Thinking about early retirement but worried about how you'll access your IRA funds before age 59½? There's a powerful IRS provision that can help, often called IRA substantially equal periodic payments (SEPPs), or more formally, 72(t) distributions. Think of a 72(t) plan as a special key that can unlock your retirement savings early, letting you build a steady, reliable income stream when you need it most.

Unlocking Early Retirement Without Penalties

The dream of retiring early often runs into a major financial roadblock: the 10% IRS penalty for taking money from an IRA before you hit age 59½. This penalty is there for a reason—to keep people from draining their retirement accounts too soon—but it can feel like a major obstacle if you've planned well and are ready to leave the workforce.

Luckily, the tax code has a built-in exception specifically designed to help you create an income bridge to your later years.

What Are Substantially Equal Periodic Payments

At its heart, a SEPP plan is a very specific, structured withdrawal strategy that lets you get to your funds without that nasty early withdrawal penalty. To qualify, you have to commit to taking a series of payments calculated using one of three specific, IRS-approved methods.

The catch? These payments must keep coming for at least five full years or until you turn 59½, whichever time period is longer.

Let’s say you’re 50 years old with a $400,000 IRA. You’re ready to retire, but that penalty is a huge concern. Substantially equal periodic payments, laid out in IRC Section 72(t)(2)(A)(iv), are a complete game-changer. They let you tap into those funds penalty-free, but only if you follow the rules to the letter. You can read up on the official guidelines directly from the source in these IRS rules for early distributions.

A SEPP isn't a one-time cash grab; it's a serious commitment to a consistent income stream. If you break the rules, the IRS can retroactively apply the 10% penalty to every single distribution you've taken, plus interest.

This guide will break down exactly how these plans work, the critical rules you can't afford to ignore, and how to figure out if this is the right move for your financial future. If you're just starting your research, getting a handle on the basics of penalty-free IRA withdrawals is an excellent first step. By the end, you'll have a clear, actionable roadmap.

Choosing Your SEPP Calculation Method

So, you've decided an IRA substantially equal payments plan might be the right move. The next big step is figuring out how your payments will be calculated. The IRS gives you three distinct, approved methods to choose from, and this isn't a small decision—it will dictate your income stream for years.

This choice isn't just about crunching numbers. It's about matching a specific formula to your real-life financial needs, whether that means prioritizing rock-solid stability or building in some flexibility.

Think of these methods as different routes on a road trip. Each one gets you to the same destination (penalty-free income), but the journey itself feels completely different. One path is a straight, predictable highway, while another is a scenic route that adjusts to the terrain.

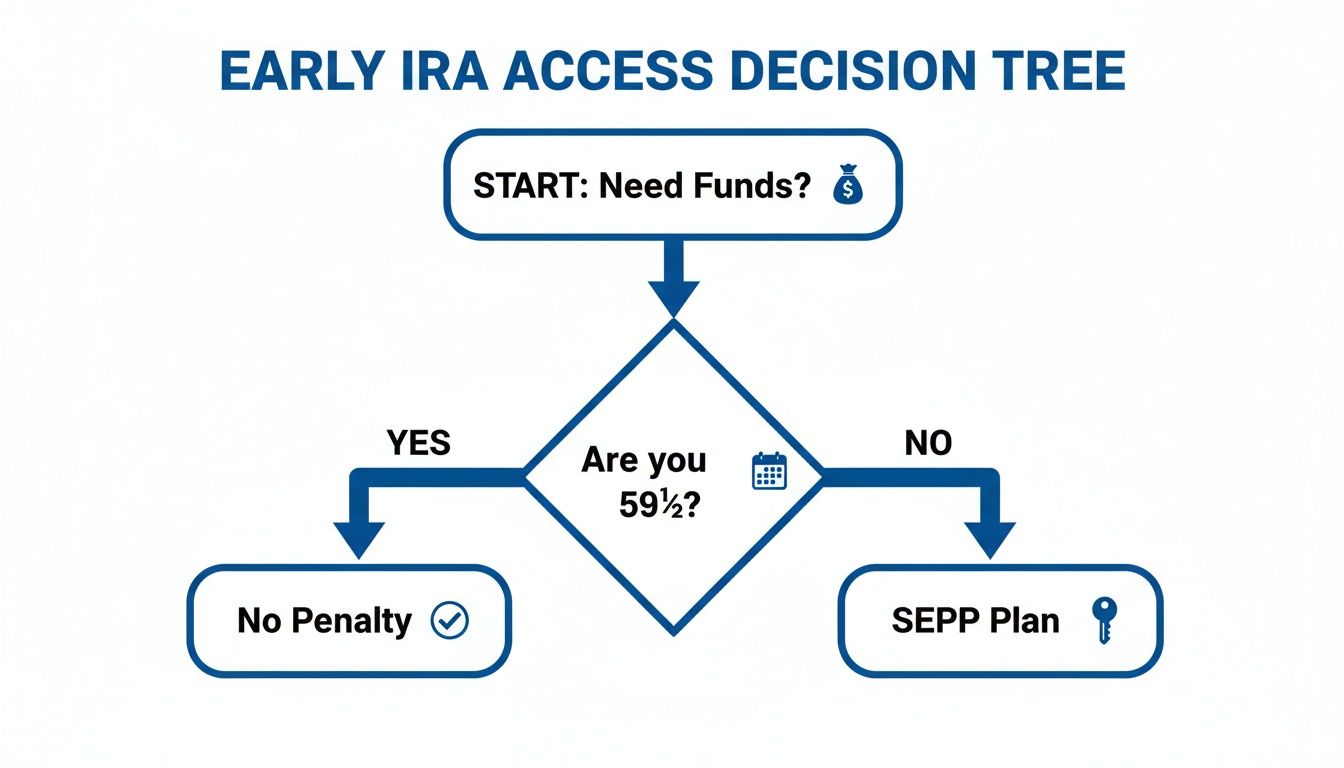

This decision tree gives a great high-level view of when a SEPP plan really comes into play for early retirement access.

As the visual makes clear, for anyone under age 59½ who needs to tap into their retirement funds, a SEPP plan is the designated path to sidestep those hefty early withdrawal penalties.

Let's break down the three paths you can take.

The Required Minimum Distribution (RMD) Method

The RMD method is the most straightforward and flexible of the bunch. Here’s how it works: your payment is recalculated each year based on your IRA's account balance from December 31 of the prior year and your current life expectancy.

Imagine your income stream is a small boat on the ocean. With the RMD method, your boat rises and falls with the market tides. If your investments do well and your account balance grows, your payment for the next year gets bigger. If the market takes a dive, your payment shrinks, which actually helps preserve your nest egg during a downturn.

Because the payments can fluctuate, this method is often the best fit for people who have other income sources and can handle a little variability. It’s the only method that allows your payment amount to change from year to year.

The Fixed Amortization Method

The Fixed Amortization method is all about predictability. It calculates a single, fixed annual payment that you'll receive for the entire life of your SEPP plan. The math is based on your life expectancy (or joint life expectancy with a beneficiary) and a reasonable interest rate set by the IRS.

This approach is like setting your financial cruise control. You lock in a specific payment amount on day one, and it stays exactly the same every single year, no matter what the market does. That predictability is its greatest strength.

Because it provides a consistent and reliable income stream, the amortization method is ideal for individuals who need to cover fixed expenses like a mortgage or insurance premiums. It offers peace of mind through stability.

The interest rate you use is a critical piece of the puzzle. The IRS allows you to use a "reasonable" rate, which is tied to the federal mid-term rates published for a recent period. Choosing a higher allowable rate will result in a larger annual payment.

The Fixed Annuitization Method

The Fixed Annuitization method also delivers a fixed annual payment, much like its amortization cousin. It works by dividing your IRA account balance by an annuity factor, which is a value pulled from IRS mortality tables and combined with your selected interest rate.

Think of this method as a close relative to the amortization method; they both result in a steady, unchanging payment. The main difference is the underlying math. For most people, the payment amount will be very similar to what the amortization method produces, though often just a little bit lower.

Like the amortization method, this option is excellent for anyone who values a predictable income stream far more than one that adjusts with market performance.

To help you get a real feel for these options, we’ve put together a handy table comparing them side-by-side.

Comparing the Three SEPP Calculation Methods

| Method | Payment Structure | Flexibility | Best For |

|---|---|---|---|

| RMD Method | Recalculated annually based on account balance and life expectancy. Payments can go up or down. | High. The only method with variable payments that adapt to market conditions. | Individuals with other income sources who can tolerate payment fluctuations and want to preserve capital in down markets. |

| Fixed Amortization Method | A single, fixed annual payment is calculated at the start and remains the same for the entire plan. | Low. Once set, the payment amount cannot be changed. | People needing a predictable, stable income to cover fixed expenses like a mortgage. It offers maximum certainty. |

| Fixed Annuitization Method | Also provides a single, fixed annual payment that doesn't change. The calculation is based on an annuity factor. | Low. Like amortization, the payment is locked in from the beginning. | Those who prioritize a reliable and consistent income stream. Payments are often slightly lower than the amortization method. |

Each method has its place, and the right one truly depends on your specific financial picture and goals.

If you want to see how these methods could play out with your own numbers, you can experiment with our substantially equal payments calculator to compare the potential outcomes. It’s a great tool for understanding the real-world dollar amounts each method could generate for you.

Ultimately, the best method for your IRA substantially equal payments depends entirely on your personal circumstances and your comfort with risk.

How to Set Up Your SEPP Plan Step by Step

Alright, let's move from theory to action. Knowing what IRA substantially equal payments are is one thing, but actually putting a plan in place is where the rubber meets the road. Setting up a SEPP is a formal process, not a casual decision, and precision is everything. One wrong move can blow up the whole plan and land you with the exact penalties you were trying to sidestep.

Think of it like building a custom piece of furniture. Every measurement has to be exact, every cut precise, and every piece joined perfectly for the final product to be stable and last for years. This section is your blueprint, walking you through each critical step to make sure your SEPP is built right from the ground up.

Step 1: Calculate Your Potential Payments

Before you do anything else, you absolutely have to run the numbers. What would your income stream actually look like? The first real step is to calculate your potential annual payment using all three IRS-approved methods: RMD, Fixed Amortization, and Fixed Annuitization.

This is your reality check. It’s where you see the hard figures each method would produce based on your specific IRA balance, your age, and a reasonable interest rate. Laying these numbers out side-by-side is the only way to get the clarity you need to pick the method that truly fits your budget and long-term goals.

Step 2: Select the Right IRA Account

Here’s a crucial strategy: you don’t have to lock up your entire IRA balance in a SEPP. In fact, it's often much smarter to carve out only the amount you need for the plan. You can do this by transferring a specific portion of a larger IRA into a brand-new, separate IRA that will be used exclusively for your 72(t) payments.

For instance, say you have a $1 million IRA but you only need an income stream based on a $400,000 balance. You would simply move $400,000 into a new IRA and then build the SEPP from that smaller account. This is a game-changer for two big reasons:

- Preservation: It shields the rest of your retirement savings from the SEPP's rigid rules, leaving that money free to keep growing without restrictions.

- Flexibility: It creates a clean boundary, making it almost impossible to accidentally break the rules by making a contribution or an extra withdrawal from the dedicated SEPP account.

Step 3: Choose a Reasonable Interest Rate

When using the Amortization or Annuitization methods, you have to select an interest rate. This isn’t a wild guess; the rate you choose directly affects how much you get paid, and the IRS has firm rules about it. You must use what they call a "reasonable interest rate."

So what's reasonable? The IRS states that the rate can be no more than 120% of the federal mid-term rate for either of the two months right before you start your distributions. Straying outside this guideline is a massive red flag that could get your entire plan disqualified.

Don't take this step lightly. Picking a compliant rate is what makes your calculations defensible if the IRS ever comes knocking. It's a cornerstone of building a plan that's both sustainable and by the book.

Step 4: Notify Your IRA Custodian

Once your numbers are crunched and the account is set up, it’s time to make it official. You can't just start taking money out on your own. You must give your IRA custodian clear, written instructions that you are starting a SEPP under IRC Section 72(t).

Your letter of instruction needs to be specific. Tell them:

- The exact dollar amount for each payment.

- How often you want the payments (monthly, quarterly, or annually).

- The start date for the very first distribution.

Your custodian will then code the withdrawal correctly on your annual Form 1099-R, which is vital for proper tax reporting. For a much deeper look into the specific regulations behind this, check out our guide on 72(t) distribution rules. This final, formal step ensures your plan is executed properly and officially documented right from day one.

Understanding the Strict Rules of a 72(t) Plan

An IRA substantially equal payments plan can be an incredible tool, but it's built on a foundation of strict, unbendable rules from the IRS. You need to think of it less like a flexible savings account and more like a binding contract. Once you start, you're locked into a very specific schedule. Deviating from it carries severe financial consequences.

Understanding these rules isn't just important—it's absolutely essential for protecting your retirement savings from the very penalties you're trying to avoid in the first place.

The Unbreakable Lock-In Rule

The most fundamental rule of any 72(t) plan is what’s known as the "lock-in" period. This rule dictates exactly how long you must continue taking your scheduled payments without fail. It’s not a suggestion; it's a mandate.

You must continue your payments for at least five full years or until you reach age 59½, whichever period is longer. This is the absolute minimum commitment you're making.

Let's see how this plays out in real life:

- If you start at age 52: You must continue payments until you turn 59½. That's a commitment of 7.5 years, which is longer than the five-year minimum.

- If you start at age 56: You must continue payments for five full years, taking you to age 61. In this scenario, the five-year rule extends beyond age 59½.

This lock-in rule is specifically designed to ensure the SEPP is used for a genuine income stream, not as a clever loophole for a one-time, penalty-free withdrawal. Once you begin, you are on a fixed path until the term is complete.

The High Cost of Modifying Your Plan

So, what happens if you break the rules? The IRS doesn't just penalize the one payment you missed or changed. It "busts" the entire plan retroactively, going all the way back to the very first dollar you took out.

This is what's known as a plan modification, and the consequences are truly severe.

If you modify your SEPP plan in any way before the lock-in period ends, the IRS will disqualify it. You will then owe the 10% early withdrawal penalty on every single distribution you have received since day one, plus accrued interest on those penalties.

Imagine you've been taking $40,000 a year for three years. If you make a mistake in year four, the IRS will retroactively hit you with a $4,000 penalty for year one, another $4,000 for year two, and a third $4,000 for year three, plus interest. It's a costly error that completely wipes out the benefit of the plan.

What Counts as a Plan Modification

The term "modification" is broad and covers a lot more than just stopping payments. Any of the following actions taken before your lock-in period is over will trigger that retroactive penalty:

- Taking an incorrect amount: Withdrawing even a dollar more or a dollar less than your calculated payment for the year (unless using the RMD method, which recalculates annually).

- Missing a payment: Failing to take a distribution within the calendar year it's scheduled.

- Making additional withdrawals: Taking any extra money out of the specific IRA that is funding your SEPP.

- Adding funds to the account: Making a contribution or rolling over new funds into the dedicated SEPP IRA.

Even actions that seem unrelated can bust your plan. This is why it is so critical to isolate the funds for your IRA substantially equal payments in a separate, dedicated IRA to prevent any accidental commingling of funds.

The One-Time Method Switch Exception

While the rules are incredibly strict, the IRS does provide one small window of flexibility. You are permitted to make a one-time switch from either the Fixed Amortization or Fixed Annuitization method to the RMD method.

Why would someone do this? The RMD method naturally adjusts payments downward if the account balance falls. If a market downturn has significantly reduced your IRA's value, switching to the RMD method can help preserve your remaining principal by lowering your required distribution amount.

But be warned, this is a one-way street. Once you switch to the RMD method, you cannot switch back. The change is permanent for the rest of your SEPP schedule. It's a strategic tool, but one that must be used with careful consideration of its long-term impact on your income. At Spivak Financial Group, our experts at 72tProfessor.com can help you navigate these critical decisions to ensure your plan remains compliant.

Common SEPP Mistakes and How to Avoid Them

Knowing the rules of an IRA substantially equal payments plan is just the starting line. The real challenge—and where many plans unfortunately fail—is avoiding the common, real-world mistakes that can derail your strategy. A 72(t) plan demands near-perfect execution, because even a tiny slip-up can cause the IRS to retroactively hit you with that 10% penalty you were trying to avoid.

Think of this section as your preventative guide. We'll walk through the most frequent and costly pitfalls people run into when managing a 72(t) plan. By learning from others' missteps, you can navigate your SEPP with confidence and keep your penalty-free income stream flowing.

Miscalculating the Initial Payment

The most critical mistake often happens before the first dollar even leaves your account: an incorrect calculation. Whether you use the wrong life expectancy table, an unapproved interest rate, or there's just a simple math error, starting with the wrong payment amount invalidates the entire plan from day one.

The IRS requires you to follow one of its three approved calculation methods with absolute precision. A flawed calculation isn’t something you can just fix down the road; it's a foundational error that disqualifies the SEPP immediately.

How to Avoid This:

- Triple-check your inputs: Make sure you're using the right IRA balance, the latest IRS life expectancy tables, and a "reasonable interest rate" that's within the allowable range (no more than 120% of the federal mid-term rate).

- Use professional tools: A simple spreadsheet error can cost you thousands. Using a reliable calculator or, even better, consulting a professional ensures your numbers are spot-on from the get-go. The experts at 72tProfessor.com can help verify your calculations.

Commingling Funds and Accidental Modifications

One of the sneakiest ways to bust a SEPP is by accidentally modifying the dedicated IRA. Things like making an extra contribution, rolling other funds into the account, or taking out a little extra for an emergency are all seen as plan modifications by the IRS.

This happens a lot when someone sets up their SEPP using their only or primary IRA, making it easy to forget its special, restricted status.

A dedicated SEPP IRA should be treated like a vault. Once the plan begins, nothing new goes in, and only the exact, scheduled payments come out. Any other transaction breaks the seal and triggers penalties.

A classic example is when someone forgets to turn off an automatic contribution from their paycheck, which instantly disqualifies the whole plan.

Failing to Take the Exact Distribution

Consistency is everything. If you're using the Fixed Amortization or Fixed Annuitization methods, you must withdraw the exact calculated amount every single year. Taking even a dollar more or a dollar less is considered a plan modification.

This requires careful communication with your IRA custodian. You can't just tell them to "start a SEPP"; you have to ensure they distribute the precise amount on the schedule you've chosen (annually, quarterly, or monthly).

How to Avoid This:

- Provide Clear, Written Instructions: Give your IRA custodian a formal letter spelling out the exact withdrawal amount and frequency.

- Verify the First Payment: As soon as your first distribution hits your bank account, double-check that the amount withdrawn matches your calculation perfectly.

- Set Calendar Reminders: If you take annual distributions, set several reminders to make sure you take the payment before December 31st. Missing that year-end deadline is an irreversible mistake.

Incorrectly Managing RMD Method Payments

While the RMD method offers more flexibility, it comes with its own unique trap: forgetting to recalculate the payment each year. Unlike the fixed methods, your RMD payment must be re-determined annually based on the account balance from the end of the previous year and your updated life expectancy factor.

If you forget this step and just keep taking the same amount as last year, you've modified the plan. The flexibility of the RMD method comes with the responsibility of annual diligence. This process keeps your distributions in sync with your account's performance, protecting your principal in down markets but requiring consistent attention to stay compliant with the rules of your IRA substantially equal payments schedule.

When to Get Professional Guidance for Your SEPP

While you can certainly get your head around the concept of an IRA substantially equal payments plan with some dedicated research, putting it into practice is another story entirely. The IRS rules are incredibly strict, and the stakes are high—one tiny miscalculation can unleash a wave of retroactive penalties and interest. This is precisely why some situations are a clear signal to call in a professional.

Trying to navigate a SEPP on your own can feel manageable at first, but the complexity can ramp up quickly. Even the most confident DIY investors often find peace of mind by having an expert double-check their math and strategy before locking into a plan that's nearly impossible to change.

When an Expert Is a Must-Have

You should seriously consider seeking professional help if you find yourself in any of these common situations:

- You Have a Complicated Financial Picture: Your retirement savings are spread across multiple IRA or 401(k) accounts. Or maybe you have other significant assets or income streams that make the whole decision-making process feel tangled.

- You're Unsure About the Calculation Methods: You're staring at the three IRS-approved methods—RMD, Amortization, and Annuitization—and have no idea which one truly fits your long-term needs and how much risk you're comfortable with.

- You're Worried About Making a Costly Mistake: You’ve read about the severe consequences of breaking the rules and want total certainty that your SEPP plan is 100% compliant with the IRS from the very first payment.

- You Want to Get It Just Right: It’s not just about being compliant; you want to be strategic. You want to make sure you're choosing the right accounts to draw from and calculating the perfect payment amount to meet your goals without leaving money on the table.

A well-designed 72(t) plan is a fantastic tool for funding an early retirement. But a poorly designed one can be a financial nightmare. Getting expert guidance turns that potential anxiety into a reliable, penalty-free income stream you can count on.

The team at 72tProfessor.com, powered by Spivak Financial Group, lives and breathes this stuff. We specialize in building accurate, compliant, and optimized SEPP strategies day in and day out. If you're thinking about going down this road, getting a specialist involved ensures your plan is built on a rock-solid foundation, giving you complete peace of mind.

Frequently Asked Questions About SEPP Plans

Once you get a handle on the basics of IRA substantially equal payments, the real-world questions start popping up. Let's tackle some of the most common ones to clear up any confusion as you consider the practical side of things.

Can I Use a 401(k) or 403(b) for a 72(t) Plan?

This is a great question, and the direct answer is no—you can't set up a 72(t) plan directly from a 401(k) or 403(b) you're still contributing to. The SEPP rules are written specifically for Individual Retirement Arrangements (IRAs).

But there's a very common workaround. If you've left the company that sponsored your 401(k), you can simply roll those funds into a brand new IRA. Once that rollover is complete, that new IRA is fair game. You can then set up the SEPP plan using those funds, giving you a penalty-free bridge to your old workplace savings.

What Happens to My SEPP Plan if the Market Crashes?

How a market downturn affects your plan comes down to one critical decision you made on day one: your calculation method. This is where you see the real-world difference between the three options.

- Fixed Amortization or Annuitization: If you chose one of these, your payment amount is set in stone and does not change, no matter what the market does. This gives you predictable income, which is great, but a big market drop means you're pulling the same dollar amount from a smaller pot, which could drain your account faster than you planned.

- RMD Method: With the RMD method, your payment is recalculated every single year based on the account balance from the previous year-end. If the market tanks, your account value drops, and your distribution for the next year will be smaller. It's an automatic adjustment that helps protect your principal during a downturn.

Think of the RMD method as a built-in shock absorber. By reducing your withdrawal amount after a market drop, it gives your portfolio a better chance to recover over the long term.

Can I Take More Than the Calculated Amount in an Emergency?

In a word: no. This is the most unforgiving rule of a 72(t) plan. Taking even one penny more—or less—than the precisely calculated amount is considered a "modification." There are absolutely no exceptions for emergencies, medical bills, or anything else.

If you break this rule, the plan is busted, and the consequences are severe. The IRS will retroactively apply the 10% early withdrawal penalty to every single distribution you've taken since the plan started, plus interest. This is why having a separate, liquid emergency fund is non-negotiable before you even think about starting a SEPP.

What Happens After I Complete My SEPP Schedule?

Once you've made it to the finish line—which means you've taken payments for at least five full years or until you hit age 59½, whichever is longer—you're done. The SEPP plan is officially complete.

From that moment on, you get full control back over the remaining money in that IRA. You're no longer locked into the rigid SEPP schedule. You can take out as much or as little as you want, whenever you want, without that 10% penalty. Of course, you'll still owe regular income tax on withdrawals from a traditional IRA, just like with any normal retirement distribution.

Navigating the complexities of an IRA substantially equal payments plan requires precision and expertise. The team at Spivak Financial Group specializes in crafting compliant and effective 72(t) strategies to help you achieve your early retirement goals. Visit us at https://72tprofessor.com or contact us at our Scottsdale, AZ office to ensure your plan is set up for success from day one.

Spivak Financial Group

8753 E. Bell Road

Suite #101

Scottsdale, AZ 85260

(844) 776-3728