Life happens, and sometimes you need to tap into your 401(k) before you officially retire. It’s a huge financial decision, and knowing your options is the first step to making a smart one. We're not just talking about one way to do this; there are a few distinct paths, each with its own set of rules, tax implications, and penalties.

Understanding Your Options to Access 401k Funds

Thinking about dipping into your retirement savings early requires some serious thought. Your 401(k) is built for the long game, but sometimes life throws a curveball that makes you consider using those funds right now. The good news? You have options. The bad news? They all come with strings attached.

It's critical to understand the difference between borrowing from your account and taking a permanent withdrawal. A 401(k) loan is essentially an advance from your future self—you have to pay it back, with interest. A withdrawal, on the other hand, is a one-way street. That money is gone from your nest egg for good.

The Three Main Pathways

When you start digging into how to get money out of your 401(k), you'll find it boils down to three main choices. Getting these straight is absolutely crucial for protecting your financial future.

- 401(k) Loans: This lets you borrow against your vested balance, usually up to 50% of your account or $50,000, whichever is less. You typically have five years to pay it back. The big advantage here is that since it's a loan, you don't get hit with immediate taxes or the 10% early withdrawal penalty, as long as you stick to the repayment plan.

- Hardship Withdrawals: If you're facing what the IRS calls an "immediate and heavy financial need," you might qualify for a hardship withdrawal. This isn't a loan; the money is yours. But it comes at a cost. You'll owe ordinary income tax on the amount, and if you're under age 59½, you'll almost certainly get hit with a hefty 10% early withdrawal penalty.

- Penalty-Free Distributions: The IRS does have a heart… sometimes. There are specific exceptions to that 10% penalty. These can include becoming totally and permanently disabled, having certain high medical bills, or leaving your job in or after the year you turn 55 (often called the Rule of 55). Another powerful, though complex, strategy is setting up a Series of Substantially Equal Periodic Payments (SEPP), also known as a 72(t) distribution plan.

These aren't just simple transactions; their impact is massive. Consider the scale of retirement savings in America. As of the second quarter of 2025, total U.S. retirement assets hit an incredible $45.8 trillion. Defined contribution plans like 401(k)s accounted for about $13.0 trillion of that, a 6.4% jump from the prior quarter. With so much wealth on the line, navigating the rules for early access correctly is paramount. For a deeper dive into the numbers, you can check out the full statistical report from ICI.

To make sense of these options at a glance, here’s a quick breakdown of how they stack up against each other.

Quick Comparison of 401k Access Methods

| Method | Is it a Withdrawal? | 10% Early Penalty Applies? | Income Tax Due? | Best For |

|---|---|---|---|---|

| 401(k) Loan | No, it's a loan. | No, if repaid on time. | No, unless you default. | Short-term cash needs when you can afford the repayments. |

| Hardship Withdrawal | Yes, permanent. | Yes, typically. | Yes, on the full amount. | True, documented financial emergencies as defined by the IRS. |

| Penalty-Free Distribution | Yes, permanent. | No, if you qualify. | Yes, on the full amount. | Specific situations like disability, high medical costs, or planned early retirement. |

This table gives you a high-level view, but the devil is always in the details. The true cost of accessing your 401(k) early goes far beyond the immediate hit to your wallet.

Immediate Costs vs. Long-Term Impact

Every time you pull money from your 401(k) ahead of schedule, you're making a trade-off. There are the costs you see right away, and then there are the ones that sneak up on you decades later.

The immediate hit is from taxes and penalties. A $20,000 hardship withdrawal doesn't mean you get $20,000. After a mandatory 20% federal tax withholding and that 10% penalty, your check might only be for $14,000, and that's before state taxes even get involved.

The real long-term cost is the loss of future growth. Money taken out of your 401(k) today can't benefit from decades of compound interest, potentially costing you hundreds of thousands of dollars by the time you reach retirement age.

This loss of compounding is the silent killer of retirement dreams. It's the cost that people often forget to calculate, but it can be the most damaging part of an early withdrawal. Before you make a move, you have to look past the immediate need and understand exactly what you'll be giving up down the road.

Weighing 401k Loans vs. Hardship Withdrawals

When an unexpected bill lands in your lap, that big number in your 401(k) statement can look mighty tempting. It’s your money, after all. For people still working, the two most common ways to tap into those funds are a 401(k) loan or a hardship withdrawal.

They both get cash in your pocket, but that's where the similarities end. These two options operate under completely different rules and can have profoundly different impacts on your financial future.

One is like borrowing from yourself and paying it back. The other is a permanent removal of funds from your retirement savings, and it comes with a steep price. Making the right call starts with understanding exactly what you're getting into.

The Mechanics of a 401k Loan

Think of a 401(k) loan less like a traditional bank loan and more like an advance on your own savings. You’re borrowing your money and paying yourself back, with interest. That interest, by the way, goes right back into your own retirement account, not a lender’s pocket.

Most plans let you borrow up to 50% of your vested balance, topping out at a maximum of $50,000. You typically have up to five years to pay it back, and the payments are conveniently deducted right from your paycheck.

The biggest selling point? A 401(k) loan lets you sidestep immediate taxes and penalties. As long as you stick to the repayment plan, the IRS doesn't consider it a taxable event.

But there’s a major catch, and it’s tied directly to your job. If you leave—whether you quit, get laid off, or are fired—the full loan balance often comes due way ahead of schedule. Under current rules, you usually have until that year's tax filing deadline to repay it all. If you can't, the outstanding balance is treated as a distribution. That means income taxes and, if you're under 59½, that brutal 10% early withdrawal penalty.

Understanding the Criteria for a Hardship Withdrawal

A hardship withdrawal is a completely different animal. This isn't a loan. It's a permanent distribution from your account, and you can only take one if you’re facing what the IRS calls an "immediate and heavy financial need."

You can't just decide you need the money; you have to prove it. The IRS lays out specific "safe harbor" reasons that automatically qualify:

- Certain medical expenses for you, your spouse, or dependents.

- Costs directly related to buying your main home (excluding mortgage payments).

- Tuition, educational fees, and room and board for the next 12 months for you, your spouse, or dependents.

- Payments needed to prevent eviction or foreclosure on your main home.

- Burial or funeral expenses.

- Certain expenses for repairing damage to your main home.

You’ll have to show your plan administrator the receipts and documents to back up your claim. This money is gone for good, and you’ll owe ordinary income tax on every dollar you take out.

A Growing Trend in Financial Distress

The number of people turning to hardship withdrawals has skyrocketed, painting a clear picture of the financial strain many families are under. After years of staying relatively flat, these withdrawals surged by 85% in 2022 compared to the previous five-year average.

That trend didn't just continue; it exploded. Withdrawals jumped 208% in 2023, 318% in 2024, and hit a staggering 365% increase by 2025. Recent legislation like the SECURE 2.0 Act has made this option more accessible, even waiving the 10% penalty in some situations, which has only added fuel to the fire. You can see more on these trends in hardship withdrawals from Paychex.

Comparing the Long-Term Costs

Let's walk through a real-world scenario. Say you need $20,000 for a critical home repair.

- With a Loan: You borrow the $20,000. Your take-home pay gets a little smaller to cover the repayments over the next five years. While that $20,000 isn't invested and growing, the interest you pay goes back into your account. The biggest risk here is losing your job.

- With a Hardship Withdrawal: You request a $20,000 withdrawal. Your plan will likely withhold 20% for federal taxes right off the top, so you'd only get $16,000. To get the full $20,000 you need, you'd actually have to withdraw more to cover the tax hit. That money is gone forever, sacrificing every bit of future compound growth it would have earned.

While a loan keeps your retirement account intact, it introduces the risk of a massive tax bill if you lose your job. A hardship withdrawal gives you cash with no strings attached for repayment, but it deals a permanent—and often costly—blow to your nest egg.

For anyone looking for penalty-free income without these risks, there are other strategies to consider. You can compare borrowing from a 401k versus using a 72(t) SEPP to see how different approaches line up with your long-term goals. Ultimately, the right choice comes down to your job stability, the urgency of your need, and your personal tolerance for risk.

Finding Penalty-Free Withdrawal Strategies

Tapping into your 401(k) before retirement often brings up the dreaded 10% early withdrawal penalty. While this is a very real concern for anyone under age 59½, it's not some unbreakable law. In fact, the tax code has several powerful, yet often overlooked, exceptions designed to help you out in specific life circumstances.

Getting familiar with these strategies is the key to accessing your own money without handing an extra 10% over to the IRS. These aren't shady loopholes; they're legitimate provisions for situations ranging from an early retirement plan to a serious personal hardship. Just knowing you might qualify can make a huge difference to your financial picture.

The Rule of 55 Explained

One of the most common and useful strategies is what's known as the "Rule of 55." The concept is pretty simple: if you leave your job—whether you quit, get laid off, or retire—in or after the calendar year you turn 55, you can start taking distributions from that specific employer's 401(k) without the penalty.

Now, here’s the critical detail: this rule only applies to the 401(k) from the company you just left. If you have old 401(k) accounts from previous jobs, you can't touch them penalty-free under this rule—unless you were savvy enough to roll them into your current 401(k) before you separated from your job.

The Rule of 55 is a direct path to your retirement funds if you're planning to retire early. But don't forget, while the 10% penalty is off the table, these distributions are still considered ordinary income and will be taxed accordingly.

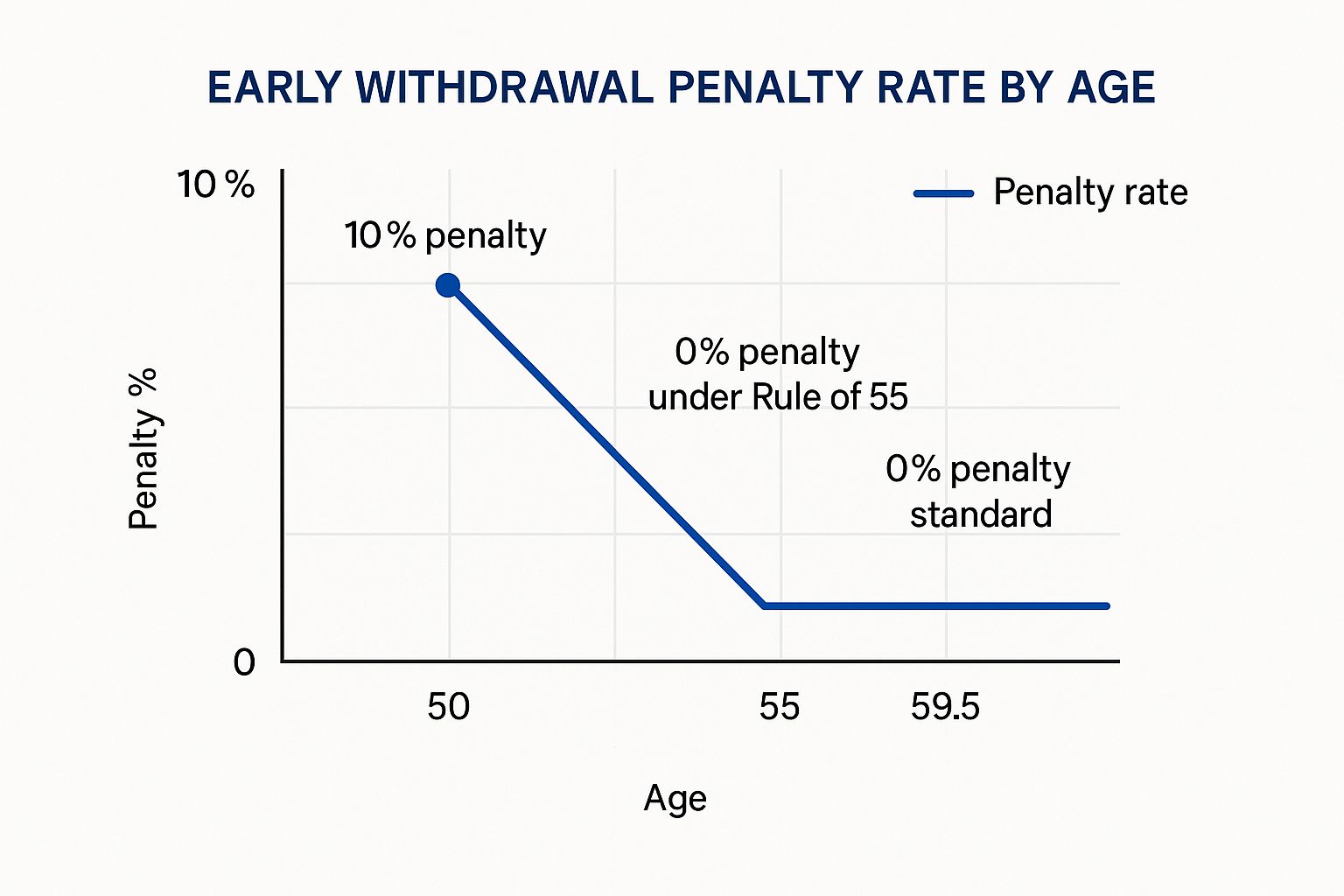

This infographic really puts into perspective how the penalty landscape shifts as you get closer to the traditional retirement age.

As you can see, hitting that age 55 milestone right as you leave your job completely changes the game, wiping out a penalty that would have applied just a few years earlier.

Other Key Penalty Waivers

The Rule of 55 is a big one, but the IRS has several other important exceptions to that early withdrawal penalty. They’re designed to give you some financial breathing room during life's most challenging moments, but each has its own set of specific requirements.

- Total and Permanent Disability: If a physician certifies that you are totally and permanently disabled and unable to perform any substantial work, you can access your 401(k) funds without the 10% penalty. Proper medical documentation is non-negotiable here.

- Unreimbursed Medical Expenses: You can take penalty-free withdrawals to pay for medical bills that are more than 7.5% of your adjusted gross income (AGI). The best part? You don't even have to itemize your deductions on your tax return to use this exception.

- Distributions to a Beneficiary: If you inherit a 401(k), you can take money out as a beneficiary without getting hit with the 10% penalty, no matter how old you are. Keep in mind, you'll still owe income tax on the withdrawals.

- Qualified Domestic Relations Order (QDRO): In a divorce, a court-issued QDRO allows 401(k) assets to be transferred to an ex-spouse without triggering the penalty.

Each of these situations demands careful paperwork and strict adherence to IRS rules. To dig deeper into the full list of exceptions, you can explore our guide on how to cash out your 401k without penalty.

Navigating these rules can feel like walking through a minefield, and one wrong move could be expensive. It's always a smart move to talk with a financial professional at Spivak Financial Group to confirm that your situation qualifies and that you handle every step correctly. You can reach us at (844) 776-3728.

Using a 72(t) for Early Retirement Income

For anyone dreaming of leaving the workforce before the traditional retirement age, the biggest question is always the same: how do you create a steady income stream? This is where a 72(t) distribution comes in.

Officially known as a Substantially Equal Periodic Payment (SEPP), this is a powerful, IRS-approved tool designed for this exact scenario. It lets you take penalty-free withdrawals from your retirement account before you turn 59½.

This isn’t some obscure loophole. It's a specific provision in the tax code—section 72(t)—that allows you to essentially turn your nest egg into a predictable paycheck. By setting up a SEPP, you commit to receiving a carefully calculated annual payment, creating a reliable income bridge to carry you from your early retirement date all the way to age 59½.

But here's the catch: this strategy demands absolute precision and a firm commitment. Once you start a 72(t) plan, you are locked into the payment schedule. Any deviation can trigger severe financial consequences, which makes understanding all the rules upfront absolutely essential.

How 72(t) Payments Are Calculated

The IRS gives you three distinct methods to figure out your annual SEPP amount. Each one uses your account balance, your life expectancy, and a specific interest rate to arrive at a number, but the results can be wildly different. Picking the right one really boils down to your personal income needs and how comfortable you are with fluctuating payments.

- The Required Minimum Distribution (RMD) Method: This is the most straightforward formula. Your annual payment is simply your account balance divided by your life expectancy factor. The critical thing to know here is that this payment is recalculated every single year. That means your income will go up or down as your account balance and age change.

- The Fixed Amortization Method: This method calculates a fixed annual payment that stays the same for the entire life of the plan. It essentially amortizes your account balance over your life expectancy using a reasonable interest rate. The result is a stable and predictable income stream you can budget around year after year.

- The Fixed Annuitization Method: Much like the amortization method, this formula also gives you a fixed annual payment. It uses an annuity factor to determine a consistent income amount, though it often comes out slightly different than the amortization calculation.

The calculation method you choose at the very beginning is critical because it directly determines your annual income. The RMD method offers more flexibility with its variable payments, while the fixed methods provide the kind of stability many early retirees need for peace of mind.

Getting a handle on the nuances of these calculations is the first step. For a much deeper dive, you can learn more about how a 72(t) works in our in-depth guide.

Sticking to the Strict Rules

The biggest thing to wrap your head around with a 72(t) plan is its rigidity. Once you begin taking payments, you must continue them for at least five full years or until you reach age 59½, whichever period is longer. This isn't a suggestion—it’s a hard-and-fast IRS rule.

For example, if you start a SEPP at age 52, you’re on the hook for payments until you are 59½. But if you start at age 56, you have to continue them for a full five years, which takes you to age 61.

Breaking this rule, often called "busting the plan," comes with some nasty penalties. The IRS will retroactively hit you with the 10% early withdrawal penalty on every single distribution you've ever taken, plus interest. A mistake like that can easily wipe out a huge chunk of the funds you’ve already withdrawn.

To see how these methods play out in the real world, let's look at an example.

Comparing 72(t) SEPP Calculation Methods

The table below shows just how different the annual payments can be depending on the method you choose. The choice you make at the start has a massive impact on your cash flow for years to come.

| Calculation Method | Example Annual Payment | Payment Flexibility | Best Suited For |

|---|---|---|---|

| RMD Method | $18,868 (recalculated annually) | High (payments change yearly) | Those who need less income initially and can handle payment fluctuations. |

| Fixed Amortization | $25,320 (fixed for the plan's duration) | Low (payments are locked in) | Individuals who need a stable, predictable income for consistent budgeting. |

| Fixed Annuitization | $25,284 (fixed for the plan's duration) | Low (payments are locked in) | Retirees who prioritize a steady income stream, similar to the amortization method. |

This example is based on a hypothetical $500,000 account balance for a 50-year-old, using IRS-approved life expectancy tables and interest rates. Actual amounts will vary.

As you can see, the difference is huge. The fixed methods provide over $6,000 more in annual income in this particular scenario, but you're locked into that amount. The RMD method starts lower but gives you the potential for higher payments down the road if your investments do well.

A 72(t) SEPP can be a fantastic way to fund an early retirement, but this is not a DIY project. The calculations are complex and the rules are completely unforgiving. Working with a specialist at Spivak Financial Group can ensure your plan is set up correctly from day one, helping you create that penalty-free income stream without risking costly mistakes.

Understanding the True Cost of a 401k Withdrawal

Dipping into your 401(k) early can feel like a quick fix when you're in a financial bind. But the real cost goes way beyond the taxes and penalties you see upfront. The biggest hit—and the one most people miss—is something called opportunity cost.

Simply put, opportunity cost is the future growth you give up by taking that money out today. Every dollar you withdraw is a dollar that's no longer invested and working for you. It's pulled off the team, missing out on potentially decades of compound interest. This invisible cost can absolutely gut your nest egg by the time you're ready to retire.

The Long-Term Impact of Lost Compounding

Let’s look at a real-world scenario. Say a 40-year-old takes a $25,000 hardship withdrawal from their 401(k). If we assume a pretty standard average annual return of 7%, that decision doesn't just cost them $25,000.

Over the next 25 years, that money could have mushroomed into nearly $136,000. By pulling it out, they didn't just solve a short-term cash crunch; they effectively vaporized over $100,000 from their own retirement fund. That's the brutal reality of lost compounding.

The most expensive money you can spend is often the money you take from your future. A 401(k) withdrawal isn't just a transaction; it's a decision that echoes through time, fundamentally altering your financial trajectory.

Grasping this long-term damage is the first thing you must do before even thinking about how to take money from your 401(k). It forces you to ask a much better question: "Are there any other options?"

Exploring Smarter Alternatives First

Before you commit to raiding your retirement savings, you absolutely must exhaust every other possibility. Too many people treat their 401(k) as a first resort when it should always, always be the last.

Here are a few far better alternatives to look into first:

- Build a Dedicated Emergency Fund: Your first line of defense is always cash. Having three to six months of living expenses stashed in a high-yield savings account gives you instant access to funds without the taxes, penalties, or lost growth.

- Use a Home Equity Line of Credit (HELOC): If you own your home and have equity built up, a HELOC can be a fantastic tool. It offers a flexible line of credit, often at a much lower interest rate than other forms of debt.

- Secure a Personal Loan: The interest rates might be higher than a HELOC, but a personal loan from a bank or credit union is still a much smarter move than a 401(k) withdrawal. It has a clear end date and doesn't sabotage your future.

The data backs this up. Research shows that about one-third of people cash out their 401(k)s when they leave a job—a move that causes incredible damage to their retirement security. The same study found that people with just $2,000 in emergency savings were much less likely to take hardship withdrawals and were better at contributing consistently. You can read more on this in a great piece about how emergency savings protect retirement funds from Vanguard.

Ultimately, the best financial habit you can build is to treat your 401(k) as untouchable. By exploring these alternatives, you protect the powerful engine of compounding that is absolutely essential for building a secure retirement.

Common Questions About 401k Withdrawals

Digging into the world of 401(k)s can feel like trying to learn a new language, especially when you need to get your hands on that money. It’s completely natural to have questions about the process, the rules, and—most importantly—the consequences. Let's walk through some of the most common queries we see.

Can I Take Money from My 401k While Still Employed?

The short answer is yes, but your options are pretty limited. If you're still working for the company that sponsors your 401(k) and are under age 59½, you generally can't just take a standard distribution. For most people, the only ways to access that cash are through a 401(k) loan or a hardship withdrawal.

Both of these come with some serious strings attached. First, your plan has to even allow them. For a hardship withdrawal, you have to prove to the IRS that you have an "immediate and heavy financial need." Always start by checking your plan's specific rules in the Summary Plan Description (SPD).

How Long Does It Take to Get Money from a 401k?

This isn't like hitting the ATM. The timeline really depends on your plan's administrator and which type of withdrawal you’re making.

A 401(k) loan is often the fastest route, with funds sometimes landing in your account within a few business days to a week. A hardship withdrawal or a full distribution after leaving your job takes a bit longer—often between one and three weeks—because there's more paperwork and verification involved. Your plan administrator is the best source for an accurate timeline.

What Happens to My 401k Loan If I Leave My Job?

This is the one that catches so many people by surprise. If you leave your job for any reason—whether you quit or get laid off—with an outstanding 401(k) loan, the repayment clock suddenly speeds up. A lot.

You typically have until the tax filing deadline for that year (including extensions) to pay back the entire balance. If you can't, the outstanding loan amount is reclassified as a taxable distribution. That means you'll owe income tax on it, and if you're under 59½, you'll get slapped with the 10% early withdrawal penalty, too.

This loan default can create a surprise tax bomb that many people just aren't prepared for. It's one of the biggest risks of taking a 401(k) loan while you're still employed.

Do I Have to Pay State Taxes on a 401k Withdrawal?

In almost every case, yes. Your 401(k) withdrawal is definitely subject to federal income tax, and most states tax retirement distributions as regular income as well. Your plan will likely withhold a mandatory 20% for federal taxes, but you're often on your own for state taxes.

There are a handful of states with no income tax, and a few others that give special treatment to retirement income. But state tax laws can be tricky and they change all the time. Your best bet is to talk with a tax professional to figure out what you'll owe and avoid any nasty surprises down the road.

Navigating the complexities of 401(k) withdrawals requires careful planning and expert guidance. At Spivak Financial Group, we specialize in helping individuals create penalty-free income streams through strategies like the 72(t) SEPP. To explore your options and build a secure financial future, visit us at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728