Yes, you can tap your 401(k) as a self-loan against your own savings. Most employer plans allow you to borrow up to 50% of your vested balance, capped at $50,000, and you’ll pay interest—typically 4%–6%—back into your account. Repayments usually stretch over five years via simple payroll deductions.

How Borrowing From Your 401k Works

Think of it as an internal line of credit fueled by your future nest egg. There’s no credit check, since you’re borrowing from yourself.

Of course, pulling money out now means those dollars aren’t invested in the market. If you can’t repay on schedule, the unpaid balance turns into a distribution—subject to income tax and possibly a 10% early-withdrawal penalty.

- Eligibility: You must have a vested balance in your plan.

- Loan Limits: Up to 50% of vested funds or a maximum of $50,000.

- Interest Rates: Normally between 4% and 6%, paid into your own account.

- Repayment Term: Generally 5 years, though policies vary by employer.

Recent statistics show 401(k) loans are edging up—average loan size rose 4% in 2024 and usage climbed 2 percentage points since 2023, according to the PSCA site. Even so, loans represent less than 1% of total 401(k) assets.

Remember: what feels like an easy lifeline today could cost you compound growth down the road.

Quick Steps To Decide

- Calculate your vested balance and confirm plan rules.

- Compare the internal loan rate with other financing options.

- Outline your repayment timeline before you borrow.

Key takeaway: Treat a 401(k) loan like any debt—understand the trade-offs before you sign on the dotted line.

Loan Pros And Cons

- Pros: No credit check, and the interest you pay goes back into your retirement.

- Cons: You lose potential market gains, and default can trigger taxes plus a 10% penalty.

Always review your plan document and weigh the numbers carefully.

Before you finalize your decision, here’s a quick reference:

Key Points Summary For 401k Loans

| Topic | Details |

|---|---|

| Eligibility | Must have a vested balance in your employer’s 401(k) plan |

| Loan Limits | Borrow up to 50% of vested funds or a maximum of $50,000 |

| Repayment Period | Typically 5 years via payroll deductions |

| Pros | No credit check; interest paid back into your retirement |

| Cons | Lost market growth; taxes and penalties if you default |

Use this table to weigh whether borrowing against your retirement savings aligns with your financial goals.

Understanding 401k Loan Basics

Picture your 401(k) as a private line of credit—only you tap into it and you pay the interest back into your own pocket. This mindset shift turns a 401(k) loan into “borrowing from yourself” rather than treating it like a straight withdrawal.

You avoid an immediate taxable distribution and any early‐withdrawal penalty as long as you stick to the repayment schedule. Instead of sending interest to a bank, you’re essentially paying yourself, rebuilding that retirement cushion with each payment.

Key Terms To Know

- Vested Balance: The amount in your account you fully own and can use as collateral.

- Plan Sponsor: Your employer or the third-party administrator handling your retirement plan.

- Loan Limit: Up to 50% of your vested funds or $50,000, whichever is less.

- Repayment Term: Generally up to 5 years, repaid through payroll deductions.

- Interest Rate: Often set between 4% and 6%, credited back into your 401(k).

“Borrowing from your future self means each payment rebuilds your retirement cushion.”

When you submit a loan request, your plan trustee reviews it—no credit check required. Once approved, repayments flow straight out of your paycheck. Skip a payment and your plan may treat the balance as a taxable distribution.

Real-World Example

Janice has a $20,000 vested balance. She borrows $10,000 at 5% interest over five years. Her payroll deduction comes to about $188 a month. At first her account dips, but it gradually climbs back up as she makes each payment.

Key Points To Remember

- Loans remain tax-free if paid on time.

- Missed payments turn any outstanding balance into a taxable distribution.

- Leaving your job often triggers a full repayment requirement.

- Interest you pay returns to your own account, helping offset lost market gains.

Differences From Hardship Withdrawals

Hardship withdrawals let you take money out without repaying it—but they come with a 10% penalty (if you’re under 59½) plus regular income tax. A 401(k) loan demands repayment but sidesteps those penalties, protecting more of your nest egg in the long run.

“Think of a 401(k) loan as borrowing green energy with the promise to recharge the battery.”

Plan Sponsor Rules Matter

Although IRS rules set broad limits, your specific plan might add layers—some impose a $10,000 cap or ban loans entirely. Fees, vesting schedules and qualifying reasons vary widely. Always flip through your plan document or call your provider before moving forward.

How Loans Compare

| Feature | 401(k) Loan | Bank Loan |

|---|---|---|

| Credit Check | No | Yes |

| Interest Rate | 4%–6% | 6%–12% |

| Repayment Term | Up to 5 years | Varies by lender |

This side-by-side view shows why many people find 401(k) loans simpler and cheaper than outside financing.

Next Steps To Borrow

- Review your plan document for eligibility and any extra rules.

- Calculate your vested balance and the maximum you can borrow.

- Request a loan form or log in to your plan’s website to apply.

- Verify the repayment schedule and payroll deduction details.

By following these steps, you’ll avoid surprises and keep your retirement strategy on track.

If you’re curious about penalty-free distributions via 72(t) SEPPs, head over to 72tProfessor.com for expert guidance.

Contact Spivak Financial Group

Need personalized advice or a deeper review? Reach out to Spivak Financial Group:

8753 E. Bell Road, Suite #101

Scottsdale, AZ 85260

(844) 776-3728

Learn more at 72tProfessor.com

401k Loan Eligibility And Mechanics

Before you get started, double-check your plan sponsor’s rules and vesting schedule. Every employer lays out its own eligibility criteria, and those details determine who can borrow and how much.

Your vested balance is what you truly own—and it sets the maximum you can take out. Log into your plan portal or request a statement to verify your exact vested amount.

- Verify your vesting percentage to see how much you can borrow.

- Scan plan documents for any caps tighter than the IRS limit.

- Note any fees tied to loan initiation or servicing.

- Watch for mandatory waiting periods before you apply.

Under IRS rules, you can borrow up to 50% of your vested balance or a maximum of $50,000, whichever is less. Your plan may set even stricter limits, so always double-check.

Interest rates usually hover between 4% and 6%, and the interest you pay goes back into your own account. Repayments are spread over five years via payroll deductions, keeping the process almost entirely hands-off.

Calculating Your Maximum Loan

To figure out how much you can borrow, follow these steps:

- Pull your vested balance from the latest statement.

- Multiply that number by 50% to get the IRS ceiling.

- Subtract any outstanding loans to find your true borrowing power.

For example, a $20,000 vested balance yields an IRS limit of $10,000, though your plan might impose a lower cap.

Key Takeaway

Checking your vested balance up front prevents surprises in your application.

Submitting Your Loan Request

When you’re ready, head to your plan’s website or provider portal and fill out the loan request form. Approval usually lands in your inbox in a few business days.

Once approved, payments flow automatically from payroll—no extra tracking required.

Although 84% of plans permit loans, only about 17.5% of participants had one outstanding in 2023, and loans made up just 0.9% of total plan assets. Vanguard data shows the average outstanding balance at $10,700.

Some plans add restrictions like minimum loan amounts or extra fees. Pay attention to any timing windows that might delay your application.

Hypothetical Case Study

Sarah has a $15,000 vested balance and borrows $7,500 at 5% interest. That works out to roughly $141 per month over four years.

By month 12, she’s paid down 25% of the principal while simultaneously rebuilding her retirement nest egg.

- Confirm your plan’s loan provisions before you apply.

- Track every repayment to avoid default penalties.

- Reach out to HR or your administrator if your payroll changes.

Check out our guide on how to take money from 401(k) to explore detailed steps and tips: Learn more about taking money from your 401(k) in our article

Armed with a clear grasp of eligibility and mechanics, you can borrow from your 401k confidently and stay on track with repayments.

401k Loan Tax And Penalty Implications

Borrowing from your 401k often feels like an interest-free perk—until you miss a deadline. Stick to your schedule, and none of this shows up on your tax return.

Missing a payment, though, instantly converts your unpaid balance into a taxable distribution.

Consequences Of Loan Default

When a loan slips into default, you’re no longer dealing with a loan. Instead, the IRS regards the outstanding balance as a distribution.

- Ordinary income tax applies to the full unpaid amount.

- A 10% penalty kicks in if you’re under 59½.

- Any interest you already paid won’t reduce your taxable base.

“Missing one payment can permanently shift your loan into a taxable event, costing thousands in extra taxes and penalties.”

Imagine a $15,000 default. At a 50% combined rate, you’d face roughly $3,000 in federal tax and an extra $1,500 penalty.

Changing Jobs Triggers A Distribution

Switch employers and you usually get a 60-day grace period to clear any outstanding 401k loan.

Failing to repay that balance turns the rest into a distribution—and a surprise tax bill that can throw your budget off course.

Key Insight

Set calendar alerts for your loan due dates, especially around job changes.

Interest Payments And Tax Deductions

Because you’re repaying yourself, the IRS disallows a deduction on 401k loan interest. In essence, you’re recycling money back into the same account—so there’s nothing to write off.

However, if your loan defaults, your taxable income shoots up as it converts into a distribution.

Distribution And Penalty Scenarios Table

| Scenario | Taxable Event | Penalty |

|---|---|---|

| On-time loan repayment | No | No |

| Default on loan balance | Yes | 10% |

| Job change without repayment | Yes | 10% |

Illustrative Example

Sara borrowed $10,000 at 5% over five years and set up automatic deductions of $188 each month. She never missed a beat, so there were no extra taxes or penalties.

Contrast that with Tom, who left his job in year three with a $4,000 balance. His plan classified it as a distribution, triggering a $400 penalty plus ordinary income tax.

Strategies To Avoid Penalties

- Automate your repayments to eliminate manual errors.

- Maintain a small emergency cushion in your checking account.

- When changing jobs, roll remaining balances into an IRA within 60 days.

- Communicate with HR about any impending job transitions.

If you are exploring penalty-free options like 72(t) SEPPs, see our resource on structured early withdrawals. You might also be interested in learning more about penalty rules: Check out our guide on 401k early withdrawal penalties

Key Takeaways

- Always repay on schedule to preserve that tax-free status.

- Track job changes closely to avoid surprise distributions.

- Interest paid back to your 401k isn’t tax-deductible.

- Defaulting can mean thousands of dollars in extra taxes and penalties.

Consult a tax professional if you face repayment challenges or plan to switch employers.

Get Expert Help

Spivak Financial Group at 8753 E. Bell Road, Suite #101 in Scottsdale, AZ can map out repayment reminders and safeguard your retirement against unexpected tax hits.

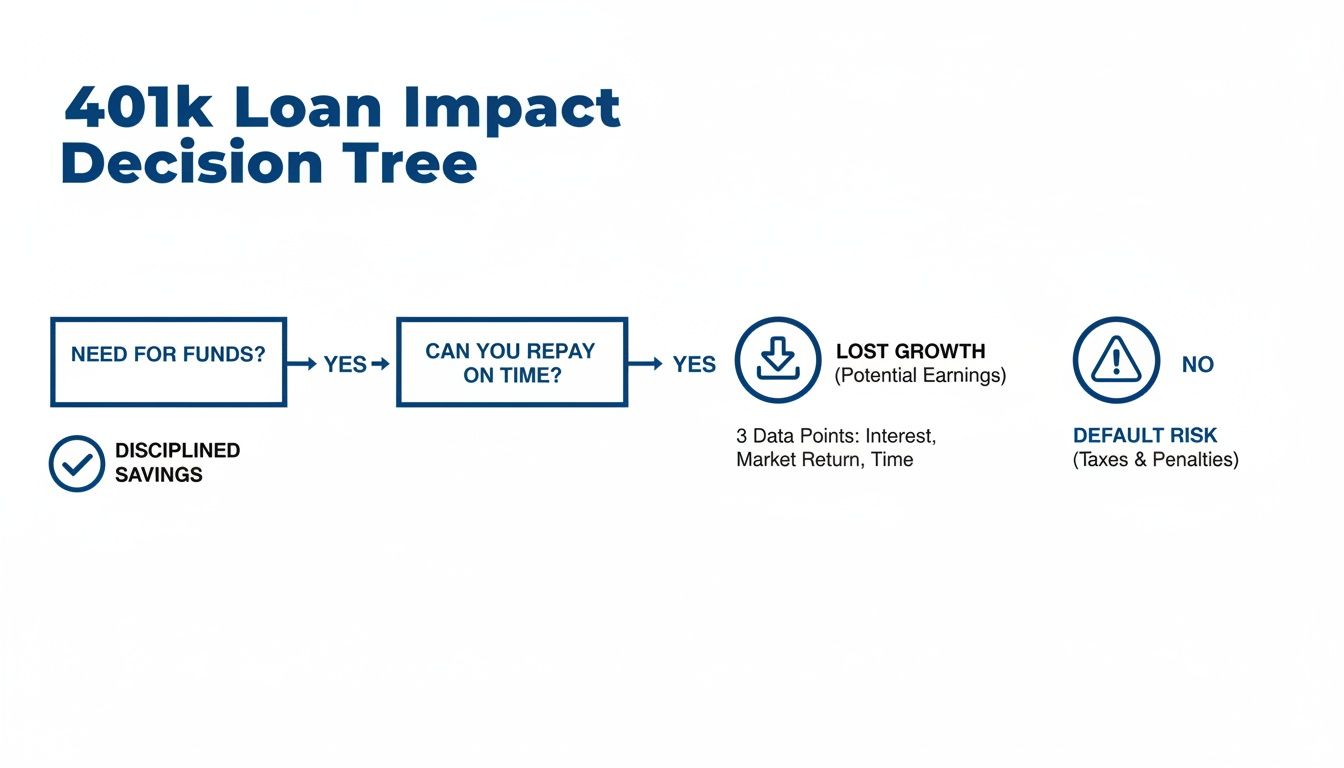

Impact Of 401k Loans On Retirement Savings

Borrowing from your 401(k) often looks like a quick way to get cash—you’re lending money to yourself at a fixed rate.

But this convenience comes at a cost: you’re pulling funds from the engine that powers decades of compounding growth.

Short Term Relief Versus Compound Growth

A 401(k) loan can serve as an emergency pump, giving you immediate liquidity. Yet, every dollar you borrow is a dollar not working in the markets.

Imagine loaning yourself $10,000 today. At a 6% average annual return over 30 years, that amount could grow to nearly $20,000 more in your nest egg.

Lost compound returns can easily eclipse whatever relief you felt at the moment.

- Snags short-term liquidity

- Halts long-term compounding

- Relies on disciplined repayments

Key Insight:

A single loan can ripple through your retirement timeline, costing you valuable growth opportunities.

If you switch employers before paying back your loan, any outstanding balance is treated as a distribution. That means ordinary income taxes and a 10% penalty if you’re under 59½.

This default risk adds pressure to stay current on your repayments.

Real World Example Of Loan Impact

Let’s look at Jamie’s story. She borrows $10,000 at 5%, then repays it over five years. On paper, she’s paying herself interest. Yet she misses out on market returns during that period.

Fast forward to age 65, her account balance is roughly 25% smaller than if she’d left the money invested.

| Scenario | Projected Value At 65 |

|---|---|

| No loan | $83,822 |

| $10,000 Loan At 5% Repaid Over 5y | $63,420 |

Those $20,402 in lost returns illustrate why debt to yourself can still feel expensive. Multiple loans only magnify this effect over a 30-year horizon.

Borrower Behavior And Plan Resilience

Despite the trade-offs, many borrowers find ways to stay on track. Research shows contributions dip by just 0.8 percentage points in the two years following a loan. Plan assets even climb to $9.3 trillion by mid-year. Read the full research about loan usage on the ICI site.

Employers often automate loan repayments through payroll deductions, turning them into a form of enforced saving.

- Automates disciplined repayment

- Keeps a baseline of contributions flowing

- Reduces temptation to pause savings

That said, job changes can trigger immediate tax events. And some plans tack on origination or maintenance fees.

“Missing a payment converts the balance into taxable income.”

Weighing Long Term Savings Vs Immediate Need

Before you tap your 401(k), sketch out the numbers. Interest paid to yourself rarely beats the market’s long-term gains. And a default can turn a loan into a costly distribution.

- Immediate cash with no credit approval needed

- Potential lost growth at 6%+ per year

- Risk of taxes and penalties on default

Importance Of Planning:

Sketch scenarios to compare net benefit over time.

Use this quick checklist to guide your decision:

- Calculate projected compound loss

- Confirm repayment schedule and employer rules

- Set calendar alerts for key repayment dates

By weighing the trade-offs, you’ll know if a 401(k) loan aligns with your goals. And as always, run the numbers and consult your advisor.

Spivak Financial Group can help you model the long-term effects of a 401(k) loan. Call (844) 776-3728 to explore options.

401k Loan Alternatives And Decision Checklist

Tapping into your 401k might feel like an easy fix when cash is tight. But before you borrow, it’s worth weighing other approaches that could save you fees, taxes, or lost growth.

Here are three popular alternatives to a 401k loan:

-

Hardship Withdrawal

Immediate access for IRS-approved reasons (think medical bills or tuition). You’ll pay ordinary income tax plus a 10% penalty if you’re under 59½. -

IRA Conversion or Rollover

Move money into an IRA, then take penalty-free distributions under certain conditions. Just watch out—this can limit your ability to contribute later. -

72(t) SEPP Distributions

Set up Substantially Equal Periodic Payments and withdraw early without the 10% penalty. You must commit to equal withdrawals over at least 5 years or until you turn 59½, whichever is longer.

Each path has its own rules on eligibility, penalties, and long-term effects.

Comparing 401k Loan Alternatives

Below is a side-by-side look at 401k loans, hardship withdrawals, IRA rollovers, and 72(t) SEPPs. Use this to spot which option fits your situation best.

| Option | Eligibility | Penalties | Repayment Requirements |

|---|---|---|---|

| 401k Loan | Up to 50% of vested balance or $50,000 cap | No immediate tax if repaid on time | Payroll deduction over 5 years |

| Hardship Withdrawal | IRS-approved hardship only | Income tax plus 10% penalty | No repayment – reduces retirement nest egg |

| IRA Rollover | Any vested or rollover funds | Taxes may apply on distributions | Depends on IRA rules and timing |

| 72(t) SEPP | Must commit to equal payments | No early withdrawal penalty if compliant | Fixed schedule over minimum 5 years |

This table makes it clear: a 401k loan sidesteps immediate taxes but requires disciplined payback. Hardship withdrawals give you cash now but shrink your balance forever. SEPPs offer penalty-free access at the cost of a rigid withdrawal schedule.

Decision Checklist

Answer these questions to pinpoint the best route:

- Do I need funds right away for an IRS-approved hardship?

- Can I handle payroll deductions for the next five years?

- Would rolling my 401k into an IRA while still employed align with my goals?

- Am I comfortable locking into equal withdrawals under 72(t) rules?

- How will taxes and penalties affect my net take-home from each choice?

Once you’ve ticked off these boxes, you’ll have a clear path forward. If you’re juggling work and retirement, check out our detailed steps on 401k Rollover to IRA While Still Employed for a step-by-step guide.

Key Takeaways

- 401k loans avoid immediate taxes but risk lost market gains and default if you can’t repay.

- Hardship withdrawals deliver cash now but incur income tax and a 10% penalty if you’re under 59½.

- SEPPs under Rule 72(t) let you tap funds early without penalty—provided you stick to the schedule.

- Rolling into an IRA grants withdrawal flexibility but watch out for future contribution limits.

“Choosing the right approach can save thousands in taxes, penalties, and lost growth.”

When To Use Each Option

- Hardship Withdrawal: Urgent, IRS-approved expenses like medical or funeral bills.

- 401k Loan: You’re confident in repaying via payroll deductions within 5 years.

- 72(t) SEPP: You need penalty-free income now and can commit to fixed payments.

- IRA Rollover: You want withdrawal flexibility post-employment but must mind contribution limits.

Next Steps

- Map your cash need against each option’s timeline and rules.

- Run net-cash scenarios, factoring in taxes and penalties.

- Review your plan’s specific definitions of hardship and loan availability.

- Set calendar reminders for loan repayments or SEPP installments.

- Consult a financial advisor for tailored advice and peace of mind.

Example Scenario

Imagine Alex needs $8,000 for unexpected dental work.

They choose a hardship withdrawal because they can’t afford loan repayments right now—but they’ll owe regular income tax plus a 10% penalty. On the flip side, a 401k loan would avoid penalties and spread repayment over five years, though it requires steady payroll deductions.

- Confirm what counts as hardship under your plan.

- Model your net proceeds after taxes and fees.

- Schedule reminders for every repayment or SEPP withdrawal.

With this checklist in hand, you’ll protect both your short-term needs and long-term retirement goals.

Frequently Asked Questions

When you’re weighing the option of borrowing from your 401(k), even small unknowns can feel daunting.

This FAQ peels back the curtain on loan limits, job-change rules, hardship withdrawals and 72(t) SEPP plans.

Think of it as your roadmap—from what-ifs to clear, actionable steps.

Real-life examples replace dry textbook scenarios. And you can always jump back to earlier sections if you need more context.

Excess Loan Requests

- Your plan won’t let you borrow more than your vested balance.

- Imagine Jane has $5,000 vested and asks for $6,000—her request gets denied.

- Always double-check your official vesting statement before you apply.

- Never count on extra cash you don’t truly own, or you risk a taxable distribution.

“You can’t borrow what you don’t own.” It holds true—even inside your 401(k).

Knowing this rule up front saves you from penalties and headaches down the line.

Repayment After Job Change

- If you change employers, most plans expect you to repay within 60 days.

- Miss that deadline, and the unpaid portion becomes a taxable distribution.

- Think of Aaron: he switched jobs, missed the deadline by ten days and ended up with $300 in penalties plus tax on his $7,000 balance.

- Pro Tip: Roll your outstanding loan balance into an IRA to sidestep surprise taxes.

Planning for career moves shields you from unexpected tax bills.

Hardship Withdrawals Vs Loans

- A hardship withdrawal is a permanent distribution—it’s not a loan.

- You’ll pay income tax plus a 10% penalty if you’re under 59½.

- Loans, by contrast, avoid that penalty and rebuild your balance with interest.

- Use hardship withdrawals only when a loan truly isn’t feasible for urgent expenses.

Keep in mind: hardship withdrawals often force a contributions pause—sometimes up to six months.

Choosing between these paths can feel like navigating a maze.

When A 72(t) SEPP Makes Sense

- SEPP stands for Substantially Equal Periodic Payments under IRS Rule 72(t).

- It sidesteps the 10% early-withdrawal penalty without requiring loan paybacks.

- For example, Laura sets up a 72(t) plan and draws $1,200 every month from her IRA.

- It fits if you need steady income and can stick to a rigid schedule.

Remember: once you start SEPPs, changing or stopping payments triggers taxes on all prior withdrawals.

With those scenarios in mind, here’s a concise action guide.

Quick Do’s And Don’ts

- Do verify your plan’s specific loan rules.

- Don’t overborrow or assume payroll deductions survive a job change.

- Do set up automated repayments to protect your tax status.

- Don’t overlook SEPPs and hardship options—they may suit different needs.

- Do check fees, timing windows and fine print before you apply.

- Don’t underestimate how loans or withdrawals chip away at long-term growth.

Still have questions? A chat with a trusted financial advisor can help tailor the right strategy for your circumstances.

These pointers should give you the confidence to navigate your borrowing options and avoid unintended tax events.

Ready to compare penalty-free early income strategies? Contact:

Spivak Financial Group

8753 E. Bell Road, Suite #101

Scottsdale, AZ 85260

(844) 776-3728

72tProfessor.com