A substantially equal payments calculator is your best friend when you’re mapping out an early retirement. It’s the tool that takes the guesswork out of tapping your retirement accounts before age 59½, letting you figure out penalty-free withdrawal amounts under the IRS Rule 72(t).

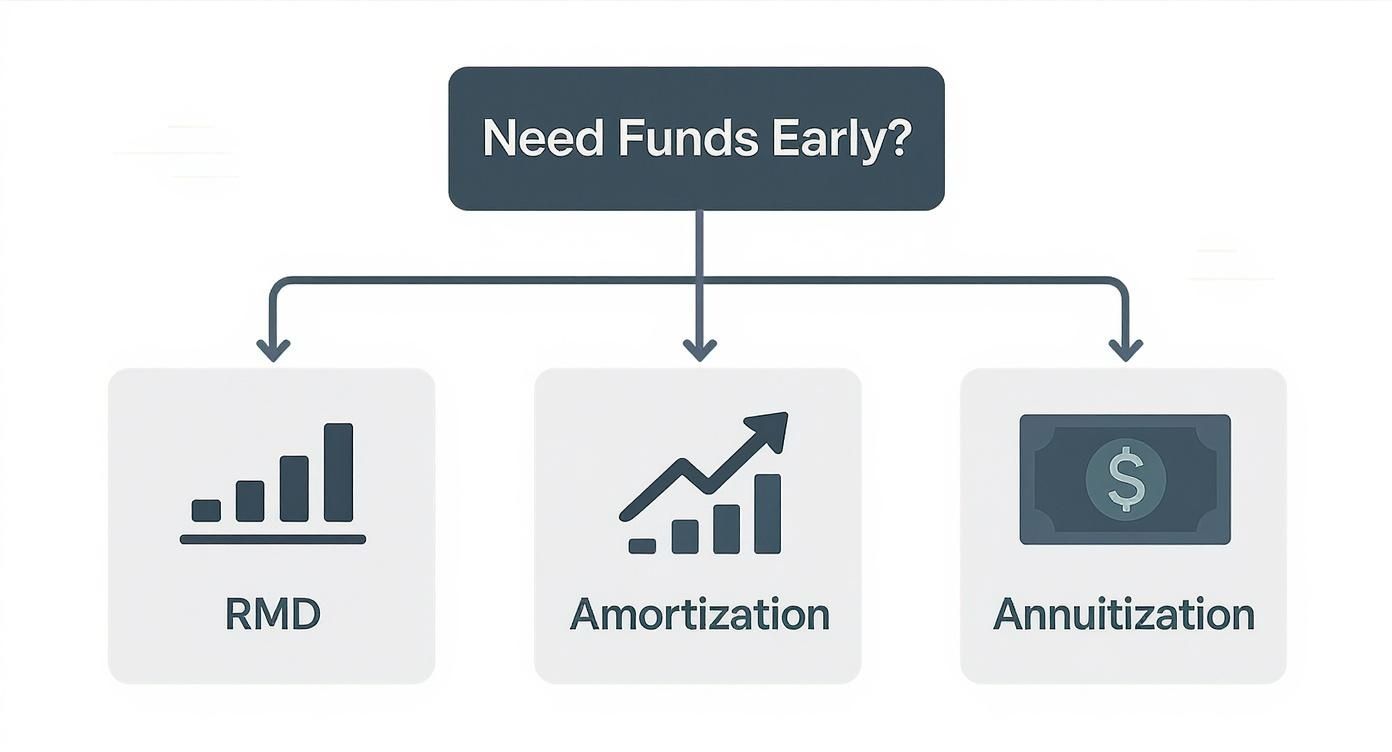

The calculator runs the numbers on the three IRS-approved methods: the Required Minimum Distribution (RMD), Amortization, and Annuitization methods. Seeing the different annual payment each one produces side-by-side gives you the clarity you need to build a solid financial strategy.

How a SEPP Calculator Unlocks Your Early Retirement Funds

One of the biggest hurdles in planning for early retirement is figuring out how to access your own savings without getting hit with that brutal 10% early withdrawal penalty. This is exactly where a Substantially Equal Periodic Payment (SEPP) plan, which falls under IRS Rule 72(t), comes into play. A SEPP lets you create a steady income stream from your IRA or other retirement accounts long before you hit the traditional retirement age.

A substantially equal payments calculator is the digital key that makes this complex planning possible. It handles all the complicated IRS formulas behind the scenes, allowing you to project what your income could look like based on your specific numbers. Think of it as a flight simulator for your early retirement income.

What a 72(t) Calculator Needs to Work

At its core, the calculator is just a machine that crunches numbers based on the three distinct IRS-approved methods. To get you an answer, it needs a few key inputs from you:

- Your Account Balance: The total value of the retirement account you plan to use for the SEPP.

- Your Date of Birth: This is essential for determining your life expectancy from the official IRS tables.

- A Reasonable Interest Rate: The Amortization and Annuitization methods require an interest rate. This isn’t a number you just guess; it has to be a "reasonable" rate, which is usually tied to the federal mid-term rate.

Once you plug in that information, the calculator will immediately spit out the annual distribution amount for all three methods. This direct comparison is incredibly valuable when you're making decisions that will affect you for years.

I’ve seen it time and time again: people are often surprised by how much the payment amounts can vary between the three methods. The Amortization method, for instance, might give you a higher, more stable payment. The RMD method, on the other hand, starts lower and will change every single year based on your account balance and age. Seeing these numbers upfront prevents nasty surprises down the road.

Comparing the Three IRS-Approved SEPP Calculation Methods

Choosing the right method is one of the most critical decisions you'll make when setting up a SEPP plan. Each has its own characteristics, and the best one for you depends entirely on your financial needs and risk tolerance. Here’s a quick breakdown to help you compare them at a glance.

| Calculation Method | Payment Amount | Payment Flexibility | Best For |

|---|---|---|---|

| RMD Method | Lowest initial payment, recalculates annually | High flexibility (changes each year) | Those who want smaller initial withdrawals or expect their account to grow significantly. |

| Amortization Method | Typically the highest, stable payment | Low flexibility (fixed for the plan's duration) | Individuals needing a predictable, maximized income stream from the start. |

| Annuitization Method | A moderate, stable payment | Low flexibility (fixed for the plan's duration) | A good middle-ground option for those seeking a consistent income that's less aggressive than Amortization. |

As you can see, there’s a clear trade-off between getting a higher payment and having flexibility. The RMD method gives you the most wiggle room, but the Amortization and Annuitization methods provide the kind of income predictability that many early retirees are looking for.

Why Bother Using a Calculator?

Let's be blunt: trying to calculate these payments by hand is a recipe for disaster. It's not just tedious; it’s incredibly easy to make a mistake. One small error—a misplaced decimal, the wrong life expectancy factor—could cause your entire plan to "bust." If that happens, the IRS can come back and retroactively apply penalties and interest on every single distribution you've taken.

Using a reliable substantially equal payments calculator is your first line of defense. It ensures accuracy and compliance right out of the gate.

More importantly, it gives you the power to play with different scenarios. What happens if you only use a portion of your IRA for the plan? How much does your payment change if the interest rate goes up or down? A calculator gives you instant answers, turning abstract IRS rules into real, tangible numbers you can build a financial plan around.

For a deeper dive into the specific regulations, you can learn more about the substantially equal periodic payments rules and how they apply. The ultimate goal is to create a predictable income stream that lets you live the life you want without putting your long-term financial health at risk.

Exploring the Three SEPP Calculation Methods

When you decide to start a SEPP plan, you're faced with a big choice: picking one of the three IRS-approved methods to figure out your payments. Each one has its own formula and gives you a different result, so it's absolutely essential to get a handle on how they work before you lock anything in.

Ultimately, your decision will come down to what you need. Are you looking for a steady, predictable income stream? Or do you prefer something that adapts to the market, even if it means less certainty?

This little decision tree gives you a great visual of the core differences.

As you can see, it really boils down to whether you want your payments to fluctuate (the RMD method) or stay fixed (Amortization and Annuitization). Let's dig into what that actually means in the real world.

The Required Minimum Distribution (RMD) Method

Folks often gravitate to the RMD method because it’s the most straightforward of the bunch. The key thing to know is that your payment amount gets recalculated every single year. This gives you some flexibility but throws predictability out the window.

The math is pretty simple. You take your account balance from December 31st of last year and divide it by a life expectancy factor from one of the official IRS tables (Single Life, Uniform Lifetime, etc.). Since both your account balance and your life expectancy factor will be different next year, your payment will change, too.

- The Upside: This method usually gives you the lowest initial payment, which can be great for preserving your nest egg. Because it's recalculated annually, your payments can rise if the market does well.

- The Downside: If you need a consistent number to build your budget around, this isn't it. The initial payments might also be too low to cover your actual living expenses.

Let's see it in action: Imagine you're 52 years old and have a $500,000 IRA. Looking at the IRS Single Life Expectancy Table, your factor is 34.2.

Your first-year payment: $500,000 ÷ 34.2 = $14,619.88. Next year, you'll run this same calculation again with your new balance and updated life expectancy factor.

The Fixed Amortization Method

Now, if you're looking for the polar opposite of the RMD method, this is it. The Fixed Amortization method calculates one payment amount that stays the same for the entire life of the plan. It offers maximum stability, which is why it's so popular for people who need a reliable income they can count on.

This method essentially works like a loan, amortizing your account balance over your life expectancy using a "reasonable" interest rate. That interest rate is a huge deal—a higher rate means a bigger annual check. The IRS says you can use any rate up to 120% of the federal mid-term rate from either of the two months before your first withdrawal.

- The Upside: You get a predictable, fixed payment every year. Period. It also tends to generate the highest possible annual payment of the three methods, which is perfect if you need to maximize your cash flow right now.

- The Downside: There is zero flexibility. If the market takes a nosedive, you're still locked into taking that same high distribution, which can drain your account much faster than you'd like.

Back to our example: We've got the same 52-year-old with $500,000. This time, we'll use a 4.0% interest rate and the same 34.2-year life expectancy.

A good substantially equal payments calculator would spit out an annual payment of about $28,883. That exact amount is what you'd receive every single year.

The Fixed Annuitization Method

Think of the Fixed Annuitization method as a middle ground. Just like the Amortization method, it gives you a fixed annual payment you can rely on. The calculation is a bit different, though, and it often lands you with a more moderate distribution.

Here, you use an annuity factor from the IRS, your account balance, and a reasonable interest rate (same rules as above) to find your magic number. It’s basically calculating what you’d get if you bought a commercial annuity with your retirement funds.

- The Upside: You get the same predictability as the Amortization method—a stable, unchanging payment you can budget around.

- The Downside: The payment is typically a bit lower than what you'd get from the Amortization method. And it has the same major drawback: you're locked in, for better or worse, no matter what the market does.

One last time: For our 52-year-old with $500,000 and a 4.0% rate.

The Annuitization method would generate an annual payment of around $28,782. In this specific case, it's incredibly close to the Amortization result, but the gap can be much wider depending on your age and the interest rate you use.

These three methods can lead to vastly different outcomes, directly impacting your cash flow in retirement. The differences are real. For instance, a 55-year-old using the amortization method might get an initial payment of $5,824, while the RMD method could yield a much smaller $2,404. The amortization method gives you level payments, while the RMD method gives you fluctuating payments that usually start small and grow over time.

Picking the right strategy is a serious decision that demands careful thought and precise math. For a deep dive into the specific formulas and variables involved, check out our complete guide on how to calculate substantially equal periodic payments. This choice will define your income for years, so you want to be sure you get it right from day one.

How to Use an Online SEPP Calculator

Diving into a substantially equal payments calculator can feel a little intimidating, but these tools are designed to make your life easier. They take the complex IRS rules we’ve been talking about and distill them into real, tangible numbers you can use for your early retirement planning.

The trick is to come prepared. Think of it like a chef prepping their ingredients before starting a recipe—having your information ready makes the whole process smooth and, most importantly, accurate.

Gathering Your Essential Information

Before you can get any meaningful numbers, the calculator needs a few key data points from you. And when I say key, I mean that accuracy is non-negotiable. A small mistake here could throw off your entire plan and lead to serious compliance headaches later on.

Here’s the short list of what you absolutely need to have on hand:

- Your Exact Account Balance: This isn't the time for a ballpark estimate. You need the precise value of the specific IRA or retirement account you intend to use for your SEPP. This number is the foundation of the entire calculation.

- Your Date of Birth: The calculator uses this to pinpoint your exact age, which is then cross-referenced with official IRS life expectancy tables. This is a critical factor in all three calculation methods.

- The Applicable Federal Mid-term Rate (AFR): For the Amortization and Annuitization methods, you need to select a "reasonable" interest rate. The IRS gives you a specific window here—you can use a rate up to 120% of the federal mid-term rate for either of the two months right before your first distribution.

Once you have these three pieces of info, you’re ready to let the calculator do the heavy lifting.

Inputting Your Data and Running Scenarios

Most online SEPP calculators are refreshingly straightforward. You'll find simple fields to plug in the account balance, birth date, and interest rate you just gathered. Hit "calculate," and you’ll instantly see the annual distribution amounts for all three IRS-approved methods.

This is where the planning really begins. You get a clear, side-by-side comparison of what your income would look like under the RMD, Amortization, and Annuitization methods. But don't just stop at one calculation. The real power here is in experimentation.

One of the best things about using a substantially equal payments calculator is the freedom to play with "what-if" scenarios. What happens if you only use half of your IRA balance? How much does a slightly lower interest rate change your Amortization payment? Answering these questions gives you a much richer understanding of your options and the trade-offs involved.

For instance, the official IRS website provides the guidance and tables that are the bedrock of these calculations. Any reputable calculator is built upon these exact resources, ensuring the life expectancy tables and interest rate rules are applied correctly for accurate projections.

Interpreting Your Calculator Results

Seeing a list of numbers is one thing, but understanding what they mean for your day-to-day life is what really matters. The results from a substantially equal payments calculator aren't just figures on a screen; they represent your potential cash flow for years—or even decades—to come.

As you look at the results, start asking yourself some practical questions:

- Is the Amortization payment enough to cover my essential expenses? Since this method often generates the highest fixed payment, it’s a great starting point for seeing if your basic needs will be met.

- Could I manage on the lower initial payment from the RMD method? If you can, this method preserves more of your retirement savings in the early years and offers more growth potential.

- Does the Annuitization method provide a comfortable middle ground? It gives you a predictable, fixed payment like the Amortization method, but the amount is often a bit more conservative.

By thinking through the results this way, you move beyond abstract math and into genuine financial planning. You can start building a realistic budget and see exactly how this new income stream fits into your life. Remember, this is an exploratory process, not a final commitment. Use the calculator to arm yourself with the confidence and clarity you need before making one of the biggest financial decisions of your life.

Avoiding Costly SEPP Plan Mistakes

Starting a Substantially Equal Periodic Payment (SEPP) plan isn't a decision to take lightly. Think of it as a binding contract you're signing with the IRS. And trust me, it’s one where even a tiny mistake can have major financial consequences. The rules are strict and unforgiving for a reason—they're designed to make sure you're genuinely using the money for early retirement income.

If you break the rules and your plan gets "busted," the consequences are severe. The IRS will retroactively apply the 10% early withdrawal penalty to every single distribution you've taken since day one, and they'll add interest on top. A simple error in your fourth year could suddenly trigger a massive penalty bill on money you withdrew and spent years ago.

The Five-Year Rule Explained

One of the absolute cornerstones of a SEPP plan is what’s known as the "five-year rule." This regulation sets the minimum time you have to keep your payment plan active. Once you take that first distribution, you are locked in for a period that is the longer of these two timelines:

- A full five years from the date of your very first payment.

- Until you reach age 59½.

This is a point of frequent confusion. For example, if you start your plan at age 57, you can't just stop payments when you hit 59½. You must continue for the full five-year term, which means you'll be taking payments until you're 62. On the flip side, if you start at age 50, you’re committed until you turn 59½—a period much longer than just five years.

Common Pitfalls That Bust a SEPP Plan

Knowing the rules is one thing, but actively avoiding the common traps people stumble into is how you keep your plan intact. These slip-ups might seem minor, but in the eyes of the IRS, they're direct violations that can invalidate your entire strategy.

A surprisingly frequent mistake is making an additional contribution or deposit into the specific IRA that’s funding your SEPP. Once a plan is active, that account is effectively sealed off. No new money can go in—not even rollovers from other retirement accounts.

Another major landmine is miscalculating or missing a payment. The phrase "substantially equal" is not a suggestion; you have to take the precise, pre-calculated amount every year. Taking too much, taking too little, or skipping a year will instantly bust your plan.

"The single most dangerous assumption people make is that there's flexibility. With a 72(t) plan, there is none. Every action, from the initial calculation to the final payment, must be executed with precision. One accidental deposit or a mis-timed withdrawal can undo years of careful planning."

Real-World Scenarios and Consequences

Let's walk through how easily this can go sideways.

Imagine Sarah, age 53, who starts a SEPP plan with a fixed annual withdrawal of $30,000. In her third year, she receives a small $5,000 inheritance and, without thinking, deposits it into the same IRA funding her plan. That single deposit is considered a modification, and her plan is busted. She now owes a $3,000 penalty (10% of $30,000) for each of the three years, adding up to a $9,000 bill, plus interest.

Understanding the calculations from the start is your first line of defense. The entire concept of SEPPs, governed by IRS Section 72(t), is built on precise formulas that allow penalty-free withdrawals before age 59½. For instance, using the RMD method, a 50-year-old with a $400,000 IRA would calculate a first-year payment of about $11,050. Getting this right is critical.

To steer clear of these disasters, meticulous record-keeping and automation are your best friends. Set up automatic, recurring distributions with your IRA custodian for the exact calculated amount. This simple step can prevent most accidental missteps. And always, always double-check every transaction connected to that designated SEPP account.

For a deeper dive into what not to do, check out our guide on the top 10 things to avoid with a Rule 72(t) SEPP. Staying informed is the best way to protect your hard-earned retirement savings.

Making Changes to Your SEPP Plan and Facing the Tax Man

Once you start a Substantially Equal Periodic Payment (SEPP) plan, you're pretty much committed. The IRS designed these plans to be rigid to stop people from gaming the system, but they also know that life happens and markets can go haywire. Because of this, they’ve built in one very specific, limited escape hatch to adjust your plan without facing disastrous penalties.

This flexibility comes in the form of a one-time switch. If you began your SEPP journey using either the Fixed Amortization or Fixed Annuitization method, you get one chance to permanently switch to the Required Minimum Distribution (RMD) method for any future year. Just know that you can't switch back.

Why on Earth Would You Switch to the RMD Method?

The main reason for making this switch is a strategic one: to lower your required withdrawal, almost always after a major market downturn. Let’s paint a picture. Say you set up an Amortization plan that spits out $40,000 a year. Then, the market tanks and your portfolio drops 25%. You're still on the hook for that $40,000 withdrawal, which means you're selling more of your assets at rock-bottom prices just to meet the requirement. That’s a fast track to depleting your principal.

This is where the switch becomes a lifesaver. By moving to the RMD method, your payment for the next year is recalculated using your new, lower account balance and your current age. This almost always results in a smaller required payout, leaving more of your money invested with a chance to recover when the market turns around. It's a critical tool for preserving your nest egg during volatile times.

This one-time switch is a powerful tool, but it's a one-way street. Once you move to the RMD method, with its fluctuating annual payments, there is no going back to the stability of a fixed payment plan.

Don't Forget About Taxes

A huge misconception is that SEPP withdrawals are tax-free because they avoid the 10% early withdrawal penalty. Nothing could be further from the truth. While you do dodge that nasty penalty, every dollar you take out from a traditional IRA or 401(k) via a SEPP plan is taxed as ordinary income.

This is a detail that can really bite you if you're not ready. A $50,000 annual SEPP distribution means you've just added $50,000 of taxable income to your tax return for the year. Depending on your bracket, that could lead to a significant tax bill you weren't expecting.

Responsible tax planning isn't just a good idea here; it's essential.

- Set Money Aside: The easiest strategy is to treat your SEPP distribution like a regular paycheck. Earmark a portion of every payment—maybe 20-25%, depending on your situation—and put it into a separate account just for taxes.

- Think About Estimated Payments: If your SEPP is your main source of income, you'll likely need to make quarterly estimated tax payments to the IRS. This keeps you square with Uncle Sam and helps you avoid underpayment penalties when you file.

Forgetting about the tax hit can blow up your early retirement budget in a hurry. While a substantially equal payments calculator is great for figuring out your gross distribution, it’s up to you and your financial advisor to plan for what you’ll actually get to keep after taxes.

Common Questions About SEPP Calculations

Even after you've dug into the rules and run the numbers with a substantially equal payments calculator, you're bound to have some lingering questions. Let's be honest, navigating the finer points of Rule 72(t) can feel like trying to solve a puzzle.

To help clear things up, I've put together answers to some of the most common scenarios and concerns I hear from people planning their early retirement.

Can I Take Distributions From Multiple IRAs?

This is a big one. People often wonder if they can just lump all their IRA accounts together for one big SEPP calculation. The IRS has a very firm answer here: No, you cannot aggregate multiple IRAs for a single SEPP plan. The math has to be based on the balance of one specific IRA.

But this isn't necessarily a bad thing. In fact, it opens the door to a smart strategy. You can split a single large IRA into two smaller ones before you start your plan. Then, you set up the SEPP on just one of them. This gives you the income stream you need while leaving the other IRA to keep growing, completely free of SEPP rules.

What if My Account Balance Drops Significantly?

Market swings are a fact of life, and a major downturn is a legitimate fear for anyone on a SEPP plan. If you chose the Amortization or Annuitization method, your annual payment is locked in. If your account value tanks, you're still forced to take out that same amount, which can eat away at your principal much faster than you planned.

This is exactly why the IRS gives you a lifeline: a one-time switch to the RMD method. By making this change, your payment gets recalculated based on the new, lower account balance and your current age. The result is a smaller required withdrawal, which can give your portfolio some much-needed breathing room to recover.

Do I Have to Take My SEPP Payment All at Once?

While your SEPP calculation gives you a total annual distribution number, you have plenty of flexibility in how you actually receive that money. You are absolutely not required to take it as a single lump sum each year.

You can work with your account custodian to set up payments monthly, quarterly, or on whatever schedule makes sense for your personal cash flow. The only thing that truly matters is that the total amount you withdraw for the entire calendar year matches your calculated SEPP amount to the penny. Compliance hinges on that precision.

Can I Use My 401(k) for a SEPP Plan?

Yes, you can apply a SEPP directly to a 401(k) or similar qualified plan, but there’s a significant string attached: you must have already separated from service with that employer.

Frankly, dealing with a former employer's plan administrator can add layers of complexity. That's why most people find it much easier to first roll their 401(k) funds into a traditional IRA. From there, setting up the SEPP plan is a far more straightforward process with fewer administrative headaches.

A 72(t) SEPP unlocks life-changing, consistent income you can use to pursue the things that make life better without punishing penalties from the IRS. The possibilities are endless! To ensure your calculations are accurate and your plan is compliant, trust the experts at Spivak Financial Group.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728

https://72tprofessor.com