Yes, you can absolutely borrow against your 401k, but it's not like getting a loan from a bank. It’s more like taking a cash advance from your future self—money you’ll have to repay, with interest, right back into your own retirement account.

How Borrowing Against Your 401k Actually Works

When you borrow from your 401k, you're tapping into your retirement nest egg before you officially hang up your work boots. Because it's your money, the process skips the credit checks and lengthy bank approvals you’d normally face. This makes it a tempting option for quick cash to handle an emergency, fund a down payment on a house, or cover other big-ticket expenses.

The process itself is pretty simple. You put in a request with your 401k plan administrator, who then sells off a portion of your investments to free up the cash for your loan. Within a few days or a couple of weeks, the money is yours, and you'll start paying it back.

Repayments are almost always handled through automatic deductions from your paycheck. This is a huge help, as it seriously lowers the risk of ever missing a payment. And the interest? It doesn't go to a bank or lender. It goes right back into your own 401k, helping to rebuild what you took out.

The Basic Steps of a 401k Loan

From start to finish, the whole process follows a few key stages. Knowing the flow can make what feels like a complicated financial decision much more straightforward.

Here’s a simple play-by-play:

- Kick Off the Request: You’ll start by reaching out to your company's HR department or the 401k plan administrator to get the loan paperwork.

- Get Your Funds: Once everything is approved, a piece of your 401k investments is sold off, and the cash is sent to you, usually by check or direct deposit.

- Pay It Back Automatically: Your loan payments—which cover both the principal and the interest—are automatically taken out of your regular paychecks over the loan's term.

This setup makes sure you're consistently paying yourself back. But it’s critical to remember that the money you borrow is no longer in the market working for you, which means you're missing out on any potential investment growth while it's gone.

Key Features of a 401k Loan at a Glance

Before we get into the weeds, it helps to see the main rules of the road laid out. While every plan has its own specific quirks, there are some common features and IRS regulations that apply pretty much everywhere. These rules set the boundaries for how much you can borrow and how quickly you need to pay it back.

The table below gives you a quick snapshot of the fundamental rules you'll likely run into.

Key Features of a 401k Loan at a Glance

| Feature | Typical Rule or Limit |

|---|---|

| Maximum Loan Amount | The lesser of $50,000 or 50% of your vested account balance. |

| Repayment Period | Generally up to 5 years. |

| Interest Rate | Usually the Prime Rate plus one or two percentage points. |

| Repayment Method | Automatic payroll deductions. |

| Credit Check Required? | No. |

| Use of Funds | Typically unrestricted, unless specified by the plan. |

At the end of the day, a 401k loan is a tool that gives you access to your own money. But it definitely comes with strings attached. The entire structure is built around repayment, and if you can't stick to the terms, you could face some serious tax consequences and penalties. That can turn what seemed like a simple loan into a very expensive mistake.

Understanding the Rules and Eligibility for a 401k Loan

Before you can even think about borrowing against your 401(k), you've got to understand the rulebook. While tapping into your own money might seem straightforward, it's not a universal right.

The very first hurdle is your employer’s specific 401(k) plan. Does it actually permit loans? Surprisingly, not all of them do. If your plan doesn't include a loan provision, that’s the end of the road—you simply won't be able to borrow from it, no matter your financial situation.

Let's say your plan does offer loans. You're not in the clear just yet. There are federal guidelines and company-specific rules that dictate how much you can take and under what conditions. These regulations exist to protect both you and your retirement nest egg from being drained irresponsibly.

IRS Borrowing Limits

The Internal Revenue Service (IRS) sets firm, non-negotiable limits on how much you can borrow. This is a safety net to prevent you from taking out too much and jeopardizing your future financial security.

You can borrow the lesser of two amounts:

- $50,000, or

- 50% of your vested account balance.

What this means in practice is that even if your 401(k) has a million dollars in it, the absolute most you can ever borrow is $50,000. If your vested balance is smaller, the 50% rule acts as your ceiling. For a broader look at accessing these funds, our guide on how to take money from a 401k offers more detailed insights.

What Is a Vested Balance?

That term, "vested balance," is absolutely critical here. It’s the portion of your 401(k) that is truly yours to keep, even if you leave your job tomorrow. Your own contributions are always 100% vested the moment they hit your account.

Employer matching contributions, however, usually come with a vesting schedule. Think of it as a waiting period you must complete to gain full ownership of the money your company has put in for you.

Example of Vesting in Action:

Imagine you have $80,000 in your 401(k). Of that, $60,000 is from your own contributions and $20,000 is from your employer’s match. If you are only 50% vested in the company match, your vested balance is your $60,000 plus half of the employer match ($10,000), for a total of $70,000. In this scenario, your loan limit would be 50% of this amount, or $35,000.

Common Plan-Specific Restrictions

On top of the federal limits, your employer's plan can add its own layers of rules. These are mostly to manage the administrative side of things and can vary quite a bit from one company to the next.

You might run into restrictions such as:

- Minimum Loan Amounts: Some plans won't bother processing a loan for less than a certain amount, often $1,000.

- Number of Active Loans: Many plans will limit you to having only one loan outstanding at any given time.

- Purpose of the Loan: While most loans are for general purposes, some plans might offer special, more favorable terms if the loan is for buying a primary residence.

Because these rules are unique to your specific plan, you absolutely have to get the details directly from the source. A quick call or email to your plan administrator is the best way to get the clarity you need to move forward with confidence.

The Hidden Costs of a 401k Loan

When you look into borrowing from your 401(k), the interest rate your plan administrator shows you can look pretty good—often a lot lower than a bank loan. But that simple number doesn't tell the whole story. The real financial hit isn't the interest you pay back to yourself; it's the opportunities you miss and the serious risks you take on.

One of the sneakiest costs is double taxation. Think about it: you repay your 401(k) loan with money from your paycheck, which has already been taxed. But once that money goes back into your retirement account, the IRS treats it as pre-tax money all over again. That means you’ll pay income tax on those exact same dollars a second time when you finally withdraw them in retirement.

It's literally like paying for the same dinner twice. You earn money, pay tax on it, use the rest to repay the loan, and then those funds get taxed again when you need them most. Even with a low loan interest rate, this tax inefficiency chips away at your long-term savings in a way that's easy to miss upfront.

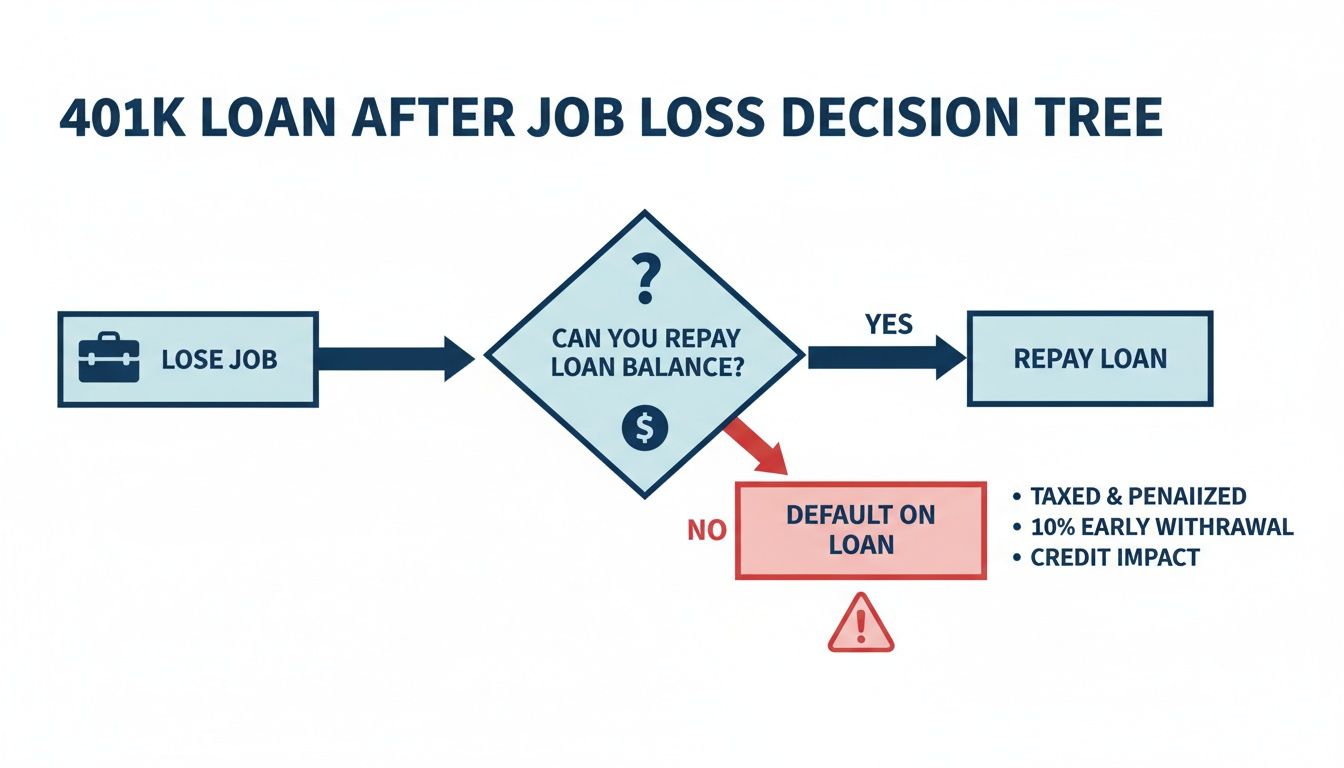

The Catastrophic Risk of Default

The biggest danger lurking behind a 401(k) loan is the risk of default, which usually happens when you leave your job. It doesn't matter if you're laid off, find a better opportunity, or just decide to retire early—the clock on your loan repayment suddenly speeds way up.

Those convenient payroll deductions disappear overnight. Your plan will almost certainly require you to pay back the entire remaining balance in full, often within a very tight 60 to 90-day window. If you can't get that cash together in time, the loan defaults.

When a default occurs, the IRS reclassifies your outstanding loan balance as a "deemed distribution." This is just a formal way of saying it's treated like an early withdrawal, and the consequences are brutal. You'll owe ordinary income tax on the full amount, plus a painful 10% early withdrawal penalty if you're under age 59½. A manageable loan can become a massive tax nightmare in an instant.

A Real-World Example of Default

Meet Sarah. She took a $20,000 loan from her 401(k) for a kitchen renovation. A year later, she got a fantastic job offer she couldn't pass up. When she left her old job, she was told she had 60 days to repay the $15,000 still owed on her loan. She couldn't come up with that much cash so quickly, and the loan defaulted. That $15,000 was then treated as income, which pushed her into a higher tax bracket and cost her about $3,600 in federal income tax. On top of that, she got hit with a $1,500 penalty (10%). Her loan turned into a $5,100 mistake that also permanently shrank her retirement nest egg.

The Widespread Reality of 401k Loans

Sarah's story is incredibly common. Data shows that while borrowing from a 401(k) is popular—nearly 40% of participants take a loan over a five-year period—the risk is tied directly to your job. While an impressive 90% of loans are paid back by people who stay put, a shocking 86% of people who change jobs end up defaulting.

This default problem is so massive that it adds up to about $5 billion in loan defaults every year in the U.S. For anyone thinking about early retirement or just needing funds before age 59½, that statistic is a huge red flag. A simple job change can flip what seems like a safe financial move into a costly disaster.

For a deeper dive into the repercussions, you can learn more about the consequences of borrowing from your 401k in our detailed guide. In contrast, strategies like a 72(t) SEPP provide penalty-free income without these default risks tied to your employment, offering a much safer way to access your funds early.

Weighing the Pros and Cons of Taking a 401k Loan

Deciding whether to borrow from your 401k is a huge decision. You have to take a clear-eyed look at the immediate benefits versus the very real long-term risks. On one hand, it can feel like a financial lifeline, offering a quick and easy way to get your hands on cash. On the other hand, it can quietly torpedo your retirement goals if you're not incredibly careful.

A 401k loan can certainly seem like the perfect solution in a pinch. Since you're just borrowing your own money, there’s no credit check, and the whole process is usually much faster than getting a traditional bank loan. Plus, the interest rate is often lower than what you’d find with personal loans or credit cards, which is always a big draw.

Maybe the biggest selling point, though, is that the interest you pay doesn’t go to some big bank—it goes right back into your own 401k account. You're essentially paying yourself back, which feels a lot smarter than lining a lender's pockets.

The Advantages of a 401k Loan

When you’re staring down a big expense, the upsides of a 401k loan are pretty hard to ignore. They offer a direct path to the funds you need to solve an immediate problem.

The main benefits usually boil down to these:

- No Credit Check: Your credit score doesn't matter, which makes it accessible even if your credit history has seen better days.

- Lower Interest Rates: Rates are typically tied to the Prime Rate plus a point or two, often making it cheaper than other kinds of debt.

- Convenient Repayment: Payments are automatically deducted from your paycheck, so it’s almost impossible to miss one and fall behind.

- Interest Paid to Yourself: Every dollar of interest you pay goes back into your retirement account, not a bank's bottom line.

These factors make a 401k loan a compelling option, especially for someone who needs money fast and has a stable job to guarantee the repayments. But these advantages come with some serious trade-offs you absolutely have to consider.

The Disadvantages You Cannot Ignore

The downsides of a 401k loan are significant and can have lasting damage on your financial future. The biggest and most immediate hit is the missed investment growth. The money you borrow is pulled out of the market, which means it stops earning returns. If the market goes on a run while your money is on the sidelines, you could miss out on substantial compound growth that you can never get back.

Another hidden sting is double taxation. You repay the loan with after-tax dollars from your paycheck. Then, when you finally retire and withdraw that same money, it gets taxed again as income.

The most catastrophic risk, by far, is default. This is almost always triggered by losing your job. If you leave your employer—whether you quit or are laid off—you typically have a very short window (often just 60-90 days) to repay the entire loan balance in full. If you can't, the loan is treated as a taxable distribution, which means you'll owe income taxes on the whole amount plus a nasty 10% early withdrawal penalty if you're under age 59½.

This decision tree shows you exactly what that moment of truth looks like if you lose your job while you have an outstanding 401k loan.

As you can see, losing your job forces an immediate decision that can lead to some painful tax penalties if you aren't able to repay the loan on the spot. This one risk factor is what makes a 401k loan so dangerous for so many people.

401k Loan Advantages vs Disadvantages

To really understand the trade-offs, it helps to see them side-by-side. Here’s a clear comparison to help you weigh the immediate benefits against the significant risks.

| Advantages | Disadvantages |

|---|---|

| Quick Access to Cash | Missed Market Growth on borrowed funds |

| No Credit Check Required | Double Taxation on repayments |

| Lower Interest Rates than credit cards | Risk of Default if you lose your job |

| Interest Paid Back to Yourself | Major Tax Penalties if you default |

| Simple Repayment via payroll deduction | Reduced Retirement Savings long-term |

Ultimately, while the pros can solve a short-term problem, the cons can create a long-term disaster for your retirement. The risk is all on you.

Research backs this up—while borrowing is common, an estimated 86% of people who lose their jobs with an outstanding loan end up defaulting. This leads to a staggering $5 billion in annual defaults. These numbers show how a 401k loan, often seen as a lifeline, can quickly become a trap, especially for those under 59½. An IRS-approved 72(t) SEPP from Spivak Financial Group, on the other hand, provides a steady income stream without any repayment or default worries, making it a much more secure path. You can explore these in-depth findings on 401k borrowing patterns to get the full picture of the risks involved.

A Smarter Way to Access Your Funds Early

After weighing the hefty risks of a 401(k) loan—from stalling your account's growth to the disaster of a loan default—it becomes pretty clear that borrowing from yourself isn't always the wisest move. If you're under age 59½ and need access to your retirement money, it's worth looking past the loan option.

Luckily, there's a far more strategic alternative that offers real financial freedom without the constant worry of repayment. It’s called a 72(t) Substantially Equal Periodic Payments (SEPP) plan, and it's a game-changer.

This IRS-approved method lets you draw a steady, predictable stream of income from your retirement accounts before age 59½, completely sidestepping that dreaded 10% early withdrawal penalty. Don't think of it as a loan. Think of it as activating your own personal pension, years ahead of schedule.

The Power of a 72(t) SEPP Explained

First things first: a 72(t) SEPP is not a loan. It's a distribution strategy. That distinction is everything. When you take out a 401(k) loan, you get a lump sum and are immediately shackled to a rigid repayment schedule. A 72(t) SEPP, on the other hand, gives you consistent payments over a set period. It's designed to provide reliable income for early retirement, to fund a new business, or to handle ongoing family needs.

This approach transforms your retirement savings from a locked-away asset into a flexible source of cash flow. It’s an incredibly powerful tool for people who want to fund life’s next chapter—whether that’s traveling the world or switching careers—without having to borrow against their 401k and stress about what happens if they leave their job. The whole structure is built for stability.

The real beauty of a 72(t) plan is the total freedom from having to pay anything back.

- No Repayment Required: The money is yours. It’s a distribution, not a debt you have to settle.

- No Default Risk: Since it isn't a loan, there’s zero risk of defaulting if you change jobs or your income takes a dip.

- Penalty-Free Access: The plan is specifically designed to let you get your money early without that 10% IRS penalty.

This strategy offers a level of security and predictability that a 401(k) loan just can't touch. It’s all about building a sustainable income bridge to your future, not creating another bill to pay.

Why a 72(t) SEPP Beats a 401(k) Loan

Comparing a 72(t) plan to a 401(k) loan is like comparing a long-term investment strategy to a payday advance. One is designed for your lasting financial health, while the other is often just a quick fix with serious hidden costs.

A 72(t) SEPP delivers steady, penalty-free income without the repayment burden or default risk tied to 401(k) loans, making it an ideal strategy for those planning early retirement, needing to support family, or wanting to travel the world without financial worry.

The rules for these plans are admittedly complex, and you have to get the calculations just right to stay on the IRS's good side. But when it's structured correctly by an expert, a 72(t) plan offers unparalleled flexibility and peace of mind. To make sure your plan is set up properly from the start, it's smart to get familiar with the official Substantially Equal Periodic Payments rules and avoid any costly missteps.

At Spivak Financial Group, this is what we do. We specialize in crafting these plans to help you reach your goals with confidence.

Your Top Questions About 401k Loans, Answered

Deciding to borrow against your 401k always kicks up a lot of "what if" scenarios. Even after you weigh the big pros and cons, the practical, day-to-day questions can still cause some hesitation. Let’s tackle some of the most common questions head-on.

Getting straight answers is non-negotiable before you sign on the dotted line. The small details—like how a loan impacts your ongoing savings or what happens if you switch jobs—are what really matter.

Can I Still Contribute to My 401k if I Have a Loan?

Yes, for the most part. The vast majority of plans will let you continue making your regular 401k contributions even while you're paying back a loan. This is huge, because it means you can keep your retirement savings on track.

But here’s a major catch you need to watch out for. Some employers will suspend their company matching contributions for as long as your loan is active. Giving up that "free money" is a serious financial hit. Before you do anything, you have to get confirmation from your plan administrator about your specific company's rules on this.

What Happens to My 401k Loan if I Lose My Job?

This is easily the biggest risk you take when borrowing from your 401k. If your employment ends for any reason—whether you're laid off, you quit, or you retire—that convenient loan repayment schedule comes to a screeching halt. No more payroll deductions.

Suddenly, the clock starts ticking. Most plans demand you repay the entire outstanding loan balance in full, usually within an incredibly tight window of 60 to 90 days. If you can't pull together the cash that quickly, the loan goes into default. That remaining balance is then reclassified as a taxable distribution. This means you'll be on the hook for income taxes on the full amount, plus a painful 10% early withdrawal penalty if you're under age 59½.

Can I Repay My 401k Loan Ahead of Schedule?

Absolutely, and you should if you can. Nearly every 401k plan allows you to make extra payments or pay off the entire balance early with no prepayment penalties. From a financial perspective, it’s a smart move.

Repaying your loan faster accomplishes two critical things. First, it cuts down on the total interest you pay (even though it's technically to yourself). More importantly, it gets your money back into the market, invested and working for your retirement that much sooner. The faster that balance is back to growing, the better your long-term picture will be.

This flexibility is a great feature, allowing you to minimize the damage once your financial situation stabilizes.

How Quickly Can I Receive Funds From a 401k Loan?

Compared to a traditional bank loan, the process is usually much faster. Because you're borrowing your own money, there’s no credit check or lengthy underwriting to go through. That cuts out a lot of the usual red tape.

Once you’ve filled out and submitted the necessary paperwork with your plan administrator, you can generally expect the money to hit your account within a few business days to two weeks. The funds are typically sent via direct deposit or a mailed check.

Navigating these complexities highlights the need for a solid financial strategy, especially when you need early access to your funds. A 401(k) loan is one path, but it's filled with potential pitfalls. A 72(t) SEPP plan offers a more stable, penalty-free way to create a consistent income stream without the risks of repayment or default. To explore a smarter alternative designed for your long-term success, contact the experts at Spivak Financial Group.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

Learn more about how you can achieve your financial goals at https://72tprofessor.com.