So, you need to get money out of your 401(k) early. Let’s be real—life happens. The good news is you have options. Usually, this means going down one of three paths: a hardship withdrawal, a 401(k) loan, or just a straight-up early distribution.

Each route has its own set of rules and, you guessed it, distinct tax implications. No matter which you choose, the first step is always the same: contact your plan administrator to get the ball rolling and tackle the paperwork.

The Reality of Early 401k Withdrawals

Dipping into your retirement savings before you hit age 59½ is a major financial decision. It might feel like a quick fix for a pressing problem, but it almost always comes with long-term consequences. Before we get into the "how," it's critical to understand the true cost. This isn't just about getting cash now; it's about permanently changing your financial future.

The first hit you'll feel comes from taxes and penalties. The IRS typically slaps a 10% early withdrawal penalty on whatever you take out. Ouch. On top of that, the entire amount is considered ordinary income, so you'll owe federal and probably state income taxes on it. This one-two punch can easily turn a $20,000 withdrawal into less than $14,000 in your pocket, depending on your tax bracket.

Early 401(k) Withdrawal Options At a Glance

To make this clearer, let's break down the main ways you can access your funds before retirement age. This table gives you a quick snapshot of what to expect with each option.

| Withdrawal Type | 10% Penalty Applies? | Income Tax Applies? | Repayment Required? |

|---|---|---|---|

| Standard Early Withdrawal | Yes | Yes | No |

| Hardship Withdrawal | Yes | Yes | No |

| 401(k) Loan | No (if repaid) | No (if repaid) | Yes |

As you can see, a 401(k) loan is the only option that lets you avoid immediate taxes and penalties, but it comes with its own string attached: you have to pay it back. We'll dig deeper into these options, but this gives you a solid starting point for comparison.

The Hidden Cost of Lost Growth

Beyond the immediate financial sting, there’s a quieter, more damaging consequence: you lose out on future compound growth. When you pull money from your 401(k), you’re not just taking the principal. You’re also sacrificing all the potential earnings that money could have generated for you over the next few decades.

A seemingly small withdrawal today can create a massive shortfall in retirement. For example, taking out just $10,000 at age 35 could cost you over $75,000 in potential growth by the time you reach retirement age, assuming a modest 7% annual return.

And this isn't an uncommon scenario. In 2024, 4.8% of 401(k) holders took hardship distributions, while another 4.5% opted for non-hardship withdrawals. This highlights a growing trend of people using retirement accounts as emergency funds. If you want to dive deeper into this trend, Business Insider offers some great insights on early 401k withdrawals.

Understanding these costs gives you a realistic foundation for making your decision. While life throws curveballs, there are many valid reasons why you may need to access your 401k early. This guide will walk you through the process step-by-step, making sure you know exactly what’s at stake.

Calculating the True Cost of an Early Withdrawal

It's tempting to look at your 401(k) statement, see a big number, and think that's what you have to work with. But if you're thinking about cashing some of it out early, you're in for a surprise. The number you withdraw and the number that actually hits your bank account are often wildly different.

The real cost comes from a one-two punch of penalties and taxes that take a serious bite out of your funds before you ever see a dime.

The first hit is the one most people know about: the 10% early withdrawal penalty. This is the standard tax the IRS slaps on almost any distribution you take before you turn 59½. Let's say you pull out $20,000. Right off the top, $2,000 vanishes. Poof. Your withdrawal is already down to $18,000, and we haven't even gotten to the tax man yet.

Adding Income Tax to the Equation

This is where the financial pain really kicks in. The entire amount you withdraw—the full $20,000 in our example—is treated as ordinary income for the year. It gets piled right on top of your regular salary, which can easily bump you into a higher federal and even state tax bracket.

Imagine you’re in the 22% federal tax bracket. Taking out that $20,000 means you'll owe another $4,400 in federal income tax.

Let's do the painful math on that scenario:

- Initial Withdrawal: $20,000

- 10% IRS Penalty: -$2,000

- 22% Federal Income Tax: -$4,400

- Amount You Actually Get: $13,600 (and that's before state taxes)

Just like that, your $20,000 emergency fund shrinks to just $13,600. That’s a massive 32% cut, a stark reminder of how costly this move can be.

The Full Picture: A Real-World Example

Let's look at another common situation. Sarah makes $60,000 a year and needs $30,000 for a major, unexpected home repair. If she pulls that from her 401(k), her taxable income for the year jumps to $90,000, pushing a chunk of her earnings into a higher bracket.

The combination of the $3,000 penalty (10% of $30,000) and the higher income tax bill means she might only end up with about $20,000 in hand. The other $10,000 goes straight to the government.

The IRS rules are set up this way for a reason—to keep people from raiding their long-term retirement savings. Early distributions are designed to be painful unless you meet a specific exception, like a qualifying hardship. You can learn more about the IRS rules for hardships and early withdrawals directly on their site to see if your situation might qualify. Knowing these rules inside and out is the only way to figure out what an early withdrawal will truly cost you.

How to Qualify for Penalty-Free Exceptions

That 10% early withdrawal penalty feels like a brick wall for most people, but it’s not always set in stone. The IRS knows life happens, so they've carved out specific exceptions for certain situations.

Knowing these rules can be the difference between keeping a significant chunk of your hard-earned money and just handing it over. These aren't sneaky loopholes; they're financial lifelines for genuinely tough times. Think of something as serious as a total and permanent disability—obviously, in a case like that, the government isn't going to penalize you for accessing the funds you desperately need.

The Deal with Hardship Withdrawals

You've probably heard the term "hardship withdrawal" thrown around. It’s the most common way people access their 401(k) early, but there's a huge misconception here. A hardship withdrawal gets you access to the money, but in most cases, you still owe the 10% penalty on top of income taxes unless you meet a separate penalty exception.

Still, the sheer number of people taking them tells a story. Recent data from Paychex shows a staggering 365% surge in hardship withdrawals in 2025 compared to the pre-2022 average, mostly due to inflation and other financial pressures. It’s clear that more families are being forced to turn to their retirement savings as a last resort.

To even qualify for a hardship withdrawal, you have to prove an "immediate and heavy financial need." Typically, this includes things like:

- Unreimbursed medical bills for you or your family.

- Funds to prevent foreclosure on your primary home or eviction.

- Tuition and educational fees for the next 12 months.

- Money for a down payment on a primary residence (up to $10,000 can often be withdrawn penalty-free for a first home).

Beyond Hardships: Key Penalty-Free Scenarios

Hardship reasons open the door, but several other situations let you sidestep the 10% penalty entirely. The rules are constantly evolving, so it's smart to stay updated on the latest new 401k penalty-free withdrawal rules for emergencies.

One of the most powerful but lesser-known strategies is setting up Substantially Equal Periodic Payments (SEPP) under IRS Rule 72(t). This lets you take a series of penalty-free annual withdrawals for any reason at all.

This approach is perfect for funding an early retirement, but it's complex. You have to follow the rules to the letter, or you could face retroactive penalties. To see if it fits your plan, you need to understand the specifics here: https://72tprofessor.com/what-are-the-rules-for-a-72t-distribution/

Another big one is the Rule of 55. If you leave your job—whether you quit, get laid off, or retire—in or after the year you turn 55, you can take penalty-free withdrawals from that specific company's 401(k).

The IRS has a number of official exceptions that can save you from the 10% penalty. Here are some of the most common ones.

Common Exceptions to the 10% Early Withdrawal Penalty

| Exception Type | Brief Description | Key Requirement |

|---|---|---|

| Total & Permanent Disability | You can no longer work due to a physical or mental condition. | Requires proof from a physician that the condition is expected to be long-term or terminal. |

| Rule of 55 | You separate from service with your employer during or after the year you turn 55. | The withdrawal must be from the 401(k) of the employer you just left. |

| Medical Expenses | You have unreimbursed medical bills exceeding 7.5% of your adjusted gross income. | You don't have to itemize deductions, but the expenses must exceed the threshold. |

| IRS Levy | The IRS is seizing your assets to satisfy a tax debt. | The withdrawal is made to pay the IRS levy; only that amount is exempt. |

| Qualified Domestic Relations Order (QDRO) | A court orders a portion of your 401(k) to go to a spouse or dependent, typically in a divorce. | The withdrawal must be part of a legal QDRO settlement. |

| Military Reservist Called to Active Duty | You are a qualified reservist called to active duty for more than 179 days. | The distribution must be made during your active-duty period. |

This table isn't exhaustive, but it covers the main scenarios where you might be able to get your money early without that painful 10% hit. Always double-check the fine print for your specific situation.

The Practical Steps for Making a 401k Withdrawal

So, you’ve weighed the costs, looked at the penalty exceptions, and decided that tapping into your 401(k) is the right move. Knowing the exact steps transforms what feels like a monumental task into a totally manageable process. It’s all about being methodical and understanding how your specific plan works.

Your first move? Get in touch with your 401(k) plan administrator. This isn't your boss or someone in HR—it's the financial company managing the investments, like Fidelity or Vanguard. You can find their contact info right on your account statements or by logging into your online portal.

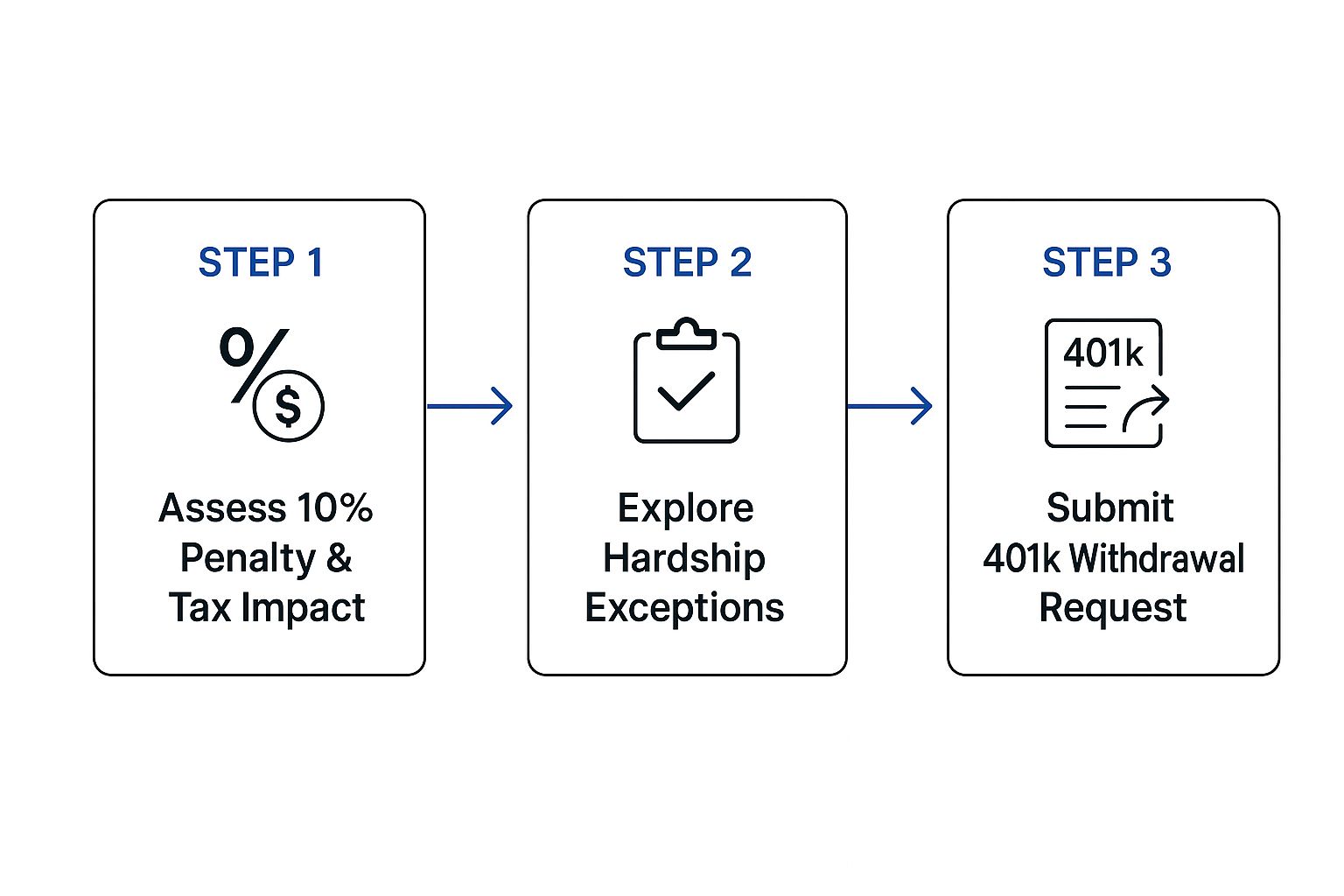

This visual guide gives you a quick, high-level overview of the whole process, from that initial gut check to finally hitting "submit."

Think of it as a simple flowchart for the journey ahead, reminding you to consider those pesky penalties and potential exceptions before you dive into the official paperwork.

Contacting Your Plan Administrator

When you get your administrator on the phone, you need to ask a few key questions to get the ball rolling. Don’t just say, “I need to withdraw money.” Getting specific from the get-go will save you a ton of time and potential headaches.

Here’s a quick list of what you should ask:

- What are the specific withdrawal options my plan allows (e.g., hardship, standard early distribution, loan)?

- What are the exact forms I’ll need for the withdrawal I’m requesting?

- If it’s a hardship claim, what kind of proof do you need? (Think medical bills, eviction notices, etc.)

- What’s the real-world timeline for processing the request and actually getting the funds?

Their answers will basically hand you a personalized roadmap. Every single plan has slightly different rules, so this step is absolutely non-negotiable.

Navigating the Paperwork

Alright, now for the paperwork. Your administrator will send over a distribution request form. This is where you’ll officially state how much you want and why. Fill this out with extreme care—I’ve seen simple errors send people right back to square one.

If you’re claiming a hardship, this is where you’ll submit your supporting documents. For instance, if you're trying to stop a foreclosure, you’ll almost certainly need to provide a copy of the default notice from your mortgage company. Keep everything organized to make the review process as smooth as possible for the person on the other end.

A critical piece of the puzzle is the tax withholding form, usually the IRS Form W-4R (Withholding Certificate for Nonperiodic Payments and Eligible Rollover Distributions). This form is where you tell them how much federal income tax to hold back upfront.

While the default is often a flat 20% withholding for many distributions, you might have the option to withhold more. Honestly, choosing to withhold a higher percentage can be a smart move to avoid a nasty, unexpected tax bill when you file your annual return. Mismanaging this step is a classic mistake that can have some serious financial consequences down the line.

Understanding the Timeline

Once you’ve submitted your completed application and all the required documents, the waiting game begins. The timeline can vary quite a bit, depending on the plan administrator and how complex your request is.

Generally speaking, you can expect it to take anywhere from a few business days to several weeks to see the money. A simple, straightforward withdrawal might get processed in 5-10 business days. But a hardship claim that requires someone to manually verify documents could easily take longer. The funds will typically arrive via direct deposit or a paper check, so double-check that your payment info is perfect on the forms.

Exploring Smarter Alternatives to a 401k Withdrawal

Dipping into your 401(k) before retirement should feel like a true last resort, almost like breaking the emergency glass on a fire alarm. Before you take that drastic step, it's absolutely crucial to explore other financial lifelines that could solve your immediate problem without torching your long-term security.

Taking money out of a 401(k) early isn’t just a simple transaction; it's a decision with lasting consequences. Think of it this way: you’re not just spending that money today. You’re also spending all the growth it would have generated for you over the next 10, 20, or even 30 years. That’s why walking through a checklist of alternatives first is so important.

Your Financial Toolkit of Alternatives

If you're facing an immediate cash crunch, there are several avenues to consider before you even think about that retirement account. For instance, you could explore various personal loan options. A personal loan from a bank or credit union can be a solid choice. While it comes with interest, that rate might be far lower than the effective 30% or more you could lose to taxes and penalties from an early 401(k) withdrawal.

Another powerful tool, especially for homeowners, is a Home Equity Line of Credit (HELOC). This lets you borrow against the equity you've painstakingly built in your home, often at a very competitive interest rate. It provides a flexible source of funds you can draw from as needed, which is ideal for ongoing expenses like medical bills or unexpected home renovations.

Sometimes, though, the simplest solution is the most direct. Before you start borrowing from any source, pick up the phone and try negotiating with your creditors. You might be surprised.

- Medical Bills: Hospitals and clinics are often more than willing to set up long-term, interest-free payment plans if you just ask.

- Credit Card Debt: A quick call to your credit card company could result in a temporarily lowered interest rate or a hardship plan that makes your payments much more manageable.

This proactive approach can often resolve a financial squeeze without creating new debt or, worse, raiding your future. The goal is always to find a solution that doesn't compromise the retirement you've worked so hard for.

Comparing Your Options Wisely

It’s also smart to weigh these alternatives against other ways of accessing retirement funds. A 401(k) loan, for example, is generally a much better option than an outright withdrawal because you’re repaying the funds to yourself—with interest—preserving your retirement principal.

But even a loan isn't the only specialized option on the table. For those planning a more structured early retirement, a 72(t) SEPP offers a way to create penalty-free income streams under specific IRS rules. You can find a detailed analysis of borrowing from your 401k versus a 72(t) SEPP to see which strategy might better align with your specific goals.

By thoroughly evaluating personal loans, HELOCs, and direct negotiations, you empower yourself to make a proactive financial decision, not a reactive one. This careful consideration ensures you're choosing the best path for both your present needs and your future self.

Frequently Asked Questions About 401k Withdrawals

It’s completely normal to have questions when you’re thinking about touching your 401(k) early. Even after you’ve weighed the pros and cons, the details can feel overwhelming. Let's walk through some of the most common questions we get, so you can feel more confident about your next steps.

Should I Take a 401k Loan Instead of a Withdrawal?

In many cases, taking a 401(k) loan is a much better move than an outright withdrawal. Think of it this way: you're borrowing from your future self and paying yourself back with interest, so the money eventually returns to your account. This strategy lets you sidestep the immediate pain of income taxes and that brutal 10% early withdrawal penalty, as long as you stick to the repayment plan (which is usually five years).

But there's a huge string attached. If you leave your job for any reason—quit, get laid off, whatever—the entire loan balance can become due right away. If you can't pay it back on schedule, the IRS reclassifies it as a distribution. Suddenly, you're on the hook for all the taxes and penalties you were trying to avoid in the first place.

Your very first move should be to call your plan administrator. Find out if they even offer loans and get the specific rules for repayment.

How Does an Early 401k Withdrawal Affect My Retirement?

Taking an early withdrawal hurts your retirement savings in two ways, and the second one is by far the most destructive. The first hit is obvious: the money you pull out is just gone. But the real, long-term damage comes from permanently erasing all the future compound growth that money would have generated.

A $10,000 withdrawal taken 30 years before retirement could cost you over $75,000 in potential gains, assuming an average annual return of 7%. It permanently shrinks your nest egg, making it significantly harder to reach your financial goals.

This isn't a small setback. It fundamentally alters your financial trajectory, and clawing your way back from that loss is incredibly difficult.

Will I Owe State Taxes on My 401k Withdrawal?

Almost definitely. On top of federal income tax and that potential 10% penalty, your state government will likely view your 401(k) distribution as taxable income. How much you'll owe is completely dependent on your state’s specific tax code.

The rules in Arizona are different from those in New York, and some states have no income tax at all. It's critical to account for both federal and state taxes to get a realistic picture of how much money you'll actually walk away with.

What Happens if I Forget to Report My Withdrawal on My Taxes?

"Forgetting" to report an early 401(k) distribution simply isn't an option. Your plan administrator is legally required to send the IRS a Form 1099-R detailing the withdrawal. The IRS has automated systems designed to catch discrepancies by matching that form to your tax return.

When the numbers don't line up, you can expect a notice demanding the underpaid taxes, plus extra penalties and interest. To steer clear of serious financial and legal trouble, you absolutely must report every 401(k) distribution accurately on your tax return.

Making the right decision with your retirement funds is a heavy lift, but you don't have to figure it all out on your own. At Spivak Financial Group, we specialize in helping people explore all their options, including sophisticated strategies like the 72(t) SEPP. To ensure your financial choices align with your long-term goals, visit us at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728