When you're building a nest egg, the goal is pretty simple: grow it as much as you can. But once you retire, the game changes entirely. The big question is no longer "How much did I save?" but "How do I make this money last for the rest of my life?"

This is where retirement withdrawal strategies come in. Think of them as your personal game plan for turning that lump sum you've saved into a steady, reliable income stream. It’s all about figuring out which accounts to tap first and how much to pull out each year. The goal is to create a sustainable "paycheck" that covers your needs without running out of money too soon, all while being smart about taxes and market swings.

How to Make Your Retirement Savings Last

Making the switch from saving to spending—from accumulation to decumulation—requires a massive mental shift. You're no longer chasing growth at all costs. Instead, you're focused on creating a durable, lifelong income stream that you can count on.

This guide is designed to help you master that shift. We're moving past the basics of saving and diving deep into the critical skill of spending your nest egg wisely. We’ll break down potentially confusing topics like sequence of returns risk and tax-efficient distributions, giving you clear, actionable advice to build a withdrawal plan that supports your lifestyle and gives you real peace of mind.

The Foundation of a Lasting Strategy

A solid withdrawal plan isn't about finding one magic number and sticking to it forever. It's about building a financial structure that's resilient enough to handle whatever life—and the market—throws your way. A few core ideas form the foundation of any successful strategy:

- Understanding Your Timeline: How long does your money actually need to last? A 30-year retirement looks very different from a 40-year one, and your strategy needs to reflect that.

- Managing Major Expenses: Nothing can derail a retirement plan faster than a massive, unexpected bill. To make your savings last, you have to get ahead of the big costs. For instance, it's smart to explore health insurance options for seniors to keep potential medical bills from eating into your nest egg.

- Defining Your Income Needs: At the end of the day, your spending habits drive your entire withdrawal plan. You need a crystal-clear picture of your budget. A great first step is learning about calculating disposable income to nail down exactly what you need each month.

A successful withdrawal strategy is less about a single, perfect rule and more about a flexible framework that adapts to your life and the market. It’s a living plan, not a static calculation.

By focusing on these pillars, you're not just hoping your money will last—you're building a robust plan to ensure it does. The goal is to transform your nest egg from a simple pile of cash into a well-oiled income machine that will support you for decades, letting you enjoy the retirement you worked so hard for.

Rethinking the Classic 4 Percent Rule

For decades, retirees and financial advisors had a simple, go-to guideline for a massive question: "How much can I safely spend each year without my money running out?" The answer was the 4% Rule, and it brought a welcome sense of clarity to the complex puzzle of retirement income.

Think of your retirement savings as a big reservoir of water you've spent your entire career filling up. The idea was to sustain you for a 30-year journey. The 4% Rule said you could safely draw 4% of that reservoir's initial volume in your first year. From then on, you’d just adjust that dollar amount for inflation to keep your spending power the same.

It was designed to be a straightforward, set-it-and-forget-it strategy, giving you a predictable income no matter what the market was doing. For many, it was the perfect starting point.

The Origins of the 4 Percent Rule

So, where did this rule come from? It wasn't just pulled out of thin air. One of the most influential withdrawal strategies in history, the '4% Rule' came from a 1994 study by financial planner William Bengen. His deep dive into historical market data suggested retirees could withdraw 4% of their nest egg in year one, adjust for inflation each year after, and have a very high probability of their money lasting for 30 years.

But here's the catch: recent analysis shows that today's market conditions—things like lower bond yields and sky-high stock valuations—have pushed that "safe" number down. As of 2025, it's now closer to 3.7%. You can dig deeper into how market conditions affect safe withdrawal rates on Schwab.com.

That slight drop from 4% to 3.7% might not sound like much, but it signals a critical shift. The financial "climate" has changed, and relying on old assumptions can be a risky game.

The 4% Rule is an excellent starting point for a conversation about retirement income, but it should never be the end of it. Modern financial realities demand a more personalized and flexible approach.

Why Is the Rule Being Questioned Today?

What's changed so much that this long-standing rule of thumb is now under the microscope? A few key factors are forcing a major rethink. These modern challenges poke holes in the very assumptions that once made the 4% Rule feel like a guarantee.

The main pressures on this classic strategy include:

- Lower Expected Returns: Bengen's original study was based on historical data when bond yields were much higher. Today, the "safe" part of your portfolio—bonds—generates far less income, forcing your stocks to do all the heavy lifting.

- Increased Longevity: It's a great thing, but people are living longer than ever. A plan built for a 30-year retirement might not cut it for someone who ends up spending 35 or even 40 years in retirement. Your money simply has to stretch further.

- Market Valuations: This is a big one. Retiring when the stock market is at an all-time high can expose you to something called sequence of returns risk. If a nasty market downturn hits right after you retire, pulling out a fixed amount can chew through your principal so fast that your portfolio never has a chance to recover.

These factors don't make the 4% Rule totally useless, but they do reveal its biggest weakness: its rigidity. It was created as a one-size-fits-all solution, but modern retirement planning demands a tailored suit.

To see the real-world impact of this small adjustment, let's compare the traditional 4% rule against the modern 3.7% rate.

Comparing Fixed vs. Adjusted Withdrawal Rates

| Scenario | Initial Portfolio | Year 1 Withdrawal (4% Rule) | Year 1 Withdrawal (3.7% Adjusted Rate) | Projected 30-Year Sustainability |

|---|---|---|---|---|

| Traditional 4% Rule | $1,000,000 | $40,000 | N/A | High, based on historical 20th-century market returns. |

| Modern 3.7% Adjusted Rate | $1,000,000 | N/A | $37,000 | Higher, factoring in lower bond yields and current valuations. |

As the table shows, a seemingly minor reduction in the withdrawal rate can significantly bolster a portfolio's long-term health in today's environment.

Sticking blindly to a fixed rate without considering today's market or your own timeline is a gamble. This is exactly why so many people are now exploring more dynamic retirement withdrawal strategies—methods that can adapt to the current economic reality and provide a more resilient income stream for the long haul.

Using Dynamic Withdrawals to Navigate Market Swings

What if your retirement withdrawal plan wasn't a rigid, set-it-and-forget-it rule? What if it could breathe, flexing and adapting to whatever the market throws at it? That’s the whole idea behind dynamic withdrawal strategies, a smarter, more flexible way to manage your income in retirement.

Think of it like sailing a boat across the ocean. A fixed withdrawal strategy is like setting your sails once and just hoping the wind stays perfect for the next 30 years. Good luck with that.

A dynamic strategy, on the other hand, is like being an active sailor. You’re constantly adjusting the sails based on the financial weather—tightening up during storms (market downturns) and letting them out when the seas are calm (bull markets).

This adaptability is a direct counterpunch to one of the biggest threats to your portfolio's longevity: sequence of returns risk. This is the nightmare scenario where a big market downturn in your first few years of retirement cripples your portfolio's ability to ever recover. By automatically pulling back on withdrawals during those down years, dynamic strategies shield your nest egg when it's most vulnerable.

Introducing Guardrails for Your Portfolio

So how does this actually work? One of the most popular dynamic methods uses a system of "guardrails." Picture them as the bumpers on a bowling lane for your finances. They’re pre-set rules that guide your spending and keep you from veering off course into dangerous territory.

You start with an initial withdrawal rate, but you also build in triggers for when to adjust that amount. If your portfolio has a fantastic year and grows past a certain point (the upper guardrail), the rules give you the green light to take a raise for the next year.

But if the market takes a dive and your portfolio value drops below a lower guardrail, the rules require a modest spending cut. This temporary pullback is crucial. It preserves your capital and gives it a fighting chance to rebound when the market eventually recovers, preventing the catastrophic damage that happens when you sell too many shares at rock-bottom prices.

The real beauty of a guardrail strategy is that it takes emotion completely out of the picture. Instead of making panicked decisions during a market crash, you simply follow a pre-determined plan that was designed for long-term survival.

This systematic approach gives you a logical framework for both enjoying the good times and weathering the bad, adding a layer of resilience that fixed strategies just can’t match.

The Guyton-Klinger Rules in Action

A classic example of a guardrail strategy is the Guyton-Klinger method. This system lays out specific rules that tell you exactly when and how to adjust your spending. It’s a proactive approach that has been shown to seriously improve a portfolio's chance of lasting a lifetime.

Instead of a rigid percentage, the Guyton-Klinger method uses its guardrails to trigger withdrawal adjustments, often increasing or decreasing your income by about 10% depending on market performance. Research from Jonathan Guyton and others has shown that this kind of dynamic approach can support initial withdrawal rates as high as 5% or even 6%, as long as you’re comfortable with some year-to-year fluctuation in your income. You can learn more about how dynamic strategies adapt to market returns on retirementplannersanmateo.com.

Let’s walk through a simple example of how this might play out.

- Initial Setup: A retiree starts with a $1 million portfolio and a 5% initial withdrawal rate, taking out $50,000 in their first year.

- The Guardrails: They decide to cut spending if their withdrawal rate ever goes above 6% (20% higher than the initial 5%) and give themselves a raise if it drops below 4% (20% lower than the initial 5%).

- A Good Year: The market soars, and their portfolio grows. Their $50,000 withdrawal is now only 3.5% of their bigger nest egg. Since that's below the 4% lower guardrail, they trigger a 10% spending increase. Their income for the next year is now $55,000.

- A Bad Year: A few years later, a bear market hits. Their portfolio shrinks, and their withdrawal rate spikes to 6.5% of the new, lower balance. This is above the 6% upper guardrail, triggering a 10% spending cut. Their income is reduced to $49,500 until the portfolio recovers.

This simple mechanism lets you enjoy the fruits of good years while automatically protecting your capital during the bad ones. It’s this built-in flexibility that makes dynamic withdrawal strategies such a powerful tool for modern retirees.

Unlocking Funds Early with 72(t) SEPP Plans

For most people, the age 59½ looms large in retirement planning. It's the magic number when you can finally get your hands on your IRA or 401(k) money without the IRS hitting you with a punishing 10% early withdrawal penalty. But what happens if your dream retirement starts sooner? This is a huge hurdle for anyone looking to leave the workforce early.

Luckily, there's a powerful IRS rule designed specifically for this situation. It’s not some clever loophole; it’s a structured, legal way to access your own money called Rule 72(t). This rule lets you set up what's known as Substantially Equal Periodic Payments (SEPPs), creating a predictable income stream directly from your retirement accounts, completely penalty-free.

Think of a 72(t) plan as a formal deal you make with the IRS. You agree to take a specific, calculated amount of money from your account each year, and in return, they agree to waive that nasty early withdrawal penalty. It’s a game-changer for people who have saved diligently and are ready to retire on their own terms, not the government's.

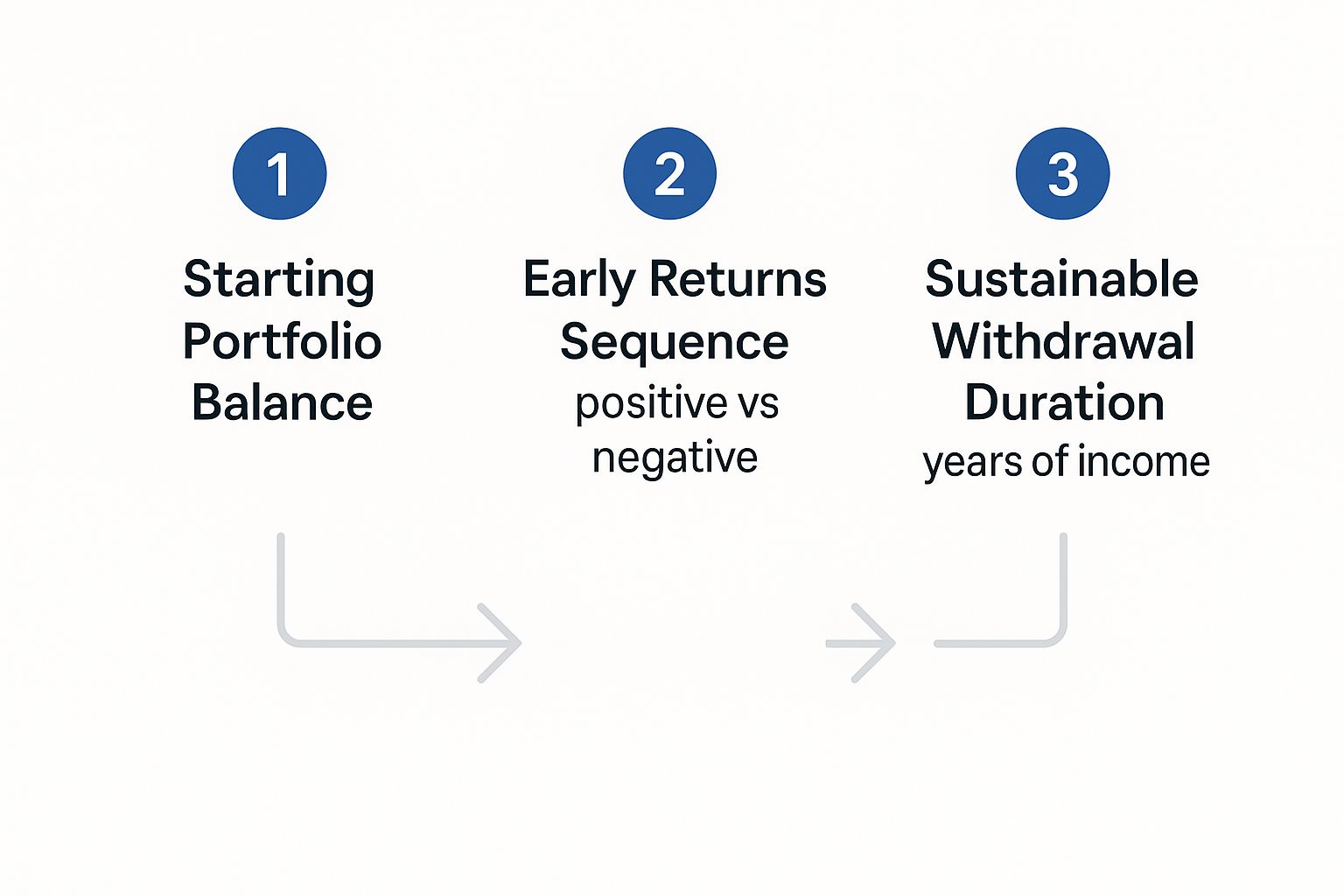

The infographic below shows just how critical a well-planned withdrawal strategy is. The sequence of your investment returns right after you retire can make or break how long your money lasts.

As you can see, strong returns at the start can give your portfolio a huge boost, while early losses can seriously shorten its lifespan. This is exactly why a structured plan like a 72(t) is so important—it's designed for stability.

How Your SEPP Income Is Calculated

The IRS isn't going to let you just pull a number out of thin air. The "substantially equal" part of the name is the key here. Your payments have to be figured out using one of three very specific, IRS-approved methods. Each one uses your account balance, your life expectancy, and a set interest rate to land on your annual income, but they can give you pretty different results.

Picking the right method is a massive decision because it sets your yearly cash flow. And once you lock it in and start the plan, there are no do-overs.

The three approved calculation methods are:

- The Amortization Method: This approach basically amortizes your account balance over your single or joint life expectancy. It almost always spits out the highest possible annual payment, making it a great option if you need to maximize your income.

- The Annuitization Method: This one uses an annuity factor to figure out your yearly withdrawal. The payment amount usually lands somewhere in the middle, offering a solid balance between the other two methods.

- The Required Minimum Distribution (RMD) Method: This is the most straightforward calculation. It just divides your account balance by your life expectancy factor each year. While it gives you the lowest payment to start, the amount recalculates annually based on your new age and account balance.

A 72(t) plan is not a casual decision. The rules are strict, and the consequences for breaking them are severe. It demands precision and a long-term commitment.

Let’s run a quick example to see how this plays out. Imagine you have a $500,000 IRA. The final numbers would depend on the official interest rates and life expectancy tables when you start, but the outcome would look something like this:

| Calculation Method | Estimated Annual Income | Characteristics |

|---|---|---|

| Amortization Method | ~$25,000 | Often provides the highest, fixed annual payment. |

| Annuitization Method | ~$23,000 | Offers a moderate, fixed annual payment. |

| RMD Method | ~$18,000 | Provides the lowest initial payment, which adjusts yearly. |

This simple comparison makes it obvious why choosing the right calculation method upfront is absolutely vital to building a successful early retirement income stream.

The Inflexible Nature of a 72(t) Plan

While a SEPP is a fantastic tool, it comes with an ironclad set of rules. This is a serious commitment: once you kick off a 72(t) plan, you are required to continue taking those exact payments for at least five full years or until you reach age 59½, whichever period is longer.

There's zero wiggle room. If you mess with the payment, miss one, or try to stop the plan early, the fallout is brutal. The IRS will go back and retroactively apply the 10% penalty to every single distribution you've ever taken under the plan, and they’ll add interest on top.

This rigidity is both the plan's greatest strength and its biggest risk. It gives you structure and predictable income, but it strips away all flexibility. This is precisely why getting expert guidance isn't just a good idea—it's essential. To dig into the nitty-gritty, you can find a detailed breakdown of 72(t) distribution rules that lays out the whole process.

Navigating these regulations requires real, specialized knowledge. A financial professional who lives and breathes 72(t) plans, like the specialists at Spivak Financial Group, can make sure your plan is buttoned up and correct from day one. They'll help you sidestep those costly mistakes so you can confidently unlock your funds and start your early retirement journey. You can reach them at (844) 776-3728 to discuss your options.

Creating Tax-Free Income with Roth Conversions

So far, we’ve been looking at ways to draw money out of your retirement accounts. But what if you could play offense instead? What if you could actively shape your future tax bill and build a stream of completely tax-free income?

That’s exactly what a Roth conversion lets you do. It’s one of the most powerful moves you can make for your long-term financial health.

Think of it like pre-paying the taxes on your retirement. A Roth conversion is simply the process of moving money from a pre-tax account, like a Traditional IRA or 401(k), over to a post-tax Roth IRA. There's a catch, of course: you have to pay ordinary income tax on the amount you move, and you pay it in the year you make the conversion.

Paying a tax bill today might feel wrong, but you're making a strategic trade. In exchange, every single dollar that grows in that Roth account—and every dollar you eventually pull out in retirement—is 100% tax-free. Forever.

The Strategic Timing of a Conversion

The real magic of a Roth conversion lies in the timing. You want to make your move when your income, and thus your tax rate, is as low as possible. Getting this right minimizes the tax bite and supercharges the long-term value of your growing tax-free nest egg.

For many people planning an early retirement, a "golden window" opens up. It’s that period between your last day at work and the day you start taking Social Security or a pension. In these gap years, your taxable income can plummet, giving you a perfect opportunity to convert funds while staying in the lowest tax brackets.

A Roth conversion isn't just a simple transaction; it's a strategic maneuver. By paying taxes at a potentially lower rate today, you shield yourself from the risk of facing much higher tax rates in the future.

This kind of proactive tax planning is what separates a good withdrawal plan from a great one. A financial professional can help map out your income projections and pinpoint the absolute best years to pull the trigger on a conversion, ensuring you get the most bang for your tax buck.

Building Your Roth Conversion Ladder

For early retirees who need access to their money before age 59½, the Roth conversion ladder is an absolutely brilliant strategy. It allows you to build a pipeline of tax-free, penalty-free cash to live on. But it requires some serious forethought because of a critical IRS regulation: the five-year rule.

Here’s the deal: the IRS makes you wait five years after a conversion before you can touch the converted principal without getting hit with a penalty. And this rule applies to each conversion separately.

This is where the "ladder" idea comes from. You don’t do one massive conversion and call it a day. Instead, you create a series of conversions, year after year.

Here’s a simple breakdown of how it works:

- Year 1 Conversion: You convert a chunk of your Traditional IRA—enough to cover one year's living expenses—into a Roth IRA. You pay the income tax on this amount now.

- Year 2 Conversion: You do it again, converting another year’s worth of expenses.

- Years 3, 4, and 5: You keep this up, building the "rungs" of your ladder.

- Year 6 Withdrawal: The five-year waiting period is now over for your Year 1 conversion! You can pull that principal out completely tax-free and penalty-free to cover your expenses for the year. At the same time, you make your sixth annual conversion to keep the ladder going for the future.

This creates a predictable, rolling stream of tax-free income. Every year, a new "rung" of converted money becomes available, funding your life while you continue building the ladder for the years ahead. Planning these conversions is a critical part of learning how to reduce taxable income over your entire lifetime, giving early retirees a powerful tool to bridge the financial gap until their other retirement funds are unlocked.

Designing Your Personalized Withdrawal Strategy

There's no such thing as a single, perfect retirement withdrawal strategy. There's only the one that's perfect for you. We've explored fixed rules, dynamic guardrails, and tax-advantaged accounts, but the real magic happens when you bring these concepts together to build a plan that fits your life.

The most effective strategies are rarely off-the-shelf solutions. They're almost always hybrids, blending the stability of a fixed rule with the nimbleness of dynamic adjustments. For instance, you could cover your non-negotiable living expenses with a conservative fixed withdrawal amount. Then, for discretionary spending—like travel or hobbies—you could use a more flexible, dynamic approach. This gives you both security and adaptability.

Building a Resilient Hybrid Model

A successful hybrid plan isn't a "set it and forget it" document. Think of it as a living blueprint that needs regular check-ups. Markets shift, life happens, and your own circumstances will inevitably change. An annual review is non-negotiable to ensure your plan stays aligned with your goals and protects you from unforeseen risks.

Let's be honest, global uncertainty can create a lot of anxiety around retirement. The 2025 Global Retirement Reality Report found that over 50% of people in some regions feel pessimistic about their financial future, which really highlights the need for a solid plan. In fact, some experts are now pushing for "guided spending rates" that set withdrawal boundaries based on a retiree's specific needs and timeline. You can dig into the details in the full retirement reality report.

Of course, a sustainable withdrawal plan is only as good as the portfolio it's drawing from. To protect your assets and encourage long-term growth, it's a good idea to explore essential investment diversification strategies.

Your retirement plan is your personal financial roadmap. It should offer clear direction but also have built-in detours for when the unexpected happens, ensuring you always stay on course toward your destination.

Ultimately, crafting a plan that truly secures your finances means carefully considering every tool at your disposal. This is where partnering with a specialist can make all the difference. The experts at Spivak Financial Group can help you design a personalized withdrawal strategy that secures your finances and lets you enjoy the retirement you worked so hard to achieve.

Common Questions About Retirement Withdrawals

As you start to map out your retirement income, it's natural for a lot of questions to pop up. Let's tackle some of the most common ones that people have when they're figuring out how to draw down their savings.

What Is the Biggest Risk of the 4 Percent Rule?

The single greatest danger of sticking to the classic 4% Rule is something called "sequence of returns risk." It sounds complicated, but the concept is simple: it’s the risk of a major market downturn hitting right as you begin retirement.

Think about it. If you're forced to withdraw a fixed, inflation-adjusted amount while your portfolio's value is plummeting, you have to sell more shares at rock-bottom prices just to get the cash you need. This can eat away at your principal so aggressively that your nest egg might never bounce back, even when the market eventually recovers. It's a brutal trap, and it’s why so many modern strategies are built to be more flexible.

Can I Use a 72(t) SEPP for a Short-Term Need?

Absolutely not. This is a common misconception and a very costly one. A 72(t) Substantially Equal Periodic Payment (SEPP) plan is strictly designed for creating a long-term income stream, not for a quick cash grab.

Once you start a SEPP, you are locked in. It’s a serious commitment. You are legally required to continue taking those exact calculated payments for a minimum of five full years or until you turn 59½, whichever period is longer. If you break the rules, the IRS will come back and retroactively apply the 10% early withdrawal penalty to every single distribution you've taken, plus interest.

How Often Should I Review My Retirement Withdrawal Strategy?

You should sit down and review your withdrawal strategy at least once per year with a qualified financial advisor. Life doesn't stand still, and neither should your plan. An annual check-in is the bare minimum for making smart adjustments based on:

- How the market has performed and what that means for your portfolio balance.

- The current inflation rate and how it's impacting your actual spending power.

- Any shifts in your personal life, spending habits, or long-term goals.

On top of that, you’ll want to do a much deeper dive after any major life event—think a significant health diagnosis, a change in your family, or a large, unexpected expense. Staying proactive is the key to making sure your plan continues to work for you.

Building a reliable withdrawal plan takes real precision and know-how, especially when you're dealing with the intricate rules of a 72(t) SEPP. If you need specialized guidance to create a penalty-free income stream for your early retirement, get in touch with the experts at Spivak Financial Group. With an office at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260, they are ready to help you explore your options at https://72tprofessor.com.