Retirement planning has moved far beyond simple spreadsheets and savings goals. Today's environment requires a more dynamic approach, one that accounts for market volatility, complex tax implications, and the growing desire for financial independence and early retirement. The challenge isn't a lack of information; it's finding the right tools that provide clarity and actionable insights tailored to your specific financial situation. This is precisely where our comprehensive guide to the best retirement planning tools comes in. We’ve meticulously evaluated a dozen leading platforms to help you navigate your path to a secure future with confidence.

This article cuts through the noise. Instead of generic descriptions, we provide in-depth analysis of each tool’s strengths and weaknesses, complete with screenshots and direct links for easy access. We explore how sophisticated DIY software can model complex withdrawal strategies, and we highlight specialized services for those considering unique options, such as penalty-free early distributions. One such specialized tool, 72tProfessor.com, is offered by the Spivak Financial Group at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260, providing expert guidance on specific early retirement rules.

Whether you're a young professional just starting to save, a family planning for caregiving costs, or an individual aiming for early retirement to travel the world, this resource list is designed for you. Our goal is to empower you to find the perfect platform that aligns with your financial goals, helping you move from uncertainty to a clear, well-defined retirement strategy. Let's dive in and discover the tools that will help you take control of your financial destiny.

1. 72tProfessor.com

For individuals under the traditional retirement age seeking to access their retirement funds without incurring the standard 10% penalty, 72tProfessor.com stands out as a premier, specialist service. Powered by the Spivak Financial Group, this platform is not a DIY calculator but a comprehensive, end-to-end solution for implementing a Substantially Equal Periodic Payment (SEPP) plan under IRS Rule 72(t). It is a powerful resource for those who need early access to their retirement savings for income, travel, or caregiving expenses.

This service excels by managing the entire complex process, from initial assessment to ongoing compliance. The team, led by a wealth management veteran with over 37 years of experience, provides a fiduciary-level service that has successfully guided more than 500 clients. This makes it one of the best retirement planning tools for a very specific but critical need: penalty-free early distributions.

Core Offerings and Unique Value

72tProfessor.com demystifies the intricate rules of 72(t) distributions. The core value is its hands-on, expert-led approach that minimizes the risk of costly IRS penalties, which can be retroactively applied if a SEPP plan is established or managed incorrectly.

- Expert Structuring: The team helps clients choose the right IRS-approved calculation method (amortization, annuitization, or life expectancy) to create a predictable income stream.

- Custodian Coordination: They assist in placing funds with 72(t)-friendly custodians, a crucial step that simplifies the entire implementation process.

- Ongoing Compliance Management: This is a key differentiator. The service monitors the plan to ensure it remains compliant with IRS regulations for its full term (at least five years or until age 59½, whichever is longer).

- Free Educational Resources: Potential clients can start with a complimentary consultation, receive a personalized income estimate, or enroll in a free masterclass. To get a foundational understanding of the process, you can learn more about what a 72(t) SEPP is on their website.

Who Is It For?

This service is ideal for pre-retirees with significant retirement balances (the site suggests candidates with over $200,000 in qualified accounts) who require a steady income stream before age 59½. The primary focus is on providing a turnkey solution that prioritizes compliance and risk mitigation over a do-it-yourself approach. While some structuring options are advertised as "No Fee, No Market-Risk," prospective clients should expect advisory or management fees, which are determined during the consultation process.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

Website: https://72tprofessor.com

2. Fidelity Planning & Guidance Center

For those who prefer a more integrated experience, the Fidelity Planning & Guidance Center stands out as one of the best retirement planning tools available directly from a major brokerage. It offers a powerful, free suite of calculators and analysis features that seamlessly connect your planning activities with your actual investment accounts. This makes it incredibly simple to turn insights into action, whether that's increasing your 401(k) contributions or executing an IRA rollover.

The platform's core strength is its ability to provide a comprehensive retirement analysis. Users can input their financial data to generate a "retirement score," forecasting their income needs and estimating the probability of success. What makes it particularly useful is the robust scenario testing; you can adjust variables like your retirement age, savings rate, and investment mix to immediately see the impact on your long-term outlook. This is invaluable for individuals exploring early retirement strategies.

Key Features and User Experience

While the basic tools are free and accessible without an account, linking your Fidelity accounts unlocks its full potential. The portfolio analysis provides a "next steps" report with actionable advice. Though some users have noted occasional UI changes or instability with the retirement score display, the overall experience is robust.

- Pricing & Access: Free for all users, with enhanced features for Fidelity account holders. Advisory services are available for a fee.

- Best For: Current Fidelity customers or those looking for a one-stop-shop to plan and invest.

- Limitations: The most advanced features and personalized advice are tied to paid managed accounts. Its recommendations are, naturally, geared toward Fidelity's own products and services.

Website: https://www.fidelity.com/calculators-tools/retirement-planning

3. Vanguard Retirement Planning Tools

Vanguard is renowned for its low-cost investing philosophy, and its suite of retirement planning tools reflects this practical, education-first approach. Rather than a single integrated dashboard, Vanguard offers a collection of focused calculators and resources designed to tackle specific retirement questions. This makes it an excellent starting point for individuals who want to understand core concepts like retirement income needs and healthcare expenses without the complexity of a full-blown financial aggregation app.

The standout feature is its detailed healthcare cost estimator, built with Mercer, which allows users to project future medical expenses based on their zip code and Medicare choices. This tool addresses a critical, often underestimated, component of retirement planning. Vanguard’s calculators are straightforward, helping you estimate if your savings will last and what your income might look like, making it one of the best retirement planning tools for foundational knowledge. This is especially useful for those considering an early retirement and needing to understand withdrawal strategies, a topic explored by specialists like Spivak Financial Group who advise on complex distributions.

Key Features and User Experience

Vanguard's tools are less about a slick, modern interface and more about providing solid, research-backed educational content. The experience can feel somewhat decentralized, as users navigate between different pages for various calculators. However, the information is clear, and the tools are seamlessly integrated with options to open a Vanguard account or roll over an existing IRA.

- Pricing & Access: Completely free and accessible to the public, with or without a Vanguard account.

- Best For: DIY investors who value education and want to understand specific retirement variables like healthcare costs.

- Limitations: The toolset is not a single consolidated application, which can feel disjointed. It lacks the advanced scenario modeling and account aggregation found in more comprehensive platforms.

Website: https://investor.vanguard.com/investor-resources-education/retirement/planning

4. Charles Schwab Retirement Calculators

Similar to Fidelity, Charles Schwab provides an excellent suite of free retirement planning tools integrated directly into its brokerage platform. This approach is ideal for individuals who want to bridge the gap between financial planning and immediate action. Schwab’s calculators offer a straightforward way to project your retirement savings, estimate future income, and understand complex topics like Required Minimum Distributions (RMDs) from inherited accounts. This direct integration makes it one of the best retirement planning tools for existing Schwab clients.

The platform's primary advantage is its blend of powerful digital tools with access to human expertise. While the online calculators are robust, clients can also receive complimentary, personalized financial planning from a professional. This hybrid model is particularly beneficial for those who start their planning online but want to validate their strategy with an expert, perhaps exploring early retirement scenarios or complex estate considerations. For instance, a firm like Spivak Financial Group might recommend such tools for initial assessments before diving into specialized strategies.

Key Features and User Experience

Schwab’s calculators are user-friendly and provide clear, actionable outputs without overwhelming users with data. The interface is clean, guiding you through the necessary inputs to generate a comprehensive retirement snapshot. The true value is unlocked for Schwab clients who can connect their accounts for a more accurate, holistic view and then schedule a consultation at a local branch or over the phone to discuss the results.

- Pricing & Access: The calculators are free for public use. Complimentary financial planning is available for Schwab clients.

- Best For: Schwab clients and investors who value the option of combining DIY digital planning with professional, in-person guidance.

- Limitations: The digital tools lack the advanced tax modeling found in specialized software. Comprehensive advisory and investment management services come with separate fees.

Website: https://www.schwab.com/retirement-planning-tools/retirement-calculator

5. Social Security Administration (SSA) Benefit Calculators

While many tools focus on your investment portfolio, understanding your Social Security benefits is a non-negotiable part of any solid retirement plan. The Social Security Administration's (SSA) official website provides the most authoritative and accurate retirement benefit calculators available. By creating a my Social Security account, you can access personalized estimates based directly on your complete earnings record, eliminating the guesswork inherent in third-party tools.

This direct access to your data is what makes the SSA's platform an essential component of the best retirement planning tools. The site clearly illustrates how your benefit amount changes depending on whether you claim at age 62, your full retirement age, or age 70. This is crucial for anyone considering early retirement, as it allows for a precise understanding of the long-term financial trade-offs. For more detail on this topic, you can learn more about how delaying Social Security benefits can impact early retirement strategies.

Key Features and User Experience

The user interface is straightforward and government-issue, prioritizing function over form. Creating an account is a necessary step for personalized data but provides unparalleled accuracy once complete. The platform also offers several calculators, including a detailed downloadable version for running more complex "what-if" scenarios, such as the impact of future earnings on your benefits.

- Pricing & Access: Completely free and available to any U.S. worker with a Social Security number. A my Social Security login is required for personalized estimates.

- Best For: Everyone planning for retirement in the U.S. It is the foundational source of truth for Social Security income projections.

- Limitations: The calculators are strictly focused on Social Security benefits and do not integrate with other financial accounts like your 401(k) or IRA.

Website: https://www.ssa.gov/benefits/calculators/

6. Betterment Retirement Tools

For those who want to automate their retirement savings and investment management, Betterment offers one of the most streamlined solutions. As a leading robo-advisor, it integrates planning directly with execution, making it a powerful tool for individuals who prefer a hands-off approach. Betterment’s platform excels at creating personalized retirement goal projections and providing clear savings advice, then automatically invests and rebalances your portfolio to stay on track. This makes it an excellent choice for simplifying complex tasks like IRA rollovers.

The core of Betterment's appeal is its ability to translate your retirement goals into a tangible, automated investment strategy. You can link external accounts to get a holistic view of your finances and see how much you need to save to reach your desired retirement income. The platform's guided rollover process for IRAs and old 401(k)s is particularly user-friendly, removing much of the friction and paperwork that often discourages people from consolidating their retirement accounts.

Key Features and User Experience

Betterment is known for its transparent pricing and remarkably simple onboarding process, making it accessible even for novice investors. While its core digital service is powerful, the platform also offers access to human advisors for more complex situations, such as those seeking guidance on early retirement or needing help navigating a 72(t) distribution strategy, which a firm like Spivak Financial Group could also advise on. The platform's automated portfolio management is a key benefit, handling rebalancing and tax-loss harvesting without requiring user intervention.

- Pricing & Access: Digital plan has a 0.25% annual advisory fee. The Premium plan (0.65% fee, $100k minimum) includes unlimited access to Certified Financial Planners.

- Best For: Individuals seeking a "set it and forget it" automated investment and retirement planning solution.

- Limitations: The most personalized human advice is reserved for the pricier Premium plan, and its investment options are limited to Betterment's curated ETF portfolios.

Website: https://www.betterment.com/rollover

7. Wealthfront Path (Planning) + Automated Investing

For those seeking a software-driven, automated approach, Wealthfront Path offers a compelling combination of financial planning and low-cost investing. This platform excels at providing a holistic view of your financial life by aggregating all your linked accounts to model your net worth and retirement readiness. It’s designed to be an always-on financial advisor in your pocket, making it one of the best retirement planning tools for hands-off investors who value data-driven insights over human interaction.

The core of the experience is its continuous, automated scenario modeling. Wealthfront's engine projects your financial future based on your current savings, spending, and investments, allowing you to easily see how changes in your savings rate or retirement age could affect your long-term goals. This is particularly effective for those exploring early retirement, as the tool can instantly model the financial impact of leaving the workforce sooner. The integration with its robo-advisor service makes it seamless to implement the suggested investment strategy.

Key Features and User Experience

Wealthfront’s Path planning tool is free for all clients, providing powerful projections without needing to schedule a call with an advisor. The platform is built for simplicity, though some users note that the dashboard can feel limited and that feature updates are sometimes slow to arrive. While the account aggregation is powerful, the projections may not always incorporate all external accounts or goals exactly as a user might expect.

- Pricing & Access: The planning tool is free with a Wealthfront investment account. Investment management has a 0.25% annual advisory fee.

- Best For: Individuals who want a fully automated, low-cost solution for both planning and investing in one place.

- Limitations: Lacks the human touch and complex financial planning capabilities of a traditional advisor. Projections are only as good as the linked account data.

Website: https://www.wealthfront.com/planning

8. Empower Personal Finance (formerly Personal Capital) – Retirement Planner

Empower Personal Finance, widely recognized from its time as Personal Capital, offers one of the most powerful free retirement planning tools available. Its core strength lies in comprehensive account aggregation, allowing you to link all your financial accounts, from 401(k)s and IRAs to bank accounts and mortgages, to get a real-time, holistic view of your net worth. This complete picture serves as the foundation for its highly detailed retirement planner.

The platform's retirement calculator uses your aggregated data to run Monte Carlo simulations, projecting your portfolio's potential growth and estimating your chances of a successful retirement. Users can model various "what-if" scenarios, such as a major healthcare expense or an inheritance, to see the direct impact on their long-term plan. For those pursuing early retirement, this feature is invaluable for stress-testing different income and spending assumptions. The built-in Fee Analyzer also shines by exposing hidden fees within your investment accounts, which can significantly erode returns over time.

Key Features and User Experience

The primary dashboard and retirement planner are free, serving as a gateway to Empower's paid advisory services. While the tools are robust, it's important to note the ongoing migration from the legacy Personal Capital app to the main Empower platform has caused some login issues and data transfer hiccups for existing users. The user experience may vary during this transition, but the underlying planning engine remains top-tier.

- Pricing & Access: The dashboard, net worth tracker, and retirement planner are completely free. Paid wealth management services are optional.

- Best For: Individuals who want a complete, 360-degree view of their finances and a sophisticated, data-driven retirement forecast.

- Limitations: Users should be prepared for potential UI inconsistencies during the platform migration. The free tools may come with calls from advisors about their paid services.

Website: https://www.empower.com

9. Boldin (formerly NewRetirement) Planner and PlannerPlus

For the dedicated DIY investor who wants planner-grade tools without the high cost of a human advisor, Boldin stands out as one of the best retirement planning tools available. It is designed for deep, detailed analysis, moving far beyond basic calculators to offer a sophisticated engine for cash-flow projections, tax modeling, and complex scenario comparisons. This makes it an ideal platform for individuals meticulously planning for early retirement or navigating intricate financial situations like Roth conversions.

The platform's core strength is its comprehensive modeling capability, which includes over 100 input fields to capture a truly holistic view of your finances. Users can link accounts and then dive into detailed "Explorer" tools to model the long-term impact of Social Security claiming strategies, Roth conversions, and even Medicare IRMAA surcharges. This hands-on approach empowers users to test and validate their strategies with a high degree of precision, providing clarity on how specific decisions will affect their financial future.

Key Features and User Experience

Boldin is built for users who are not afraid to get into the weeds of their financial plan. While the interface has a learning curve due to its depth, the PlannerPlus subscription adds significant value with live classes and Q&A sessions. Users have noted occasional quirks in the UI, but the power of its Monte Carlo simulations and state and federal tax projections is undeniable. It's a tool for those who want to build and manage their own detailed retirement blueprint. For specialized advice on strategies like early withdrawals, consider consulting with experts like Spivak Financial Group.

- Pricing & Access: A free basic version is available. PlannerPlus, with advanced features and live classes, is offered via a paid annual subscription.

- Best For: Advanced DIY planners, individuals exploring Roth conversion strategies, and those needing detailed tax and Medicare planning.

- Limitations: The sheer number of features can be overwhelming for beginners. Applying insights from the "Explorer" tools often requires manual data entry.

Website: https://www.boldin.com/retirement/pricing/

10. Morningstar Investor

For the serious do-it-yourself investor, Morningstar Investor offers a research-first approach to retirement planning. Instead of focusing solely on forecasting calculators, it provides the deep, independent data and analysis needed to construct and vet a robust retirement portfolio. This makes it an indispensable tool for those who want to move beyond basic planning and take active control over their investment choices, such as selecting specific funds or ETFs for their IRA or 401(k).

The platform’s strength lies in its renowned, unbiased ratings for mutual funds, ETFs, and stocks, allowing you to scrutinize your current holdings or find new ones based on performance, fees, and strategy. For individuals pursuing early retirement, this level of due diligence is critical for building an efficient portfolio. The platform complements other retirement planning tools by helping you implement the investment strategy your plan calls for, ensuring your chosen assets align with your long-term goals.

Key Features and User Experience

Morningstar Investor's interface is data-rich and utilitarian, designed for research rather than casual browsing. While some tool memberships were adjusted in 2025, the core offering remains powerful. Linking your accounts allows for in-depth portfolio analysis, identifying concentration risks or high-fee funds. The key is using its screeners and research to make informed decisions that a standard brokerage calculator might not highlight. This is a tool for building and refining, not just forecasting.

- Pricing & Access: Basic features are free, but full access to premium research and tools requires a paid subscription (trials are often available).

- Best For: DIY investors who want to actively manage and research their retirement portfolio components.

- Limitations: The subscription cost can be a barrier, and it's less of a holistic planning platform and more of a specialized investment research tool.

Website: https://www.morningstar.com/mm

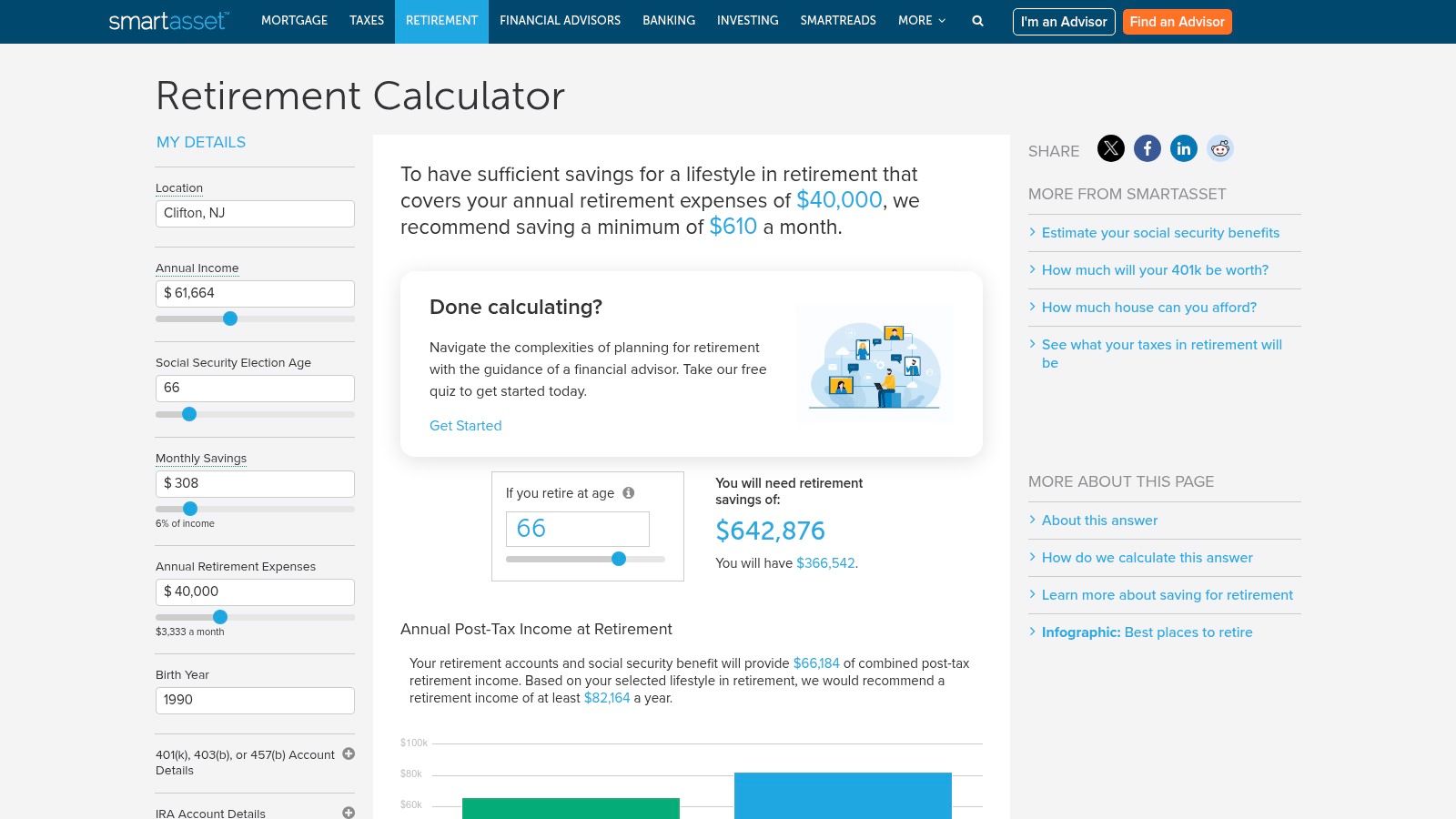

11. SmartAsset Retirement Calculator + Advisor Matching

For those seeking a straightforward starting point or a bridge to professional advice, SmartAsset offers one of the best retirement planning tools for high-level analysis. Its popular online calculator provides a quick, interactive way to model your financial future. Users can easily adjust key variables like retirement age, savings rate, and investment returns to get an immediate sense of their readiness, including estimated Social Security benefits.

The platform's unique value proposition is its dual function. After using the free calculator, users who feel they need more personalized guidance have the option to connect with a human advisor. SmartAsset's free advisor-matching service helps bridge the gap between DIY planning and professional management, making it an excellent resource for individuals who realize their situation requires a more sophisticated strategy.

Key Features and User Experience

The calculator is intuitive and fast, designed for quick "what-if" scenarios rather than deep, granular analysis. Opting into the advisor service is a separate step, allowing users to first explore on their own. While the tool itself is simple, the real power comes from the optional handoff to a vetted professional, which can be invaluable when you're ready to choose the right advisor for your specific needs.

- Pricing & Access: The retirement calculator is completely free. The advisor-matching service is also free to use, though the advisors themselves will have their own fee structures.

- Best For: Individuals who want a quick retirement check-up and a streamlined path to finding a professional financial advisor.

- Limitations: The calculator is a high-level tool and not a substitute for comprehensive cash-flow or tax-planning software. The advisor-match service will lead to outreach from financial professionals.

Website: https://smartasset.com/retirement/retirement-calculator

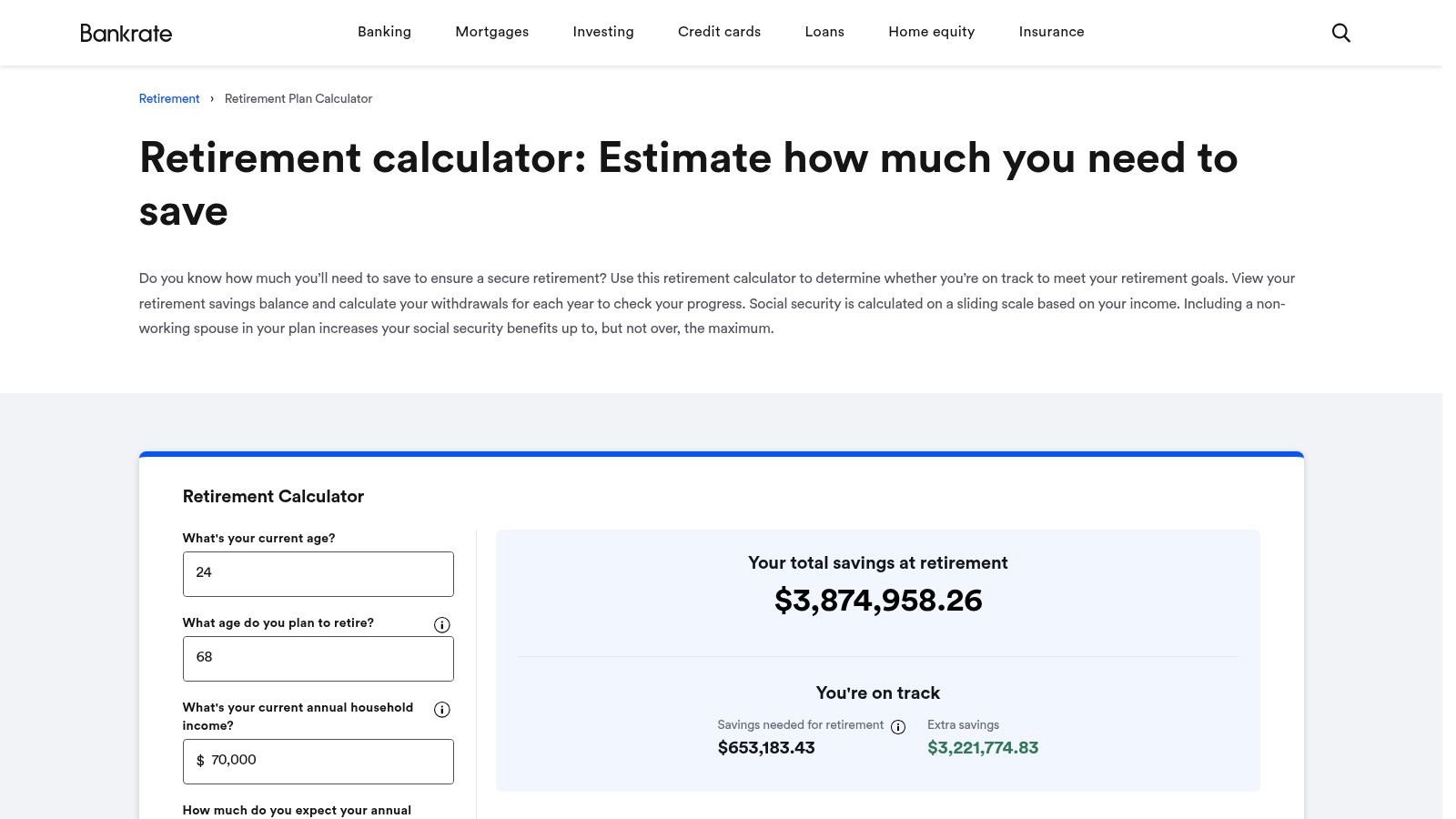

12. Bankrate Retirement Calculator

For those seeking a quick, no-frills assessment of their retirement trajectory, the Bankrate Retirement Calculator is a standout. It excels in its simplicity, providing an instant snapshot of where you stand without requiring you to create an account or link sensitive financial data. This makes it a perfect starting point for beginners or an excellent tool for experienced planners who want a fast, unbiased second opinion on their existing strategy.

The calculator's primary function is to perform a rapid gap analysis. You input your current age, planned retirement age, pre-tax income, savings rate, and existing retirement balance to get an immediate projection. It visualizes whether you are on track to meet your goals, making it one of the most accessible and best retirement planning tools for a quick sanity check. Its simplicity is its strength; it avoids overwhelming users with complex variables, focusing instead on the core drivers of retirement success.

Key Features and User Experience

The user interface is clean and intuitive, designed for speed and clarity. After generating your initial report, you can easily adjust assumptions like your rate of return or annual contribution increases to see how these changes impact your long-term outlook. This makes it a great educational resource for understanding the power of compounding and consistent saving.

- Pricing & Access: Completely free and accessible to all users without an account.

- Best For: Individuals needing a quick estimate, a second opinion on other plans, or a simple tool to visualize their savings progress.

- Limitations: It is not a comprehensive financial planner. The tool lacks detailed modeling for taxes, Social Security, healthcare costs, or advanced withdrawal strategies like a 72(t) distribution, for which specialized advice from a firm like Spivak Financial Group would be necessary.

Website: https://www.bankrate.com/calculators/retirement/retirement-plan-calculator.aspx

Top 12 Retirement Planning Tools Comparison

| Service | Core offering | Unique selling points ✨ | Quality ★ | Target & Price 👥 / 💰 |

|---|---|---|---|---|

| 72tProfessor.com 🏆 | Turnkey 72(t) SEPP setup, custodian placement, ongoing compliance | ✨ SEPP specialist — A-to-Z SEPP structuring, ongoing IRS-compliance, A+ BBB, fiduciary | ★★★★★ — 37+ yrs, 500+ clients | 👥 Early retirees / $200k+ qualified plans · 💰 Free consult + personalized estimate; fees vary (some no-fee options) |

| Fidelity Planning & Guidance Center | Retirement forecasting, scenario testing, portfolio analysis | ✨ Integrated with Fidelity accounts & rollovers | ★★★★ — comprehensive tools; occasional UI quirks | 👥 DIY & Fidelity clients · 💰 Basic tools free; managed/advice fees apply |

| Vanguard Retirement Planning Tools | Retirement income & health-care cost estimators; guidance | ✨ Health-care cost modeling (Mercer) + clear education | ★★★★ — trusted, low-cost provider | 👥 Low-cost investors · 💰 Free tools; advisory/managed account fees apply |

| Charles Schwab Retirement Calculators | Savings/income projections, RMD & inherited IRA tools, branch support | ✨ In-branch help & complimentary planning for clients | ★★★★ — broad toolset & client support | 👥 Clients wanting human/branch access · 💰 Tools free; advisory fees for managed services |

| Social Security Administration (SSA) Calculators | Official Social Security benefit estimates tied to earnings record | ✨ Authoritative, most accurate SS estimates & claim-age effects | ★★★★★ — official SSA data | 👥 All Social Security claimants · 💰 Free (personalized requires my Social Security login) |

| Betterment Retirement Tools | Retirement goal projections, automated investing, rollovers | ✨ Robo-advisor with optional CFP access (Premium) | ★★★★ — automated, easy onboarding | 👥 Hands-off investors · 💰 Transparent fees; Premium advisory costs higher |

| Wealthfront Path + Automated Investing | Account aggregation + continuous scenario modeling, automated portfolios | ✨ Always-on planning engine with linked accounts | ★★★ — strong automation; some dashboard limits | 👥 Tech-savvy DIY planners · 💰 Low advisory fee; planning free for clients |

| Empower Personal Finance (Personal Capital) | Net worth dashboard, retirement planner, fee analysis | ✨ Fee/unseen-cost discovery + robust aggregation | ★★★★ — powerful planner; migration hiccups reported | 👥 Net-worth trackers · 💰 Free dashboard; paid advisory optional |

| Boldin (NewRetirement) Planner | Deep cash-flow, tax, Social Security, Roth & Monte Carlo modeling | ✨ 100+ inputs, Roth/Medicare/IRMAA explorers, PlannerPlus classes | ★★★★ — planner-grade detail | 👥 Advanced DIY / planners · 💰 Freemium with paid PlannerPlus features |

| Morningstar Investor | Independent research, fund/ETF ratings, portfolio analysis | ✨ Deep independent research for lineup construction | ★★★★ — research-led (subscription) | 👥 Investors doing due diligence · 💰 Subscription-based |

| SmartAsset Retirement Calculator | Interactive retirement calc with SS age assumptions + advisor matching | ✨ Fast checks + free advisor-matching service | ★★★ — quick & simple | 👥 High-level planners / advisor seekers · 💰 Calculator free; advisor-match generates outreach |

| Bankrate Retirement Calculator | Quick savings needs estimator and gap analysis | ✨ Fast second-opinion tool for account/IRA shopping | ★★★ — simple and speedy | 👥 Shoppers wanting quick sanity checks · 💰 Free |

Building Your Personalized Retirement Toolkit

Navigating the landscape of retirement planning can feel overwhelming, but as we've explored, you are not without powerful aids. This journey from uncertainty to clarity is made possible by leveraging the best retirement planning tools available today. We've dissected everything from comprehensive dashboard aggregators like Empower Personal Finance to the specialized, authoritative calculators offered by the Social Security Administration. The core lesson is clear: there is no single "magic bullet" application. The most robust retirement strategy is built not with one tool, but with a curated toolkit.

Think of it like building a house. You wouldn't use only a hammer. You need a tape measure for accuracy (like the detailed inputs in Boldin), a blueprint for the overall vision (like the holistic view from Empower), and specialized equipment for complex tasks (like the SEPP expertise of 72tProfessor.com). Your financial future deserves the same level of dedicated, multi-faceted preparation. The strength of your plan lies in the strategic combination of these resources, allowing them to cover each other's blind spots and validate your assumptions.

Key Takeaways and Actionable Next Steps

To move from reading to doing, consider this your roadmap. The goal is to create a dynamic, layered approach to your retirement planning that evolves with you.

- Establish Your Foundation: Start with a broad, high-level view. Use a tool like Empower Personal Finance or Wealthfront Path to link all your financial accounts. This creates your "net worth dashboard," a single source of truth that shows you where you stand today. This is a non-negotiable first step for gaining clarity.

- Stress-Test Your Assumptions: Once you have your baseline, use scenario-modeling tools to ask "what if?" This is where platforms like Boldin (NewRetirement) and the calculators from Fidelity and Vanguard excel. Run Monte Carlo simulations to see how your portfolio might withstand market downturns. Adjust your retirement age, savings rate, and expected returns to understand which variables have the biggest impact on your success.

- Validate with Authoritative Sources: For critical components of your income plan, go directly to the source. Never estimate your Social Security benefits. Use the official SSA.gov benefit calculator to get the most accurate projection based on your actual earnings record. This number is a foundational piece of your retirement income puzzle.

- Seek Specialized Guidance for Complex Needs: General-purpose tools are designed for the most common retirement path, typically post-age 59½. If your goals fall outside this norm, such as planning for early retirement or needing penalty-free access to funds, these tools are insufficient. Their algorithms do not account for the intricate rules of regulations like IRS Code 72(t).

For these specific, high-stakes situations, a specialized tool backed by human expertise is paramount. A miscalculation in a Substantially Equal Periodic Payment (SEPP) plan can trigger significant taxes and penalties. This is where a dedicated service like 72tProfessor.com, offered by Spivak Financial Group, becomes an indispensable part of your toolkit. Their focus on navigating the rigid IRS guidelines provides a level of security and precision that automated software alone cannot replicate. To understand if a SEPP plan is a viable option for your early retirement strategy, you can contact Spivak Financial Group at (844) 776-3728 or visit their office at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260.

Ultimately, the best retirement planning tools are the ones you actually use consistently. The most sophisticated software is useless if its complexity prevents you from taking action. Start small, build your toolkit one piece at a time, and commit to regular check-ins. Your financial future is not a destination you arrive at, but a journey you actively navigate. With the right combination of digital resources and expert guidance, you can build a resilient, confident, and prosperous retirement.

Navigating the complexities of early retirement income requires more than a standard calculator; it demands specialized expertise. If you need to access your retirement funds before age 59½, 72tProfessor.com provides the specialized tools and expert guidance necessary to structure a penalty-free 72(t) distribution plan. Visit 72tProfessor.com to ensure your early retirement strategy is built on a compliant and secure foundation.