Yes, you can absolutely withdraw from a 401(k) early, but it’s a move that should be reserved for true emergencies, and even then, with extreme caution. The moment you tap those funds before age 59 ½, you’re hit with a 20% mandatory federal tax withholding right off the top. That's just the beginning—you'll also face a potential 10% early withdrawal penalty and state income taxes, which can dramatically shrink the amount of cash that actually lands in your bank account.

The True Cost of an Early 401k Withdrawal

Dipping into your 401(k) before retirement might feel like a lifeline when you're under financial pressure. But this decision triggers a cascade of taxes and penalties that can wipe out a huge chunk of your savings before you even see a dime. It’s not just a simple transfer; it’s a major taxable event with lasting consequences.

Think of your 401(k) like a young fruit tree you’ve been carefully nurturing. Every dollar you contribute strengthens its roots, and market growth is the fruit it promises to bear in the future. An early withdrawal is like ripping that tree out of the ground years before its harvest. You get some firewood for today, but you forfeit decades of potential growth.

The Triple Threat of Taxes and Penalties

When you request an early withdrawal, your plan administrator is legally required to withhold 20% for federal income taxes immediately. This isn't the final tax bill, just a down payment. The entire withdrawal is treated as ordinary income, which can easily bump you into a higher tax bracket for the year, meaning you might owe even more come tax time.

On top of that, the IRS slaps on a 10% early withdrawal penalty for most people under age 59 ½. When you add it all up, you’re facing a serious financial headwind right from the start.

The immediate financial hit is only part of the story. The bigger, often overlooked cost is the loss of future compound growth. Money taken out today can no longer work for you, potentially costing you hundreds of thousands of dollars by the time you reach retirement age.

A Real-World Example

To really see how these costs stack up, let's walk through a quick scenario. The table below breaks down the immediate financial damage from a typical early withdrawal.

The Immediate Financial Impact of a $20,000 Early 401k Withdrawal

| Item | Amount | Description |

|---|---|---|

| Initial Withdrawal Amount | $20,000 | The total amount requested from your 401(k) plan. |

| Mandatory Federal Tax Withholding | -$4,000 | Your plan administrator must withhold 20% for federal taxes. |

| IRS Early Withdrawal Penalty | -$2,000 | A 10% penalty is applied for distributions before age 59 ½. |

| Estimated Net Amount Received | $14,000 | The approximate cash you receive after initial deductions. |

As you can see, you’ve lost $6,000, or 30% of your money, right out of the gate. And remember, state income taxes could take an even bigger bite, depending on where you live.

For federal employees facing a similar choice with their Thrift Savings Plan, there's a helpful guide to early withdrawal of TSP funds that explains their specific rules.

Unfortunately, this is an increasingly common story. We’re seeing more people tap into their 401(k)s just to make ends meet. The long-term damage can be staggering. Pulling out $30,000 at age 35 could mean sacrificing over $500,000 by age 65, assuming a solid 10% annual return. It's a stark reminder of the massive opportunity cost.

How to Avoid the 10 Percent Penalty

The dreaded 10% early withdrawal penalty is probably the biggest roadblock people face when they need to get into their 401(k) before age 59 ½. It feels like an unavoidable hit, but the truth is, the IRS has carved out specific exceptions. Knowing these rules is the key to potentially saving yourself thousands of dollars.

It’s really important to remember one thing, though: even if you qualify for an exception and dodge the penalty, the money you take out still counts as ordinary income. That means you'll still owe federal and maybe even state income taxes on the full amount. The exceptions just let you skip the extra 10% sting, not your main tax bill.

Medical and Disability Exceptions

Life throws curveballs, and some of the most common penalty exceptions are designed to give you a financial lifeline during serious health challenges.

-

Unreimbursed Medical Expenses: You can take a penalty-free withdrawal to cover medical bills, but only the amount that exceeds 7.5% of your adjusted gross income (AGI). So, if your AGI is $60,000, you could use your 401(k) penalty-free for any medical costs over $4,500.

-

Total and Permanent Disability: If you become totally and permanently disabled, the IRS lets you access your 401(k) funds without the penalty. To qualify, a doctor must certify that you can't perform any substantial gainful work due to a condition that's expected to be long-term or terminal.

Exceptions Related to Your Home or Family

Big life events can also open the door for penalty-free access to your funds. These rules acknowledge that sometimes, your family's needs have to come first.

Now, a lot of people think about the first-time homebuyer exception. Here's a critical distinction: that rule is for IRAs, not 401(k)s. If you want to use 401(k) money for a down payment, you usually have to roll it over into an IRA first, which is a whole separate process that requires careful planning.

A Qualified Domestic Relations Order (QDRO) is another major exception.

A QDRO is a legal order, typically part of a divorce settlement, that splits a retirement account. Any money distributed to an ex-spouse or dependent under a QDRO is completely exempt from the 10% early withdrawal penalty.

Job Separation and Other Special Circumstances

How and when you leave your job can make a huge difference. If you part ways with your employer—whether you quit, get laid off, or retire—during or after the year you turn 55, you can take penalty-free distributions from that specific company's 401(k). This is what's known as the "Rule of 55."

There are a handful of other less common situations where the penalty is waived, too. This includes distributions paid out to a beneficiary after the account owner passes away or withdrawals taken by a qualified military reservist who gets called to active duty. You can dive deeper into the complete list of 10% early withdrawal penalty exceptions to see if any others apply to you.

Ultimately, avoiding penalties is just one piece of the puzzle. It’s also wise to look into broader tax-efficient investing strategies to keep your overall tax burden as low as possible. These rules demand attention to detail—one small mistake could lead to a big, unexpected bill from the IRS.

Understanding Hardship Withdrawals

When you're staring down a real financial crisis, the term "hardship withdrawal" can sound like a get-out-of-jail-free card for your 401(k). This is probably one of the most common—and most expensive—misunderstandings people have when they need to withdraw from 401k early.

Here's the hard truth: while a hardship withdrawal gives you access to your retirement funds for a true emergency, it absolutely does not waive the 10% early withdrawal penalty.

The IRS has a very specific definition for this. A hardship distribution is only for an "immediate and heavy financial need." Think of it as the absolute last resort, a move you make only after you've tried every other reasonable option to get the cash you need. It’s not a special pass, but a regulated emergency valve on your retirement savings.

This is a critical distinction. Even if your reason is 100% legitimate, the withdrawal is still an early distribution if you're under age 59 ½. That means you're on the hook for ordinary income taxes on the entire amount, plus the extra 10% penalty.

What Qualifies as a Financial Hardship

The IRS lays out several "safe harbor" reasons that automatically count as an immediate and heavy financial need. Your specific 401(k) plan might not allow for all of them, so you always have to check with your plan administrator first.

But generally, the approved reasons include:

- Medical Care Expenses: For you, your spouse, or dependents, but only for costs not covered by insurance.

- Preventing Eviction or Foreclosure: Money needed to stop you from being kicked out of your primary rental home or losing your main residence to foreclosure.

- Home Purchase Costs: Certain costs tied to buying your principal residence (but this doesn't include ongoing mortgage payments).

- Tuition and Educational Fees: To pay for the next 12 months of postsecondary education for yourself, your spouse, kids, or other dependents. This includes tuition, fees, and room and board.

- Funeral Expenses: Covering burial or funeral costs for a deceased parent, spouse, child, or dependent.

- Home Repair Costs: For fixing major damage to your principal residence that would qualify for a casualty deduction on your taxes.

To get approved, you'll need to show proof, like medical bills, eviction notices, or tuition invoices. You also have to certify that you’re only taking out what’s absolutely necessary to cover the need.

The Hidden Downsides of a Hardship Withdrawal

Getting the cash you need today can feel like a huge relief, but a hardship withdrawal carries some serious long-term baggage that can permanently hurt your retirement. First off, any money you take out is gone for good. Unlike a 401(k) loan, you can't pay it back. That means you lose out on all the future tax-deferred growth that money would have generated.

On top of that, after you take a hardship distribution, your 401(k) plan might legally suspend you from making any new contributions for up to six months. This forced time-out doesn't just halt your savings; it means you could miss out on thousands in employer matching funds, making a bad situation even worse.

Unfortunately, more and more Americans are being forced into this corner. Recent data shows a troubling trend: hardship withdrawals have surged, more than doubling from just 2% of participants in 2018 to 5% in 2024. As Fidelity Investments reports, that's the highest rate they've ever recorded, a clear sign that soaring living costs are pushing people to raid their retirement accounts. You can read more about this in the full MarketWatch report on retirement savings.

Before taking this irreversible step, you have to understand the full picture. For a complete breakdown of how it all works, check out our guide on how to take money from a 401(k). Given the steep price you'll pay, a hardship withdrawal should only ever be an option after every other door has been closed.

Smarter Alternatives to Cashing Out Your 401k

Before you pull the trigger on an early 401(k) withdrawal, it’s critical to hit pause and look at your other options. Thinking of your retirement savings as a last-resort emergency fund is the right mindset—it should only be touched after every other avenue has been explored.

Fortunately, there are much smarter ways to get your hands on cash that won't sabotage your long-term financial security. These alternatives are meant to be a bridge during a tough time, not a wrecking ball to the nest egg you’ve worked so hard to build.

Weighing Your Loan Options

When you're in a financial pinch, borrowing money is almost always a better move than permanently taking it from your future self. For many, a 401(k) loan is the most straightforward choice because you're essentially borrowing from yourself.

The big difference here is that you pay yourself back—with interest—rebuilding your account balance over time. This approach lets you sidestep the dreaded 10% early withdrawal penalty and immediate income taxes, as long as you stick to the repayment plan. Be warned, though: if you leave your job for any reason, the loan often has to be paid back in full very quickly, which can trigger a whole new financial crisis if you aren't ready.

Personal loans or even a Home Equity Line of Credit (HELOC) are other solid alternatives. While their interest rates might be a bit higher than a 401(k) loan, they create a clean separation between your debt and your retirement savings. This keeps your nest egg safe and sound, no matter what happens with the loan.

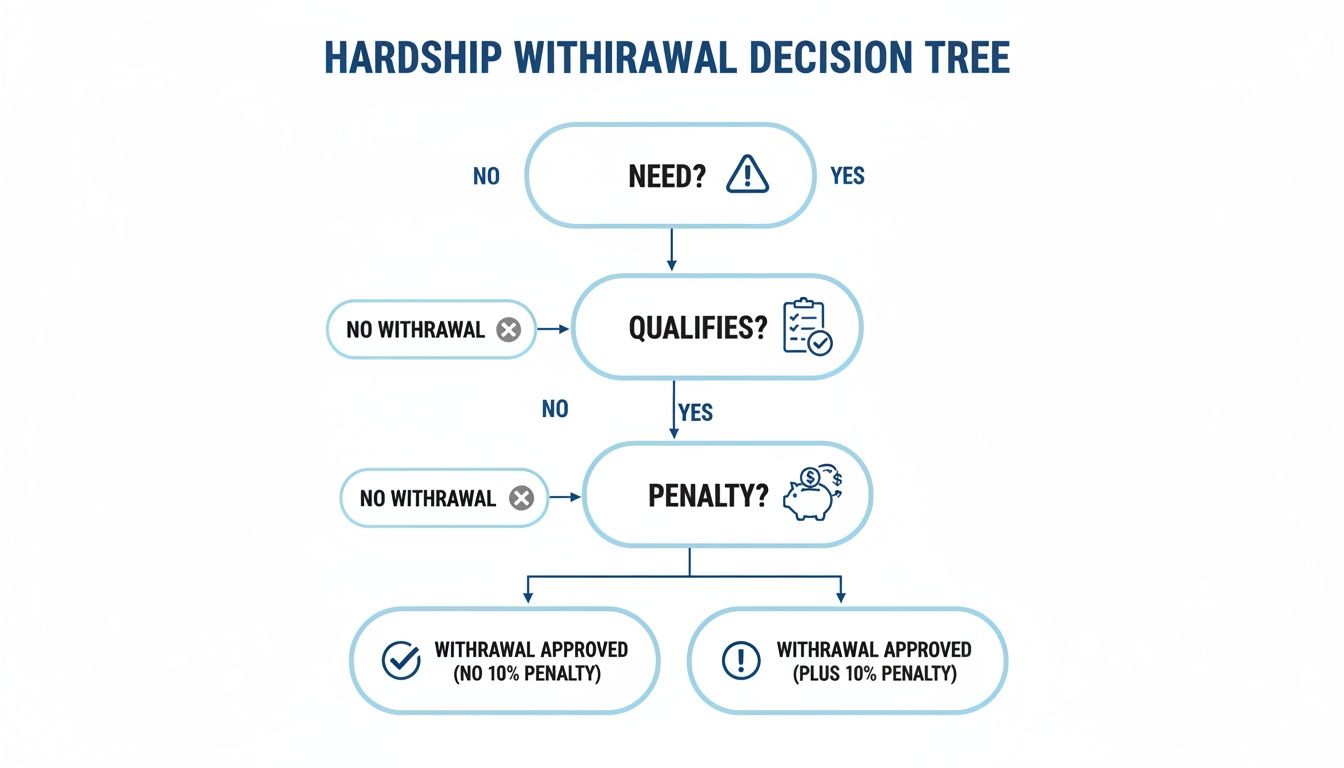

This decision tree gives you a clear visual for the tough questions you need to ask before ever considering a hardship withdrawal.

As the flowchart shows, just because you qualify for a hardship distribution doesn't mean you're magically protected from the painful financial consequences that come with it.

To help you see the differences more clearly, let's compare these options side-by-side.

Comparing Funding Options 401k Withdrawal vs. Alternatives

| Feature | Early 401k Withdrawal | 401k Loan | Personal Loan |

|---|---|---|---|

| Taxes & Penalties | Subject to ordinary income tax + 10% penalty | No immediate taxes or penalties | None on the loan amount |

| Repayment | Not applicable; funds are gone for good | Required; you pay yourself back with interest | Required; payments made to a lender |

| Impact on Savings | Permanently reduces your retirement balance | Temporarily reduces balance until repaid | No direct impact on your retirement account |

| Credit Impact | No impact on credit score | Does not appear on credit reports | Requires a credit check; affects credit score |

| Job Separation | Not affected by employment status | Loan may become due immediately | Unaffected by employment status |

| Best For | Absolute last resort for severe emergencies | Short-term cash needs when you have stable employment | Financial needs without risking retirement funds |

This table makes it obvious: an early withdrawal comes with the steepest long-term costs. The alternatives, while not without their own rules, are designed to preserve your retirement savings.

Introducing Substantially Equal Periodic Payments (SEPP)

What if you need a steady, reliable income stream before you turn 59 ½? For this, there's a powerful but very specific strategy known as Substantially Equal Periodic Payments (SEPP), often called a 72(t) distribution. This isn't a fix for a one-off emergency, but rather a way to create your own personal pension for an early retirement.

Think of it this way: instead of one big, destructive lump-sum withdrawal, a SEPP plan sets up a series of smaller, precisely calculated payments from your retirement account. When set up according to strict IRS rules, these payments are completely exempt from that 10% early withdrawal penalty.

A 72(t) plan is a serious commitment. Once you start the payments, you must continue them for at least five years or until you turn 59 ½, whichever period is longer. Modifying the plan can trigger retroactive penalties on all the money you’ve taken out.

This makes the 72(t) strategy an excellent tool for someone who is deliberately planning to retire early, but a terrible choice for dealing with a surprise medical bill. To use this strategy, you generally need to move your funds from an employer's 401(k) into an IRA. For those still working, understanding a 401(k) rollover to an IRA while still employed is the critical first step.

At Spivak Financial Group, we specialize in designing these complex plans. A properly structured 72(t) distribution demands precise calculations and a deep knowledge of IRS regulations to avoid very costly errors. The key is always to match the right financial tool to your specific situation. Before you decide to withdraw from 401k early, make sure you’ve carefully analyzed every choice on the table.

The Step-by-Step Process for an Early Withdrawal

So, you've weighed the alternatives and decided you absolutely must withdraw from your 401k early. Now what? The key is to follow the right procedure to the letter. Moving through the process methodically will help you avoid frustrating delays, expensive mistakes, and a lot of extra stress during what is probably already a tough time.

Let’s break it down into a clear, manageable roadmap.

Your first call is always to your 401(k) plan administrator. This is the company that actually manages the plan for your employer, and they are the gatekeepers for all the specific rules and forms you'll need. Every single plan has slightly different procedures, so what worked for a coworker or friend might not apply to your situation at all.

Ask them directly about their process for early distributions. Get the details on any plan-specific limits or required waiting periods. They’re the ones who will provide the official withdrawal application, which is the document that gets the entire process started.

Gather Your Documentation

Once you have the initial paperwork, it's time to play detective and gather all your supporting documents. This step is especially critical if you're trying to qualify for a penalty exception or a hardship withdrawal. You can't just say you need the money; you have to prove it.

For instance, if you're withdrawing to cover major medical bills, you’ll need to produce the actual invoices and statements from the hospital or doctor. If you're trying to stop a foreclosure, you must have the official notice from your mortgage lender. Having this evidence organized and ready to go will make everything else so much smoother.

It's a common mistake to think the process is one-size-fits-all. The data tells a different story. Hourly workers, who often deal with more volatile incomes, tend to cash out their 401(k)s at rates 10-15 percentage points higher than their salaried peers. This isn't a small trend—about 33% of Vanguard plan participants cashed out their savings when they left a job in 2023. You can dig into the factors driving these decisions and see more detailed research on retirement plan trends.

Complete the Forms and Prepare for Taxes

With your documentation in hand, it’s time to fill out the distribution forms. Be meticulous. Pay close attention to every single field, but put a magnifying glass on the tax withholding section. Your plan administrator is legally required to withhold a mandatory 20% for federal income taxes on most early withdrawals.

Some forms will give you the option to withhold more than that 20%. It definitely stings to see a bigger chunk of your money disappear upfront, but choosing to withhold extra for both federal and state taxes can be a smart move. It can help you avoid a truly massive, gut-wrenching tax bill when you file your return next year.

After you submit the completed application and all your proof, the final step is to wait for the funds. The timeline can vary quite a bit, but it usually takes anywhere from a few days to several weeks to get the request processed and the money into your bank account. Make sure you plan your finances around this waiting period.

When to Partner With a Financial Professional

Trying to make huge decisions about your retirement savings when you're under financial stress can feel impossible. It’s one thing to read the rules, but it’s another thing entirely to figure out how they apply to your life. This is exactly where getting professional guidance isn't just a nice-to-have—it's essential for protecting your future.

Going it alone on an early 401(k) withdrawal is like trying to do your own complex surgery after reading a first-aid manual. You might know the basics, but the risk of a costly, irreversible mistake is incredibly high. A qualified financial professional is the surgeon in this scenario, bringing experience and precision to the table. They can show you the true long-term impact of your decision, often revealing consequences you never even considered.

When an Expert Is Non-Negotiable

Some situations are just too complex to handle on your own. If you find yourself in any of the following scenarios, it's time to call in a professional:

- Considering a Large Withdrawal: The tax hit from a big withdrawal can be absolutely devastating if not handled correctly. An advisor can help structure the distribution to minimize the damage come tax time.

- Planning a 72(t) SEPP Distribution: Setting up a Substantially Equal Periodic Payment plan is a minefield of intricate rules. Just one small miscalculation can trigger retroactive penalties on every single dollar you've already taken.

- Navigating a Complex Penalty Exception: Proving to the IRS that you qualify for a specific exception requires perfect documentation and a deep understanding of tax law.

A financial professional's real value is their ability to see the alternatives you've missed. They look at your entire financial picture and can often find much less destructive ways to get you the cash you need.

Before you make a choice you can't take back, getting personalized advice is the single best investment you can make for your future. The team at Spivak Financial Group lives and breathes these exact scenarios. We know how to ensure you're compliant with all IRS rules while protecting your hard-earned savings.

Give us a call at (844) 776-3728 for a consultation before you decide to withdraw from your 401k early. Our offices are located at 8753 E. Bell Road, Suite #101, Scottsdale, AZ 85260.

Your Top 401(k) Withdrawal Questions, Answered

Once you start looking into the rules for tapping your 401(k) early, it’s natural for questions to pop up. Let’s tackle some of the most common ones to clear up the confusion between your options and what they really mean for your money.

Can I Repay an Early 401(k) Withdrawal?

This is a big one, and the answer is usually no. Unlike a 401(k) loan, which you’re expected to pay back, a regular or hardship withdrawal is a permanent move. Once that money is out, it's out for good.

You can't just decide to put the funds back into the account later. This is a final decision with a serious long-term cost: you forfeit all the future tax-deferred growth that money would have earned on its way to your retirement.

Think of it this way: a 401(k) loan is like a boomerang that comes back to you. A withdrawal is more like an arrow—once you let it fly, it’s not coming back. Keeping this distinction in mind is critical when you decide to withdraw from your 401k early.

How Does an Early 401(k) Withdrawal Affect My Taxes?

Brace yourself, because an early withdrawal can pack a serious punch at tax time. The entire amount you take out is considered ordinary income by the IRS. It gets tacked right on top of all your other earnings for the year, like your salary.

This instantly inflates your total income, which can easily bump you into a higher tax bracket. If that happens, you’ll owe more in taxes not just on the withdrawal itself, but on your overall income. And don't forget the cherry on top: that extra 10% early withdrawal penalty you'll almost certainly have to pay.

What's the Real Difference Between a 401(k) Loan and a Withdrawal?

Knowing the difference between a loan and a withdrawal is absolutely essential for making a sound financial decision. They both get you cash, but that’s where the similarities end. Their inner workings and consequences couldn't be more different.

A 401(k) loan is exactly what it sounds like—you’re borrowing from yourself.

- You pay the money back to your own account, plus interest.

- As long as you stick to the repayment plan, the whole transaction is tax- and penalty-free.

- It temporarily lowers your account balance but is designed to be fully paid back over a few years.

A withdrawal, on the other hand, is a permanent distribution.

- The money is gone forever and is not repaid, which permanently shrinks your retirement savings.

- It gets hit with both ordinary income tax and, if you're under 59 ½, that painful 10% penalty.

- You lose the future growth potential of those funds permanently.

In short, a loan is a temporary bridge built to preserve your retirement savings for the long haul. A withdrawal is a permanent, and often expensive, demolition of a piece of it. Which path is right for you depends entirely on your situation and what you want for your future.

Making the right call when you need early access to retirement funds is a high-stakes decision with lasting consequences. The expert team at Spivak Financial Group specializes in navigating these intricate IRS rules, including sophisticated strategies like 72(t) SEPP plans, to help you make choices that protect your financial future. Before you take a step you can't undo, get personalized guidance. Learn more at https://72tprofessor.com.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728