At its core, calculating your adjusted gross income is a straightforward process: you take your total gross income and subtract a specific list of deductions known as "above-the-line" deductions. The result is a single, crucial number on your tax return that serves as the foundation for figuring out your tax bill and whether you qualify for a whole host of financial benefits.

What Is Adjusted Gross Income and Why It Matters

Adjusted Gross Income, or AGI, is much more than just a box to fill out on your tax forms. It's the primary way the IRS—and many other institutions—measures your financial reality. Think of it as the starting line for your taxes. The calculation begins by tallying up all your income sources, from wages and investments to earnings from a side hustle. From that total, you subtract a specific, IRS-approved list of deductions.

This number is truly the cornerstone of the U.S. tax system. To give you a sense of scale, back in 2016, the total AGI reported across all individual income tax returns hit a staggering $10.226 trillion. Its importance becomes even clearer when you realize it affects eligibility for programs like the Earned Income Tax Credit, which helped 27 million families in that same year.

The Broader Impact of Your AGI

Getting a handle on how to calculate your AGI is critical because it has a direct ripple effect across your entire financial life. A lower AGI can open doors to significant savings and benefits you might not even know you're missing.

Here’s why it really pays to pay attention to your AGI:

- Tax Credits and Deductions: So many valuable tax credits, like the Child Tax Credit and various education credits, are tied to AGI-based income limits. A lower AGI could be the difference between qualifying for these credits or not.

- Retirement Contributions: Your AGI dictates whether your contributions to a traditional IRA are deductible. It also determines if you can contribute to a Roth IRA at all.

- Loan and Assistance Programs: It’s not just the IRS that cares. Lenders often review AGI when you apply for a loan, and it’s a key metric for determining eligibility for certain government assistance programs and even some student loan repayment plans.

At Spivak Financial Group, we see AGI not just as a tax figure, but as a strategic tool. Proactively managing the deductions that lower your AGI can lead to substantial long-term financial advantages, especially when planning for early retirement.

Mastering your AGI gives you more control over your financial story. If you want to dig deeper into tax strategies, including AGI calculations and their implications, you might find their collection of additional articles on tax planning helpful. It’s the first step toward smarter financial planning and hitting your long-term goals.

Tallying Up Your Gross Income to Find Your AGI

Before you can even think about adjustments and deductions, you need a solid starting point: your gross income. This is the grand total of every single dollar you earned throughout the year from all sources. It's the top line of your entire tax calculation.

Most people think of their salary, and that's definitely the biggest piece for many. You'll find this number in Box 1 of your Form W-2. But in today's economy, income is rarely that simple. If you're freelancing or have a side hustle, you'll also need to grab your Form 1099-NEC documents.

What Else Counts as Income? A Look Beyond Your Paycheck

To get a true picture of your financial year, you have to look beyond a traditional paycheck. A whole host of other financial activities generate taxable income, and every one of them needs to be included in your initial count. Missing even small amounts can throw off your AGI and potentially cause problems with the IRS later on.

Make sure you've gathered the paperwork for these common sources:

- Investment Earnings: This covers interest from your savings accounts (Form 1099-INT) and any dividends you received from stocks or mutual funds (Form 1099-DIV).

- Capital Gains: Did you sell stocks, real estate, or other assets for a profit? Those gains are income. Your brokerage will send a Form 1099-B with all the details.

- Retirement Distributions: Any money you took from a 401(k), a traditional IRA, or a 72(t) plan is generally treated as taxable income. Knowing whether a retirement distribution counts as income is absolutely critical for an accurate AGI, especially if you're planning an early retirement.

- Other Income: Don't forget the less common stuff. This could be rental income, royalties, or even certain alimony payments from divorce agreements finalized before 2019.

A classic mistake is ignoring the small income streams. That $50 in bank interest or the profit from selling a few shares of stock might not seem like much, but leaving them out means your AGI is wrong from the start. Your goal is to build a complete, accurate financial snapshot.

To give you a handy reference, here’s where to find the numbers for the most common types of income.

Common Sources of Gross Income

| Income Type | Common Tax Form | Notes |

|---|---|---|

| Wages, Salaries, Tips | Form W-2 | Found in Box 1. This is the most common income source. |

| Freelance/Contractor Income | Form 1099-NEC | Reports payments for non-employee services. |

| Interest Income | Form 1099-INT | From banks, credit unions, and other financial institutions. |

| Dividend Income | Form 1099-DIV | From stocks, mutual funds, and other equity investments. |

| Capital Gains/Losses | Form 1099-B | Sent by your brokerage firm detailing asset sales. |

| Retirement Distributions | Form 1099-R | Reports withdrawals from IRAs, 401(k)s, pensions, etc. |

| Social Security Benefits | Form SSA-1099 | A portion of these benefits may be taxable. |

This table isn't exhaustive, but it covers the main documents you'll need to pull together.

The Sheer Scale of Gross Income in the U.S.

When you add it all up, the total gross income across the country is staggering, and it highlights just how many different ways Americans earn a living. Historically, we see this number climb significantly. For instance, total AGI in the U.S. hit an incredible $10.226 trillion back in 2016.

That was a huge jump from $9.094 trillion just three years earlier in 2013, largely driven by a surging stock market that generated massive capital gains for high-income earners. The Tax Policy Center has fascinating historical data on these trends if you want to dig deeper.

Once you’ve meticulously tracked down every income document—from W-2s to the very last 1099—you can add it all up. This total is your gross income, the crucial first figure you need before you can start applying those valuable "above-the-line" deductions to find your AGI.

Finding Every Above-The-Line Deduction You Deserve

Once you have a firm handle on your total gross income, the real strategy begins. This is where you can actively shave down your taxable income by finding every single "above-the-line" deduction you're entitled to.

These adjustments are incredibly powerful. Why? Because they’re available to all taxpayers, regardless of whether you take the standard deduction or itemize your heart out.

You'll find these valuable deductions on Schedule 1 of the IRS Form 1040. Each one you claim directly reduces your gross income to arrive at your AGI, putting you in a much better financial position.

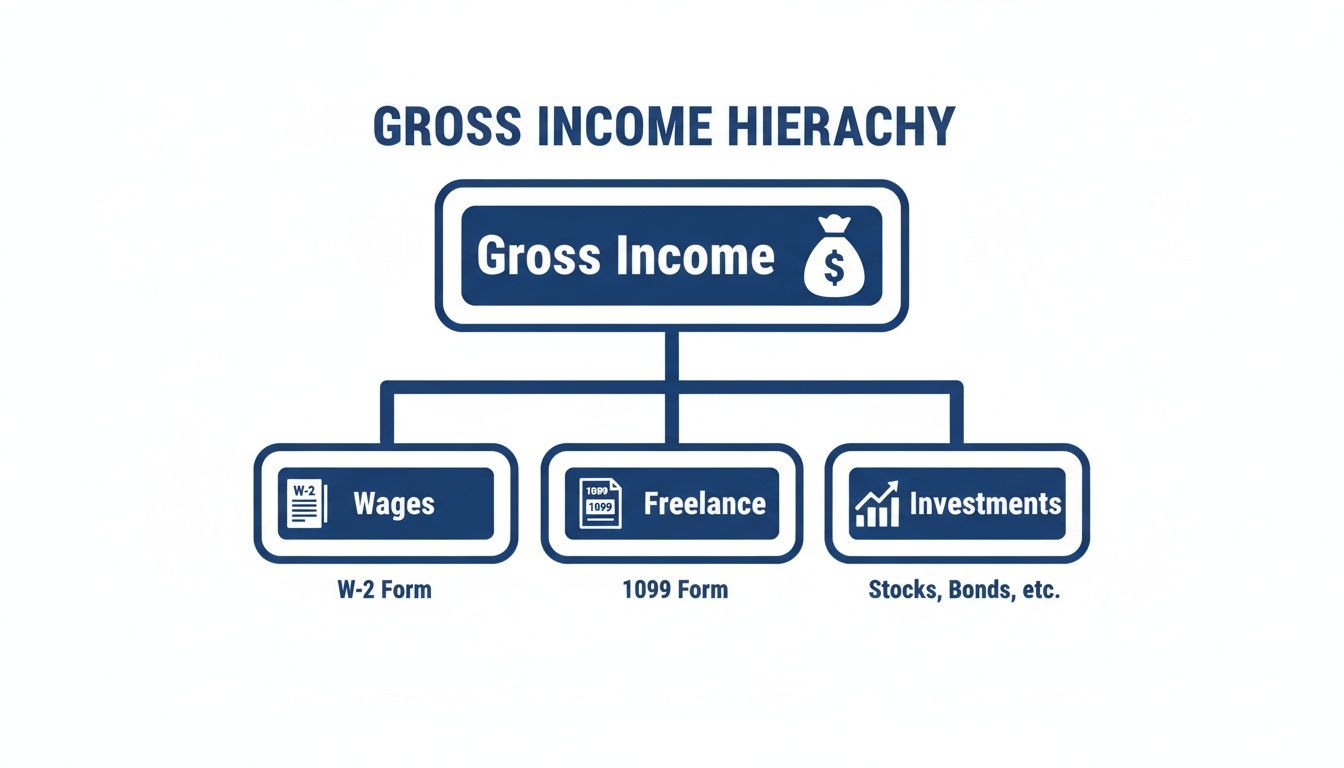

The image below shows how different income streams flow together to create your gross income—the starting point before we start chipping away at it with deductions.

As you can see, wages, freelance work, and investments are the main building blocks. Now, let's talk about how to take them down a notch.

Unpacking the Most Common AGI Adjustments

Think of these deductions as tools designed to reward you for doing smart things like saving for retirement, paying for education, or covering certain business costs. Let's break down some of the most common—and impactful—ones.

A big one is the traditional IRA deduction. If you (and your spouse, if filing jointly) aren't covered by a retirement plan at work, you can usually deduct your full contribution, right up to the annual limit. But if you are covered by a workplace plan, your ability to deduct those contributions might be limited depending on how much you earn.

Another huge one is the student loan interest deduction. You may be able to deduct up to $2,500 of the interest you paid on student loans during the year. This is a massive help for anyone tackling education debt, but be aware that it also comes with income limitations that can phase out the deduction for higher earners.

Key Deductions for the Self-Employed and Savers

If you work for yourself, you unlock a few unique and powerful deductions that directly lower your AGI. These are absolutely essential for managing your overall tax burden.

- One-half of self-employment tax: As a self-employed person, you’re on the hook for both the employee and employer portions of Social Security and Medicare taxes. The good news? The IRS lets you deduct the "employer" half, which can be a pretty substantial adjustment.

- Self-employed health insurance premiums: If you aren't eligible for an employer-sponsored health plan (and that includes through a spouse's job), you can deduct the premiums you paid for medical, dental, and even long-term care insurance.

- HSA contributions: Contributions to a Health Savings Account (HSA) are a fantastic tool. Not only does the money grow tax-free, but your contributions are deductible "above-the-line," giving you an immediate reduction to your AGI.

The structure of AGI and these deductions have been a cornerstone of U.S. tax policy for a long time. In fact, business net income, a major component for the self-employed, showed up on 18.96 million returns back in 2016 alone. Adjustments like these reduce the nation's total AGI by hundreds of billions each year. For a deeper dive into these economic trends, you can explore historical data on the Federal Reserve Economic Data website.

A common mistake we see at Spivak Financial Group is people overlooking the smaller deductions, like educator expenses. If you're an eligible educator, you can deduct up to $300 for unreimbursed classroom supplies. It might not seem like much, but every single deduction counts toward lowering your AGI.

Claiming every deduction you legally deserve isn't just about saving a few bucks on this year's taxes. It's about strategically setting a lower AGI. A lower AGI can unlock eligibility for other tax credits and benefits down the road, playing a vital role in your long-term financial health.

Real-World AGI Calculation Scenarios

The formula itself is simple enough, but seeing AGI calculations in action is where the lightbulb really goes on. Let's walk through three common, yet distinct, financial profiles to see how it all comes together in the real world. Think of these as a practical blueprint you can adapt for your own situation.

The core equation never changes: Gross Income – Adjustments = AGI. The tricky part is correctly identifying what goes into each bucket based on your life.

Scenario 1: The W-2 Employee

First up, meet Sarah. She's a single marketing manager, and her financial picture is pretty straightforward. It's built around her primary job and a solid commitment to retirement savings.

-

Gross Income:

- W-2 Salary: $85,000

- Bank Interest (from a 1099-INT): $500

- Total Gross Income: $85,500

-

Adjustments:

- Traditional IRA Contribution: Sarah diligently contributes $6,500 to her IRA. We'll assume she qualifies for the full deduction, though it's important to know that having a workplace 401(k) can sometimes limit this.

-

AGI Calculation:

- $85,500 (Gross Income) – $6,500 (IRA Deduction) = $69,000 AGI

Just by making that one IRA contribution, Sarah lowered her AGI by a full $6,500. This single move directly reduces her overall tax bill. Keeping meticulous records of these contributions is key, and if you want to dig deeper, it's worth understanding your IRA basis and how it affects taxes down the line.

Scenario 2: The Self-Employed Consultant

Now let's look at David, a self-employed graphic designer. His income and deductions are a bit more complex, which really highlights why tracking every business-related expense is so critical for freelancers.

-

Gross Income:

- 1099-NEC Earnings: $120,000

- Dividend Income (from a 1099-DIV): $2,000

- Total Gross Income: $122,000

-

Adjustments:

- One-Half of Self-Employment Tax: $8,478

- Self-Employed Health Insurance Premiums: $7,200

- HSA Contribution: $3,850

-

AGI Calculation:

- $122,000 (Gross Income) – $19,528 (Total Adjustments) = $102,472 AGI

David's proactive use of deductions available to the self-employed made a massive dent in his AGI. These adjustments aren't just nice to have; they are absolutely essential for any freelancer or small business owner looking to manage their tax liability effectively.

Scenario 3: The Early Retiree

Finally, we have Maria, who is navigating early retirement. Her income is a mix of retirement funds and investment earnings—a very common situation for those who have left the traditional workforce.

For retirees, managing AGI isn't just a yearly task; it's a long-term strategic game. Every decision, from when to take distributions to how you sell assets, ripples through your financial plan and tax burden for years to come.

-

Gross Income:

- 401(k) Distributions (from a 1099-R): $60,000

- Capital Gains (from a 1099-B): $5,000

- Total Gross Income: $65,000

-

Adjustments:

- In this simplified scenario, Maria doesn't have any "above-the-line" deductions.

-

AGI Calculation:

- $65,000 (Gross Income) – $0 (Adjustments) = $65,000 AGI

In Maria’s case, her AGI is identical to her gross income. This is a common outcome if you don't have qualifying adjustments like IRA or HSA contributions. It really underscores the importance of planning for deductions before you actually need them, especially in retirement.

To make these differences even clearer, here's a quick side-by-side comparison.

AGI Calculation Examples at a Glance

| Taxpayer Profile | Total Gross Income | Total Adjustments | Final AGI |

|---|---|---|---|

| W-2 Employee (Sarah) | $85,500 | $6,500 | $69,000 |

| Self-Employed (David) | $122,000 | $19,528 | $102,472 |

| Early Retiree (Maria) | $65,000 | $0 | $65,000 |

As you can see, even though David had the highest gross income, his AGI wasn't drastically higher than Sarah's after he took advantage of all his available adjustments. Maria's situation shows that without those adjustments, every dollar of income flows directly into her AGI.

How AGI Impacts Your Early Retirement and 72(t) Strategy

Your Adjusted Gross Income isn't just a number you calculate for the IRS each year; it takes on a whole new level of importance when you're mapping out an early retirement.

For anyone considering a 72(t) plan—which lets you tap into retirement accounts before age 59½ without that nasty 10% penalty—managing your AGI becomes a critical piece of your entire financial strategy, not just a once-a-year chore.

When you start taking distributions under a 72(t) plan, that money is almost always treated as ordinary income. Every dollar you withdraw lands on top of your other income sources, directly pushing your AGI higher. That might not seem like a big deal at first, but a higher AGI can have a ripple effect, potentially kicking you out of eligibility for certain tax credits or even bumping up what you pay for Medicare premiums down the road.

Turning AGI into a Strategic Tool

This is where the real planning comes in. Yes, your 72(t) distributions will raise your income. The key is to find ways to counteract that increase by smartly managing other parts of your financial picture to create deductions. The goal here is simple: keep your AGI as low as you legally can, even while you’re pulling in that steady income from your retirement funds.

Think about making some of these strategic moves:

- Tax-Loss Harvesting: If you hold investments in non-retirement accounts, you can sell some at a loss. This can wipe out capital gains and even offset up to $3,000 of your ordinary income each year.

- Charitable Giving: Once you're over 70½, making qualified charitable distributions (QCDs) directly from an IRA can satisfy your required minimum distributions without ever hitting your AGI.

- Managing Other Income: Be thoughtful about when you sell other assets. Timing things right can help you avoid major spikes in your AGI during the years you’re relying on 72(t) payments.

Understanding how to calculate adjusted gross income transforms it from a simple tax figure into a dynamic lever you can pull to optimize your retirement. At Spivak Financial Group, we help clients see this bigger picture, ensuring their early retirement income strategy is as tax-efficient as possible.

Juggling all these moving parts requires a solid grasp of the rules. To make sure your strategy is both compliant and effective, you can learn more by reviewing the official 72(t) distribution rules. A bit of expert planning here can make a world of difference to your long-term financial health.

Common Questions About Calculating AGI

Even after you've run the numbers, a few common questions tend to pop up. These are the little details that can trip people up, so getting them straight is key to making sure your tax return is spot on. Let's clear up a few of the most frequent points of confusion.

What's the Difference Between AGI and MAGI?

You’ll often hear another acronym floating around with AGI: MAGI, which stands for Modified Adjusted Gross Income. They sound almost the same, but they serve very different purposes in the tax world.

Think of AGI as your foundational number. To get to your MAGI, you start with your AGI and then add back certain deductions you already took, like student loan interest or contributions to a traditional IRA.

So, why the extra step? The IRS uses MAGI as a specific income gatekeeper to determine if you're eligible for a whole host of tax credits and deductions. For example, your ability to contribute to a Roth IRA or deduct traditional IRA contributions is based on your MAGI, not your AGI. The same goes for qualifying for the Premium Tax Credit for health insurance or certain education credits.

Your AGI is what you calculate for your tax return itself. But your MAGI is the number the government uses to decide which tax benefits you're allowed to take. They're closely related, but MAGI is the gatekeeper for many valuable tax breaks.

Can Your AGI Be a Negative Number?

It might sound odd, but yes, it’s entirely possible for your AGI to be negative. This usually happens when your "above-the-line" deductions are so substantial that they completely wipe out your total gross income for the year.

The most common reason for this is a significant business loss. If you're self-employed and your business expenses were much higher than your revenue, you could easily end up with a net loss. That loss can then offset your other sources of income (like any interest or dividends you earned) and pull your AGI down into negative territory. While this probably means you won't owe any income tax for that year, it's a situation that requires very careful documentation.

Where to Find Your AGI on a Tax Return

Knowing where to find your AGI on a previous tax return is incredibly useful. Whether you're planning for the future, applying for a loan, or filling out financial aid forms, it's a number you'll need again and again.

Thankfully, the IRS makes this pretty straightforward. You can find your Adjusted Gross Income on Line 11 of your IRS Form 1040. Having this number from a prior year gives you a quick financial snapshot and a great baseline for estimating your AGI in the current year.

At Spivak Financial Group, we know that navigating the fine points of AGI and early retirement planning can feel overwhelming. If you're looking to unlock penalty-free income from your retirement accounts using a 72(t) SEPP, expert guidance is essential.

Visit us at https://72tprofessor.com to see how we can help you build a solid plan for your financial goals. You can reach us at our Scottsdale office:

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728