Retirement planning can feel overwhelming. Balancing savings, investments, and understanding complex rules is a significant challenge for many. Fortunately, technology offers powerful solutions to simplify this process. The right app can transform abstract financial goals into a clear, actionable roadmap, providing crucial insights into your portfolio, projecting future income, and keeping you on track. But with countless options available, finding the one that fits your specific needs can be difficult. Which tools truly deliver on their promises?

This guide cuts through the noise. We've analyzed the top contenders to bring you a definitive list of the best retirement planning apps for 2025. Whether you're a hands-on DIY investor, someone seeking automated guidance, or an individual exploring early retirement income strategies, you'll find a tool here to empower your financial journey. This includes specialized platforms like the 72tProfessor.com software, developed by Spivak Financial Group, designed for those needing to access retirement funds early without penalty.

We will explore each app's unique strengths, practical use cases, and honest limitations to help you make the smartest choice. Each entry includes screenshots and direct links, providing a comprehensive resource to help you build the secure future you deserve.

1. 72tProfessor.com

Best for Early Retirement Income Strategy & Management

For individuals aspiring to retire before the traditional age of 59½, 72tProfessor.com offers an indispensable and highly specialized service. Rather than being a conventional DIY app, it functions as a comprehensive, expert-guided platform dedicated exclusively to implementing IRS Rule 72(t) Substantially Equal Periodic Payments (SEPP). This makes it one of the most powerful resources for those needing to access their qualified retirement funds, such as a 401(k) or IRA, without incurring the standard 10% early withdrawal penalty.

The platform, powered by the Scottsdale, AZ-based Spivak Financial Group, provides an end-to-end solution that navigates the complexities of a 72(t) distribution. This process is notoriously difficult and fraught with risks of severe IRS penalties if mishandled. 72tProfessor.com mitigates this risk by offering full A-to-Z fiduciary support, from initial strategy design and calculation to ongoing management and coordination with 72(t)-friendly custodians. This level of hands-on, expert management is its defining feature, setting it apart from generic retirement calculators or robo-advisors.

Key Features & Use Cases

This service is not for passive planning; it's for active implementation. The platform's strength lies in its personalized, high-touch approach led by Stuart J. Spivak, a financial advisor with over 37 years of experience.

- Expert Strategy Design: The team analyzes your financial situation to determine the optimal IRS-approved distribution method (amortization, annuitization, or life expectancy) to create a consistent, predictable income stream.

- Penalty-Free Access: The core benefit is unlocking your retirement savings to fund life goals like early retirement, supporting family members, or long-term travel without losing a significant portion to penalties.

- Ongoing Fiduciary Management: They don't just set up the plan; they manage it to ensure ongoing compliance, a critical step often overlooked in DIY attempts.

- Educational Resources: For those wanting to understand the mechanics, the site offers masterclasses and articles. You can learn more about strategic tax planning for retirement on their blog.

Why It's Our Top Choice

While many tools help you plan for retirement, 72tProfessor.com is a unique service that helps you execute an early retirement. Its laser focus on the niche but powerful 72(t) rule, combined with decades of proven expertise and an A+ BBB rating, provides a level of security and strategic advantage that is virtually impossible to replicate alone. It's an essential service for anyone with over $200,000 in retirement accounts who wants to confidently access their funds early.

- Website: 72tProfessor.com

- Contact: Spivak Financial Group, 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260 | (844) 776-3728

- Pricing: Services are customized; a free initial consultation and personalized income estimate are available.

2. Betterment

Betterment excels as an automated investing platform, making it one of the best retirement planning apps for those who prefer a hands-off approach. It uses robo-advisor technology to build and manage a diversified portfolio based on your risk tolerance and retirement timeline. Users can set a specific retirement goal, and the app’s forecasting tools project potential outcomes, helping you stay on track by showing how much you need to save.

Its highly-rated iOS and Android apps offer a clean, intuitive user experience ideal for beginners. The platform automatically handles complex tasks like portfolio rebalancing and tax-loss harvesting, optimizing your returns without requiring you to intervene. This focus on automation, combined with a low management fee and no minimum investment, makes it an accessible and powerful tool for building long-term wealth.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Automated Portfolios | Diversified ETF portfolios managed by robo-advisors. | 0.25% annual fee (Digital plan) |

| Retirement Planner | Goal-based forecaster to track progress toward retirement savings. | Included in all plans. |

| CFP Access | Unlimited access to Certified Financial Planners. | 0.65% annual fee (Premium plan) |

Pros:

- $0 minimum to begin investing.

- Excellent, easy-to-use mobile and web interface.

- Automated features simplify sophisticated investing strategies.

Cons:

- No option to invest in individual stocks or ETFs.

- Higher management fee for unlimited CFP access.

Website: https://www.betterment.com

3. Wealthfront

Wealthfront stands out as one of the best retirement planning apps due to its powerful, digital-only automated financial planning engine, Path. It excels at aggregating all your financial accounts, including IRAs, 401(k)s, and taxable accounts, to provide a holistic view of your net worth. This comprehensive data allows its planning tools to model sophisticated "what-if" scenarios, showing you how different savings rates or retirement ages could impact your financial future.

This platform is ideal for self-directed individuals who want deep, data-driven retirement insights without the pressure of speaking to a human advisor. Path’s projection capabilities help you visualize your progress and make informed trade-offs between goals like saving for retirement and buying a home. For specialized needs like accessing retirement funds early, a consultation with a firm like Spivak Financial Group can complement Wealthfront’s automated advice.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Path Planning Engine | Models retirement spending, contributions, and ‘what-if’ scenarios. | Free |

| Account Aggregation | Links external retirement, investment, and savings accounts for a complete financial picture. | Free |

| Automated Investing | Managed investment portfolios with a low advisory fee. | 0.25% annual advisory fee |

Pros:

- Advanced automated planning provides deep insights with no sales pressure.

- Comprehensive account aggregation creates more accurate projections.

- Excellent for data-driven, hands-off investors.

Cons:

- No default option for human financial advisor support.

- Some users report occasional app connectivity issues.

Website: https://www.wealthfront.com/planning

4. Charles Schwab Intelligent Portfolios + Intelligent Income

Charles Schwab Intelligent Portfolios is a standout choice for investors seeking a powerful robo-advisor without advisory fees. The platform builds and manages a diversified portfolio of ETFs based on your goals, automatically handling rebalancing to keep you on track. It is one of the best retirement planning apps, particularly for its unique Intelligent Income feature, which helps create a predictable, tax-efficient monthly withdrawal stream from your accounts once you retire.

This seamless integration of accumulation and decumulation planning sets Schwab apart. Users can model different withdrawal scenarios and see their potential impact, turning a complex nest egg into a reliable "paycheck." Combined with Schwab’s renowned 24/7 customer support and an optional premium tier for those who want dedicated CFP guidance, it offers a robust solution for the entire retirement journey. When considering if this hands-off approach is for you, you can learn more about how to choose the right advisor and planning style for your needs.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Automated Investing | Robo-advisor manages a diversified portfolio of ETFs. | $0 advisory fees. |

| Intelligent Income | A tool to create a tax-smart, automated withdrawal strategy in retirement. | Included with the portfolio. |

| Premium Access | One-on-one guidance with a Certified Financial Planner. | One-time $300 setup fee + $30/month. |

Pros:

- No advisory fees for the core robo-advisor service.

- Excellent tools for automating retirement income.

- Strong customer support and a trusted brand name.

Cons:

- Requires a higher cash allocation compared to some competitors.

- Premium tier for CFP access involves a setup fee and monthly subscription.

Website: https://www.schwab.com/intelligent-portfolios

5. Vanguard

Vanguard stands out as a titan in low-cost investing, making it ideal for DIY investors who want robust, free tools alongside their investment accounts. While not a dedicated app for planning alone, its platform integrates powerful retirement income and expense calculators that help users project their financial future with precision. These tools allow you to model different scenarios, estimate your retirement nest egg, and understand how long your savings might last, providing a solid foundation for your strategy.

The highly-rated mobile app brings account management and educational resources directly to your fingertips, allowing you to manage IRAs, rollovers, and other investments easily. Vanguard's strength lies in combining its acclaimed low-cost fund family with practical planning resources. It is one of the best retirement planning apps for individuals who prefer to take an active role in their financial journey, supported by a wealth of trusted information and straightforward, powerful calculators to guide their decisions. For more complex needs like early retirement distributions, services like Spivak Financial Group can offer specialized guidance.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Retirement Calculators | Detailed online tools to calculate retirement income and expenses. | Free |

| Mobile App | Manage Vanguard IRAs, brokerage accounts, and access educational content. | Free to use (investment fees apply). |

| Advice Services | Access to financial advisors for personalized planning. | Varies (e.g., Vanguard Personal Advisor) |

Pros:

- Robust calculators and educational resources for DIY retirement planning.

- Industry-leading low-cost investment options and a frequently updated app.

- Excellent for consolidating investments and planning in one place.

Cons:

- Some advanced tools require a Vanguard account and login to use.

- Personalized planning typically requires enrolling in paid advisory services.

Website: https://investor.vanguard.com/tools-calculators

6. Fidelity Investments

Fidelity stands out as an all-in-one financial powerhouse, offering robust brokerage services alongside comprehensive retirement planning tools. It’s an ideal platform for investors who want to manage their IRAs, 401(k)s, and other investment accounts under a single roof. The platform provides detailed goal-tracking features that allow users to model different retirement scenarios, estimate future income needs, and adjust their strategy accordingly, making it one of the best retirement planning apps for hands-on investors.

The highly-rated mobile app provides access to extensive research, market news, and account management, allowing users to trade, monitor portfolios, and track retirement goals on the go. Fidelity’s combination of zero-commission stock and ETF trades, a massive selection of mutual funds, and powerful planning resources makes it a top choice. For those needing expert guidance, professionals like the Spivak Financial Group at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260 can help manage and optimize accounts held at full-service brokerages like Fidelity.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Full-Service Brokerage | Trade stocks, ETFs, mutual funds, and options with powerful research tools. | $0 commission on US stock/ETF trades. |

| Retirement Goal Planning | Integrated tools to set, track, and model retirement savings goals. | Free for Fidelity account holders. |

| IRA & 401(k) Management | Full support for various retirement accounts, including rollovers. | No account fees or minimums for IRAs. |

Pros:

- Comprehensive platform for all investing and retirement needs.

- Extensive research tools and educational resources.

- $0 commission on stock and ETF trades.

Cons:

- Can be overwhelming for complete beginners due to the vast number of features.

- Some advisory services come with higher fees.

Website: https://www.fidelity.com

7. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard stands out as one of the best retirement planning apps for those who want a holistic, 360-degree view of their financial life. It aggregates all your financial accounts, including bank accounts, investments, and loans, into a single dashboard. This comprehensive overview is crucial for effective retirement planning, as it allows you to track your net worth and see exactly how your assets and liabilities are changing over time.

The platform’s strength lies in its powerful, free analytical tools. The Retirement Planner feature uses your aggregated data to project your retirement savings and allows you to test different scenarios, like saving more or retiring earlier. Its Investment Fee Analyzer uncovers hidden fees in your 401(k)s and other investment accounts, which can significantly impact your long-term growth. This focus on high-level analysis and tracking makes it ideal for DIY investors who want deep insights without paying a fee.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Retirement Planner | A goal-based forecaster with scenario testing to project retirement readiness. | Free |

| Net Worth Tracker | Aggregates all accounts to provide a real-time view of your total net worth. | Free |

| Investment Fee Analyzer | Identifies and analyzes the fees within your investment accounts. | Free |

Pros:

- Robust and feature-rich platform is completely free to use.

- Excellent visibility into investment portfolio allocation and hidden fees.

- Aggregates data from multiple institutions for a complete financial snapshot.

Cons:

- The transition from Personal Capital has caused some login and connectivity issues.

- Focus is on wealth management, with frequent prompts for advisory services.

Website: https://www.personalcapital.com

8. Boldin (formerly NewRetirement) – Planner and PlannerPlus

Boldin positions itself as a powerhouse among retirement planning apps, designed for users who want to dive deep into the numbers. It moves beyond simple calculators by offering an incredibly detailed modeling experience with over 250 data inputs. This web-based platform excels at creating a comprehensive picture of your financial future, incorporating everything from federal and state tax projections to complex Roth conversion scenarios and Monte Carlo simulations.

Its strength lies in its ability to compare different scenarios, allowing users to see the long-term impact of decisions like retiring early, changing investment strategies, or downsizing a home. While its extensive features present a steeper learning curve, the platform provides personalized coaching tips, live classes, and Q&A sessions to guide users. For those seeking in-depth, personalized guidance without a dedicated financial advisor, Boldin offers an unmatched level of control and insight. For instance, individuals looking for early retirement options could model a 72(t) distribution plan with precision.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Deep Financial Modeling | Over 250 inputs for taxes, Roth conversions, and Monte Carlo analysis. | Free (Planner); $120/year (PlannerPlus) |

| Scenario Comparisons | Model and compare different financial decisions to see their impact. | Included in all plans. |

| Live Classes & Q&A | Access to educational classes and expert Q&A sessions. | Included with PlannerPlus. |

| Account Aggregation | Link and sync all financial accounts for a complete picture. | Included with PlannerPlus. |

Pros:

- Exceptionally deep and detailed retirement modeling capabilities.

- Allows for robust scenario planning and comparisons.

- Transparent pricing with a 14-day free trial for the premium plan.

Cons:

- Web-only platform with no native mobile app.

- Steep learning curve due to its power-user focus.

- Users occasionally report aggregator connection issues.

Website: https://www.boldin.com/retirement/pricing

9. Social Security Administration (my Social Security + official calculators)

While not a traditional app, the Social Security Administration's website is an indispensable resource for anyone planning for retirement in the U.S. It provides the most authoritative and personalized data on your future benefits. By creating a secure my Social Security account, you can view your complete earnings record, verify its accuracy, and get an official estimate of your retirement benefits at various claiming ages. This foundational information is critical for any comprehensive retirement strategy.

The site’s official calculators offer unparalleled accuracy, allowing you to model different retirement scenarios based on your actual earnings history. While using official calculators is essential, a deeper dive into optimal timing can significantly impact your benefits. Consult this guide on when to start collecting Social Security for more detailed strategies. The platform's direct access to personal data makes it one of the best retirement planning "apps" for building a realistic financial forecast.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| my Social Security Account | Secure portal to view your earnings history and personalized benefit estimates. | Free |

| Official Benefits Calculator | Tools to estimate retirement, disability, and survivor benefits based on your record. | Free |

| Retirement Planning Guides | Authoritative information on retirement ages, rules, and strategies. | Free |

Pros:

- Authoritative and most accurate source for Social Security benefit data.

- Free and secure access to personal SSA records.

- Essential tool for foundational U.S. retirement planning.

Cons:

- Identity-proofing process may be challenging and require multiple attempts.

- The website interface is functional but less modern than commercial apps.

Website: https://www.ssa.gov/retirement/plan-for-retirement

10. T. Rowe Price – Retirement Income Calculator and Tools

For those prioritizing straightforward income modeling, T. Rowe Price offers one of the best free retirement planning tools available. Instead of being a comprehensive app, it provides a powerful, web-based Retirement Income Calculator that helps you visualize how long your savings might last. The calculator uses a sophisticated Monte Carlo analysis to run 1,000 simulations, giving you a probability-based forecast of your portfolio’s sustainability, which is a key differentiator from simpler tools.

This platform is ideal for individuals who want a clear, no-frills answer to the question, "Will my money last?" It’s supported by extensive educational resources that explain complex retirement income strategies in plain language. While the tools are free, there is an option to connect with an advisor for personalized guidance. This makes it an excellent starting point for anyone looking to understand their retirement income potential before committing to a full-service platform.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Retirement Income Calculator | Uses Monte Carlo analysis to estimate the probability of retirement income success. | Free |

| Educational Resources | A deep library of articles and guides on retirement income strategies. | Free |

| Advisory Services | Optional access to financial advisors for personalized planning. | Varies based on service level. |

Pros:

- Clear and powerful retirement income modeling at no cost.

- Strong educational content helps users understand income sustainability.

- Backed by a reputable investment firm.

Cons:

- Lacks the comprehensive account aggregation of dedicated apps.

- No native mobile app; experience is web-based only.

Website: https://www.troweprice.com/personal-investing/resources/tools/

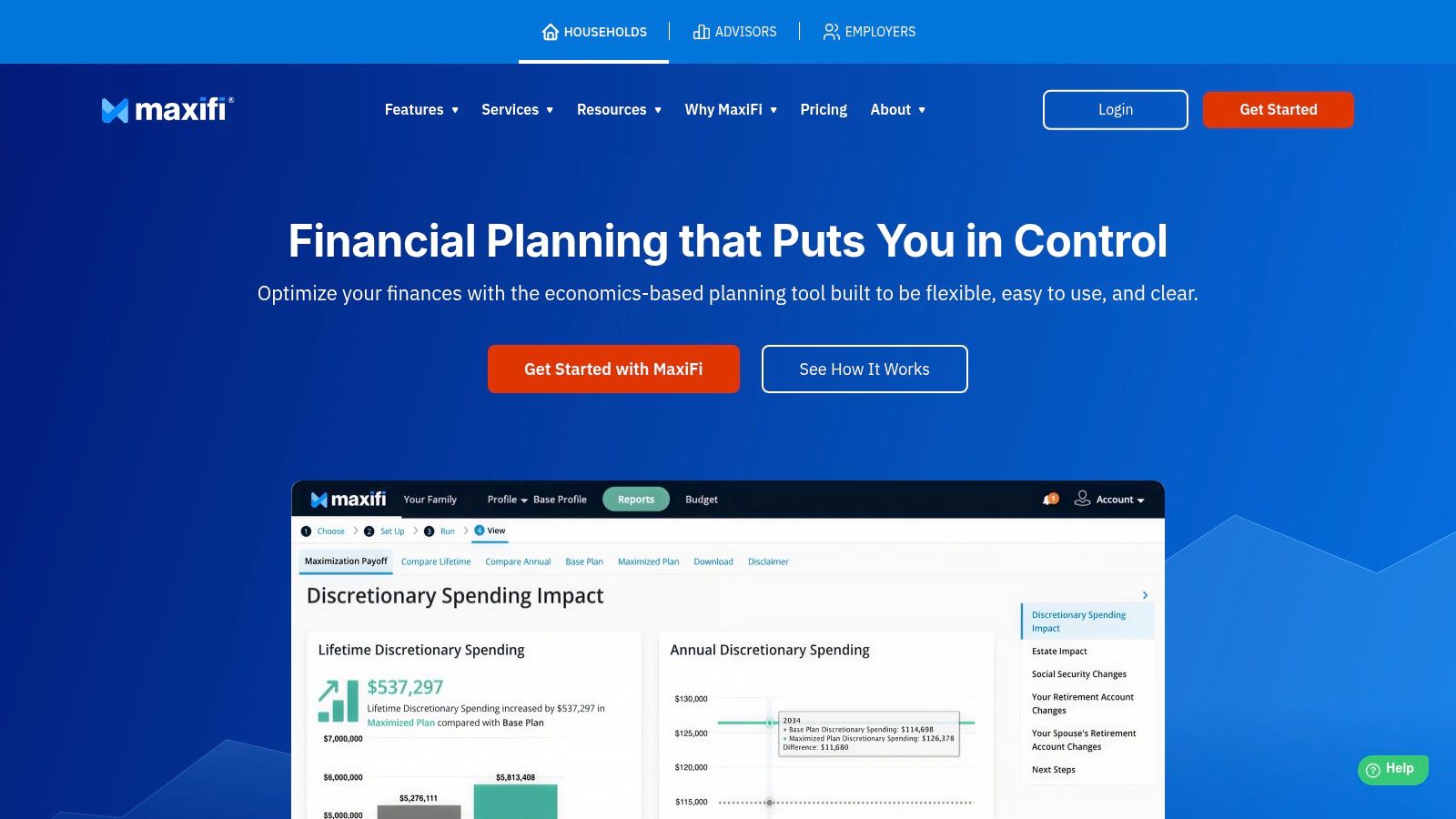

11. MaxiFi Planner

MaxiFi Planner is a highly sophisticated, web-based software designed for meticulous DIY planners and financial advisors. Unlike simpler apps, it uses economic principles to calculate a sustainable "living standard" over your lifetime. The platform excels at optimization, finding the best strategies for Social Security claiming, retirement account withdrawals, and Roth conversions to maximize your spending power without running out of money.

This tool is one of the best retirement planning apps for users who want to go beyond basic projections and engage in deep, scenario-based analysis. Its powerful engine considers taxes, inflation, and complex financial products to provide a data-driven path. While its interface has a steep learning curve, its analytical depth is unmatched for those seeking rigorous, personalized financial modeling without paying asset-based fees. This makes it an ideal choice for complex situations, such as those needing early retirement fund access, which experts like Spivak Financial Group at 72tprofessor.com can help navigate.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Lifetime Planning | Optimizes Social Security, withdrawals, and Roth conversions. | $109 (Standard annual license) |

| Living Standard Monte Carlo | Runs risk analysis to show the probability of maintaining your lifestyle. | Included in all plans. |

| Scenario Comparison | Compare different retirement scenarios side-by-side to make informed decisions. | Included in all plans. |

Pros:

- Extremely powerful and detailed modeling for advanced users.

- Fixed annual license fee instead of AUM-based pricing.

- Robust documentation and support to help master the tool.

Cons:

- No native mobile app; only accessible via a web browser.

- Complex interface that requires a significant time investment to learn.

Website: https://maxifiplanner.com

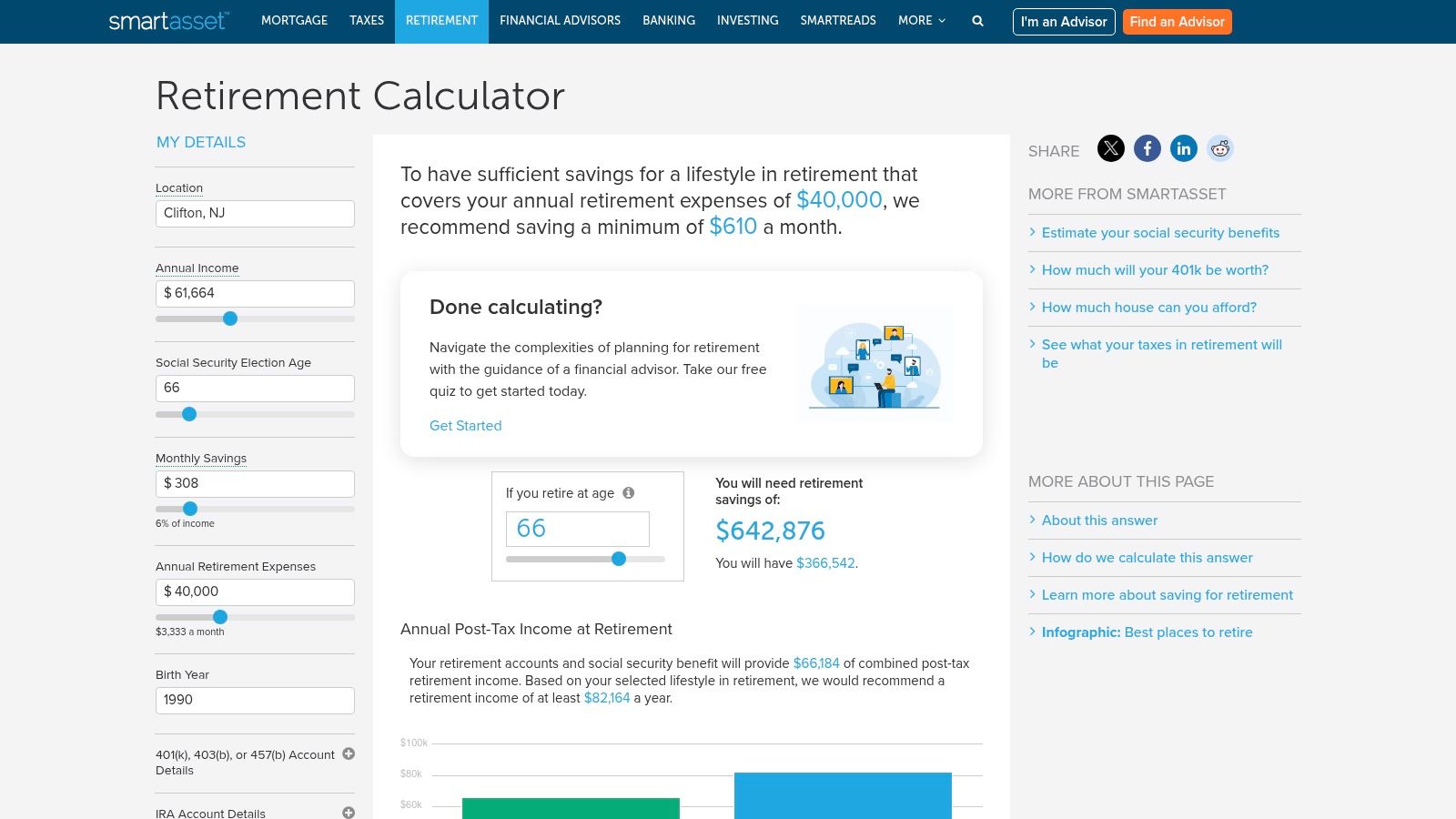

12. SmartAsset – Retirement & Social Security Calculators

SmartAsset offers a suite of free, interactive tools that serve as an excellent starting point for retirement planning. It excels at providing quick, high-level estimates for crucial figures like your total savings needs and potential Social Security benefits. By inputting details like your location, age, and income, its calculators generate ballpark numbers that are perfect for a preliminary financial check-up, making it one of the best retirement planning apps for foundational insights.

While not a comprehensive portfolio management tool, SmartAsset's strength lies in its accessibility and educational value. The platform is designed to help you visualize different outcomes, such as how claiming Social Security at various ages impacts your monthly income. Its primary function is to provide these initial calculations and then offer a connection to a vetted financial advisor for those who want personalized guidance. The tools are also useful for exploring different strategies, like converting a portion of your savings into a guaranteed income stream. Learn more about pensionizing your assets.

Key Features & Pricing

| Feature | Description | Cost |

|---|---|---|

| Retirement Calculator | Estimates your required savings based on income, expenses, and location. | Free |

| Social Security Calculator | Models how your claiming age affects your lifetime benefits. | Free |

| Advisor Matching | An optional service that connects users with local financial advisors. | Free (Advisors have their own fees) |

Pros:

- Completely free and easy-to-use calculators.

- Excellent for getting a quick sanity check on your retirement numbers.

- Provides a straightforward way to see how variables impact your plan.

Cons:

- Functions primarily as a lead-generation tool for financial advisors.

- Calculations are based on generalized assumptions and lack deep personalization.

Website: https://smartasset.com/retirement/retirement-calculator

Top 12 Retirement Planning Apps Features Comparison

| Service | Core Features/Characteristics | User Experience/Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| 🏆 72tProfessor.com | Expert 72(t) SEPP strategy, ongoing management | ★★★★★ A+ BBB rating | Penalty-free retirement income, fiduciary care | Individuals <59½ with $200K+ retirement | Full A-Z IRS-compliant support, free consultation | Customized, consult-based |

| Betterment | Automated portfolios, retirement goal tracking | ★★★★ Beginner-friendly app | Low fees, $0 minimum start | First-time retirement savers | CFP guidance at premium tier | Low fees, premium tier higher |

| Wealthfront | Path planning engine, account aggregation | ★★★★ Advanced automation | Deep automated retirement planning | Users wanting no advisor contact | Retirement trade-off modeling | Competitive robo fees |

| Charles Schwab Intelligent Portfolios | ETF portfolios + Intelligent Income withdrawals | ★★★★ Strong tools & support | No advisory fee base, automated income | Robo-advisor users & retirees | Tax-smart withdrawal automation | No advisory fee, premium costs std |

| Vanguard | Planning calculators, IRA management | ★★★★ Robust educational resources | Low-cost investment options | DIY investors | Fund family strength, frequent app updates | Low-cost funds, paid advice optional |

| Fidelity Investments | Full brokerage + retirement planning | ★★★★ Comprehensive & updated | All-in-one solution, 24/7 support | Broad investor base | Research & goal tracking integration | Standard advisory/trading fees |

| Empower Personal Dashboard | Retirement planner, net worth & fee analysis | ★★★★ Feature-rich, free platform | Free comprehensive investment insights | Long-term retirement planners | Multi-account aggregation | Free |

| Boldin (formerly NewRetirement) | 250+ inputs, Monte Carlo, tax projection | ★★★★ Deep modeling; power-user | In-depth personalized retirement planning | Advanced DIY planners | Tax & scenario depth, coaching, live sessions | Transparent pricing, trial available |

| Social Security Administration | Official SSA benefits & calculators | ★★★★ Authoritative, secure | Most accurate SSA data and benefit estimates | U.S. Social Security claimants | Official SSA tools & account access | Free |

| T. Rowe Price | Monte Carlo income calculator, education | ★★★★ Clear & educational | Straightforward income modeling | Retirement income planners | Simple Monte Carlo & advisory option | Free calculators, advisory upsell |

| MaxiFi Planner | Lifetime plan, Social Security timing, Roth optimization | ★★★★ Detailed modeling; complex | Advanced scenario-driven modeling | DIY advanced planners & advisors | Optimized withdrawals & Social Security timing | Paid annual license |

| SmartAsset | Retirement & Social Security calculators | ★★★✓ Quick & approachable | Fast rough retirement estimates | Early retirement checkers | Advisor matching & interactive tools | Free calculators |

Choosing the Right App: When to Use a Tool vs. an Expert

Navigating the landscape of the best retirement planning apps can feel overwhelming, but the right tool can transform your financial future from a source of anxiety into a clear, actionable plan. We've explored a range of powerful options, from comprehensive dashboards like Empower Personal Dashboard that offer a 360-degree view of your net worth, to sophisticated robo-advisors like Betterment and Wealthfront that automate your investment strategy with precision.

For DIY enthusiasts who thrive on detailed scenario planning, tools like Boldin and MaxiFi Planner provide the granular control needed to model countless financial futures. Similarly, institutional powerhouses such as Fidelity, Vanguard, and Charles Schwab offer robust calculators and integrated income tools that leverage their vast resources to support your long-term goals. These applications are invaluable for building a strong foundation, tracking progress, and staying engaged with your retirement strategy.

Understanding the Limits of Technology

While these digital platforms offer incredible utility, it's crucial to recognize their limitations. An app can aggregate your data, project future growth, and even manage your portfolio, but it cannot provide the nuanced, personalized advice required for complex life situations. Automated systems operate on algorithms and pre-defined rules, which often fall short when faced with unique circumstances that require human judgment and strategic interpretation of complex regulations.

Consider these critical questions where a human expert's guidance becomes indispensable:

- Complex Tax Implications: How can I structure withdrawals to minimize my tax burden in retirement, especially with a mix of pre-tax and Roth accounts?

- Early Retirement Scenarios: I want to retire before age 59½. What are the specific, compliant ways to access my retirement funds without incurring a 10% early withdrawal penalty?

- Estate Planning Integration: How does my retirement plan fit into my overall estate plan, and how can I ensure my assets are passed on efficiently to my heirs?

- Life Goal Organization: Beyond financial specifics, how do I organize all my life goals and timelines? General planning tools can also assist, with options like the Harmony advanced AI planner app offering integrated solutions to map out broader objectives.

When to Call in a Professional

The most significant gap between an app and an expert emerges when dealing with intricate regulations like IRS Rule 72(t) for Substantially Equal Periodic Payments (SEPP). A miscalculation or procedural error in setting up a 72(t) distribution can trigger steep penalties and unravel years of careful planning. This is a high-stakes scenario where an app's general guidance is insufficient.

For those navigating these specialized needs, particularly individuals under 59½ seeking early access to retirement funds, partnering with a seasoned professional is not a luxury; it is a necessity. The experts at Spivak Financial Group, for instance, specialize in these complex financial strategies, ensuring every detail is managed with precision and compliance. They provide the dedicated, tailored guidance that technology simply cannot replicate, turning a potentially risky maneuver into a secure and confident step toward your financial goals.

For those specific, high-stakes situations like establishing penalty-free early retirement income, a dedicated tool backed by human expertise is essential. Discover how the specialized software and expert guidance at 72tProfessor.com can help you navigate complex IRS rules with confidence by visiting 72tProfessor.com today.