Of course you can cash out your 401(k), but the much more important question is, should you? That's a decision loaded with heavy financial consequences—ones that are easy to overlook when you're in a pinch. We're talking about a potential 10% early withdrawal penalty from the IRS, on top of paying mandatory income taxes.

Understanding the Realities of Cashing Out Your 401k

Life happens. When a financial curveball comes your way—an unexpected medical bill, an urgent home repair—that growing 401(k) balance can start to look like an easy solution. In those moments of stress, the question "can I cash out my 401(k)?" feels less like an option and more like a necessity.

This immediate need is driving a very real trend. Imagine you’re 45 years old and facing a huge expense that your emergency fund just can't handle. The pull to dip into your retirement savings is incredibly strong, even if you know there are penalties. You’re not alone in feeling this way; 4.8% of retirement plan participants recently took a hardship withdrawal. That’s a sharp jump from 3.6% the year before and 2.8% the year before that, reflecting the growing financial pressure on households. You can discover more insights about this 401k early withdrawal trend from recent economic reports.

The True Cost of Early Access

Think of your 401(k) as a fruit tree you’ve been tending for years. Cashing it out early is like picking all the fruit when it's still small and green. Sure, you get something to eat right now, but you give up all the future growth and the much bigger harvest you'd have if you just waited for it to mature.

If you're under age 59½, you'll get hit with two significant costs right off the bat:

- The 10% Early Withdrawal Penalty: This is the IRS's way of discouraging people from raiding their retirement savings before they actually retire.

- Mandatory Income Taxes: The entire amount you take out is considered ordinary income for the year. This can easily bump you into a higher tax bracket, costing you even more.

Between the penalty and the taxes, the actual cash that lands in your bank account will be a lot less than the amount you thought you were taking out.

To give you a clearer picture, let's compare the different paths you can take when you need early access to your 401(k) funds.

Quick Overview of 401k Early Access Options

| Action | Immediate Consequence | Long-Term Impact | Best For |

|---|---|---|---|

| Cash Out (Distribution) | 10% penalty (if under 59½) + income taxes on the full amount. Immediate cash, but much less than the withdrawal amount. | Permanently reduces retirement savings. Loses all future tax-deferred growth on the withdrawn amount. Can significantly delay retirement. | Extreme, one-time emergencies when no other options are available. |

| 401(k) Loan | No immediate taxes or penalty. You pay interest back to yourself. Access to a portion of your funds (usually up to 50% or $50,000). | The borrowed money is out of the market, missing potential growth. If you leave your job, the loan may be due in full immediately. | Short-term, predictable financial needs where you are confident you can repay the loan on schedule, even if you change jobs. |

| 72(t) SEPP | No 10% penalty. You receive a steady stream of income. Regular income taxes still apply. Must stick to the payment schedule for 5 years or until 59½. | Preserves the rest of your retirement account to continue growing. Provides predictable income without liquidating the entire account. | Needing a reliable, long-term income stream for early retirement or a prolonged period of unemployment, without the shock of a huge tax bill. |

| Hardship Withdrawal | No 10% penalty if you qualify. Still subject to income tax. Requires documented proof of an "immediate and heavy financial need." | Permanently removes funds from your retirement account, sacrificing future growth. Doesn't need to be repaid. | Very specific, dire financial situations like preventing foreclosure, paying major medical bills, or covering funeral expenses. |

This table shows that while cashing out provides the quickest access, it often comes at the highest long-term cost. Exploring alternatives like a 401(k) loan or a more structured plan can protect your future self.

Exploring Smarter Strategies

Before you make a move you can't take back, it's critical to know that cashing out isn't your only play. Other strategies can give you access to your money without completely torpedoing your retirement.

This guide will walk you through the true, detailed cost of that early withdrawal. More importantly, we'll dive into smarter alternatives like a 72(t) SEPP (Substantially Equal Periodic Payments), which can provide penalty-free income. Understanding all your choices is the first step toward making a sound financial decision for today and tomorrow.

Calculating the True Cost of an Early Withdrawal

When you look at your 401(k) statement, it's easy to see that big number and think of it as a lump sum of cash ready for the taking. But that headline figure is a bit of an illusion. The actual amount you’ll pocket if you cash out early is a whole lot smaller, and the real cost goes far beyond what you lose on day one.

Think of it this way: cashing out your 401(k) is like selling your house in a desperate rush for way below market value. You get some cash now, sure, but you lose a massive amount of its real worth and all the future appreciation it would have earned. Let's break down exactly how expensive this decision can be.

The Immediate Hit: Penalties and Taxes

For anyone under age 59½, the first things that chip away at your savings are the immediate penalties and taxes. The IRS hits you with a 10% early withdrawal penalty right off the top. No ifs, ands, or buts.

After that, the entire amount you withdraw is treated as ordinary income. This means it gets added to your regular earnings for the year and is subject to federal and, most likely, state income taxes. This isn't just some minor fee—it’s a huge slice of your principal. That big withdrawal can even bump you into a higher tax bracket, making the tax bill even more painful than you expected.

A Real-World Example

Let's put some real numbers to this. Meet Sarah, a 40-year-old who needs to cover some major expenses and decides to cash out $50,000 from her 401(k). For our example, let's say she's in the 22% federal tax bracket.

Here’s a play-by-play of how her $50,000 evaporates:

- Initial Withdrawal Amount: $50,000

- Less 10% IRS Penalty: -$5,000 (10% of $50,000)

- Less Federal Income Tax: -$11,000 (22% of $50,000)

- Net Amount Before State Tax: $34,000

Just like that, Sarah's $50,000 in savings becomes $34,000 in her pocket. She lost $16,000—or 32% of her money—instantly. And we haven't even factored in state income taxes, which would shrink that number even more.

The question "Can I cash out my 401(k)?" is often followed by a shocking realization of how little you actually receive. You’re paying an enormous premium to borrow from your own future.

The Hidden Cost: Loss of Compound Growth

Losing nearly a third of your money upfront is tough to swallow, but the long-term damage is where the real devastation lies. When you cash out your 401(k), you aren’t just losing the money you take out today. You’re permanently erasing all the future growth that money could have generated for decades to come.

This is the incredible power of compound growth—where your earnings start generating their own earnings. It’s the secret sauce of retirement saving.

Let’s go back to Sarah's $50,000. What if she had left it alone? Assuming a fairly conservative 7% average annual return, here's a glimpse of what she gave up:

| Timeframe | Potential Growth of $50,000 |

|---|---|

| After 10 Years (Age 50) | ~$98,350 |

| After 20 Years (Age 60) | ~$193,500 |

| After 25 Years (Age 65) | ~$271,400 |

By taking $34,000 today, Sarah didn't just lose $16,000. She traded over a quarter of a million dollars in future retirement security. That’s the true, heartbreaking cost of an early withdrawal. It’s an irreversible decision that robs your future self of financial stability and peace of mind.

How to Legally Avoid the 10% Early Withdrawal Penalty

While that 10% early withdrawal penalty is a powerful incentive to keep your retirement funds locked up, the IRS isn't completely heartless. They know life happens.

Think of the penalty as a fence around your savings. But in that fence, the IRS has built a few specific gates for genuine emergencies. If you have the right key—meaning your situation matches one of their approved exceptions—you can walk through that gate without paying the 10% toll. You'll still owe regular income tax on the money, but avoiding the penalty is a huge win.

Knowing what these exceptions are is your first step. Each one has its own strict set of rules, so let's walk through which scenarios might apply to you.

Key Exceptions for Penalty-Free Withdrawals

Several major life events can unlock your 401(k) funds before age 59½ without that extra sting. These aren't loopholes; they're designed to provide a financial lifeline when you truly need one.

Here are some of the most common exceptions people use:

- The Rule of 55: This is a big one. If you leave your job for any reason—quit, laid off, or retired—in the calendar year you turn 55 (or later), you can take penalty-free distributions from that specific employer's 401(k).

- Total and Permanent Disability: If you become disabled to the point where you can't work, you can access your 401(k) funds without the penalty. You will need a doctor's certification to prove your condition to your plan administrator.

- High Medical Bills: You can take a penalty-free withdrawal to cover medical expenses that are more than 7.5% of your adjusted gross income (AGI). What's great is that you don't even have to itemize your deductions on your tax return to use this exception.

- Divorce (QDRO): If you're going through a divorce, a court may issue a Qualified Domestic Relations Order (QDRO). This legal order can assign a portion of your 401(k) to your ex-spouse or dependent, and any money distributed under a QDRO is exempt from the 10% penalty.

Newer Provisions Under the SECURE 2.0 Act

Congress has been paying attention to the real-world financial pressures families face. The SECURE 2.0 Act, passed recently, added several new penalty-free withdrawal options to address modern hardships.

These newer exceptions include withdrawals for:

- Terminal Illness: An individual with a physician-certified illness expected to result in death within 84 months can take distributions without penalty.

- Domestic Abuse: A survivor of domestic abuse can withdraw up to $10,000 (a figure that will adjust with inflation) or 50% of their account balance, whichever is less.

- Natural Disasters: If you're impacted by a federally declared natural disaster, you may be able to withdraw up to $22,000 penalty-free.

Understanding the full scope of penalty waivers is crucial. If your situation fits one of these scenarios, you could save thousands of dollars when accessing your funds. For a deeper dive into these rules, you might be interested in our detailed guide on 10 early withdrawal penalty exceptions.

This growing list of exceptions highlights a broader trend. Financial fragility is a major reason people raid their retirement accounts. Without adequate emergency savings, workers are twice as likely to tap into their 401(k)s during a crisis. Recent data shows hardship withdrawals hit nearly 6% of participants, a significant jump from 2.7% just a few years ago. You can read the full research about this trend to learn more about the factors driving these decisions.

Exploring Smarter Alternatives To Cashing Out

The moment you realize the true cost of cashing out your 401(k), the next logical question is, "Okay, so what else can I do?" Thankfully, liquidating your entire account is rarely the only path forward. Far more strategic options exist that can get you the cash you need without torching your entire financial future.

Instead of viewing your 401(k) as an all-or-nothing emergency piggy bank, think of it as a financial multi-tool. You don't have to break the whole thing just to use one of its features. Let's walk through three powerful alternatives that can help you meet today's needs while keeping your retirement goals on the map.

Option 1: The 401(k) Loan

One of the most common ways to get your hands on your funds is through a 401(k) loan. Most plans will let you borrow up to 50% of your vested account balance, with a hard cap of $50,000. The concept is pretty straightforward: you're just borrowing money from yourself.

The biggest selling point is that you pay the interest back into your own account, not to a bank. On the surface, it feels like a win-win. But you absolutely need to be aware of the risks.

- Job Separation: This is the big one. If you leave your job for any reason—quit, get laid off, whatever—the entire loan balance can become due almost immediately. If you can't repay it in full within a short window, the IRS treats the outstanding amount as a taxable distribution, hitting you with both the 10% penalty and regular income taxes.

- Opportunity Cost: The money you borrow is pulled out of the market. That means it isn't invested, it isn't growing, and it isn't compounding. Over the long haul, this can leave you with a much smaller nest egg than if you'd left it alone.

A 401(k) loan works best for a short-term, predictable financial crunch when you're rock-solid in your job stability and confident you can pay it back quickly.

Option 2: The IRA Rollover

Another strategic move, especially if you've recently left an employer, is to roll your old 401(k) into an Individual Retirement Account (IRA). While this doesn't give you immediate cash, it sets the stage for much greater flexibility and control down the road.

An IRA typically offers a universe of investment choices compared to the limited menu in most 401(k) plans. More importantly, it consolidates your money under one roof, making it easier to manage and opening up more advanced strategies. This move essentially puts you back in the driver's seat of your own retirement savings.

Option 3: The 72(t) SEPP

For anyone needing a steady, predictable income stream before hitting age 59½, the 72(t) Substantially Equal Periodic Payments (SEPP) plan is a complete game-changer. This is a specific, IRS-approved method that lets you take a series of scheduled withdrawals from your retirement account without that dreaded 10% early withdrawal penalty.

Think of a 72(t) SEPP as creating your own private pension. Instead of one big, destructive cash-out, you're designing a reliable income flow to bridge the gap until you reach traditional retirement age. You'll still pay regular income taxes on each distribution, but dodging the penalty can save you a fortune.

This option is incredibly powerful for:

- Early Retirees: People ready to leave the workforce in their 50s who need income to live on.

- Entrepreneurs: Business owners who need to cover living expenses while their new venture gets off the ground.

- Career Changers: Anyone taking a sabbatical or shifting to a lower-paying but more fulfilling career path.

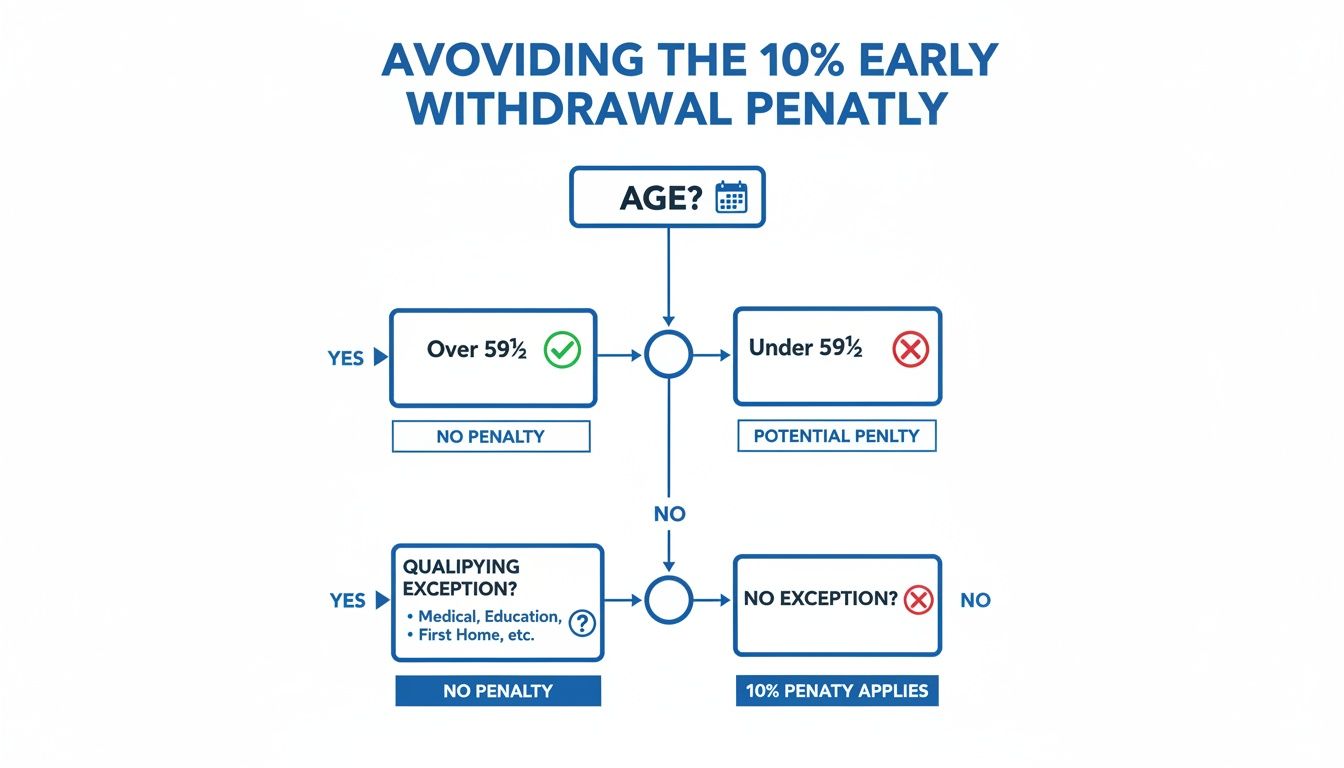

This flowchart shows a simplified path for figuring out if you're likely to face the 10% penalty.

As you can see, being under age 59½ is the main trigger for the penalty, which is exactly why a strategy like a 72(t) SEPP is so essential for those who need early access.

A 72(t) SEPP is a highly structured plan with very strict IRS rules. Once you start, you must stick to the payment schedule for at least five years or until you turn 59½, whichever is longer. If you modify the plan, the IRS can retroactively apply all penalties back to day one.

Because the rules are so complex and the consequences of a mistake are so severe, getting professional guidance isn't just a good idea—it's essential. An expert can calculate the precise payment amounts and ensure the plan is structured correctly to avoid disastrous and costly errors.

If you are exploring how to take money from your 401(k) without penalties, a properly designed 72(t) plan is one of the most effective tools available.

401k Early Access Options Compared

When you're weighing your options, seeing them side-by-side can make the decision much clearer. Each path has its own set of pros, cons, and ideal use cases.

| Feature | Cashing Out | 401(k) Loan | 72(t) SEPP |

|---|---|---|---|

| Immediate Tax Hit | 10% penalty + income tax on the full amount. Very high. | None, unless you default on the loan. | Income tax on each payment, but no 10% penalty. |

| Access to Funds | Full lump sum. | Up to 50% of your balance (max $50,000). | A series of smaller, calculated payments over time. |

| Repayment | No repayment needed; the money is gone. | You must repay the loan with interest to your account. | No repayment. These are permanent distributions. |

| Job Stability Risk | Not directly tied to your job. | Very high risk. Leaving your job can trigger full repayment. | No risk. Your plan continues regardless of employment. |

| Impact on Retirement | Catastrophic. Wipes out savings and future growth. | Negative. Money is out of the market, losing growth potential. | Controlled. You only withdraw what you need, leaving the rest to grow. |

| Best For | True, last-resort emergencies when no other option exists. | Short-term, predictable needs with high job security. | Creating a reliable income stream for early retirement or a career change. |

This table highlights the stark differences. Cashing out is a scorched-earth tactic, a loan is a temporary fix with significant risks, and a 72(t) SEPP is a structured strategy for creating long-term income. Your personal situation will determine which, if any, is the right tool for the job.

The Job Change Dilemma: Cashing Out Versus Rolling Over

Leaving a job is one of those major life transitions, and it’s often the first time people seriously ask, "can I just cash out my 401(k)?" It’s tempting. The idea of getting a lump sum of cash feels like a clean break and a chance to tackle immediate needs.

But this decision point is also one of the most critical moments for your financial future. What feels like a simple choice today can either protect decades of hard work or seriously damage your long-term security. While the pull of a big payout is strong, rolling over your old 401(k) is almost always the smarter financial move.

Let's walk through a story of two people at this exact crossroads to see how different their outcomes can be.

A Tale of Two Job Changers

Meet Alex and Ben. Both just left their jobs, and they each have a 401(k) with a $75,000 balance. They’re facing the same financial fork in the road, but their choices will send their retirement savings down drastically different paths.

Alex decides to cash out. He’s got $30,000 in high-interest credit card debt, and the thought of wiping that slate clean feels liberating. He fills out the paperwork and waits for his check, but what shows up in the mail is a shock. Assuming he’s in a 22% federal tax bracket and pays 5% state tax, his $75,000 shrinks dramatically.

Here's the painful math on Alex's withdrawal:

- 10% Early Withdrawal Penalty: -$7,500

- 22% Federal Income Tax: -$16,500

- 5% State Income Tax: -$3,750

- Total Lost to Taxes & Penalties: -$27,750

- Alex's Net Payout: $47,250

In an instant, Alex loses over 36% of his retirement savings. Sure, he pays off his debt, but he's left with just over $17,000 and has essentially hit the reset button on his retirement clock.

The Smarter Path: Rollover and Preserve

Ben takes a different approach. He has debt too, but he chooses to roll his $75,000 over into a new Individual Retirement Account (IRA). The entire process is tax-free and penalty-free. His whole nest egg remains intact, ready to keep growing for his future.

By moving his funds to an IRA, Ben unlocks several key advantages:

- Preservation of Capital: His $75,000 stays $75,000. It’s still in the market, continuing to benefit from tax-deferred compound growth.

- Greater Investment Choice: He’s no longer stuck with the limited fund menu from his old 401(k). Now, he has access to a much wider world of investments.

- Future Flexibility: He keeps the door open for advanced strategies down the road. If he ever needs to create a penalty-free income stream before 59½, a 72(t) SEPP becomes an option. You can explore how a 401(k) rollover to an IRA works to see the strategic benefits for yourself.

This "cash-out fever" is alarmingly common. Around 33% of people who leave their jobs take a full lump-sum payout, a trend often fueled by income volatility and a lack of emergency savings. One study noted that those without at least $2,000 in savings were far more likely to cash out. You can learn more about the drivers of early withdrawals from recent industry research.

Ultimately, Ben’s decision protects his hard-earned savings, while Alex’s choice provides a short-term fix at the very high cost of his long-term security. A job change is the perfect time to take control of your retirement funds, not liquidate them.

Your Decision Checklist Before Accessing 401(k) Funds

Making a big financial move that could impact your retirement for decades to come isn't something to take lightly. When you're in a tough spot, rushing to cash out your 401(k) can feel like the only option, but it's crucial to shift from a reactive mindset to an informed one. That pause can save you from some very costly mistakes down the road.

This checklist is designed to walk you through that thought process. Answering these questions honestly will bring clarity and help you decide if a withdrawal is truly the right move, or if a smarter alternative is hiding in plain sight.

Evaluating Your Financial Situation

First things first, you need to look at the complete picture of your finances. This is the only way to understand the true urgency and scale of your need.

- Have I exhausted all other sources of liquidity? Before you even think about touching your retirement funds, have you looked at your emergency savings? What about a personal loan or a line of credit? Sometimes even selling non-essential assets is a better first step.

- Is this a short-term problem or a long-term need? A temporary cash crunch might be a perfect fit for a 401(k) loan that you can simply repay. But if you're looking for sustained income for an early retirement, a strategically structured 72(t) SEPP is a far better tool for the job.

- Do I fully understand the tax and penalty implications? It's not enough to know the rules exist. Have you actually run the numbers to see how much money you'll lose to the 10% penalty on top of federal and state income taxes? Seeing the net amount you'll walk away with, not the gross, often changes the entire decision.

Making a decision under financial pressure can lead to long-term regret. The goal is to ensure your solution today doesn't create a much larger problem for your future self.

Seeking Professional Guidance

Navigating the labyrinth of IRS rules, especially for a sophisticated strategy like a 72(t) SEPP, is absolutely not a DIY project. One small mistake in a calculation or a misstep in execution can trigger severe, retroactive penalties that completely wipe out any benefit you were trying to achieve.

Getting professional guidance ensures you make the most of your options while staying fully compliant. At Spivak Financial Group, our specialty is crafting penalty-free income strategies designed for your unique circumstances. If you're asking yourself, "can I cash out my 401k?" let us help you explore all the smarter alternatives first. Give us a call at (844) 776-3728 for a consultation.

Your Top 401(k) Withdrawal Questions, Answered

Thinking about tapping into your retirement savings early brings up a lot of questions. When people ask, "Can I actually cash out my 401(k)?" what they really want to know are the nitty-gritty details of the process and the financial fallout.

Let's clear up some of the most common uncertainties so you can see the full picture.

How Long Does It Take to Get My Money After Cashing Out a 401(k)?

Once you’ve jumped through all the paperwork hoops, you can typically expect the money in about 7 to 10 business days. This timeline isn't set in stone; it really hinges on how quickly your specific plan administrator gets things done.

For the fastest access, always choose direct deposit. If you opt for a paper check in the mail, you'll need to factor in extra time for the postal service to deliver it.

Can I Take a Partial Withdrawal From My 401(k)?

Yes, absolutely. Most 401(k) plans let you take out just a portion of your savings, so you aren't forced into an all-or-nothing decision. This is often a much smarter move to lessen the immediate financial hit.

Just remember, the 10% early withdrawal penalty (if you're under 59½) and the mandatory income taxes still apply to whatever amount you pull out. Sticking to only what you truly need can save you a bundle in taxes and penalties.

What Happens If I Need to Stop a 72(t) SEPP Plan Early?

Modifying or stopping a 72(t) SEPP schedule before you’re supposed to has some pretty severe consequences. The rules state the payments must run for at least five years or until you turn 59½, whichever period is longer.

If you break that schedule, the IRS reaches back in time and retroactively applies the 10% early withdrawal penalty, plus interest, to every single distribution you've taken since the plan started. This is exactly why a 72(t) strategy demands professional setup and a rock-solid, long-term commitment.

Can I Pay Back the Money If I Cash Out My 401(k)?

For the most part, no. A 401(k) withdrawal is a one-way street—it’s a permanent distribution, not a loan you can repay to reverse the damage. Once that money is out, the taxes and penalties are a done deal.

The only sliver of an exception is the 60-day rollover rule. It lets you put the funds back into another qualified retirement account within 60 days of the withdrawal. But let's be realistic—if you needed the money for an emergency, it's probably already been spent, making this option impractical for most.

Making complex financial choices, like taking an early 401(k) distribution, is best done with an expert guide to help you steer clear of expensive missteps. At Spivak Financial Group, we specialize in building penalty-free income streams designed to protect your financial future. To see how a strategic alternative could work for your unique situation, visit us at https://72tprofessor.com. Our office is located at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260.