Hitting your 40s is often a wake-up call for retirement planning. Suddenly, retirement isn't some far-off concept—it’s a destination that’s getting closer every year. The good news? This is a decade of immense opportunity. You're likely in or approaching your peak earning years, which means you have the financial muscle to make a huge impact on your future.

What does it really take? It boils down to a few core actions: getting brutally honest about where your money is, aggressively ramping up your savings rate to at least 15% of your income, and squeezing every last drop of value out of tax-advantaged accounts like your 401(k) and IRA.

Your Retirement Roadmap Starting in Your 40s

Life in your 40s is often a whirlwind. You might be juggling a mortgage, raising kids, or even helping out aging parents. With so many demands on your wallet, it’s easy to feel like you're playing catch-up with retirement savings.

But here’s the thing: the next 10 to 20 years are incredibly powerful for building wealth. The decisions you make now will directly shape the quality of life you’ll have down the road. This isn't about perfection; it's about making a focused, intentional push.

The Mid-Career Checkpoint

Think of this decade as the halftime show of your career. It's the perfect moment to pause, look at the scoreboard, and adjust your game plan for the second half.

How are you tracking? Financial experts often suggest having two to three times your annual income saved by age 40, and maybe three to four times by the time you hit 45. So, if you're earning $100,000, that's a target nest egg of $200,000 to $300,000 at 40.

If your number isn't there, don't panic. These are just guideposts, not pass/fail grades.

The real goal isn't to fixate on a benchmark you may have missed. It's about using it as a catalyst. This is your motivation to get serious and build a concrete plan that turns the vague idea of "saving for retirement" into a series of clear, achievable steps.

Laying the Foundation for Success

So, how do you build that plan? A solid retirement strategy created in your 40s stands on a few key pillars. We’re going to walk through each one, giving you the structure needed to move forward with real confidence.

- Honest Financial Assessment: This means putting it all on the table—income, spending, debts, and investments. You need a clear baseline to build from.

- Defining Your Goals: Let's get specific. What does retirement actually look like for you? We'll figure out what that lifestyle costs and how much you need to save to make it happen.

- Strategic Savings: It's time to supercharge your contributions. We’ll look at how to max out your 401(k)s and IRAs, grab every dollar of your employer match, and use tax advantages to your benefit.

- Advanced Planning: We'll also touch on more sophisticated strategies, like understanding early withdrawal options, that can protect your money and help it grow more efficiently.

This roadmap provides a high-level overview of how to plan for retirement in your 40s, zeroing in on the unique challenges and powerful opportunities you have right now.

To get started, it's helpful to see the big picture. The table below outlines the essential actions and mindset shifts needed to build a strong retirement foundation during this critical decade.

Key Retirement Planning Focus Areas for Your 40s

| Focus Area | Primary Goal | Key Actions |

|---|---|---|

| Financial Assessment | Gain total clarity on your current financial position (net worth). | • Track all income and expenses. • List all assets (savings, investments, home equity). • Tally all liabilities (mortgage, car loans, credit cards). • Use a retirement calculator for a baseline projection. |

| Savings & Investing | Aggressively increase your savings rate and optimize your investment strategy. | • Automate contributions to reach at least 15% of your pre-tax income. • Maximize 401(k) contributions to get the full employer match. • Fund a Roth or Traditional IRA. • Review and rebalance your asset allocation. |

| Debt Management | Systematically eliminate high-interest debt to free up cash flow. | • Prioritize paying off credit card balances and personal loans. • Evaluate mortgage refinancing options. • Avoid taking on new, non-essential debt. |

| Future Planning | Protect your family and plan for long-term expenses like healthcare and taxes. | • Review life and disability insurance coverage. • Start an initial estate plan (will, power of attorney). • Understand basic Medicare and long-term care options. • Learn about tax-efficient withdrawal strategies. |

Looking at these areas together gives you a comprehensive framework. It's not about doing everything at once, but about making steady, consistent progress across each category throughout your 40s.

Taking an Honest Look at Your Finances

Before you can map out a path to retirement, you have to know exactly where you’re starting from. For those of us in our 40s, this means moving past rough estimates and getting brutally honest with ourselves through a complete financial self-audit. It's not about judgment; it's about gaining the clarity you need to make every other decision more effective.

The first move is to gather all your financial documents. Think of it like assembling the pieces of a puzzle. You’ll need the latest statements from every account you own—checking, savings, 401(k)s, IRAs, brokerage accounts, and any HSAs. Don't forget to pull the statements for all your debts, too: mortgage, car loans, student loans, and credit cards.

This initial data dump gives you the raw numbers. Once everything is in one place, you can finally build a clear, accurate picture of where you stand right now.

Getting to Your True Net Worth

Your net worth is the simplest, most powerful snapshot of your financial health. It's a straightforward formula: Assets (what you own) – Liabilities (what you owe) = Net Worth. This single number acts as your financial scorecard, and tracking it year-over-year is one of the best ways to measure your progress.

Assets are more than just the cash in your bank account. Be sure to list everything:

- Liquid Assets: The cash sitting in your checking and savings accounts or money market funds.

- Investments: All the balances in your 401(k), IRAs, HSAs, and any taxable brokerage accounts.

- Physical Assets: The current market value of your home, cars, and other significant property.

Next, list out every single liability with its current balance. This means your mortgage, any home equity lines of credit (HELOCs), auto loans, lingering student debt, and all credit card balances. Subtracting the total you owe from the total you own gives you your current net worth.

Seeing Where Your Money Really Goes

If net worth is a snapshot, cash flow is the movie of your financial life. It shows where your money is coming from and, more importantly, where it's going each month. Getting a handle on this is the key to finding more money to save.

Start by tracking every dollar you spend for at least one full month. Use a budgeting app like Mint or YNAB, a spreadsheet, or even a simple notebook—the tool doesn't matter as much as the habit itself. Be sure to categorize your spending into fixed costs (mortgage, car payment) and variable costs (groceries, entertainment, subscriptions).

People are almost always shocked to find "spending leaks"—those small, recurring expenses that add up to a fortune. Discovering you're blowing $250 a month on unused subscriptions or daily coffee runs can free up $3,000 a year to shovel directly into your IRA or 401(k).

This exercise isn't about feeling guilty; it's about empowerment. For example, a couple in their mid-40s might realize that the 18% interest on their credit card debt is completely wiping out the 8% average return they’re earning on their investments. That single insight makes their next financial move crystal clear: attack that high-interest debt with everything they've got.

Knowing exactly where your money is going is the first step toward telling it where to go next.

Figuring Out Your Retirement Vision and Finding Your Number

After you’ve taken a hard look at where your money is today, it's time for the fun part: deciding what you're actually saving for. Retirement isn’t just some finish line you cross; it’s a whole new chapter of your life, and it comes with its own price tag. Getting specific about this vision is what turns a vague goal into a concrete target you can actually hit.

First, just ask yourself what your ideal retirement looks like. Do you see yourself jet-setting around the globe, or are you more of a stay-at-home-and-enjoy-the-grandkids type? Maybe you want to finally start that passion project, move to the beach, or just live a quiet life filled with hobbies you never had time for.

Each of these dreams costs something different. A retirement spent exploring Europe is going to demand a much bigger nest egg than one spent gardening in your backyard. Be honest here—this isn't about what you think you should want, but what you genuinely desire for your future.

Turning Those Dreams into Dollars

Once you’ve got a clearer picture, you can start putting a number to it. A common rule of thumb is the income replacement method. A lot of financial planners will tell you that you'll need about 80% of what you earned right before you retired to keep up a similar lifestyle.

So, if you're making $120,000 a year, you’d aim for a retirement income of $96,000 annually. The thinking is that some expenses will drop off (like saving for retirement itself), while others, like healthcare, are likely to go up.

But remember, this is just a guideline. Your personal number could easily be higher or lower. If you plan to have your mortgage paid off and you’re aiming for a simpler life, you might need less. If you’ve got a taste for expensive hobbies or world travel, you’ll probably need more. The whole point is to connect your personal vision to a realistic annual income figure.

Calculating Your Ultimate Retirement Number

With that annual income target in your back pocket, you can figure out the total nest egg you’ll need to generate it. One of the most popular tools for this is the 4% Rule. The rule suggests you can safely withdraw 4% of your starting portfolio each year without running out of money over a 30-year retirement.

To use it, just multiply your desired yearly income by 25.

- Example: If you're aiming for $96,000 a year in retirement, your target number is $2,400,000 ($96,000 x 25).

This simple math gives you a tangible, long-term goal. It takes "retirement savings" from a fuzzy concept to a specific number—your number. Seeing that figure can feel a little scary, but it’s also incredibly motivating. Now you have a clear benchmark to work toward.

Of course, this is a simplified model. It doesn't magically account for big variables like inflation, the fact that we're living longer, and the ever-climbing cost of healthcare. These are real-world pressures that are changing how people plan.

The game is different now. More people expect to work longer, with roughly 20% pushing their target retirement age to 70 or beyond simply because they have to. And healthcare is a massive concern; over half of workers say its cost is hurting their ability to save, while about 38% of retirees find their medical bills are much higher than they ever planned for. You can see more on this in the latest retirement confidence survey from EBRI.

The Power of Working a Little Longer

Given these realities, it’s worth playing with the numbers to see how different retirement ages affect your goal. Pushing back your retirement date by just a few years can make a huge difference.

Let's look at the impact of retiring at 65 versus 70 for someone trying to hit that $2.4 million goal.

- Retire at 65: You have five fewer years for your money to grow and compound. Plus, your Social Security benefit will be permanently lower than if you'd waited.

- Retire at 70: You get five extra years of contributions and investment growth. You also get a much bigger Social Security check—it increases by about 8% for every year you delay claiming past your full retirement age.

Delaying gives you a powerful one-two punch: it grows your savings while shrinking the number of years your nest egg has to support you. It’s a strategy that can make an intimidating retirement number feel much more within reach.

Supercharging Your Savings and Investment Strategy

With a clear vision of your retirement, it's time to build the engine that gets you there. Your 40s are when your savings strategy needs to shift gears—from a steady cruise to a powerful, focused acceleration. This is the decade to get serious, optimize every dollar, and make your money work just as hard as you do.

The first, non-negotiable step is taking full advantage of your workplace 401(k), especially if there’s an employer match. Honestly, this is the closest thing you’ll ever get to free money.

If your employer matches 50% of your contributions up to 6% of your salary, contributing that full 6% gives you an instant 50% return on your investment. Not contributing enough to capture the full match is like turning down a raise. It's a critical mistake you simply can't afford to make.

Maximizing Your Tax-Advantaged Accounts

Beyond securing the 401(k) match, your goal should be to max out tax-advantaged accounts whenever possible. Aim to save at least 15% of your pre-tax income, but if you can push that higher, do it. These accounts are your primary wealth-building tools, and knowing their unique benefits is key.

-

Traditional vs. Roth IRA: An Individual Retirement Arrangement (IRA) is a powerful supplement to your 401(k). A Traditional IRA gives you a tax deduction now on your contributions, which can be a huge help in your 40s—often your peak earning years. On the flip side, a Roth IRA offers completely tax-free withdrawals in retirement. It's a great way to build a bucket of tax-free income for the future.

-

Preparing for Catch-Up Contributions: As you approach 50, you unlock a new savings superpower: catch-up contributions. This allows you to save above the standard limits in your 401(k) and IRA. While you can't use them just yet, you should be planning for them now by getting into the habit of saving aggressively. This will make it much easier to take full advantage of these higher limits the moment you're eligible. To get a better handle on your progress, you can check out our guide on the best retirement planning apps that make tracking these contributions a breeze.

Retirement Account Contribution Limits and Catch-Up Provisions

Understanding the limits for different retirement accounts is crucial for maximizing your savings. The table below outlines the standard contribution limits and the additional amounts you can contribute once you hit age 50.

| Account Type | Standard Contribution Limit | Catch-Up Contribution (Age 50+) | Total Potential Contribution |

|---|---|---|---|

| 401(k), 403(b), TSP | $23,000 | $7,500 | $30,500 |

| Traditional IRA | $7,000 | $1,000 | $8,000 |

| Roth IRA | $7,000 | $1,000 | $8,000 |

As you can see, turning 50 gives you a significant opportunity to ramp up your savings. Planning to use these catch-up provisions can make a massive difference in your final nest egg.

Tailoring Your Asset Allocation

How you invest your savings is just as important as how much you save. A 45-year-old's portfolio should look fundamentally different from a 65-year-old's, mainly because you have a longer time horizon to weather market ups and downs. This is where asset allocation—your mix of stocks, bonds, and other assets—comes into play.

A common rule of thumb for someone in their 40s is a portfolio heavily weighted toward stocks, maybe an 80/20 or 70/30 split between stocks and bonds. This growth-oriented approach gives your money the best chance to outpace inflation over the next couple of decades.

As you get closer to retirement, you'll want to gradually shift to a more conservative allocation to protect what you've built. This strategic, gradual reduction in risk is known as a risk glidepath. Think of it as slowly easing off the gas as you approach your destination to ensure a smoother ride.

Don't let the fear of market volatility push you into an overly conservative portfolio too early. With 20 or more years until you'll need the money, you have plenty of time to recover from downturns. Taking on calculated risk is what drives long-term growth.

The importance of ramping up your savings in your 40s really can't be overstated. Statistics show a wide gap in preparedness; median retirement balances for households aged 45–54 are around $115,000. That's only about 9–11% of the $1.0–$1.3 million many advisors suggest for a comfortable retirement. This is precisely why maxing out contributions and using future catch-up provisions, like the $7,500 catch-up for those 50 and over, is so critical.

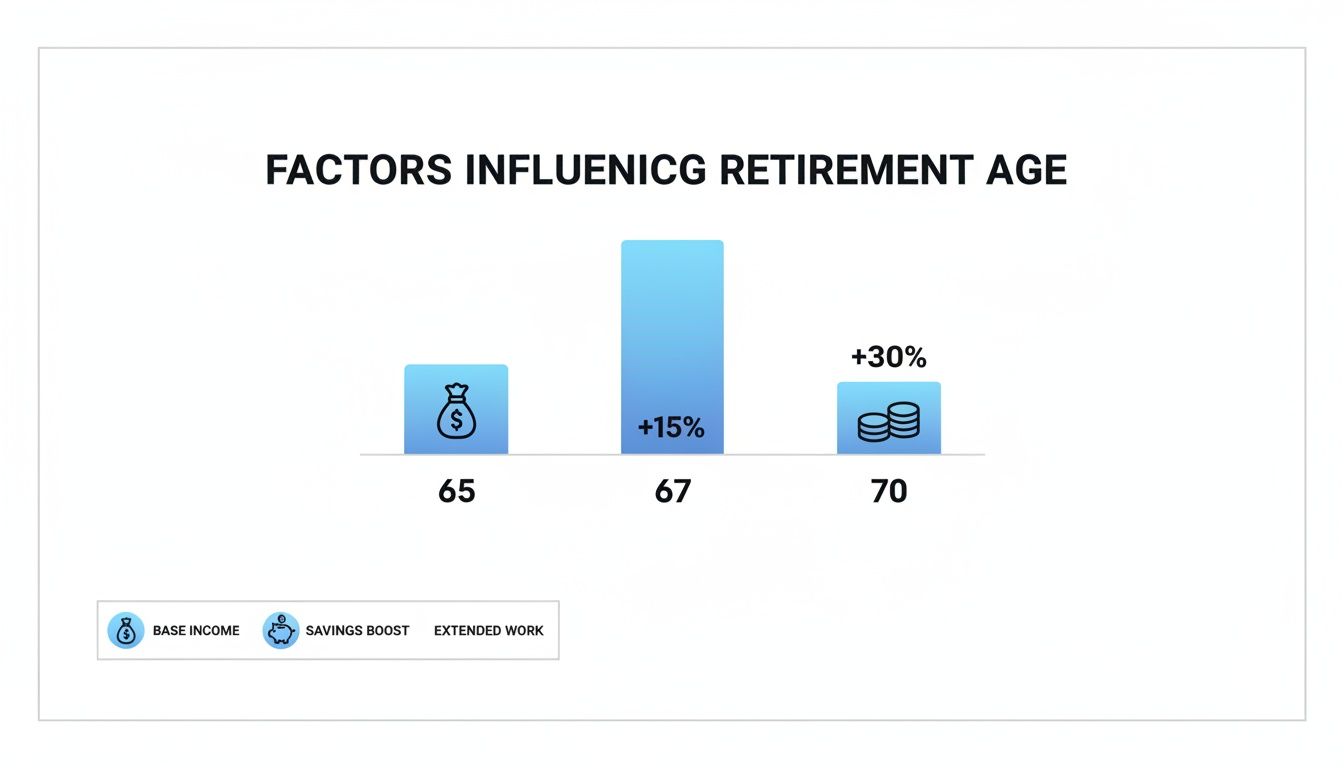

This chart shows just how much small changes in your savings strategy and timeline can impact your retirement readiness.

As you can see, delaying retirement by just a few years can boost your total nest egg by 15% to 30% or more. It’s a powerful combination of continued savings and letting your investments keep growing.

Time for Advanced Moves to Protect and Grow Your Nest Egg

Once you’ve got the basics down and your savings plan is humming along, it’s time to start thinking about the finer points. These are the strategies that can shield your hard-earned money from taxes, debt, and life’s unexpected curveballs, giving you a lot more breathing room as you head toward retirement.

One of the most overlooked—yet incredibly powerful—tools is the Health Savings Account (HSA). If you’re on a high-deductible health plan, an HSA is a financial powerhouse. It offers a triple tax advantage you won't find anywhere else: your contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also completely tax-free.

Think of it as a retirement account specifically for healthcare, but on steroids. If you can afford to pay for current medical expenses out-of-pocket and let your HSA balance grow, you're setting yourself up with a dedicated, tax-free war chest for medical needs down the road.

Getting Smart About Debt and Risk

Managing your financial exposure in your 40s isn’t just about paying off every last dollar of debt. It's about being strategic. The absolute priority should be wiping out high-interest consumer debt like credit cards or personal loans. The interest rates on that kind of debt will almost always outrun any investment gains you could hope for.

A low-interest mortgage, however, is a different animal. It might feel great to pay it down aggressively, but let's look at the numbers. If your mortgage rate is 3% but your investment portfolio is historically earning 7-8%, you're likely better off putting that extra cash to work in your investments.

Protecting your plan also means building a firewall around your savings with the right insurance.

- Disability Insurance: This is non-negotiable in your 40s. It protects your most valuable asset: your ability to earn an income.

- Life Insurance: If anyone depends on you financially, a simple term life insurance policy provides a critical safety net to cover their needs if you’re gone.

- Long-Term Care Insurance: It may feel a long way off, but your 40s or early 50s are the prime time to explore long-term care policies. Premiums are much more affordable when you're younger and healthier.

Need to Tap Your Retirement Funds Early?

What if your dream is to retire before age 59½? A lot of people assume their 401(k) or IRA is completely locked down until then, but the IRS actually has approved ways to access your money without that painful 10% early withdrawal penalty.

The screenshot below from 72tProfessor.com shows that there's specialized help available for people navigating these exact kinds of early retirement decisions.

This really highlights that you don't have to figure out these complex rules on your own.

Two of the most common pathways for early access are the Rule of 55 and what's known as a Substantially Equal Periodic Payment (SEPP) plan.

The Rule of 55 is pretty straightforward. If you leave your job—whether you quit, get laid off, or retire—in the calendar year you turn 55 or later, you can start taking penalty-free withdrawals from that specific company's 401(k). Keep in mind, this rule doesn't work for IRAs or 401(k)s from previous employers.

For those looking to retire even earlier, a SEPP plan (often called a 72(t) distribution) offers more flexibility. This strategy allows you to set up a series of calculated annual withdrawals from your IRA or 401(k) at any age, penalty-free. It demands careful planning, though, because you have to commit to the payment schedule for at least five years or until you hit 59½, whichever is longer. You can get a much deeper look into how to take money from a 401(k) using a 72(t) SEPP to see if it’s a good fit for your own early retirement timeline.

Building Your Action Plan for the Next Decade

It's one thing to understand the concepts of retirement planning, but it's another thing entirely to turn those ideas into real-world progress. This is where the rubber meets the road. Instead of getting bogged down by the sheer size of the goal, the key is to focus on simple, repeatable actions that build powerful momentum over time.

You're not just creating a financial plan; you're building a habit. The best tools for this job are surprisingly simple: consistency and automation. By setting up systems that do the heavy lifting for you, saving for retirement becomes a seamless part of your financial life, not a constant source of stress.

Creating a System for Success

Your action plan for the next decade really boils down to making smart choices automatic. Start by creating a simple checklist of things you can implement right now, and then put a reminder on your calendar to review it once a year. This takes your goals from abstract ideas to concrete steps.

Here’s a practical checklist to get you started:

- Schedule an Annual Financial Check-In: Seriously, open your calendar right now and put a recurring annual appointment with yourself. This is your dedicated time to track your net worth, see how your investments are doing, and make sure you’re still headed in the right direction.

- Automate Your 401(k) Increases: Log in to your 401(k) provider's website and look for an "auto-escalation" feature. Set it to bump up your contribution by 1% or 2% each year. If you time it with your annual raise, you'll barely even notice the change in your take-home pay.

- Set Up and Fund an IRA: If you don't have an IRA, now's the time to open one. The next step is crucial: set up automatic transfers from your checking account to fund it, whether it's monthly or with every paycheck. The consistency is what matters most here.

- Rebalance Your Portfolio: At least once a year, take a look at your asset allocation. The market's ups and downs will inevitably cause your portfolio to drift from your target mix. If your stock allocation has crept up, for example, rebalance it back to your plan.

Automation is the secret weapon that closes the gap between what you plan to do and what you actually do. It takes willpower and emotion out of the equation, ensuring you save and invest consistently even when life gets hectic. For those looking to cross the finish line a bit sooner, our guide on how to retire at 50 dives deeper into how these disciplined habits can seriously speed up your timeline.

The very design of your retirement savings system has a massive impact. It’s no coincidence that research shows workers with access to workplace plans are nearly twice as likely (54%) to be on track for retirement compared to those without (28%). Features like auto-enrollment and auto-escalation simply work. You can read more about the impact of plan design on retirement readiness from Vanguard.

Answering Your Top Retirement Planning Questions

As you start getting serious about your financial future, a few big questions always seem to surface. It's totally normal. Trying to figure out how to plan for retirement in your 40s means facing some tough choices, balancing competing priorities, and maybe even making up for lost time.

Let's cut through the noise and get you some clear, straightforward answers to the questions I hear most often from people in this critical decade.

Is It Too Late to Start Saving for Retirement in My 40s?

Let me be direct: Absolutely not. It's easy to get hung up on not starting sooner, but that's a waste of energy. Your 40s are very often your peak earning years, which means you have more financial firepower to save aggressively than ever before. The real key is to stop worrying about the past and take decisive action today.

Focus on what you can control right now. Start immediately, be relentlessly consistent, and squeeze every drop of value out of the tools you have, like your employer's 401(k) match and tax-advantaged accounts. If you can commit to a disciplined plan and ramp up your savings rate to 15% or more of your income, you can still build a very impressive nest egg over the next 20 to 25 years.

How Should I Balance Saving for Retirement with My Kids' College?

This is the big one—the financial tug-of-war that keeps so many parents up at night. You want to give your kids every advantage, but here’s the hard truth from virtually every financial advisor out there: you have to prioritize your own retirement.

The logic is simple and unshakable: your kids can get scholarships, grants, and loans for college. There are no loans for retirement.

A balanced approach is usually the smartest path. The first non-negotiable step is to contribute enough to your 401(k) to get the full employer match—it's free money. After that, you can split the remaining funds between your retirement accounts and a college savings plan, like a 529. It also helps to start having honest conversations with your kids about what you can realistically afford.

What Is the Biggest Mistake People in Their 40s Make?

Without a doubt, one of the most damaging mistakes I see is lifestyle inflation. It’s that all-too-human tendency to let your spending rise right alongside every pay raise you get. But a bigger paycheck should mean a bigger contribution to your future self, not just a bigger car payment or a more expensive vacation.

Another common slip-up is getting too conservative with investments too early. With a 20+ year horizon until you'll likely need the money, you have plenty of time to ride out market ups and downs. Sticking with a growth-oriented portfolio is essential.

Finally, and this might be the most fundamental error, many people simply fail to create a written plan. A concrete, written-down plan is what turns vague hopes into real, actionable steps. It’s your roadmap.

Navigating these decisions, especially when early retirement is on the table, can get complicated fast. Spivak Financial Group specializes in helping people create crystal-clear strategies, including advanced options like 72(t) SEPPs that allow you to access funds before age 59½. Find out how you can build a personalized plan at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com