Leaving your 9-to-5 behind years ahead of schedule is a powerful dream. But making it happen requires more than just aggressive saving; it’s about having a rock-solid plan for smart withdrawals, a clear financial vision, and a resilient investment portfolio.

It also means mastering the tax rules and, just as importantly, designing a post-work life that’s actually fulfilling. This is how you turn the idea of early retirement into your reality.

The Reality of Retiring Early

So, you’re dreaming of ditching the daily grind well before the traditional retirement age? You're definitely not alone. The pull of financial independence is strong, but in today's world, it takes more than just wishful thinking to get there.

Understanding how to prepare for early retirement means facing a completely different set of challenges. People are living longer, which is great news, but it also means your retirement funds might need to last 30, 40, or even 50 years. When you factor in market swings and inflation, having a bulletproof financial plan isn't just a good idea—it's essential.

Why Planning Is More Critical Than Ever

Retirement just isn't what it used to be. Decades ago, the path was more predictable. In the U.S., the average retirement age actually dipped from 65.5 years in 1970 to around 62.4 in the 90s, but it has since climbed back up to 64.9 by 2020. This shift reflects big changes in the workforce and longer life expectancies, both of which can put a serious strain on your nest egg. You can discover more about global retirement trends and see what they mean for your own planning.

Despite how appealing it sounds, only about 3% of workers actually believe they can retire by age 55. That's a huge gap between the dream and the reality, and this guide is designed to help you close it.

This isn't about crushing dreams; it's about building a realistic, resilient plan. We provide the strategic framework needed to turn your early retirement goals into a tangible outcome.

Core Pillars of a Successful Early Retirement

To get there, you need to build your plan on several core pillars. Think of these as the foundation for your financial freedom—if one is weak, the whole structure is at risk.

Our approach here at Spivak Financial Group is to create one cohesive strategy that hits every single one of these critical points:

- Creating a Clear Financial Vision: This is way more than just picking a target number. It’s about defining what your retired life will actually look like, from day-to-day activities to your biggest goals.

- Building a Resilient Investment Portfolio: Your investments are the engine that will power your retirement. A well-diversified, cost-effective portfolio is absolutely key for generating income that lasts.

- Mastering Tax-Efficient Strategies: Growing your wealth is only half the battle. Knowing how to access it before age 59½ without getting hammered by tax penalties is the other half.

- Designing a Fulfilling Lifestyle: The final piece of the puzzle is making sure your retirement is as rich in purpose and happiness as it is in financial security.

This guide will walk you through each of these pillars with actionable advice and real-world examples to help you prepare with confidence. For personalized guidance, the experts at Spivak Financial Group are here to help. You can reach us at (844) 776-3728 or visit our office at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260.

Defining Your Early Retirement Vision

Before you even touch a calculator, you need a destination. The single most important step in planning for early retirement isn’t about crunching numbers; it’s about designing the life you actually want to live.

What does "retirement" even look like when it starts at 50 instead of 65? This vision becomes your personal blueprint. It’s the North Star that guides every financial decision you make, from savings goals to investment strategies. Without it, you’re just saving money without a purpose.

From Vague Dreams to a Concrete Plan

Most people have a fuzzy idea of retirement: "more travel," "less stress," or "finally getting to my hobbies." To build a plan that actually works, you have to translate those dreams into tangible, specific goals. If you're serious about how to prepare for early retirement, start by getting honest with yourself on a few key questions.

- Where will you live? Are you staying put, downsizing, or maybe relocating to an area with a lower cost of living? The financial difference between staying in your current home and moving can easily be hundreds of thousands of dollars over your lifetime.

- What will fill your days? Will you be pursuing expensive hobbies like boating or flying? Or will your time be filled with low-cost activities like hiking, volunteering, or hanging out with the grandkids? Be realistic.

- How will you handle healthcare? This is the big one for early retirees. You'll need to fund your own health insurance until Medicare kicks in at age 65, an expense that can easily top $15,000 per year for a couple.

Your answers here are what create the framework for a realistic budget. This isn't about restriction; it's about making sure your money is aligned with what genuinely brings you fulfillment.

Calculating Your Financial Independence Number

Once you have a detailed vision, you can start putting a price tag on it. This is where you calculate your Financial Independence (FI) number—the pile of money you need saved to live off your investments without ever having to work again.

A common starting point for this is the 4% rule. The theory suggests you can safely withdraw 4% of your initial portfolio value each year, adjusting for inflation, without depleting your funds over a 30-year retirement. To get your target number, you simply multiply your estimated annual retirement expenses by 25.

For example, if you figure out your ideal early retirement lifestyle will cost $80,000 per year, your target FI number would be $2,000,000 ($80,000 x 25).

But a word of caution for early retirees. You have a much longer timeline, potentially 40+ years. Because of that, many financial planners recommend a more conservative withdrawal rate, maybe closer to 3.5% or even 3%. Using a 3.5% rate means you'd multiply your annual expenses by about 28.5, pushing that target number up to $2,280,000.

Building a Detailed Early Retirement Budget

An estimate is a good start, but a line-by-line budget is non-negotiable. You have to account for everything, from the fixed costs you can't avoid to all the fun, discretionary spending—and a cushion for what you don't see coming.

The worksheet below is a fantastic exercise to see how your expenses might shift from your working years to your retirement years.

Estimating Your Annual Retirement Expenses

This simple table can be a real eye-opener. Go through your current spending and then project how each category might change once you've left the 9-to-5.

| Expense Category | Current Monthly Cost | Projected Retirement Monthly Cost | Notes (e.g., will this increase/decrease?) |

|---|---|---|---|

| Housing (Mortgage/Rent/Taxes) | $2,500 | $800 | Mortgage paid off; taxes and insurance remain. |

| Healthcare Premiums | $300 (employer-subsidized) | $1,200 | Pre-Medicare private insurance. |

| Groceries & Dining Out | $900 | $700 | More home cooking, less convenience food. |

| Transportation (Car/Gas/Maint.) | $600 | $350 | No daily commute reduces gas and wear. |

| Travel & Entertainment | $500 | $1,500 | Major increase for planned international trips. |

| Utilities & Subscriptions | $400 | $400 | No significant change expected. |

This exercise is more than just math; it's a reality check. It forces you to get honest about the real-world costs of the lifestyle you've been dreaming about. At Spivak Financial Group, we specialize in helping clients build these detailed financial blueprints, making sure no stone is left unturned.

If you need a hand defining your vision and calculating your number, give us a call at (844) 776-3728. A clear vision is the most powerful tool in your entire financial arsenal.

Building a Resilient Investment Portfolio

Once you’ve mapped out your retirement vision and know the target number you’re aiming for, it’s time to build the engine that will actually get you there. Think of your investment portfolio as the workhorse of your early retirement plan. Its one job is to generate enough growth to fund decades of financial freedom.

The key here isn't chasing fleeting market trends or trying to pick the next hot stock. Forget that. The real goal is to construct a well-diversified machine that can weather economic storms and consistently compound your wealth over the long haul. This requires a smart mix of different investments, each playing a specific role in your financial journey.

The Core Components of Your Portfolio

A strong portfolio is like a well-balanced team, with different players bringing unique strengths to the field. Relying too heavily on a single type of investment is a recipe for disaster. True resilience comes from spreading your capital across various asset classes that don't always move in the same direction.

Here are the key players you'll want to consider for your team:

- Low-Cost Index Funds and ETFs: These are the bedrock of most early retirement portfolios for a reason. They give you instant diversification by tracking broad market indexes (like the S&P 500), which minimizes the risk of picking individual stocks and keeps fees incredibly low.

- Dividend-Paying Stocks: If you’re looking for an income stream, quality companies with a long history of paying and increasing dividends can be fantastic. They provide regular cash flow you can either reinvest to supercharge growth or use to cover living expenses once you've retired.

- Real Estate: Whether you're directly owning rental properties or investing in Real Estate Investment Trusts (REITs), real estate can offer both appreciation and rental income. It also often serves as a powerful hedge against inflation.

Making sure your nest egg can withstand market fluctuations is paramount. To do this, it’s critical to understand effective strategies to diversify your stock portfolio for long-term growth. A diversified portfolio is your best defense against the market's inherent unpredictability.

Tailoring Your Asset Allocation to Your Timeline

Your asset allocation—the specific mix of stocks, bonds, and other investments in your portfolio—is the single biggest factor determining your long-term returns. This mix isn’t a one-size-fits-all solution; it has to reflect your age, your personal tolerance for risk, and how far away you are from your retirement date.

Someone in their 30s can afford to take on more risk for higher potential growth. On the flip side, someone in their late 40s who is getting close to their goal will likely want more stability to protect the wealth they've already built.

Let's look at a couple of simplified examples:

| Investor Profile | Stock Allocation | Bond Allocation | Other Assets (e.g., Real Estate, Gold) | Rationale |

|---|---|---|---|---|

| Aggressive Growth (35-year-old) | 80% | 15% | 5% | A long time horizon allows for riding out market volatility in pursuit of maximum growth. |

| Moderate Growth (48-year-old) | 60% | 35% | 5% | Balances the need for continued growth with increased capital preservation as retirement nears. |

These allocations aren't set in stone. As you get older and closer to your retirement date, you'll want to gradually shift your portfolio from being growth-focused to more conservative. For a deeper dive into how to structure income from these assets, our guide on the concept of "pensionizing" your portfolio can offer some great insights.

Staying the course is often the hardest—and most important—part of investing. Market downturns are inevitable, but panic-selling is one of the biggest wealth destroyers. A disciplined plan helps you ignore the noise and stick to your long-term strategy.

The Power of Disciplined Rebalancing

Over time, your carefully planned asset allocation will naturally drift. If stocks have a fantastic year, they might grow to become a much larger chunk of your portfolio than you originally intended, exposing you to more risk. This is where disciplined rebalancing comes in.

About once a year, take a look at your portfolio. If your allocation has strayed from your target—say, your 60/40 portfolio is now 70/30—it’s time to rebalance. You simply sell some of the outperforming asset (stocks, in this case) and buy more of the underperforming one (bonds).

This simple action forces you to buy low and sell high, locking in some of your gains and keeping your risk level exactly where you want it. It's a simple, powerful habit that ensures your portfolio stays perfectly aligned with your early retirement goals.

Mastering Tax-Advantaged Withdrawal Strategies

Building a healthy nest egg is a huge win for anyone dreaming of early retirement, but it's really only half the battle. The true test of your financial plan is how you access that money before age 59½ without getting hammered by taxes and penalties.

This is where the real strategy comes into play. It's not just about saving; it’s about creating a tax-smart income stream years before you hit the traditional retirement age. To do that, you have to know the rules of the game and use them to your advantage.

Unlocking Your 401(k) Early with The Rule of 55

One of the most straightforward ways to tap your 401(k) is the Rule of 55. This handy IRS provision lets you take penalty-free distributions from your current employer's 401(k) or 403(b) if you leave your job in the year you turn 55 or later.

Let's say Sarah decides to retire from her corporate gig at age 55. She can immediately start pulling money from that company's 401(k) without facing the typical 10% early withdrawal penalty.

A couple of critical points to remember here:

- This rule only works for the 401(k) of the employer you just separated from. Money in old 401(k)s or IRAs doesn't qualify.

- The withdrawals might be penalty-free, but they are still taxed as ordinary income.

The Rule of 55 is simple, but it locks you into staying with your employer until that milestone birthday. If you roll those funds into an IRA, you lose this special privilege, so timing is everything.

Building a Roth Conversion Ladder

For those planning to retire much earlier than 55, a Roth conversion ladder is a brilliant long-term play. The idea is to systematically convert pre-tax funds from a traditional IRA or 401(k) into a Roth IRA. You'll have to pay income tax on the amount you convert each year, but this sets you up for tax-free withdrawals down the road.

Here's the magic: every conversion starts its own five-year clock. Once those five years are up, you can withdraw the principal amount you converted completely tax-free and penalty-free, no matter your age.

If you start building a ladder years before you actually retire, you can create a steady pipeline of accessible cash. For example, a conversion you make at age 45 is available at 50. The one at 46 is ready at 51, and so on.

This strategy offers incredible control over your future income, but it demands careful planning to keep the tax bill manageable during your conversion years.

Using Substantially Equal Periodic Payments (SEPP)

What if you need income right away and can't wait five years for a Roth ladder to mature? That's where Substantially Equal Periodic Payments (SEPPs), often called 72(t) distributions, come in. This rule lets you take penalty-free withdrawals from your IRA at any age.

The trade-off is that you have to commit to taking a series of calculated annual payments for at least five years, or until you reach age 59½—whichever is longer.

The IRS gives you three ways to calculate your annual payment:

- Required Minimum Distribution (RMD) Method: Payments are based on your account balance and life expectancy, and you recalculate them each year.

- Fixed Amortization Method: This gives you a fixed annual payment based on your life expectancy and a specific interest rate.

- Fixed Annuitization Method: This method calculates a fixed annual payment using an annuity factor.

Choosing a SEPP is a serious commitment. Once you begin, you can't really change or stop the payments without facing major penalties. To really dig into the details, you can learn more about how a 72(t) plan works and see if it's the right fit for you.

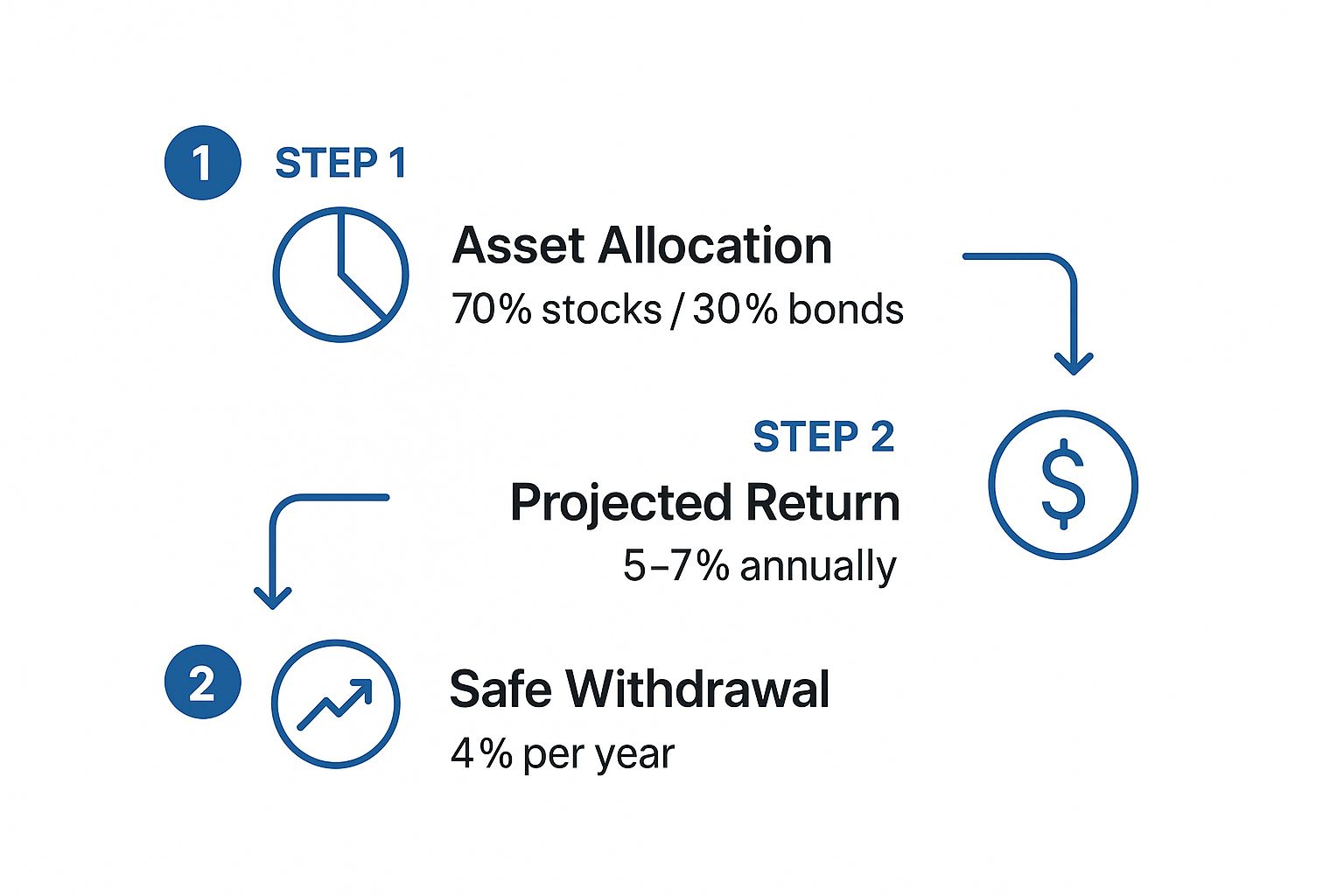

This infographic shows how a typical portfolio might be structured to generate the income needed for these kinds of strategies.

This flow demonstrates how a balanced asset allocation, combined with reasonable return projections, can support a sustainable withdrawal rate—which is the absolute foundation of any solid early retirement plan.

Stretching Your Savings with Geographic Arbitrage

What if you could shave years off your retirement timeline without saving another dime? It sounds too good to be true, but it’s the core idea behind a powerful strategy called geographic arbitrage.

This isn’t some complicated financial trick. It's about moving from a high-cost area to a place where life is more affordable, making your retirement savings stretch much, much further. For many early retirees, this simple shift is the key that unlocks financial freedom years ahead of schedule. By cutting your biggest expenses—like housing, taxes, and healthcare—you can dramatically lower the amount of money you need to live comfortably, and maybe even upgrade your lifestyle in the process.

The Power of Lowering Your Cost of Living

Let’s put some numbers to it. Say you need $80,000 a year to live in a major U.S. city. Based on the 4% rule, that means you need a $2 million nest egg.

But what if you could maintain that same quality of life—or even a better one—in a different city or country for just $50,000 a year? Suddenly, your target number drops to $1.25 million. That's a massive difference that could mean retiring five or ten years sooner.

This doesn't mean you have to move to a cabin in the woods. It could be as simple as swapping a pricey coastal city for a vibrant Midwestern town. Or maybe it’s an adventure abroad in a country with modern amenities and rich culture for a fraction of the cost. The impact is huge. To see just how much location affects your needs, check out our guide on what constitutes a good monthly retirement income.

Geographic arbitrage is more than just a cost-cutting measure; it's a lifestyle design tool. It empowers you to align your financial resources with your desired quality of life, often making early retirement an achievable goal rather than a distant dream.

Exploring International Retirement Destinations

The idea of retiring abroad isn't just a fantasy anymore; it’s a well-trodden path for many early retirees. People are actively seeking destinations that offer that perfect mix of a high quality of life, friendly tax laws, and great healthcare.

In fact, international retirement is now a serious consideration in financial planning. The Global Retirement Report 2025 looked at 44 countries with retirement visa programs and found some clear winners. Places like Portugal, Spain, Uruguay, Mauritius, and Austria consistently pop up at the top of the list for their safety, healthcare, affordability, and tax benefits. You can read the full report on global retirement options to dive into the details.

Navigating the Logistics of Moving Abroad

Of course, packing up and moving to another country is a major undertaking. It’s more than just a long vacation—it requires some serious planning.

You'll need to get a handle on a few key things:

- Visa Requirements: Every country has its own set of rules. Some have specific retirement visas, while others offer long-stay or passive income visas. Understanding the various digital nomad visa requirements is a great place to start your research.

- Tax Implications: As a U.S. citizen, you’re not off the hook for filing U.S. taxes, even if you live abroad. You’ll also need to understand the tax laws of your new country. The good news is that many countries have tax treaties with the U.S. to help you avoid getting taxed twice on the same income.

- Healthcare Access: This is a big one. You need to research the quality, cost, and accessibility of healthcare. Can you get into the public system, or will you need to budget for a comprehensive international health insurance plan?

Thinking through the financial side of a big move like this can be overwhelming. At Spivak Financial Group, we can help you model different scenarios and see how geographic arbitrage could fit into your early retirement strategy. Give our team a call at (844) 776-3728 to talk it through.

Navigating Common Early Retirement Questions

Even with the most buttoned-up early retirement plan, you're bound to have some lingering questions. As you get closer to the finish line, it's natural for "what-if" scenarios to pop into your head. Tackling these concerns is a huge part of feeling confident enough to finally make the leap.

Let's walk through some of the most common questions we hear from clients. Our goal is to give you clear, practical answers to help you handle specific challenges, from a shaky market to the big psychological shift of leaving your career behind.

How Do I Calculate How Much Money I Need to Retire Early

This is the big one, the question on everyone's mind. While there isn't a single magic number that fits all, there are some great frameworks to get you started. A popular jumping-off point is the "4% Rule," which suggests you need a portfolio worth 25 times your estimated annual expenses in retirement.

So, if you think you'll spend about $60,000 a year, you'd be shooting for a $1.5 million nest egg ($60,000 x 25). But here's the catch: that rule was originally built for a standard 30-year retirement. For early retirees looking at a much longer runway—say, 40 or even 50 years—most planners will steer you toward a more conservative path.

For an extended retirement, a safer withdrawal rate of 3% or 3.5% is often a smarter move. This bumps your savings target up to around 33 times your annual expenses, giving you a much beefier cushion against inflation and inevitable market dips.

To nail down your number, you've got to create a detailed budget for your future lifestyle. This goes way beyond just the bills. You need to account for healthcare, travel, new hobbies you want to pick up, and a healthy buffer for life's surprises. Only then can you find your true financial independence number.

What Is the Biggest Mistake People Make

One of the most painful and costly mistakes we see is underestimating healthcare costs. It's a huge blind spot. Unlike folks who retire at 65 and can jump on Medicare, early retirees are on their own for private health insurance for all those years in between.

And it can be a massive expense. People often forget to budget for sky-high premiums, deductibles, and out-of-pocket costs that can easily stack up to thousands of dollars every single year.

Another common pitfall is not planning for the mental and social side of leaving work. Here are a few things to really think about:

- Loss of Identity: For many of us, our career is a massive part of who we are. What fills that space when it's gone?

- Finding Purpose: Without the daily grind and structure of a job, how will you stay engaged and find fulfillment?

- Maintaining Social Connections: A lot of friendships are built around the office. It's vital to have a plan to keep those connections strong and build new ones.

Walking away from a long career can be a real shock to the system. A truly successful early retirement plan doesn't just focus on the money; it's about designing a life that's rich with purpose, community, and meaning.

How Can I Access My Retirement Funds Before Age 59.5 Without a Penalty

This is where things get a bit more complex, but the good news is you have options. There are several well-established strategies to get to your money early, but each one requires very careful execution to stay on the right side of the IRS.

The "Rule of 55" is a fairly straightforward choice. It lets you take penalty-free distributions from your current employer's 401(k) if you leave that job in or after the year you turn 55. The key limitation here is that it only applies to the 401(k) of the company you're leaving.

Another popular strategy is building a Roth Conversion Ladder. This involves moving money from a pre-tax 401(k) or IRA into a Roth IRA. After a five-year waiting period on each chunk you convert, you can withdraw that converted principal completely tax-free and penalty-free.

A third route is using Substantially Equal Periodic Payments (SEPP), which you'll also hear called a 72(t) distribution. This lets you take a series of calculated payments from your IRA at any age. The trade-off is that you have to stick with the payment plan for at least five years or until you turn 59.5, whichever is longer.

Each of these methods comes with its own strict rulebook.

| Strategy | Best For | Key Consideration |

|---|---|---|

| Rule of 55 | Individuals retiring at age 55 or later from their current job. | Only applies to the 401(k) of the employer you are leaving. |

| Roth Conversion Ladder | Those with years to plan before needing the funds. | Requires a five-year waiting period for each conversion to become accessible. |

| SEPP / 72(t) | Individuals who need immediate income and cannot wait. | A long-term commitment with very little flexibility once started. |

Trying to navigate these complex withdrawal strategies on your own is risky. One wrong move could trigger hefty taxes and penalties that could seriously damage your plan. It's highly recommended to work with a financial professional to make sure you choose the right strategy and implement it correctly for your unique situation.

Navigating the complexities of early retirement withdrawals is our specialty. At Spivak Financial Group, we help clients build tax-efficient income streams to fund their dreams. If you're ready to create a clear path to financial freedom, contact us today.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

Learn how a 72(t) SEPP can unlock penalty-free income at 72tProfessor.com.