Yes, retiring at 55 is absolutely possible. But let's be clear: it’s not as simple as just saving a big pile of money and calling it a day. It requires a completely different financial playbook. You’re not just planning for retirement; you’re planning to fund a life that could easily last another 30 years or more, all while covering huge costs like healthcare long before traditional safety nets like Social Security and Medicare kick in.

The Reality of Retiring at 55

Aiming for 55 is a fantastic goal, but it fundamentally changes the rules of the retirement game. Don't think of it as a sprint to a finish line. Instead, picture yourself building a sturdy bridge. This bridge needs to be strong enough to carry you from your last day at work across a wide, decade-long gap until you reach the familiar shores of traditional retirement.

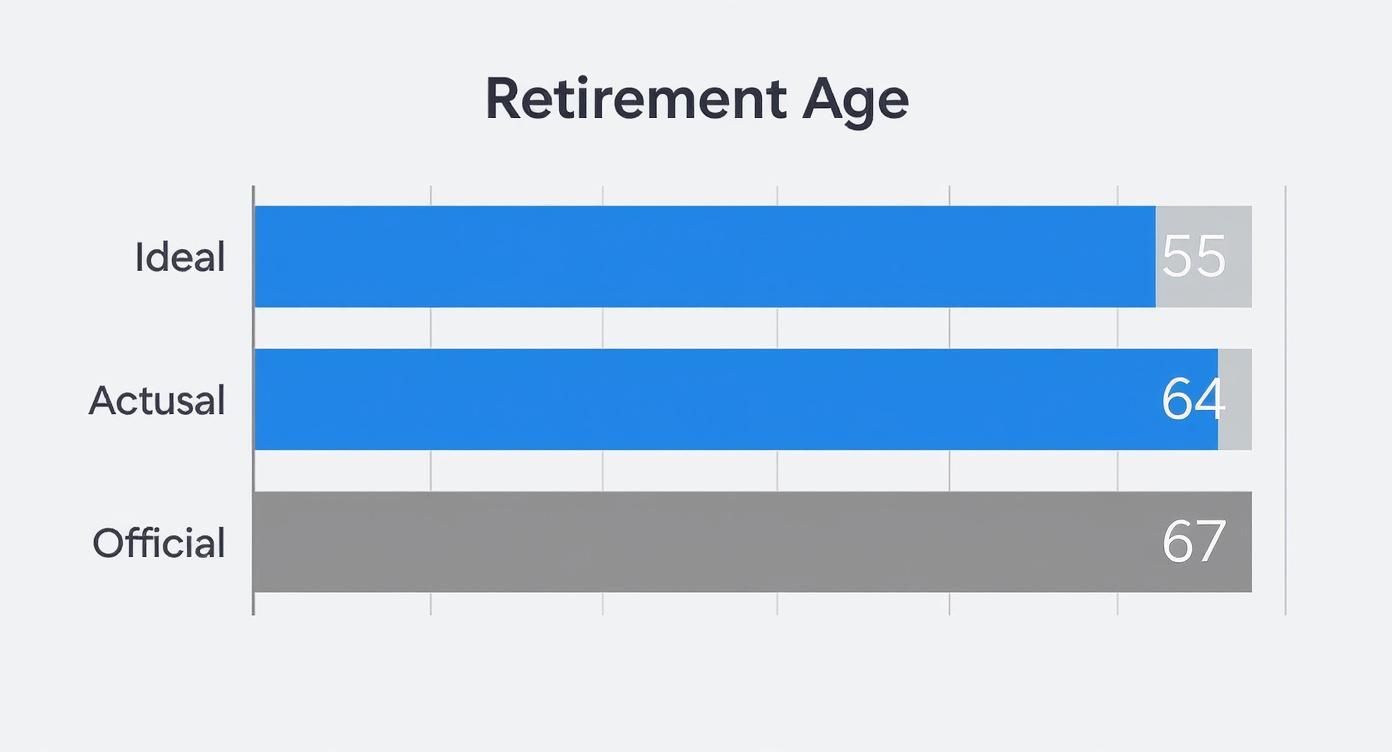

Make no mistake, leaving the workforce at 55 is considered quite early. Data from the OECD shows that in 2022, the average age people left the labor market was around 64.4 for men and 63.1 for women. With most pension systems kicking in around age 65, retiring at 55 puts you a full decade ahead of the curve. This means you need a strategy built entirely on self-reliance. You can find more about these global retirement trends directly from the OECD.

Building Your Financial Bridge

To build that bridge, you need more than just a pile of materials (your savings). You need a detailed blueprint—a plan that tackles the unique challenges of early retirement head-on. A successful plan is engineered around a few critical pillars:

- Calculating Your Number: You must know, with a high degree of precision, exactly how much money you need to sustain your lifestyle for three-plus decades. This isn't a back-of-the-napkin number; it has to account for inflation and the inevitable ups and downs of the market.

- Creating Reliable Income: Your nest egg can't just sit there. It has to be turned into a dependable stream of income that replaces your paycheck right away, often years before the standard withdrawal age of 59 ½.

- Solving the Healthcare Puzzle: This is a big one. You have to figure out how to find and pay for comprehensive health insurance to cover the 10-year gap until you’re eligible for Medicare at 65.

- Using Smart Tax Strategies: Keeping your tax bill low is absolutely crucial to making your money last. This involves a thoughtful withdrawal strategy and understanding specific rules, like the 72(t) SEPP, that can help you access your funds early without penalties.

Retiring at 55 isn't just about having enough money; it's about having a durable plan to access it, protect it, and make it last. The focus shifts dramatically from accumulation to intelligent distribution.

This guide will walk you through each of these pillars, piece by piece, so you can start drawing up your own blueprint.

Calculating How Much You Need to Retire at 55

Okay, let's move past the daydreaming phase. The very first step toward making a 55 retirement a reality is figuring out your "number." Answering the question, "Can I retire at 55?" starts with a concrete, realistic savings target.

A lot of people throw around the "4% Rule," which suggests you can safely withdraw 4% of your portfolio each year in retirement. It's a decent starting point.

But retiring at 55 means your money needs to last a long time—potentially 30 years or more. That puts a lot of stress on your nest egg. That's why for early retirees, a more conservative approach is almost always smarter. Many financial experts will steer you toward a withdrawal rate closer to 3% or 3.5%. It might not sound like a big difference, but that small tweak dramatically boosts the odds that your money will outlast you.

Start with Your Retirement Budget

Before you can land on that magic number, you have to know exactly what you'll be spending. And I don't mean guessing. You need to build a detailed retirement budget that accounts for everything—from the mortgage and groceries to your travel dreams and new hobbies. The more honest you are here, the more accurate your savings goal will be.

One of the biggest budget-busters for early retirees? Healthcare. This is a big one. Before you hit 65 and become eligible for Medicare, you're on your own for health insurance. These costs can be huge, and forgetting to budget for premiums, deductibles, and co-pays is a classic mistake that can sink an early retirement plan fast.

This chart really puts the dream of a 55 retirement into perspective against the average reality.

As you can see, there's a pretty big gap between the dream and what most people actually achieve. It highlights just how much financial discipline it takes to bridge that decade of extra work.

Turning Your Budget into a Target Number

Once you’ve nailed down your estimated annual spending, the math is actually pretty simple. You just divide your yearly expenses by your chosen withdrawal rate.

Formula: (Desired Annual Income) / (Safe Withdrawal Rate) = Required Retirement Savings

So, let's say you figure out you need $70,000 per year to live the life you want. If you use that conservative 3.5% withdrawal rate, your target nest egg is $2 million ($70,000 / 0.035).

This table gives you a quick look at how your annual spending translates into a savings goal, using that more cautious 3.5% rate.

Retirement Savings Targets at Age 55 by Annual Spending

| Desired Annual Income in Retirement | Required Savings Nest Egg (at 3.5% Withdrawal Rate) |

|---|---|

| $60,000 | $1,714,285 |

| $70,000 | $2,000,000 |

| $80,000 | $2,285,714 |

| $90,000 | $2,571,428 |

| $100,000 | $2,857,142 |

Having a number like this changes everything. A vague wish becomes a tangible goal. This is now the north star for your entire financial plan, guiding every saving and investment choice you make on your path to retiring at 55.

It’s a tough goal, and it seems to be getting tougher. Recent data shows an 8% decline in Americans who even plan to retire before 65. People are feeling the pinch from inflation and the staggering rise in healthcare costs. If you want to dig into how retirement expectations are changing, you can read the full 2025 Global Retirement Reality Report for a deeper dive.

How to Access Retirement Funds Early Without Penalties

You’ve done the hard work. You saved diligently, invested wisely, and now your nest egg is ready for you to enjoy an early retirement. But there’s a catch. Most retirement accounts, like your 401(k) or IRA, are designed to keep your money locked up until you’re 59 ½.

If you try to touch that money even a day sooner, the IRS typically hits you with a steep 10% early withdrawal penalty—and that’s on top of the regular income taxes you’ll owe.

For anyone aiming to retire at 55, that penalty feels like a major roadblock. How are you supposed to cover your living expenses for those four and a half years without surrendering a huge chunk of your savings?

Luckily, the IRS provides a special key for this exact situation.

Introducing the 72(t) SEPP

That key is a provision in the tax code called IRS Rule 72(t). It allows you to take a series of Substantially Equal Periodic Payments (SEPP) from your retirement account before age 59 ½, all without triggering that dreaded 10% penalty.

Think of it as a pre-approved, structured income stream. It’s designed to bridge the financial gap between your early retirement date and the age when you can normally access your funds.

But this isn’t like making a simple one-off withdrawal. When you set up a 72(t) SEPP plan, you’re making a formal commitment. You’re agreeing to a specific distribution schedule that you must stick to for at least five years, or until you turn 59 ½—whichever time frame is longer.

A 72(t) SEPP plan transforms your locked-up retirement account into a predictable paycheck. It’s a powerful tool that answers the question, "Can I retire at 55 and still get to my money?"

This strategy demands absolute precision. One wrong move can have serious consequences, including the retroactive application of all the penalties you were trying to avoid, plus interest. This is exactly why getting expert guidance is so important.

How Your Payments Are Calculated

The IRS gives you three approved methods for calculating your annual SEPP amount. Each formula uses your account balance, your life expectancy, and a reasonable interest rate to figure out a sustainable yearly payment. The right one for you really depends on your income needs.

- The Required Minimum Distribution (RMD) Method: This is the most straightforward option. Your annual payment is simply your account balance divided by a life expectancy factor from IRS tables. The payment amount gets recalculated every year, so it will rise and fall with the market.

- The Amortization Method: This method calculates a fixed annual payment that won't change, making it perfect for budgeting. It essentially amortizes your total account balance over your life expectancy, giving you a steady, predictable income stream year after year.

- The Annuitization Method: Similar to the amortization method, this approach uses an annuity factor to produce a fixed annual payment. It also provides that same consistency and predictability you need for stable cash flow in retirement.

Choosing the right calculation method and setting up the plan flawlessly is non-negotiable. For a deeper dive, you can explore our comprehensive guide to cashing out your 401(k) without penalty.

Given how complex this rule is, getting it right is everything. At Spivak Financial Group, our specialists at 72t Professor design these plans to ensure you get the income you need while staying 100% compliant with every IRS regulation.

Building Your Early Retirement Income Streams

Having a healthy nest egg saved up is a huge win, but honestly, that’s only half the story. The real challenge when you retire at 55 is figuring out how to turn that big pile of money into a steady, reliable income stream that feels just like a paycheck. It’s a complete mental shift, moving from a lifetime of accumulating wealth to a new phase of strategic distribution.

A practical way many early retirees tackle this is with an "income bucket" strategy. Think of it like setting up different bank accounts for different jobs. Each bucket has one specific role, and when you put them all together, they create a durable financial system built to last through a long retirement. This approach helps organize your assets, manage risk, and bring some much-needed clarity to your cash flow.

The Core Income Buckets

A classic three-bucket system is designed to give you a mix of stability, flexibility, and growth. Each one plays a unique and critical part in funding your life after you leave the workforce.

-

Bucket 1: The Foundation: This is your non-negotiable income source. It’s filled with the money you need for essential, must-pay expenses—think mortgage, utilities, and healthcare premiums. For a lot of people retiring at 55, this bucket is funded by a 72(t) SEPP plan, which is designed to provide predictable, penalty-free payments from your retirement accounts.

-

Bucket 2: The Flexible Fund: Your second bucket is usually a taxable brokerage account. This is your go-to money for more flexible or discretionary spending—things like travel, hobbies, or those unexpected home repairs that always seem to pop up. Since it isn’t locked away in a retirement account, you can get to these funds whenever you need them without worrying about early withdrawal penalties.

-

Bucket 3: The Growth Engine: This last bucket is all about long-term growth. It could hold a mix of different assets, like dividend-paying stocks that generate passive income, real estate investments, or even earnings from a part-time consulting gig or a passion project you've turned into a small business. This bucket is what helps your overall portfolio keep up with inflation over a 30-plus-year retirement.

The whole point of the bucket strategy is to create a clear, predictable path for your money. You know exactly where your essential income is coming from, where your "fun money" is, and which of your assets are still working hard for future growth.

This kind of structured approach is absolutely crucial for managing the unique complexities of retiring early. By carefully planning the sequence of withdrawals from these different buckets, you can manage your tax bill and make sure your money lasts for the long haul. A well-designed distribution plan is the key to figuring out what is a good monthly retirement income for your specific lifestyle.

Working with a specialist, like the team at Spivak Financial Group, can help you customize this strategy to fit your personal financial picture, setting you up for a secure and truly enjoyable retirement.

Solving the Healthcare Puzzle Before Age 65

Of all the hurdles you'll face when retiring at 55, healthcare is easily the most expensive and intimidating. You're looking at a full decade between your last day on the job and your 65th birthday when Medicare finally kicks in. This gap is a massive financial challenge that demands a solid, well-researched plan.

Underestimating this expense is one of the fastest ways to sink an otherwise perfect early retirement strategy. We're not just talking about monthly premiums. You also have to budget for deductibles, co-pays, and potential out-of-pocket maximums that can run into thousands of dollars each year.

This financial reality often clashes with the dream of retiring early. A 2025 Pew Research survey highlighted this exact issue, finding that while younger adults would love to retire around age 57, the high cost of things like healthcare often pushes that timeline back. You can find more global retirement age expectations at Pew Research.

Your Primary Coverage Options

To bridge that ten-year gap to Medicare, you generally have three main routes to get health insurance. Each has its own set of pros and cons, and the best choice really boils down to your specific financial situation and health needs.

- COBRA: This lets you keep your old employer's health plan for up to 18 months. The big win here is continuity—you keep your doctors and network. The downside is the shocking cost. You’ll pay 100% of the premium plus an administrative fee, which feels incredibly expensive once the employer subsidy is gone.

- ACA Marketplace Plans: The Affordable Care Act (ACA) marketplace is a game-changer for many early retirees. Because your income will likely be lower in retirement, you could qualify for significant premium tax credits (subsidies) that make coverage surprisingly affordable.

- Private Insurance: You can always buy a policy directly from an insurance company. This route might give you more plan choices, but you typically won't get any income-based subsidies, making it one of the priciest options on the table.

The Power of a Health Savings Account

Beyond just covering your insurance premiums, a Health Savings Account (HSA) is probably the single most powerful tool for managing healthcare costs in retirement. If you're currently enrolled in a high-deductible health plan (HDHP), you can contribute to an HSA.

An HSA offers a unique triple tax advantage: your contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also completely tax-free.

This makes an HSA an incredible way to build a dedicated healthcare fund. You can use it to pay for premiums, deductibles, and other medical bills before you turn 65. Even after you’re on Medicare, it keeps its tax-free status for medical expenses and can be used like a traditional IRA for anything else.

If you want to confidently answer "can I retire at 55?", you need a rock-solid plan for healthcare. An HSA is a critical piece of that puzzle.

Common Mistakes to Avoid When Retiring at 55

Pulling off a successful retirement at 55 is about more than just having a great plan on paper. It's about sidestepping the common mistakes that can quietly unravel decades of hard work. Even with a healthy nest egg, a few wrong turns in those first few years can seriously jeopardize your long-term financial security.

One of the sneakiest threats is underestimating inflation. It's easy to look at your income needs today and feel comfortable, but that same dollar amount will buy a lot less 10, 20, or even 30 years from now. If you don't bake a realistic inflation rate into your plan, you could find yourself forced into painful lifestyle cuts when you're least able to go back to work.

Becoming Too Cautious Too Soon

Another big misstep is slamming on the investment brakes and getting far too conservative the day you retire. Of course, protecting your capital is a priority, but shifting everything into low-yield assets can be just as dangerous as being too aggressive. Your portfolio still needs to grow enough to outpace inflation and last for the long haul.

A common mistake is treating age 55 as the finish line for investment growth. In reality, it's just the starting line for a long distribution phase that still requires a smart, balanced investment strategy to succeed.

Completely overlooking the potential need for long-term care is another critical error. It’s natural to assume you’ll stay healthy, but the reality is that care costs can be astronomical. A single health event can wipe out a carefully constructed retirement fund in a surprisingly short amount of time, leaving your entire financial future vulnerable.

Finally, trying to navigate complex early access rules like the 72(t) SEPP without a seasoned guide is a recipe for disaster. Small, seemingly minor administrative errors can trigger massive, retroactive penalties from the IRS, completely wiping out the benefits you were trying to gain. You can learn about the most damaging errors by reviewing the top 10 things to not do with a Rule 72(t) SEPP.

Avoiding these traps is fundamental to answering "can I retire at 55" with a confident "yes." It requires a forward-thinking strategy that balances today’s income needs with tomorrow’s realities, making sure your retirement is as secure as it is enjoyable.

Answering Your Questions About Retiring at 55

As you get closer to making a decision, a few key questions always seem to pop up. Let's tackle some of the most common ones to help bring your plan into focus.

What Is the Biggest Financial Risk of Retiring at 55?

Without a doubt, the two biggest worries are outliving your money (what the pros call longevity risk) and getting hit with a nasty market downturn right after you stop working (sequence of returns risk).

Imagine this: a big drop in your portfolio's value during those first few years of retirement can be a real gut punch. Why? Because you're actively drawing down that money to live on, which makes it incredibly difficult for your investments to recover. It's a double whammy you have to plan for.

Can I Still Work Part-Time with 72(t) Distributions?

Yes, absolutely. Setting up a 72(t) SEPP plan doesn't stop you from earning other income.

Just be smart about it. Any extra money you bring in is taxable income. It's entirely possible that a part-time gig could bump you into a higher tax bracket, so you'll want to factor that into your overall financial and tax strategy from day one.

How Does Retiring at 55 Affect Social Security?

This is a big one. Your Social Security benefits are calculated based on your 35 highest-earning years.

When you hang it up at 55, you're almost guaranteed to have several years with zero earnings plugged into that formula. This will almost certainly lower your final benefit amount compared to what you would've received by working until your full retirement age.

Answering the question "can I retire at 55" means getting deep into the weeds of some pretty complex financial rules. For expert guidance on structuring early retirement income streams, especially a 72(t) SEPP, the team at Spivak Financial Group can help. Our office is located at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260. Visit https://72tprofessor.com or call us at (844) 776-3728 to learn how you can access your funds without penalty.