Retiring at 50 isn't some far-off dream. It's an ambitious goal, absolutely, but one that comes down to a clear strategy: aggressive saving, intelligent investing, and disciplined spending.

This isn't your typical retirement timeline. It requires a complete shift in how you think about money, moving you past the slow-and-steady approach to build a serious nest egg much, much faster. This journey has less to do with luck and everything to do with creating a financial blueprint you can actually follow.

Your Blueprint for Retiring at 50

Leaving the workforce decades ahead of schedule is a calculated financial objective. It’s built on the core principles of financial independence, which is a world away from standard retirement planning that assumes you’ll be working well into your 60s.

Financial independence means one thing: accumulating enough income-generating assets to cover your living expenses forever, without ever needing to work again.

Getting there demands a deliberate change in mindset. Simply tucking away 10-15% of your income won't cut it. Instead, you need a more focused approach where every financial decision—from your daily coffee to long-term investments—is weighed against your early retirement goal.

The Three Pillars of Early Retirement

Achieving this kind of financial freedom by 50 really boils down to mastering three core areas. Think of these as the foundation of your entire strategy; they have to work together to speed up your progress.

- Aggressive Saving: You can't hit an ambitious target with a timid savings rate. People who retire early are often saving 30%, 40%, or even over 50% of their income. This means making a conscious effort to cut spending and widen the gap between what you earn and what you spend.

- Intelligent Investing: Your savings need to be put to work. This is all about building a diversified, growth-focused investment portfolio designed to compound over time. The goal is to make your money work harder for you, so you don't have to.

- Disciplined Expense Management: You have to know where your money is going. This isn't about being cheap or living a life of extreme frugality. It's about intentional spending that lines up with your values and, more importantly, your long-term goals.

To help you visualize the path ahead, here's a look at the essential targets you'll need to hit.

| Milestone | Description | Target |

|---|---|---|

| Define Your "Why" | Clearly articulate the personal and financial reasons for retiring at 50. This is your core motivation. | A written statement of your retirement vision. |

| Calculate Your FI Number | Determine the total nest egg needed to cover your annual expenses indefinitely. | 25-30x your projected annual retirement spending. |

| Achieve High Savings Rate | Systematically increase the percentage of your income you save and invest. | 30-50%+ of after-tax income. |

| Optimize Investments | Build and maintain a diversified, low-cost portfolio aligned with a long-term growth strategy. | An asset allocation that matches your risk tolerance. |

| Track Net Worth | Regularly monitor your financial progress to stay on track and make necessary adjustments. | Monthly or quarterly review. |

This table isn't just a set of goals; it's your roadmap. Each milestone is a critical step toward making retirement at 50 a reality.

Setting a Tangible Target

The very first step is to put a number on your goal. A good rule of thumb for early retirees is to accumulate roughly 25 to 30 times their expected annual expenses by the time they hang it up.

So, if you think you'll need $60,000 a year to live comfortably, your target nest egg is somewhere between $1.5 million and $1.8 million. Diving into how to calculate your own savings targets is a crucial first step.

Hitting that number by 50 requires a detailed plan. It's about turning a vague idea of "freedom" into a concrete set of numbers and actions you can track and execute over the next couple of decades.

Ultimately, the journey to retiring at 50 is a marathon, not a sprint. It demands consistency, patience, and a solid plan that you can stick with through market ups and downs and all of life's curveballs. This guide will give you that blueprint.

Calculating Your Financial Independence Number

Turning the dream of retiring at 50 into something real starts with a single, powerful figure: your Financial Independence (FI) number. This isn't just some arbitrary savings goal; it's the total amount of invested assets you need to fund your lifestyle for the rest of your life, without ever having to work again. Getting this number right is the most critical first step in building a roadmap you can actually follow.

The most common starting point for figuring out your FI number is the well-known 4% Rule. At its core, this guideline suggests you can safely withdraw 4% of your retirement portfolio in your first year, adjust that amount for inflation each year after, and have a very high chance of your money lasting at least 30 years.

To get your target number, you simply flip that rule on its head and multiply your projected annual retirement expenses by 25.

Your Annual Expenses x 25 = Your Financial Independence Number

This simple formula immediately shifts your thinking from a vague "I need to save a lot" mindset to a precise, motivating figure that will guide every financial decision you make from here on out.

Projecting Your Retirement Spending

Of course, before you can multiply by 25, you need a solid estimate of what you'll actually spend each year in retirement. This means doing a deep dive into your current expenses and making some thoughtful projections about how they'll change. The best way to start is by tracking your spending for a few months to get a truly clear picture of where your money is going now.

From there, it's time to look ahead. You'll need to adjust for how life will be different in retirement.

- Healthcare: This is often the biggest question mark for early retirees. Without a job providing insurance, you'll be on the hook for ACA marketplace plans or private insurance, which can easily run into thousands of dollars a year.

- Travel and Hobbies: You're planning for decades of freedom. Be honest with yourself about how much you want to spend on the travel, hobbies, and other lifestyle goals you've been putting off.

- Housing: Will your mortgage be paid off by 50? Do you see yourself downsizing or maybe even relocating to an area with a lower cost of living?

- Inflation: Your money has to keep its buying power for 40 years or more. Historically, inflation has hovered around 3% per year, so your expense projections absolutely must account for this slow but steady erosion.

Working through this process helps you define what a good monthly retirement income looks like for you. For a more detailed breakdown, you can explore our guide on planning your retirement income.

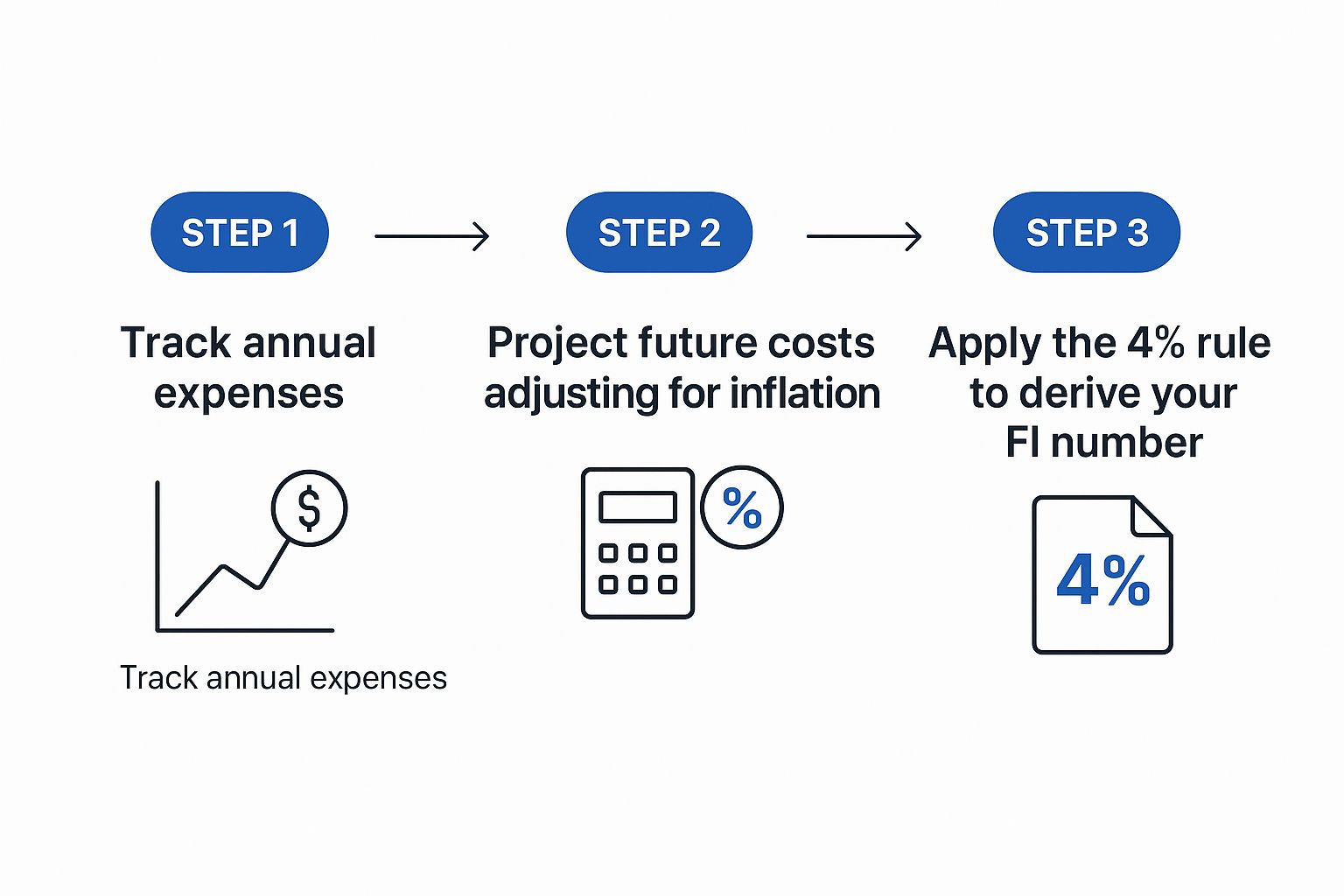

This infographic breaks down the simple logic behind calculating your target number.

As you can see, it boils down to three key parts: know what you spend now, project those costs into the future, and apply the 25x rule to get your final goal.

Real-World FI Number Scenarios

Your FI number is deeply personal. It's tied directly to the life you want to live. A 30-year-old couple dreaming of backpacking across Europe will have a vastly different target than a 35-year-old professional who's happy with a quiet life at home.

Let's look at a couple of examples.

Example 1: The Adventurous Couple

A couple, both 30, wants an active retirement packed with international travel. They estimate their annual expenses will be $80,000.

- FI Number: $80,000 x 25 = $2,000,000

Example 2: The Homebody Professional

A single 35-year-old is planning for a simpler retirement. With their mortgage paid off, they project annual expenses of $50,000.

- FI Number: $50,000 x 25 = $1,250,000

It’s amazing how much of a difference lifestyle makes. A $30,000 gap in annual spending creates a massive $750,000 difference in the nest egg required to support it.

Adjusting for a Longer Retirement

Here’s a crucial point: the 4% Rule was originally stress-tested for a traditional 30-year retirement. When you hang it up at 50, you're planning for a timeline that could easily stretch 40, 50, or even 60 years. That longer horizon introduces more risk and uncertainty, like the possibility of living through several major market downturns.

Because of this, many early retirees choose to be more conservative with their withdrawal rate to give their plan a higher chance of success.

- A 3.5% withdrawal rate (annual expenses x 28.5) gives your portfolio more breathing room and increases its longevity.

- A 3% withdrawal rate (annual expenses x 33.3) provides an even bigger safety margin for true peace of mind.

Going with a more conservative rate means you'll need a larger nest egg, but it buys you a whole lot of confidence. For our adventurous couple needing $80,000 a year, dropping to a 3.5% withdrawal rate would bump their FI number from $2 million to about $2.28 million. That extra buffer could be the very thing that ensures your money outlives you.

Building Your Early Retirement Portfolio

Simply saving cash is a slow, uphill battle against inflation. If you want to build the kind of wealth that lets you retire at 50, you have to put your money to work through smart investing. A well-designed portfolio doesn’t just sit there; it actively grows, turning your aggressive savings into a nest egg that can support you for decades.

This is where the magic of compounding really kicks in. Compounding is how you earn returns not just on your original investment, but on the accumulated returns as well. It creates a snowball effect that can turn a modest sum into a fortune over time, making it your single greatest tool on the path to an early exit from the workforce.

Crafting a Growth-Oriented Strategy

To hit your FI number by age 50, your portfolio needs to be built for long-term growth. For most people, this means creating a solid foundation with low-cost, diversified investments like index funds and exchange-traded funds (ETFs).

These funds hold a basket of stocks—like all the companies in the S&P 500—giving you broad exposure to the market without forcing you to become a stock-picking genius. This approach has some serious advantages:

- Instant Diversification: You own a tiny piece of hundreds or thousands of companies, which dramatically reduces your risk. If one company tanks, its impact on your overall portfolio is minimal.

- Low Costs: Index funds and ETFs are known for their rock-bottom expense ratios compared to actively managed funds. Over decades, those small savings can add up to tens of thousands of extra dollars in your pocket.

- Proven Performance: History has shown that even professional fund managers struggle to consistently beat the market average. By simply matching the market, you're already outperforming the vast majority of active investors.

This strategy is the polar opposite of riskier moves like day trading or dumping all your money into a few individual stocks. While those bets can produce huge wins, they also carry the risk of devastating losses that could push your retirement goal back by years.

Aligning Your Portfolio with Your Timeline

Your asset allocation—the specific mix of stocks, bonds, and other assets you hold—is crucial. Since you have a couple of decades until your target retirement age of 50, you can generally afford to take on more risk in exchange for higher potential returns.

A common starting point for someone in their 30s might be 80-90% stocks and 10-20% bonds. Think of stocks as the engine for growth and bonds as the shock absorbers that add stability during market downturns. As you get closer to 50, you can gradually shift this mix to be more conservative, protecting the wealth you've worked so hard to build.

Remember, your risk tolerance is deeply personal. The right portfolio is one that lets you sleep at night, even when the market gets choppy. Don't chase someone else's high-risk strategy if it doesn't align with your own comfort level.

Maximizing Your Tax-Advantaged Accounts

The government offers some incredibly powerful tools to help you save for retirement. Using them to their full potential is non-negotiable if you're serious about retiring early.

First, contribute enough to your employer's 401(k) to get the full company match—it's literally free money. After that, your next priority should be maxing out a Roth IRA. Roth contributions are made with after-tax dollars, which means all your qualified withdrawals in retirement are completely tax-free.

Once your IRA is maxed out, circle back to your 401(k) and contribute as much as you possibly can, up to the annual limit. These pre-tax contributions lower your taxable income today, giving you an immediate tax break that frees up more cash for investing. Many people find themselves needing to tap into these funds early, and you can learn more from our comprehensive guide on accessing your 401(k) funds.

If you’re fortunate enough to max out both your 401(k) and IRA, the next stop is a taxable brokerage account. It doesn't have the same tax perks, but it offers complete flexibility with no contribution limits.

The Psychology of Staying the Course

Building a portfolio is only half the job; the other half is sticking to your plan when things get scary. Market crashes are a normal, inevitable part of the investing cycle. The S&P 500 has weathered dozens of corrections (a drop of 10% or more) over the last 50 years, and it has always recovered to reach new highs.

When the market tumbles, every instinct will scream at you to sell and cut your losses. Giving in to that fear is one of the most destructive mistakes you can make as an investor. Successful early retirees understand that market downturns are actually buying opportunities.

By continuing to invest consistently through thick and thin, you're practicing dollar-cost averaging. You automatically buy more shares when prices are low and fewer when they are high. This discipline is what separates those who reach their goals from those who panic and fall short. Your journey to retiring at 50 is a marathon, and emotional discipline is what will get you across the finish line.

Supercharge Your Savings Without Sacrificing Your Life

Let's be blunt: a standard 15% savings rate isn't going to cut it for early retirement. That might work if you plan to clock out at 65, but it's just not enough gas in the tank to reach financial freedom by 50.

To hit an ambitious target like that, you need to think bigger. We're talking about a much higher savings rate—often 30%, 40%, or even more of your income. Now, before that number sends you running, know this: it doesn't mean you have to give up everything you enjoy. It’s about being smart, not just frugal.

The trick is to focus your energy where it makes the biggest difference. By making a few strategic, intentional changes to your largest expenses, you can free up a surprising amount of cash and dramatically speed up your investment timeline.

Master the Big Three Expenses

For most of us, the lion's share of our money goes to just three things: housing, transportation, and food. These are the "big levers" you can pull to make a real dent in your spending and boost your savings rate without obsessing over every latte.

Small optimizations in these areas can unlock thousands of dollars a year.

- Housing: This is almost always the biggest opportunity. Could you downsize? Relocate to a lower cost-of-living area? Or maybe "house hack" by renting out a spare room or basement apartment to have someone else pay down your mortgage? Even a simple refinance to a lower interest rate can free up hundreds each month.

- Transportation: Your car is likely your second-largest expense. It's time to question the status quo. Think about becoming a one-car family, buying reliable used cars instead of new, or maybe even moving closer to work. Just by driving an older, paid-off car, you could save $500 or more per month compared to a new car payment and the higher insurance that comes with it.

- Food: This one sneaks up on you because it's a daily expense. The goal isn't to live on rice and beans, but to be more intentional. Focus on meal planning, cooking at home more often, and buying staples in bulk. Cutting back from eating out three times a week to just once can easily put $300 a month back in your pocket.

The goal isn't deprivation; it's optimization. A few smart decisions about these major expenses can have a greater impact than a hundred small sacrifices, allowing you to supercharge your savings while still enjoying life.

Expand the Gap by Increasing Your Income

Cutting expenses is only half the battle. The other, often more powerful side of the equation, is actively increasing your income. Widening the gap between what you earn and what you spend from both ends is the absolute fastest way to build wealth and hit that age-50 retirement goal.

Think about it: even a modest bump in your income, when directed entirely toward your investments, can shave years off your working life. The best part? Once you've optimized your spending, any new income becomes pure savings fuel.

Actionable Ways to Boost Your Earnings

There are countless ways to bring in more money each month. The key is finding a strategy that aligns with your skills, your schedule, and what you actually want to do.

Negotiate a Raise

Your primary job is your most powerful wealth-building tool. Don't leave money on the table. Regularly research your market value, document your wins at work, and professionally negotiate your salary. This can easily lead to a 5-10% pay bump, or sometimes much more.

Develop a Side Hustle

Turn a skill or a hobby into a real income stream. This could be anything from freelance writing and graphic design to tutoring, consulting, or starting a small e-commerce shop. A side hustle that brings in an extra $1,000 per month adds $12,000 to your investment portfolio every single year.

Create Passive Income Streams

This is the holy grail for any aspiring early retiree. Passive income is money you earn with minimal ongoing effort. This could mean investing in dividend-paying stocks, exploring real estate crowdfunding, or creating a digital product like an e-book or an online course that generates revenue while you sleep.

Finding a sustainable balance is what makes this whole thing work. By strategically cutting your biggest costs while actively finding ways to earn more, you create a powerful financial engine. This is how you build a secure future without feeling like you're sacrificing the present.

Navigating Healthcare and Taxes in Early Retirement

Cracking the code on healthcare and taxes is the bedrock of a solid plan to retire at 50. If you don't have a strategy for these two giants, even the most carefully built nest egg is at risk. When you walk away from your job, you're also walking away from employer-subsidized health insurance and predictable paychecks. Suddenly, you're your own benefits manager.

It's a big shift, no doubt, but it's completely doable with some smart planning. The whole game is about understanding your options and setting up your finances to keep these costs as low as possible. You want to preserve your capital so it can do its job for the long haul.

Securing Affordable Healthcare Before Medicare

One of the first puzzles every early retiree has to solve is that 15-year gap between retiring at 50 and Medicare kicking in at 65. Thankfully, you have better options than just sticking with a pricey COBRA plan.

Most people turn to the Affordable Care Act (ACA) Marketplace. The beauty of these plans is that your premiums are tied to your Modified Adjusted Gross Income (MAGI) for the year. This is a massive lever for early retirees because you now have direct control over how much income you realize each year.

By keeping your taxable income low through strategic withdrawals, you can often qualify for huge Premium Tax Credits (subsidies). These credits can slash your monthly health insurance bill. It’s not uncommon for early retirees to lock in excellent coverage for just a few hundred bucks a month this way.

Planning your income to qualify for ACA subsidies is one of the most powerful financial moves an early retiree can make. It’s not about earning less, but about realizing income in the most tax-efficient way possible.

There are other routes, too, like health sharing ministries. They aren't traditional insurance, and you have to dig into the details—they aren't required to cover pre-existing conditions, for example. But for some, they can be a lower-cost alternative worth exploring.

The Power of a Health Savings Account

I'm convinced a Health Savings Account (HSA) is the single best retirement tool out there, especially if you're planning to leave the workforce early. If you have a high-deductible health plan (HDHP), you can contribute to an HSA, which gives you a triple-tax advantage you can't find anywhere else:

- Tax-Deductible Contributions: The money you put in lowers your taxable income right now.

- Tax-Free Growth: Your HSA funds can be invested, and they grow completely tax-free.

- Tax-Free Withdrawals: You can pull money out for qualified medical expenses at any time, totally tax-free.

Think of it as a supercharged IRA just for medical costs. By maxing out your HSA while you're still working, you're building a dedicated, tax-free war chest to cover healthcare expenses for the rest of your life.

Creating a Tax-Efficient Withdrawal Strategy

Your other big challenge is getting to your retirement money before age 59½ without getting hit by the IRS's 10% early withdrawal penalty. At the same time, you need to manage those withdrawals to keep your taxable income low and hold onto those valuable ACA subsidies.

There are a few well-established ways to do this, all perfectly legal and effective.

-

The Rule of 55: This is a fantastic option, but it has a specific trigger. If you leave your job in the calendar year you turn 55 (or later), you can take penalty-free withdrawals from that specific company's 401(k) or 403(b). The catch? It doesn't help you if you retire at 50.

-

Roth Conversion Ladder: This is a popular strategy. You convert money from a traditional, pre-tax account (like an IRA or 401(k)) into a Roth IRA. You have to pay income tax on the amount you convert that year. But after a five-year aging period, you can withdraw that converted principal—not the earnings—completely tax-free and penalty-free.

-

Substantially Equal Periodic Payments (SEPP): Often called a 72(t) distribution, a SEPP plan lets you take a series of calculated annual withdrawals from your IRA without a penalty. The rules are very strict. You have to stick to the payment schedule for at least five years or until you turn 59½, whichever is longer. To get a handle on the mechanics, check out our in-depth guide on how 72(t) distributions work.

By layering these strategies—maybe living off a taxable brokerage account for the first few years, getting a Roth ladder "cooking," and maybe even using a SEPP for steady income—you can build a flexible, tax-smart income stream to fund your life from 50 until all your accounts are open for business.

Common Questions About Retiring at 50

Even with the best roadmap, aiming to retire at 50 brings up a ton of "what if" scenarios. It's only natural. Let's be honest, walking away from work a decade and a half early is a big move, and you need to feel confident in your plan.

Think of this as digging into the nitty-gritty. We’ve covered the broad strokes, but now it’s time to tackle the specific questions that can trip people up. Answering these is key to making sure your strategy is built to last.

What if I Start Planning in My Late 30s or 40s?

Look, it's absolutely possible to pull this off if you're starting later in the game. But you have to be realistic—the intensity level gets dialed way up. A 25-year-old has a long runway for their investments to compound. If you're starting at 38 or 42, that runway is much shorter. You have to make up for lost time with sheer force.

The core principles don't change, but your timeline is compressed. That means your savings rate has to be your absolute top priority. We're talking 50% or more of your after-tax income, which requires a relentless focus on both sides of the coin: slashing expenses while aggressively boosting your income.

Here's what your game plan will likely involve:

- Supercharge Your Accounts: You need to be maxing out every single tax-advantaged account you can get your hands on—401(k), IRA, HSA, you name it. No exceptions.

- Destroy High-Interest Debt: Credit card balances and personal loans are like an anchor dragging you down. They have to go. Immediately.

- Invest for Maximum Growth: With less time on your side, your portfolio needs to work harder. This usually means a heavier allocation to growth-focused assets like stocks.

- Be Flexible with the Finish Line: Don't get so fixated on 50 that you miss the bigger picture. Shifting your target to 52 or 54 might be what it takes. A few extra years of extreme saving can make an unbelievable difference.

How Do I Access My Funds Before Age 59½?

This is probably the single most important technical question for any early retiree. We all know the IRS hits you with a nasty 10% penalty for touching most retirement accounts before age 59½. But thankfully, there are well-established, totally legal ways around it.

For someone retiring at 50, the two most common strategies are the Roth Conversion Ladder and Substantially Equal Periodic Payments (SEPP).

A Roth Conversion Ladder is a clever way to access your pre-tax retirement money. You systematically move funds from a traditional IRA or 401(k) into a Roth IRA. You'll owe income tax on whatever you convert that year, but here’s the magic: once each conversion has "seasoned" for five years, you can pull out the converted principal (the original amount you moved) completely tax- and penalty-free.

A SEPP plan, which you might also hear called a 72(t) distribution, is different. It lets you take a series of calculated annual payments from your IRA without a penalty. The catch? The rules are incredibly strict. You have to stick to the calculated payment amount for at least five years or until you turn 59½, whichever is longer. It provides a steady, predictable income stream but doesn't offer much flexibility.

A lot of savvy early retirement plans actually use a mix of strategies. You might live off a taxable brokerage account for the first few years, giving your Roth conversions time to season. This creates a seamless bridge to penalty-free income.

How Does My Plan Handle Major Life Events?

A financial plan that shatters the first time life throws you a curveball isn't much of a plan. A strong early retirement strategy is built to be adaptable, with buffers for things like having kids, a medical emergency, or a nasty market crash.

If kids enter the picture, you absolutely have to revisit your Financial Independence number. You’ll need to project new costs for everything from daycare to college savings. This will almost certainly push your savings target higher and might add a few years to your timeline. That's not failure; it's just adjusting the plan to fit your life.

When it comes to market crashes, your best defense is a long-term mindset and a solid cash buffer.

- Don't Panic Sell: Market history has proven one thing again and again: it always recovers. Selling everything in a downturn is the single most destructive thing you can do to your portfolio.

- Keep a Cash Cushion: Having 1-2 years of living expenses parked in a safe, liquid account (like a high-yield savings account) is a game-changer. It means you can pay your bills without being forced to sell your investments when they're at their lowest point.

Your plan isn't meant to be carved in stone. It's a living, breathing document that evolves right along with you.

Is the 4% Rule Realistic for a 40-Year Retirement?

The 4% Rule is a fantastic starting point, but it's important to remember what it was designed for: a traditional 30-year retirement. When you retire at 50, you could easily be looking at a 40- or even 50-year retirement. That longer timeframe exposes your portfolio to a lot more risk and uncertainty.

Because of this, many early retirees and financial planners lean toward a more conservative withdrawal rate. Dropping down to 3.5% or even 3% dramatically increases the odds that your money will outlast you. Yes, it means you need a bigger nest egg to start with, but it buys you an incredible amount of peace of mind.

It’s also smart to think dynamically about your withdrawals.

- In years when the market soars, feel free to take your full planned amount.

- But in years when the market is down significantly, you could temporarily tighten your belt a bit. This simple adjustment gives your portfolio precious breathing room to recover.

This kind of flexibility is the real secret to making your money last, ensuring your early retirement is not only achievable but sustainable for the long haul.

Navigating complex withdrawal strategies like a 72(t) SEPP can feel daunting, but you don't have to do it alone. At Spivak Financial Group, we specialize in helping individuals unlock their retirement funds early, providing the expertise needed to build a penalty-free income stream.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

Explore your options and take the next step toward financial freedom by visiting us at https://72tprofessor.com.