Yes, you can absolutely tap into your IRA funds before hitting age 59½ without that dreaded 10% penalty. But—and this is a big but—it has to be for one of the specific reasons the IRS has laid out.

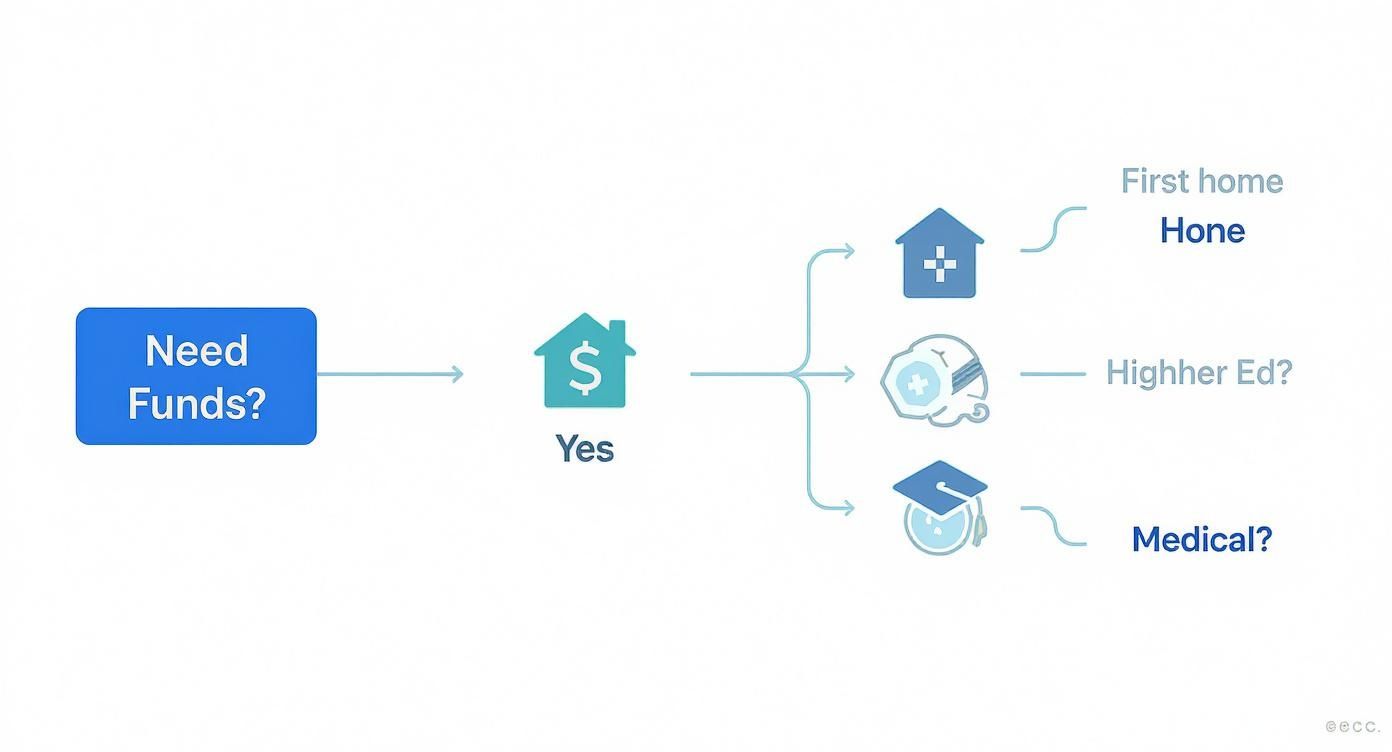

These penalty-free IRA withdrawal exceptions are designed for major life events, like buying your first home, dealing with hefty medical bills, or covering college tuition. Knowing exactly what qualifies is the key to accessing your own money without giving an unnecessary chunk of it back to Uncle Sam.

Understanding the IRA Early Withdrawal Penalty

Think of your Individual Retirement Account (IRA) as a long-term savings vault. The government offers some pretty sweet tax advantages to encourage you to keep that vault locked up tight until you hit the official retirement age of 59½. The main lock on that vault? A steep 10% early withdrawal penalty.

This penalty isn't just a slap on the wrist. It’s an extra tax piled right on top of the regular income taxes you'll already owe on any money you take out of a Traditional IRA. The goal is simple: to make you think twice before dipping into your retirement funds for short-term wants, helping preserve your financial security for the long haul.

The Double Whammy of Taxes and Penalties

When you pull money from a Traditional IRA before age 59½ without a valid excuse, the financial hit is no joke. It's not just the 10% penalty you have to worry about; you also have to pay income tax on that distribution at whatever your current tax rate is.

For a lot of people, this one-two punch can easily eat up 30% to 40%—or even more—of the money they withdraw.

To really see what this looks like, let's break down the real-world cost of a standard early withdrawal.

The Real Cost of a Standard Early IRA Withdrawal

| Item | Example Calculation (on a $10,000 Withdrawal) | Description |

|---|---|---|

| Gross Withdrawal Amount | $10,000 | The total amount you request from your IRA. |

| 10% Early Withdrawal Penalty | -$1,000 | The immediate penalty for a non-qualified early withdrawal. |

| Federal Income Tax (22% Bracket) | -$2,200 | Your regular income tax on the distribution. |

| Net Amount You Receive | $6,800 | The actual cash that ends up in your pocket. |

As you can see, needing $10,000 might mean pulling out a much larger amount just to cover the taxes and penalties, which is a painful way to drain your nest egg. This is precisely why getting familiar with the rules for penalty-free IRA withdrawals is so critical.

Why Do These Rules Even Exist?

The government’s primary goal here is to help people build a secure retirement. The tax breaks are the carrot, and the 10% penalty is the stick. It's all designed to discourage you from raiding your future to pay for today.

This structure creates a powerful incentive to just let your investments grow. The longer your money stays put, the more you benefit from the magic of compounding, building a much stronger financial foundation for your later years.

But life happens. A sudden job loss, a medical emergency, or the chance to finally buy your first home can create an immediate need for cash. Recognizing this, the IRS has carved out specific exceptions that act like special keys to that vault.

Our complete guide on taking money out of retirement early explores these situations in much more detail. These exceptions are what allow you to make penalty-free IRA withdrawals, giving you access to your savings in those critical moments without getting hammered by that extra 10% fee.

IRS Exceptions for Penalty-Free Withdrawals

That 10% early withdrawal penalty is a pretty powerful motivator to keep your retirement savings locked up. But the IRS knows that life happens. Unexpected financial hurdles can pop up, forcing you to look at your IRA as a potential lifeline. Thankfully, they’ve built in several specific exceptions that let you access your money without that extra penalty.

It's absolutely critical to get one thing straight from the start: penalty-free does not mean tax-free. If you’re pulling money from a Traditional IRA, you’re almost certainly going to owe ordinary income tax on that distribution, just like you would in retirement. These exceptions simply save you from the extra 10% hit on top.

Disability or Death

One of the most clear-cut exceptions is for a total and permanent disability. If a physical or mental condition prevents you from working—and it’s expected to be long-term or terminal—the IRS won't penalize you for tapping into your IRA funds. You'll just need to provide your IRA custodian with proof from a physician to qualify.

Likewise, when an IRA owner passes away, their beneficiaries can take money from the inherited IRA without getting hit with the 10% penalty, no matter how old the beneficiary is. This rule helps ensure loved ones can access the funds they need during a tough time without an immediate financial penalty. Just keep in mind that the income tax rules for inherited IRAs can be tricky and will still apply.

Buying Your First Home

For a lot of people, the down payment is the biggest barrier to owning a home. The IRS offers a helping hand here. You're allowed to withdraw up to a $10,000 lifetime maximum from your IRA, penalty-free, to buy, build, or rebuild your very first home.

A couple of important rules apply here:

- You must be a true first-timer. This means you haven't owned a main home in the two years leading up to the new purchase.

- It can be for family. The money can also be used for a spouse, child, or grandchild who meets the first-time homebuyer definition.

- There's a deadline. You have to use the funds for qualified home-buying costs within 120 days of taking the withdrawal.

That $10,000 can be a game-changer, giving you a real boost for your down payment or closing costs.

Covering Higher Education Expenses

College is expensive, there's no way around it. To ease some of that burden, the IRS lets you take penalty-free withdrawals from your IRA to pay for qualified higher education expenses. This can be for yourself, your spouse, your children, or even your grandchildren.

The money can be used for all sorts of costs at an eligible school, including:

- Tuition and fees

- Books and required supplies

- Room and board (as long as the student is enrolled at least half-time)

There's no specific dollar limit on this exception beyond the actual cost of the expenses. This makes your IRA a viable funding source when other options just aren't enough.

Unreimbursed Medical Expenses

Major medical bills can come out of nowhere and cause a huge amount of financial stress. The IRS understands this and allows penalty-free withdrawals to cover unreimbursed medical expenses that go above a certain threshold of your adjusted gross income (AGI).

For 2024, you can take a penalty-free withdrawal for medical costs that exceed 7.5% of your AGI. So, if your AGI is $60,000, you could use IRA funds to pay for medical bills above the first $4,500 ($60,000 x 0.075) without the penalty.

This can be a financial lifesaver if you're dealing with high deductibles or procedures that insurance won't cover. It lets you pay for necessary care without the added pain of a 10% penalty. For a deeper dive, check out our guide to the top 10 early withdrawal penalty exceptions and their nuances.

Paying for Health Insurance While Unemployed

Losing your job is hard enough, but losing your health insurance at the same time can be terrifying. If you find yourself out of work, you can take penalty-free distributions from your IRA to pay for health insurance premiums.

To qualify for this one, you have to meet two specific conditions:

- You must have lost your job and received unemployment benefits for 12 consecutive weeks.

- You have to take the IRA distribution in the same year you receive those benefits, or in the following year.

This rule helps you keep that critical health coverage for yourself and your family while you're between jobs, without penalizing you for using your own savings.

Other Important Exceptions

Beyond those more common scenarios, the IRS has a few other specific situations where the 10% penalty is waived. Knowing about these can give you some much-needed flexibility.

- Substantially Equal Periodic Payments (SEPP): This is a really powerful strategy, often called a 72(t) plan. It involves taking a series of carefully calculated annual withdrawals. We're going to cover this method in much more detail in the next section.

- IRS Levy: If the IRS comes after your IRA to satisfy a tax debt, any money withdrawn to pay that levy is exempt from the 10% penalty.

- Qualified Reservist Distributions: If you're a military reservist called to active duty for more than 179 days, you can take a penalty-free withdrawal during your active duty period.

- Qualified Birth or Adoption: You can withdraw up to $5,000 penalty-free from your IRA within one year of a child's birth or legal adoption.

Every one of these exceptions comes with its own set of rules and paperwork. Getting it right is key to making sure you don't end up with an unexpected and unwelcome bill from the IRS.

Using a 72(t) SEPP for Strategic Early Income

While most penalty-free IRA withdrawals are designed for specific, one-time life events like buying a home or covering a medical emergency, there’s another powerful strategy out there. It’s for those who need a consistent, predictable income stream long before they hit the traditional retirement age.

This strategy is known as Substantially Equal Periodic Payments, or SEPP. You’ll most often hear it called by its IRS rule number, Rule 72(t).

Think of a 72(t) SEPP as a way to create your own private pension from your IRA funds. It lets you sidestep the hefty 10% early withdrawal penalty by agreeing to take a series of fixed payments over a set period. This makes it an incredibly useful tool if you're planning an early retirement or need to bridge an income gap before you turn 59½.

Starting a SEPP is a major financial decision with long-term consequences, as it involves a strict commitment to the IRS. Figuring out if this path, or another withdrawal reason, fits your needs is a crucial first step.

This flowchart can help you visualize where a planned withdrawal strategy like a SEPP fits in with other more immediate needs.

As you can see, many penalty-free withdrawals are reactions to specific events, whereas a SEPP is a proactive plan designed to generate income over time.

How SEPP Calculation Methods Work

The IRS doesn't just let you pick an income amount out of thin air. Instead, you're required to calculate your annual distribution using one of three approved methods. Each one uses your account balance, your life expectancy (or joint life expectancy with a beneficiary), and a reasonable interest rate, but they often produce very different results.

Choosing the right method is critical because it directly dictates the amount of income you'll receive each year.

-

Required Minimum Distribution (RMD) Method: This is the simplest calculation of the bunch. It just divides your IRA balance by your life expectancy factor from an IRS table. This method gives you the lowest annual payment, but the amount recalculates each year, meaning it can go up or down with the market.

-

Amortization Method: This method calculates a fixed annual payment by amortizing your IRA balance over your life expectancy—kind of like how a mortgage is paid off. It typically produces a higher payment than the RMD method, and that payment amount stays constant year after year.

-

Annuitization Method: This approach uses an annuity factor from an IRS-provided mortality table to figure out your annual payment. The resulting income is also a fixed amount and is often very close to what the amortization method calculates.

Getting a handle on the nuances of these calculations is key. You can get a much deeper look into how to apply these formulas with our detailed guide on the rules for Substantially Equal Periodic Payments.

The Strict Commitment of a 72(t) Plan

Kicking off a 72(t) SEPP is not a decision to be taken lightly. Once you begin taking distributions, you are locked into the plan. You absolutely must continue taking the exact calculated payments for at least five full years or until you reach age 59½, whichever period is longer.

This commitment is ironclad. If you modify the payment amount, miss a payment, or take an extra distribution from the account, the entire plan is "busted."

Busting the plan brings on severe consequences. The IRS will go back and retroactively apply the 10% early withdrawal penalty to every single distribution you have taken since the plan began, plus interest. This can trigger a massive and unexpected tax bill that completely wipes out any benefit you got from the plan.

Comparing SEPP Calculation Methods

To help you see the practical differences, here’s a quick comparison of the three methods. Deciding which one is right for you boils down to your personal income needs and whether you’re more comfortable with a fixed or a variable payment stream.

A comparison of the three IRS-approved 72(t) SEPP calculation methods to help you understand their differences.

| Calculation Method | Key Characteristic | Best For |

|---|---|---|

| RMD Method | Produces the lowest payment, which recalculates and changes annually. | Someone who needs to preserve as much capital as possible and requires less income. |

| Amortization Method | Provides a higher, fixed annual payment that remains consistent. | Someone seeking the maximum possible income and predictability in their cash flow. |

| Annuitization Method | Also provides a higher, fixed annual payment, similar to the amortization method. | Someone who wants a stable and predictable income stream for early retirement planning. |

Ultimately, because of the complexity and the incredibly high stakes involved, setting up a 72(t) SEPP is not a DIY project. A small miscalculation or a simple misunderstanding of the rules can lead to significant financial penalties down the road. It is highly recommended to work with a financial professional who specializes in these plans.

Navigating the Different IRA Account Rules

Before you can even think about a penalty-free withdrawal, you have to know what kind of IRA you're working with. Not all IRAs play by the same rules, and the type of account you own will drastically change your options. It's a bit like having different keys for different locks; what works for one won't necessarily open another.

The big three are Traditional, Roth, and SIMPLE IRAs. Each is built differently, and those differences are what determine when and how you can get your hands on your money. Getting this straight is the first—and most important—step.

The Unique Flexibility of Roth IRAs

When it comes to early withdrawal flexibility, Roth IRAs are in a league of their own. Since you funded your Roth with after-tax money, the IRS gives you a huge perk: you can pull out your original contributions at any time, for any reason, completely tax-free and penalty-free.

This makes a Roth IRA a fantastic two-for-one tool. It’s a powerful retirement account, but it can also double as a liquid emergency fund you can access without getting hit by immediate taxes or penalties. But remember, this amazing flexibility only applies to the money you put in—your contributions. Touching the investment earnings is a whole other ball game.

Withdrawing Roth IRA Earnings

Once you’ve taken out an amount equal to your total contributions, any money you withdraw after that is considered investment earnings. And those earnings have much stricter rules. Pull them out before you’re 59½, and you’ll almost certainly face both income taxes and the nasty 10% early withdrawal penalty.

The secret to getting your Roth IRA earnings out tax-free and penalty-free is the "five-year rule." Not only must your account have been open for at least five years, but you also have to meet a qualifying reason (like turning 59½ or becoming disabled) to access the earnings without any strings attached.

Traditional and SIMPLE IRA Rules

With Traditional IRAs, things are more straightforward but also less generous. Because you likely got a tax deduction on your contributions, any money you pull out is taxed as ordinary income. So even if you use a penalty-free exception, like buying your first home, you still have to pay income tax on every dollar. With a Traditional IRA, penalty-free never means tax-free.

SIMPLE IRAs have the toughest rules of all, especially right after you open one. Take money out before age 59½, and you'll generally get hit with the 10% penalty. But if you make a withdrawal within the first two years of opening the account, that penalty jumps to a brutal 25%. This is the IRS’s way of strongly encouraging you to let that money grow, especially in the early days. To learn more, you can discover more insights about IRA withdrawal penalties and how to avoid them.

New Penalty-Free Withdrawal Rules You Should Know

The world of retirement planning isn't static. The rules change to keep up with economic shifts and real-life needs. Recent laws have opened up some brand-new ways to access your IRA money without penalties, offering a crucial financial lifeline when you need it most.

Knowing what these changes are is absolutely key to making smart decisions with your money. These new rules aren't loopholes; they're designed for specific, often urgent, situations and give you more flexibility than ever before. For many Americans, they're a direct answer to the growing financial pressures we all face.

The New Personal Emergency Expense Withdrawal

Let's face it, financial shocks happen. The data shows it, too. Early withdrawals from retirement accounts have been climbing, hitting a record high of 3.6% in 2023, up from 2.8% just the year before. This trend sent a clear signal: people need better access to their own money in an emergency. You can dig into more details about the new early withdrawal tax rules from Kiplinger.com.

In response, a new rule kicked in for 2024. You can now take one penalty-free distribution per year of up to $1,000 for what the IRS calls "unforeseeable or immediate financial needs relating to necessary personal or family emergency expenses."

This is designed for a genuine, unexpected crisis. The best part is the simplicity: you can self-certify that you meet the requirements. That means no jumping through hoops or providing piles of paperwork to your IRA custodian when you're already stressed out.

And here’s a great feature: you have the option to repay this withdrawal within three years. If you do, it’s treated like a rollover, putting that money right back to work for your future.

Domestic Abuse Survivors Withdrawal

In a groundbreaking move, another new provision creates a lifeline for those escaping abusive situations. This rule allows a victim of domestic abuse to withdraw up to $10,000 (or 50% of their vested account balance, whichever is less) without getting hit with that 10% early withdrawal penalty.

To qualify, the withdrawal has to happen within one year of the date the person became a victim of abuse by a spouse or domestic partner. Just like the emergency rule, this one also allows for self-certification. The money can also be paid back within three years, which is a huge help for survivors trying to rebuild their financial lives without permanently derailing their retirement savings.

Terminal Illness Withdrawal Exception

There's also a compassionate new rule for individuals facing a terminal illness. If a doctor certifies that you have an illness or condition that is reasonably expected to result in death within 84 months (that's seven years), you can take money from your IRA without the 10% penalty.

This is a major change. The old rule was much stricter, and this update provides critical financial resources to help manage care and final expenses during an unbelievably difficult time. It’s another example of how the rules are becoming more flexible and responsive to life's biggest challenges.

How to Report Your Withdrawal to the IRS Correctly

Successfully taking a penalty-free IRA withdrawal is only half the battle. Now you have to tell the IRS what you did—and why you don't owe them a 10% penalty. If you don't handle the reporting correctly on your annual tax return, you could find yourself with an automated penalty notice and a surprise tax bill.

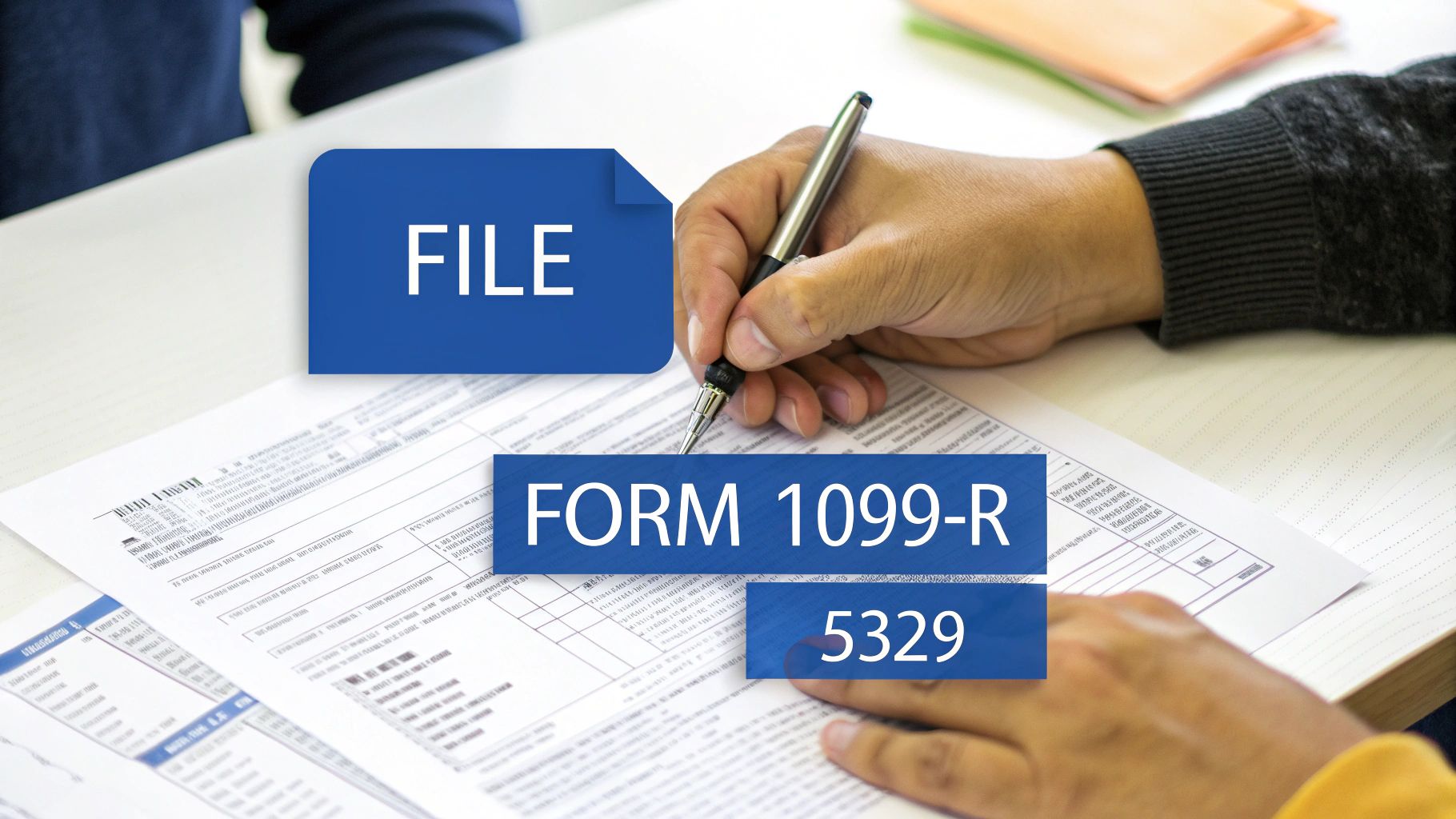

Fortunately, it all comes down to two key forms.

The first piece of the puzzle is Form 1099-R. You'll get this from your IRA custodian early in the tax year, usually by the end of January. Think of it as the official report card for your withdrawal, detailing the total amount you took out and any taxes that were withheld.

Understanding Your Form 1099-R

When you get your Form 1099-R, zoom in on Box 7. This little box holds a distribution code that gives the IRS the initial story about your withdrawal.

- Code 1: This is the most common code for an early withdrawal. It basically tells the IRS, "Hey, this person took money out before age 59.5," signaling that the 10% penalty might apply.

- Code 2: This code tells a different story. It indicates that an exception to the penalty is already known, which is common for things like a SEPP/72(t) plan.

- Other Codes: You might see different codes for specific situations, like a disability or a distribution made to a beneficiary after the original account owner's death.

Don't panic if you see a Code 1 on your form, even if you know you qualify for an exception. You still have a chance to plead your case. That’s where the second, and arguably more important, form comes into play.

Claiming Your Exemption on Form 5329

This is the big one. IRS Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts, is where you officially tell the IRS why you are exempt from the 10% early withdrawal penalty. If your 1099-R has a Code 1 but you qualify for an exception, filing this form is not optional—it's essential.

Think of Form 5329 as your formal appeal. It overrides the default penalty assumption triggered by a Code 1 on your 1099-R and provides the specific justification for your penalty-free withdrawal.

To fill it out, you'll report the total amount of your early distribution. Then, on a separate line, you'll enter the amount that is exempt from the penalty and list the specific exception code from the form's instructions. This simple calculation shows the IRS that you owe zero in penalties.

Forgetting to file Form 5329 is one of the most common—and costly—mistakes people make. The IRS computers will see the Code 1, see no Form 5329, and automatically send you a bill for the penalty. Taking a few extra minutes to file this form correctly ensures you keep the money you are rightfully entitled to.

Common Questions About Penalty-Free IRA Withdrawals

As you start to explore the world of penalty-free IRA withdrawals, a lot of practical questions are bound to pop up. Getting straight answers is key to making sure you're on the right track and not accidentally setting yourself up for a costly mistake.

Let’s tackle some of the most common questions people have when they're thinking about tapping into their retirement funds ahead of schedule.

Do I Still Pay Income Tax on a Penalty-Free Withdrawal?

Yes, in almost every case, you absolutely will. Think of "penalty-free" as a specific waiver for just one thing: the extra 10% early withdrawal fee. It doesn't mean the withdrawal is tax-free.

For any money you take from a Traditional IRA, that distribution is considered ordinary income for the year you receive it and will be taxed accordingly.

The big exception here is the Roth IRA. Since your contributions to a Roth account were made with after-tax money, you can pull out those contributions—and only the contributions—anytime you want, for any reason, without paying a dime in taxes or penalties.

Can I Repay an Early IRA Withdrawal?

Generally, the answer is no. When you take money out of an IRA, it's considered a permanent distribution. There's no simple "put it back" option like with a 401(k) loan.

However, the IRS does offer a workaround known as the 60-day rollover rule. This rule lets you effectively "borrow" from your IRA, as long as you return the full amount to an IRA within 60 days. If you meet that deadline, the transaction is tax-free. Be careful, though—you can only do this once every 12 months.

There are a few niche situations, like a first-time home purchase that falls through, that have their own special repayment rules, but these are rare exceptions.

Getting a 72(t) SEPP plan right from the start is absolutely critical. You have to choose an IRS-approved calculation method and give your IRA custodian precise instructions to start the payments. One wrong move can trigger a cascade of retroactive penalties, which is why working with a financial specialist is so highly recommended. They can ensure the math is right and the plan is executed perfectly.

Navigating the complexities of SEPP plans is what we do best. At Spivak Financial Group, we specialize in structuring these plans to provide you with the penalty-free income you need. Learn how we can help at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728