For millennials, planning for retirement isn't about dusting off your parents' old playbook. It's about crafting a whole new strategy for a world filled with student debt, side hustles, and a completely different set of life goals. This isn't your grandfather's retirement plan. It's about taking control now and building wealth on your own terms, which often means being more flexible and sometimes more aggressive with your savings than generations past. The modern path is all about using today's tools, like Roth IRAs and smart investing, to conquer today's financial challenges.

Why Retirement Planning for Millennials Looks Different

Let's be honest: staring at your financial future can be intimidating, especially when the old-school advice just doesn't resonate. The traditional roadmap—go to college, land a stable 9-to-5, work 40 years, collect a pension—feels like a story from another era. For millennials, the journey to financial independence is a different beast entirely, shaped by a unique economic and social landscape.

It’s less like following a predictable train schedule and more like navigating with a rugged 4×4 built for any terrain you might encounter. Your path requires a proactive, modern approach. It's not just an option; it's a necessity.

The Millennial Financial Landscape

A few key realities set millennials apart from Baby Boomers and even Gen X when it comes to saving for the long haul. Acknowledging these hurdles is the first step toward building a plan that can actually succeed.

- Student Loan Debt: So many millennials started their careers already in a financial hole, with hefty student loan payments delaying big life moments like buying a home or even beginning to invest.

- Changing Job Market: The rise of the gig economy and less linear career paths means income isn't always a steady, predictable stream. This can make consistent retirement contributions a real challenge.

- Higher Cost of Living: With the soaring cost of housing and stubborn inflation, everyday life just costs more, squeezing budgets and leaving less on the table for long-term savings.

This new reality demands a major shift in mindset. Instead of just saving whatever is left over at the end of the month, the focus has to be on a deliberate, intentional plan to build wealth in spite of these obstacles.

A recent study really drives this point home, showing a big gap between what millennials hope for in retirement and where their savings are today. The study found that Americans believe they'll need about $1.26 million to retire comfortably. That's a huge number, especially for a generation wrestling with unique economic pressures. With more than half of Americans worried they’ll outlive their savings, a smarter approach to retirement planning for millennials has never been more critical. You can explore the complete study on retirement expectations for more insights.

Building Your Financial Foundation

You can't build a skyscraper on a shaky foundation, and the same goes for your financial future. Ambitious goals like retiring early are fantastic, but they all depend on the strength of your day-to-day financial habits.

This isn't about pinching every penny. It's about shifting your mindset from just getting by to thinking strategically for the long haul. Mastering these fundamentals gives you control, and it's the first real step toward unlocking your investing potential and making serious headway in your retirement planning for millennials.

Before we even get to the fancy investment accounts, it's critical to lock down the proven wealth building strategies that set the stage for everything that follows.

Create a Budget That Actually Works

Let's be honest, the word "budget" often feels restrictive. But a better way to think about it is as a spending plan—a tool that gives you permission to spend money on what you genuinely value. It’s not about cutting out lattes; it’s about knowing where your cash is going so you can point it where you want it to go.

A straightforward approach like the 50/30/20 rule is a perfect starting point. It breaks down your after-tax income into three simple buckets:

- 50% for Needs: This is all the essential stuff—housing, utilities, groceries, and transportation. Think of it as the non-negotiable cost of living.

- 30% for Wants: Here’s the fun stuff. Dining out, hobbies, streaming services, and travel. This is the flexibility that keeps your plan from feeling like a chore.

- 20% for Savings and Debt Repayment: This is the powerhouse category for your future. It's where you'll fund your retirement accounts, build your emergency savings, and crush high-interest debt.

This simple framework turns budgeting from a dreaded task into an empowering tool, making sure you're always moving toward your goals.

Build Your Financial Firewall

Life happens. A car repair, a surprise medical bill, or a sudden job loss can completely derail your plans if you aren't prepared. Your emergency fund is your non-negotiable financial firewall. It’s what protects your long-term investments from being raided every time a crisis pops up.

The goal here is to save 3 to 6 months' worth of essential living expenses. Don't just leave this cash in your regular checking account. Park it in a high-yield savings account where it's out of sight, out of mind, but still easily accessible when you truly need it.

Think of your emergency fund as financial insurance. You hope you never need it, but just knowing it’s there gives you the peace of mind to invest for the long term with real confidence.

Tackle High-Interest Debt Strategically

High-interest debt, especially from credit cards, is like trying to fill a bucket with a hole in it. No matter how much you pour in (save), that debt is actively working against you, draining your wealth through compounding interest. Paying it off gives you a guaranteed, risk-free return on your money.

There are two popular strategies for attacking debt, and the best one for you depends on what motivates you:

- The Avalanche Method: You focus all your extra payments on the debt with the highest interest rate first while making minimum payments on everything else. Mathematically, this saves you the most money.

- The Snowball Method: You target the smallest debt balance first, regardless of the interest rate. Scoring a quick win by eliminating an entire account can give you a huge motivational boost to keep going.

Whether you're driven by the numbers or by momentum, having a clear plan to get rid of this debt is one of the most powerful moves you can make. It frees up your cash flow and lets you redirect that money toward what really matters: accelerating your journey to financial freedom.

Choosing the Right Retirement Accounts

The world of 401(k)s, Roth IRAs, and Traditional IRAs can feel like an alphabet soup of confusion. But here’s the secret: they aren't just random accounts. Think of them as specialized tools in your financial toolkit, each designed for a specific job.

Choosing the right ones for your situation can dramatically speed up your journey to building wealth. Let's demystify your main options, break down the core differences, and figure out the best tools for your income and career goals.

The 401(k): Your First and Best Friend

For most millennials with a traditional job, the 401(k) is the gateway to retirement saving. Consider it your primary power tool. Its single greatest feature? The employer match. It's an unbeatable, instant return on your investment.

If your employer offers to match your contributions—say, 100% of the first 3% of your salary—you need to contribute at least enough to get that full match. Not doing so is literally turning down free money. It’s an instant 100% return before your money has even had a chance to grow in the market. This is the foundational first step for nearly everyone.

Contributing up to the full employer match is the closest thing to a guaranteed win in personal finance. Make this your absolute first savings priority before directing money anywhere else.

Roth vs. Traditional: The Tax Debate

Once you've secured your full 401(k) match, the next big decision is often between a Roth and a Traditional IRA. The choice really boils down to one simple question: Do you want to pay taxes now or later?

- Traditional Accounts (401k/IRA): With these, you contribute pre-tax dollars. This lowers your taxable income today, giving you an immediate tax break. Your money then grows tax-deferred, and you pay income tax on withdrawals in retirement.

- Roth Accounts (401k/IRA): Here, you contribute after-tax dollars. You don't get a tax deduction now, but your investments grow completely tax-free. Better yet, all your qualified withdrawals in retirement are 100% tax-free.

Why Roth Accounts Are a Millennial Superpower

For a lot of millennials, a Roth account offers a massive long-term advantage. Since you're likely in a lower tax bracket now than you will be later in your career, paying the taxes today just makes sense. You're essentially locking in today's lower tax rate for good.

Think about it. You're at the beginning of your career, and your income and tax bracket will probably rise over the next 30 years. By using a Roth, you pay taxes on your contributions—your "seeds"—now, while your income is lower. Then, the entire harvest of investment growth over the decades is yours to keep, completely free from future taxes, which could be much higher.

This tax-free growth is an incredible benefit that becomes more valuable the longer your money has to compound. It also gives you tax diversification, ensuring you have a source of tax-free income to pull from in retirement. That offers some serious financial flexibility.

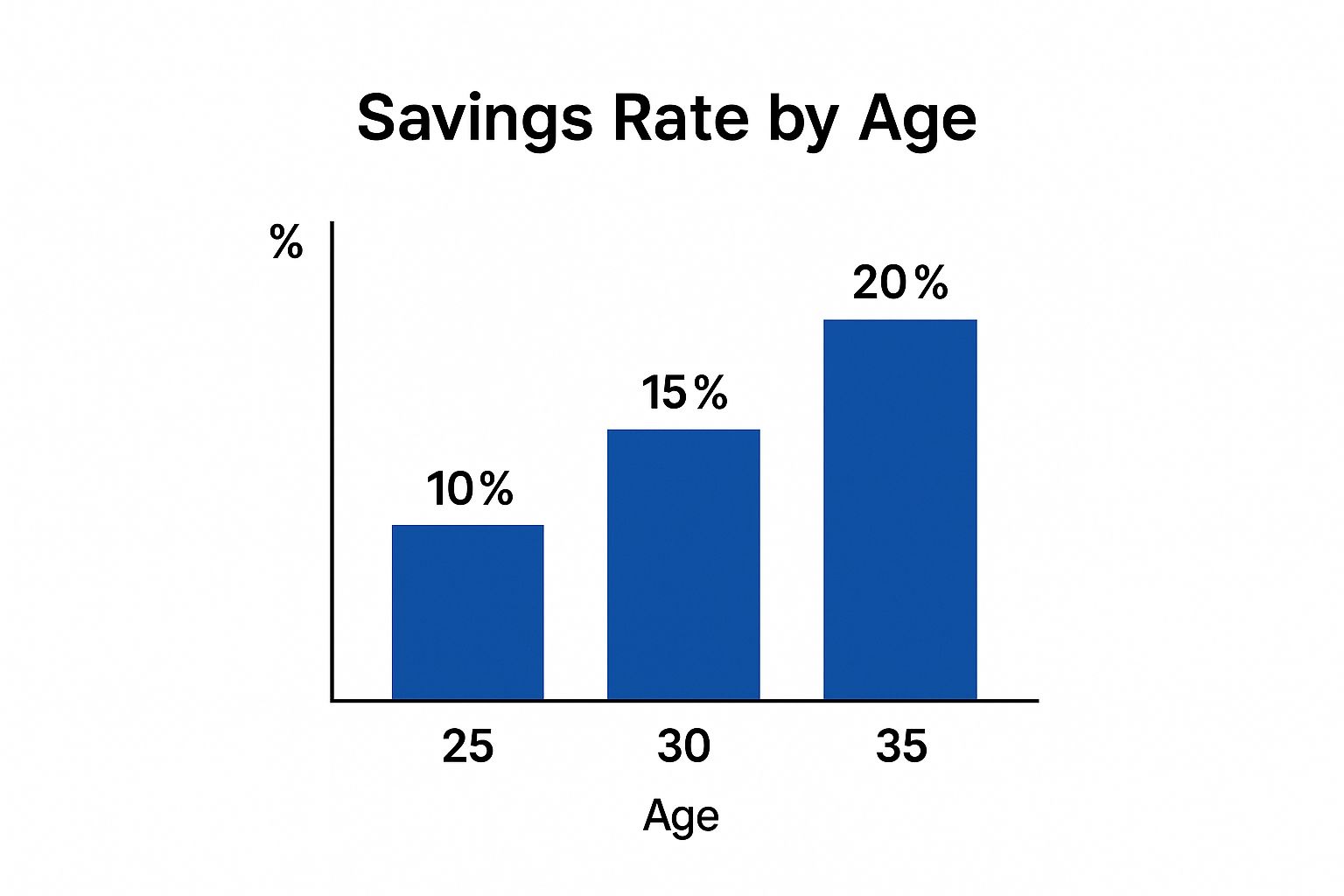

The chart below shows how your savings rate should ideally ramp up as you progress in your career.

This really highlights the importance of increasing your savings as your earning potential grows through your 20s and 30s.

Unfortunately, many aren't on track. Recent data reveals that millennials under 35 have median retirement savings of just $18,880, while those aged 35 to 44 have around $45,000. These figures are a stark reminder of the gap between where many people are and where they need to be. You can see more details on millennial retirement savings benchmarks on synchrony.com.

It's also critical to understand the rules of these accounts. While they are designed for retirement, there are specific situations where you might need access sooner. If you're ever curious about that, check out our guide on understanding how to access 401(k) funds early.

Smart Investing Strategies for Long-Term Growth

Putting money away is a great start, but it's only half the battle. If you really want to build wealth and stay ahead of inflation, you have to put that money to work. That means investing.

It might sound intimidating, but the truth is, the most powerful investing strategies are often the simplest ones. Let's break down how you can use patient, consistent investing to build a solid foundation for your retirement goals.

The Magic of Compound Interest

You've probably heard that Albert Einstein called compound interest the "eighth wonder of the world." For a millennial, it's the single most powerful tool you have.

Think of it like a snowball. At the top of the hill, it’s tiny. But as it starts rolling, it picks up more snow, getting bigger and faster with every turn. Your investments do the exact same thing. Your initial contributions—the snowball—earn returns. Then, those returns start earning their own returns. It creates a growth cycle that gets more powerful over time. The earlier you start, the longer your snowball has to roll.

Keep It Simple with Index Funds and ETFs

So many people think investing is about finding the next Amazon or Tesla before anyone else does. That's like trying to find a needle in a haystack. It's exciting, sure, but it's also incredibly risky.

A far more reliable path is to just own a tiny piece of the entire haystack. That's where low-cost index funds and Exchange-Traded Funds (ETFs) come in.

- Index Funds: These are funds that hold all the stocks in a specific market index, like the S&P 500. When you buy a share, you instantly own a tiny slice of 500 of the biggest companies in the U.S.

- ETFs: These are similar baskets of investments that you can buy and sell on a stock exchange, just like a single stock. They offer instant diversification and usually have very low fees.

This strategy is called passive investing, and over the long haul, it consistently beats the majority of professional stock pickers. You aren't just betting on one company; you're betting on the growth of the whole economy.

For the vast majority of investors, the goal isn't to beat the market—it's to be the market. A simple, diversified portfolio of low-cost funds is the most effective way to capture the market's long-term growth without unnecessary risk or fees.

This disciplined approach is more critical than ever. The 2025 BlackRock Retirement Survey found that median savings rates have fallen from 12% in 2022 to just 10% in 2025, while retirement costs keep climbing. This shows just how urgent it is for effective retirement planning for millennials to focus on smart, consistent investing. Learn more about the latest retirement survey findings from BlackRock.

Consistency Over Timing

One of the biggest mistakes new investors make is trying to "time the market." They sell when things look scary and try to jump back in when things look good. It’s a losing game. Nobody can predict what the market will do tomorrow or next week.

A much better approach is dollar-cost averaging. All this means is investing a set amount of money on a regular schedule—like every paycheck—no matter what the market is doing.

Here’s why it works so well:

- It takes emotion out of the equation. You stop making panicked decisions based on scary headlines.

- You buy more when prices are low. Your fixed dollar amount automatically buys more shares when the market takes a dip.

- You smooth out your purchase price. Over time, you build your portfolio at a blended cost, reducing the impact of market swings.

This automated, steady approach keeps you in the game, ready to capture the market's growth over the decades. To really nail down your approach, check out a comprehensive guide to the investment decision-making process to make sure your investments line up with your retirement goals. Building a solid plan is your ticket to financial freedom.

Advanced Tools for Financial Independence

Once you’ve got the fundamentals of saving and investing down, you can start looking at more specialized tools to really accelerate your journey to financial independence. These advanced strategies aren't for everyone, but if you're a millennial aiming for early retirement or just want maximum efficiency, they can be absolute game-changers.

Think of these as high-performance upgrades for your financial engine. They definitely require more attention and a solid understanding, but the payoff can be a much faster and more flexible path toward your long-term goals. Let's dig into two powerful options that can seriously enhance your retirement planning for millennials.

The Ultimate Retirement Account: The HSA

Most people see a Health Savings Account (HSA) as just a bucket of money for medical bills. And while that's its main job, it also happens to be one of the most powerful retirement savings vehicles out there, all thanks to its incredible triple-tax advantage.

An HSA is like a supercharged IRA. Here’s a breakdown of its three killer tax benefits:

- Contributions are tax-deductible: The money you put in lowers your taxable income for the year, just like a Traditional IRA.

- The money grows tax-free: You can invest the funds inside your HSA, and all the earnings and growth are completely tax-free.

- Withdrawals for qualified medical expenses are tax-free: This is the big one. You can pull money out for medical bills at any time, totally tax-free.

But here's where the pro-level strategy comes in: pay for your current medical expenses out-of-pocket and let your HSA balance grow, untouched, for decades. Once you hit age 65, you can withdraw the money for any reason—a vacation, a new car, whatever—and it’s just taxed as ordinary income, exactly like a 401(k). The best part? You can still use it completely tax-free for medical expenses in retirement, which, let's face it, are likely to be a significant cost. This flexibility makes it an unbelievable tool for long-term wealth building.

Accessing Your Funds Early With Rule 72(t)

So what happens when you build a massive nest egg and decide you want to retire at 50? The standard rule slaps you with a hefty 10% early withdrawal penalty if you touch your 401(k) or IRA funds before age 59½. That's a huge roadblock for anyone dreaming of an early exit from the workforce.

But the IRS left a key in the door for early retirees: Rule 72(t). This rule lets you take Substantially Equal Periodic Payments (SEPPs) from your retirement account without that 10% penalty. The catch? You have to continue these payments for at least five years or until you turn 59½, whichever is longer.

Think of Rule 72(t) as a pre-approved, structured income stream for your early retirement. It’s not a free-for-all—you have to stick to a strict, IRS-approved payment schedule—but it makes it possible to access your own money when you need it most.

The IRS gives you three different ways to calculate your annual payment amount:

- Required Minimum Distribution (RMD) Method: Your payments are recalculated every year based on your account balance and life expectancy. This method usually gives you the lowest initial payments.

- Amortization Method: Payments are locked in for the entire duration, calculated using your life expectancy and a reasonable interest rate.

- Annuitization Method: This also gives you a fixed payment, calculated with an annuity factor provided by the IRS.

Choosing the right method and setting up a SEPP plan is a complex process. Once you lock it in, you can't change the payments without risking big penalties. It's an incredibly powerful tool, but it demands careful planning. Understanding the differences between a 72(t) SEPP and other choices is critical, which you can explore further by comparing a 401(k) loan versus a 72(t) SEPP. For anyone serious about financial independence ahead of schedule, this is a rule you absolutely need to know.

Your Millennial Retirement Action Plan

Information is great, but it's only useful when you act on it. We've walked through the unique challenges millennials are up against, why a solid financial foundation is non-negotiable, and the tools you can use to start building wealth. Now, let's turn that knowledge into a clear, step-by-step roadmap you can follow starting today.

Remember, the most important step in this long journey is always the next one you take. Don't get paralyzed by the need for perfection; just aim for progress. Taking small, consistent actions is the real secret to achieving massive long-term success in your retirement planning for millennials.

Automate Your Financial Future

The absolute easiest way to guarantee you'll save and invest is to take willpower completely out of the equation. Automation is your best friend here. Just set up automatic transfers from your checking account to your savings and investment accounts for every single payday.

This "pay yourself first" strategy forces you to treat your future goals as a non-negotiable expense, right alongside rent or utilities. Even if you start small, the simple habit of consistent, automated investing is what builds momentum and leads to incredible growth over time.

Schedule Annual Financial Check-Ins

Your life is going to change—that’s a given. Your financial plan needs to be flexible enough to evolve right along with it. Put a recurring reminder on your calendar, once a year, for a dedicated financial check-in. This is your time to review your progress and make any necessary tweaks.

During your check-in, ask yourself a few key questions:

- Am I contributing enough to get my full 401(k) match?

- Can I bump up my savings rate, even by just 1%?

- Is my mix of investments still aligned with my long-term goals and how much risk I'm comfortable with?

- Is my emergency fund still big enough? Is my insurance coverage adequate for where I am in life now?

This simple annual ritual keeps you on track and helps you adapt your strategy as your income grows and priorities shift. It's also the perfect time to gut-check your goals and figure out what a good monthly retirement income looks like for you.

Your retirement plan isn't a static document you create once and forget. Think of it as a living roadmap. Regular check-ins ensure you're always heading in the right direction, no matter what life throws your way.

Know When to Ask for Help

While DIY investing is more accessible than ever, there are moments when getting professional guidance is invaluable. If you're feeling overwhelmed, navigating a big life event like getting married or starting a new job, or considering advanced strategies like a 72(t) SEPP, it might be time to call in an expert.

For personalized strategies, you can connect with the experts at Spivak Financial Group to build a plan tailored to your unique goals. You can reach them at (844) 776-3728. A good financial professional can provide clarity, help you sidestep costly mistakes, and give you the confidence that your plan is truly built to succeed.

Answering Your Biggest Questions

Jumping into retirement planning can feel overwhelming, and it's natural to have a lot of questions. Let's tackle some of the most common ones that come up for millennials, so you can move forward with a clearer picture of what to do next.

How Much Should I Have Saved by Age 30 or 40?

You've probably heard the old rule of thumb: have one times your annual salary saved by age 30 and three times your salary by age 40. But let's be real—that's just a guideline. What really matters is your specific lifestyle, your income, and the kind of retirement you actually want to live.

A much better number to focus on is your savings rate. If you can consistently put away 15% or more of your pre-tax income, you’re building a powerful habit that’s a far better predictor of success than hitting an arbitrary net worth target. It’s about the process, not just the outcome.

Should I Pay Off Student Loans Before Investing?

This is the classic tug-of-war for so many of us, and the right move really comes down to interest rates. If you’re staring down high-interest student loans (think anything over 6-7%), attacking that debt is a guaranteed, risk-free win. Every dollar you pay down is a dollar you’re not forking over in interest later.

But what if your rates are low? In that case, the historical returns of the stock market might offer a better long-term payoff. For most people, a hybrid approach is the sweet spot:

- Contribute enough to your 401(k) to get the full employer match. Always.

- Then, split any extra cash between paying down your loans and funding an IRA.

What Is the Biggest Retirement Planning Mistake?

The most damaging mistake, without a doubt, is waiting to start. It’s so easy to think, "I don't earn enough to make a real difference yet," but that's a trap. Time is your single greatest asset, all thanks to the magic of compounding interest.

Waiting just five or ten years to start investing can literally cost you hundreds of thousands of dollars in future growth. Even small, regular contributions have the power to snowball into a massive nest egg over a few decades.

Is a 401(k) Match More Important Than a Roth IRA?

Yes, absolutely. Grabbing your full employer 401(k) match should be your first financial priority, no contest. Think about it: it’s an immediate, guaranteed 50% or 100% return on your money. You will never find a deal that good anywhere else. Not taking it is just leaving free money on the table.

Once you’ve secured the entire match, then it’s a brilliant move to pivot and direct your extra savings into a Roth IRA. This one-two punch gets you the free money and starts building a bucket of tax-free income for retirement, giving you incredible financial flexibility when you need it most.

Navigating the world of retirement planning for millennials, especially if you're aiming to retire early, requires a smart, personalized strategy. At Spivak Financial Group, we specialize in helping you see all the possibilities, including sophisticated tools like 72(t) SEPPs, to build a plan that truly fits your life. Give us a call at (844) 776-3728 to get the conversation started.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260