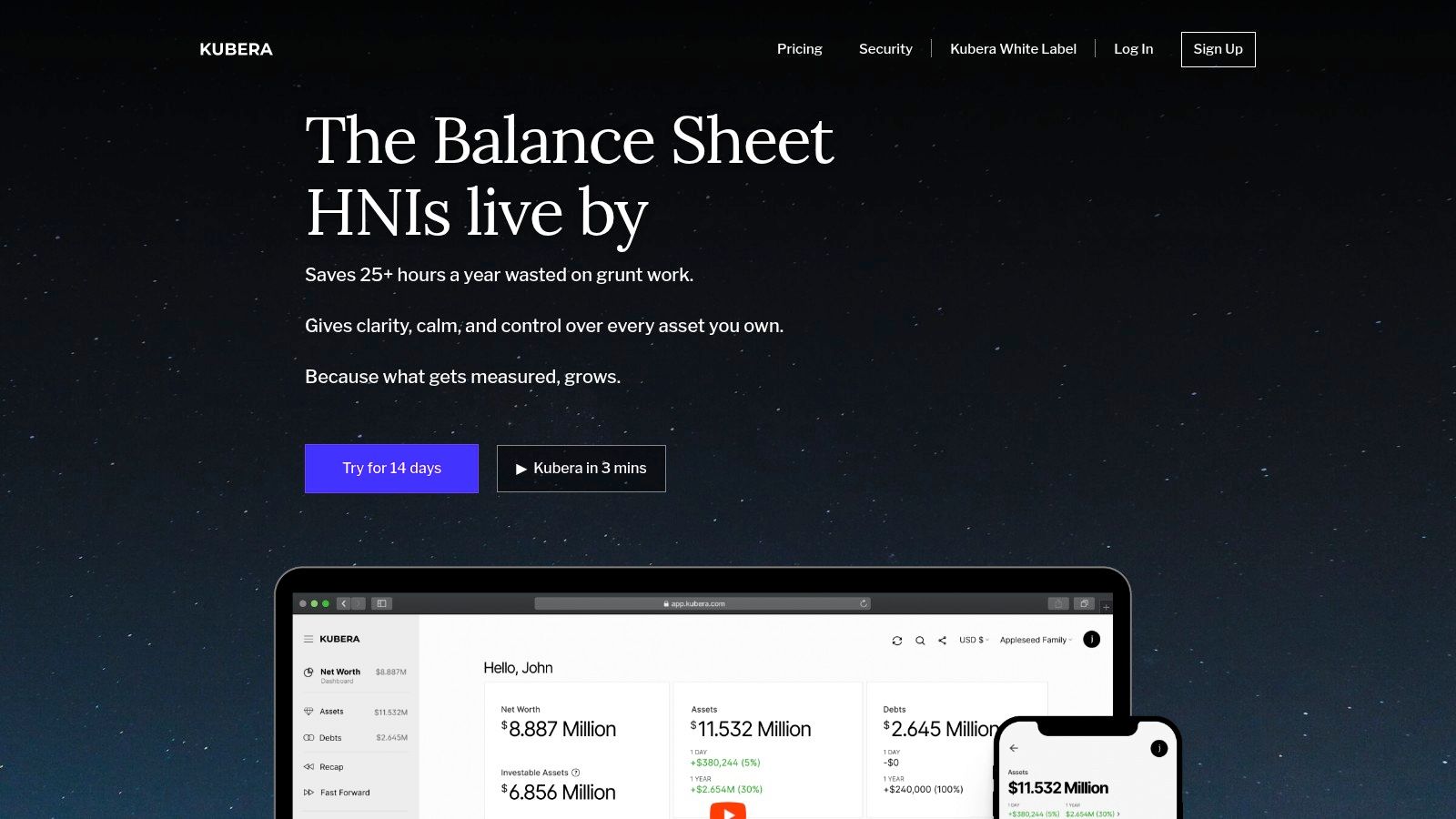

11. Kubera

Kubera positions itself as the ultimate net worth tracker for the modern, diversified investor, earning its spot as one of the best financial planning software choices for those with complex portfolios. It excels at aggregating a vast array of asset classes into a single, clean dashboard. Kubera connects not only to standard bank and brokerage accounts but also to global institutions, cryptocurrency exchanges, and can track the value of real estate, domain names, vehicles, and even collectibles. This all-in-one view is invaluable for power users who need to see a true, real-time picture of their total wealth.

The platform is built on a privacy-first, subscription-only model, ensuring user data is never sold for advertising. Its minimalist interface is designed for clarity, avoiding the budgeting and goal-setting features common in other tools to focus purely on portfolio tracking and net worth analysis. Kubera is particularly useful for families and advisors, offering nested portfolios and granular access controls in its higher-tier plans. For those who prioritize a comprehensive asset overview above all else, Kubera delivers an elegant and powerful solution.

Key Details & User Experience

Kubera’s commitment to a subscription-based model underscores its focus on data privacy and an uncluttered, ad-free experience. The interface is sleek and modern, praised by users for its simplicity and focus on displaying complex financial data clearly across its web, iOS, and Android apps.

- Pricing: Starts with a 14-day trial for $1, then plans begin at $150/year.

- Availability: Global, with support for financial institutions worldwide.

- Unique Feature: Unmatched asset class support, including direct integration for crypto, DeFi, real estate, and manually tracked collectibles.

Pros:

- Emphasis on data privacy with a subscription-only revenue model

- Excellent for users with complex, diverse holdings

- Clean, minimalist interface focused on net worth

Cons:

- Premium pricing compared to more budget-focused tools

- Lacks budgeting and cash flow features some users may need

12. Best Buy – Quicken Classic (authorized retailer)

While not a software developer itself, Best Buy serves as a crucial and often overlooked resource for acquiring some of the best financial planning software on the market, specifically Quicken Classic. As an authorized US retailer, it provides a trusted platform for purchasing digital activation codes or physical key-cards for Quicken's various subscription tiers, including Deluxe, Premier, and Business & Personal. This makes it an excellent option for users looking for competitive pricing, gift purchases, or the convenience of managing software subscriptions through a familiar retailer.

The primary advantage of purchasing through Best Buy is the potential for significant discounts compared to buying directly from the developer, especially during sales events. The platform also offers the security of its established customer service and return policies. For those who are weighing software costs against professional advice, it's worth noting that even with powerful tools like Quicken, guidance from experts like Spivak Financial Group at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260 can be invaluable for complex situations. Their team, reachable at (844) 776-3728, specializes in nuanced retirement strategies.

Key Details & User Experience

Navigating Best Buy's website is straightforward, with clear product pages detailing software features, system requirements, and customer reviews. The checkout and digital delivery process is typically instantaneous, providing immediate access to your software activation code.

- Pricing: Varies based on Quicken tier and current promotions; often below MSRP.

- Availability: Primarily for US customers, with options for digital download or physical key-card delivery.

- Unique Feature: The ability to find Quicken subscriptions at a discount and bundle them with other tech purchases from a single, trusted retailer.

Pros:

- Trusted US retailer with easy returns and multiple payment options

- Often offers discounted pricing versus direct MSRP

- Immediate digital delivery for quick software activation

Cons:

- Codes may be limited to new accounts, so check SKU details if renewing

- Activation codes can sometimes have a limited window for redemption

Top 12 Financial Planning Software Comparison

| Tool | Core Features | UX & Reliability (★) | Value & Price (💰) | Best For (👥) | Unique Selling Point (✨/🏆) |

|---|---|---|---|---|---|

| Monarch Money | Account aggregation (13k+), investments & real estate, collaborative accounts, web & mobile | ★★★★ — clean modern UI; occasional link hiccups | 💰 Subscription; ad‑free & privacy-forward | 👥 US/Canada households & advisors | ✨ Ad-free data policy, strong reporting; 🏆 modern planning tools |

| YNAB (You Need A Budget) | Zero‑based budgeting, goals, debt-payoff, real-time sync, shared up to 6 users | ★★★★ — steep learning curve; excellent education/support | 💰 Annual subscription; 34‑day free trial | 👥 Budget-focused households & behavior builders | ✨ Zero-based method + deep education; 🏆 habit formation |

| Quicken Simplifi | Cloud budgeting, cash‑flow alerts, spending dashboards, watchlists | ★★★☆ — familiar Mint-style UI; occasional bank link quirks | 💰 Competitive annual subscription | 👥 Users wanting simple cloud budgeting + investment overview | ✨ Low-cost cloud alternative to classic Quicken |

| Quicken Classic (Desktop) | Desktop-first, deep reporting, portfolio X‑ray, local data + optional cloud sync | ★★★★ — powerful for complex finances; aggregator re-auths | 💰 Perpetual/retail codes often available; connected services may need subscription | 👥 Advanced investors, tax-focused & power users | ✨ Advanced investment & tax tools; 🏆 depth for complex finances |

| Tiller | Automated bank feeds to Google Sheets/Excel, templates, AutoCat rules | ★★★☆ — highly flexible; requires spreadsheet comfort | 💰 Subscription; high data ownership value | 👥 Spreadsheet-savvy DIY planners & data owners | ✨ Max flexibility & personal data ownership; large template community |

| Empower Personal Dashboard | Net worth aggregation, cash-flow, investment analysis, retirement planner | ★★★★ — robust free tools; intermittent linking reports | 💰 Free core tools; paid advisory for $100k+ AUM | 👥 Investors who want portfolio + retirement planning | ✨ Free comprehensive investment/retirement tools; 🏆 portfolio analysis |

| PocketSmith | Cash-flow forecasting, visual budget calendar, multi-currency, web & app | ★★★☆ — strong forecasting; platform plan differences | 💰 Subscription; web vs App Store plan variations | 👥 Long-term planners & multi-currency users | ✨ Long-term what‑if forecasting & calendar view |

| Boldin (formerly NewRetirement) | Deep retirement scenario modeling, Monte Carlo, tax & Social Security inputs | ★★★★ — retirement-centric; some linking limits | 💰 Tiered pricing; coaching/advisor add-ons | 👥 Early-retirees & focused retirement planners | ✨ 100+ input retirement models; 🏆 deep retirement planning |

| EveryDollar (Ramsey) | Zero‑based budgeting; free manual tier; Premium adds bank links & coaching | ★★★ — simple & prescriptive; manual free tier is hands-on | 💰 Free basic; Premium subscription for automation & coaching | 👥 Ramsey followers & manual budgeters | ✨ Free manual zero-based option; aligned with Ramsey coaching |

| Moneydance | Desktop app, OFX downloads, multi-currency, encrypted local data, reports | ★★★★ — reliable desktop with strong reporting; less cloud convenience | 💰 One-time perpetual license; free trial available | 👥 Privacy-minded desktop users & multi-currency travelers | ✨ Perpetual license & strong privacy; 🏆 cost-effective desktop choice |

| Kubera | Aggregation across banks, crypto, real estate, collectibles; nested portfolios | ★★★★ — premium UI for complex holdings | 💰 Premium subscription (higher-cost) | 👥 HNW individuals, families & advisors with diverse assets | ✨ Broad asset coverage & privacy-forward model; 🏆 net-worth for complex portfolios |

| Best Buy – Quicken Classic (retailer) | Digital delivery of Quicken activation codes, retailer support, returns | ★★★☆ — convenient retail purchase experience | 💰 Often discounted activation codes; watch new-subscriber SKUs | 👥 Buyers seeking discounted Quicken licenses or gifts | ✨ Retail deals & easy returns; 🏆 trusted authorized retailer |

Beyond the Software: When to Partner with a Financial Professional

Navigating the world of personal finance can feel overwhelming, but as we've explored, the right tools can transform complexity into clarity. We've delved into a dozen powerful options, from Monarch Money's all-in-one dashboards to YNAB's disciplined budgeting methodology and Tiller's spreadsheet-driven flexibility. Each platform offers a unique approach to managing your money, tracking investments, and visualizing your financial future. Finding the best financial planning software for your journey starts with a clear understanding of your own goals, habits, and what you need most from a digital tool.

Making Your Choice: A Strategic Recap

The key takeaway is that no single software is universally perfect. Your ideal tool depends entirely on your specific circumstances and financial philosophy.

- For the Hands-On Budgeter: If you thrive on detailed, zero-based budgeting and want to assign every dollar a job, YNAB and EveryDollar are designed for you. They demand active engagement but deliver unparalleled control over your spending.

- For the Data-Driven Investor: If your primary focus is tracking net worth, analyzing investment fees, and planning for retirement, Empower Personal Dashboard offers robust, free tools that are hard to beat.

- For the Spreadsheet Enthusiast: For those who love the granular control of a spreadsheet without the manual data entry, Tiller provides the perfect hybrid solution, automating your financial data flow directly into Google Sheets or Excel.

- For the Future Forecaster: If you want to run complex retirement scenarios, model different life events, and get a detailed picture of your long-term outlook, Boldin (formerly NewRetirement) is a specialized and powerful choice.

- For the All-in-One Seeker: For a comprehensive view that blends budgeting, goal setting, investment tracking, and net worth monitoring, Monarch Money and Quicken Simplifi offer modern, user-friendly interfaces.

The Human Element in a Digital World

While the best financial planning software is an indispensable ally, it is crucial to recognize its limitations. These platforms are brilliant at organizing data, tracking progress, and running projections based on the inputs you provide. They can tell you what is happening with your money. However, they can't always tell you why, nor can they provide the nuanced, forward-looking advice needed for complex financial decisions.

An algorithm can’t replicate the wisdom of a seasoned financial professional who understands the emotional and psychological aspects of money. Software can show you your retirement account balance, but it can’t help you navigate the intricate IRS rules for accessing those funds early without penalty. This is where human expertise becomes not just a luxury, but a necessity.

For specialized strategies like setting up a Series of Equal Periodic Payments (SEPP), also known as a 72(t) distribution, the stakes are incredibly high. A miscalculation or a misunderstanding of the strict rules can trigger significant taxes and penalties. This is precisely the type of scenario where technology provides the data, and a professional provides the strategy.

At Spivak Financial Group, we bridge that critical gap between powerful software and personalized guidance. We work with clients to interpret the data their tools provide, ensuring their financial plan is not only data-driven but also resilient and aligned with their real-life goals. If your planning has reached a point where you need more than an app can offer, we are here to help. Contact us at Spivak Financial Group, 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260, or call us at (844) 776-3728 to explore how a partnership can elevate your financial strategy.

For those planning an early retirement and needing to access funds before age 59½, navigating the complex 72(t) SEPP rules is critical. Our specialized calculator at 72tProfessor.com works alongside your financial software, providing the precise calculations needed to execute these strategies correctly. Visit 72tProfessor.com to ensure your early retirement income plan is built on a foundation of accuracy and compliance.