When you can—and can't—take money out of your Individual Retirement Account is governed by a specific set of IRA distribution rules. These regulations are the key to understanding whether your withdrawal gets hit with income tax, a steep 10% early withdrawal penalty, or if you're even required to take money out each year. Getting a handle on them is non-negotiable if you want to access your retirement savings without any costly surprises.

Your Guide to Navigating IRA Withdrawals

Think of your IRA as a high-performance vehicle for your retirement savings. But like any powerful tool, it comes with an instruction manual. This guide is that manual. We’re going to cut through the jargon and demystify the complex regulations around taking money from your account, making sure you can get to your funds when you need them without getting blindsided by taxes or penalties.

This guide lays out a clear roadmap, turning dense IRS rules into simple, actionable knowledge. Our main goal is to help you manage your retirement savings with real confidence by breaking down the three critical timelines for IRA withdrawals.

- Before Age 59½: This is the zone most people associate with penalties, but there are some incredibly important exceptions for major life events that you need to know about.

- The "Golden Years" (59½ and beyond): This is when the doors to your funds typically swing open freely, but a new set of rules around required distributions suddenly comes into play.

- Inheriting an Account: Beneficiaries are on a completely different clock, with a unique set of timelines and requirements that have changed quite a bit recently.

Why You Can't Afford to Ignore These Rules

Now more than ever, mastering these rules is essential. As of mid-2025, Individual Retirement Accounts are holding a staggering $18 trillion in assets. That figure underscores just how central these accounts are to American retirement planning. It also represents a solid 7.0% growth from the previous year, a trend driven by consistent contributions and an aging population starting to draw down their savings. You can always find the latest details on current IRA contribution limits and trends straight from the IRS.

Think of IRA distribution rules like traffic signals for your money. Follow them, and you'll have a smooth ride to your financial destination. Ignore them, and you’re looking at costly fines (penalties) and frustrating detours (unexpected taxes).

A Quick Look at What's Ahead

Before we dive deep, let's get a bird's-eye view of the key age milestones. This table breaks down the most important timelines at a glance.

Key IRA Distribution Timelines at a Glance

| Age Milestone | Rule Type | Primary Consideration |

|---|---|---|

| Under 59½ | Early Withdrawal | Withdrawals are generally subject to a 10% penalty plus income tax, with notable exceptions. |

| Age 59½ | Penalty-Free Access | You can begin taking distributions from your IRA without the 10% early withdrawal penalty. |

| Age 73 | Required Minimum Distributions (RMDs) | You must start taking mandatory annual withdrawals from your Traditional IRA. |

This table is just the starting point. Throughout this guide, we're going to unpack each of these timelines in much greater detail. We'll cover everything from using your IRA penalty-free for a first home purchase to the nitty-gritty of how Required Minimum Distributions (RMDs) work after age 73. We’ll also clarify the huge differences between Traditional and Roth IRAs and untangle the often-baffling rules for inherited accounts.

Whether you're dreaming of an early retirement, getting close to RMD age, or have just inherited an IRA, this guide will give you the clarity you've been looking for. By the end, you'll have a rock-solid foundation to make smart decisions with your hard-earned retirement savings, protecting your wealth for the long haul.

Withdrawing Funds Before Age 59½

The IRS has a magic number when it comes to IRAs: age 59½. Think of it as a velvet rope around your retirement funds. If you try to duck under it and pull money from a Traditional IRA early, you’ll typically get hit with a 10% early withdrawal penalty on top of the regular income taxes you already owe.

The reason for this rule is simple: the government wants to make sure the money you saved for retirement is actually there for you in retirement. But let's be real—life doesn't always stick to a neat timeline. Unexpected things happen, and sometimes you need access to that money sooner than planned.

Fortunately, the IRS understands this. The rules include several important exceptions that let you take an early distribution without getting slapped with that 10% penalty. You'll still owe income tax on the withdrawal (for a Traditional IRA), but sidestepping the extra penalty can save you a bundle.

Common Penalty-Free Withdrawal Scenarios

Getting familiar with these exceptions is key, as each has specific qualifications. Not every situation gets a pass, but the approved circumstances are meant to help with major financial hurdles. Here are some of the most common reasons you can take a penalty-free withdrawal.

- First-Time Home Purchase: You can pull out up to a $10,000 lifetime maximum to buy, build, or rebuild a first home. This can be for you, your spouse, your kids, or even your grandkids.

- Higher Education Expenses: Need to cover tuition? You can use IRA funds for qualified higher education costs for yourself, a spouse, children, or grandchildren at an eligible school.

- Substantial Medical Expenses: If you have unreimbursed medical bills that add up to more than 7.5% of your adjusted gross income (AGI), you can take a penalty-free withdrawal to pay them.

- Total and Permanent Disability: If you become permanently disabled, you can access your IRA funds without the 10% penalty.

- Health Insurance Premiums: If you're unemployed, you can use IRA money to pay for health insurance after you've received unemployment checks for 12 consecutive weeks.

- Death of the Account Owner: Beneficiaries who inherit an IRA can take money out without the 10% penalty, no matter how old they are.

For a closer look at these situations, Spivak Financial Group has a great breakdown on when you can take money out of an IRA without penalty.

Understanding these exceptions is crucial. They are not loopholes but rather intentional provisions to provide financial flexibility during significant life events. Keeping proper documentation for any penalty-free withdrawal is essential in case the IRS requires it.

A Real-World Example: Maria's First Home

Let’s see how this plays out in the real world. Meet Maria, age 32. She's been saving diligently in her Traditional IRA for years and is finally ready to buy her first home, but she’s short $10,000 for the down payment.

At first, she’s worried about that 10% penalty, which would cost her $1,000 right off the top, not including income taxes. But then she learns about the first-time homebuyer exception. Game changer.

She realizes she can withdraw the $10,000 without triggering the penalty. She completes the withdrawal, uses the funds for her down payment within the required 120 days, and successfully buys her new home. While she'll still need to report the $10,000 as taxable income on her tax return, she completely avoids that extra penalty, saving herself a cool grand.

Using a 72(t) Plan for Early Retirement Income

For most people, the dream of retiring early runs into a big roadblock: the age 59½ rule. If you tap into your IRA before then, you're usually slapped with a painful 10% penalty. But what if there was an IRS-sanctioned way to turn on a steady income stream from your retirement savings, years ahead of schedule?

That’s exactly what IRS Rule 72(t) is for. Officially known as Substantially Equal Periodic Payments (SEPP), a 72(t) plan is a powerful strategy that lets you withdraw funds from your IRA or other retirement plans before age 59½—without that early withdrawal penalty. Think of it as opening a small, precisely calculated tap on your savings to bridge the financial gap until your official retirement years begin.

How a 72(t) Plan Works

A 72(t) plan isn't just a simple withdrawal. It's a commitment to a series of payments that are calculated to last over your lifetime. The IRS gives you three distinct, approved methods to figure out your annual distribution amount. Each method plugs in your account balance, your life expectancy, and a specific interest rate to generate your payment schedule.

Picking the right calculation method is a huge decision. It directly shapes your annual income and the long-term health of your retirement nest egg.

- The RMD Method: This calculation divides your account balance by a life expectancy factor from an IRS table. The payments fluctuate each year as your age and account balance change, often starting lower and getting bigger over time.

- The Amortization Method: This approach gives you a fixed annual payment. It works by amortizing your account balance over your life expectancy using a reasonable interest rate, providing a consistent and predictable income you can count on.

- The Annuitization Method: This method uses an annuity factor from IRS tables to calculate a fixed annual payment. The payment amount is usually the lowest of the three, which can be a good thing if your main goal is to preserve your principal.

Getting these calculations right is everything. Spivak Financial Group, home of the 72tProfessor, offers a deep dive into the specifics of a 72(t) distribution and can help you model different scenarios to find the perfect fit.

The Commitment is Non-Negotiable

Kicking off a 72(t) plan is a serious financial commitment that demands careful planning. Once you start taking payments, you are locked in. You must stick to the schedule for at least five full years or until you turn age 59½, whichever period is longer.

If you mess with the payment schedule—taking too much, too little, or just stopping altogether—the consequences are severe. The IRS will reach back and retroactively apply the 10% penalty to every single distribution you've taken since the plan started, plus interest.

A Real-World Example: David's Bridge to Retirement

Let's look at David. He's 56, has built up a healthy IRA, and is more than ready to leave his high-stress job. But he really doesn't want to wait another three and a half years to start enjoying life.

Working with a financial professional at Spivak Financial Group, David decides to set up a 72(t) plan. Based on his IRA balance of $800,000 and using the amortization method, they calculate he can receive an annual income of about $35,000.

This steady income stream allows David to cover his living expenses, giving him the financial freedom to retire on his own terms. He has to continue taking these payments until he turns 61 (five full years). At that point, the 72(t) plan is complete, and he can access the rest of his IRA funds under normal rules. This strategy effectively created a personalized pension for him, bridging the gap to his official retirement age without getting hit by penalties.

Understanding Required Minimum Distributions After Age 73

As you build your nest egg, your Traditional IRA is a fantastic tool. It lets your investments grow tax-deferred, meaning you don't get hit with a tax bill on the gains each year. But that deal isn't forever. The government eventually wants its cut, and once you hit a certain age, it's time to start taking money out and finally paying those deferred taxes.

This process is called a Required Minimum Distribution, or RMD. Think of it as the IRS patiently waiting for decades while your savings compounded. Now, it's their turn to collect. For many retirees, this can feel like an abrupt rule change, but it’s a totally predictable part of the retirement journey. The key is to know how it works before it starts.

The RMD Age and Recent Changes

The starting line for RMDs has moved around a bit over the years, which has caused some confusion. Thankfully, recent laws have made things clearer. As of 2025, the RMD age is officially 73.

This change comes from the SECURE 2.0 Act, which had previously pushed the age from 70½ to 72. If you're turning 73, you have until April 1 of the following year to take your very first RMD.

This deadline gives you a little wiggle room for that first distribution. You can either take it in the year you turn 73 or wait until early the next year. Be careful, though. If you delay, you'll have to take two distributions in that second year—your first RMD and your second. That could easily bump you into a higher tax bracket.

Calculating Your RMD: A Simple Formula

Calculating your RMD might sound intimidating, but the IRS formula is surprisingly straightforward. It's designed to spread your savings out over your expected lifetime, based on their official tables.

You just need two numbers:

- Your Year-End Account Balance: This is the total value of your Traditional IRA on December 31 of the previous year.

- Your Life Expectancy Factor: The IRS publishes this in its Uniform Lifetime Table. You simply find your age for the distribution year and grab the matching factor.

The formula is as simple as it gets: Year-End Account Balance ÷ Life Expectancy Factor = Your RMD for the Year.

Let’s look at a real-world example. Imagine Sarah turned 73 last year, and on December 31, her Traditional IRA was worth $500,000. To figure out her RMD for this year (when she turns 74), she'll look at the IRS table.

- The life expectancy factor for a 74-year-old is 25.5.

- She just divides her balance by that factor: $500,000 ÷ 25.5 = $19,607.84.

- That’s it. Sarah’s RMD for the year is $19,607.84.

The whole system hinges on those IRS life expectancy tables.

The Cost of Missing an RMD

While the math is easy, the penalty for messing up is not. The IRS comes down hard if you fail to take your full RMD on time. For years, the penalty was a shocking 50% of the amount you were supposed to take out.

Fortunately, the SECURE 2.0 Act eased that a bit, lowering the penalty to 25%. They even added a provision that can reduce it further to just 10% if you catch the mistake and fix it quickly.

But even at 10%, that’s a painful and completely avoidable mistake. Staying on top of your RMDs is one of the most important things you can do to protect your retirement savings. Getting some guidance from a professional at Spivak Financial Group can help ensure you never miss a deadline and handle these distributions with confidence.

How Roth and Traditional IRA Rules Differ

Picking between a Traditional or Roth IRA isn't a one-and-done decision when you open the account. It fundamentally changes the entire playbook for how you can take your money out, especially when it comes to taxes and required distributions. Getting these differences straight is an absolute must for smart retirement income planning.

Here's the easiest way to think about it: a Traditional IRA is a "tax me later" deal. You get a tax break on the money you put in now, but the IRS gets its cut when you pull the money out in your golden years.

A Roth IRA is the complete opposite—it's a "tax me now" arrangement. You use after-tax dollars to contribute, and in exchange, every qualified withdrawal you make down the road is 100% tax-free.

This single difference is a massive fork in the road for your retirement strategy. Every dollar you take from a Traditional IRA counts as ordinary income. That can bump you into a higher tax bracket and even affect how much you pay for your Medicare premiums. Roth IRA withdrawals, on the other hand, are invisible to the IRS; they don't add a single penny to your taxable income.

Understanding the Roth IRA 5-Year Rule

One of the most critical concepts for Roth owners is the 5-year rule. Think of it as a waiting period that has to pass before you can touch your earnings tax-free. It can be a little confusing because it actually works in a couple of different ways.

The first 5-year clock starts ticking on January 1st of the year you made your very first contribution to any Roth IRA you own. For your earnings to be part of a "qualified distribution" (and therefore tax-free), this clock must have run its course, and you have to be over age 59½.

There's also a separate 5-year clock for each Roth conversion you do. This one determines whether you can withdraw the converted money before age 59½ without getting hit with a penalty. It's a small detail, but it's a huge deal for anyone using conversions as part of a more advanced financial plan.

RMDs: The Great Divide

Maybe the single biggest difference for retirees is how Required Minimum Distributions (RMDs) are handled. As we’ve discussed, Traditional IRA owners are forced to start taking money out at age 73. It’s not optional. You have to take these taxable distributions whether you need the income or not.

Roth IRAs have a massive advantage here: the original owner is never required to take RMDs. This lets your money keep growing tax-free for your entire life. It gives you incredible flexibility and also makes the Roth IRA a powerhouse for estate planning, as you can let the entire tax-free balance grow for your heirs.

The absence of RMDs in a Roth IRA gives you complete control. You decide when, or if, you ever touch the money, allowing it to serve as a tax-free emergency fund or a legacy for your family.

To make these distinctions perfectly clear, let’s look at a side-by-side comparison.

It's helpful to see the key withdrawal rules laid out next to each other to really understand the strategic differences.

Traditional IRA vs. Roth IRA Key Distribution Differences

| Feature | Traditional IRA | Roth IRA (Original Owner) |

|---|---|---|

| Tax on Qualified Withdrawals | Taxed as ordinary income | 100% Tax-Free |

| Required Minimum Distributions | Yes, starting at age 73 | No, never |

| Early Withdrawal of Contributions | Contributions and earnings are mixed; withdrawals are taxable and may be penalized. | Contributions can be withdrawn tax-free and penalty-free at any time. |

| 5-Year Rule for Earnings | Not applicable | Yes, must be met for earnings to be withdrawn tax-free. |

As you can see, the right choice really boils down to your personal situation and where you think your income and tax rates are headed in the future.

Choosing between a Traditional and Roth IRA depends heavily on your expectations for future income and tax rates. At Spivak Financial Group, we help clients analyze these IRA distribution rules to align their retirement accounts with their long-term financial goals.

Navigating Inherited IRA Distribution Rules

Stepping into the role of an IRA beneficiary means you've also inherited a completely new set of rules. It can feel like learning a new language, especially during what is often a difficult time. The guidelines for beneficiaries are entirely different from those for the original account owner, and major legislative changes in recent years have only added to the complexity. Getting a handle on your specific obligations is critical to managing the inheritance wisely and avoiding costly tax surprises down the road.

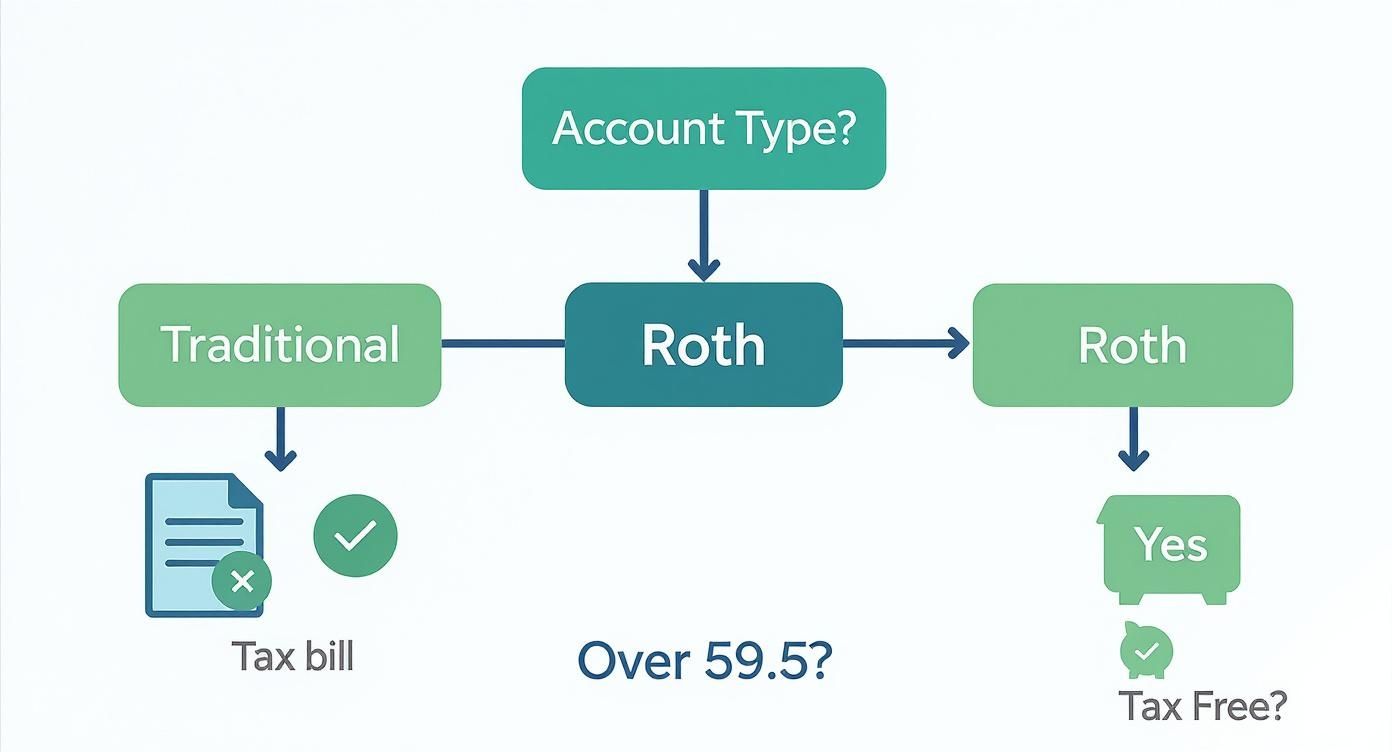

This visual decision tree is a great starting point for figuring out whether a withdrawal from a Traditional or Roth IRA will be taxable.

As the infographic shows, the core difference boils down to the tax treatment of Traditional vs. Roth accounts, pointing you toward the tax-free potential of a Roth withdrawal after age 59½.

Special Flexibility for a Surviving Spouse

When the beneficiary is a surviving spouse, the rules offer a level of flexibility no one else gets. A spouse has a powerful option: they can treat the inherited IRA as their own.

This is usually done by rolling the inherited funds directly into their existing IRA or opening a new one. Once that happens, the account essentially becomes theirs. It's now subject to the standard distribution rules based on their age, not the deceased's. This is a huge advantage, as it means RMDs won't be required until the surviving spouse hits age 73. That simple move can allow the funds to keep growing tax-deferred for many more years.

The 10-Year Rule for Most Beneficiaries

For almost everyone else—children, grandchildren, siblings—the landscape shifted dramatically with the SECURE Act of 2019. Previously, many non-spouse beneficiaries could "stretch" distributions out over their entire lifetime, a fantastic wealth-building tool. Now, most are subject to the 10-year rule.

This rule is exactly what it sounds like: the entire balance of the inherited IRA must be completely withdrawn by the end of the tenth year after the original owner's death. You can find more detail on these inherited IRA rule changes and summaries.

The 10-year rule requires careful planning. A large, lump-sum withdrawal in the final year could create a significant tax burden, potentially pushing the beneficiary into a much higher income tax bracket.

You have some flexibility within that 10-year window. You could take a little out each year, wait and pull it all out in year 10, or mix it up. However, things get tricky. Recent IRS guidance suggests that if the original owner had already started taking their RMDs, the beneficiary might also need to take annual distributions during the 10-year period. This area is still evolving, which really highlights the need for professional advice.

Exceptions for Eligible Designated Beneficiaries

Thankfully, the 10-year rule isn't a blanket policy. The IRS carved out a special category of beneficiaries who get a pass. They're called Eligible Designated Beneficiaries (EDBs), and they can still use the old "stretch" rules, taking distributions over their own life expectancy.

This select group includes:

- The surviving spouse (who, again, also has the option to treat the IRA as their own).

- A minor child of the original account owner (but only until they reach the age of majority, at which point the 10-year clock starts ticking).

- A disabled or chronically ill individual.

- Someone who is not more than 10 years younger than the deceased account owner (like a sibling or partner).

These exceptions provide critical relief for beneficiaries in very specific situations. Given how complex and high-stakes these decisions are, consulting with a financial professional at Spivak Financial Group can ensure you're making the most tax-efficient choices for your unique circumstances.

Common IRA Distribution Questions Answered

Even after you get the hang of the basics, real-life situations with IRAs can get tricky. Let's tackle some of the most common questions that pop up, clearing up the confusion so you can manage your retirement funds with confidence.

Can I Take More Than My RMD?

Absolutely. The key word in Required Minimum Distribution is minimum. Think of it as the floor, not the ceiling. You are always allowed to withdraw more than your RMD from a Traditional IRA.

Just be careful. Every dollar you take out is taxed as ordinary income. A big withdrawal could easily bump you into a higher tax bracket for the year, so it’s something you’ll want to plan for, not do on a whim.

How Does the 5-Year Rule for Roth IRAs Work?

The Roth IRA 5-year rule is a critical countdown that decides whether your investment earnings are truly tax-free. The main clock starts ticking on January 1st of the tax year you made your very first contribution to any Roth IRA. To get those earnings out tax-free, your account needs to have been open for at least five years, and you have to meet another condition, like being over age 59½.

It's crucial to know that a separate 5-year clock starts for each Roth conversion. You have to satisfy this second clock to avoid a 10% penalty on withdrawals of converted money if you're under 59½.

What Happens When I Roll a 401k into an IRA?

When you roll a 401(k) over to a Traditional IRA, the money takes on a new identity. It immediately falls under all the standard IRA distribution rules. That means the 10% early withdrawal penalty applies before age 59½, and RMDs kick in at age 73.

Here's a detail that trips a lot of people up: the "still working" exception. This rule sometimes lets you delay 401(k) RMDs if you're still working for the company that sponsors the plan. That benefit does not transfer to an IRA. Once the money is in your IRA, the RMD clock starts at 73, regardless of whether you're still working or not.

Do I Pay Taxes on All IRA Withdrawals?

Not always. It really boils down to the type of IRA you have and how you funded it.

- Traditional IRA: If you took a tax deduction for all your contributions over the years, then yes, 100% of your withdrawals are taxed as ordinary income. If you ever made non-deductible contributions, then a portion of each withdrawal will be tax-free.

- Roth IRA: This is where the magic happens. Qualified distributions are 100% tax-free. That means withdrawals made after you've met the 5-year rule and are over age 59½. This tax treatment is one of the most powerful benefits of having a Roth account.

Navigating the world of IRA distributions, especially when planning for early retirement with strategies like a 72(t) SEPP, isn't something you should do alone. The team at Spivak Financial Group is here to help you map out a clear path to your financial goals. To explore your options for creating a penalty-free early income stream, visit us at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road, Suite #101

Scottsdale, AZ 85260

(844) 776-3728